New York City Department of Finance Forms

The New York City Department of Finance is responsible for managing and enforcing various financial aspects of the City of New York. Its primary purpose is to collect and administer taxes, assess property values, and provide services related to property taxation, parking violations, and other financial matters in the city.

Documents:

716

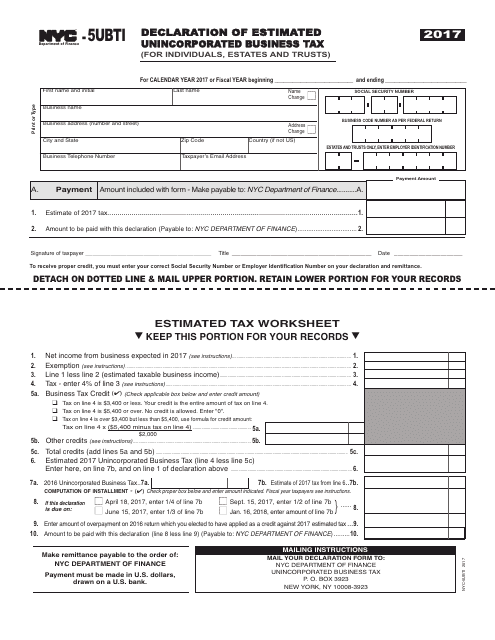

This Form is used for individuals, estates, and trusts in New York City to declare their estimated unincorporated business tax.

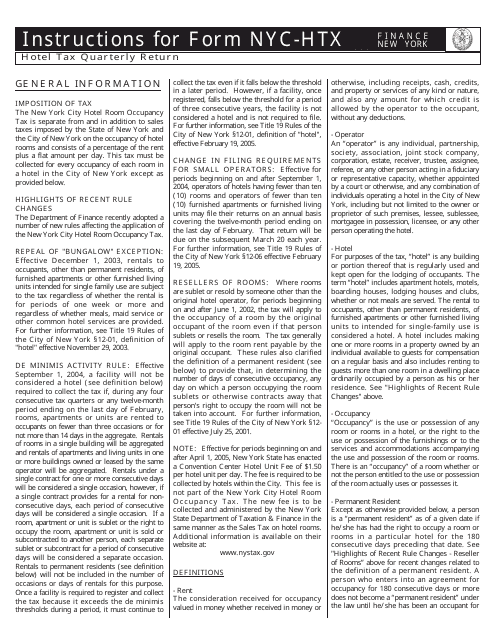

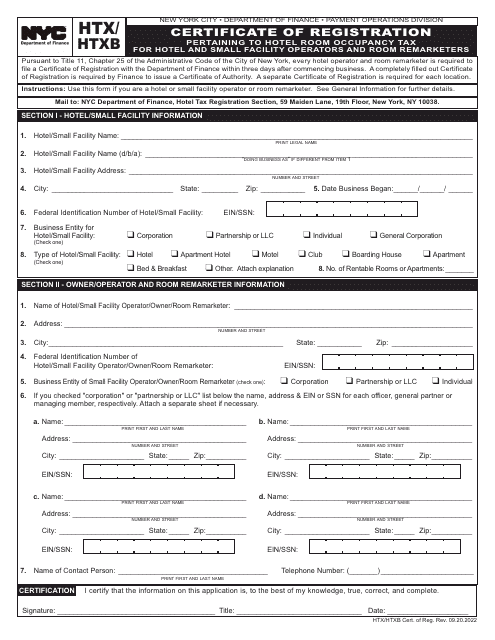

This form is used for reporting and paying hotel taxes on a quarterly basis in New York City. It provides instructions on how to complete the form and submit the necessary documentation.

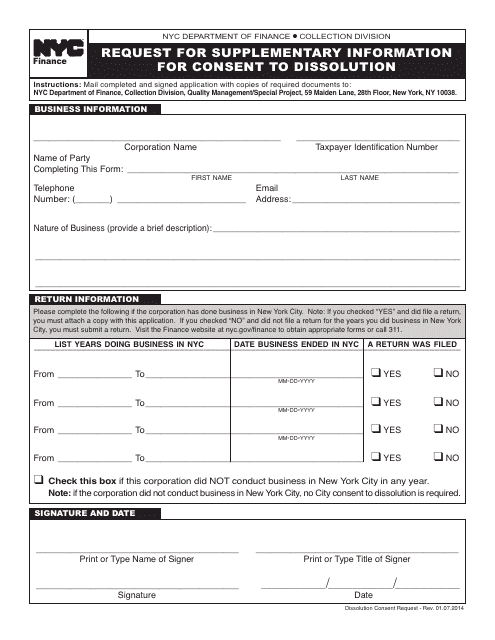

This form is used for requesting additional information to supplement the consent to dissolution in New York City. It helps ensure all necessary information is provided for the dissolution process.

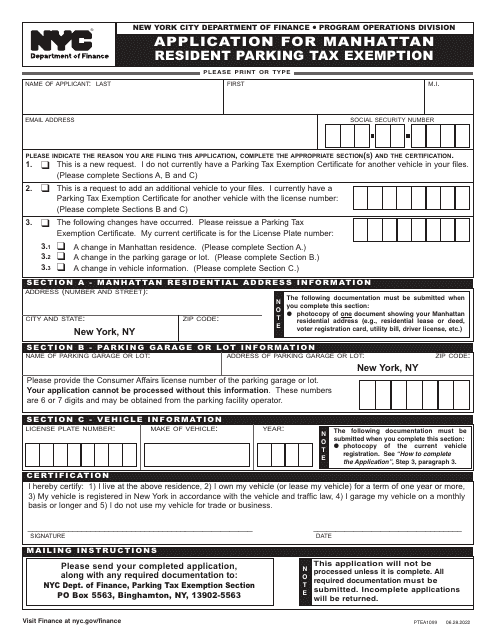

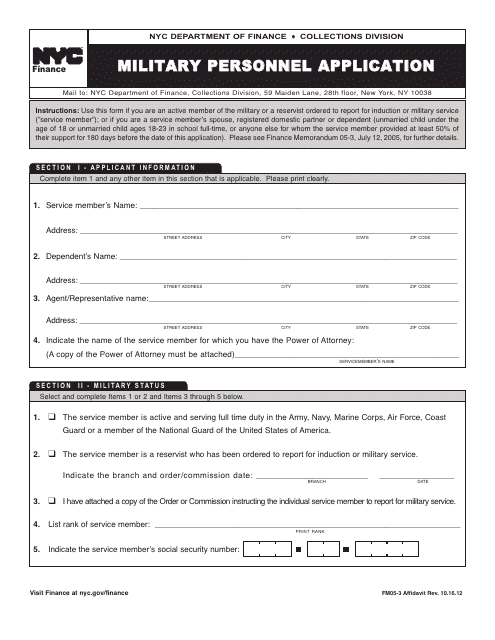

This Form is used for military personnel's application in New York City.

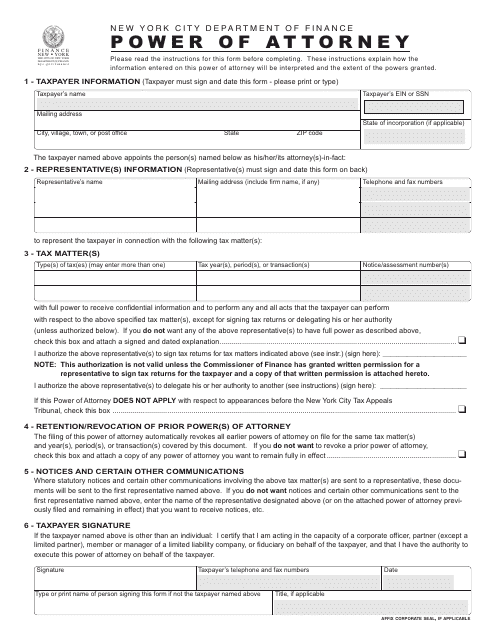

This Form is used for creating a power of attorney in New York City, allowing someone else to act on your behalf for financial or legal matters.

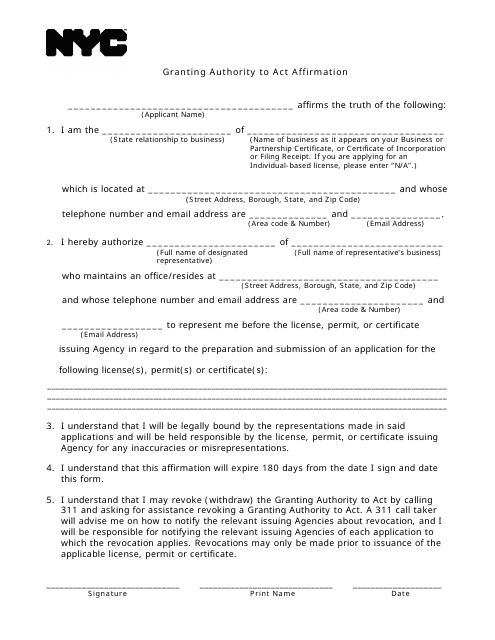

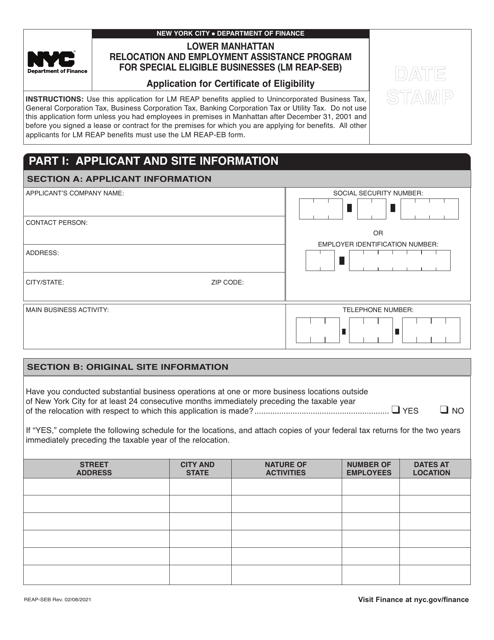

This form is used for granting authority to act in certain matters within New York City.

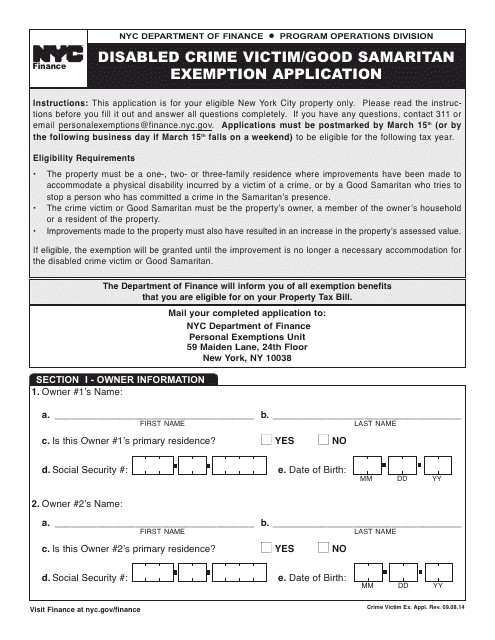

This form is used for applying for the Disabled Crime Victim/Good Samaritan Exemption in New York City.

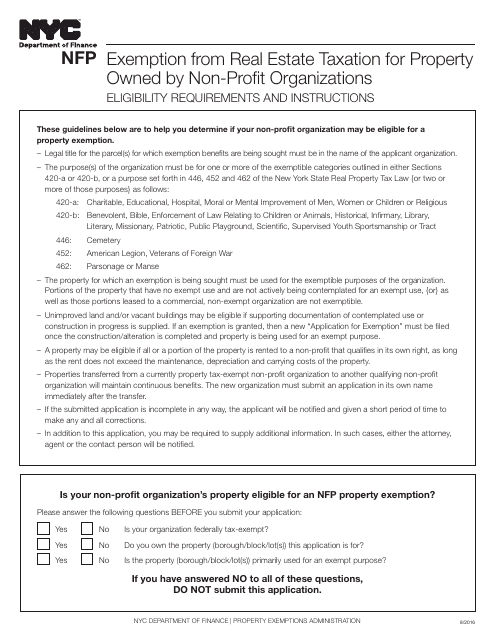

This Form is used for non-profit organizations in New York City to apply for exemption from real estate taxation for their properties.

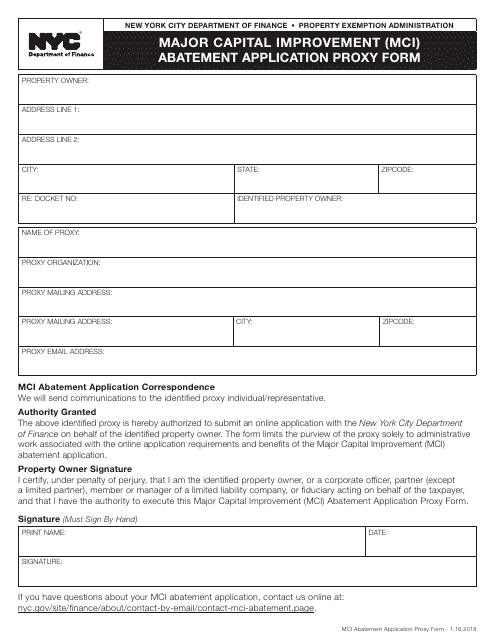

This document is used for applying for a proxy form for the Major Capital Improvement (MCI) abatement application in New York City.

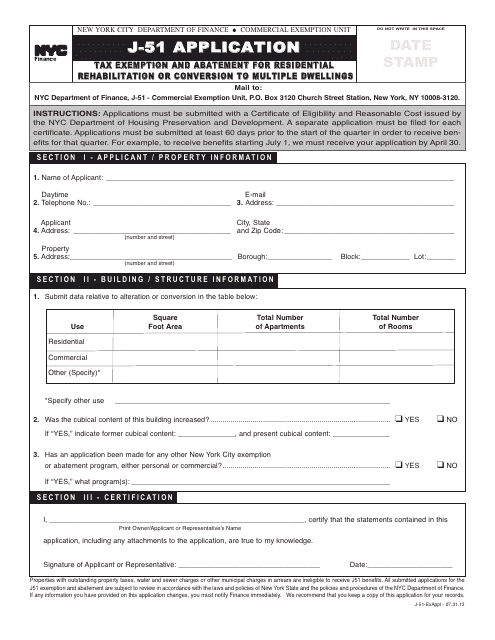

This form is used for applying for tax exemption and abatement for residential rehabilitation or conversion to multiple dwellings in New York City.

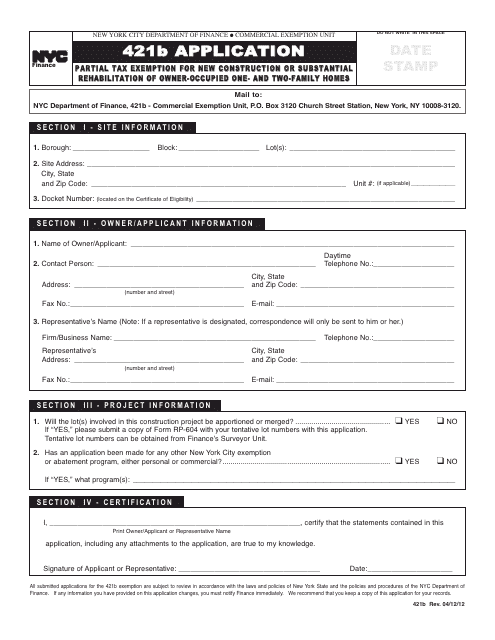

This form is used for applying for a partial tax exemption for new construction or substantial rehabilitation of owner-occupied one- and two-family homes in New York City.

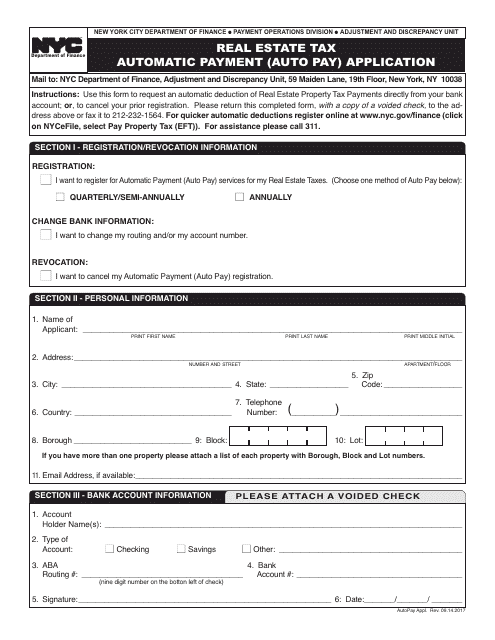

This document is an application form for enrolling in the automated real estate tax payment program in New York City. With this form, residents can apply to have their property taxes automatically deducted from their bank account each month.

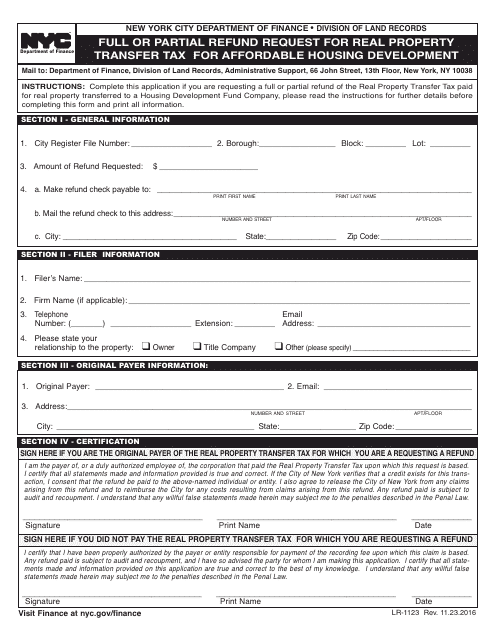

This form is used for requesting a full or partial refund of the real property transfer tax for affordable housing development in New York City.

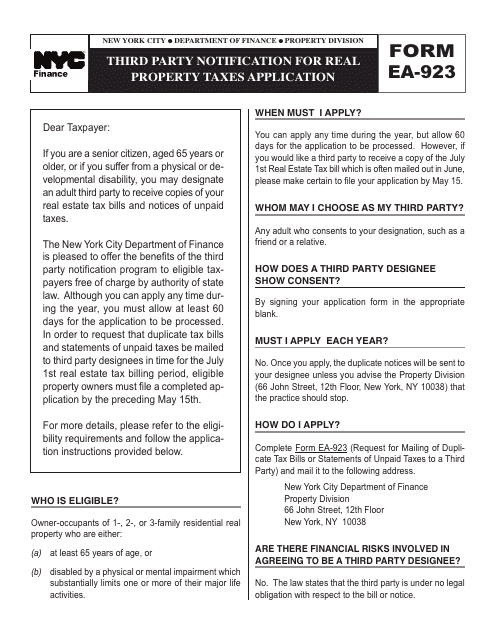

This form is used for requesting the mailing of duplicate tax bills or statements of unpaid taxes to a third party in New York City.

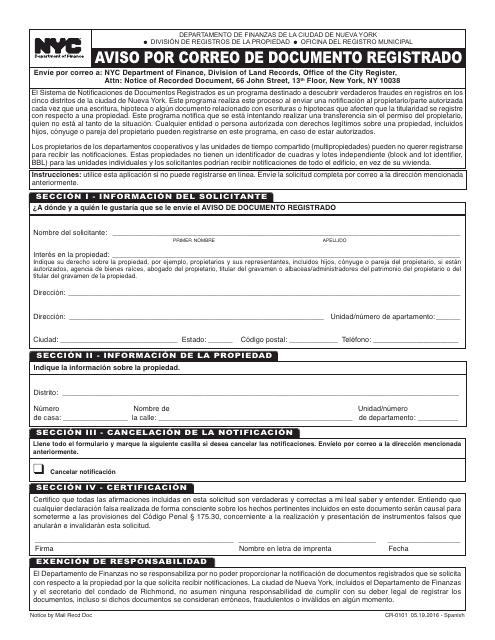

This Form is used for sending a notice by mail for registered documents in New York City. (Spanish)

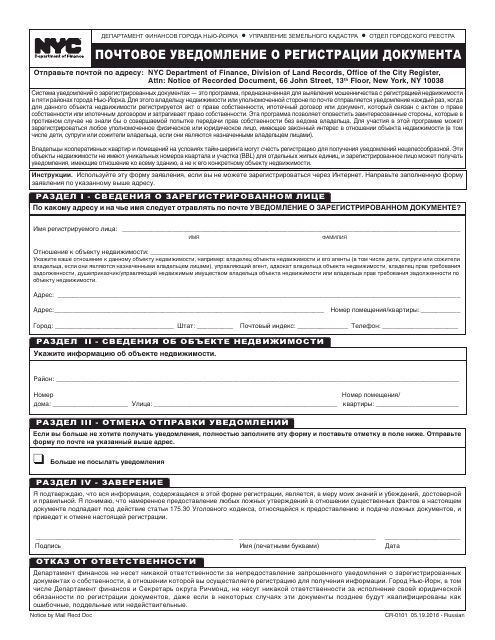

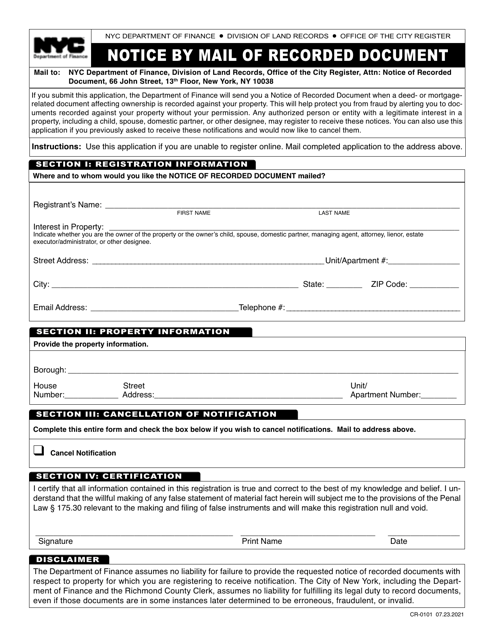

This document notifies recipients in New York City of a recorded document by mail.

This Form is used for providing notice by mail of a recorded document in New York City, specifically for Korean language recipients.

This form is used to notify individuals in New York City of a recorded document through mail, and it is available in Haitian Creole.

This form is used to provide notice through mail of a recorded document in New York City. It is available in French.

This document provides a notice by mail for a recorded document in New York City. It is available in Chinese Simplified.

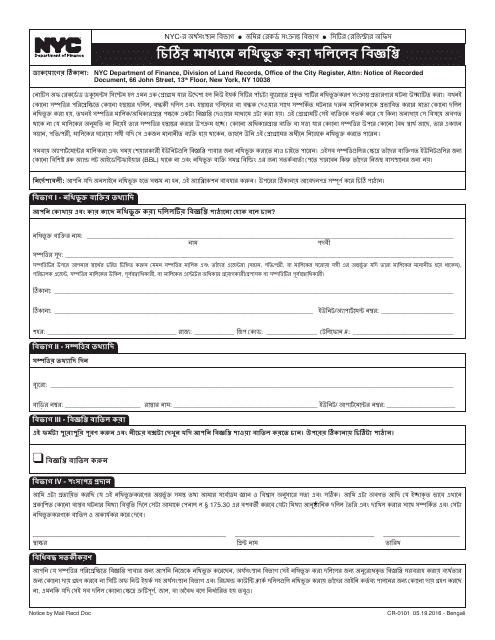

This form is used for providing a notice by mail of a recorded document in New York City. It is available in Bengali language.

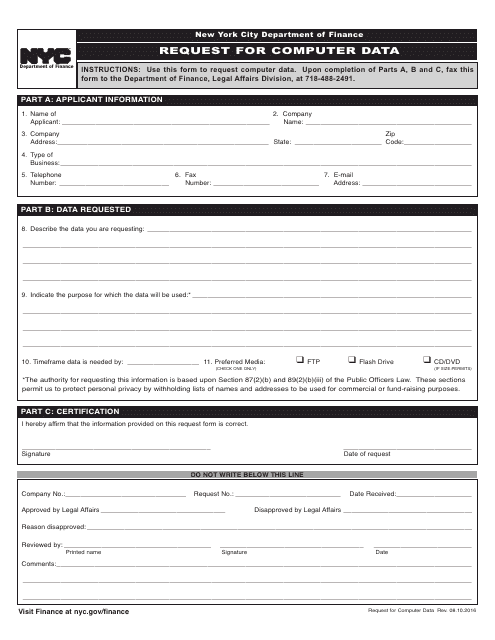

This document is a request form used to obtain computer data in New York City. It is used to request specific data or information related to computers.

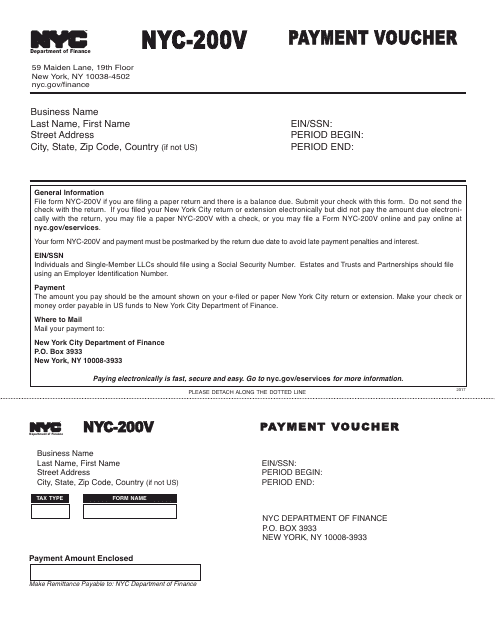

This form is used for making payment to the City of New York.

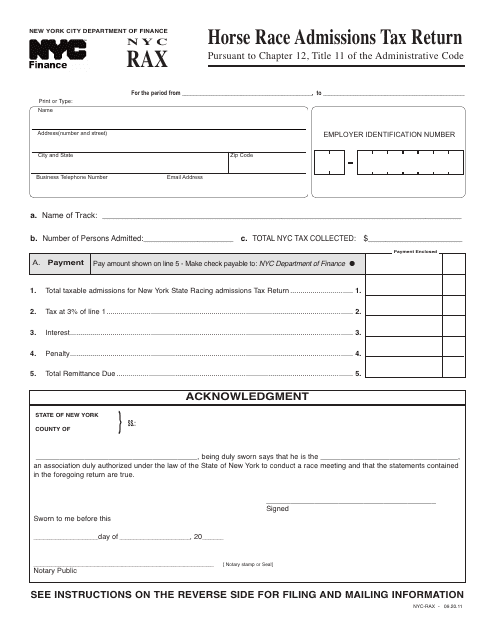

This form is used for filing the Horse Race Admissions Tax Return in New York City.

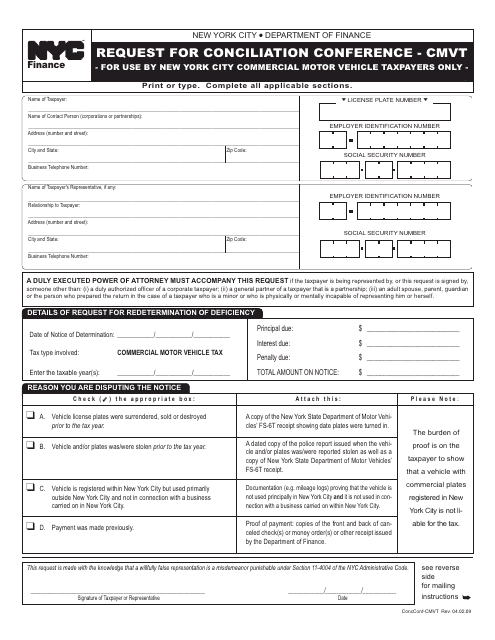

This document is a request for a conciliation conference in New York City. It is used to initiate a meeting between parties involved in a dispute in order to find a resolution through mediation.

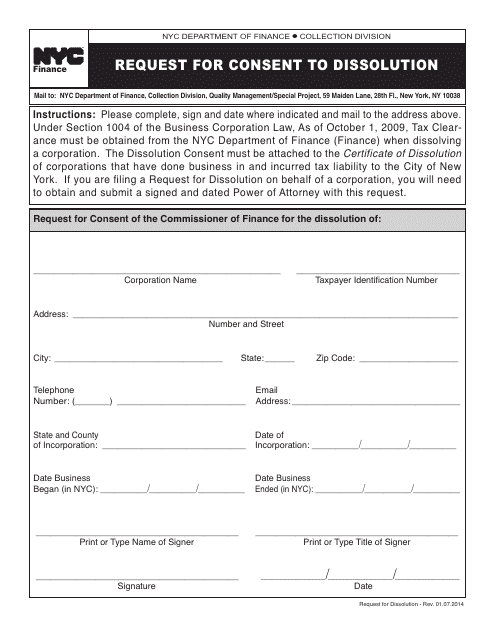

This document is used to request consent for the dissolution of a company in New York City.

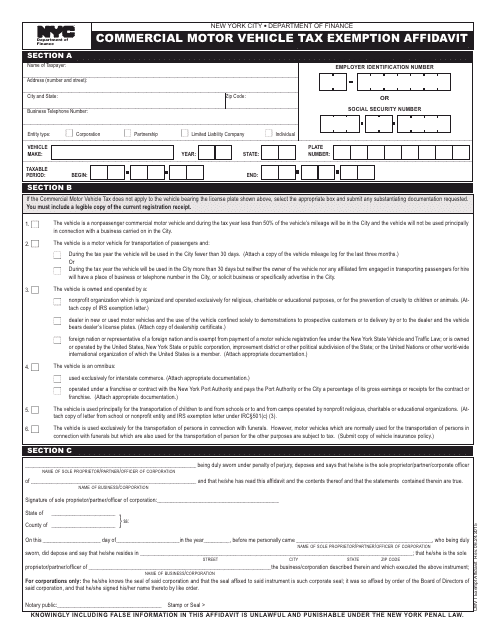

This form is used for applying for a tax exemption for commercial motor vehicles in New York City.

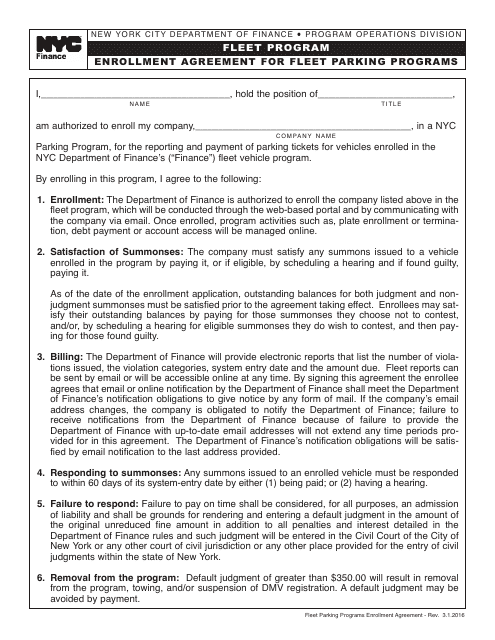

This document is used for enrolling in a Fleet Parking Programs in New York City.

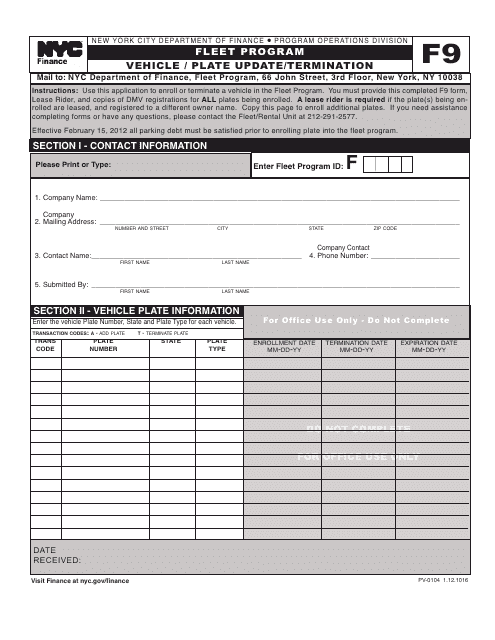

This form is used for updating or terminating vehicle or license plate information in New York City.