New York State Department of Taxation and Finance Forms

Documents:

2566

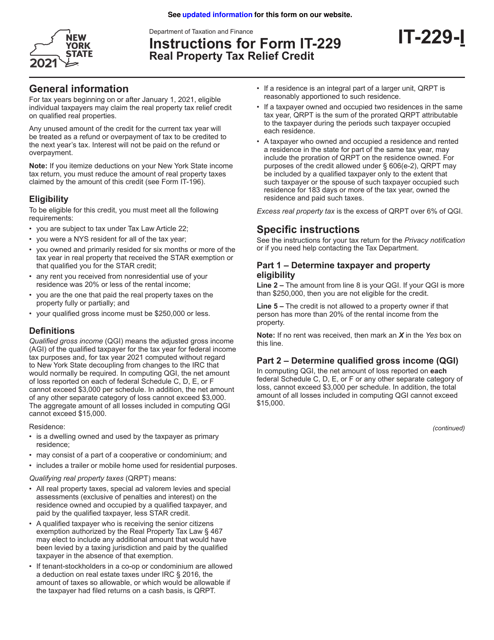

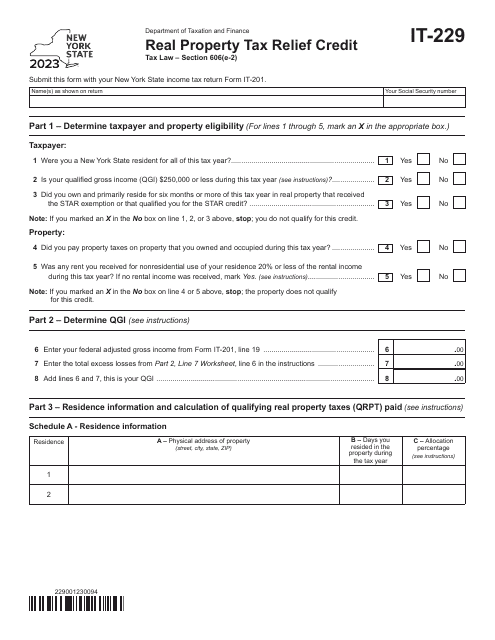

This document is used to provide instructions for Form IT-229 Real Property Tax Relief Credit in the state of New York. It helps taxpayers understand how to claim a credit for property taxes paid on their primary residence.

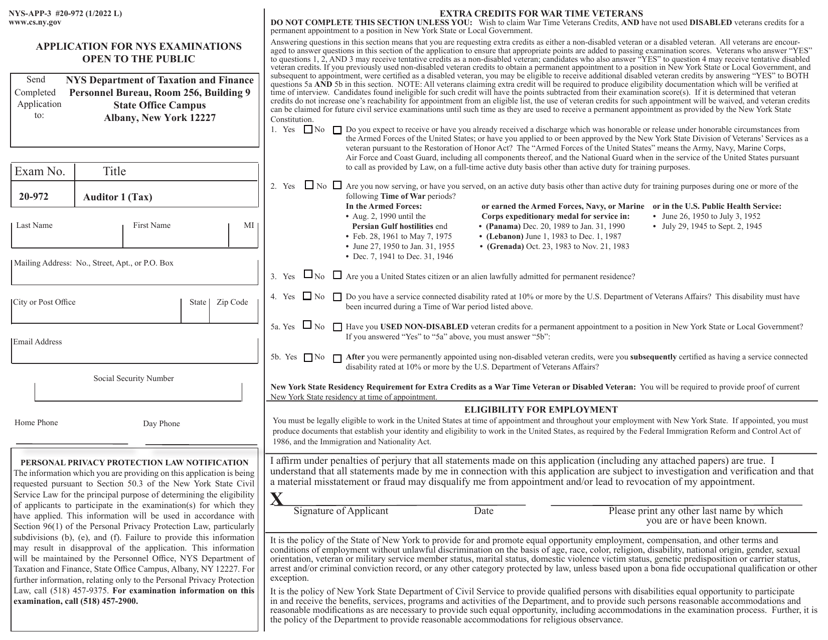

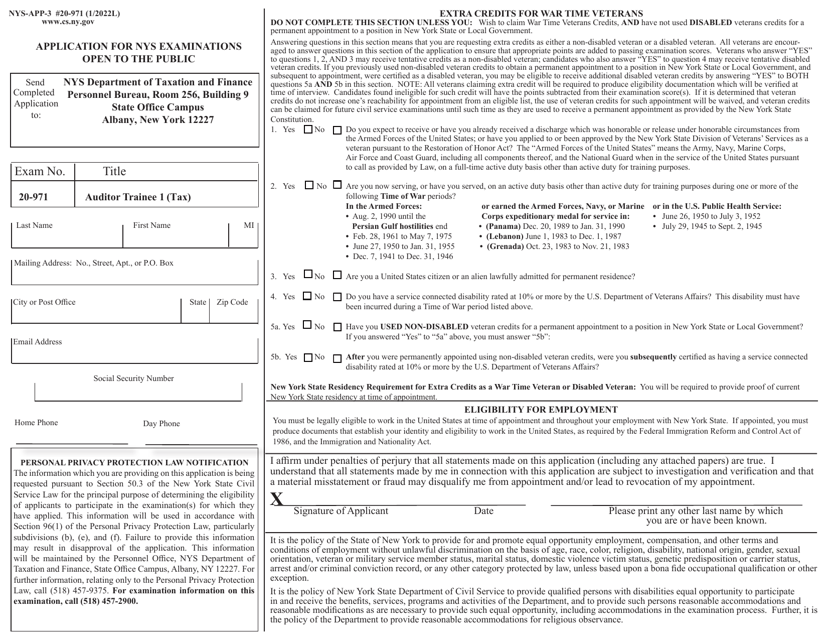

This Form is used for applying for the NYS Examinations Open to the Public - Auditor 1 (Tax) in New York.

This document is an application for New York State examinations that are open to the public. It allows individuals to apply for various exams administered by the state of New York.

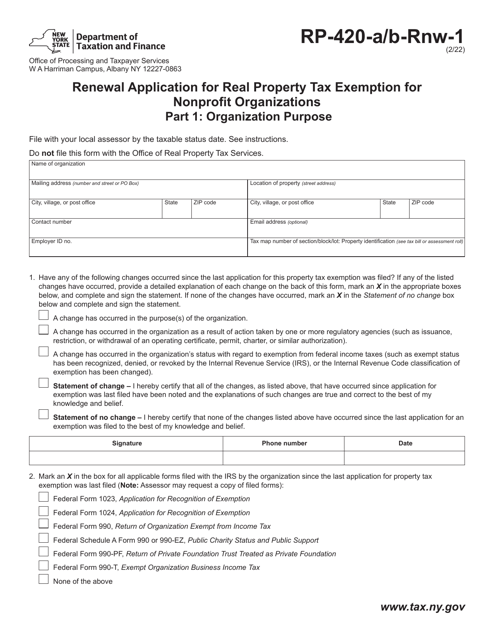

This type of document is used for renewing the application for real property tax exemption for nonprofit organizations in New York.

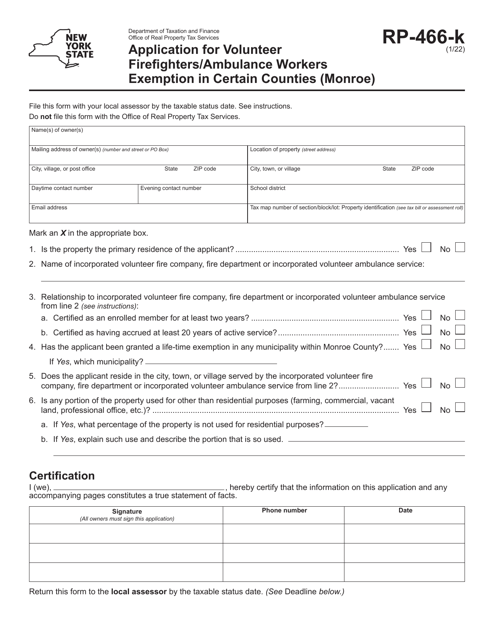

This Form is used for applying for a volunteer firefighters/ambulance workers exemption in Monroe County, New York.

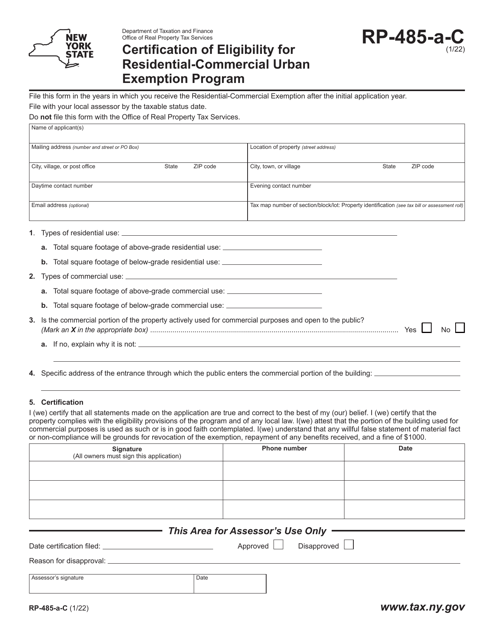

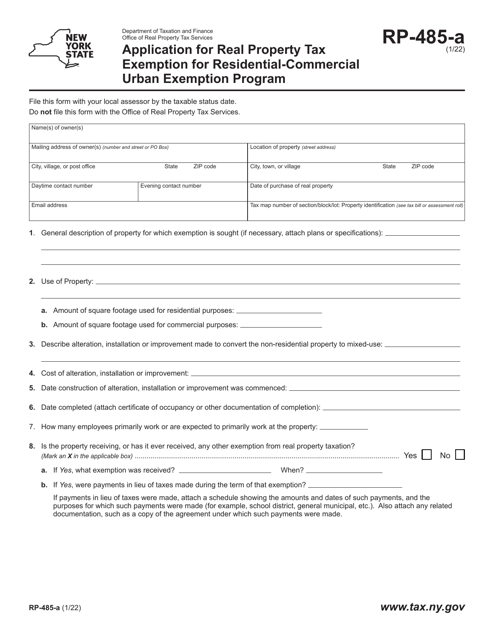

This form is used for certifying eligibility for the Residential-Commercial Urban Exemption Program in New York.

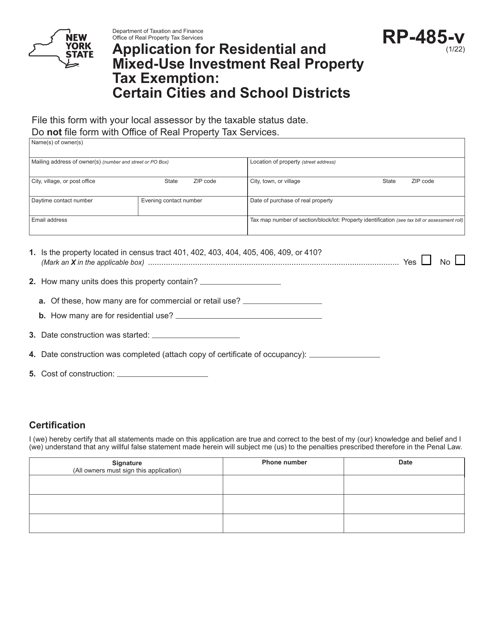

This Form is used for applying for a tax exemption on residential and mixed-use investment properties in certain cities and school districts in New York.

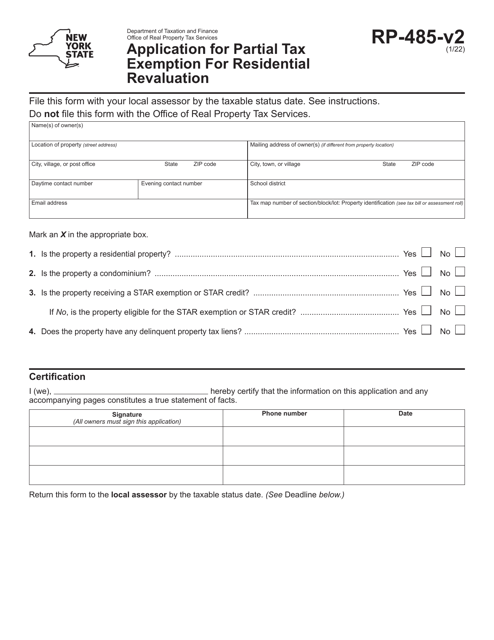

This form is used to apply for a partial tax exemption for residential revaluation in New York. It allows homeowners to potentially reduce their property taxes based on the changes in market value of their residential property.

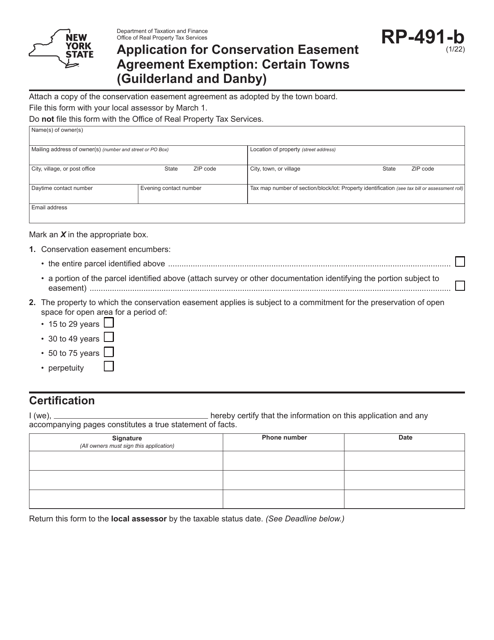

This form is used for applying for a conservation easement agreement exemption in certain towns (Guilderland and Danby) in the state of New York.

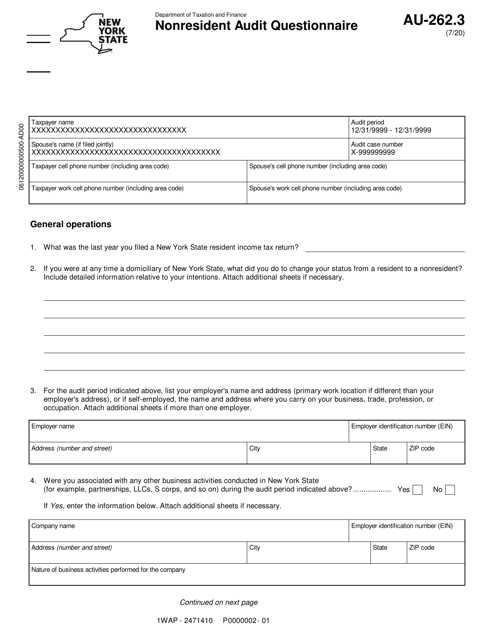

This form is used for nonresidents of New York to complete an audit questionnaire. It helps the state gather information about income and taxes for individuals who do not live in New York.

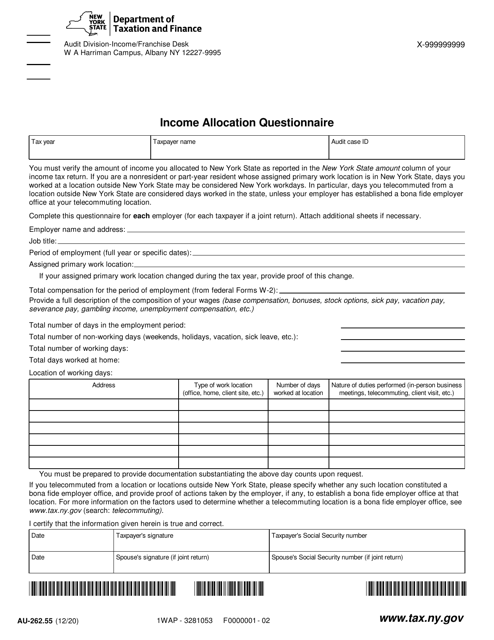

This form is used for completing an income allocation questionnaire in the state of New York.

This Form is used for reporting annual sales and use tax by individuals in New York. It provides instructions on how to fill out and submit the Form ST-140.

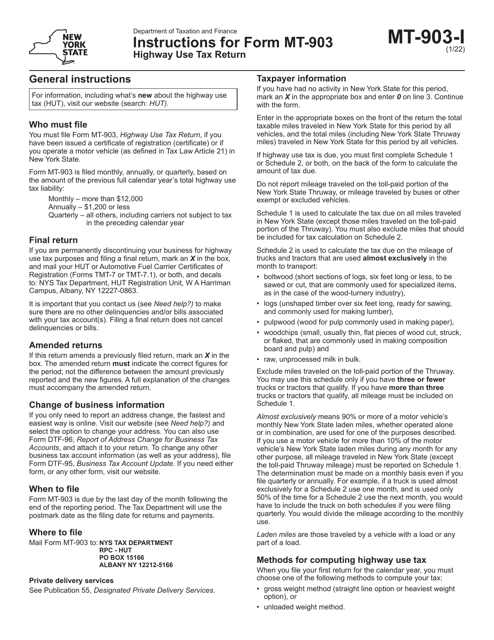

This Form is used for reporting and paying highway use tax in the state of New York. It provides instructions on how to complete and submit Form MT-903.