New Mexico Taxation and Revenue Department Forms

The New Mexico Taxation and Revenue Department is responsible for administering and enforcing tax laws and regulations in the state of New Mexico. They oversee the collection of various taxes, including income tax, sales tax, property tax, and motor vehicle excise tax. The department also handles revenue distribution, audits, and taxpayer assistance programs. Their main goal is to ensure compliance with tax laws while providing efficient and fair service to taxpayers.

Documents:

170

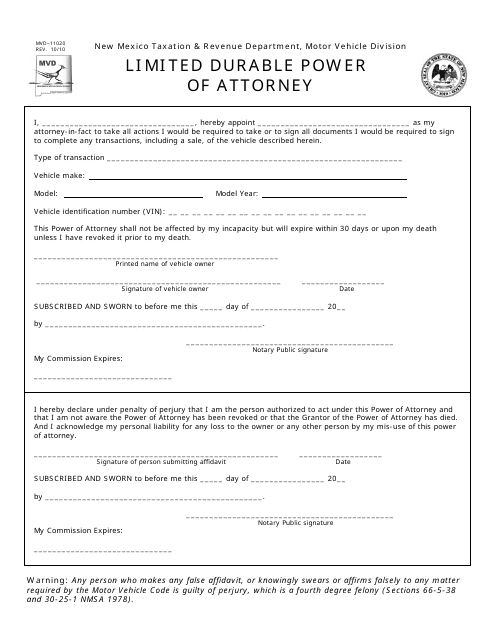

This form is used for granting someone the power to make legal decisions on your behalf for a limited period of time in the state of New Mexico.

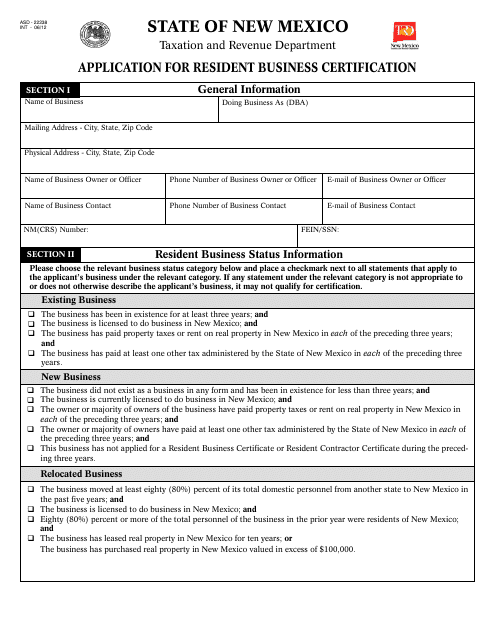

This form is used for applying for a resident business certification in the state of New Mexico. It is necessary for individuals or companies who want to establish a business residency in the state.

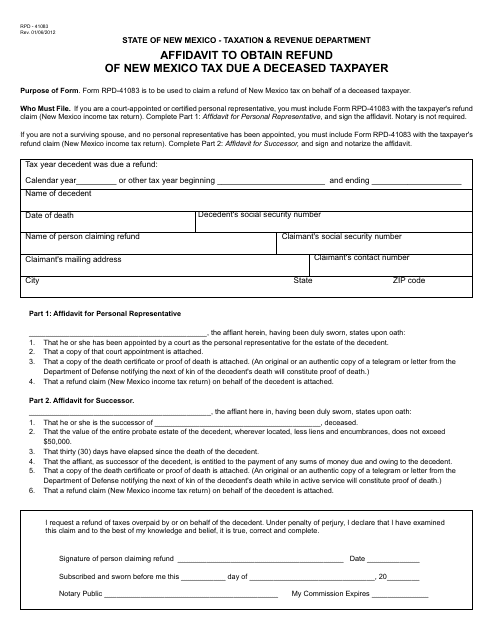

This form is used for obtaining a refund of New Mexico tax that is due to a deceased taxpayer in New Mexico.

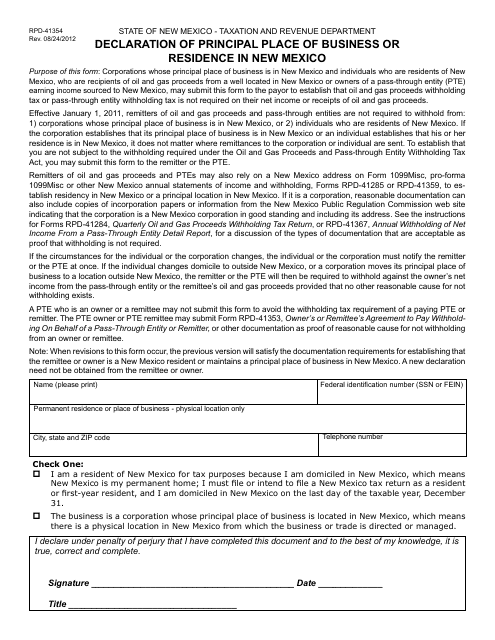

This Form is used for declaring the principal place of business or residence in New Mexico. It is required by the state of New Mexico.

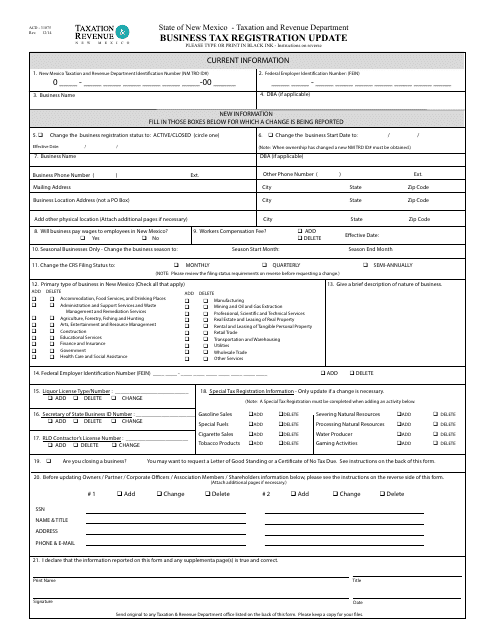

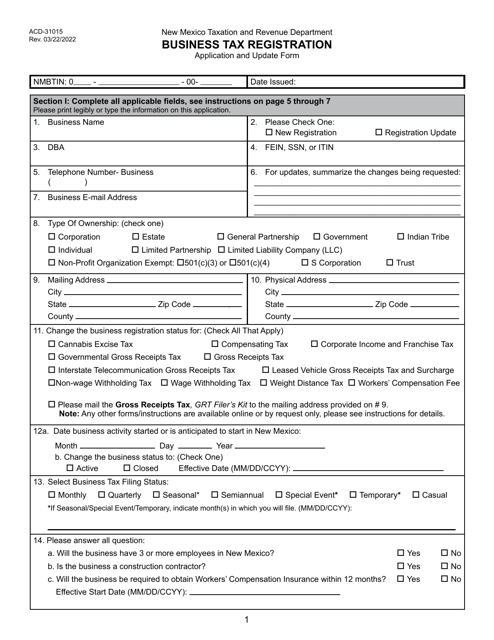

This form is used for updating the business tax registration in New Mexico.

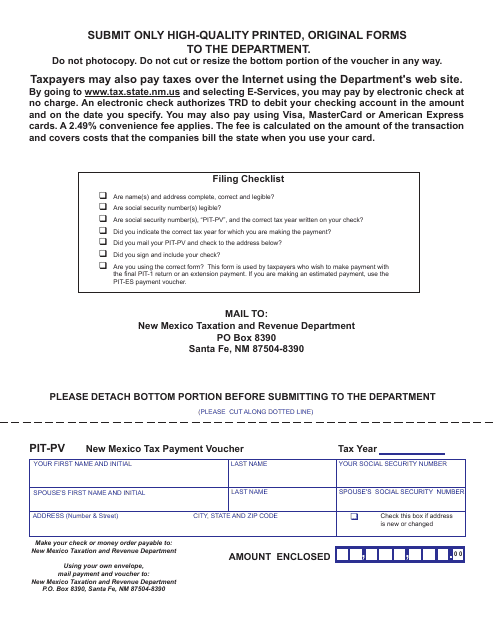

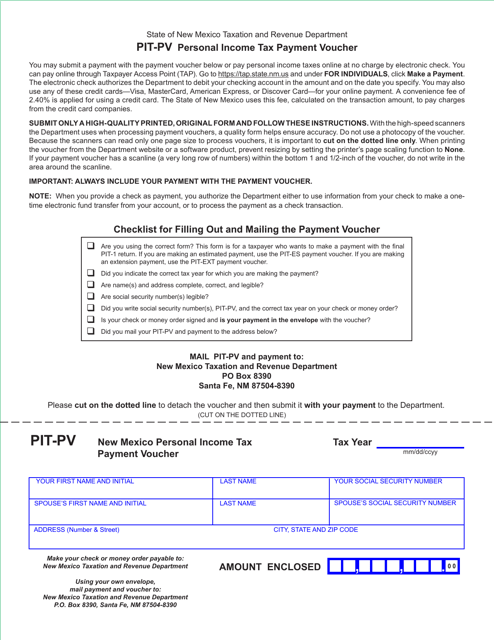

This form is used for making tax payment in New Mexico. It is called the PIT-PV (Personal Income Tax Payment Voucher) and is used to submit tax payments to the state.

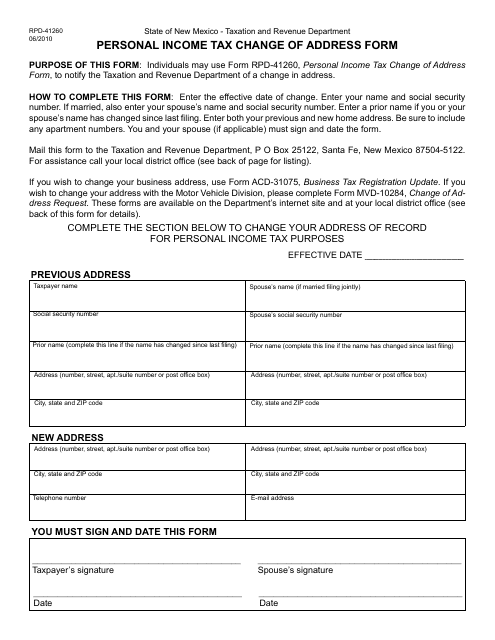

This Form is used for changing your address for personal income tax purposes in the state of New Mexico.

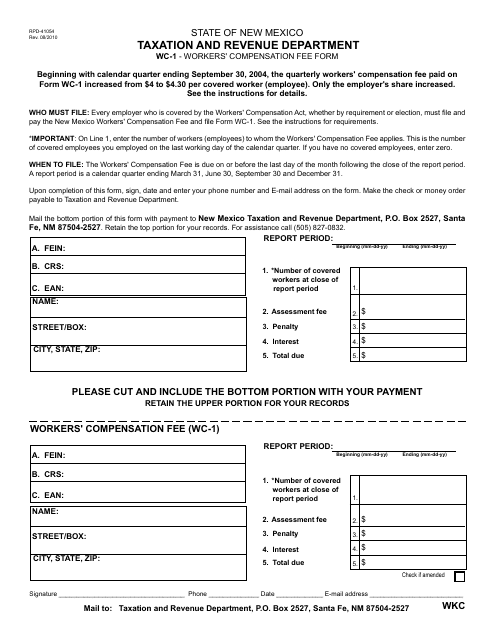

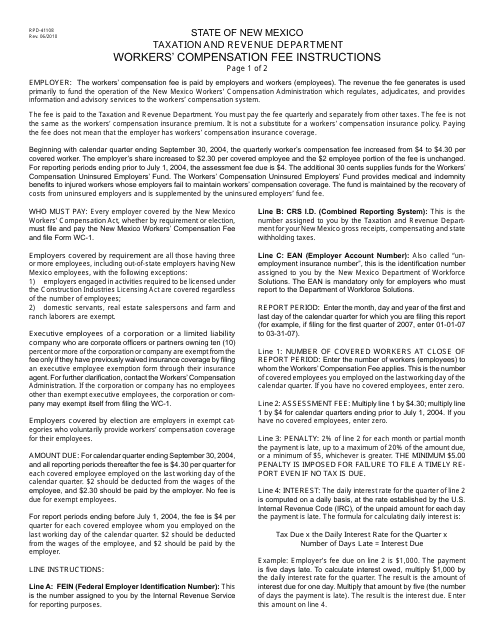

This form is used for submitting workers' compensation fees in New Mexico.

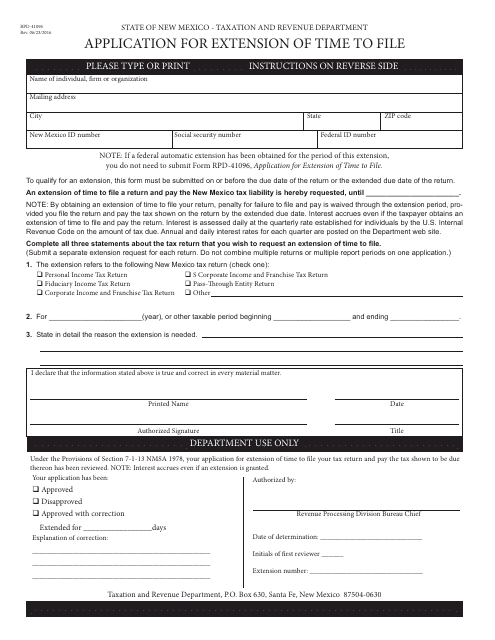

This form is used for filing an application to request an extension of time to file New Mexico state tax returns.

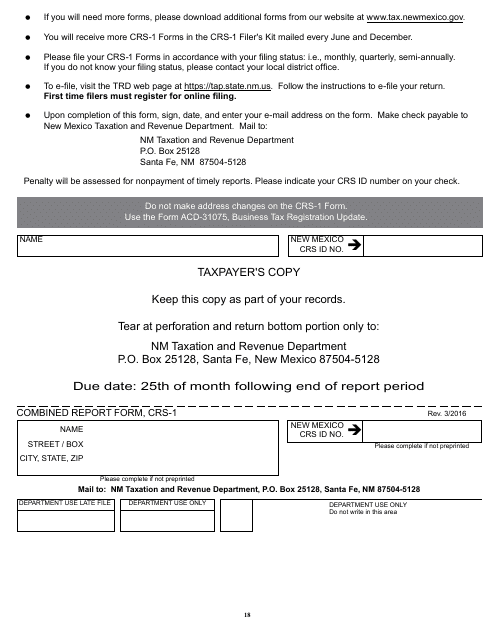

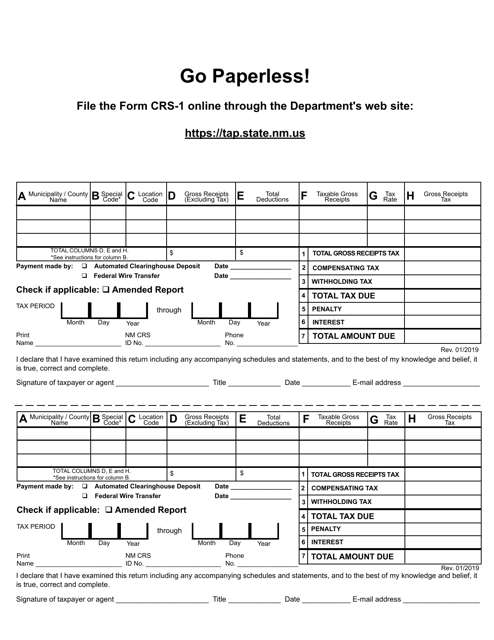

This form is used for submitting a combined report in the state of New Mexico. It allows businesses to report their financial information and activities to the appropriate authorities.

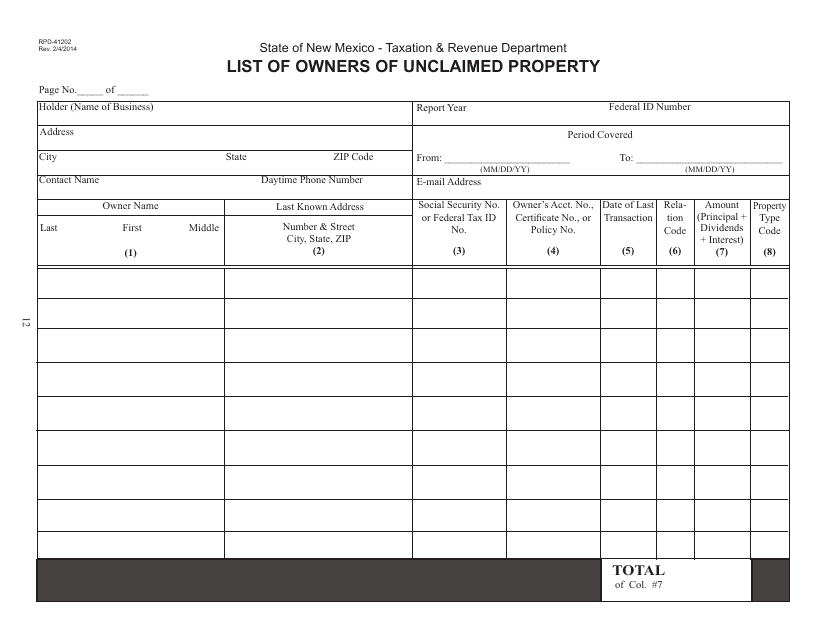

This form is used for listing the owners of unclaimed property in the state of New Mexico. It must be filled out in order to report any unclaimed property that you hold as the owner.

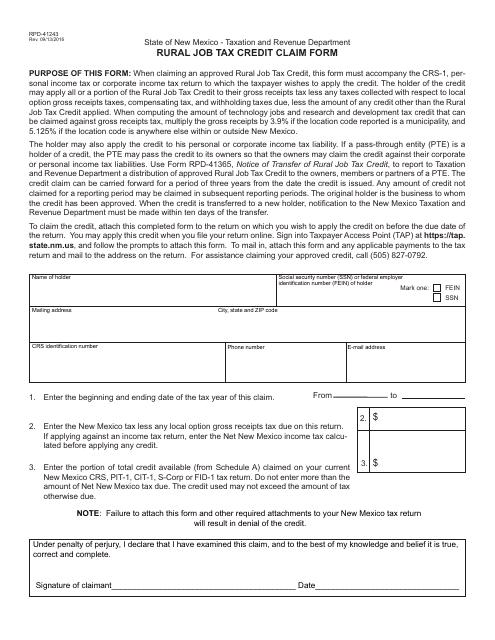

This form is used for claiming the rural job tax credit in the state of New Mexico. It is for businesses that have created jobs in rural areas and are eligible for this tax credit.

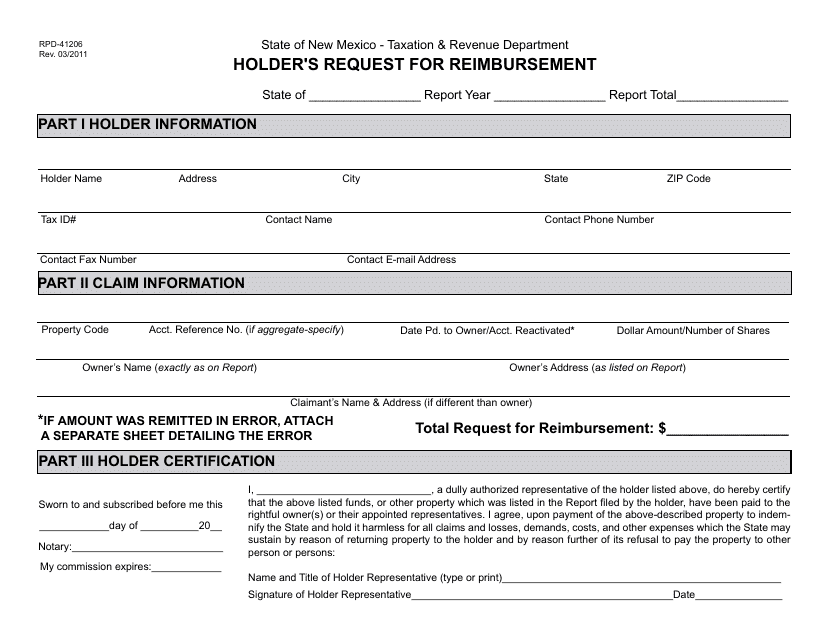

This Form is used for New Mexico residents to request reimbursement as a holder.

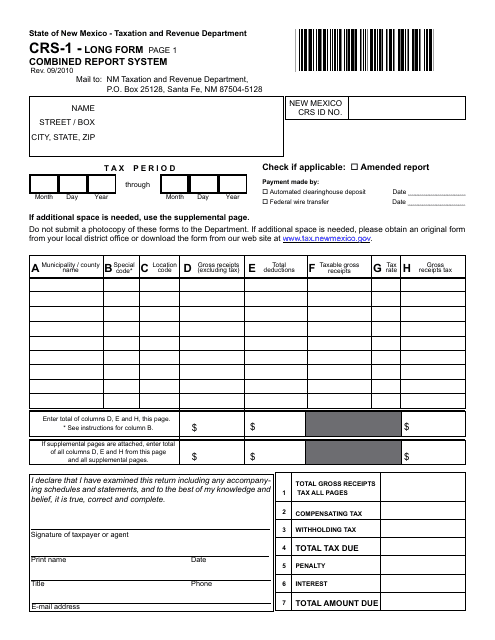

This Form is used for filing a combined report long form in the state of New Mexico. It is used to provide detailed financial information for businesses operating in the state.

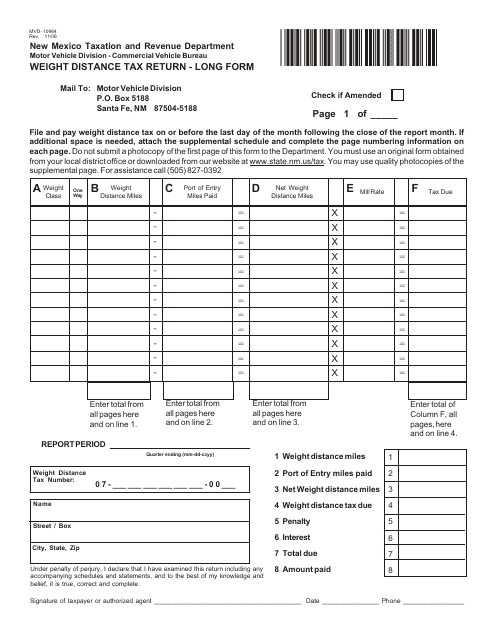

This Form is used for filing the Weight Distance Tax Return Long Form in the state of New Mexico. It is required for reporting and paying taxes based on the weight and distance traveled by commercial motor vehicles.

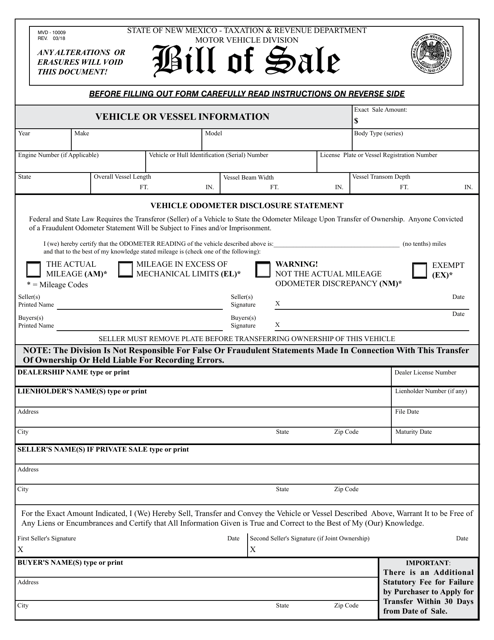

Fill out this document to record the details of a vehicle sale in the state of New Mexico. The same form is used to document the transfer of a vessel. It is the official State of New Mexico Bill of Sale.

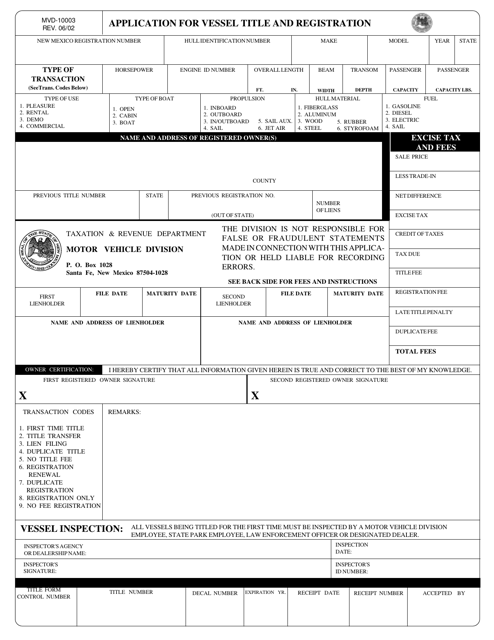

This Form is used for applying for a vessel title and registration in the state of New Mexico.

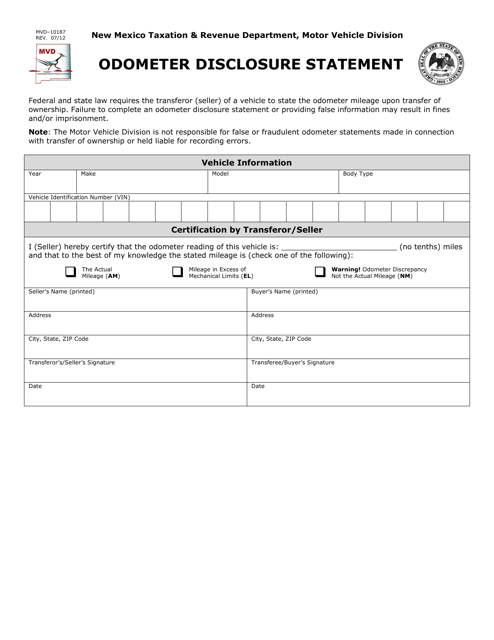

This form is used for disclosing the odometer reading of a vehicle during a transfer of ownership in New Mexico.

This Form is used for filing a combined report (short form) for 3 or fewer businesses in New Mexico.

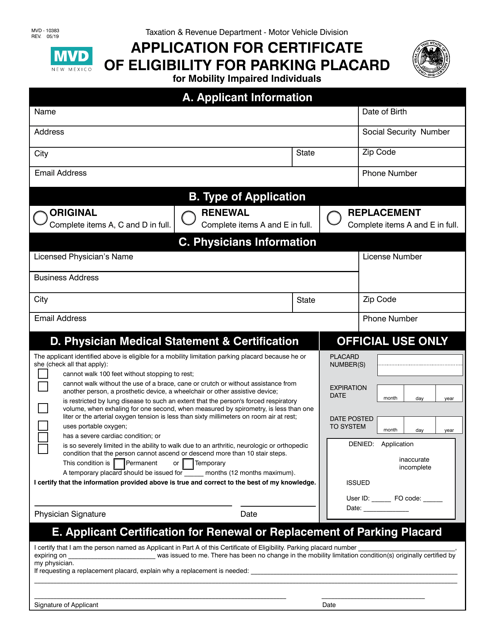

This form is used to apply for a Certificate of Eligibility for a parking placard for individuals with mobility impairments in New Mexico.

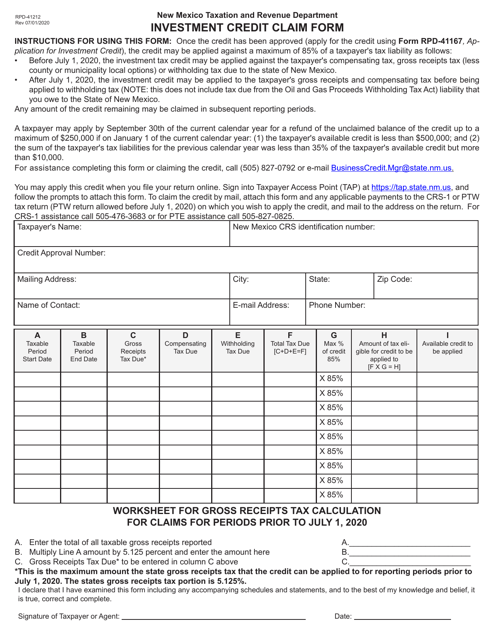

This form is used for claiming investment credits in the state of New Mexico.

This Form is used for making personal income tax payments in the state of New Mexico. It serves as a payment voucher for individuals to submit their tax payments.

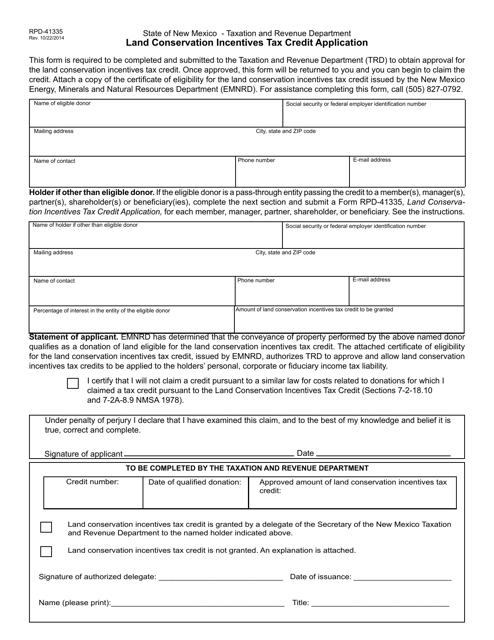

This form is used for applying for the Land Conservation Incentives Tax Credit in the state of New Mexico.

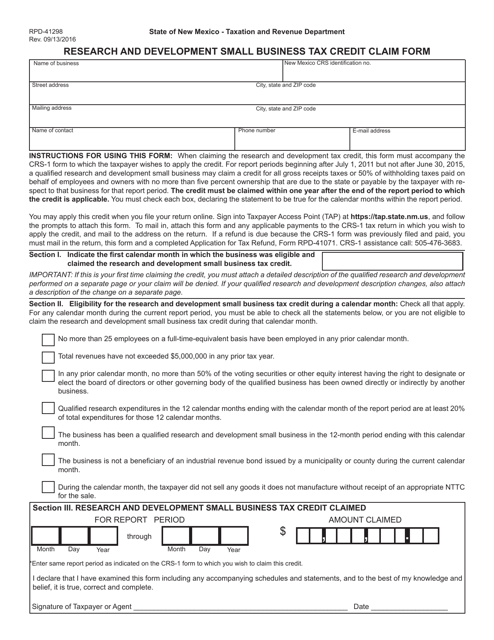

This form is used for claiming the Research and Development Small Business Tax Credit in the state of New Mexico.

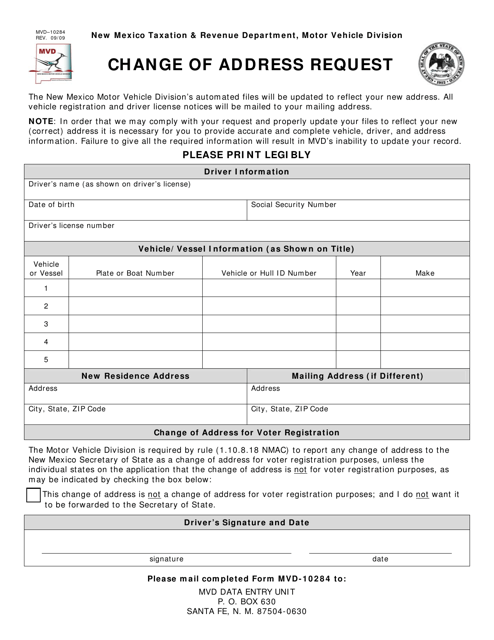

This form is used for requesting a change of address in the state of New Mexico.

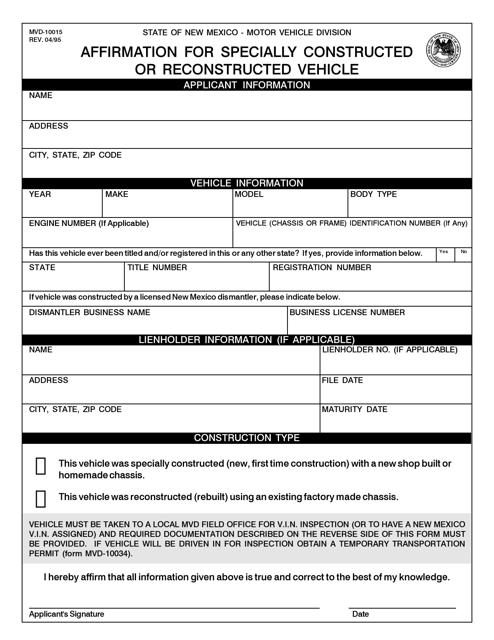

This Form is used for affirming the special construction or reconstruction of a vehicle in New Mexico. It is required for registering and titling such vehicles.

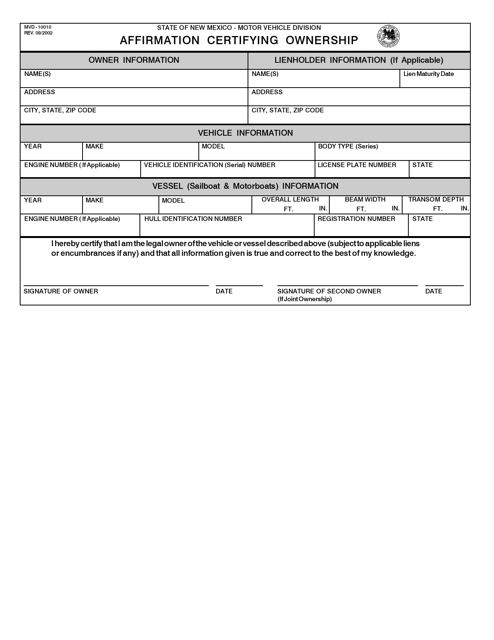

This Form is used for certifying ownership of a vehicle in New Mexico.

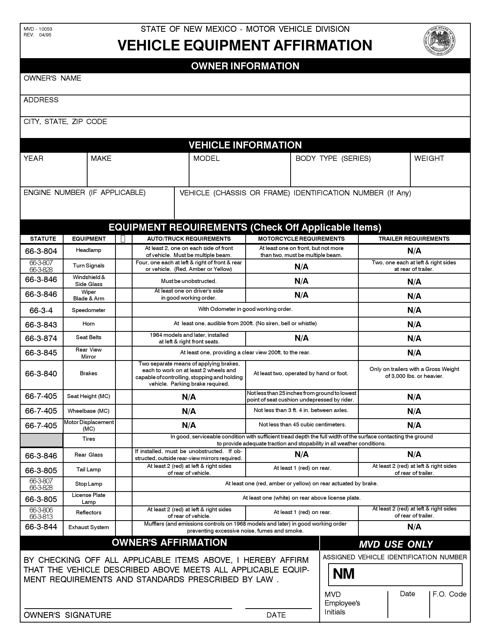

This form is used for affirming the equipment of a vehicle in New Mexico.

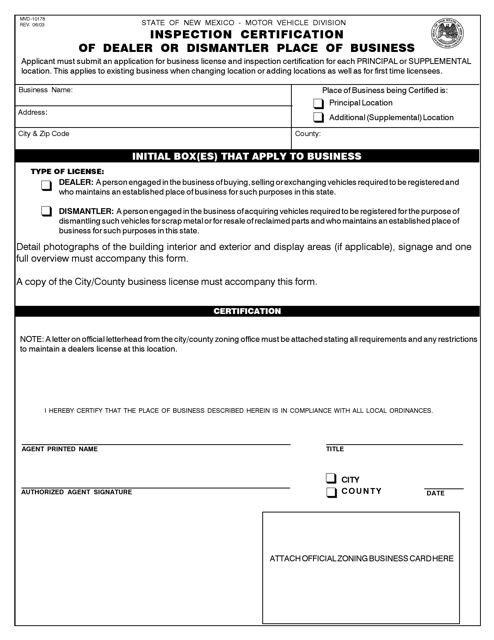

This form is used for certifying the inspection of a dealer or dismantler place of business in New Mexico.

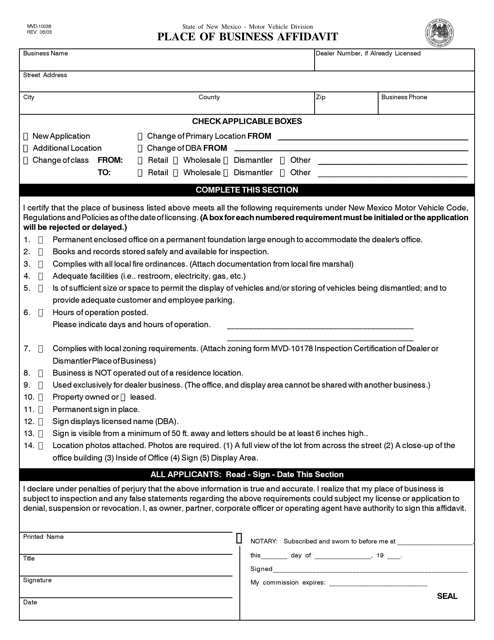

This form is used for submitting an affidavit to declare the location of a business in the state of New Mexico.

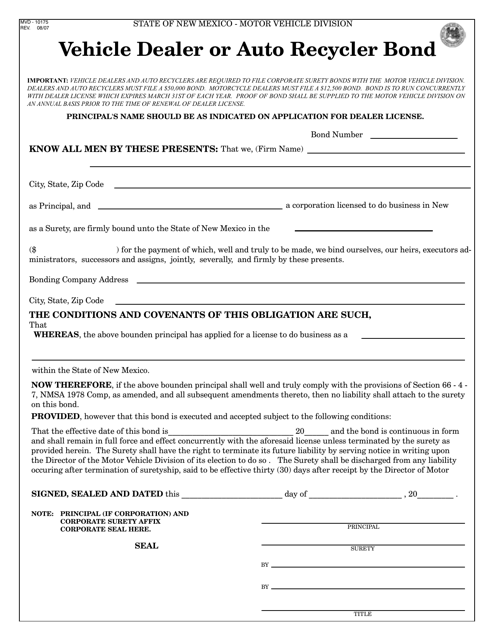

This form is used for obtaining a vehicle dealer or auto recycler bond in the state of New Mexico. It is a requirement for those who want to become a licensed vehicle dealer or auto recycler in the state.

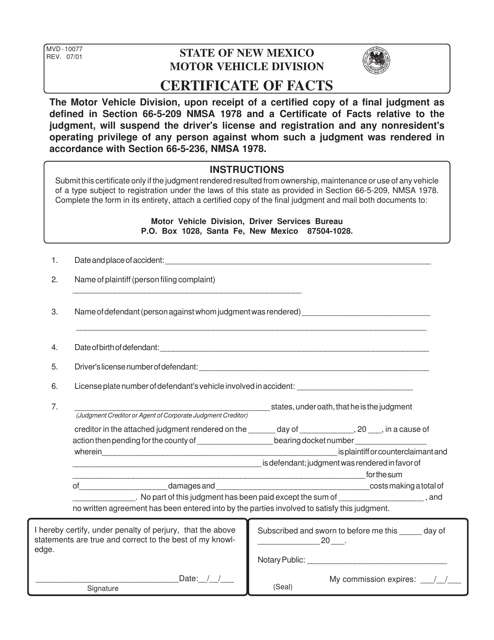

This form is used for requesting a Certificate of Facts in the state of New Mexico. It is used to obtain information about a specific vehicle or driver's record.

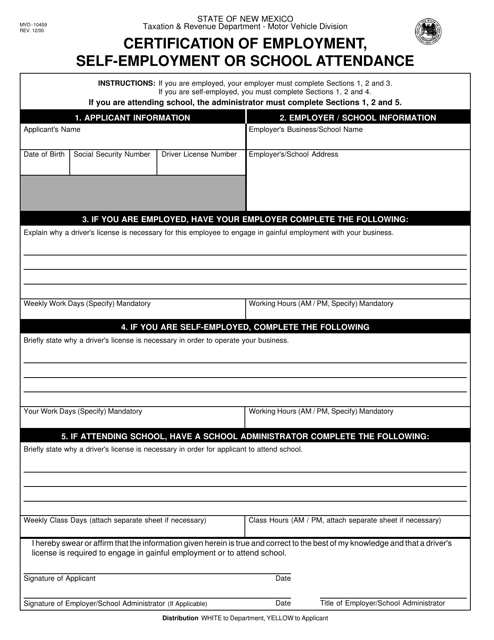

This form is used for certifying employment, self-employment, or school attendance in the state of New Mexico. It is a required document for certain purposes such as obtaining a driver's license or insurance.

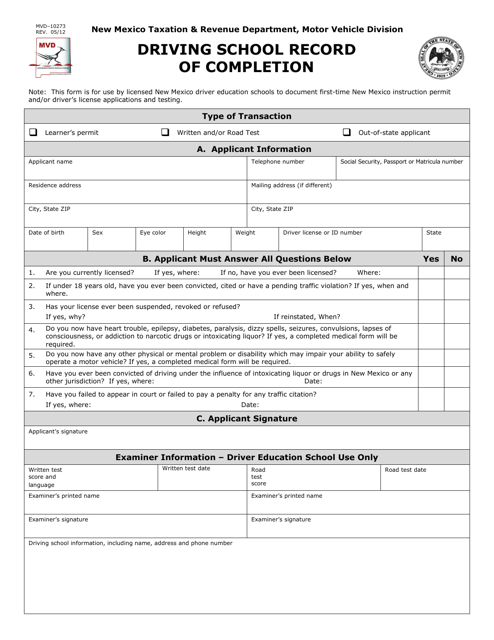

This form is used for recording completion of a driving school course in the state of New Mexico.

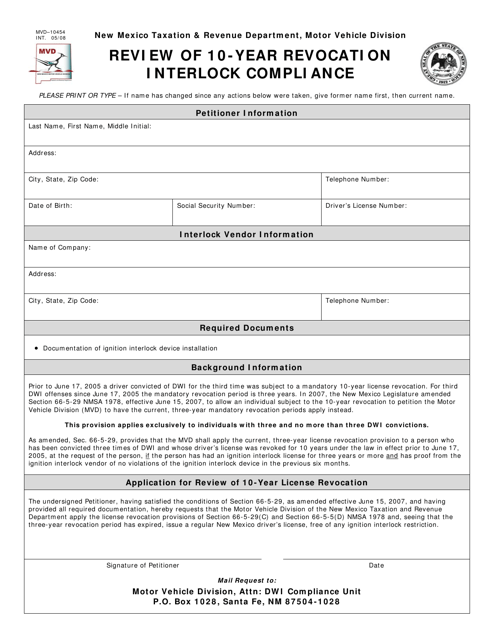

This Form is used for reviewing the 10-year revocation interlock compliance in the state of New Mexico.

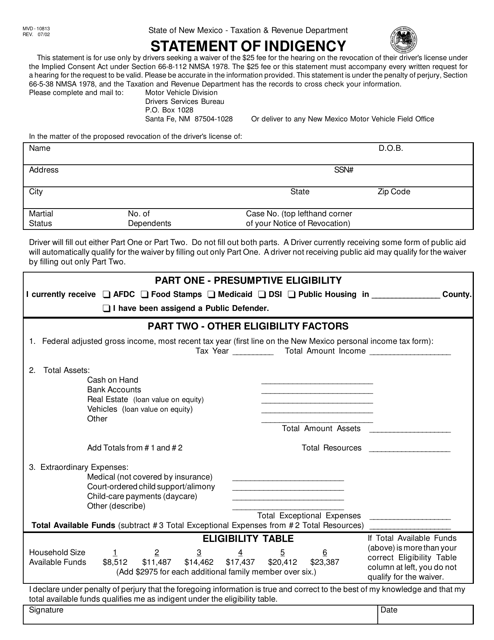

This Form is used for individuals in New Mexico to declare their indigency status when applying for certain services or benefits. It helps determine if the person qualifies for reduced fees or waivers based on their financial situation.

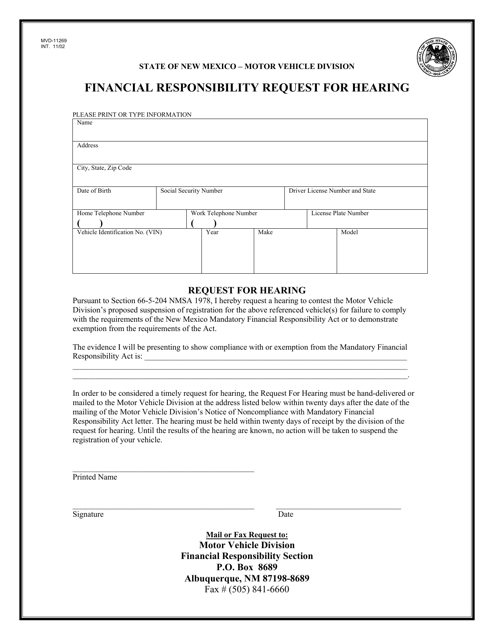

This form is used for requesting a hearing regarding financial responsibility requirements in the state of New Mexico.