New Jersey Department of the Treasury Forms

Documents:

1110

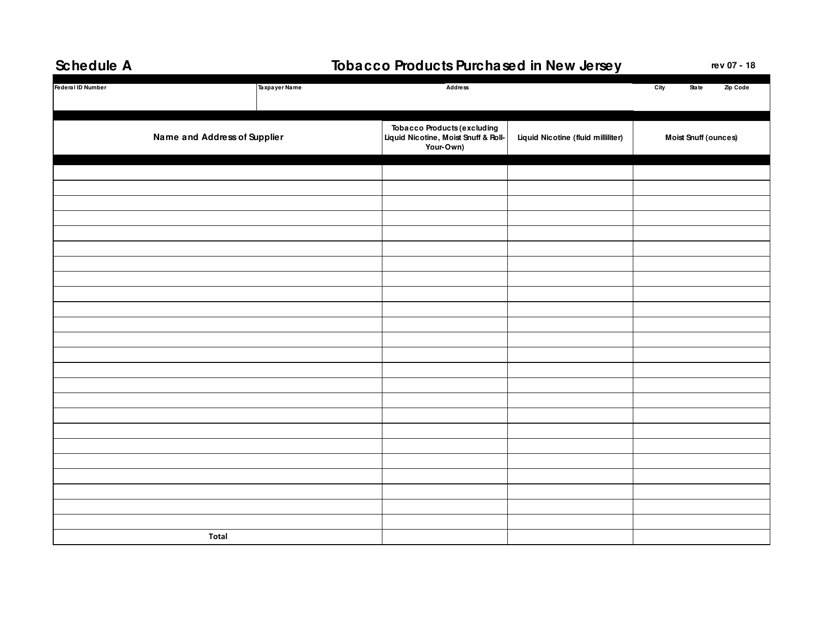

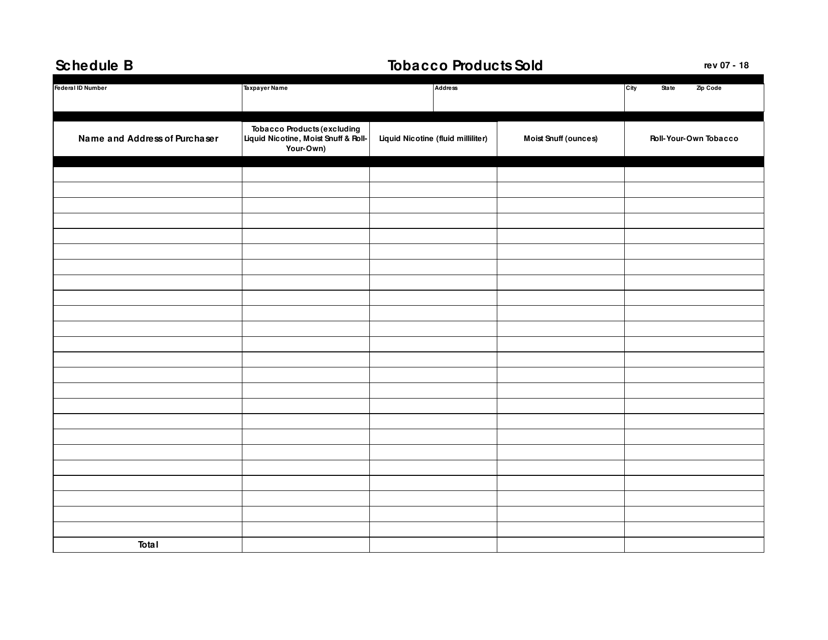

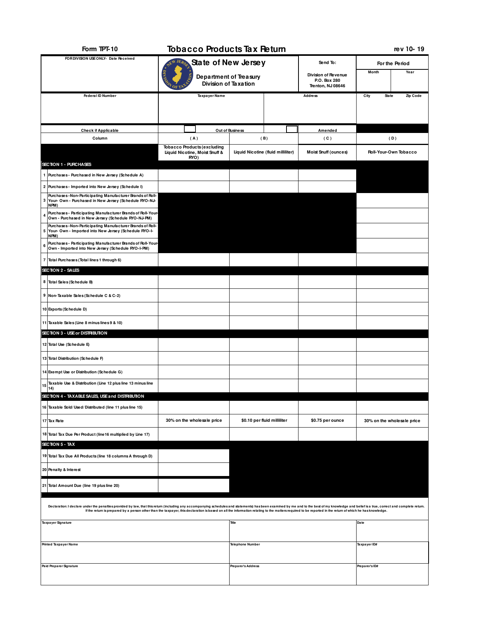

This type of document is used by tobacco product sellers in New Jersey to report their sales.

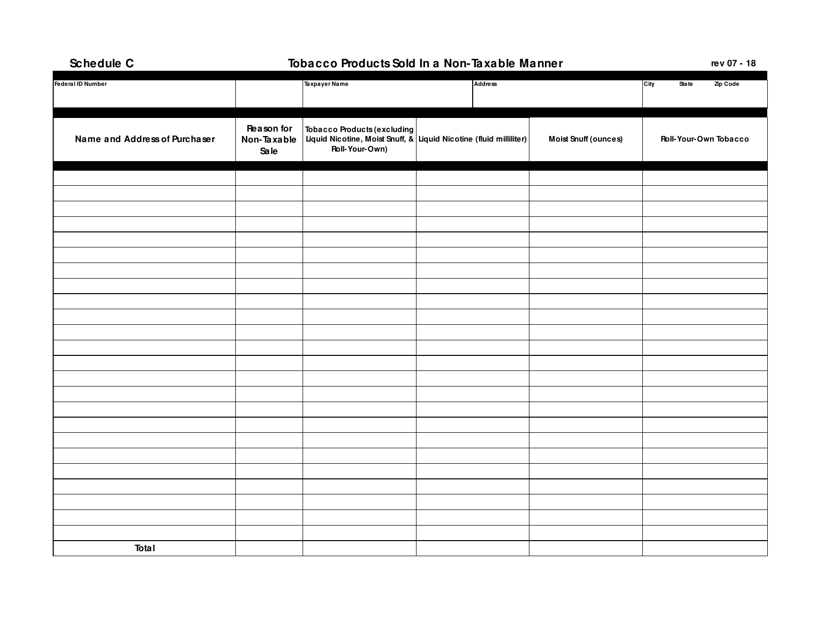

This document is for reporting tobacco products that were sold in a non-taxable manner in the state of New Jersey. It is used for recording sales that are exempt from tobacco taxes in the state.

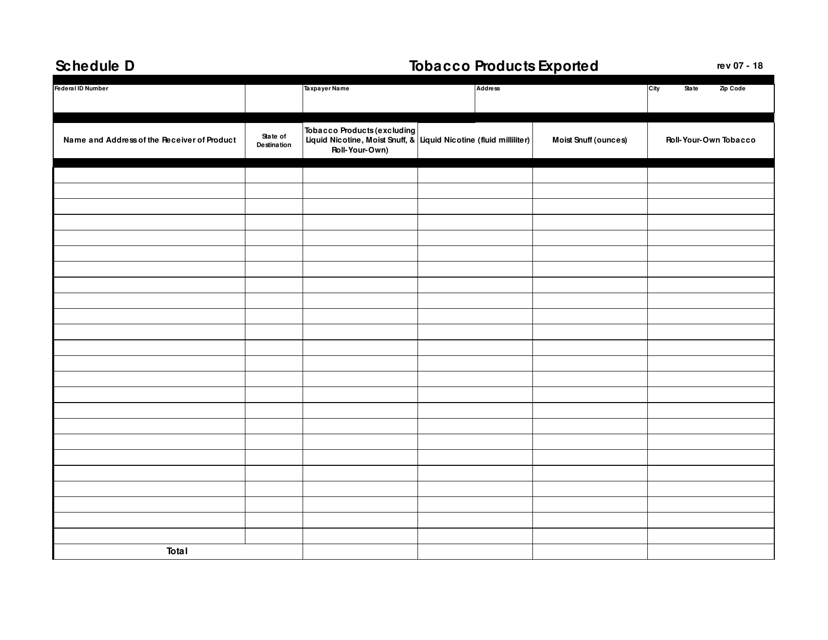

This type of document is used for reporting the export of tobacco products from New Jersey.

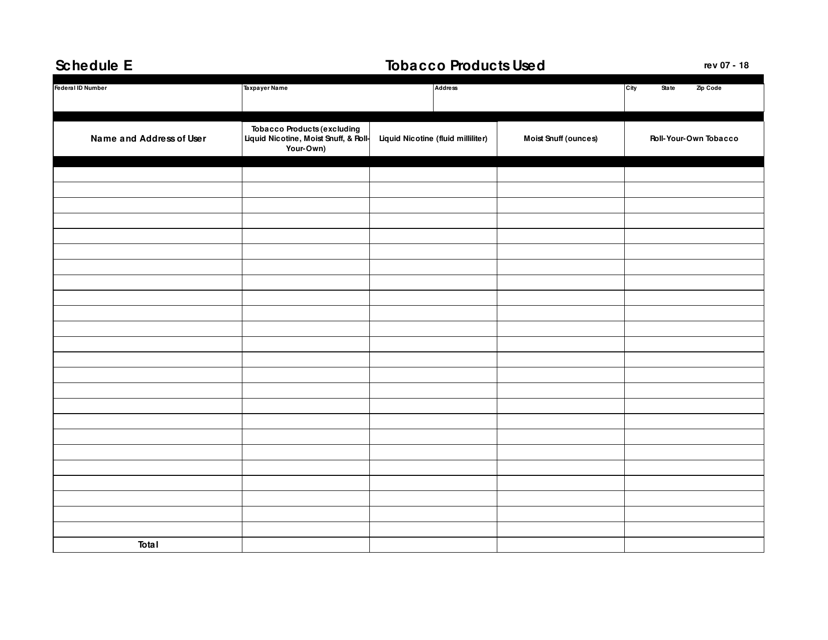

This document is used for reporting the usage of tobacco products in the state of New Jersey. It is a form that must be filled out by individuals or businesses who use tobacco products and is used for tax purposes.

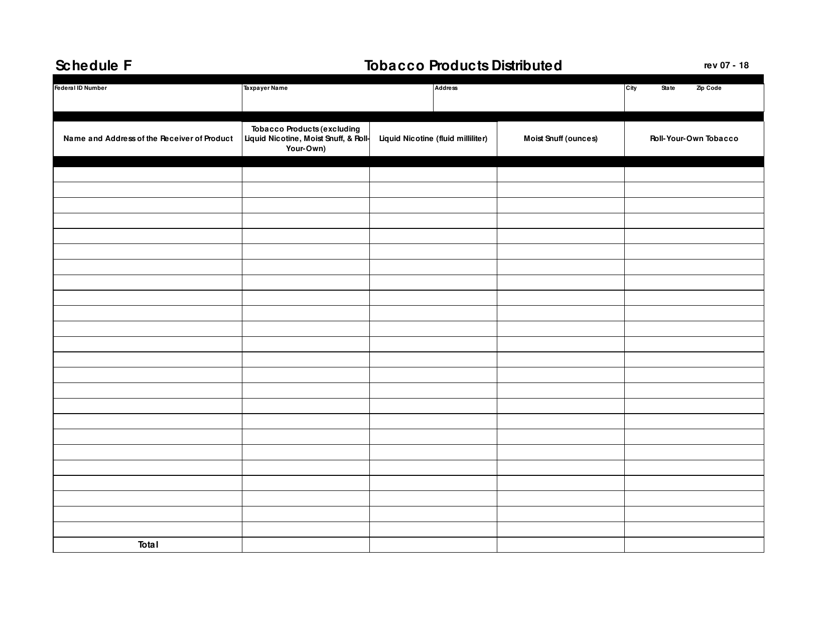

This document is used for reporting the distribution of tobacco products in New Jersey.

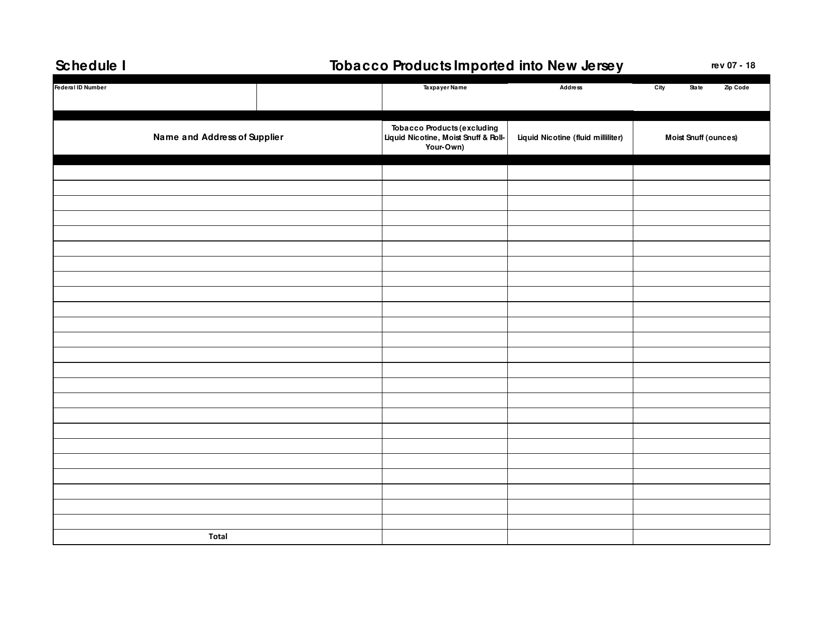

This document is a schedule for the importation of Schedule I tobacco products into New Jersey. It provides guidelines and regulations for importing these products into the state.

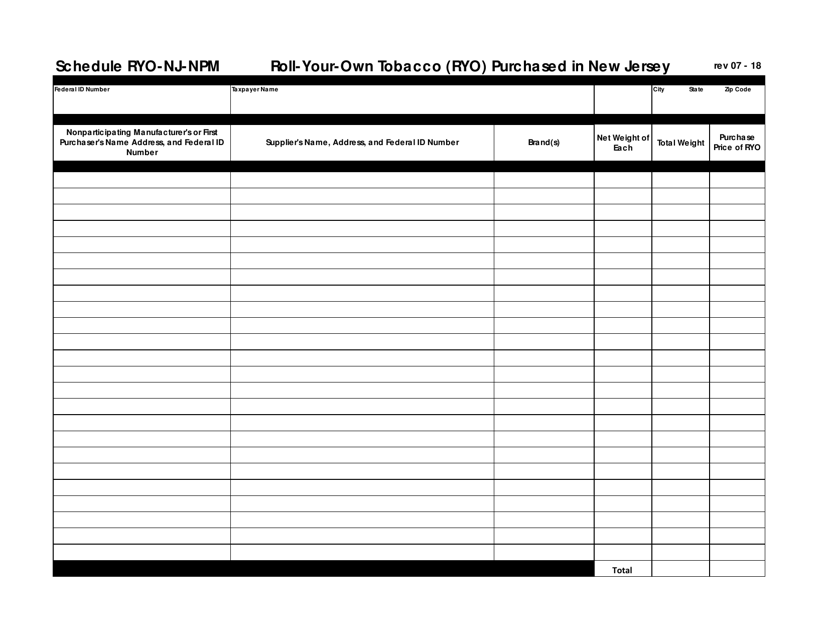

This document is used for reporting the purchase of roll-your-own tobacco (RYO) from a non-participating manufacturer (NPM) in New Jersey. It is specific to businesses in New Jersey that deal with RYO tobacco products.

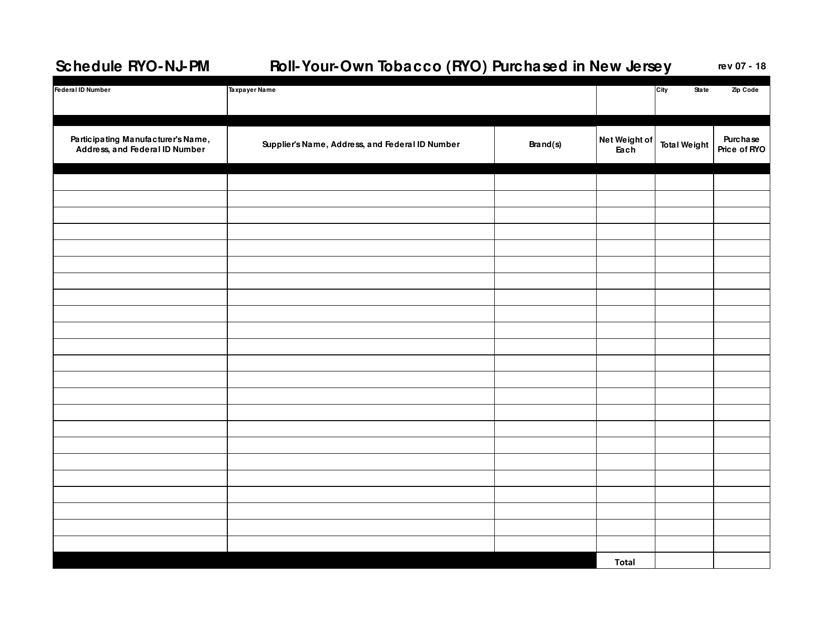

This document is for reporting the purchase of Roll-Your-Own tobacco (RYO) in New Jersey from participating manufacturers located in New Jersey.

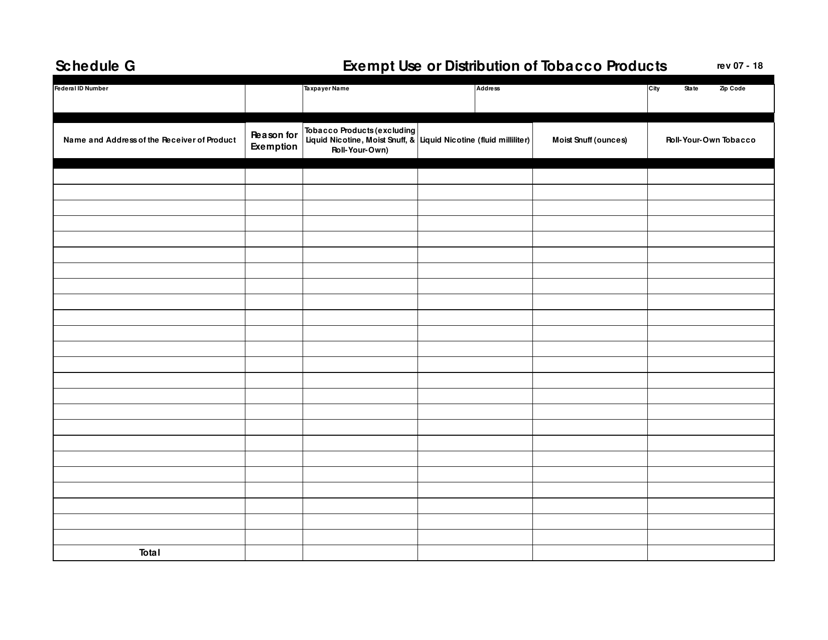

This document is used for reporting the exempt use or distribution of tobacco products in the state of New Jersey.

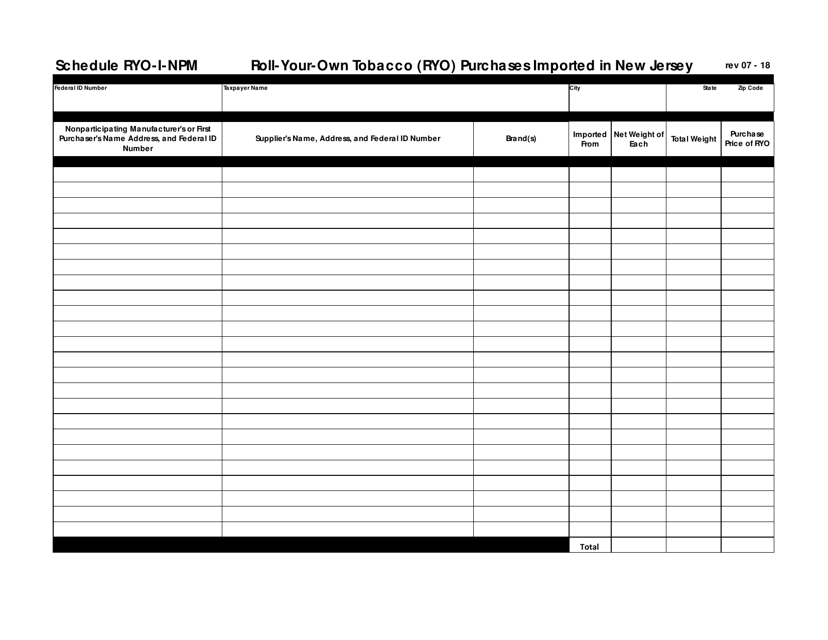

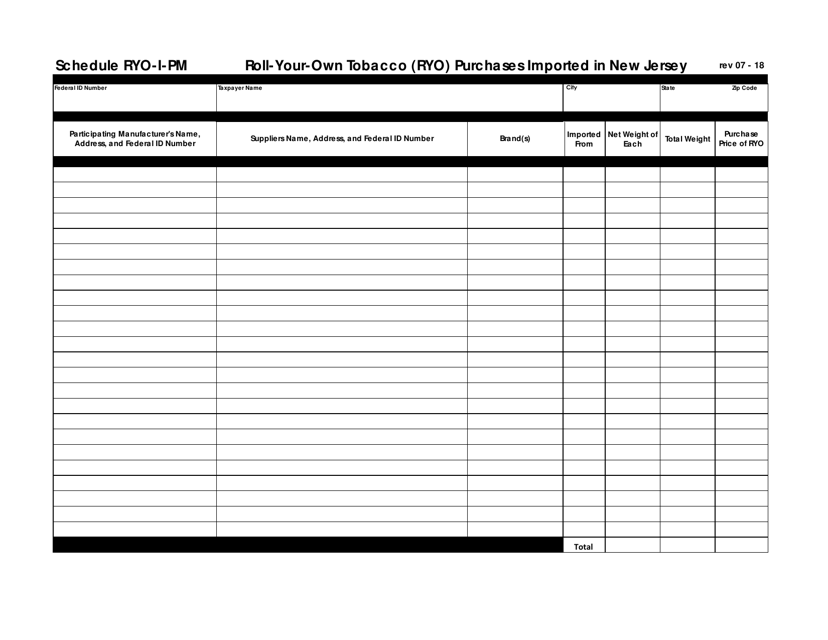

This type of document is used for reporting the imported roll-your-own tobacco (RYO) purchases in New Jersey.

This document is used for reporting imported roll-your-own tobacco purchases in New Jersey.

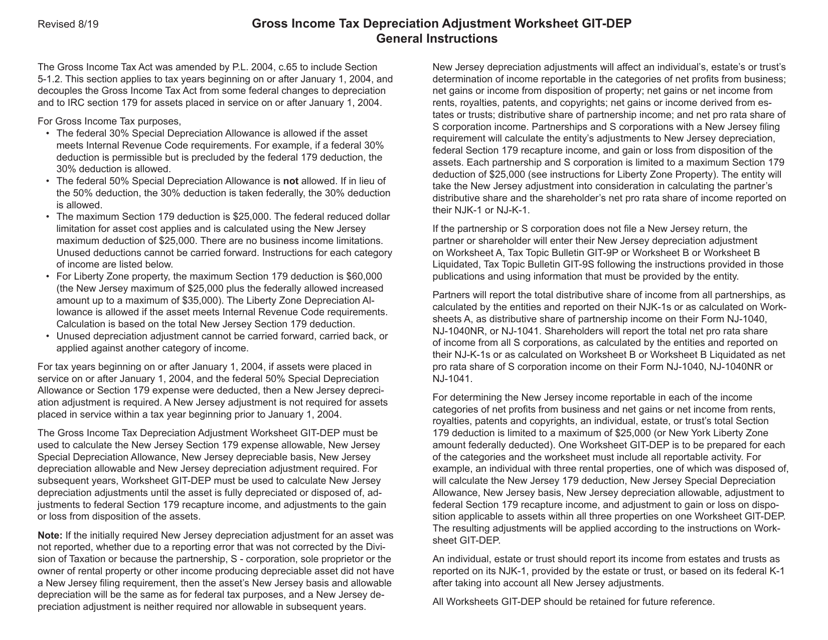

This document is a worksheet used in New Jersey to calculate the depreciation adjustment for gross income tax purposes. It helps individuals and businesses determine their taxable income by factoring in the depreciation of their assets.

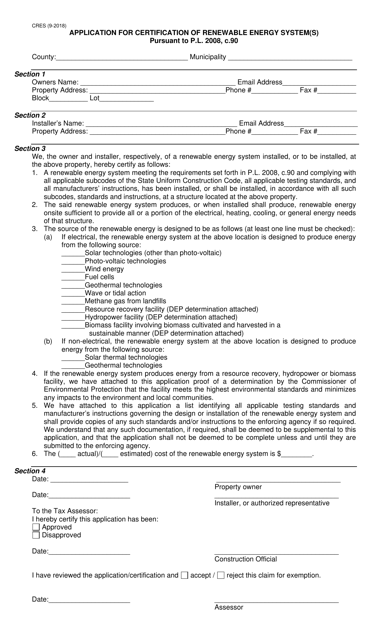

This Form is used for applying for certification of renewable energy systems in New Jersey. It is required by P.l. 2008, C.90.

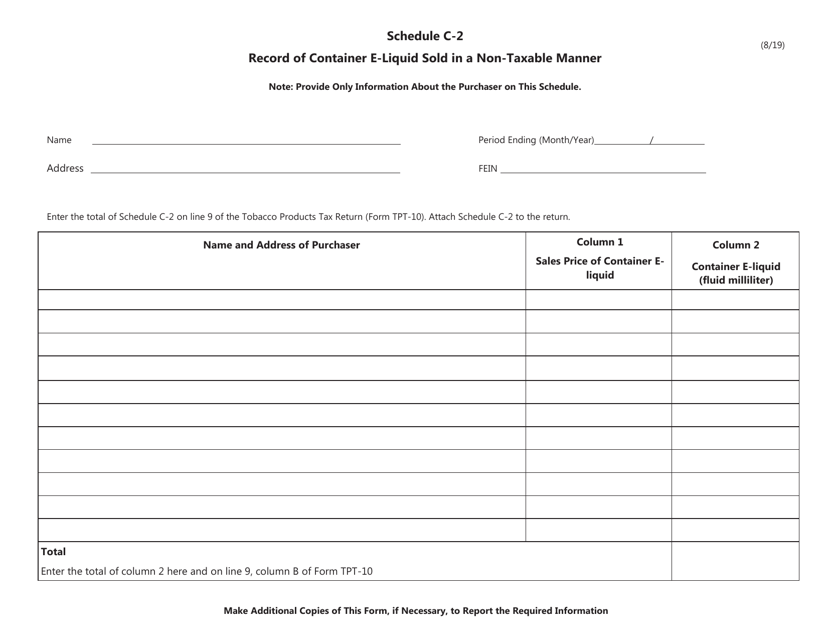

This document is used for keeping a record of the container e-liquid sold in a non-taxable manner in the state of New Jersey. It is required for businesses to track and report their sales of e-liquid products that are not subject to taxation.

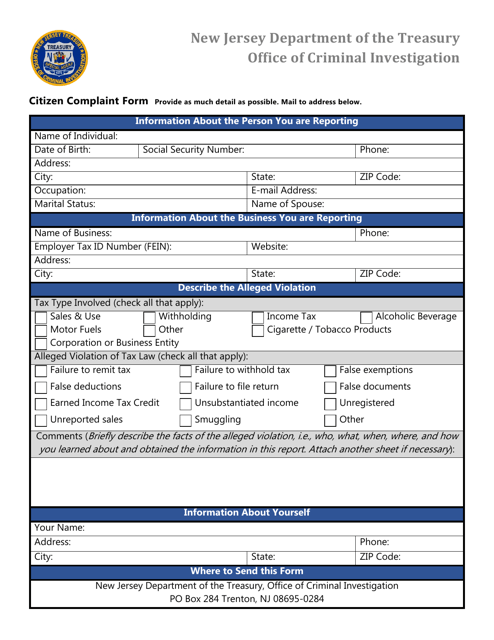

This Form is used for residents of New Jersey to file a complaint about any issue or incident involving government agencies or public officials.

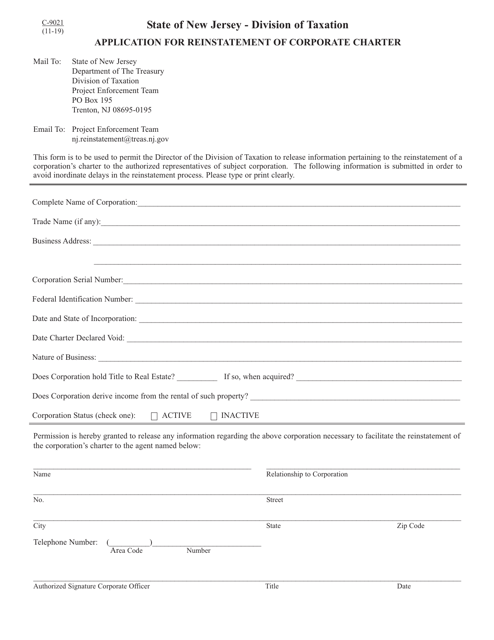

This Form is used for applying for the reinstatement of a corporate charter in the state of New Jersey.

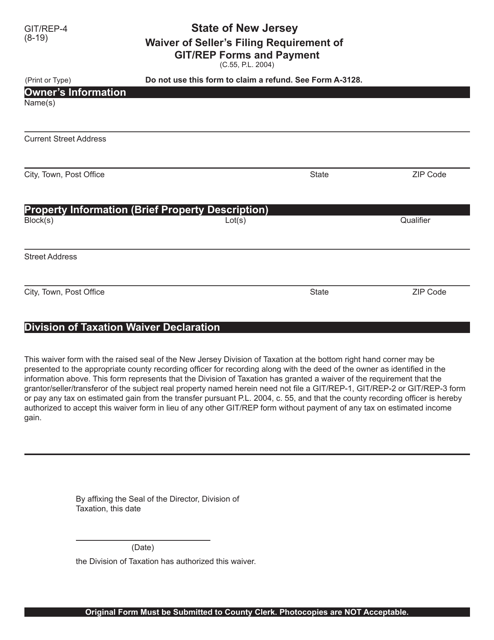

This form is used for waiving the seller's filing requirement of GIT/REP forms and payment in New Jersey.

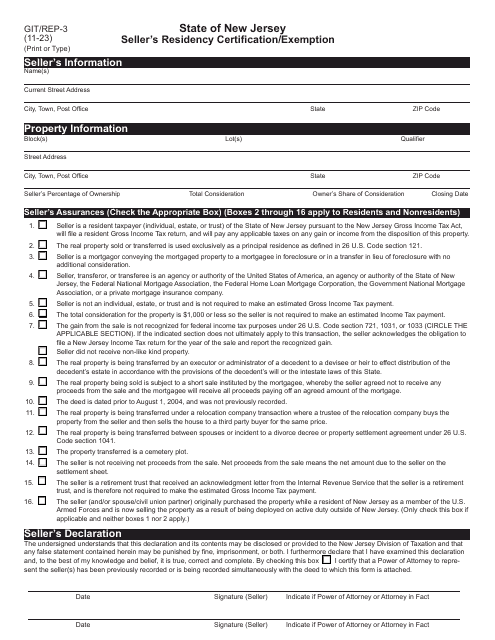

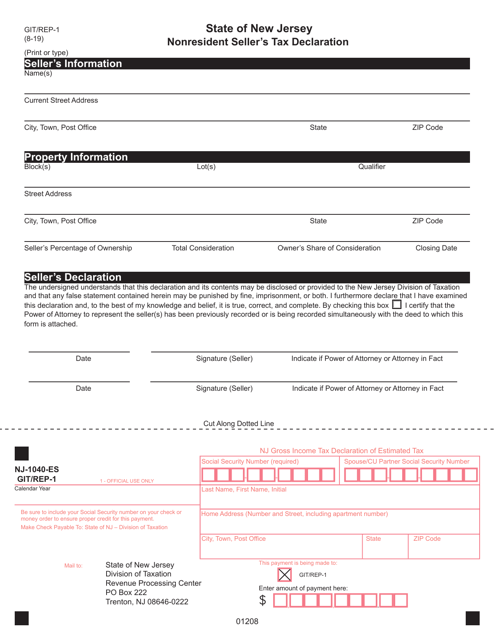

This form is used for nonresident sellers to declare their taxes in New Jersey.

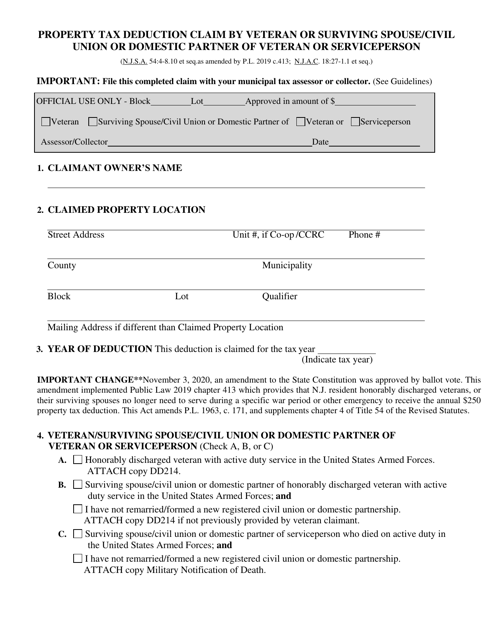

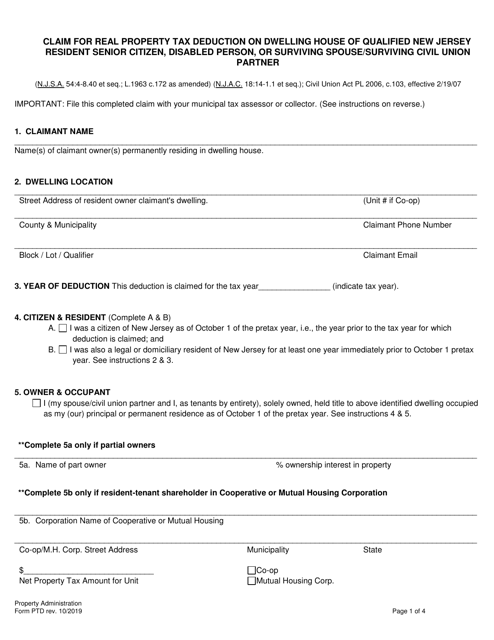

This Form is used for claiming a real property tax deduction on a dwelling house in New Jersey for qualified senior citizens, disabled persons, or surviving spouse/surviving civil union partners.

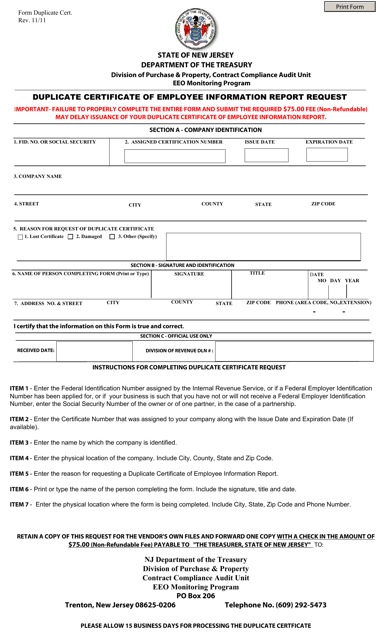

This document is used to request a duplicate certificate for an Employee Information Report in the state of New Jersey.

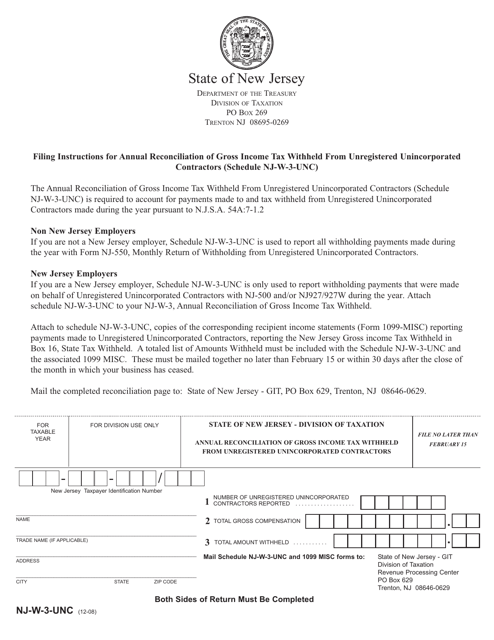

This form is used for the annual reconciliation of gross income tax withheld from unregistered unincorporated contractors in the state of New Jersey.