Nevada Department of Taxation Forms

The Nevada Department of Taxation is responsible for administering and enforcing tax laws in the state of Nevada. Its main purpose is to collect and distribute various taxes, including sales tax, use tax, gaming tax, excise tax, and other related taxes. The department is also responsible for ensuring compliance with tax laws, providing taxpayer assistance, processing tax returns, and conducting audits to prevent tax evasion and fraud.

Documents:

183

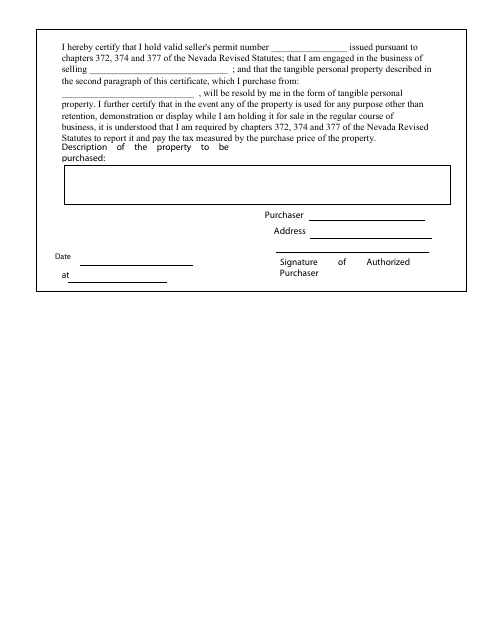

This type of document is used for certifying the resale of a property in Nevada. It provides important information about the property's condition and any liens or encumbrances.

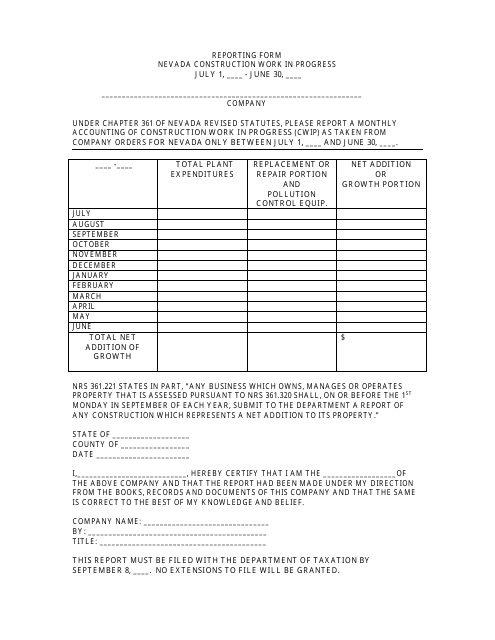

Nevada-based companies need to report a monthly accounting of construction work in progress (CWIP) to the Nevada Department of Taxation under Chapter 361 of Nevada Revised Statutes.

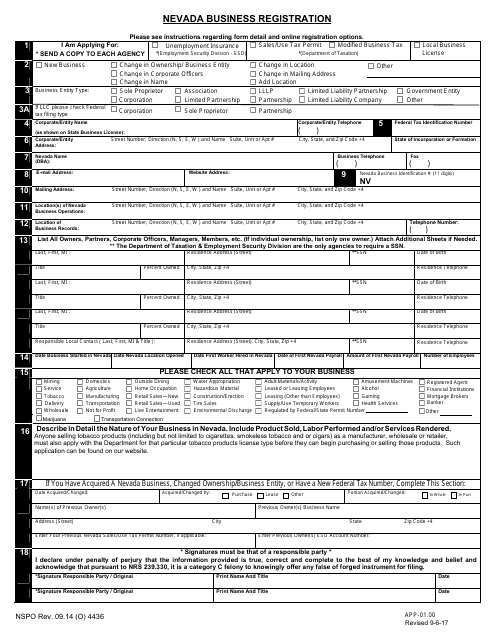

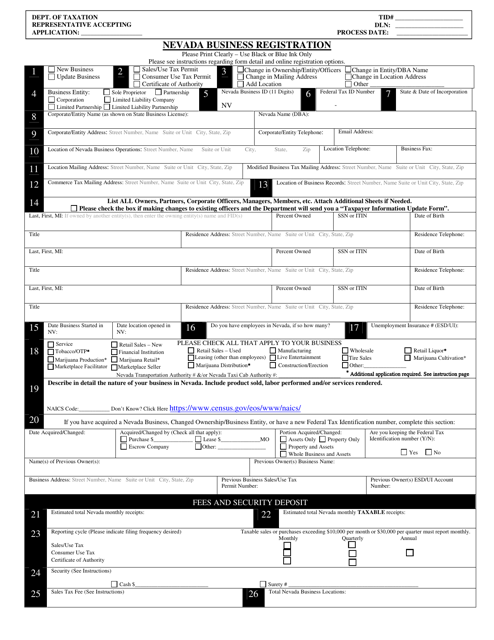

This Form is used for registering a business in Nevada.

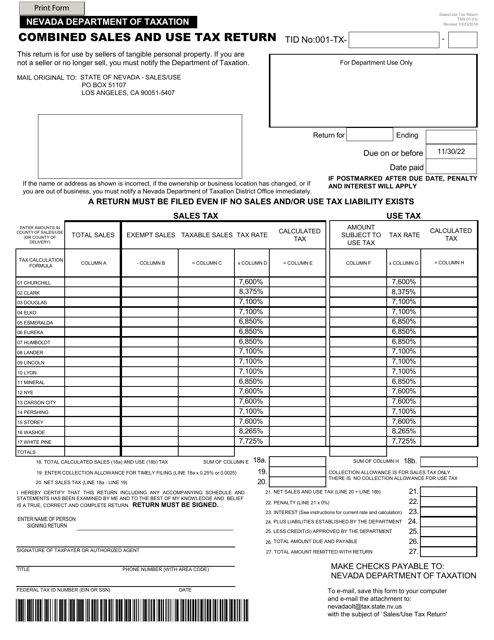

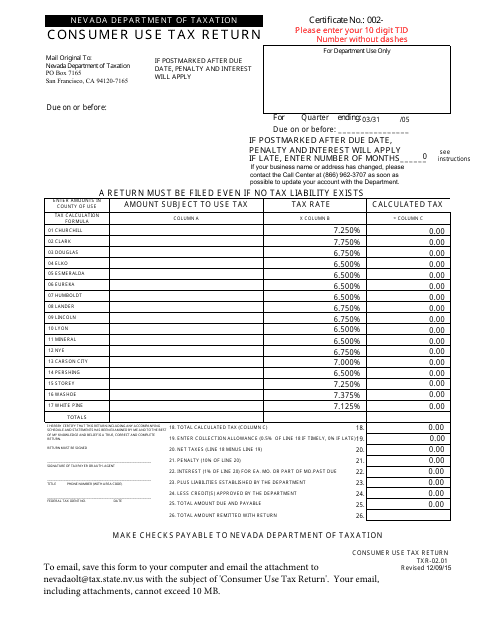

This Form is used for reporting and paying consumer use tax in the state of Nevada.

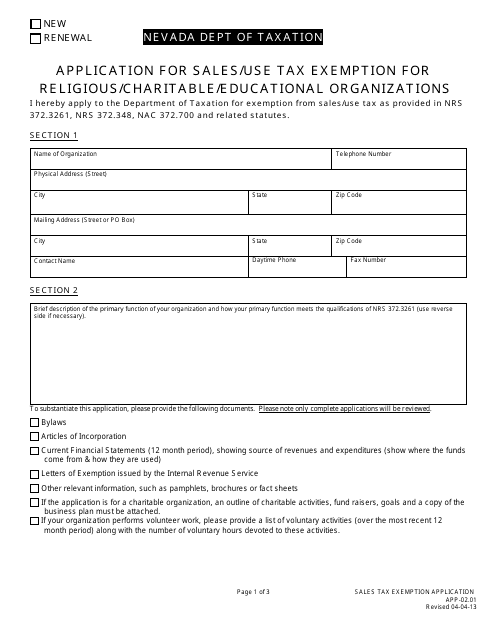

This form is used for religious, charitable, and educational organizations in Nevada to apply for sales and use tax exemption.

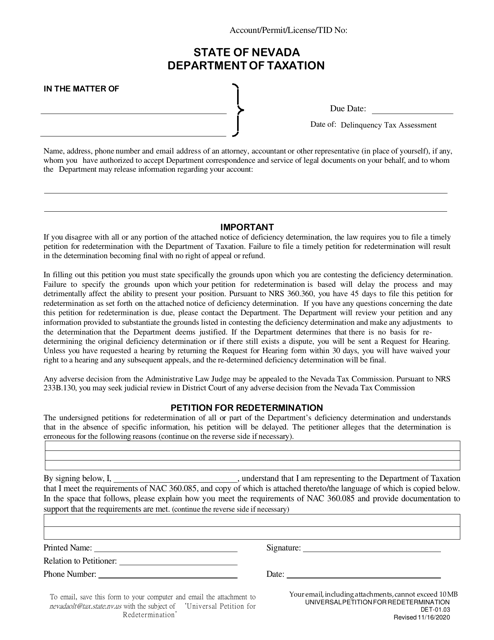

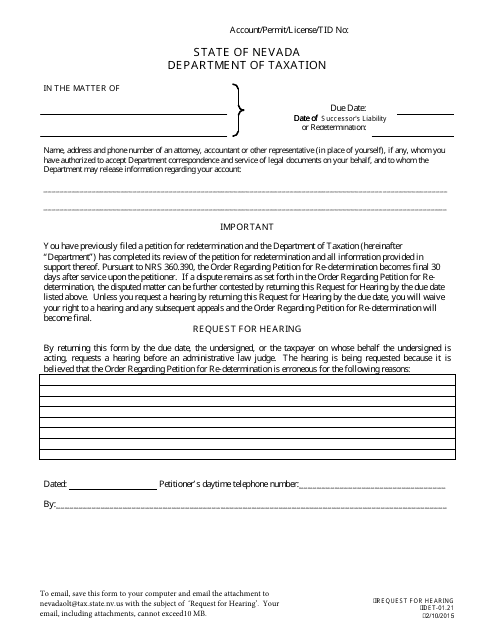

This form is used for requesting a hearing in the state of Nevada.

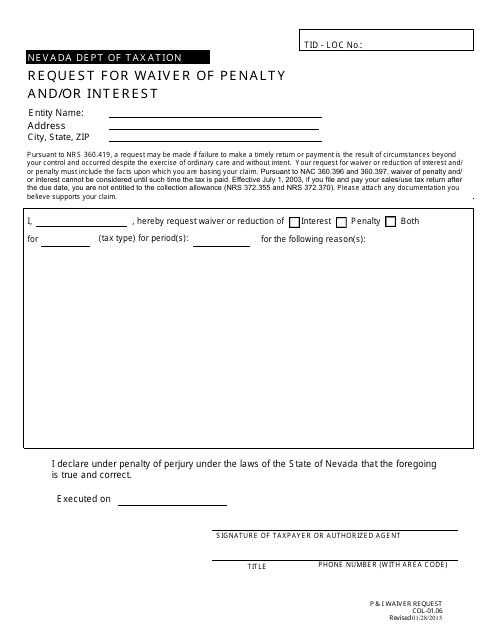

This Form is used for requesting a waiver of penalty and/or interest in the state of Nevada.

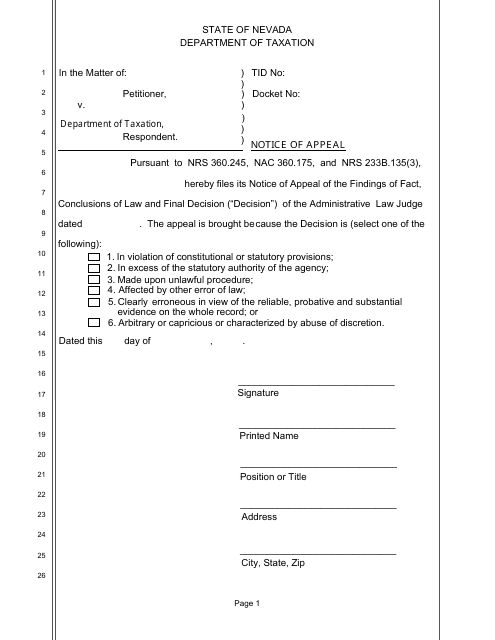

This Form is used for filing an appeal in the state of Nevada. It is a legal document that notifies a higher court of the party's intention to challenge a lower court's decision.

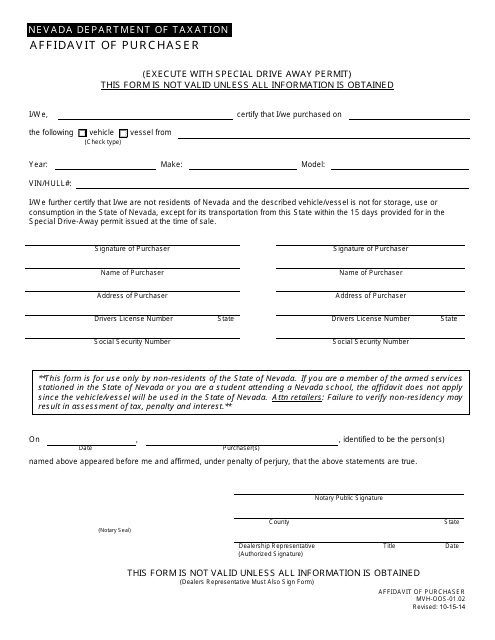

This form is used for submitting an affidavit by a purchaser in Nevada. It is a legal document that affirms details of a purchase transaction.

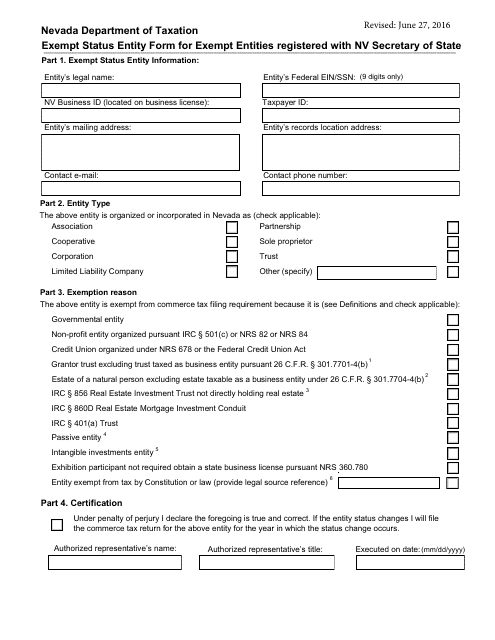

This form is used for exempt entities that are registered with the Secretary of State in Nevada to apply for exempt status. It allows these entities to claim exemptions from certain taxes or fees.

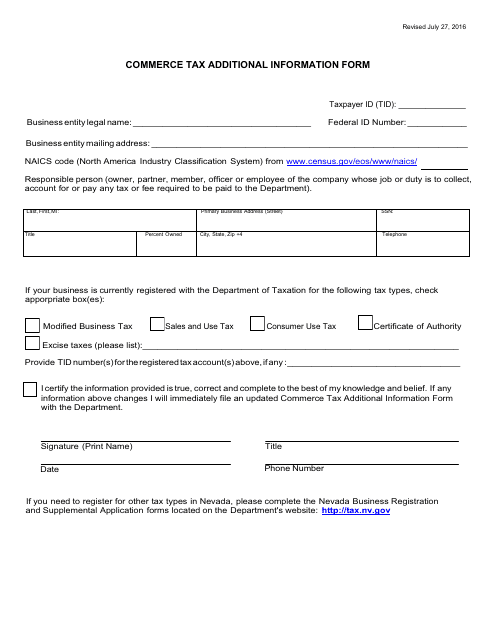

This form is used for providing additional information related to the Commerce Tax in the state of Nevada. It is required to provide additional details and clarify certain aspects of the tax filing process.

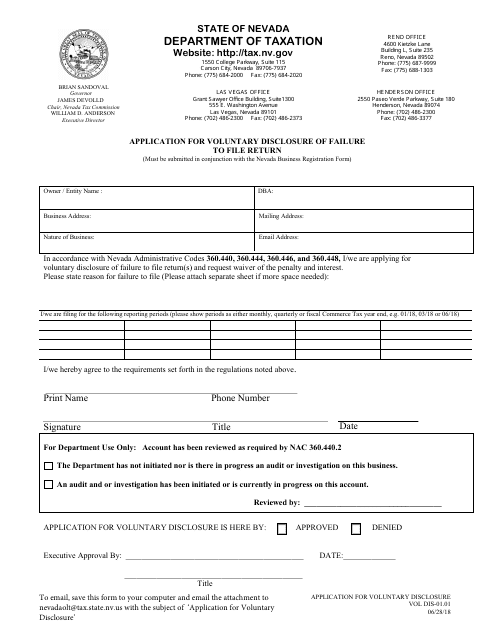

This form is used for individuals or businesses in Nevada who have failed to file a tax return and want to voluntarily disclose their mistake to the state. By filling out this application, you can avoid penalties and potential legal consequences.

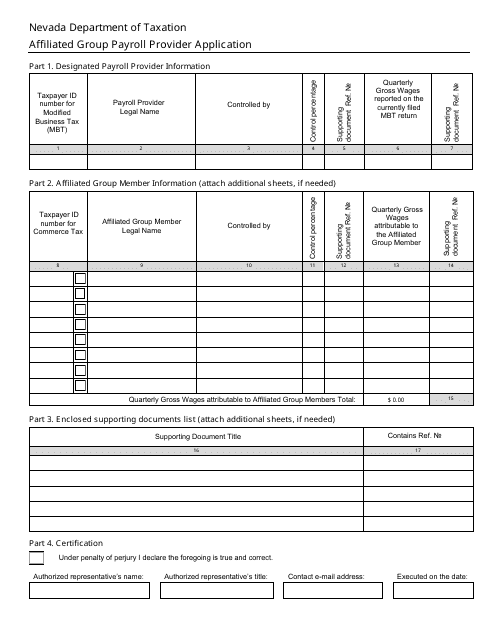

This document is an application form for a payroll provider that is seeking to become affiliated with a group in Nevada.

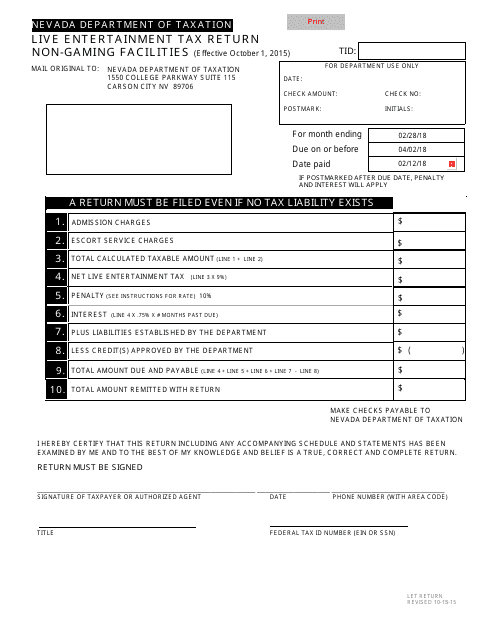

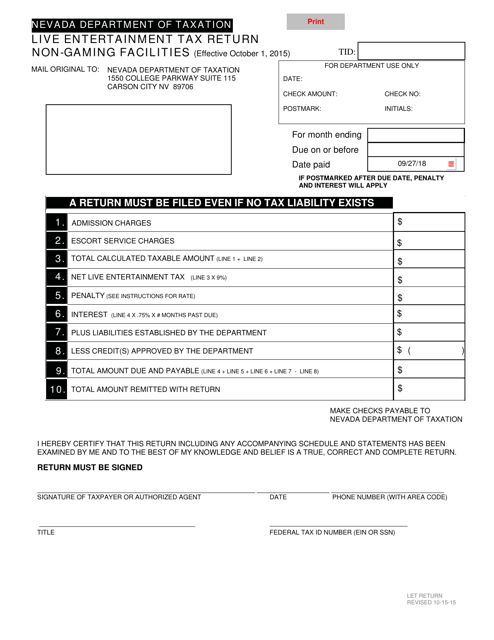

This document is used for reporting and paying the Live Entertainment Tax for non-gaming facilities in Nevada. It is required for businesses that provide live entertainment, such as concerts, shows, or performances, but do not have gaming activities.

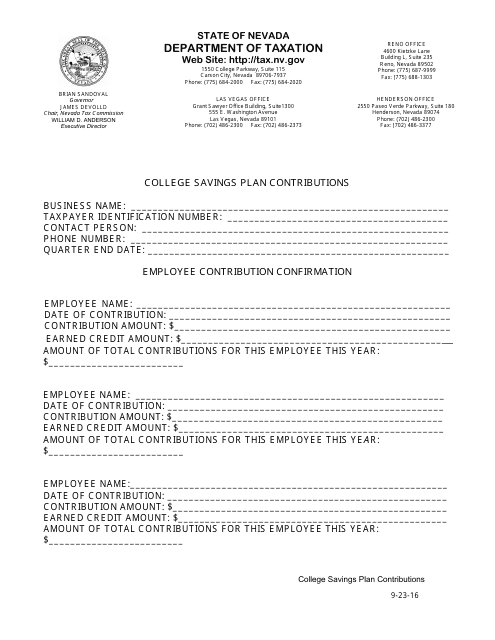

This document is for payroll tax purposes in Nevada. It provides information about a credit for matching employee contributions to prepaid tuition contracts and college savings trust accounts.

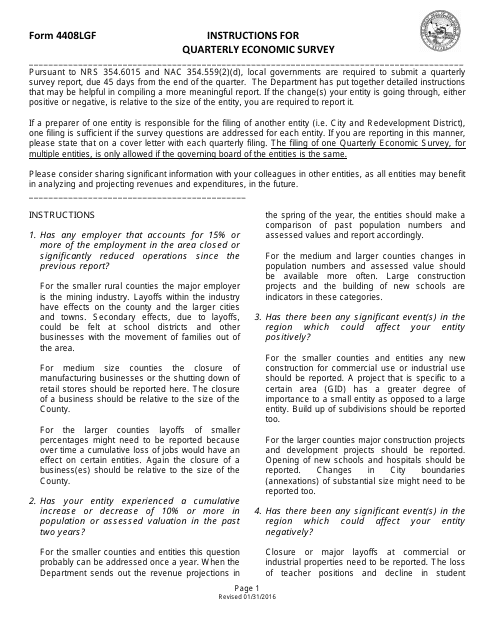

This Form is used for completing the Quarterly Economic Survey in Nevada. It provides instructions for filling out the form and gathering the necessary information for a comprehensive economic assessment.

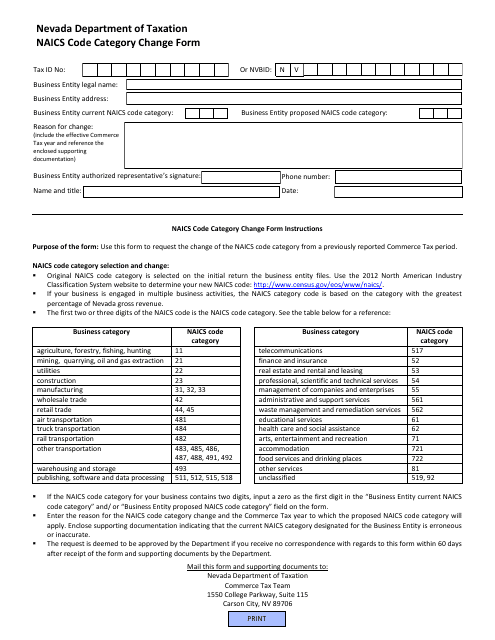

This Form is used for changing the NAICS code category in Nevada.

This document explains the Live Entertainment Tax regulations in Nevada for non-gaming establishments with an occupancy of more than 200 people. It covers the tax requirements and guidelines for businesses that provide live entertainment services to their customers.

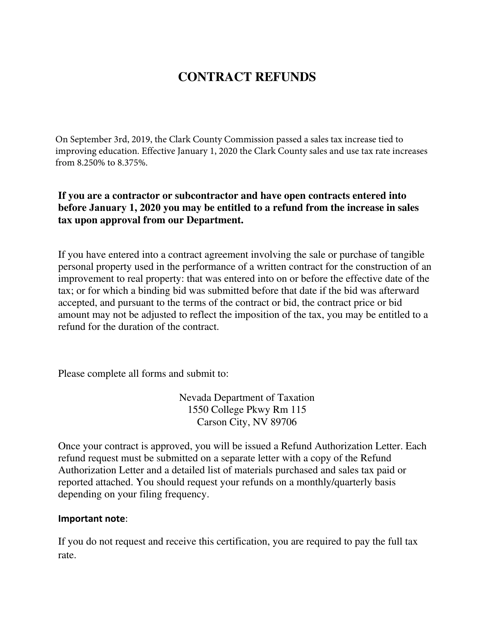

This form is used for contractors in Nevada to request a refund. Contractors can use this application to claim a refund for overpaid fees or taxes.

This Form is used for registering a business in the state of Nevada. It requires information about the business entity, owners, and other details required for registration.

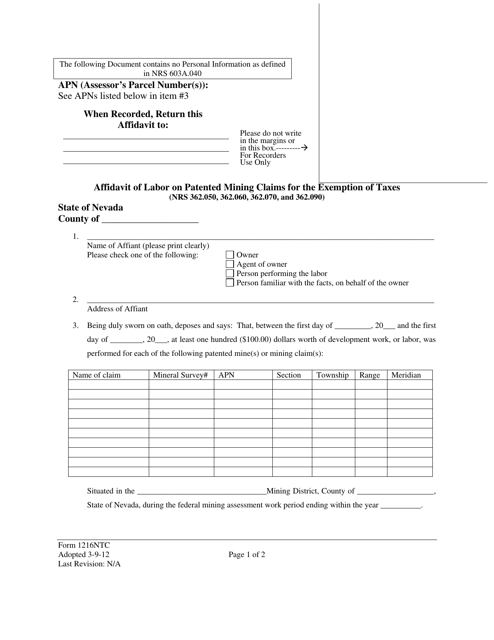

This Form is used for submitting an Affidavit of Labor on Patented Mining Claims in Nevada to qualify for tax exemptions.

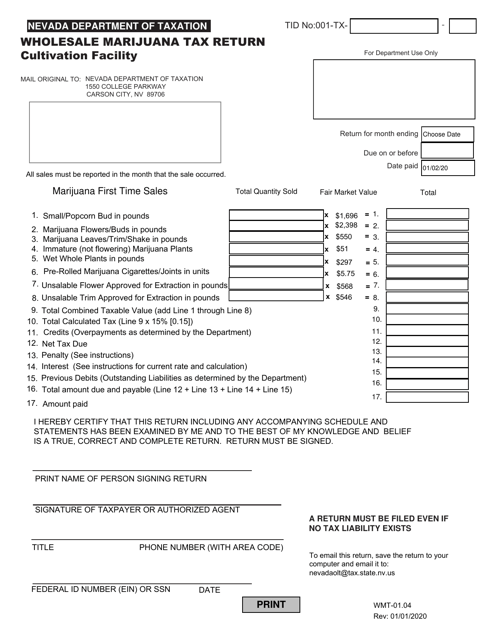

This form is used for filing wholesale marijuana tax returns in Nevada.

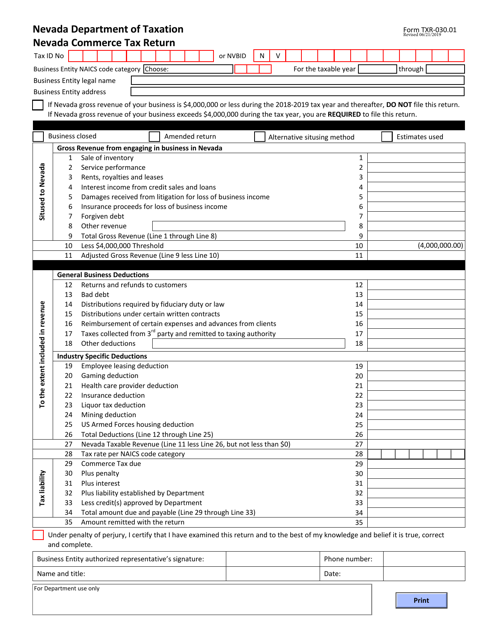

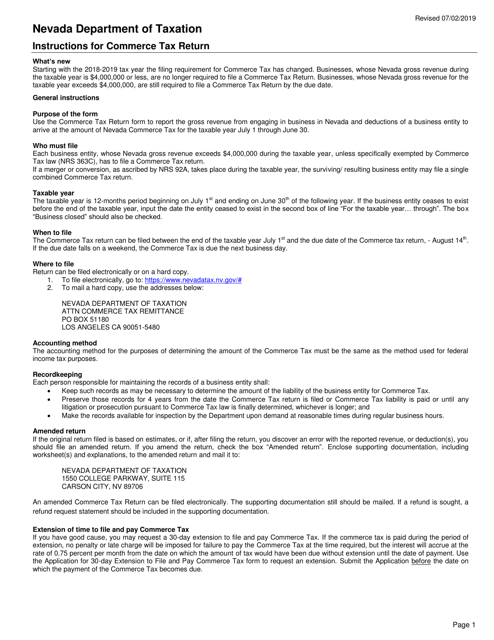

This document provides the instructions for completing the Nevada Commerce Tax Return, which is used by businesses in Nevada to report and pay their commerce tax. The form provides guidance on completing each section of the return and includes information on filing deadlines and payment instructions.

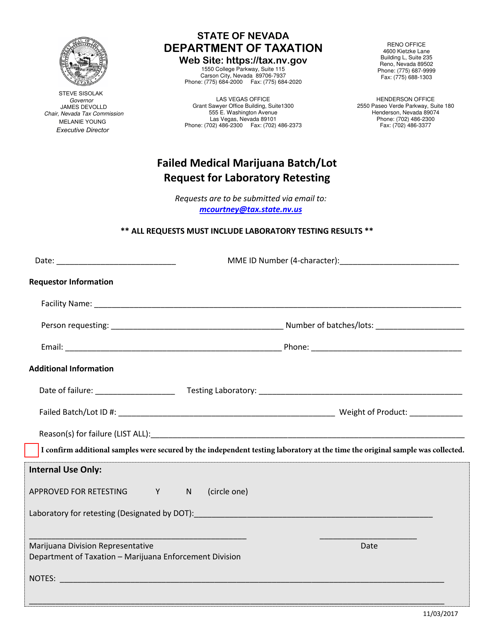

This document is a request to have a failed batch or lot of medical marijuana in Nevada retested at a laboratory.

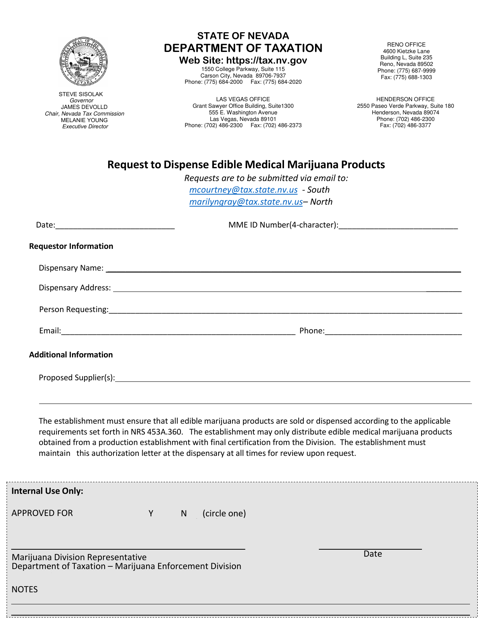

This form is used for requesting the dispensation of edible medical marijuana products in Nevada.

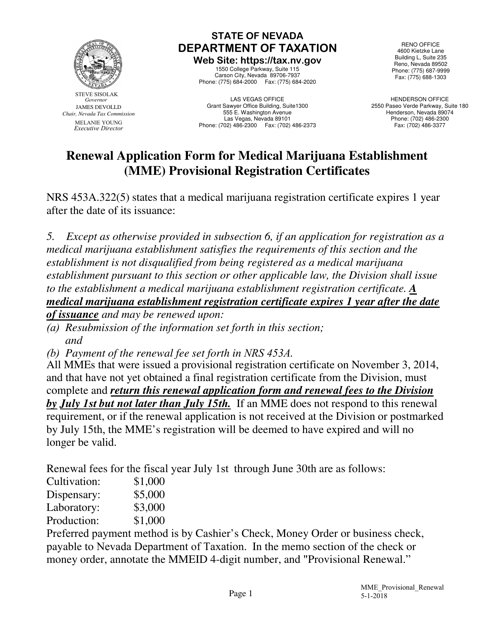

This form is used for renewing the provisional registration certificates for Medical Marijuana Establishments (MMEs) in Nevada.

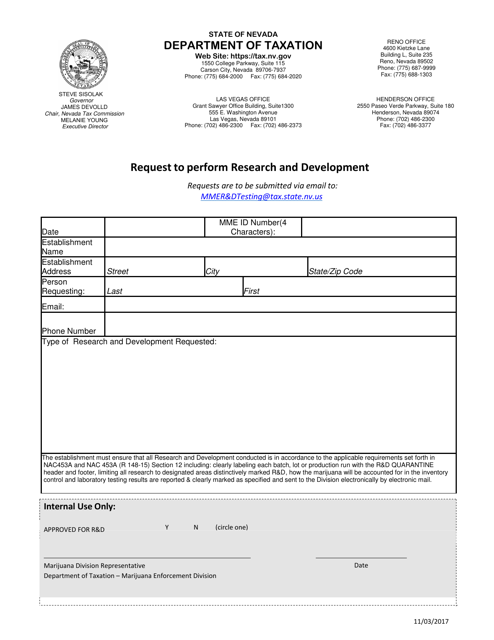

This Form is used for requesting permission to perform research and development activities in the state of Nevada.

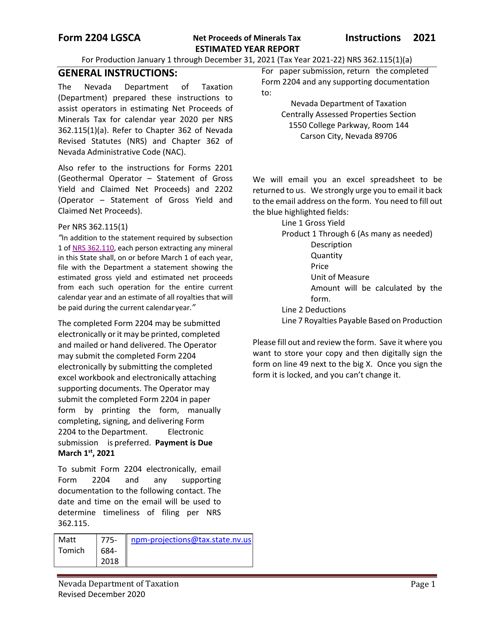

This Form is used for reporting estimated yearly net proceeds of minerals tax in Nevada.