Montana Department of Transportation Forms

Documents:

183

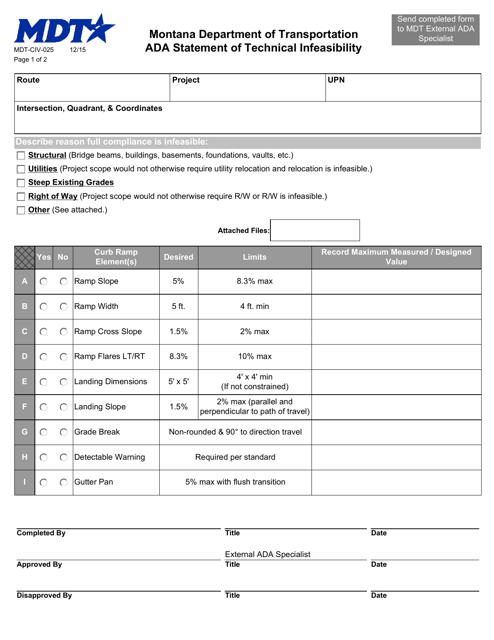

This form is used for filing a statement of technical infeasibility in the state of Montana regarding the Americans with Disabilities Act (ADA). It is a document for individuals or businesses that are claiming that making their property accessible for disabled individuals is technically impossible.

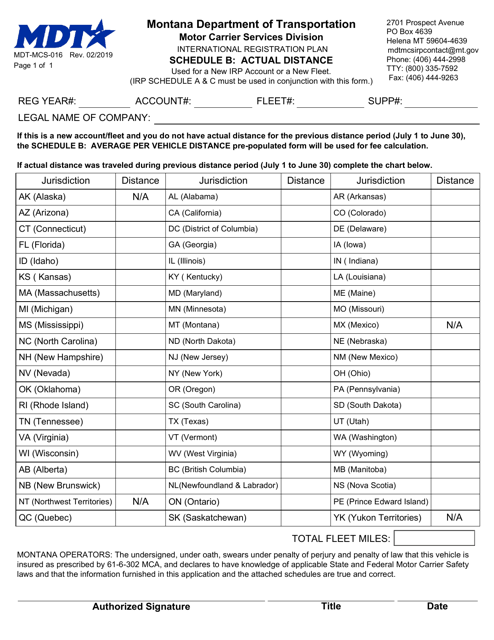

This form is used for reporting the actual distance traveled by vehicles registered under the International Registration Plan in Montana.

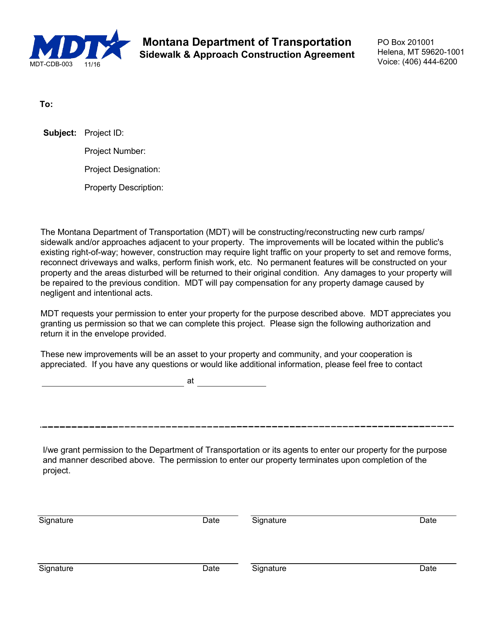

This form is used for the Sidewalk & Approach Construction Agreement in Montana.

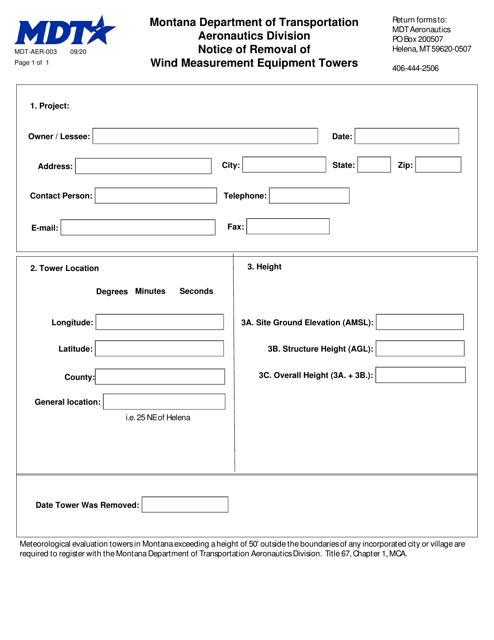

This form is used for providing notice of removal of wind measurement equipment towers in Montana.

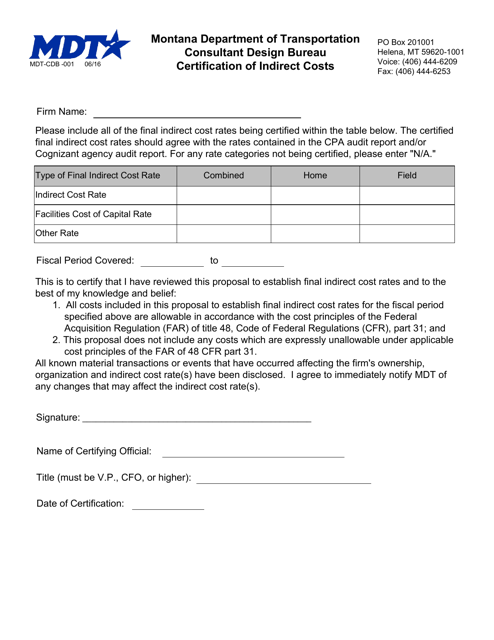

This form is used for certifying indirect costs in Montana.

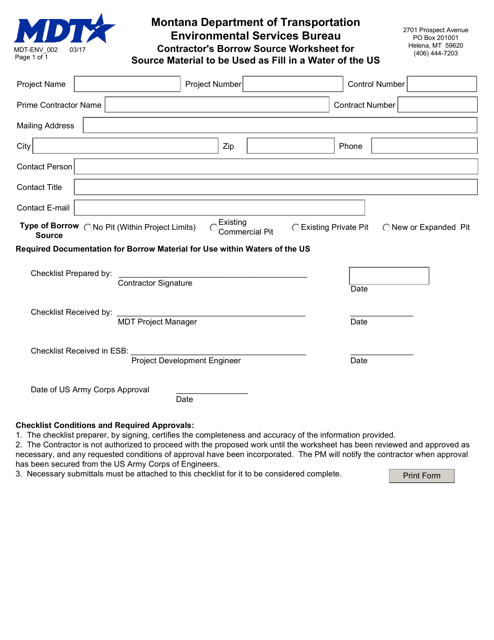

This Form is used for recording information about the contractor's borrow source material to be used as fill in a water project in Montana.

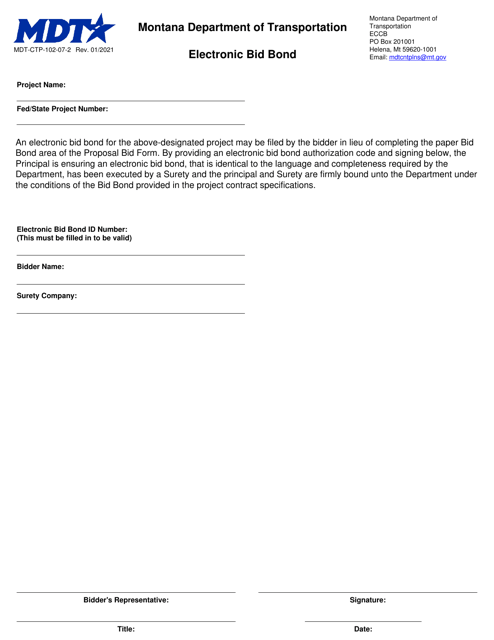

This document is used for submitting an electronic bid bond for a construction project in the state of Montana.

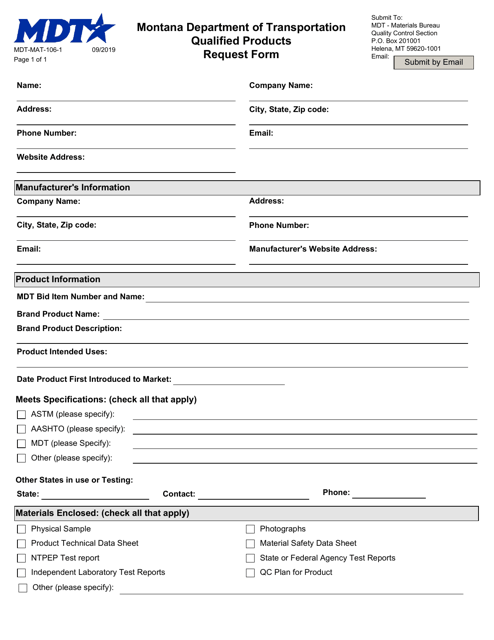

This form is used for submitting a request in Montana to qualify products for a specific purpose or project.

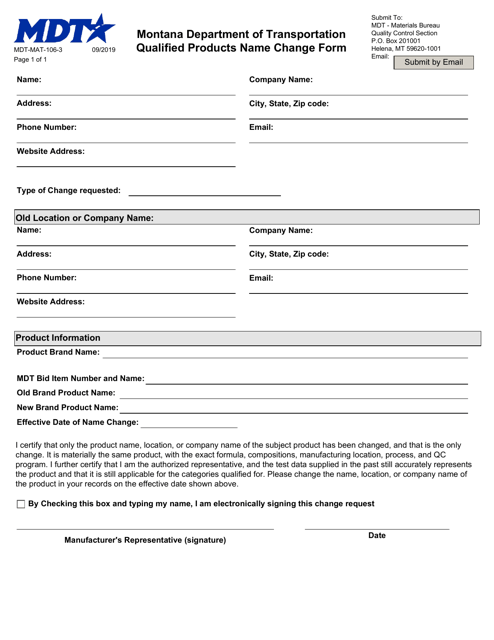

This form is used for changing the name of qualified products in Montana.

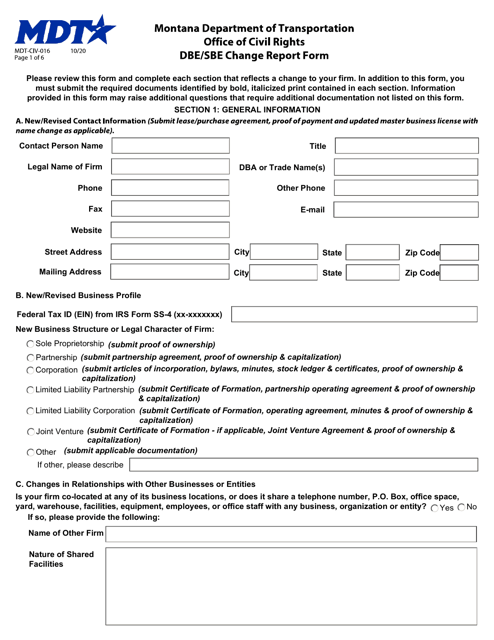

This form is used to report changes to the Disadvantaged Business Enterprise (DBE) or Small Business Enterprise (SBE) status in Montana.

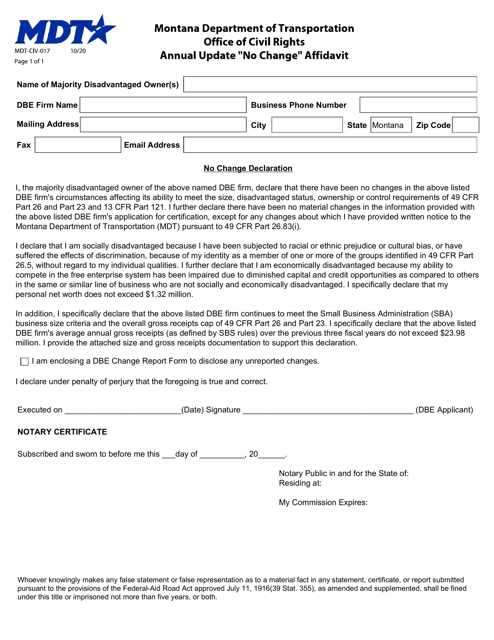

This form is used for submitting an "no change" affidavit for the annual update in Montana.

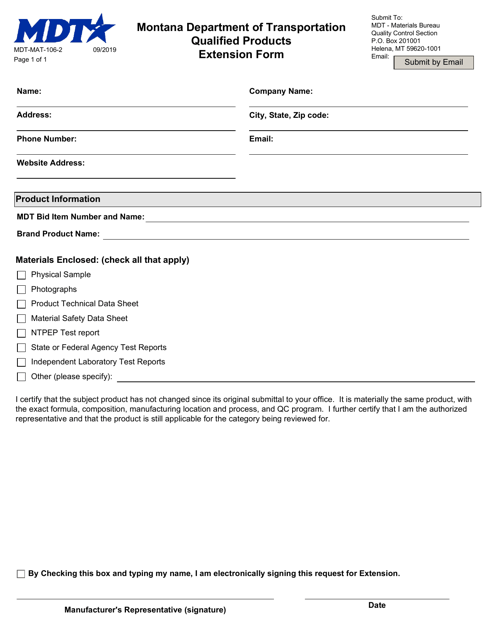

This Form is used for requesting an extension for qualified products in Montana.

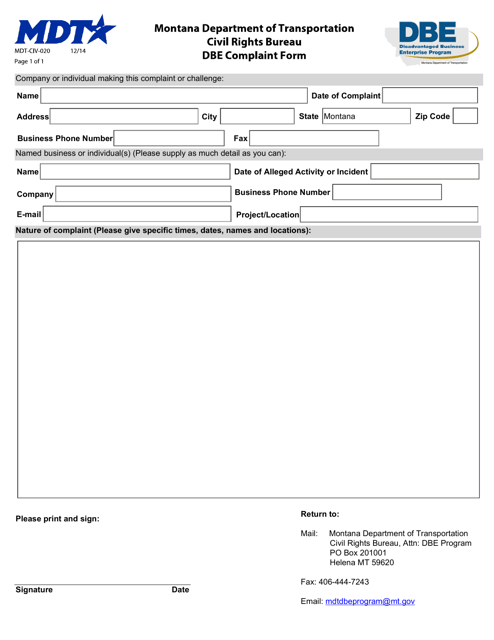

This document is used for filing a complaint concerning Disadvantaged Business Enterprise (DBE) program in the state of Montana.

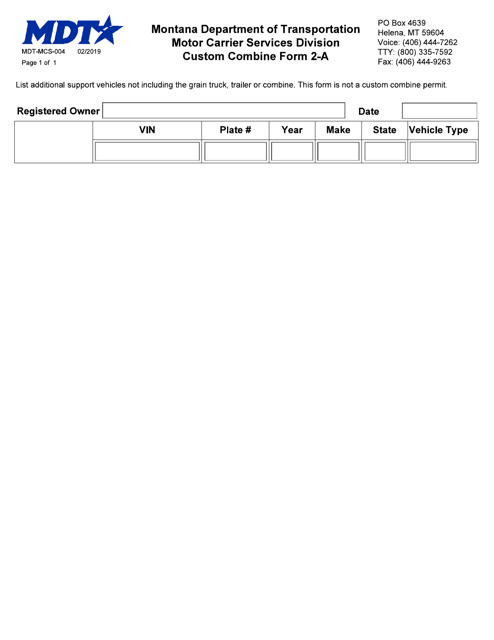

This form is used for custom combine operations in the state of Montana. It is known as Form 2A (MDT-MCS-004).

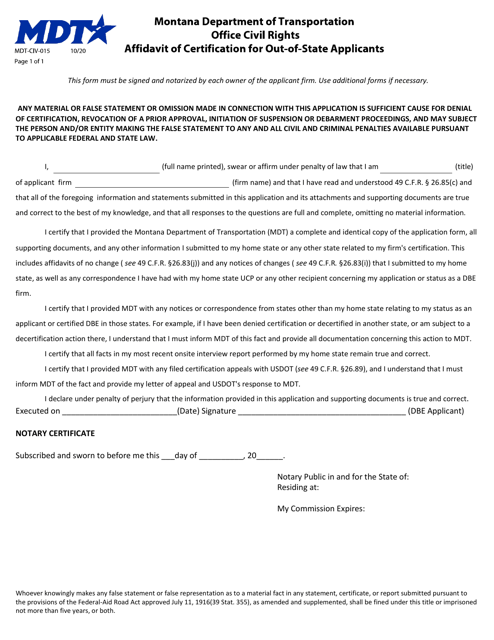

This form is used for out-of-state applicants seeking to certify their qualifications for a specific purpose in Montana. It serves as an affidavit of certification.

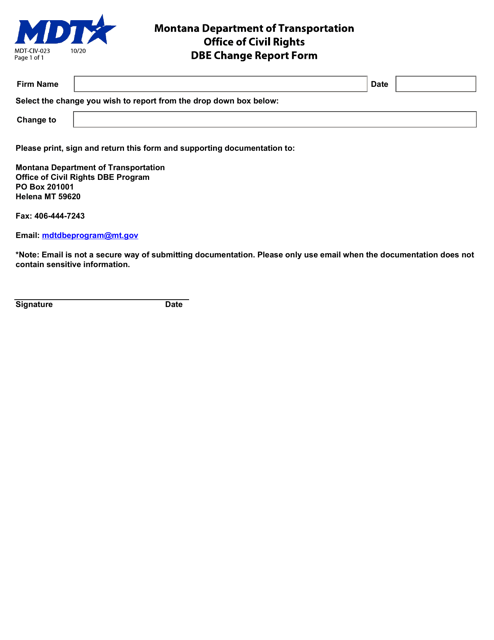

This form is used for reporting changes to the Disadvantaged Business Enterprise (DBE) program in Montana.

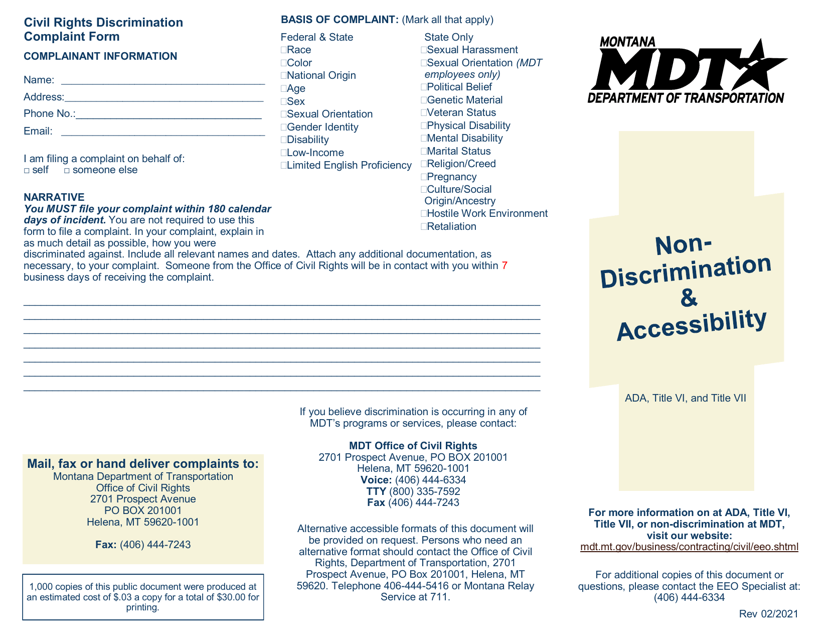

This form is used for filing a complaint regarding civil rights discrimination in the state of Montana.

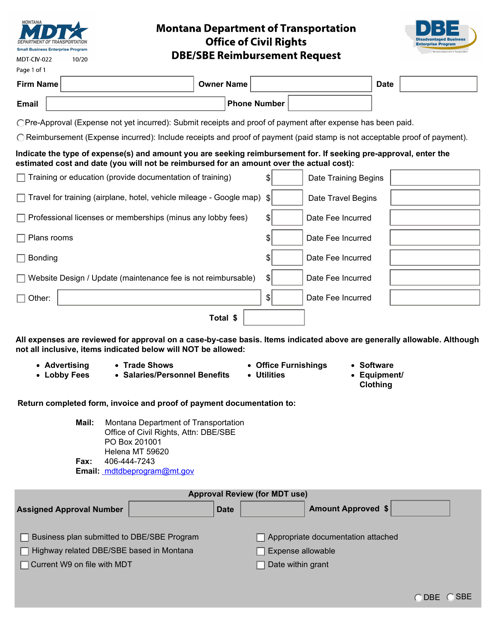

This form is used for requesting reimbursement for Disadvantaged Business Enterprise (DBE) and Small Business Enterprise (SBE) expenses in Montana.

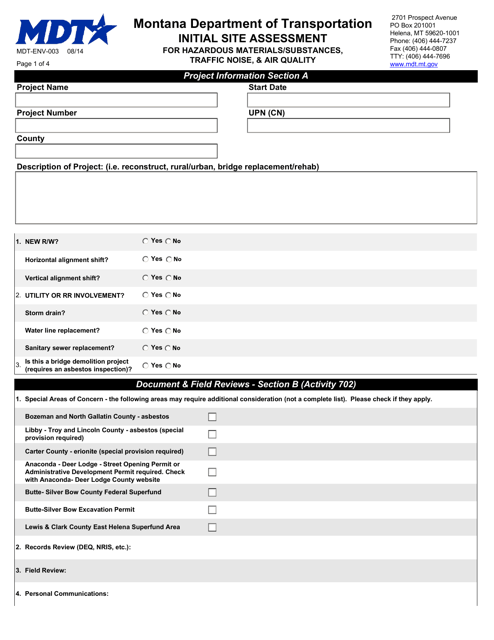

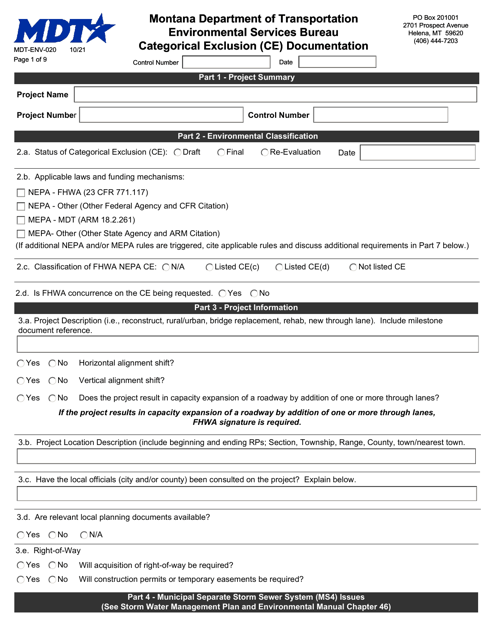

This form is used for the initial assessment of hazardous materials/substances, traffic noise, and air quality at a site in Montana. It helps to identify potential risks and ensure environmental safety.

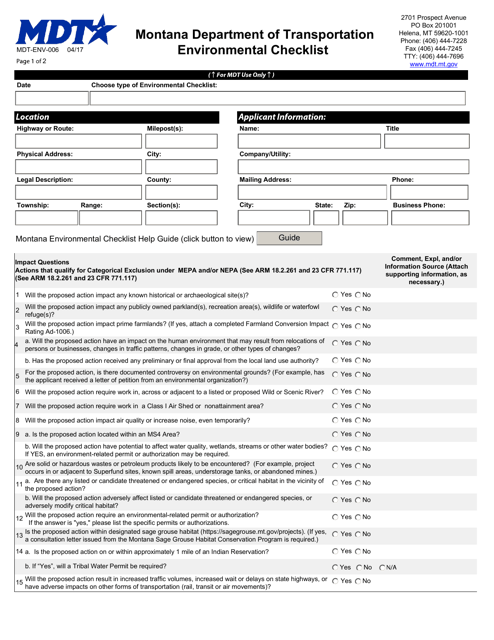

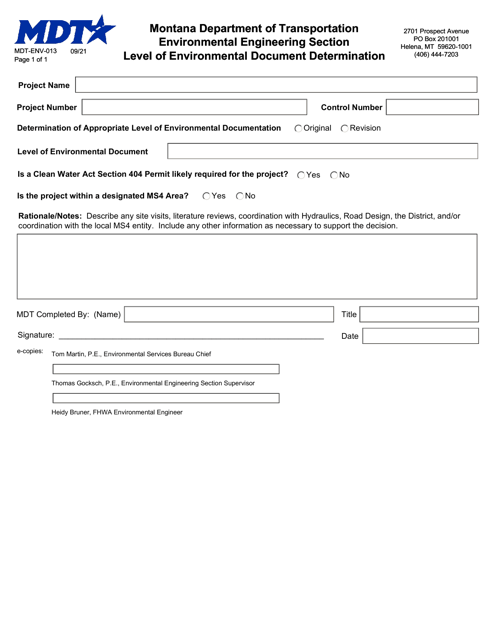

This Form is used for completing an Environmental Checklist in Montana. It is used to assess potential environmental impacts of a project or development.

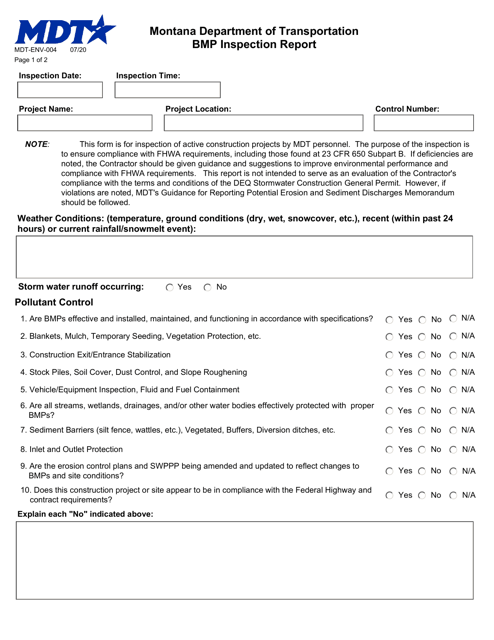

This form is used for conducting and documenting inspections of best management practices (BMPs) in Montana. It helps ensure compliance with environmental regulations and promotes the protection of natural resources.

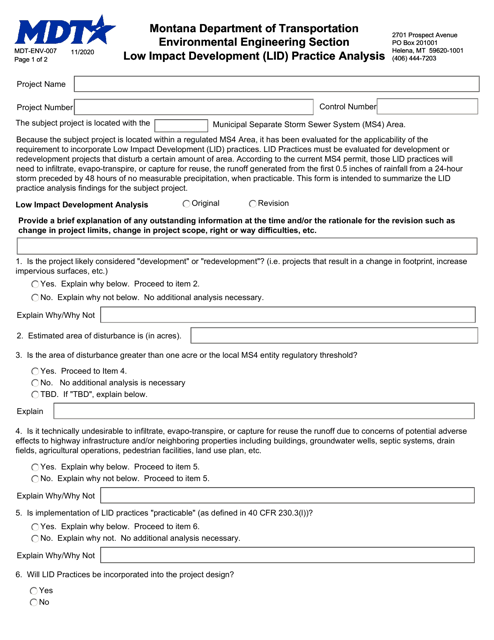

This form is used for analyzing low impact development (LID) practices in Montana. It helps to evaluate the effectiveness and impact of LID methods on the environment.

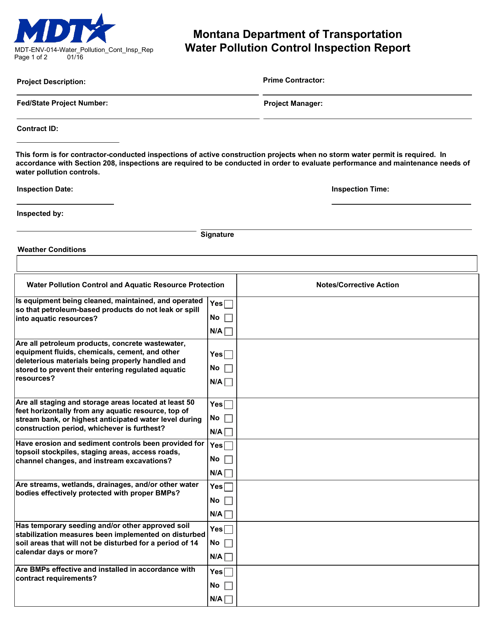

This form is used for reporting water pollution control inspections in the state of Montana.

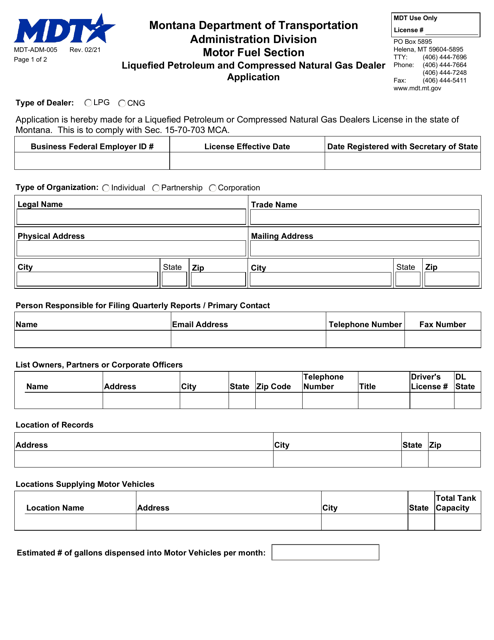

This form is used for applying to become a dealer of liquefied petroleum and compressed natural gas in Montana.

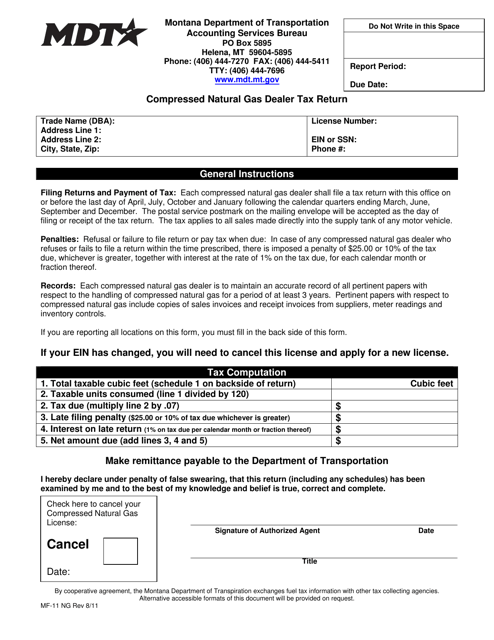

This Form is used for filing taxes related to the sale of compressed natural gas for dealers in Montana.

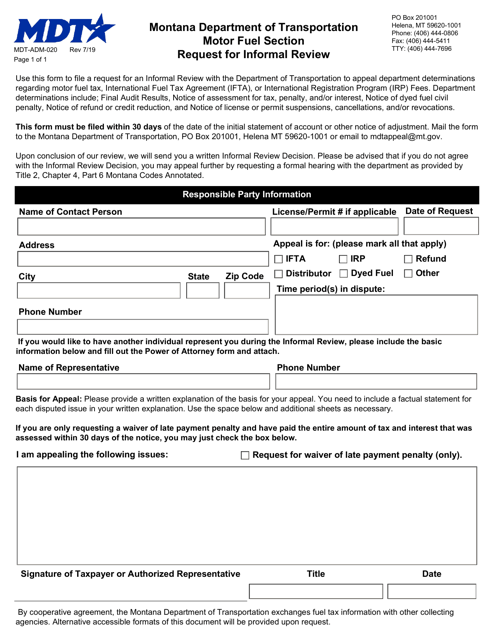

This Form is used for requesting an informal review in the state of Montana.

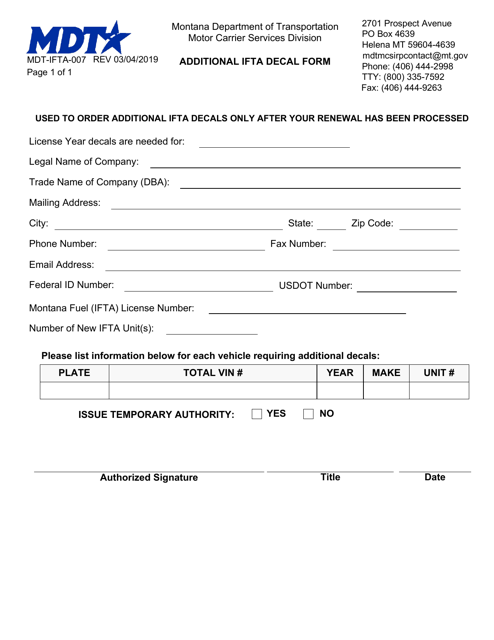

This Form is used for requesting additional IFTA decals in Montana.

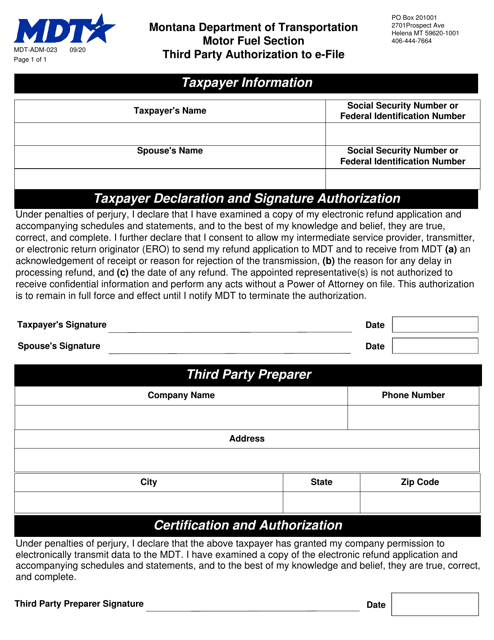

This Form is used for granting authorization to a third party to electronically file documents on behalf of the entity in the state of Montana.

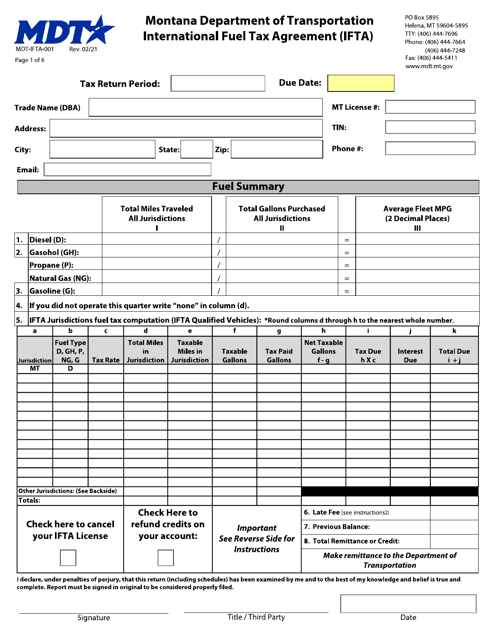

This form is used for filing the International Fuel Tax Agreement (IFTA) tax return in Montana for reporting fuel taxes paid by motor carriers operating in multiple jurisdictions.

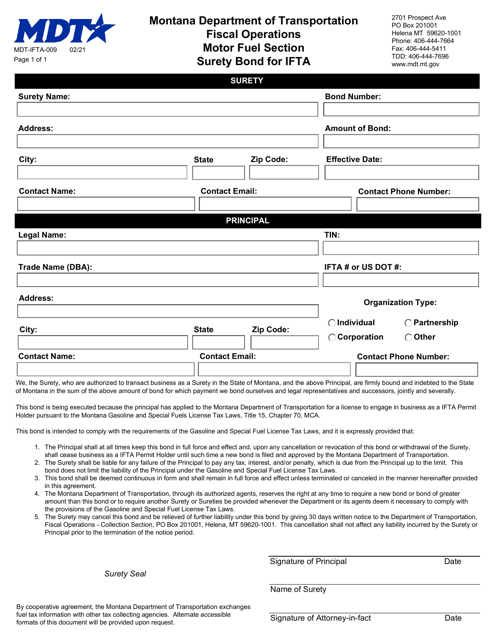

This Form is used for submitting a Surety Bond for the International Fuel Tax Agreement (IFTA) in the state of Montana.

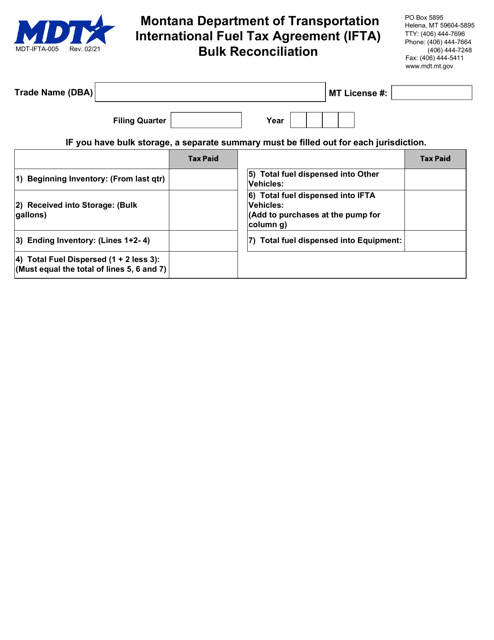

This Form is used for submitting a bulk reconciliation request under the International Fuel Tax Agreement (IFTA) for the state of Montana.

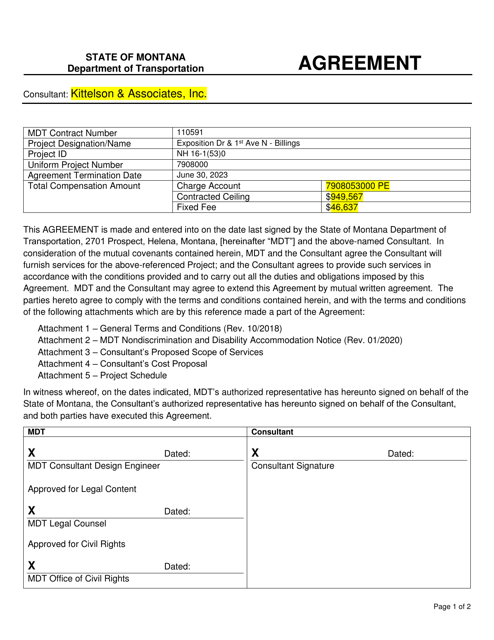

This document is used as a cover sheet for standard agreements pertaining to projects in Montana.

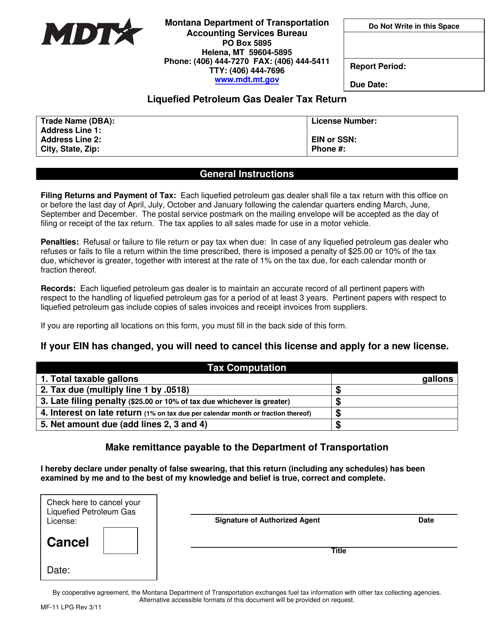

This Form is used for LPG dealers in Montana to file their tax return. It is specifically designed for reporting and paying taxes related to the sale of Liquefied Petroleum Gas.

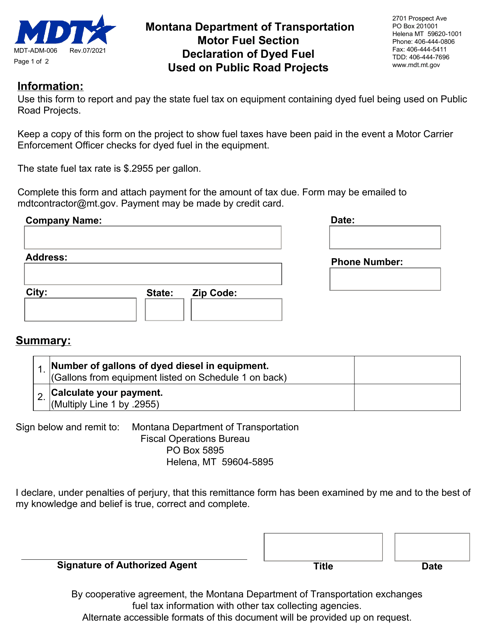

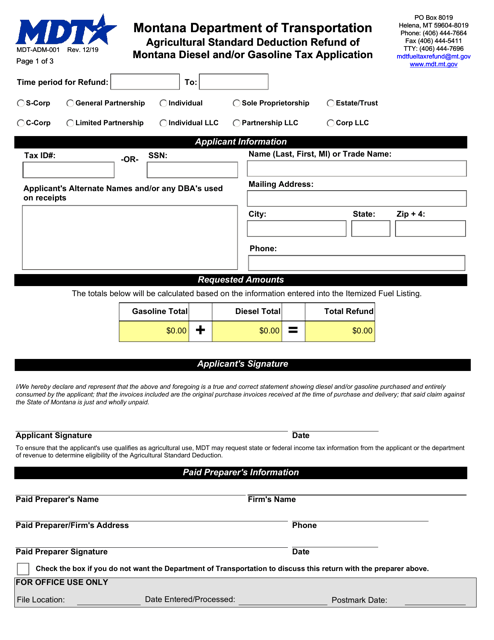

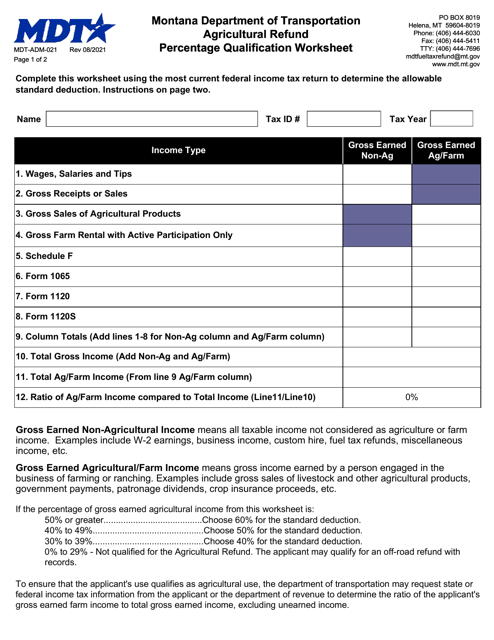

This document is for applying for a refund of Montana diesel and/or gasoline tax under the Agricultural Standard Deduction.