Montana Department of Revenue Forms

The Montana Department of Revenue is responsible for administering and enforcing tax laws in the state of Montana. Its main purpose is to collect taxes, including income tax, property tax, sales tax, and other taxes, to fund essential government services and programs. The department also provides taxpayer assistance, processes tax returns, and ensures compliance with tax laws. Additionally, it oversees various tax credits and exemptions and offers resources and information to help taxpayers understand and fulfill their tax obligations in Montana.

Documents:

294

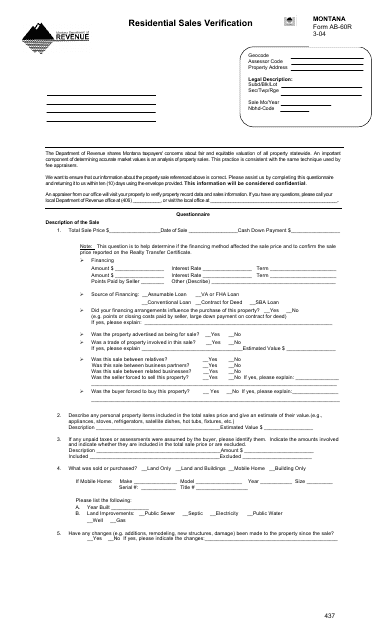

This Form is used for verifying residential sales in Montana.

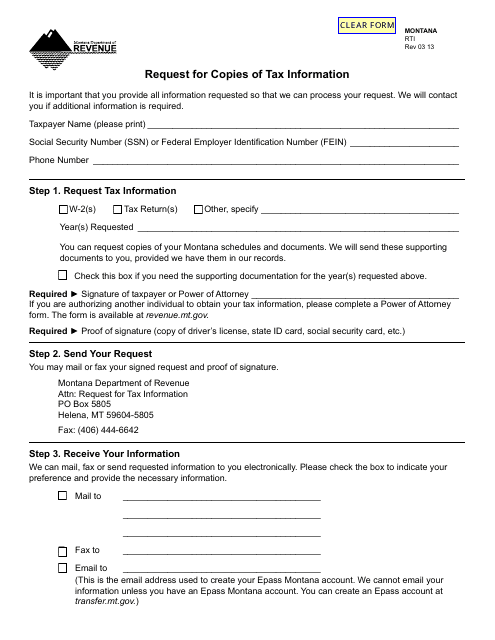

This form is used for requesting copies of tax information from the state of Montana under the Right to Information Act.

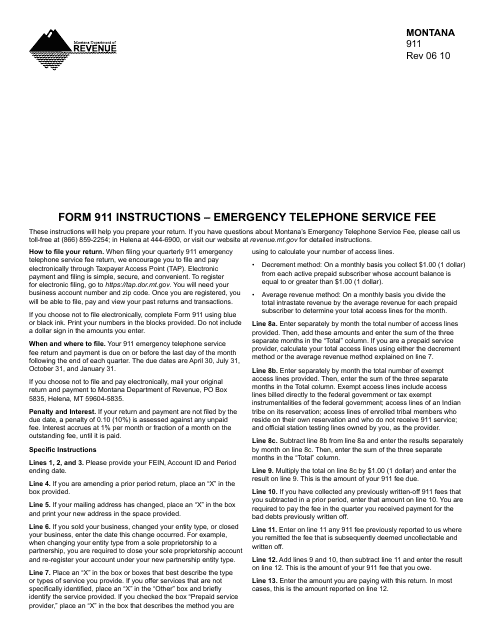

This form is used for paying the emergency telephone service fee in Montana.

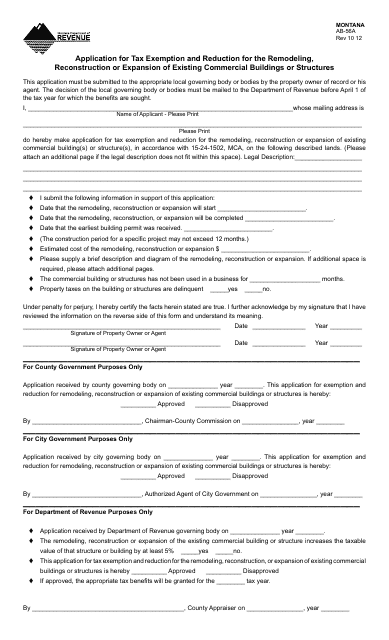

This form is used for applying for tax exemption and reduction for remodeling, reconstruction, or expansion of existing commercial buildings or structures in Montana.

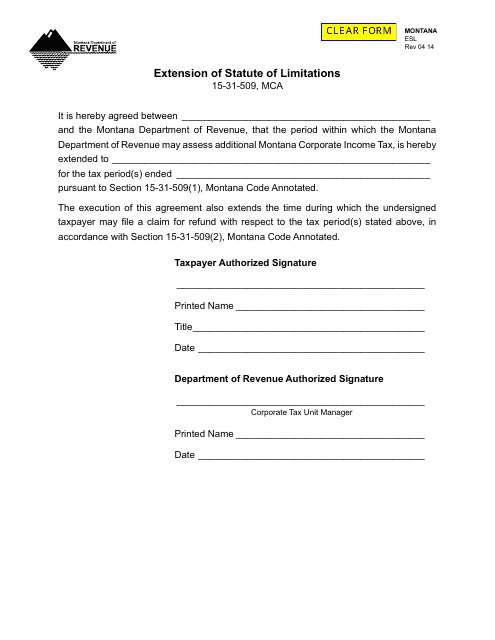

This Form is used for requesting an extension of the statute of limitations in the state of Montana for ESL-related matters.

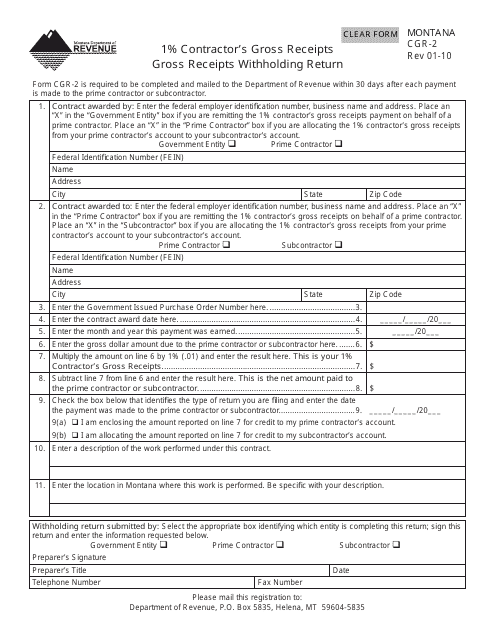

This form is used for filing and reporting 1% withholding tax on contractors' gross receipts in Montana.

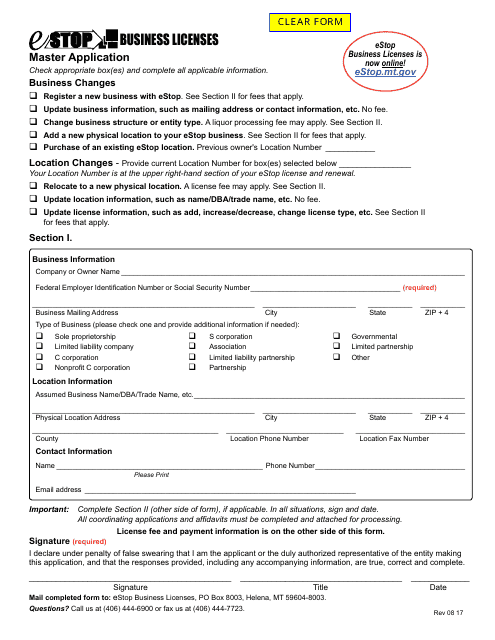

This document is used for applying for a business license in the state of Montana. It is required for individuals or entities operating a business in Montana.

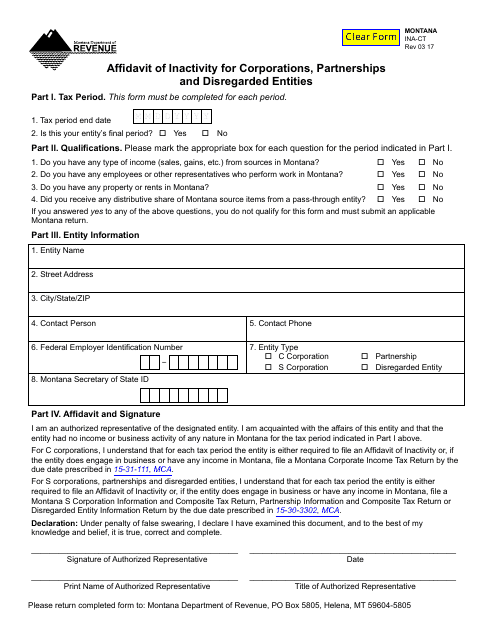

This form is used for declaring inactivity of corporations, partnerships, and disregarded entities in Montana.

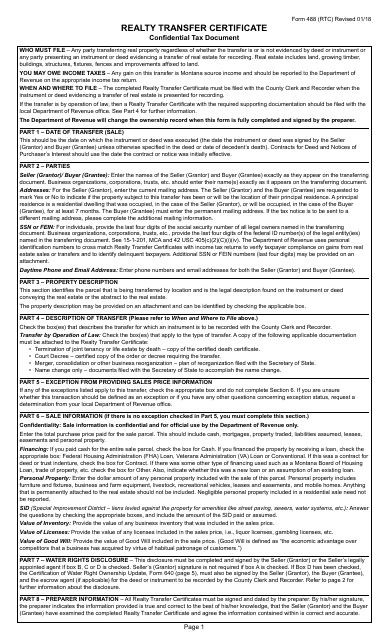

This form is used for reporting the transfer of real property in the state of Montana. It is required to be filled out and submitted to the appropriate authorities.

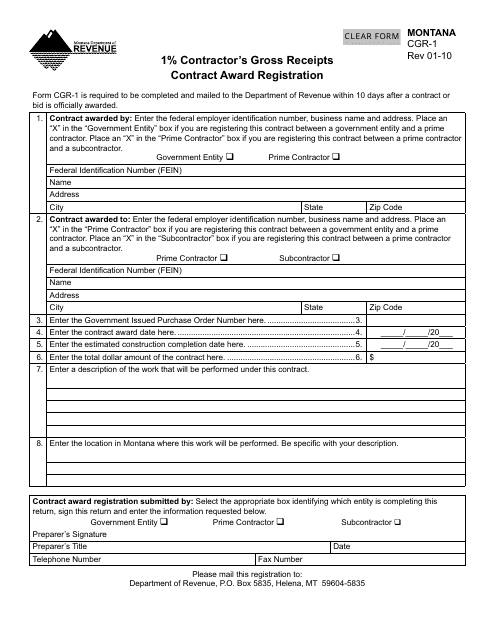

This form is used for contractor's gross receipts contract award registration in the state of Montana. It is required for contractors to register their contracts if the contract value exceeds 1% of their gross receipts for the year.

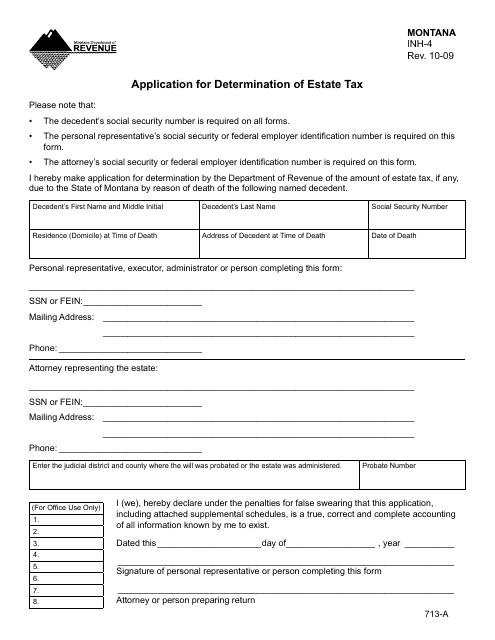

This form is used for applying for a determination of estate tax in the state of Montana.

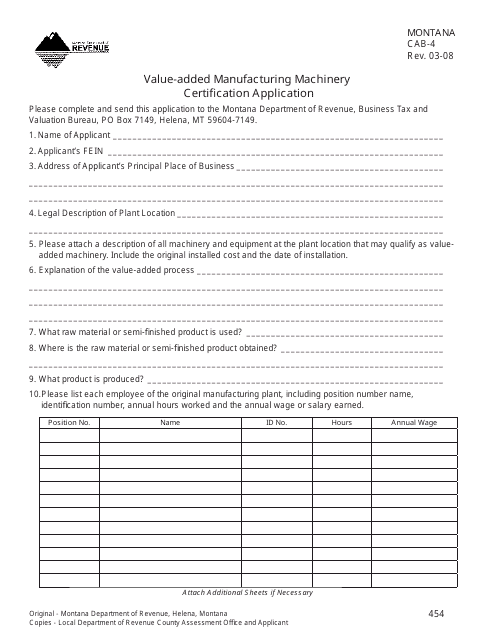

This form is used for applying for a certification for value-added manufacturing machinery in the state of Montana.

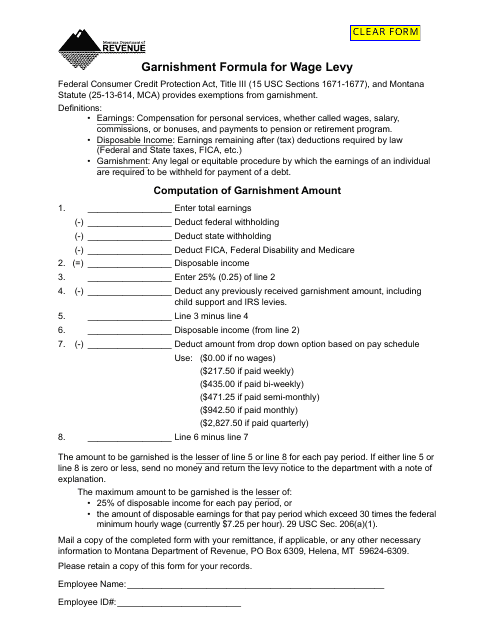

This document explains the formula used for calculating wage garnishment or wage levy in Montana. It provides information on how much of an individual's wages can be withheld for various purposes such as child support, taxes, or other debts.

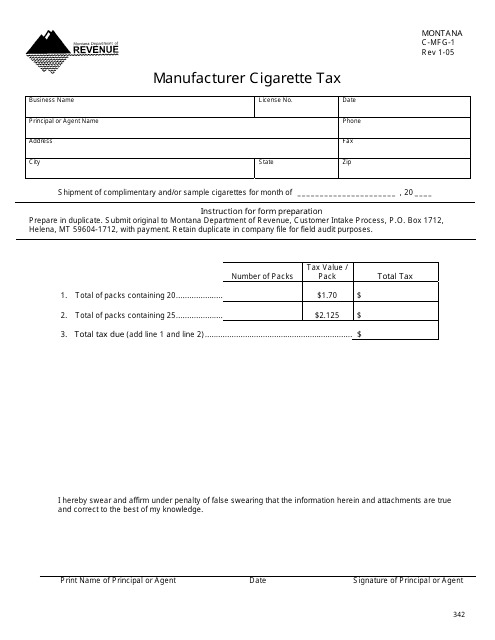

This form is used for reporting and paying the cigarette tax for manufacturers in the state of Montana.

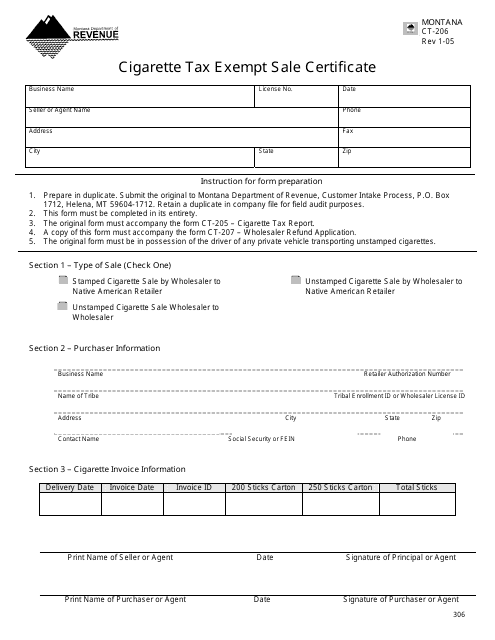

This form is used for claiming an exemption from cigarette tax for certain sales in Montana.

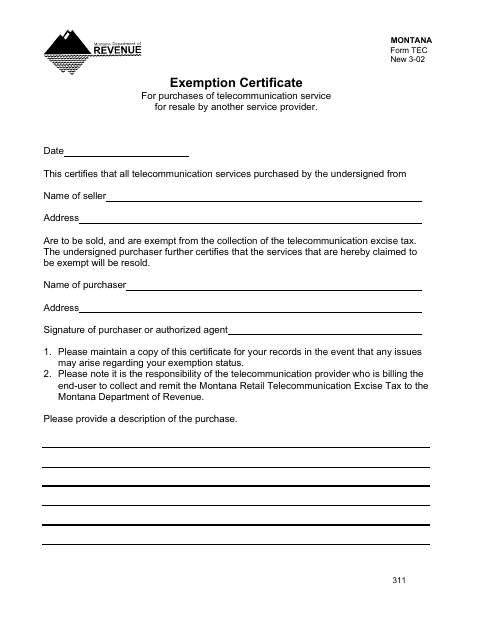

This form is used for obtaining a telecommunications service exemption certificate in the state of Montana. It allows individuals or businesses to claim exemption from certain taxes or fees related to telecommunications services.

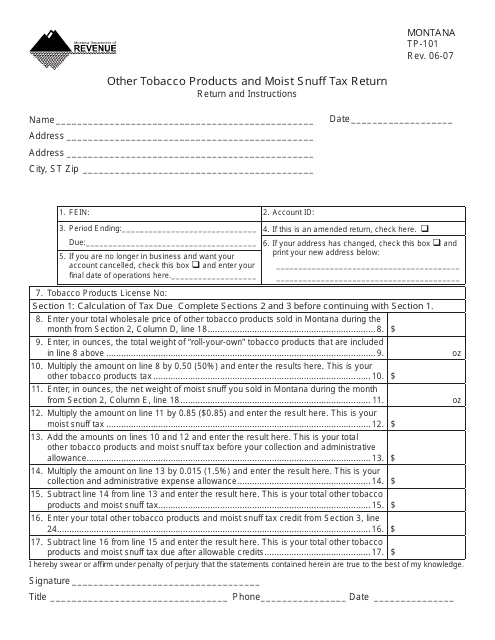

This form is used for reporting and paying taxes on other tobacco products and moist snuff in the state of Montana.

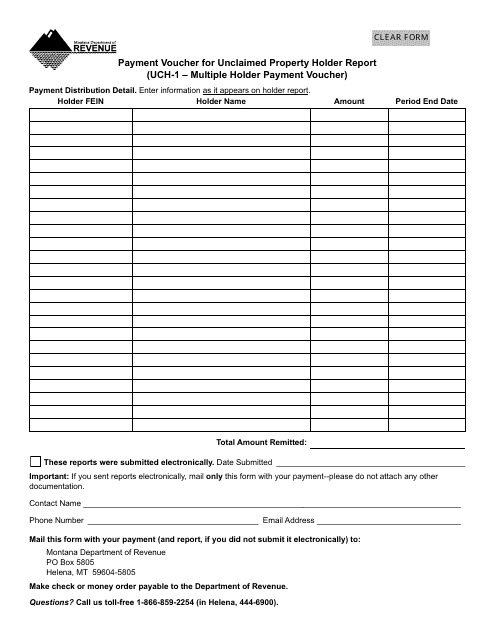

This Form is used for submitting payment vouchers for unclaimed property multiple holder reports in Montana.

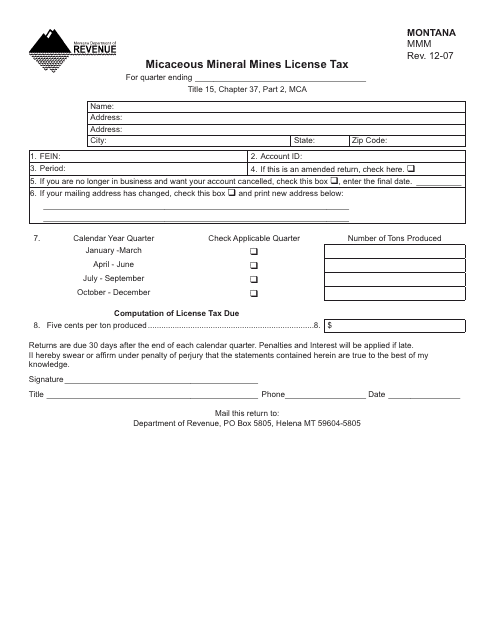

This form is used for applying and paying taxes for licenses related to micaceous mineral mines in Montana.

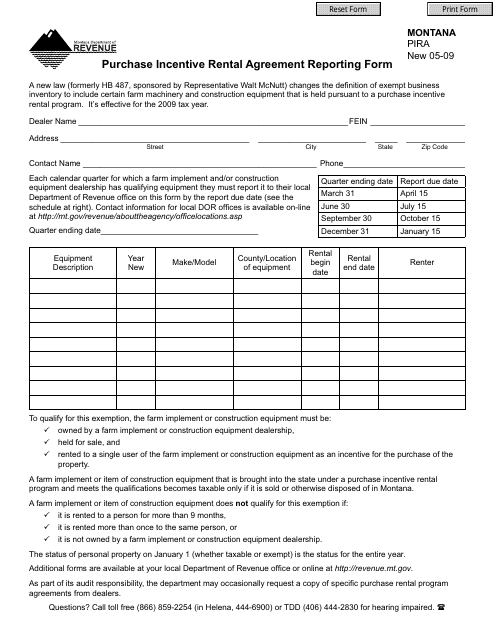

This form is used for reporting purchase incentives and rental agreements in Montana.

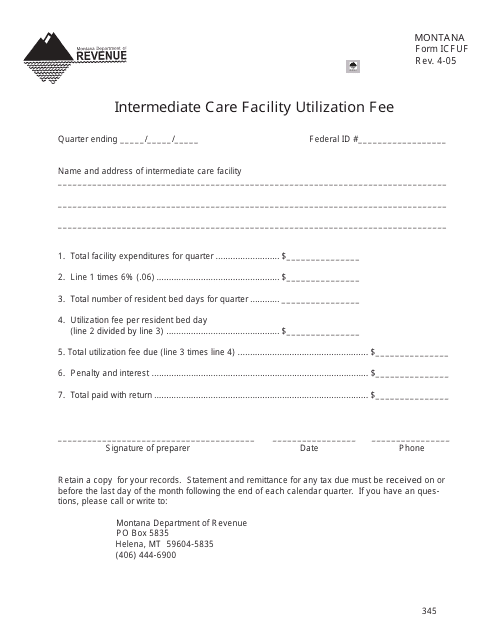

This Form is used for determining the utilization fee for intermediate care facilities in Montana.

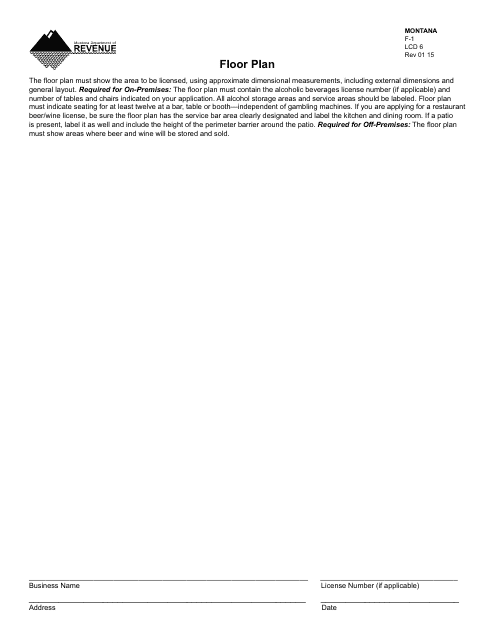

This Form is used for submitting a floor plan for a construction project in Montana. It provides detailed information about the layout and design of the building.

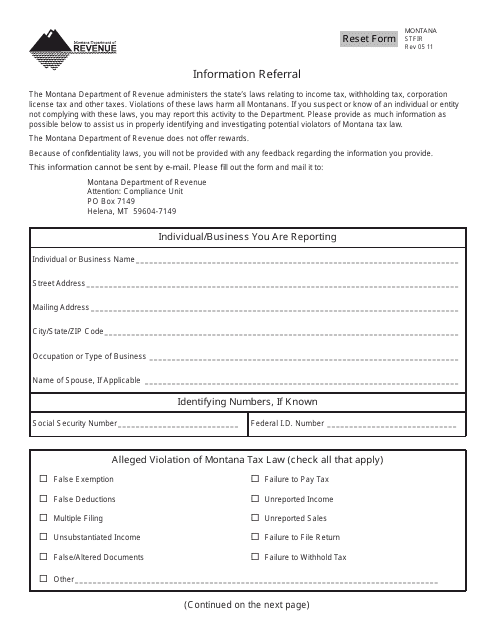

This form is used for reporting information to the state of Montana for further investigation or action. It is a way to notify authorities about potential issues or concerns.

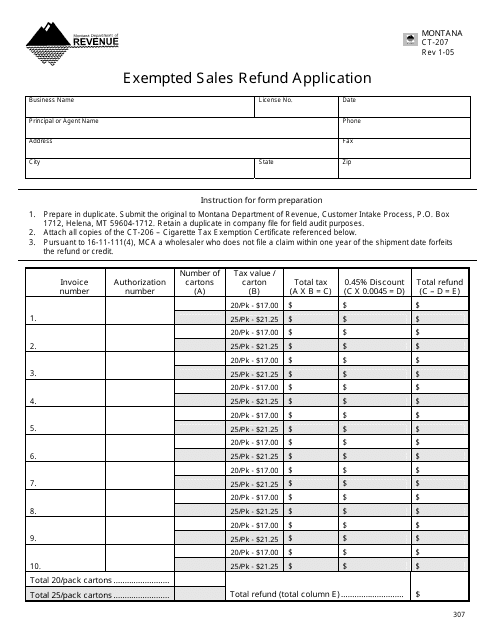

This form is used for applying for a refund on sales tax for exempted sales in the state of Montana.

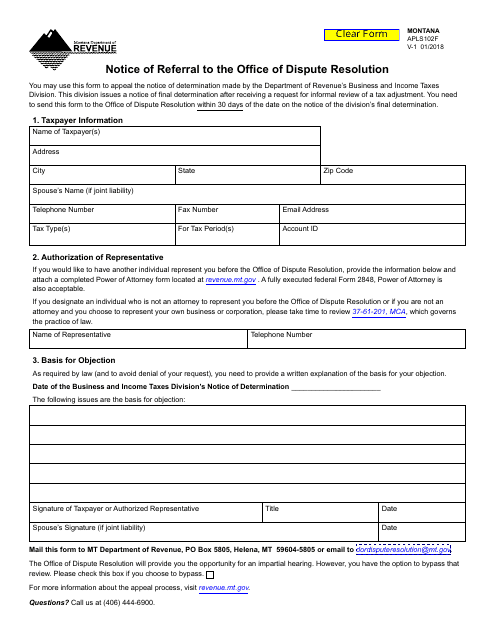

This form is used for providing a notice of referral to the Office of Dispute Resolution in the state of Montana.

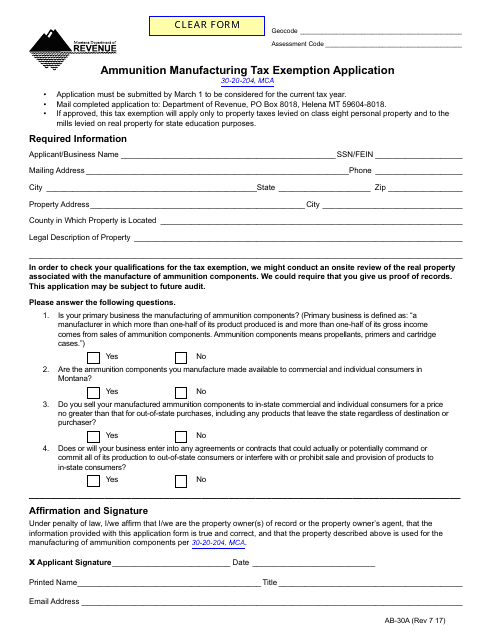

This form is used for applying for a tax exemption on ammunition manufacturing in Montana.

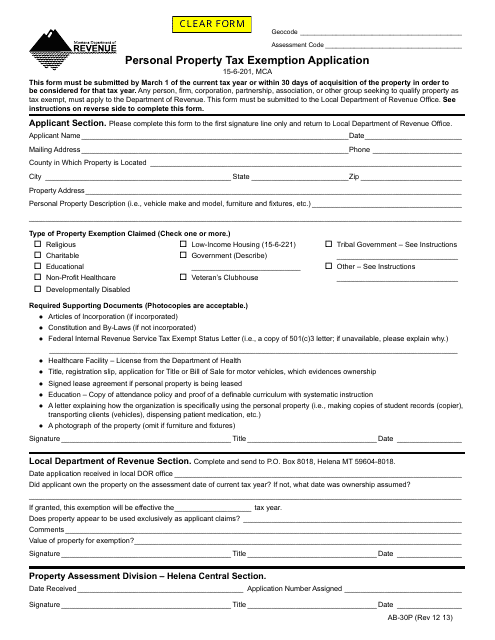

This form is used for applying for a personal property tax exemption in Montana. It allows individuals to request an exemption from paying taxes on certain personal property.

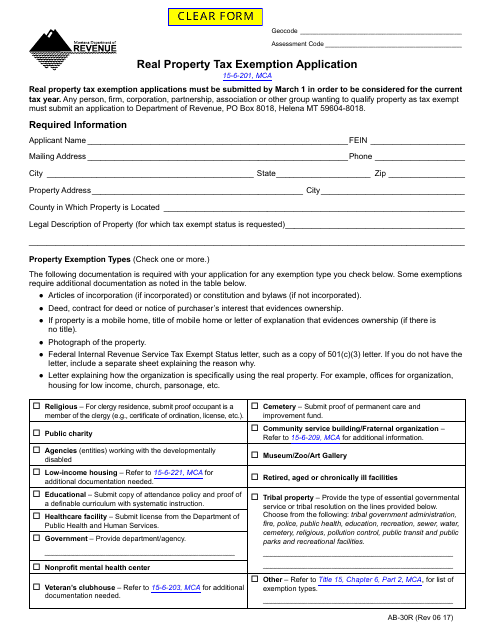

This form is used for applying for a real property tax exemption in Montana.

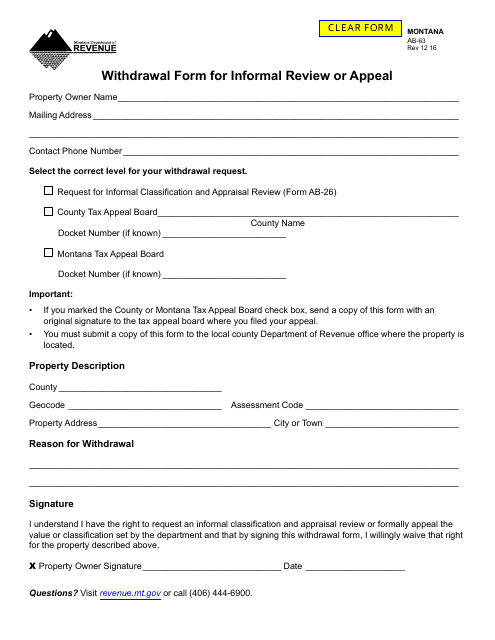

This form is used for withdrawing an informal review or appeal in the state of Montana.

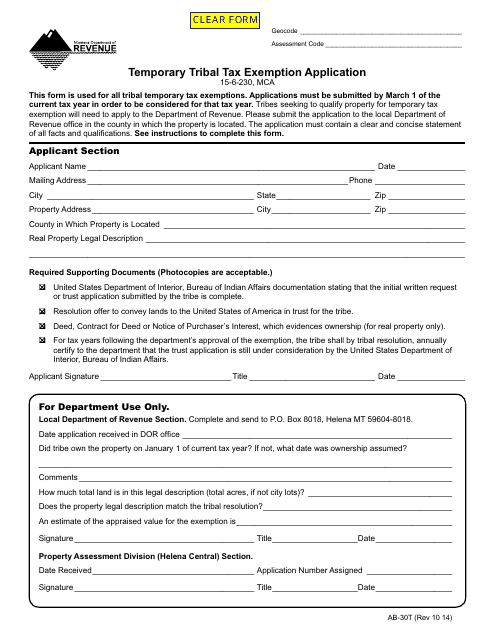

This form is used for applying for a temporary tax exemption for tribal members in Montana.

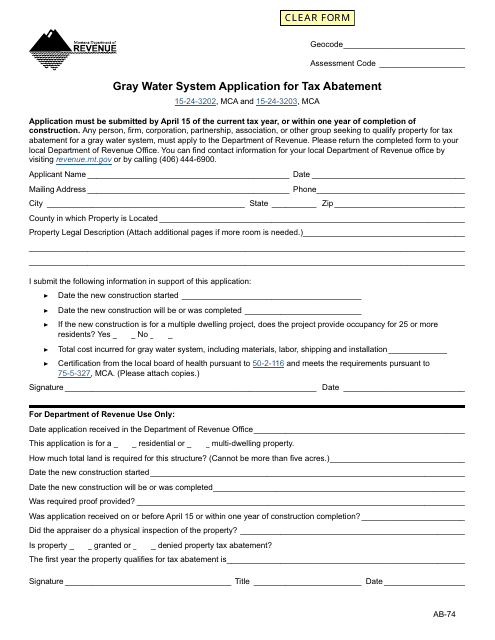

This Form is used for applying for a tax abatement for a gray water system in Montana.

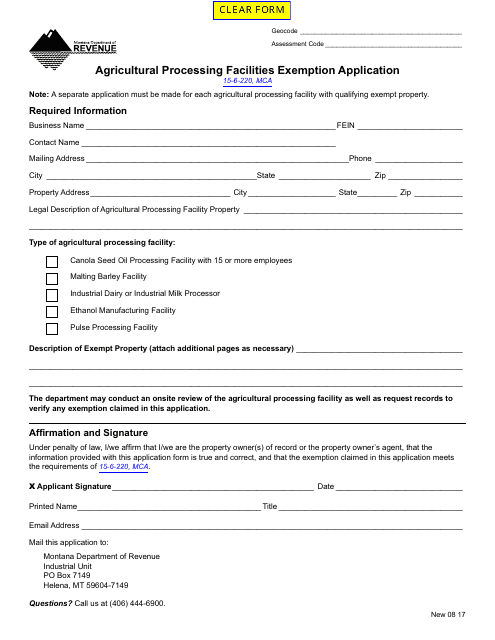

This form is used to apply for an exemption from taxes for agricultural processing facilities in Montana.