Missouri Department of Revenue Forms

Documents:

619

This Form is used for applying for a Missouri Motor Fuel Tax License in Missouri.

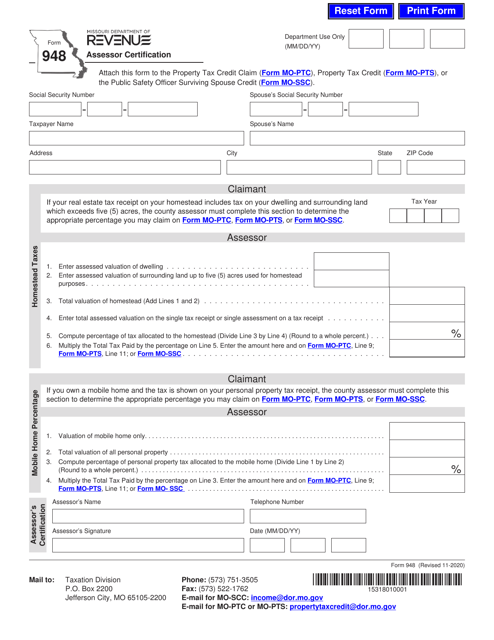

This Form is used for Assessor Certification in the state of Missouri.

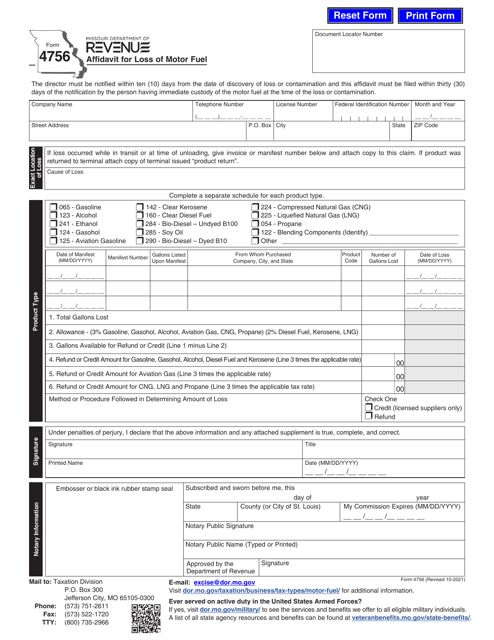

This form is used for reporting the loss of motor fuel in Missouri.

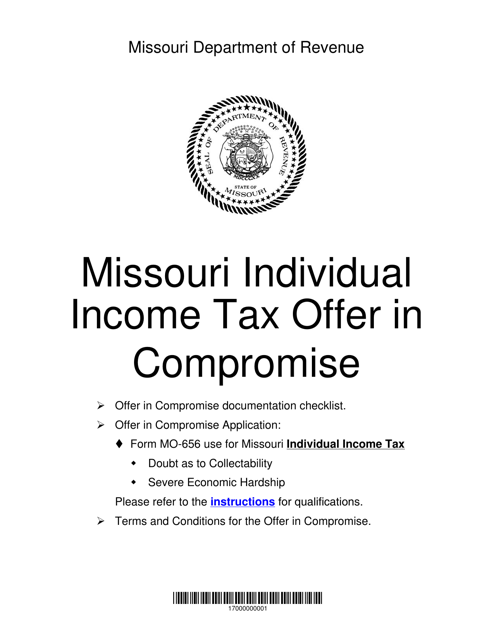

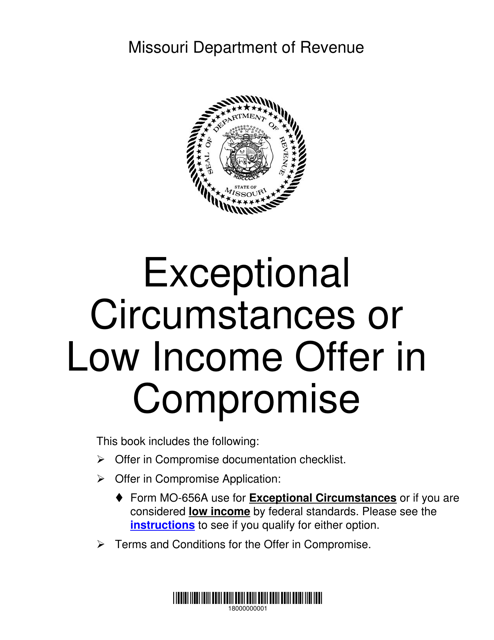

This form is used for individuals in Missouri to apply for an Offer in Compromise for their income tax. It allows taxpayers to settle their tax debts for a lesser amount if they meet certain criteria.

This Form is used for Missouri taxpayers who have exceptional circumstances and low income to apply for certain tax benefits.

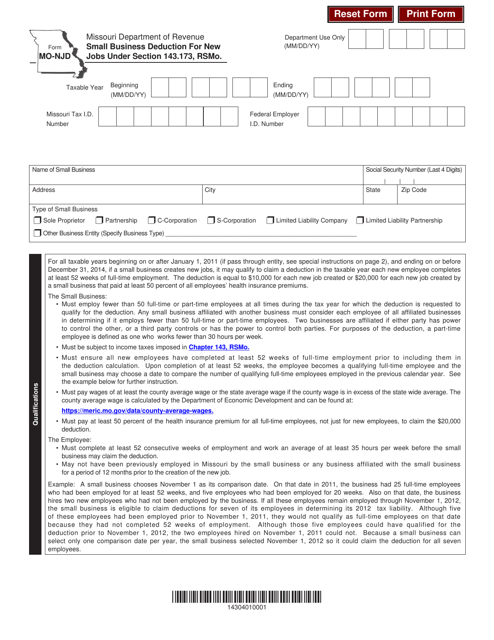

This form is used for claiming the small business deduction for creating new jobs in Missouri under Section 143.173 of the Revised Statutes of Missouri.

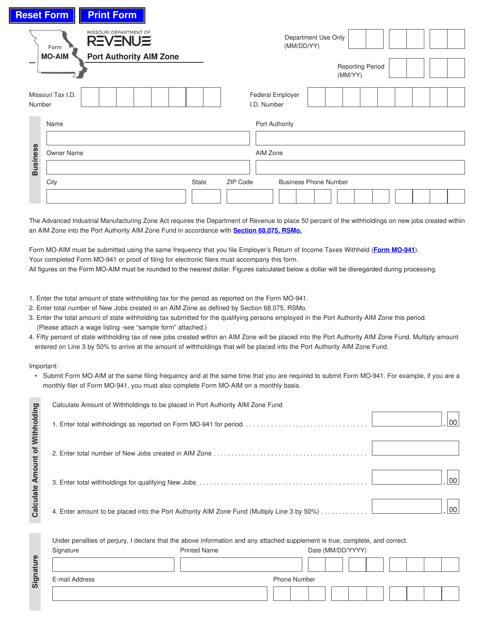

This form is used for establishing an Aim Zone with the Port Authority in Missouri.

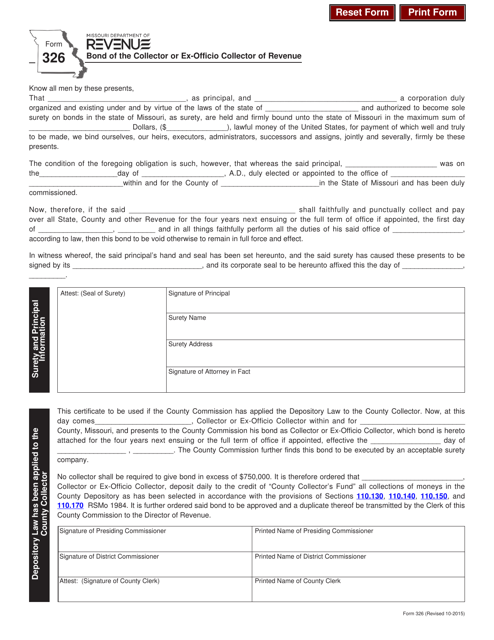

This form is used for recording a surety bond for collectors or ex-officio collectors of revenue in the state of Missouri. It ensures that the collector performs their duties responsibly and protects the state and its residents from any financial loss.

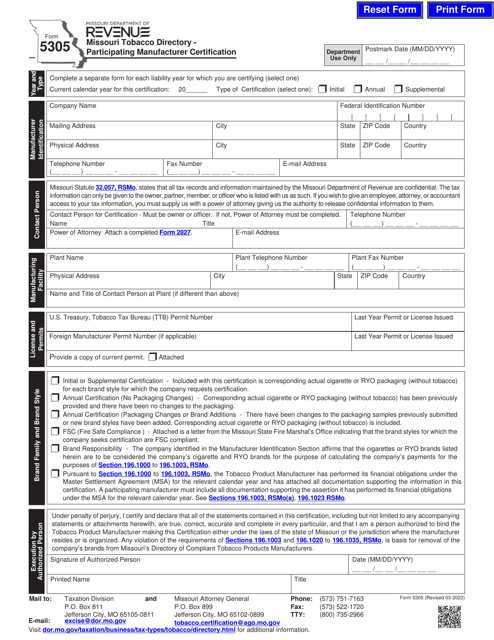

This form is used for participating tobacco manufacturers in Missouri to certify their status for the state's tobacco directory.

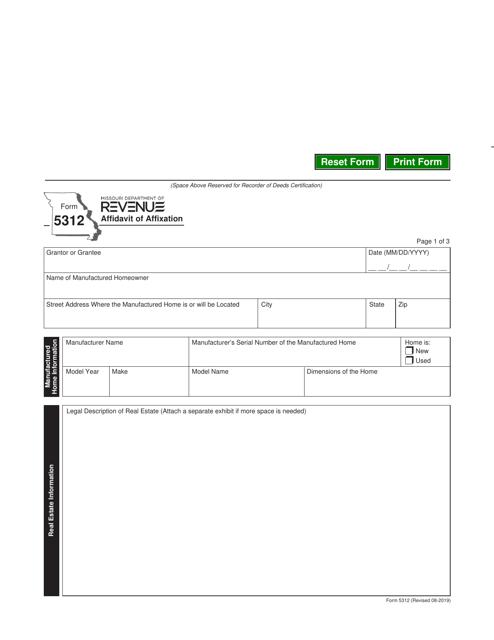

This form is used for filing an Affidavit of Affixation in the state of Missouri. It is required when a manufactured home is being affixed to a permanent foundation.

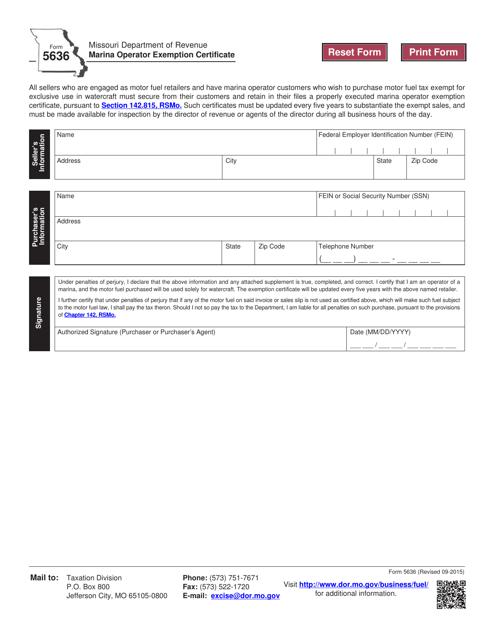

This form is used for applying for a Marina Operator Exemption Certificate in the state of Missouri. It is necessary for marina operators to obtain this certificate in order to be exempt from certain sales and use taxes.

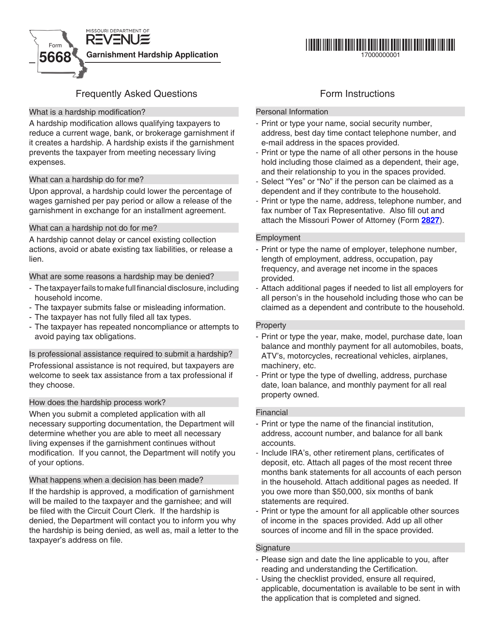

This form is used for applying for a hardship exemption from garnishment in the state of Missouri.

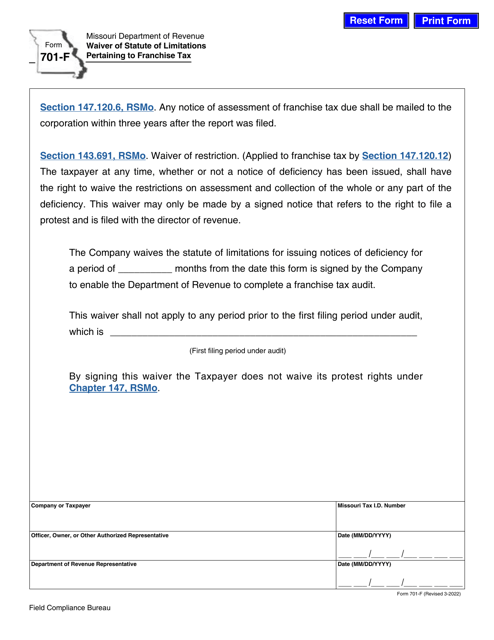

This form is used for requesting a waiver of the statute of limitations related to franchise tax in the state of Missouri.

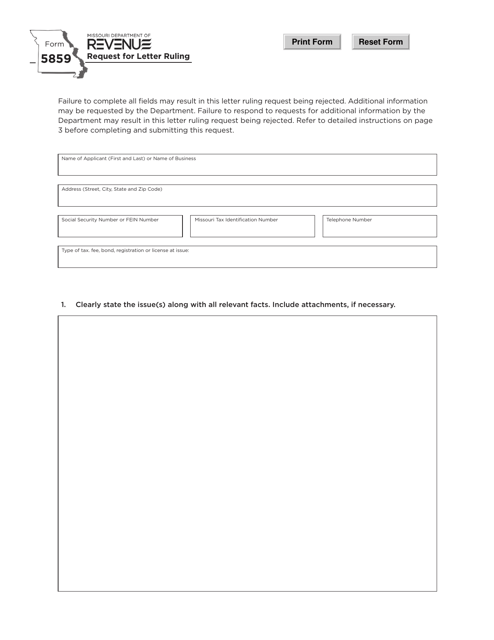

This form is used for requesting a letter ruling from the state of Missouri.

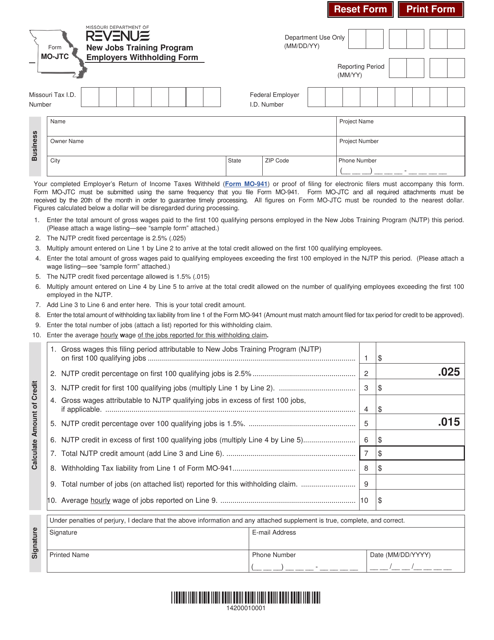

This Form is used for employers in Missouri to report withholding taxes for the New Jobs Training Program.

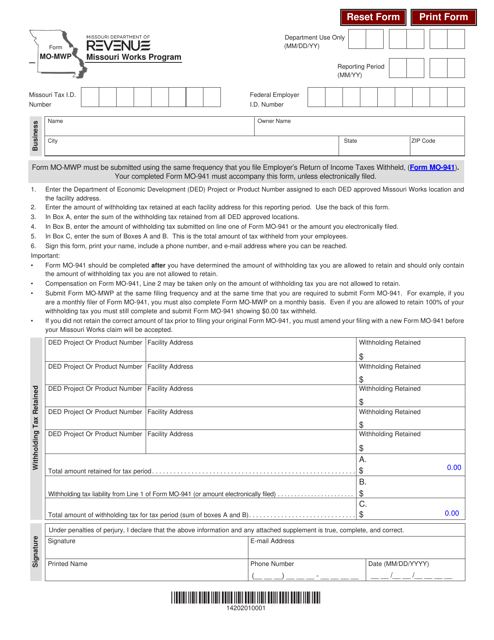

This Form is used for applying to the Missouri Works Program, which is a program designed to attract and retain businesses in Missouri by providing incentives and tax benefits.

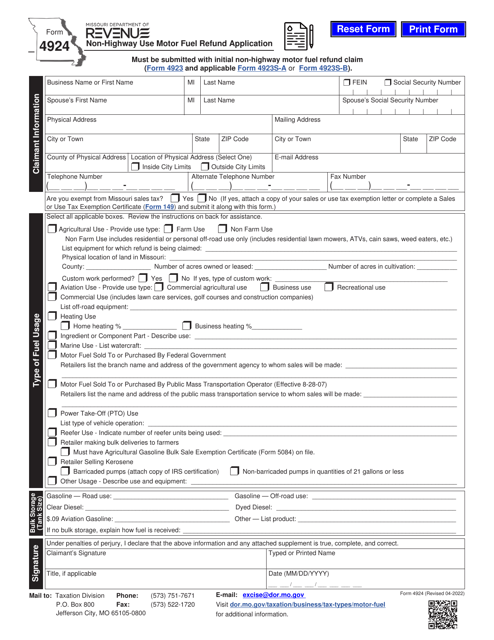

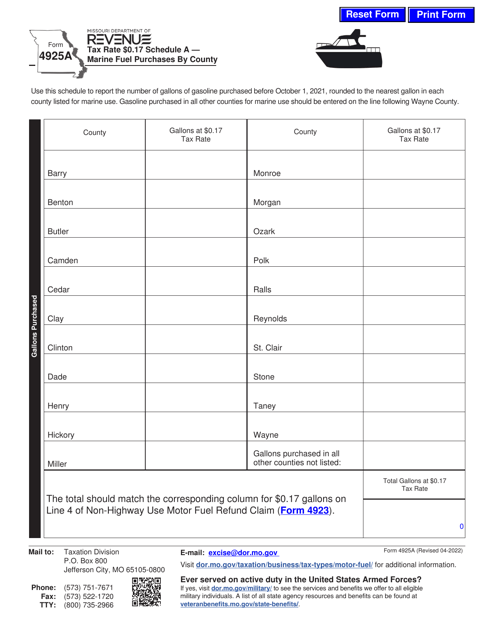

This Form is used for reporting marine fuel purchases by county in Missouri and the associated tax rate of $0.17.

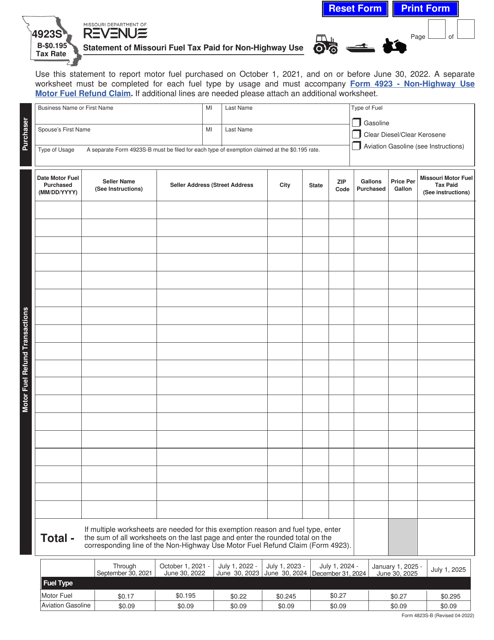

This Form is used for reporting the amount of Missouri fuel tax paid for non-highway use.