Missouri Department of Revenue Forms

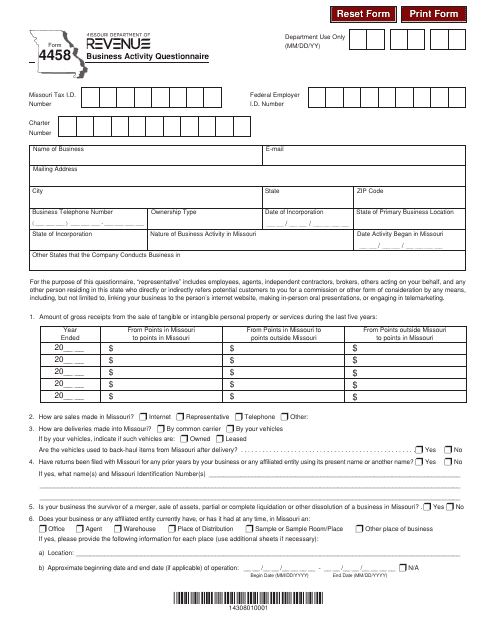

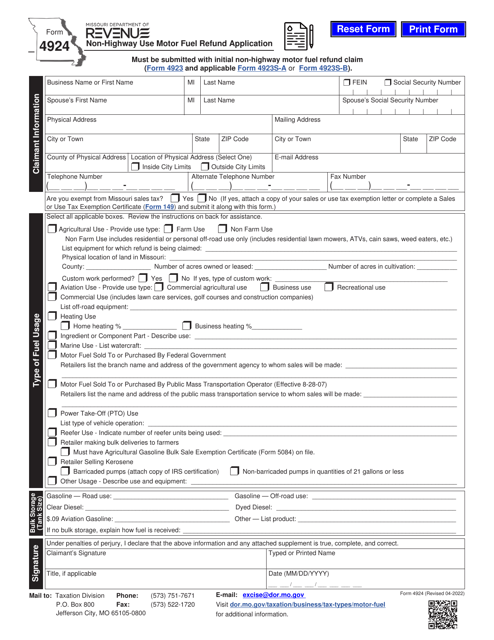

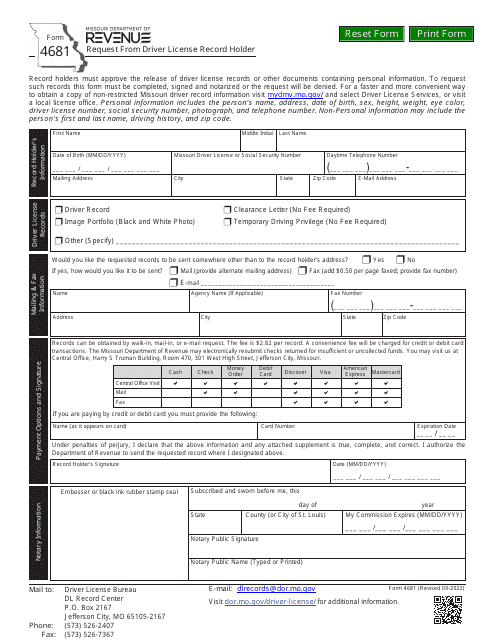

The Missouri Department of Revenue is responsible for administering the tax laws and collecting taxes in the state of Missouri. They ensure that individuals and businesses comply with tax regulations, process tax returns, issue refunds, and enforce tax laws. The department also handles other services, such as issuing driver's licenses and identification cards, registering vehicles, and providing motor vehicle titling services.

Documents:

619

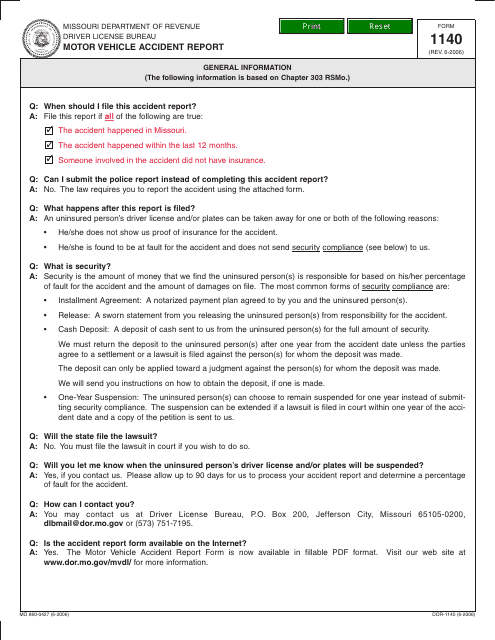

This Form is used for reporting motor vehicle accidents in the state of Missouri. It must be filled out by drivers involved in accidents resulting in property damage over $500 or any personal injury or death.

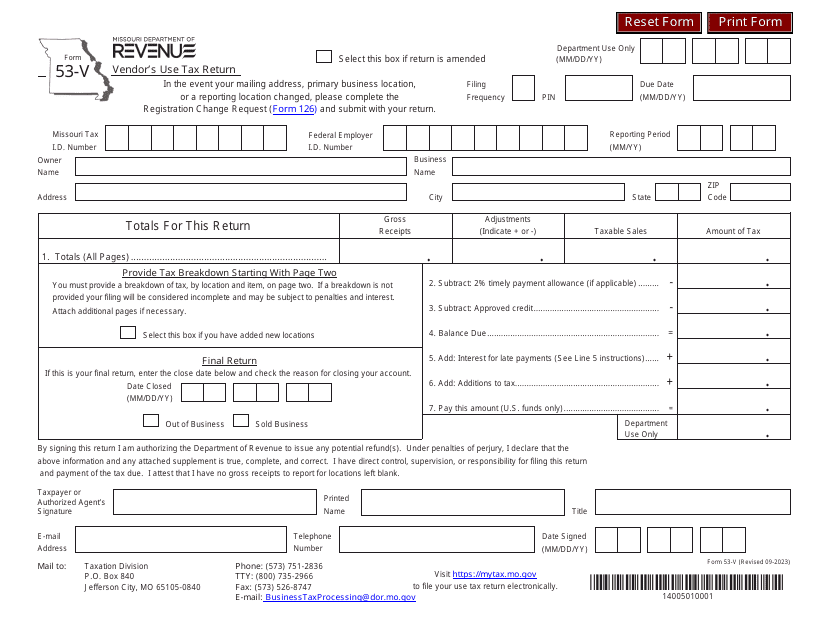

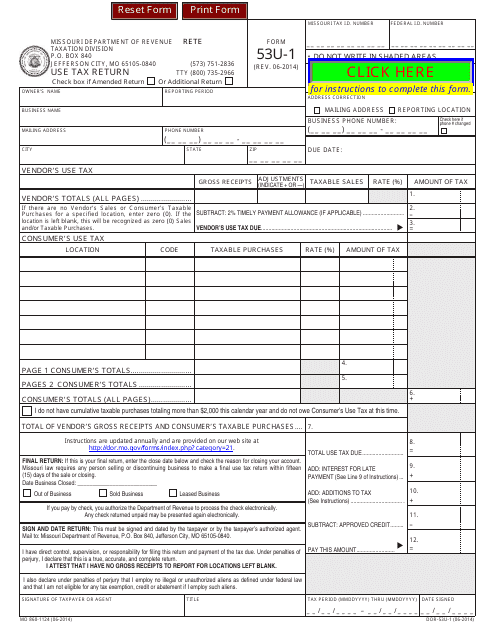

This Form is used for reporting and paying use tax in the state of Missouri. Use tax is owed on taxable items that were purchased tax-free and used in Missouri. The Form 53U-1 is used to calculate the use tax owed and submit it to the Missouri Department of Revenue.

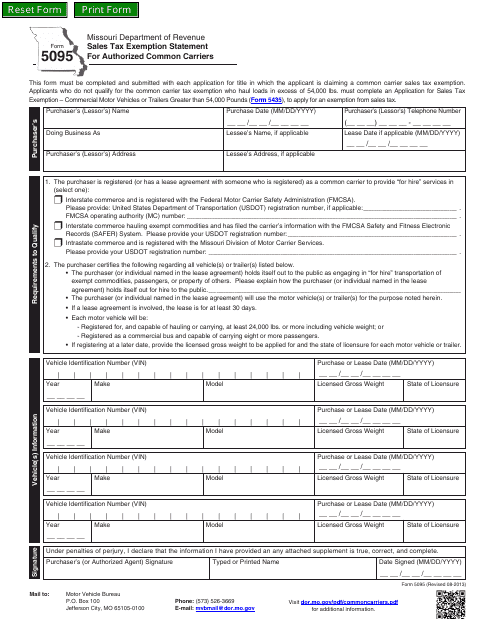

This form is used for authorized common carriers in Missouri to claim exemption from sales tax.

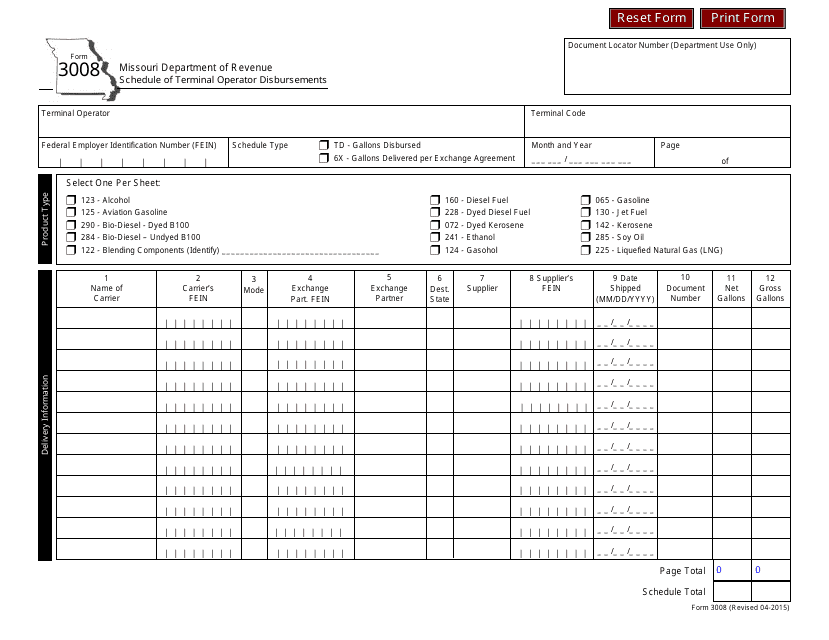

This form is used for detailing the disbursements made by terminal operators in Missouri.

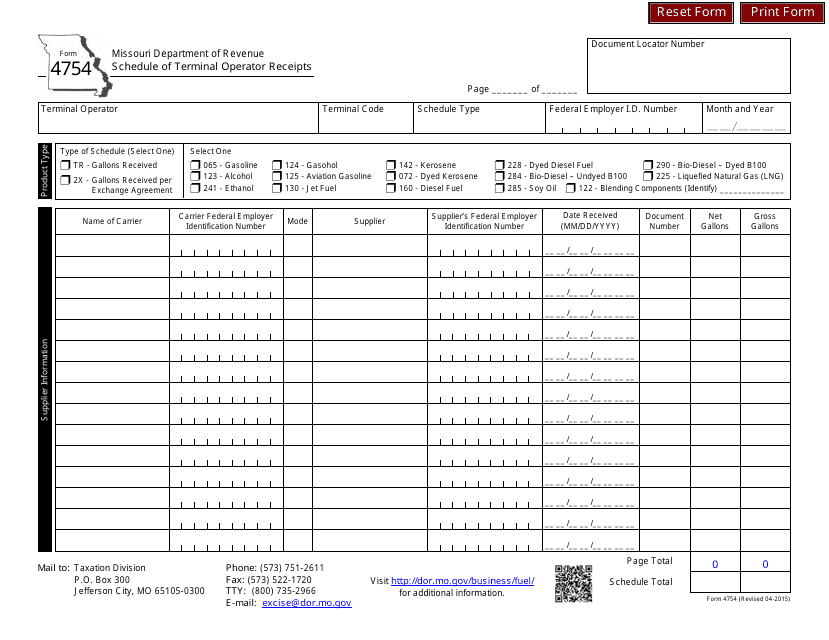

This form is used for reporting the receipts of terminal operators in Missouri. It helps to track and calculate the revenue generated by terminal operators in the state.

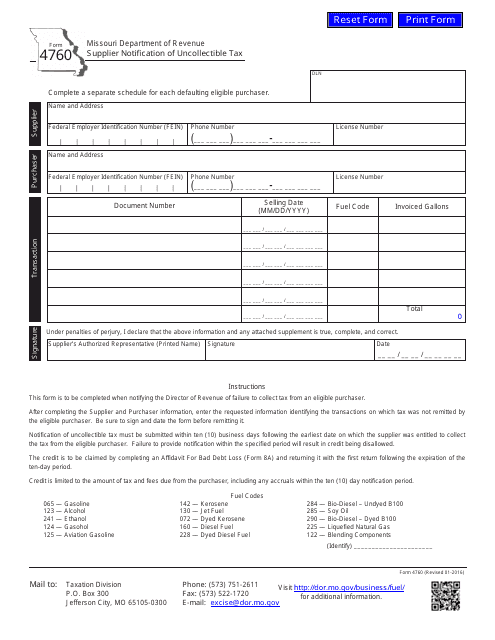

This form is used for suppliers in Missouri to notify the state about uncollectible tax.

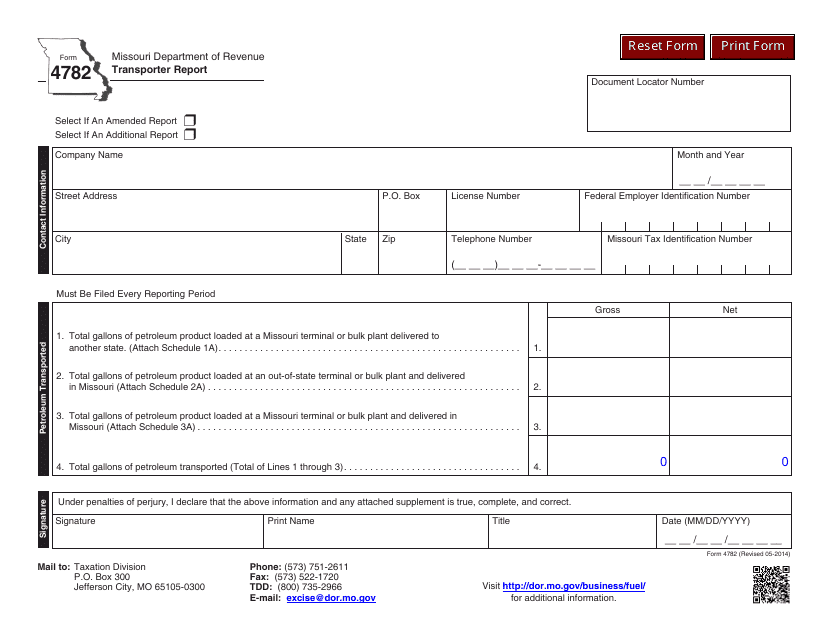

This form is used for reporting transportation details in the state of Missouri.

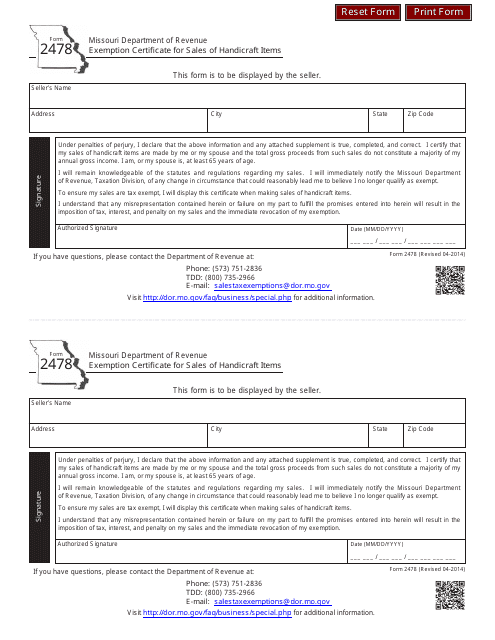

This document is used for obtaining an exemption certificate in Missouri for sales of handicraft items.

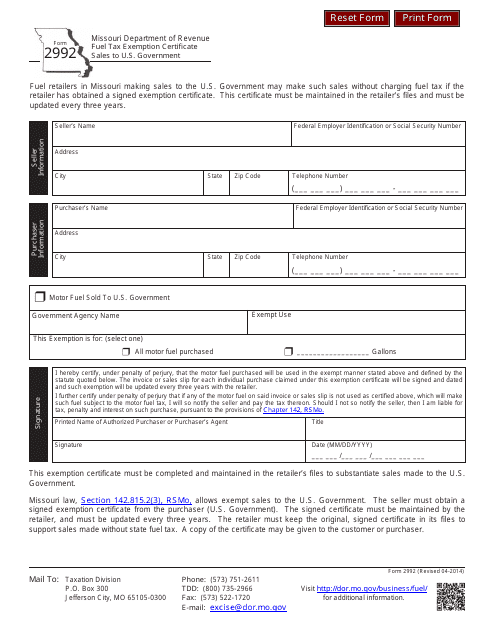

This form is used for claiming a fuel tax exemption on sales made to the U.S. Government in the state of Missouri.

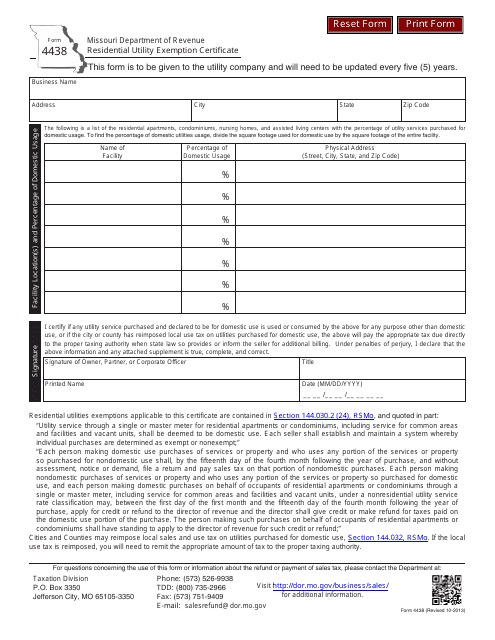

This form is used for requesting a residential utility exemption certificate in the state of Missouri.

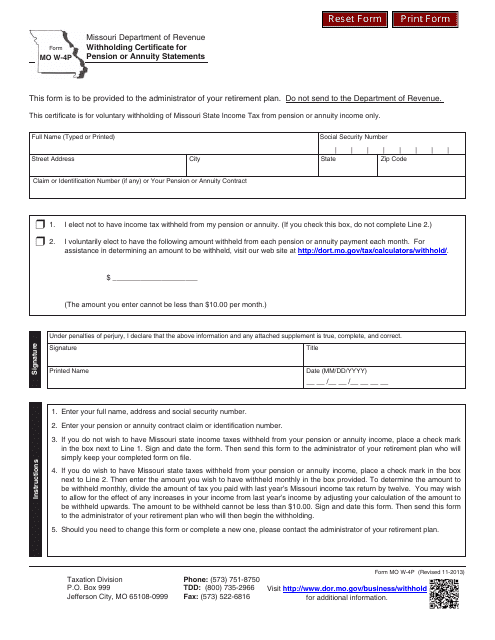

This form is used for pension or annuity statements in Missouri to determine the amount of withholding tax to be deducted from payments.

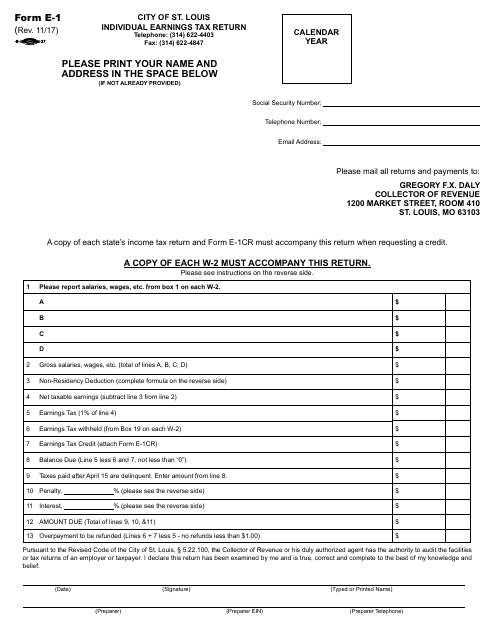

This document is for individuals in the City of St. Louis, Missouri, to file their earnings tax return.

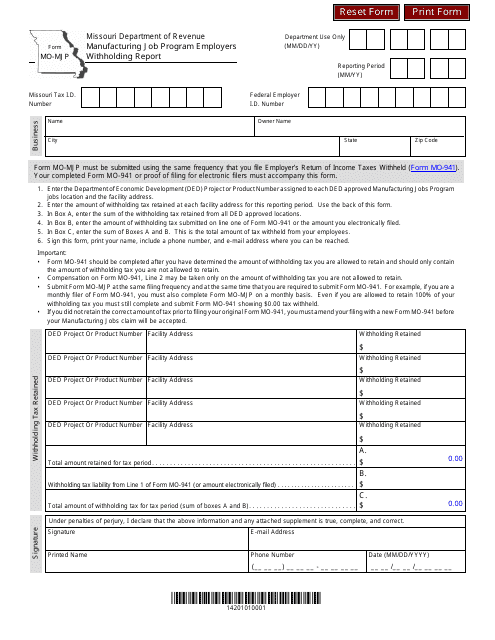

This form is used for businesses participating in the Missouri Manufacturing Job Program to report income tax withheld from employees' wages.

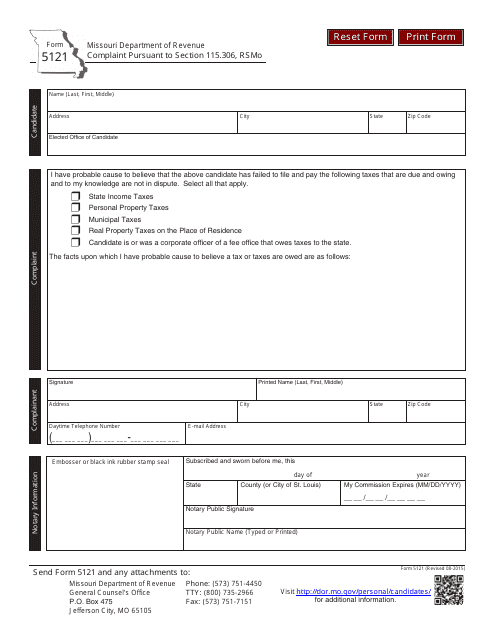

This form is used for filing a complaint in Missouri under Section 115.306 of the Revised Statutes. It allows individuals to submit a formal complaint regarding a specific matter or issue.

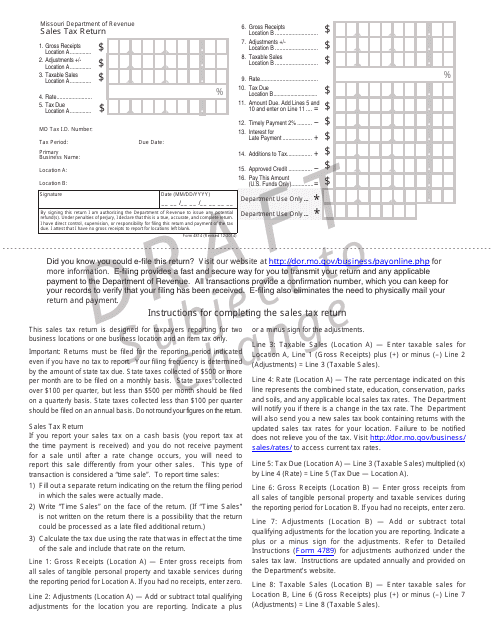

This Form is used for filing sales tax return in the state of Missouri.

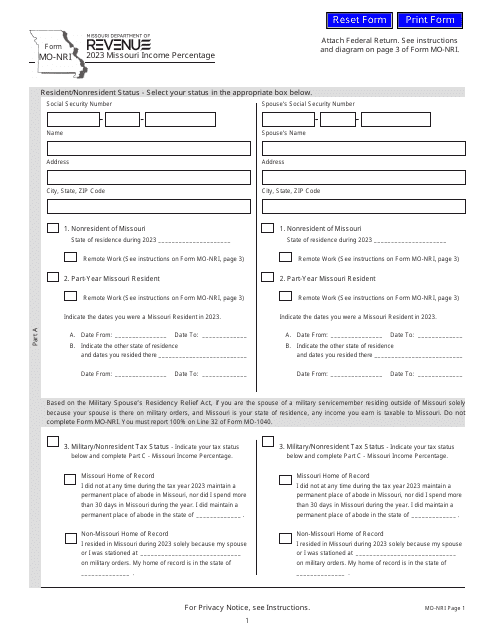

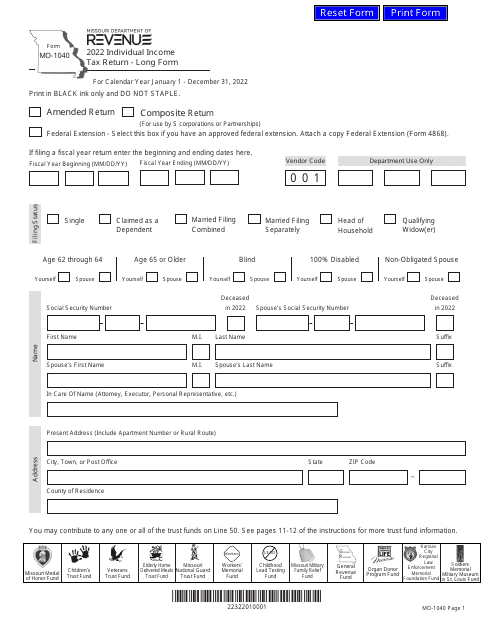

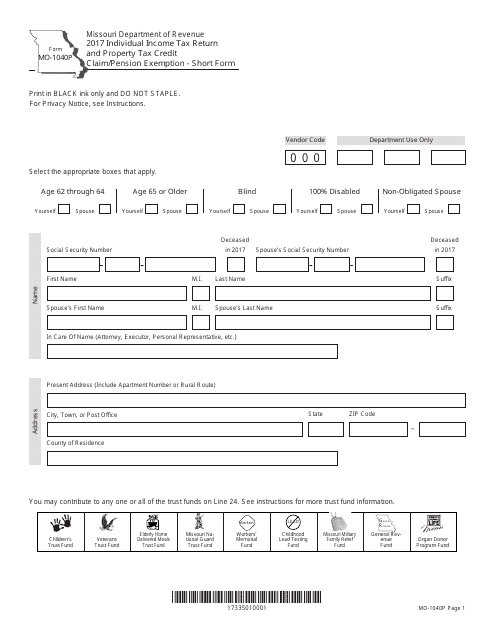

This form is used for filing individual income tax returns, claiming property tax credit, and pension exemption in the state of Missouri.