Minnesota Employment and Economic Development Department Forms

Documents:

105

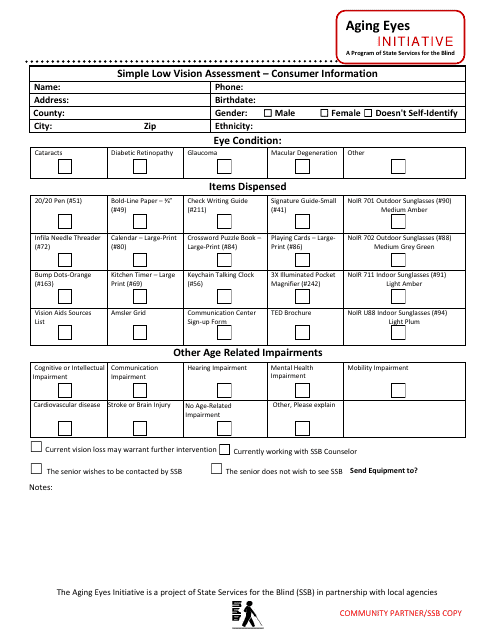

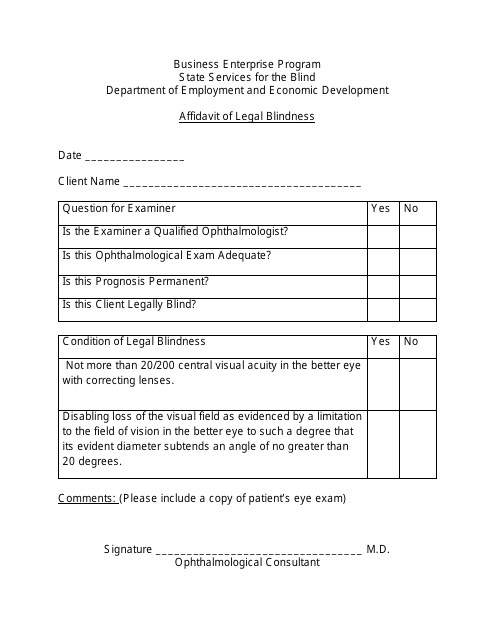

This document is used for conducting a basic assessment of visual acuity and vision impairments in individuals with low vision in the state of Minnesota.

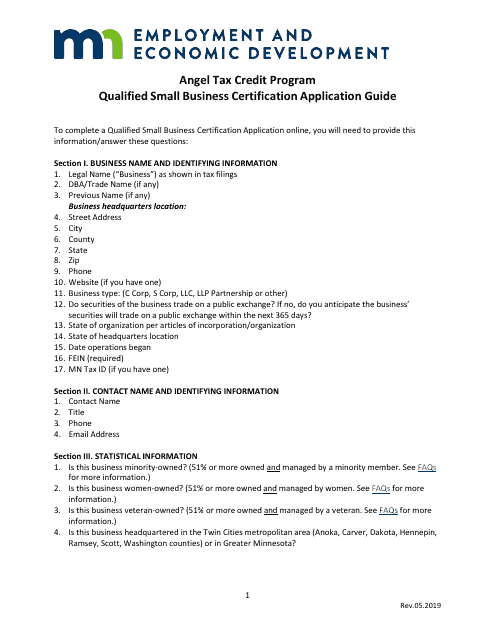

This form is used for applying for Qualified Small Business Certification under the Angel Tax Credit Program in Minnesota. It provides instructions on how to complete the application and apply for the program.

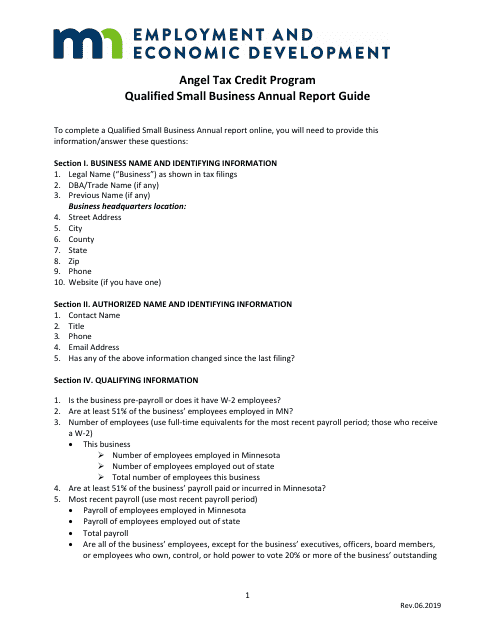

This document provides instructions for completing the Qualified Small Business Annual Report for the Angel Tax Credit Program in Minnesota. It outlines the requirements and details needed for reporting on the program's tax credits.

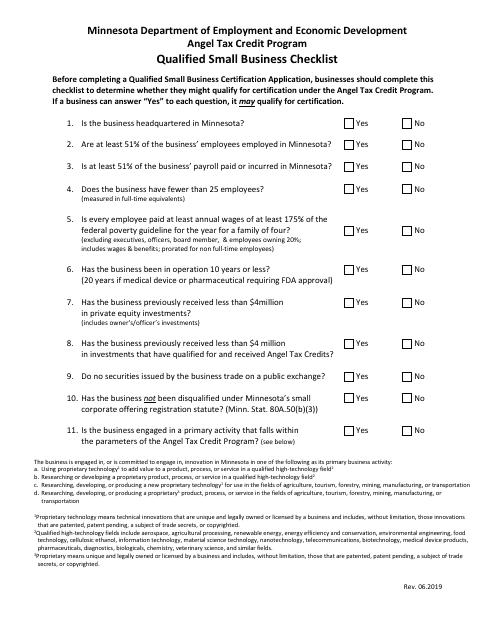

This document is a checklist for qualified small businesses in Minnesota to apply for the Angel Tax Credit Program. It provides step-by-step instructions and requirements to determine eligibility for the program.

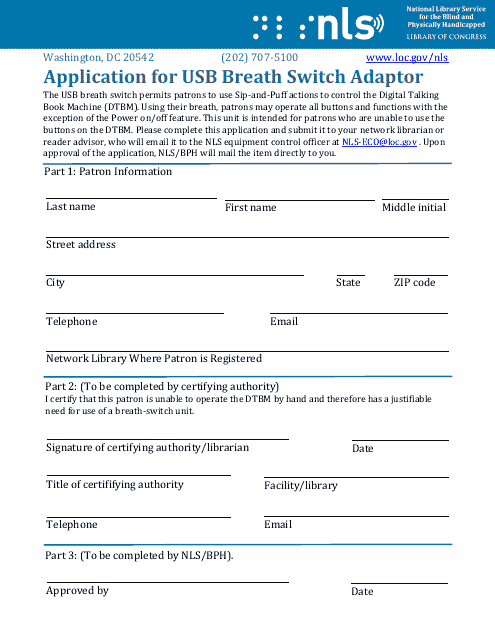

This document is an application for a USB breath switch adaptor in Minnesota. It is used for requesting a USB device that can be used as a switch by breathing into it.

This form is used for conducting a pre-award risk assessment in the state of Minnesota.

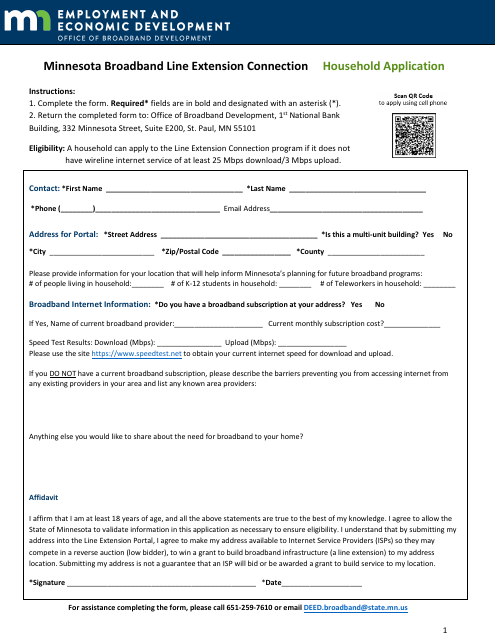

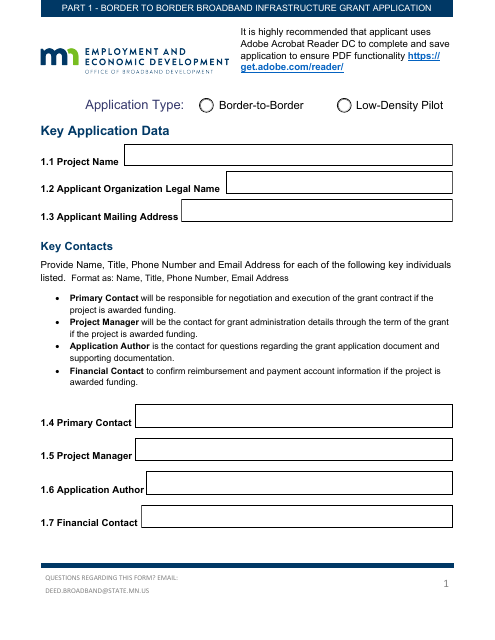

This form is used for applying for a broadband line extension connection for households in the state of Minnesota.

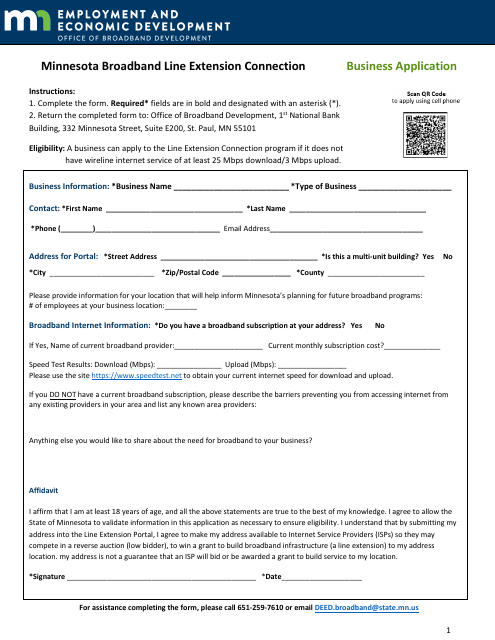

This form is used for Minnesota businesses applying for a broadband line extension connection.

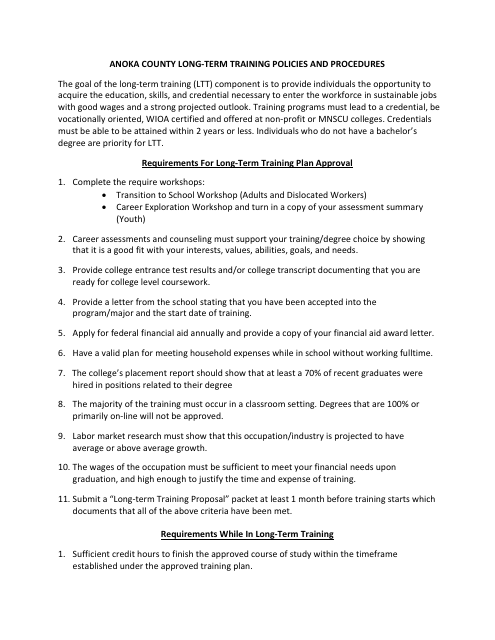

This document outlines the long-term training policies and procedures specific to Anoka County in Minnesota. It provides guidelines for employees on how to access and complete training programs.

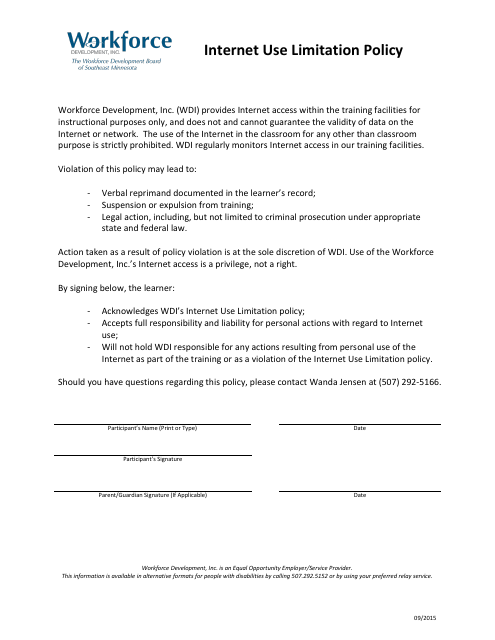

This document outlines the policy for limiting internet use in Minnesota. It provides guidelines and restrictions on internet usage for individuals and organizations.

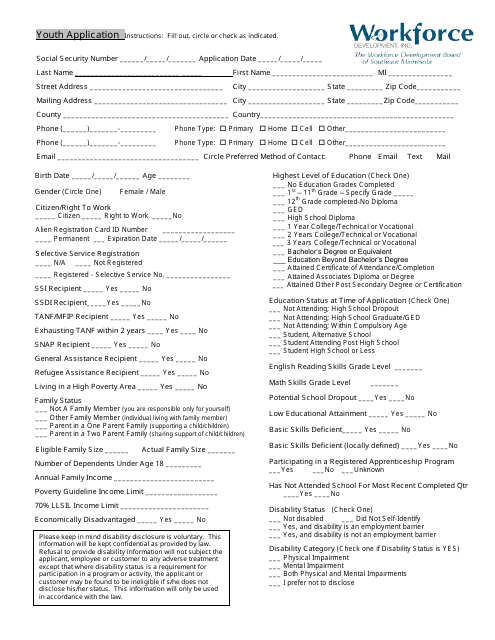

This form is used to apply for youth programs or activities in the state of Minnesota.

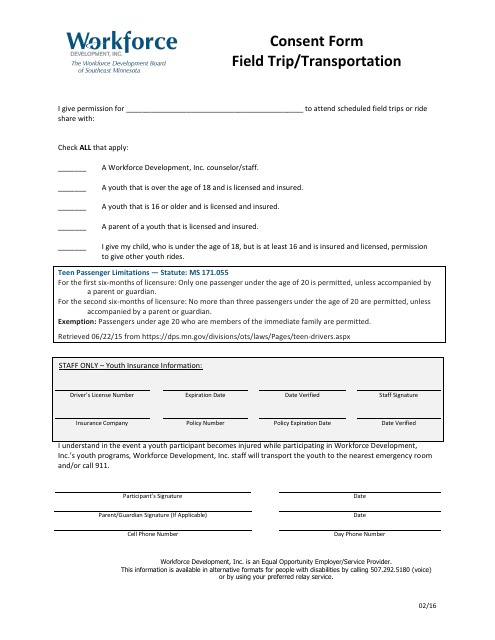

This Form is used for obtaining consent from parents or guardians for students to participate in field trips or transportation arrangements in Minnesota.

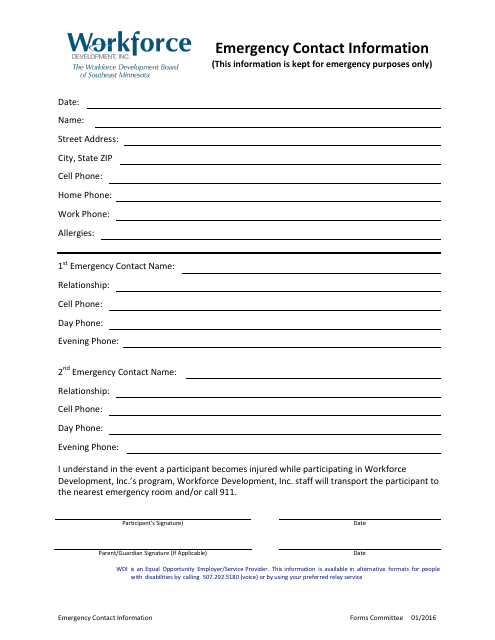

This Form is used for collecting and providing emergency contact information in the state of Minnesota.

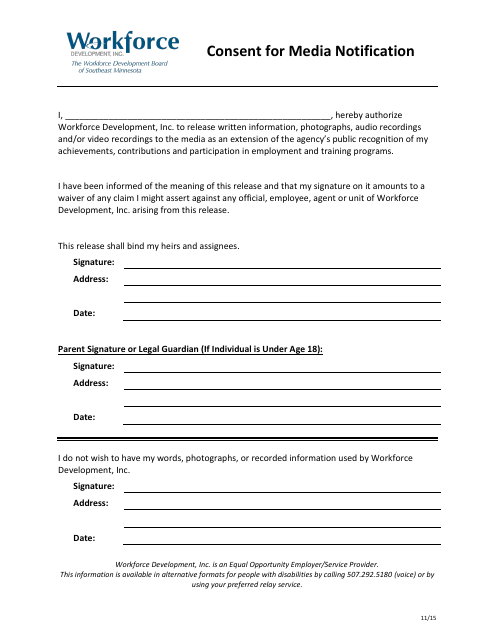

This document is used to obtain consent for notifying individuals about their appearance in media content in the state of Minnesota. It ensures that individuals are aware of and agree to their image or content being used or published.

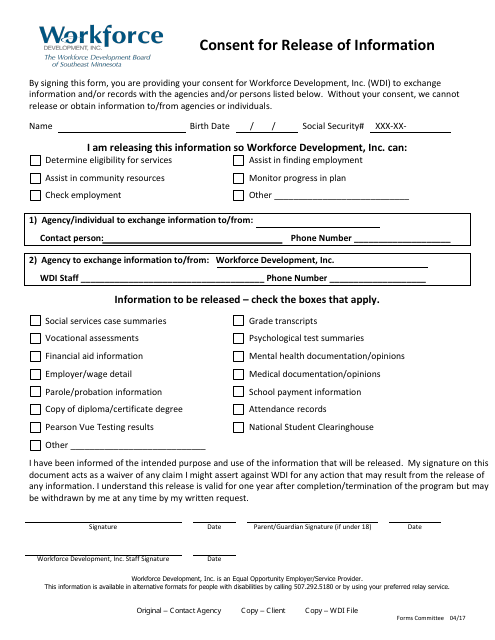

This document is used to obtain consent for the release of personal information in the state of Minnesota.

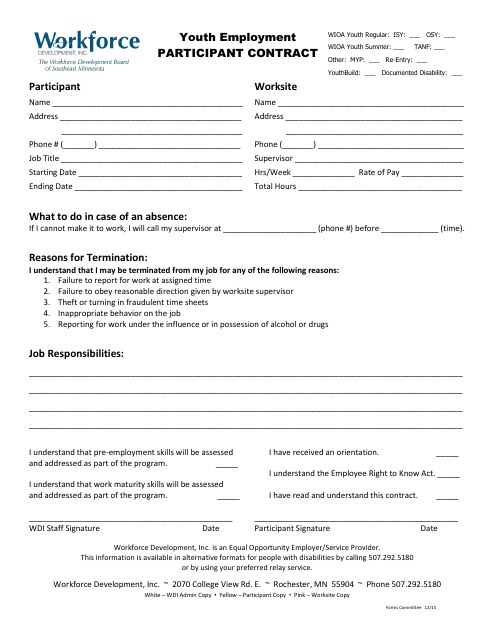

This document is used for recording the agreements between a participant and the program for youth employment in the state of Minnesota. It outlines the terms and conditions of the employment and the responsibilities of both parties.

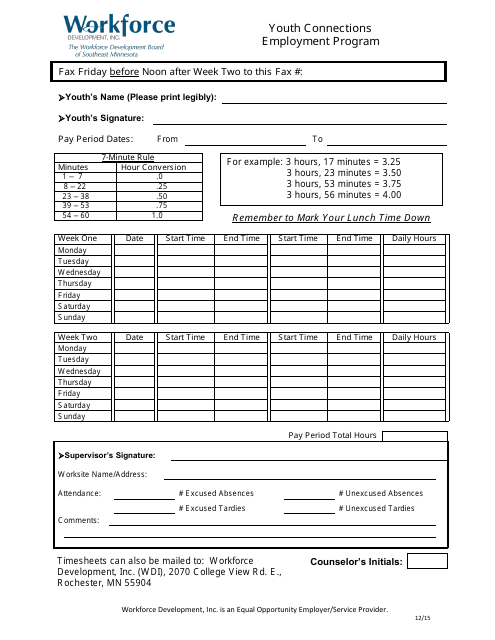

This document is used for recording hours worked by participants in the Youth Connections Employment Program in Minnesota.

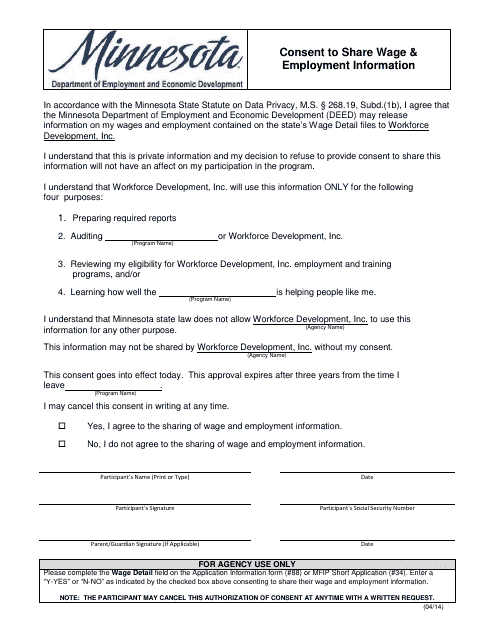

This document is for consenting to share your wage and employment information in the state of Minnesota.

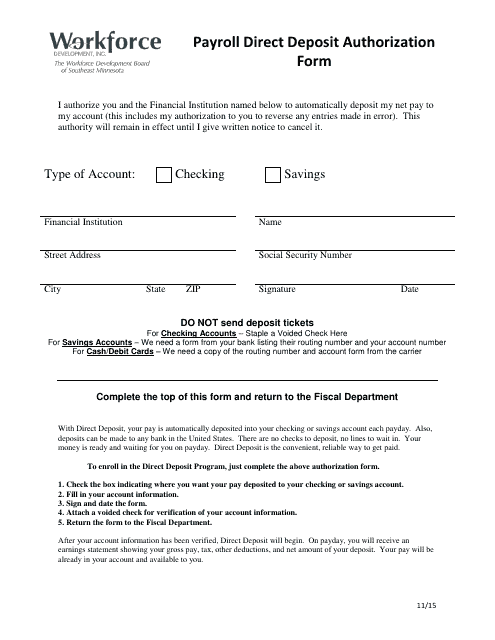

This form is used for authorizing direct deposit of payroll in the state of Minnesota.

This document is utilized to officially declare the state of legal blindness for participation in Minnesota's Business Enterprise Program. It serves as an essential prerequisite for individuals who are legally blind and wish to engage in entrepreneurial pursuits under this program.

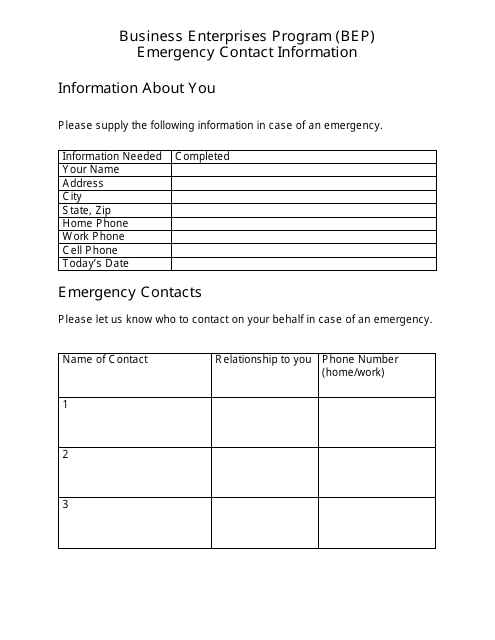

This document holds critical information used for reaching out to key contacts in case of emergency situations in the Business Enterprises Program (Bep) based in Minnesota.

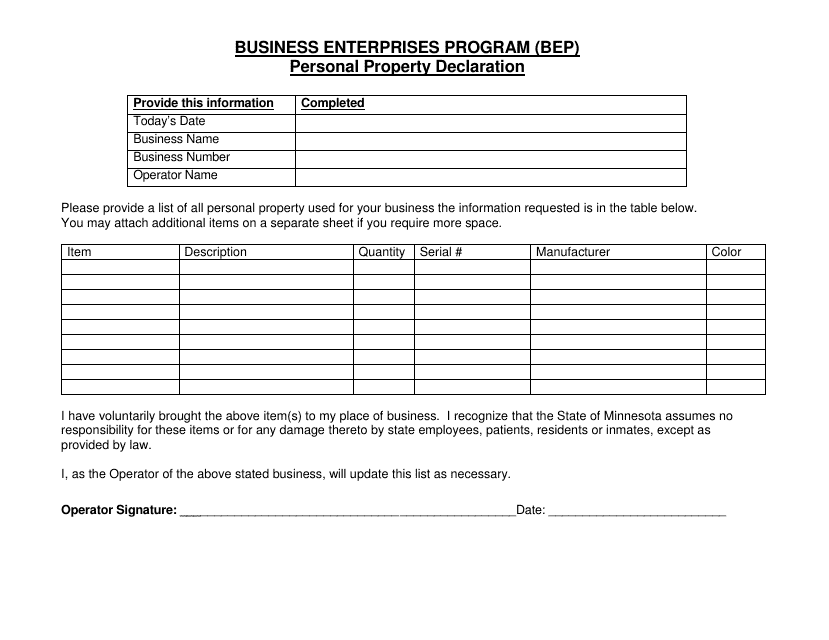

This document is used for reporting and declaring personal property as part of the Business Enterprises Program (BEP) in the state of Minnesota. It is required for businesses to disclose their assets and inventory for tax purposes.

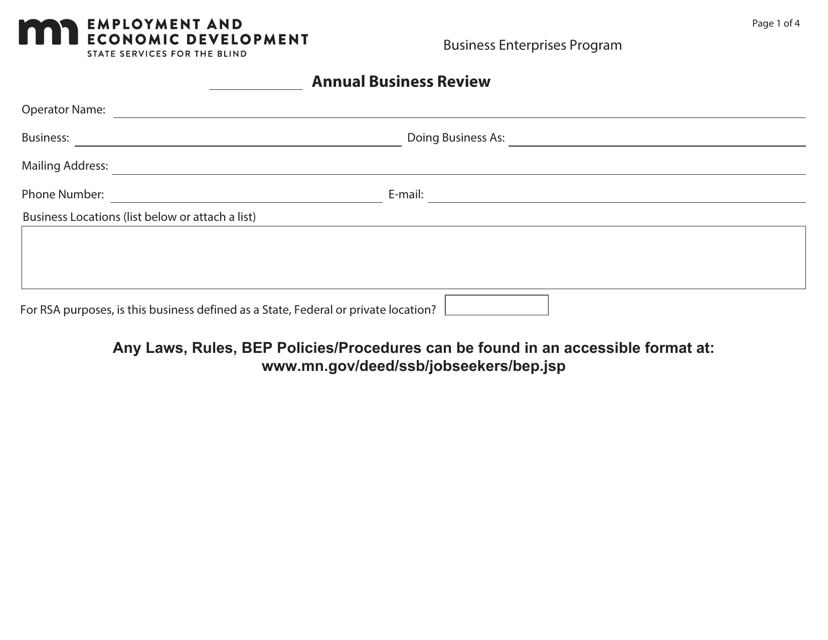

This document is an Annual Business Review specifically for the Business Enterprises Program in the state of Minnesota. It provides an overview and assessment of the program's performance over the past year.

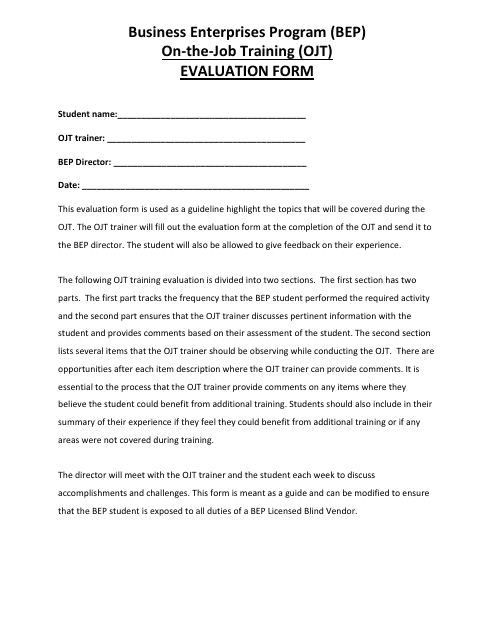

This document is used for evaluating on-the-job training in the Business Enterprises Program in Minnesota.

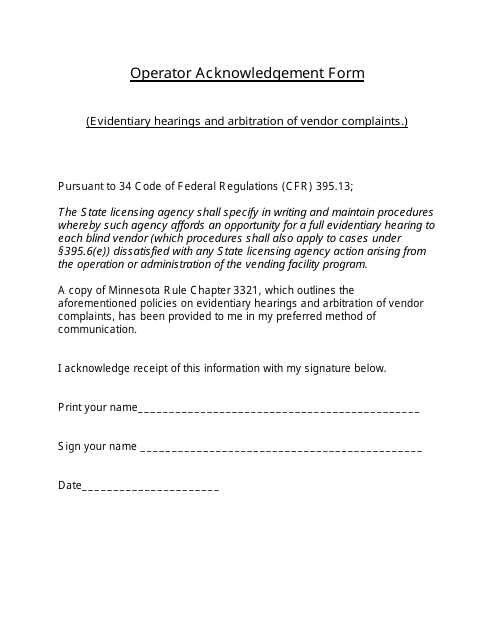

This form is typically used by operators in Minnesota to acknowledge their roles, responsibilities, and compliance with state laws and regulations. It may be required in industries like construction, transportation or energy production.

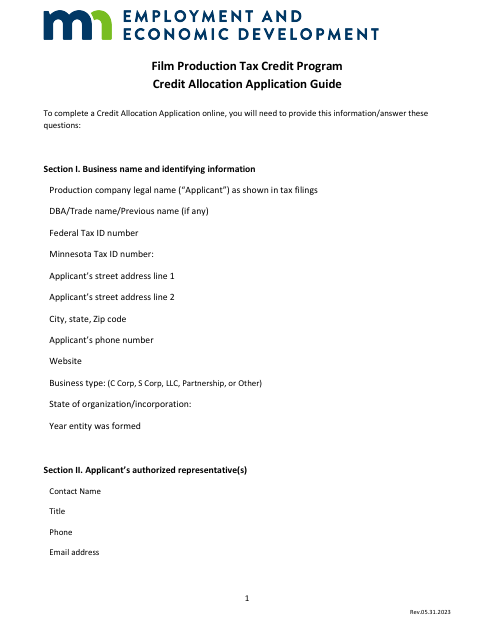

This document is for filling out the Credit Allocation Application for the Film Production Tax Credit Program in Minnesota. It provides instructions on how to apply for this credit allocation.

This type of document is an allocation application for the Film Production Tax Credit Program in Minnesota. It is used to apply for tax credits in the film production industry in the state.

This document certifies the start date of a film production project that is eligible for tax credits under the Minnesota Film Production Tax Credit Program.

This document provides a final report on the economic impact of the Film Production Tax Credit Program in Minnesota. It analyzes the effect of the program on the state's economy and the overall impact on film production in Minnesota.

This document is an application for the Automation Loan Participation Program (ALPP) in Minnesota. It is used to apply for participation in the program.

This document is used to certify the use of loan or investment proceeds and to disclose any potential conflicts of interest. It is specific to the state of Minnesota.

This document is a sample certification form used in Minnesota for borrowers or investees to declare how they will use the proceeds and to certify they have no conflicts of interest.

This document certifies that an investor or investee is not a sex offender and is eligible to participate in a venture capital or equity program in Minnesota. It is a sample certification form for reference.

This document is a sample certification used in Minnesota for Venture Capital Fund Services to Portfolio Companies. It outlines the certification process and requirements for providing such services.

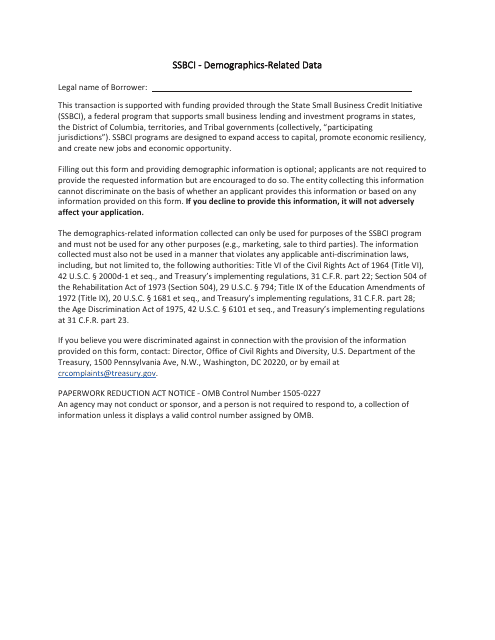

This document includes demographics-related data specific to Minnesota. It provides information on population, age distribution, ethnicity, and other demographic factors.