Michigan Department of Treasury Forms

Documents:

739

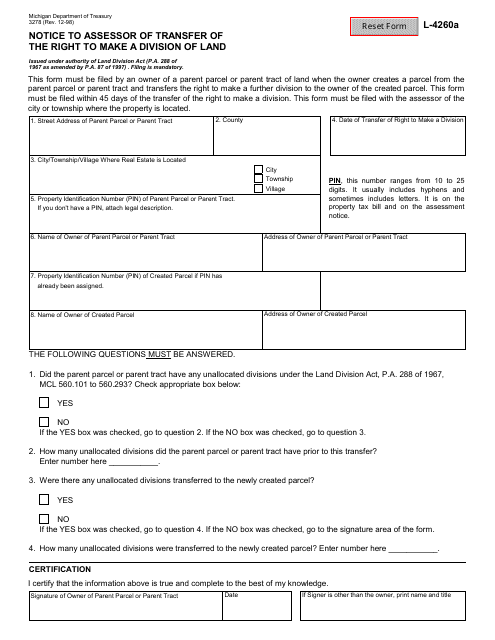

This Form is used for notifying the assessor in Michigan about the transfer of the right to make a division of land.

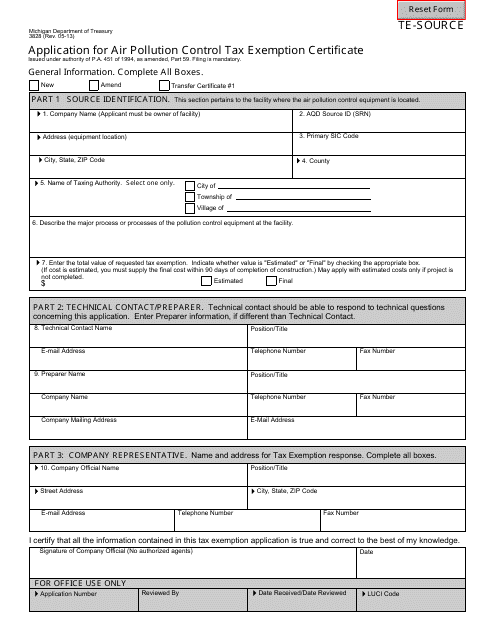

This form is used for applying for an air pollution control tax exemption certificate in Michigan. It allows businesses to request a tax exemption for equipment used to control air pollution.

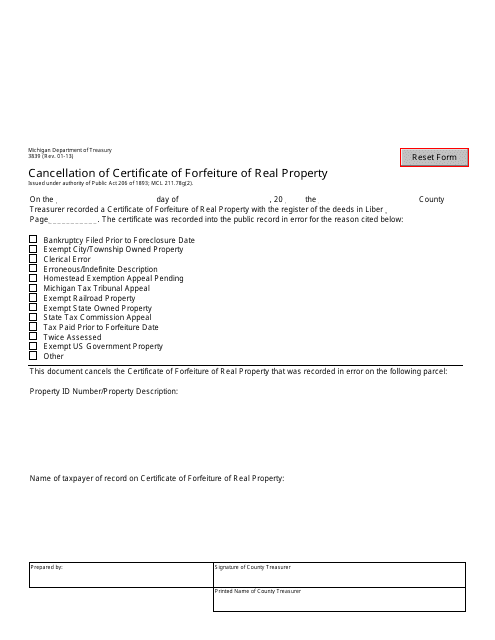

This Form is used for cancelling a certificate of forfeiture of real property in Michigan.

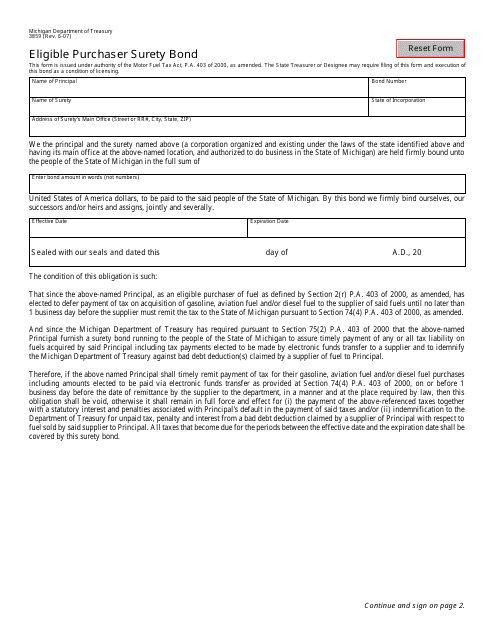

This form is used for obtaining a surety bond by eligible purchasers in the state of Michigan.

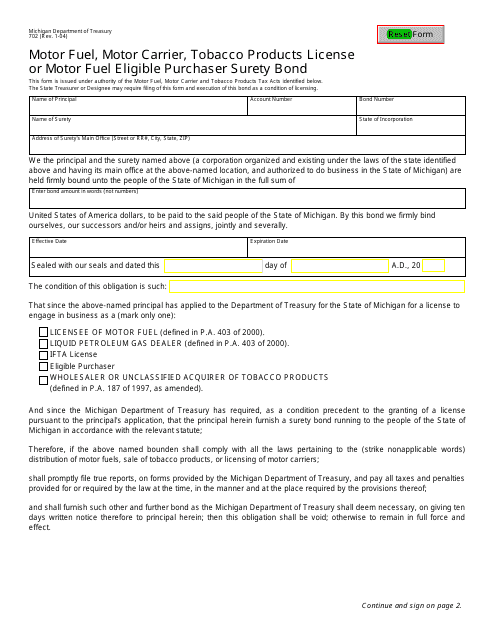

This Form is used for applying for a Motor Fuel, Motor Carrier, Tobacco Products License or Motor Fuel Eligible Purchaser Surety Bond in the state of Michigan.

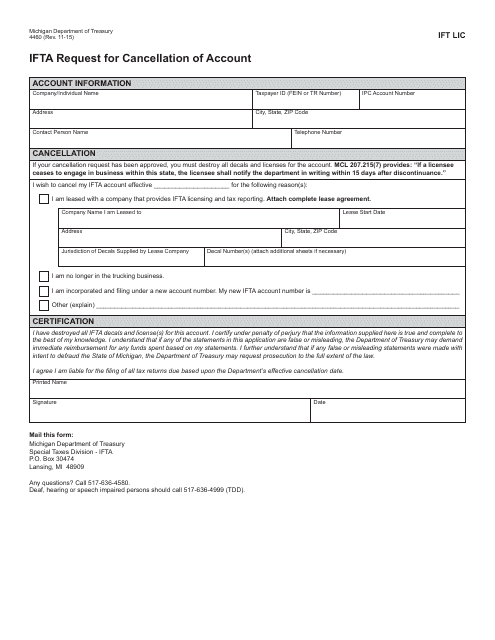

This form is used for submitting a request to cancel an IFTA (International Fuel Tax Agreement) account in the state of Michigan.

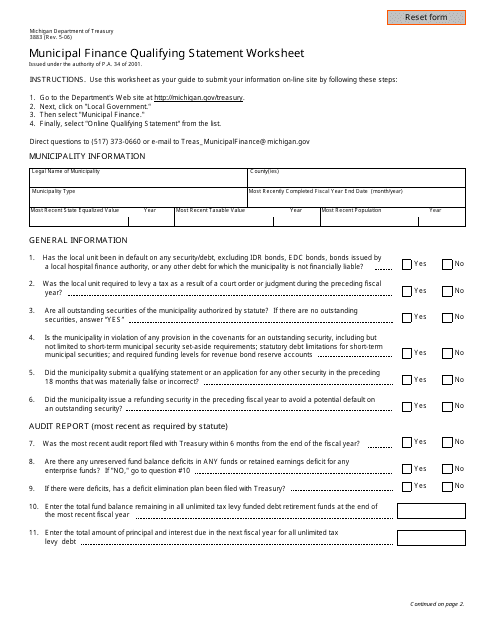

This form is used for completing the Municipal Finance Qualifying Statement Worksheet in the state of Michigan. It is used to determine the eligibility of a municipality for certain financial assistance programs.

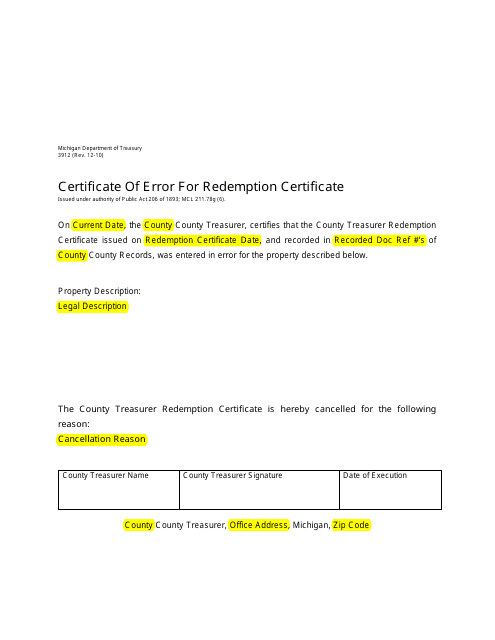

This Form is used for certifying errors in a redemption certificate in the state of Michigan.

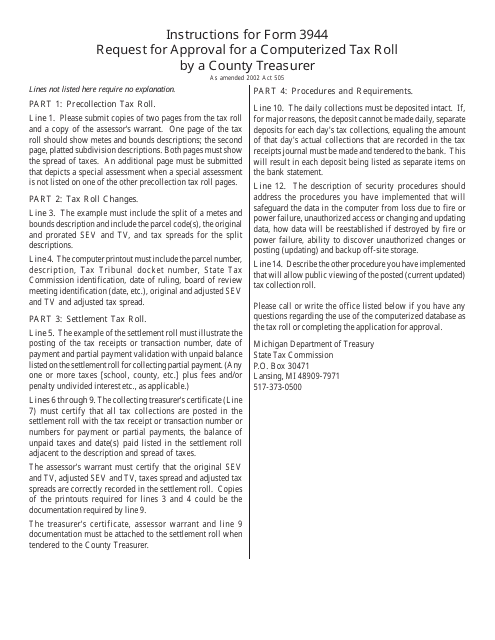

This Form is used for requesting approval for a computerized tax roll by a county treasurer in Michigan. It provides instructions on how to complete and submit the form.

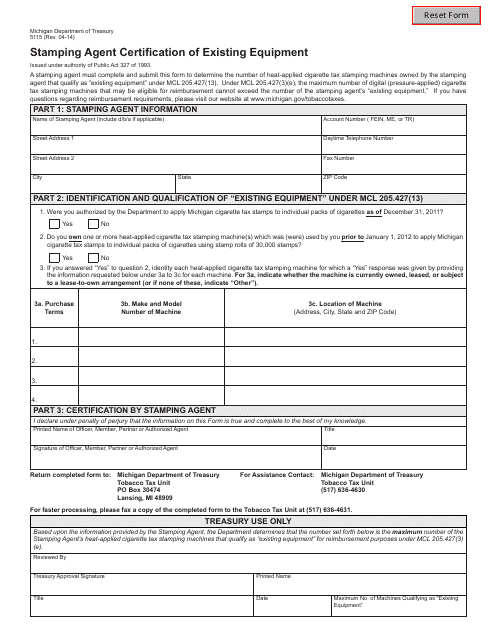

This form is used for the certification of existing equipment by stamping agents in Michigan.

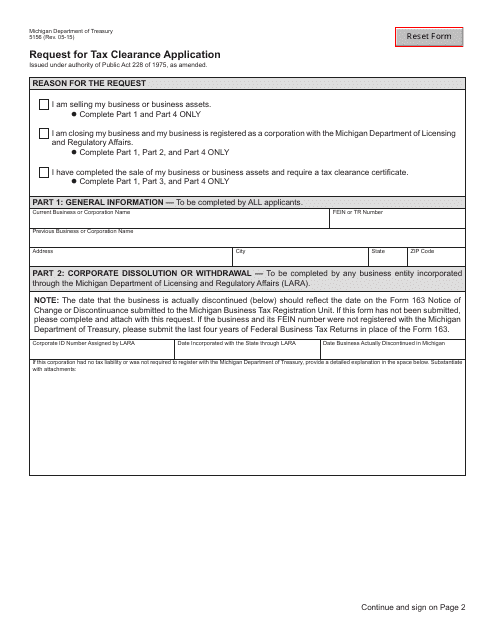

This form is used for requesting tax clearance in the state of Michigan.

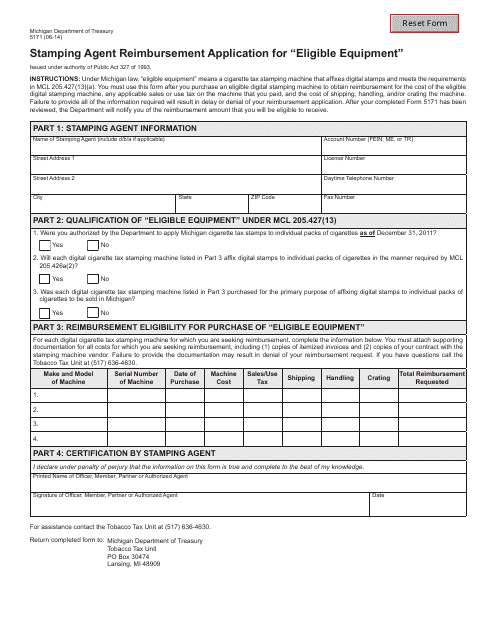

This form is used for applying for reimbursement as a stamping agent for eligible equipment in Michigan.

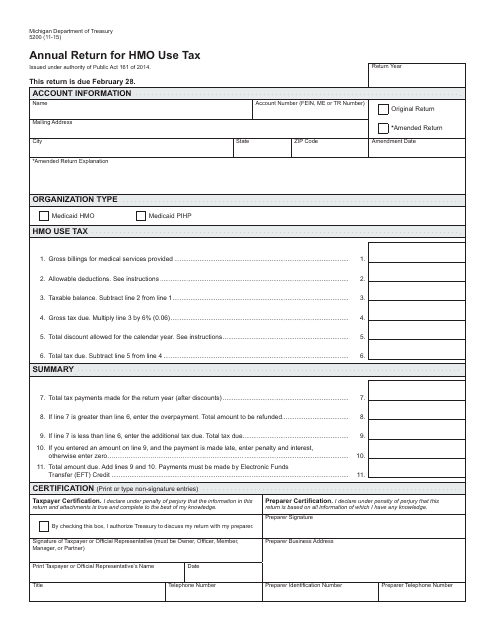

This form is used for filing the annual return for HMO use tax in the state of Michigan.

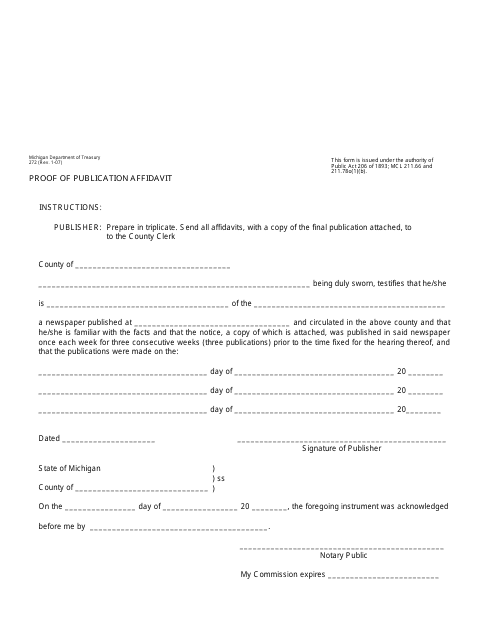

This form is used for verifying that a publication has been made in Michigan. It is used to provide proof of publication for legal purposes.

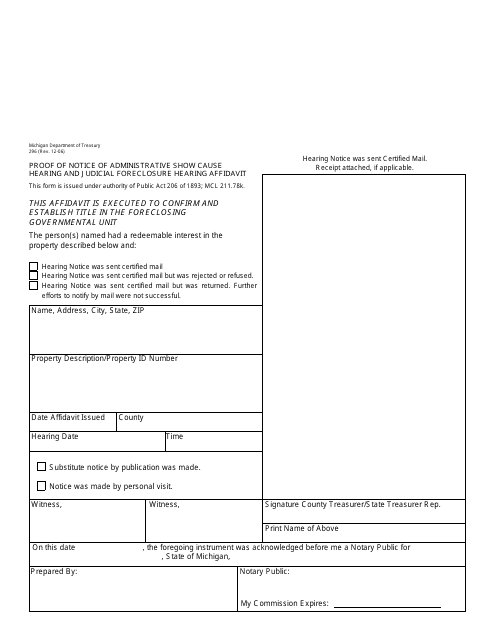

This form is used for providing proof of notice for an administrative show cause hearing and judicial foreclosure hearing in the state of Michigan.

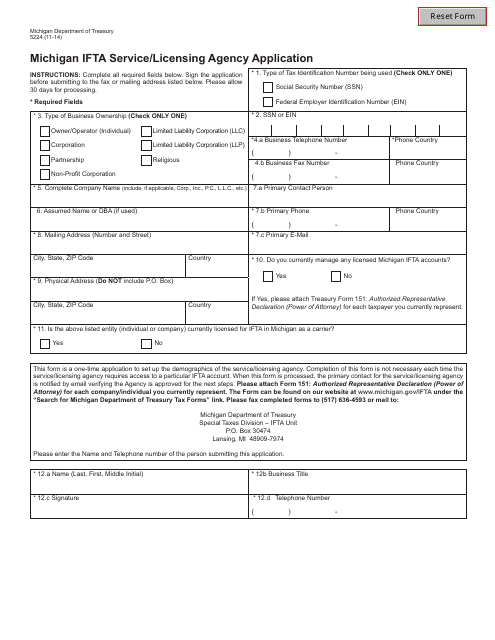

This form is used for applying for IFTA service and licensing from the Michigan agency.

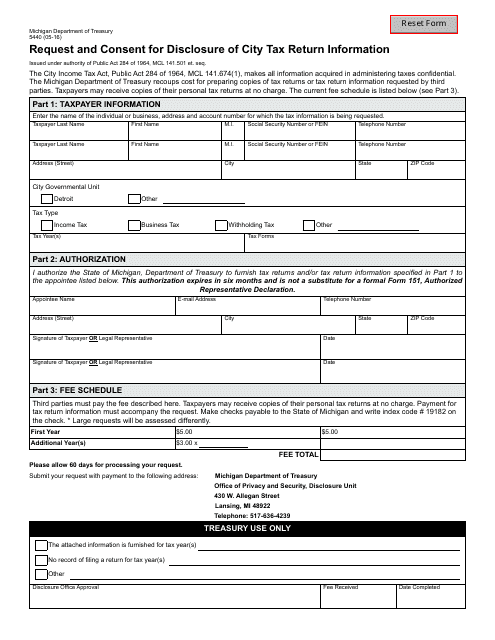

This document is used for requesting and giving consent to disclose information from a city tax return in Michigan.

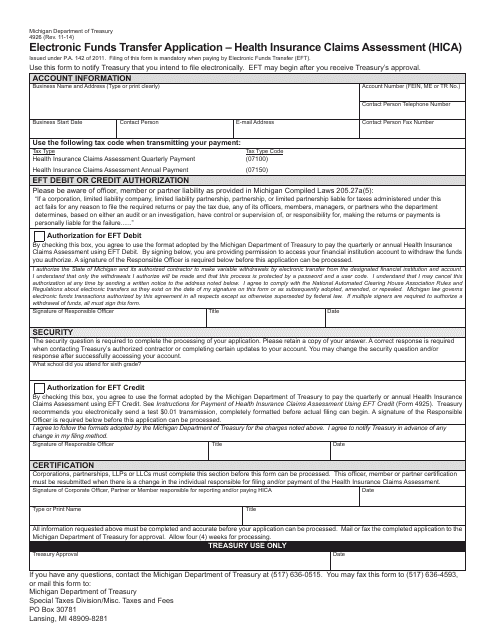

This form is used for applying for electronic funds transfer for health insurance claims assessment in the state of Michigan.

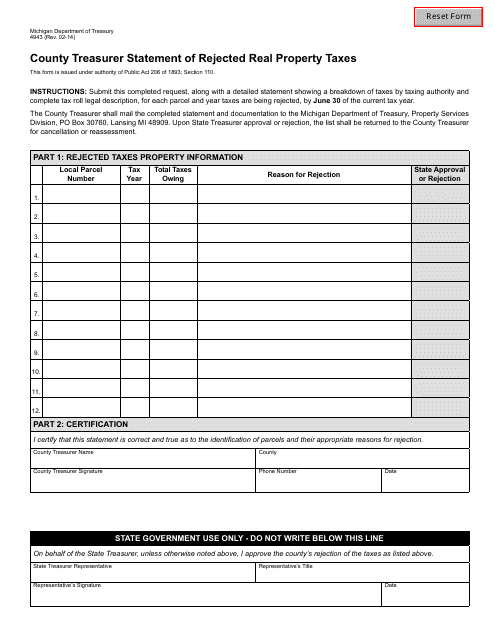

This Form is used for reporting rejected real property taxes to the County Treasurer in Michigan.

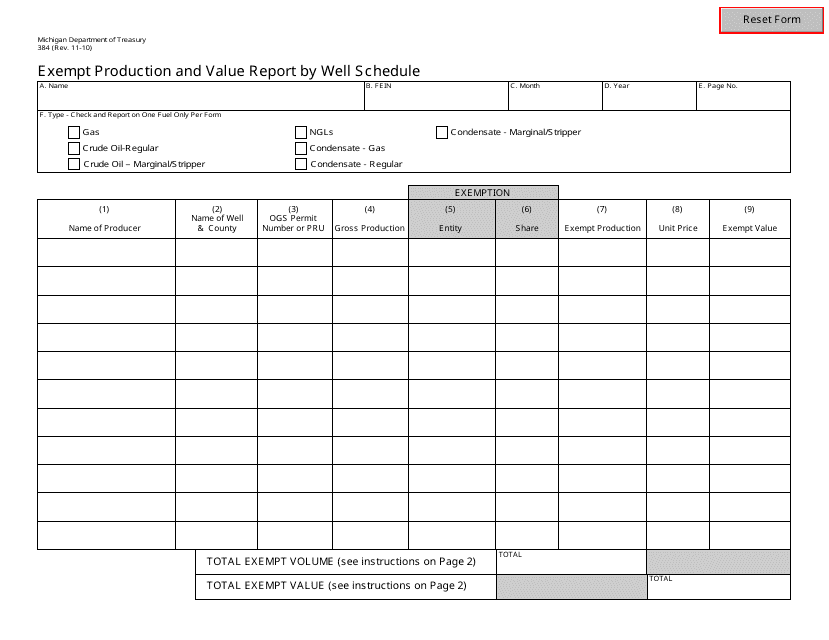

This form is used for reporting exempt production and value of oil and gas wells in Michigan.

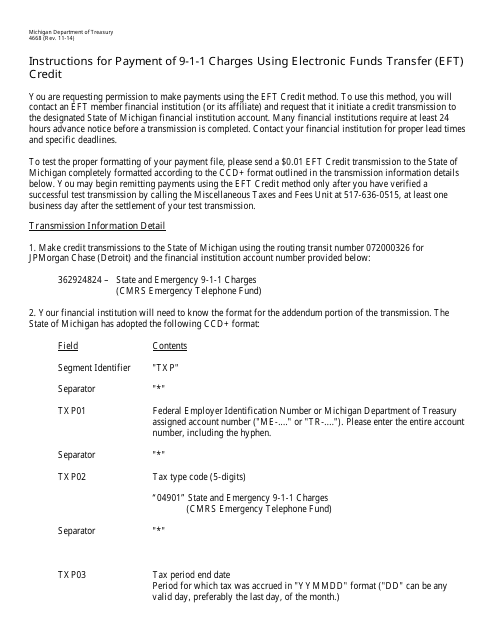

This Form is used for making electronic payments for 9-1-1 charges in Michigan.

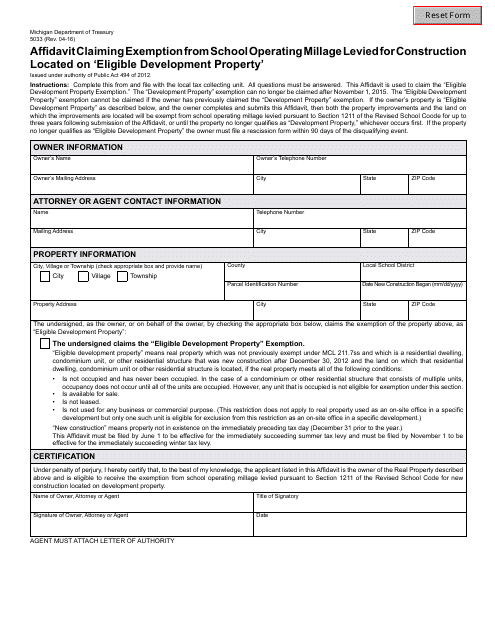

This form is used for claiming an exemption from school operating millage for constructions located on eligible development property in Michigan.

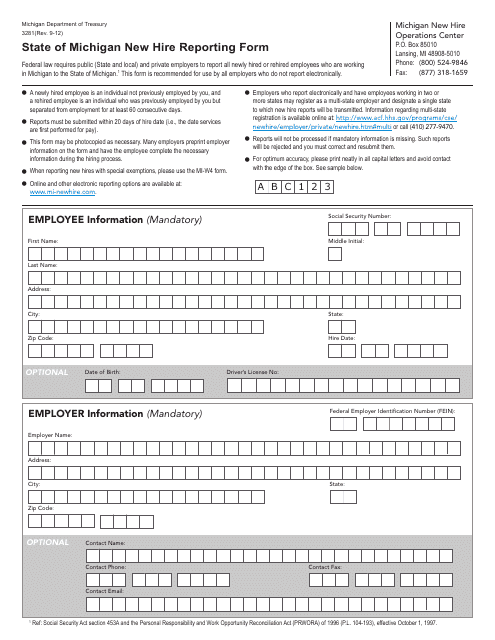

This is a legal document used by an employer to report information on newly hired employees to the Department of Treasury shortly after the date of hire in the state of Michigan.

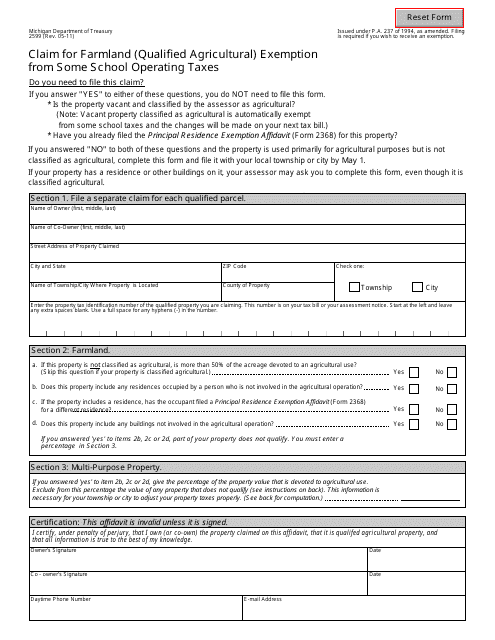

This form is used for claiming a farmland exemption from some school operating taxes in Michigan.

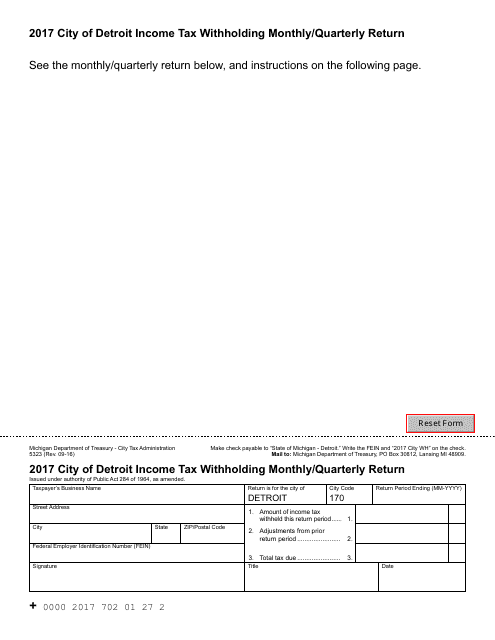

This form is used by businesses in the City of Detroit to report their monthly or quarterly income tax withholdings for employees.

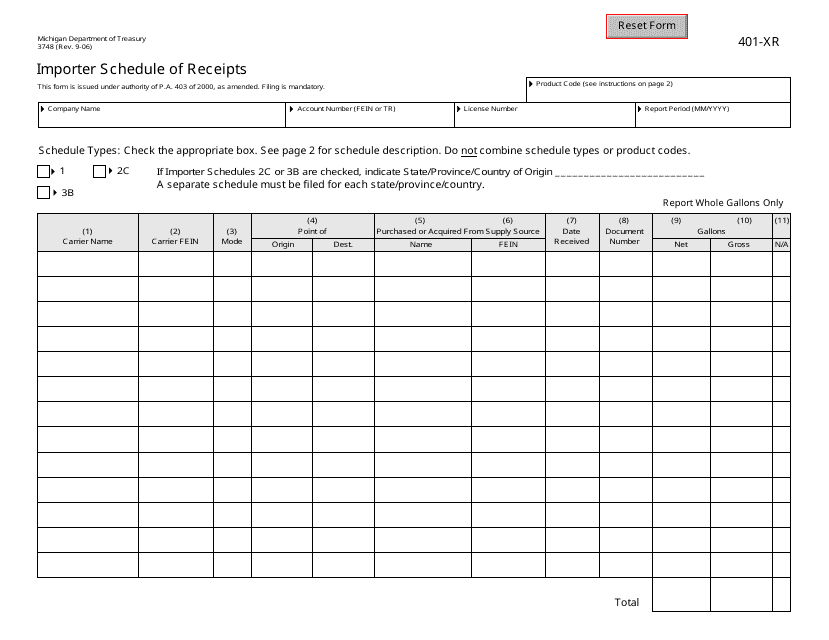

This form is used for Michigan importers to document their schedule of receipts.

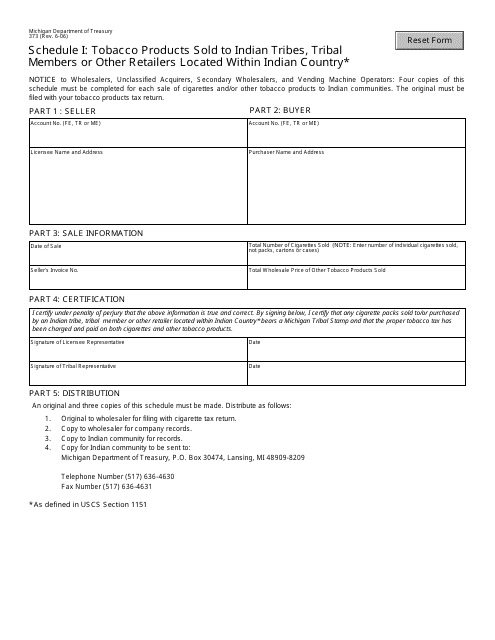

This Form is used for reporting tobacco products sold to Indian tribes, tribal members, or other retailers located within Indian Country in Michigan.

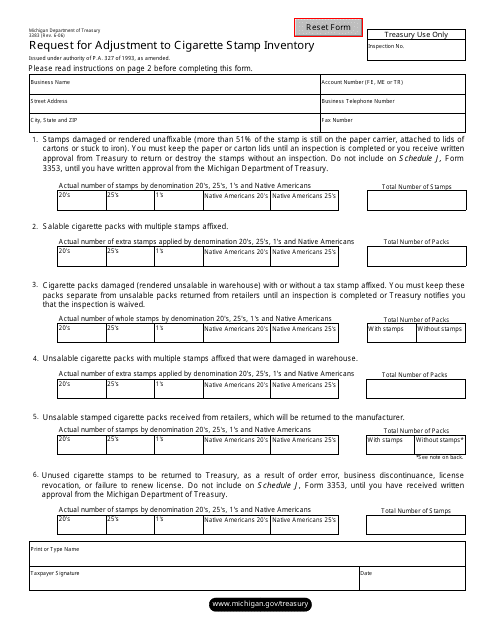

This form is used for requesting an adjustment to the cigarette stamp inventory in the state of Michigan.

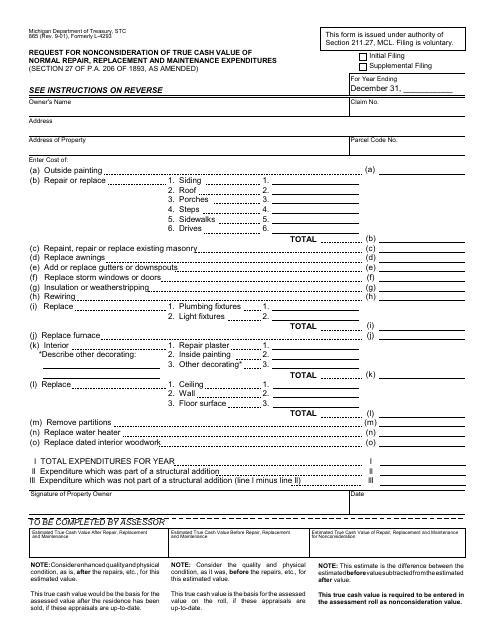

This Form is used for requesting nonconsideration of true cash value for normal repair, replacement, and maintenance expenditures in the state of Michigan.

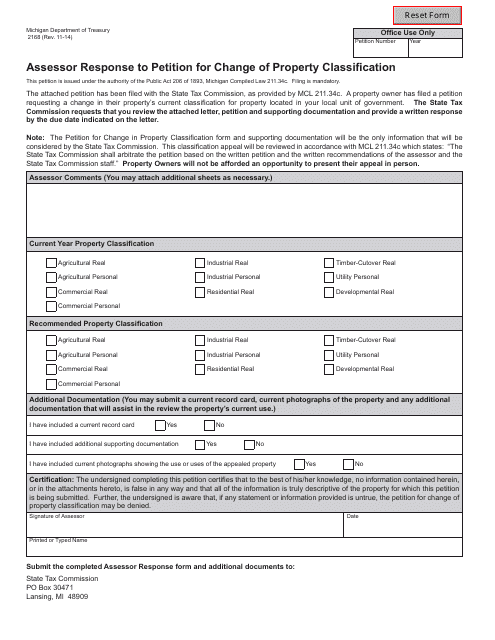

This form is used for assessors in Michigan to respond to a petition requesting a change in property classification.

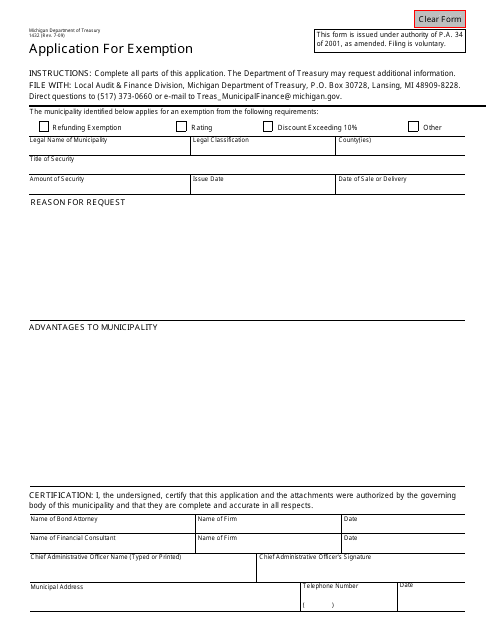

This form is used for applying for an exemption in Michigan. It is specifically for Form 1432.

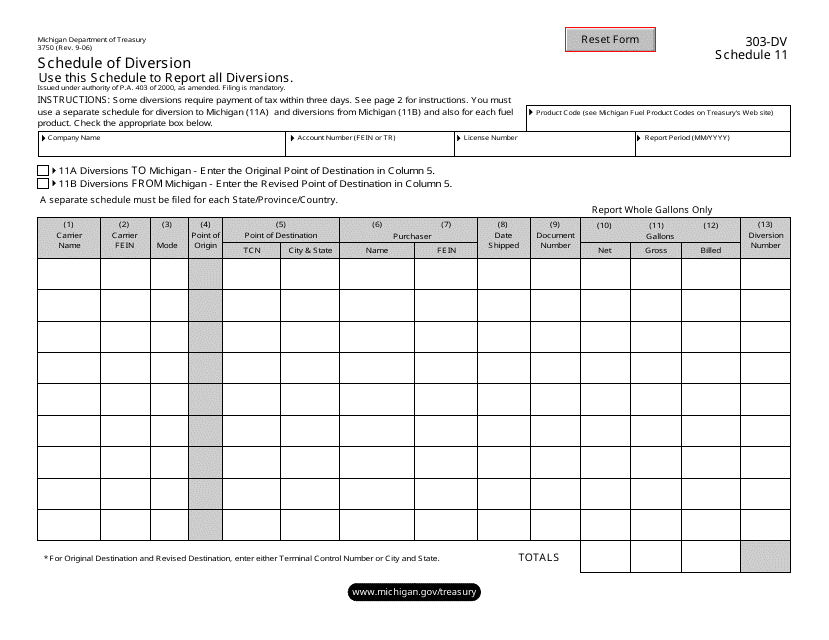

This form is used for reporting the schedule of diversion in Michigan. It is specifically designed for Form 3750 (303-DV) Schedule 11.

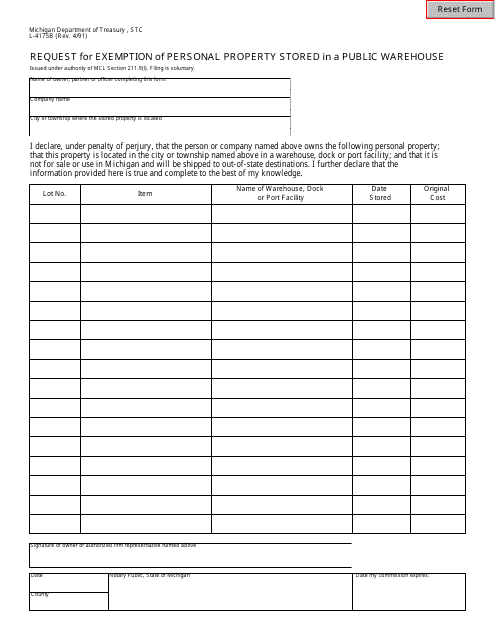

This form is used for requesting an exemption for personal property that is stored in a public warehouse in Michigan.

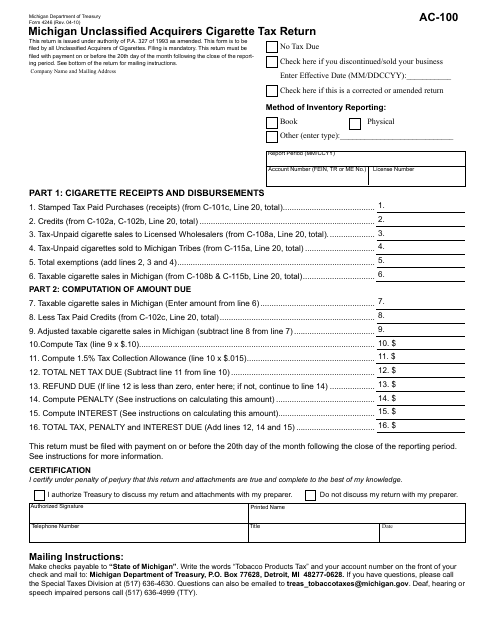

This form is used for Michigan unclassified acquirers to report and pay cigarette taxes.

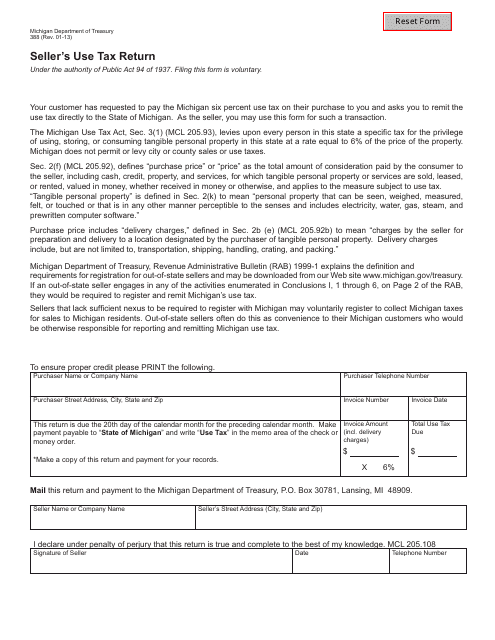

This form is used by sellers in Michigan to report and pay use tax owed on the purchase of items for resale or use in their business.