Michigan Department of Treasury Forms

Documents:

739

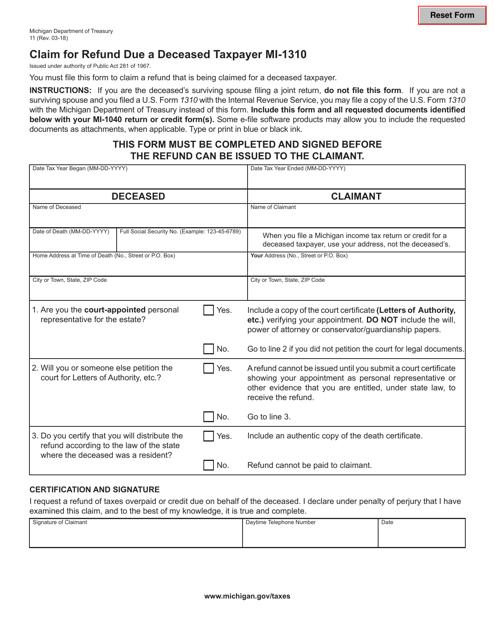

This form is used for claiming a refund on behalf of a deceased taxpayer in the state of Michigan.

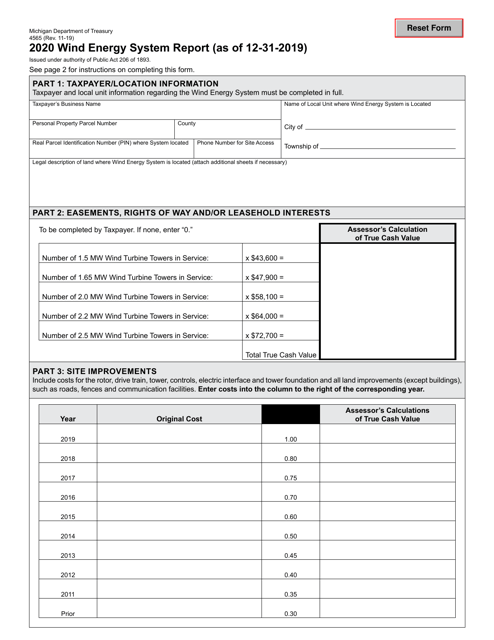

This form is used for reporting wind energy systems in Michigan.

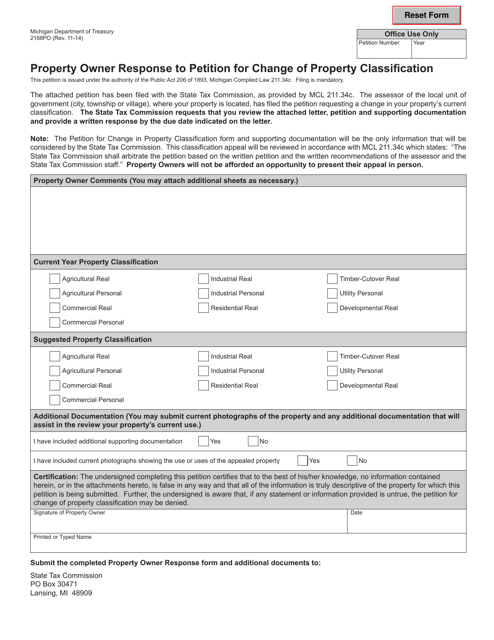

This form is used for property owners in Michigan to respond to a petition for changing the property classification.

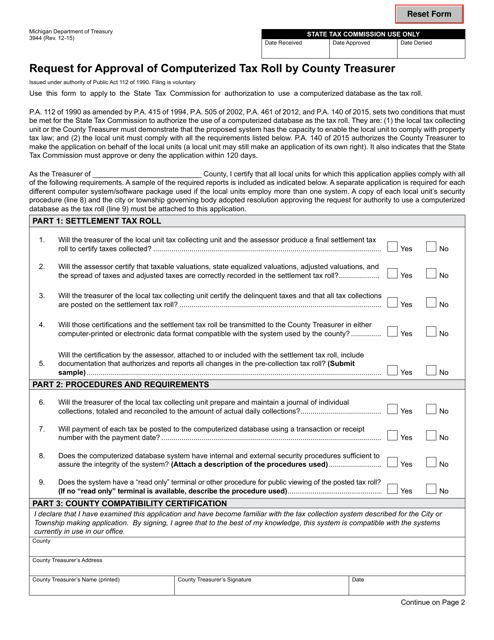

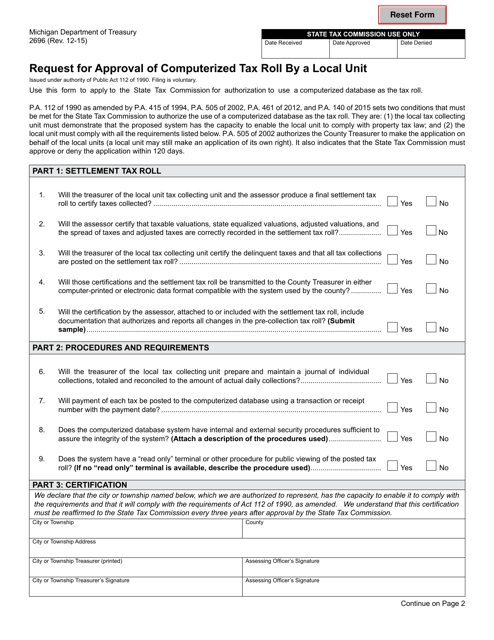

This form is used for requesting approval of a computerized tax roll by the County Treasurer in Michigan. It is an important document for ensuring accurate tax information and compliance.

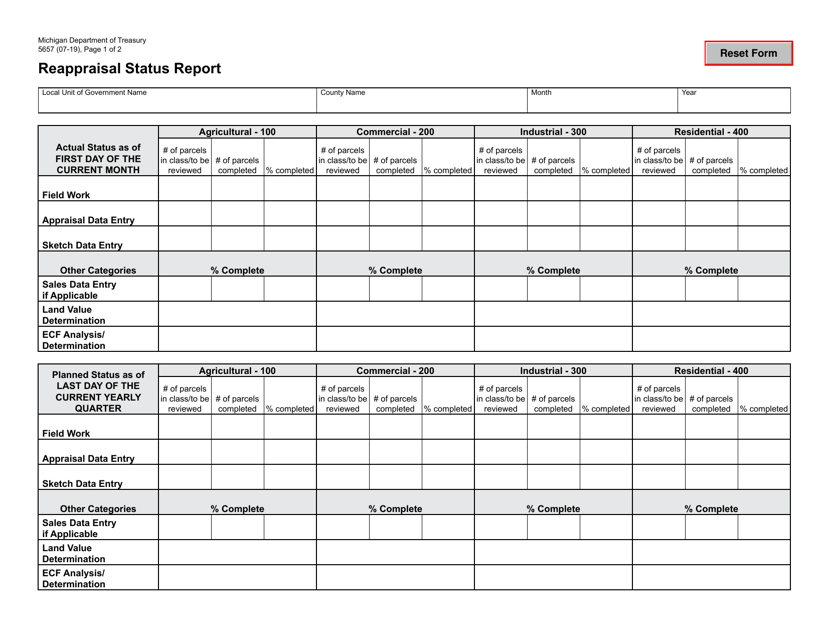

This Form is used for reporting the current status of property reappraisal in the state of Michigan. It provides important information regarding the assessment of property values for tax purposes.

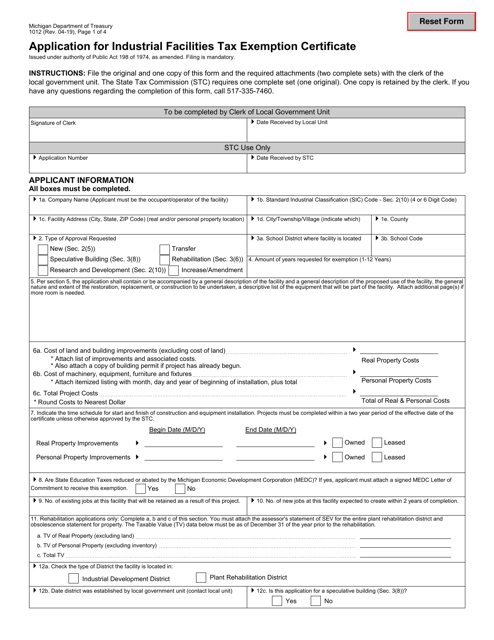

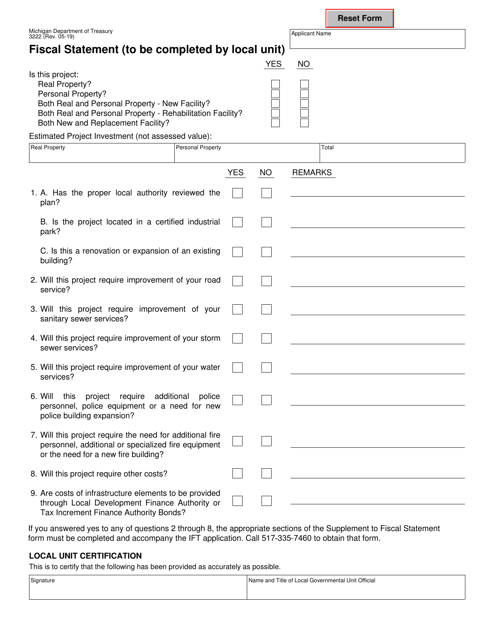

This Form is used for applying for an industrial facilities tax exemption certificate in the state of Michigan.

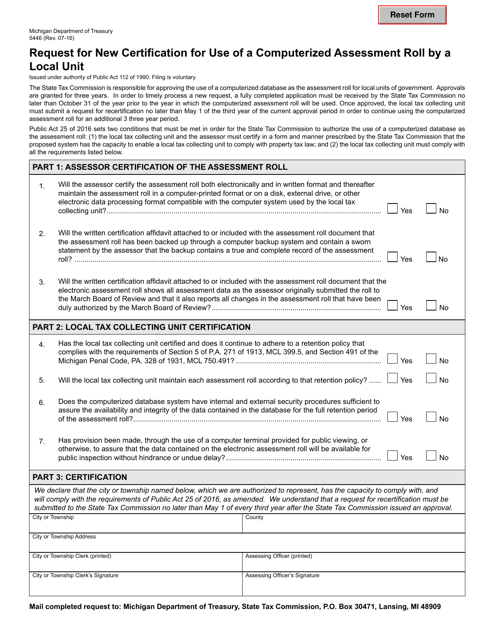

This Form is used for local units in Michigan to request a new certification for the use of a computerized assessment roll in property assessment.

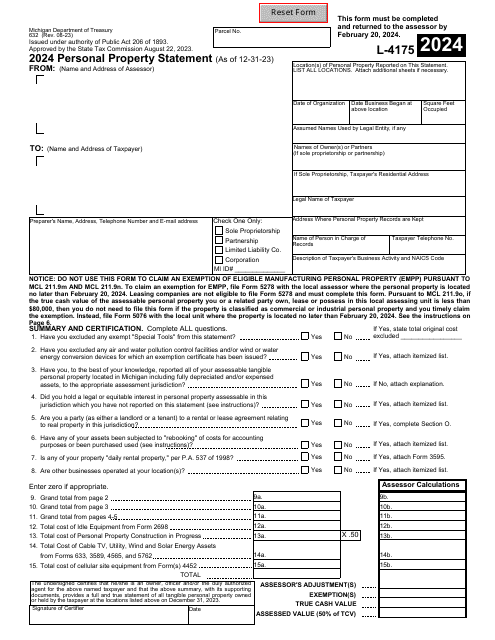

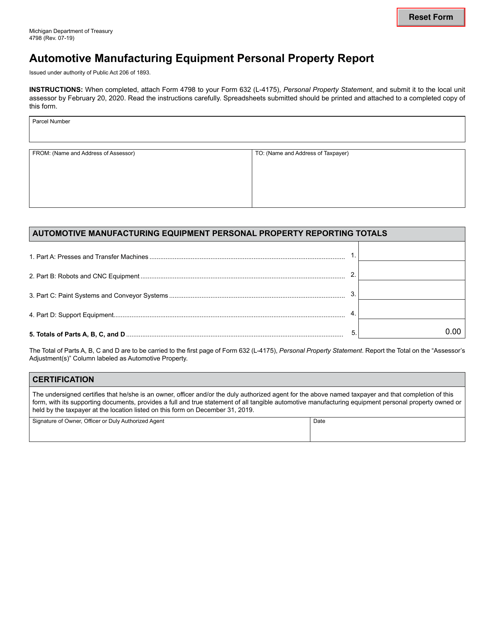

This Form is used for reporting personal property related to automotive manufacturing equipment in Michigan.

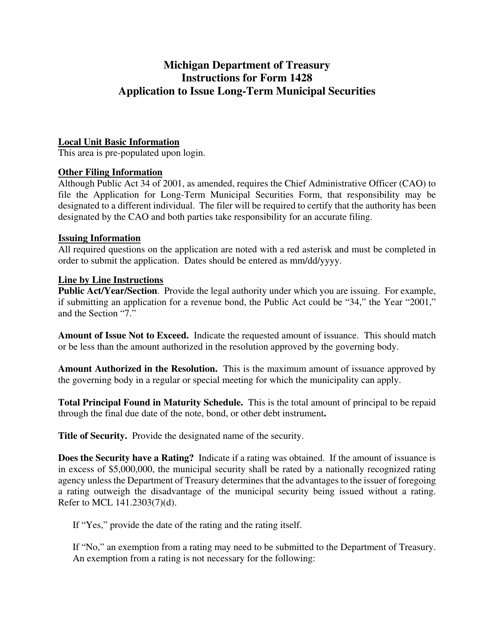

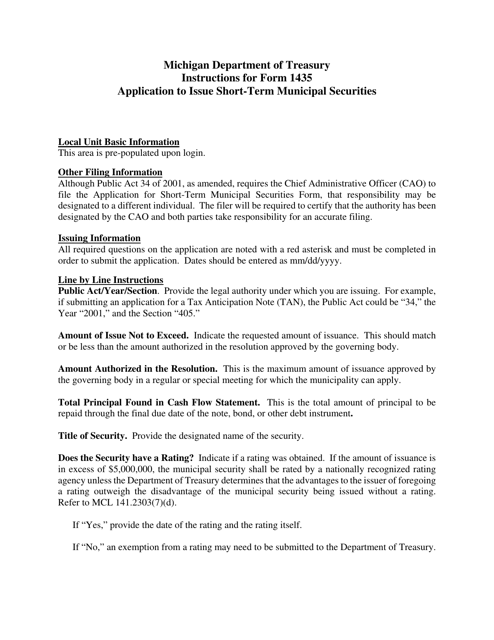

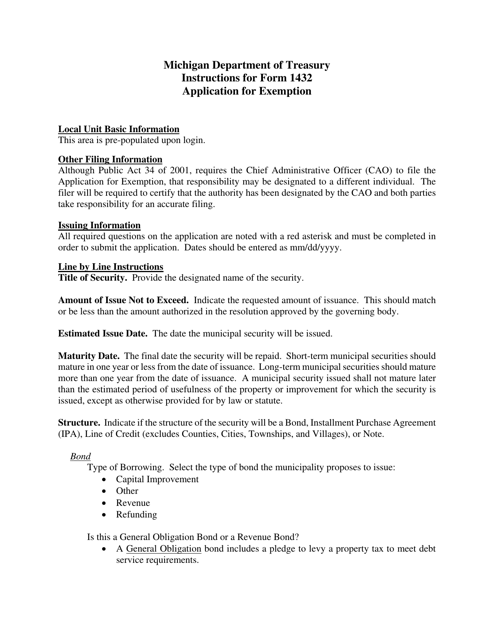

This form is used for applying for the State Treasurer's approval to issue long-term securities in Michigan. It provides instructions on completing the application process.

This form is used for a local unit in Michigan to request approval for a computerized tax roll. It helps streamline the tax collection process.

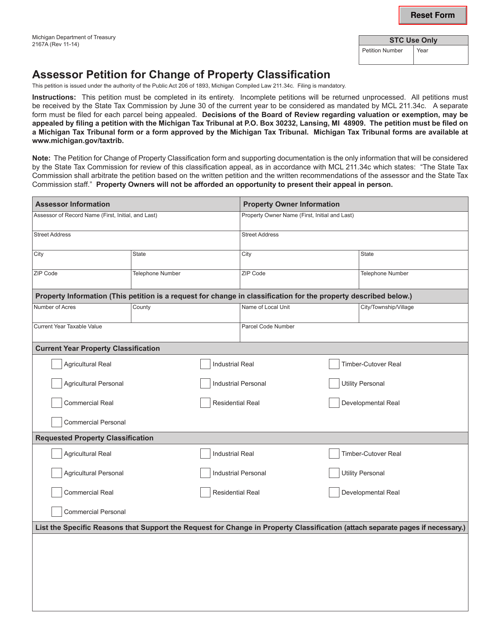

This document is used for filing a petition in Michigan to request a change in property classification. It is typically filed by property owners who believe their property has been classified incorrectly for tax purposes.

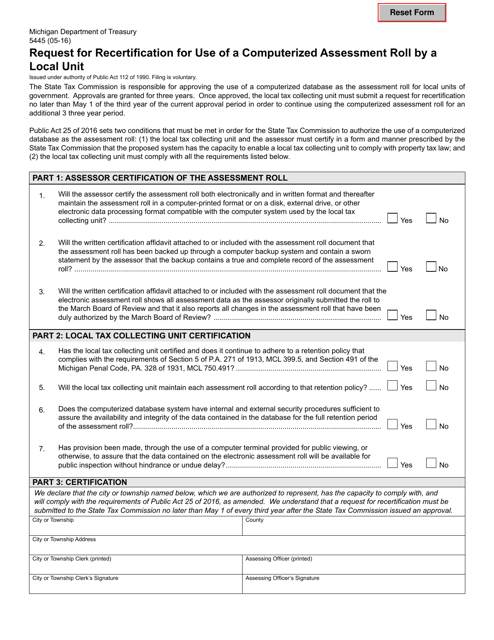

This form is used for requesting recertification to use a computerized assessment roll by a local unit in Michigan.

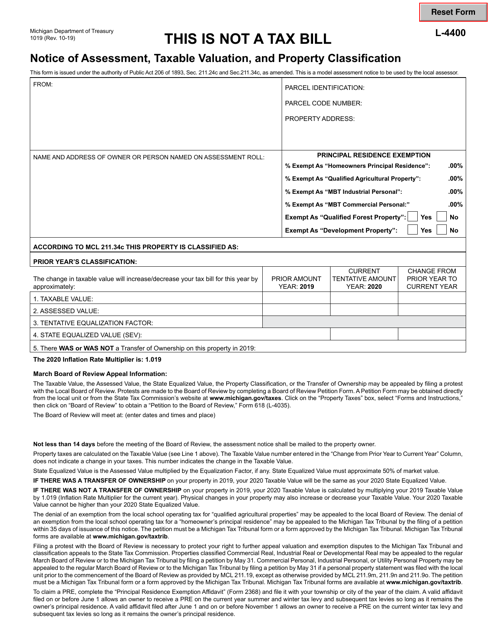

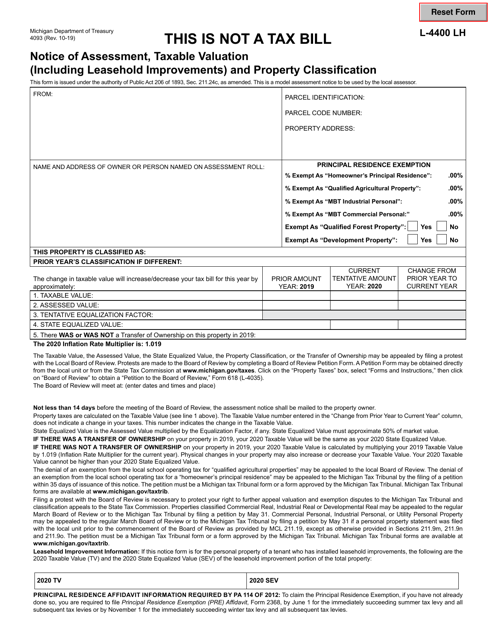

This form is used for the Notice of Assessment, Taxable Valuation (Including Leasehold Improvements) and Property Classification in Michigan. It provides information about the assessed value, taxable value, and classification of a property.

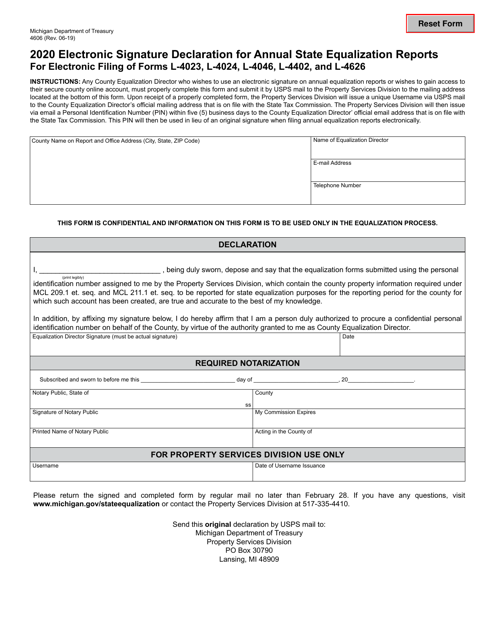

This form is used for declaring electronic signatures for annual state equalization reports in Michigan.

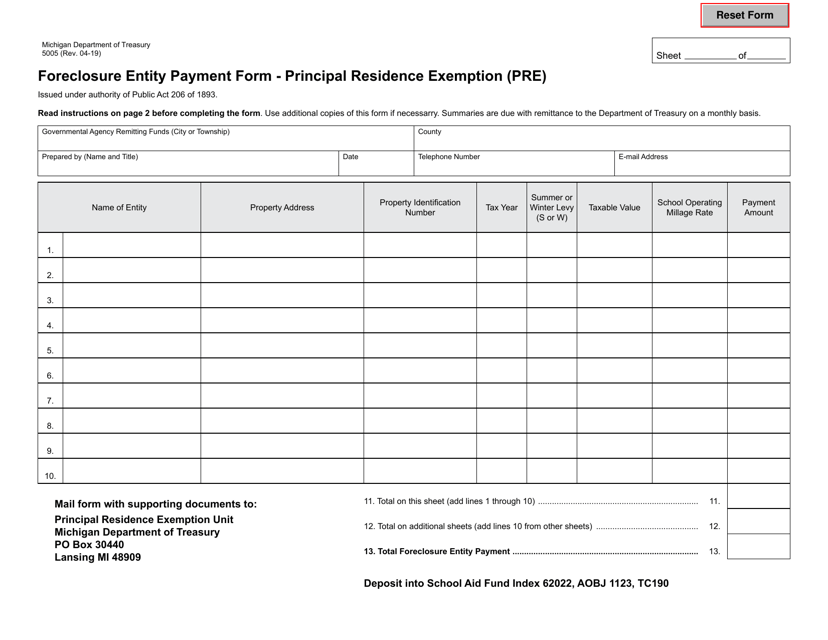

This document is used for making foreclosure entity payment for principal residence exemption in the state of Michigan.

This Form is used for applying for an exemption in the state of Michigan. It provides instructions on how to complete and submit Form 1432.

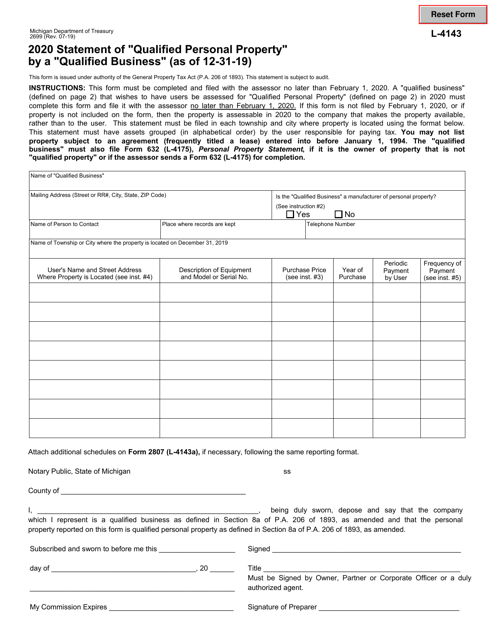

This Form is used for businesses in Michigan to report their qualified personal property as of December 31, 2019.