Michigan Department of Treasury Forms

The Michigan Department of Treasury is responsible for managing and administering various financial activities in the state of Michigan. Their primary role includes collecting taxes, overseeing revenue distribution, and ensuring compliance with tax laws. They also provide assistance and resources to taxpayers, including filing tax forms, answering tax-related inquiries, and offering tax credits and incentives. Additionally, the Department of Treasury is involved in managing the state's financial resources, including investments and debt management.

Documents:

739

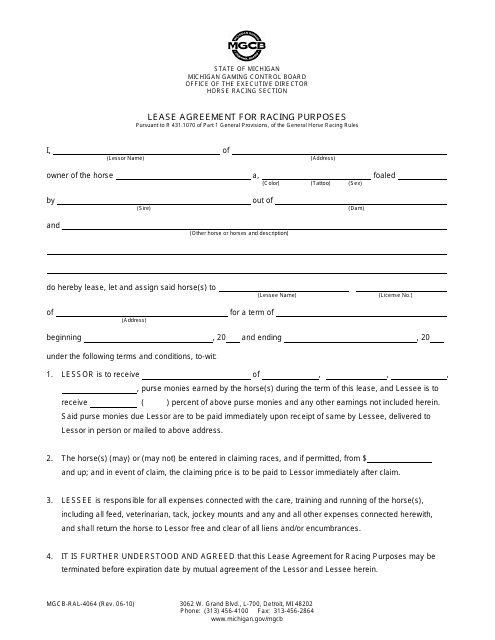

This document is used for a lease agreement in Michigan specifically for racing purposes.

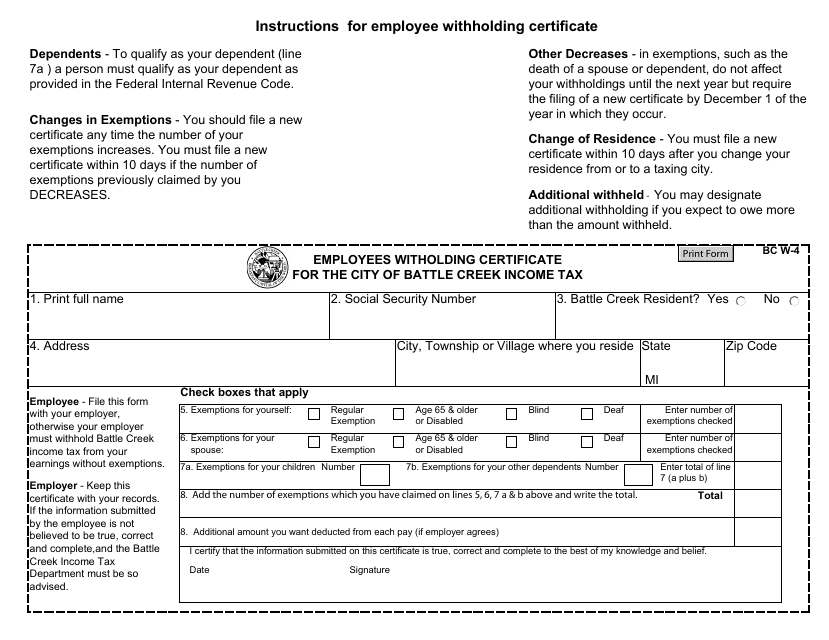

This form is used for employees in Battle Creek, Michigan to declare their withholding for the City of Battle Creek Income Tax.

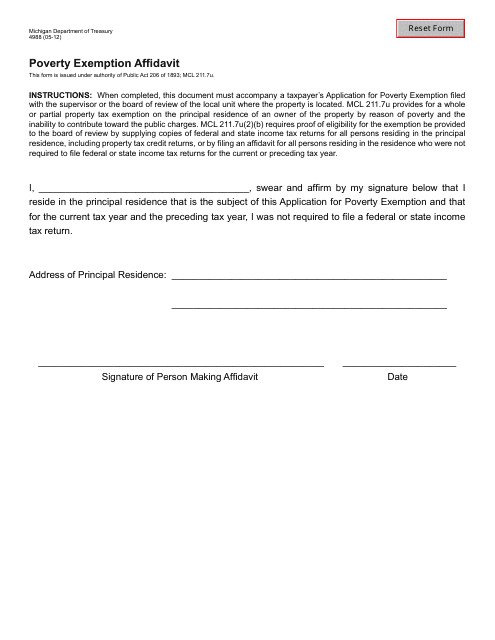

This Form is used for requesting a poverty exemption in the state of Michigan.

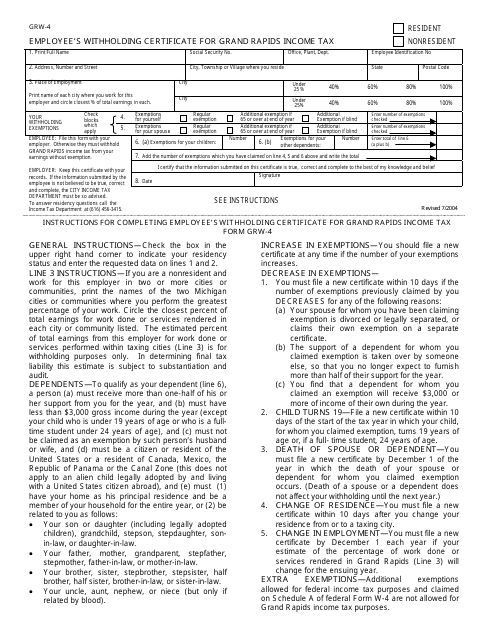

This form is used for employees in Grand Rapids, Michigan to declare their withholding certificate for Grand Rapids income tax.

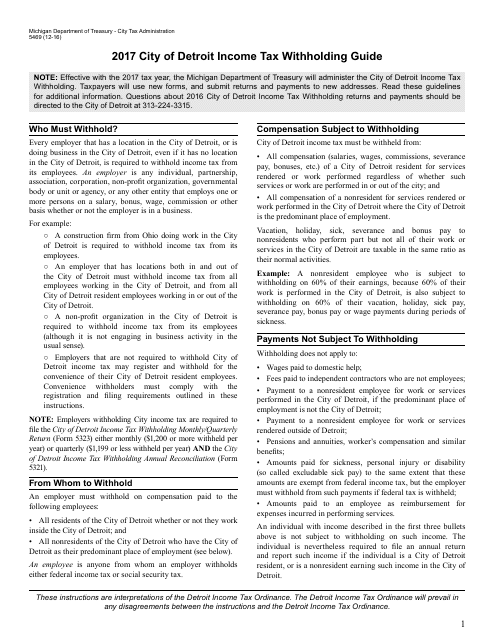

This Form is used for withholding income tax in the City of Detroit, Michigan. It provides instructions on how to correctly complete Form 5489 and comply with the city's tax regulations.

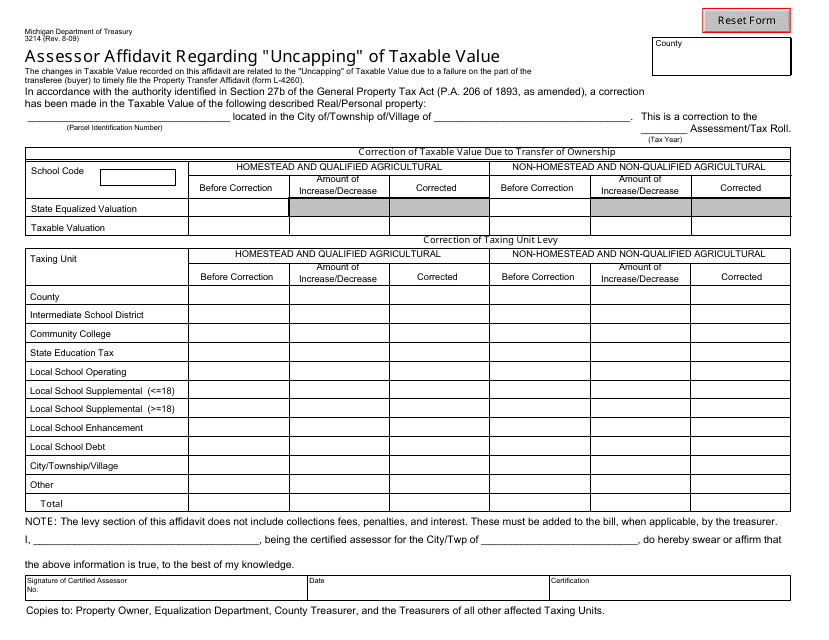

This form is used for submitting an Assessor Affidavit in Michigan regarding the "uncapping" of taxable value for property taxes.

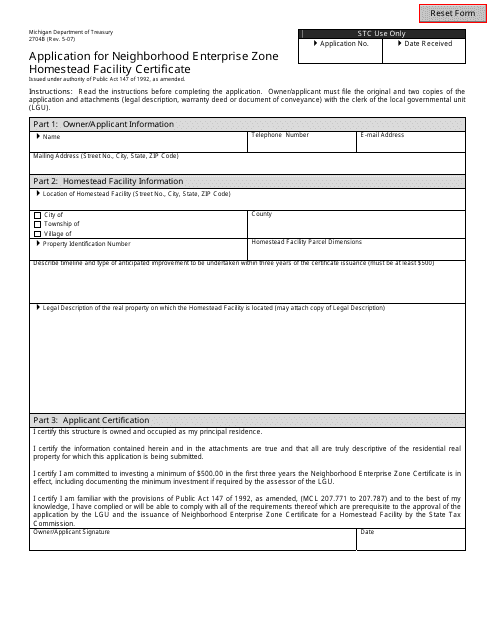

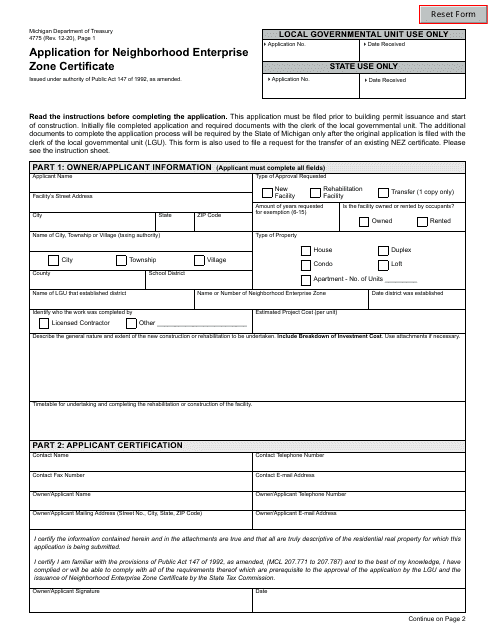

This form is used for applying for a Homestead Facility Certificate in the Neighborhood Enterprise Zone in Michigan.

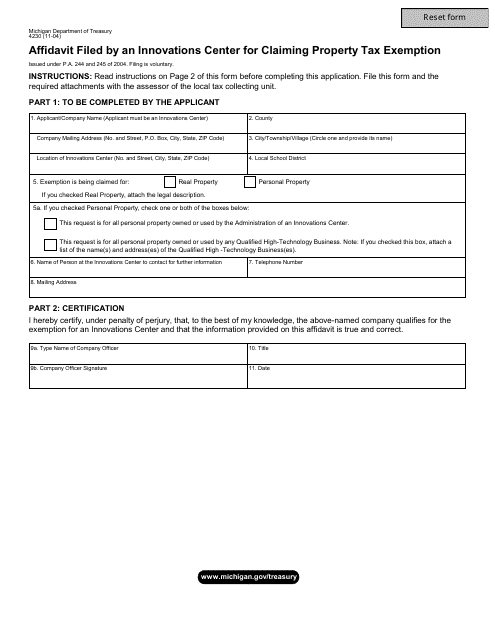

This document is used for filing an affidavit by an Innovations Center in Michigan to claim a property tax exemption.

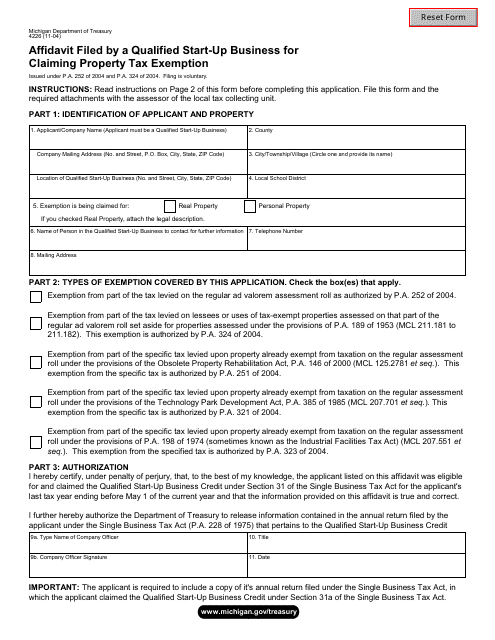

This form is used for filing an affidavit by a qualified start-up business in Michigan to claim a property tax exemption.

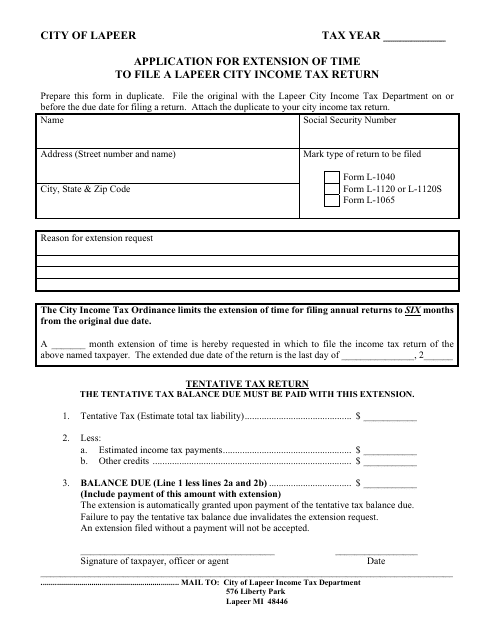

Application for Extension of Time to File a Lapeer City Income Tax Return - City of Lapeer, Michigan

This document is used for requesting an extension of time to file an income tax return for residents of Lapeer City, Michigan.

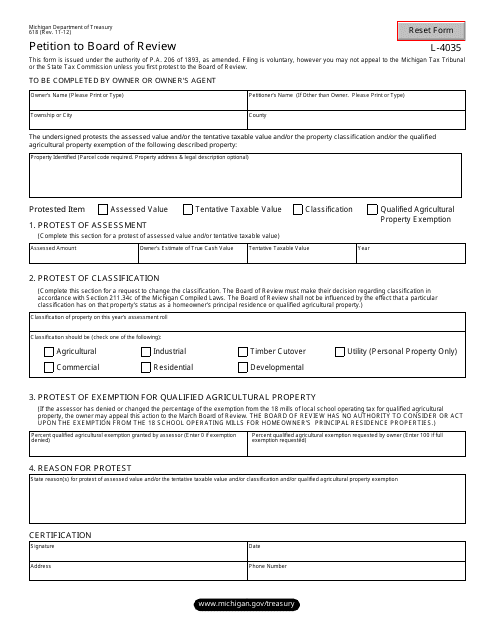

This form is used for filing a petition to the Board of Review in the state of Michigan.

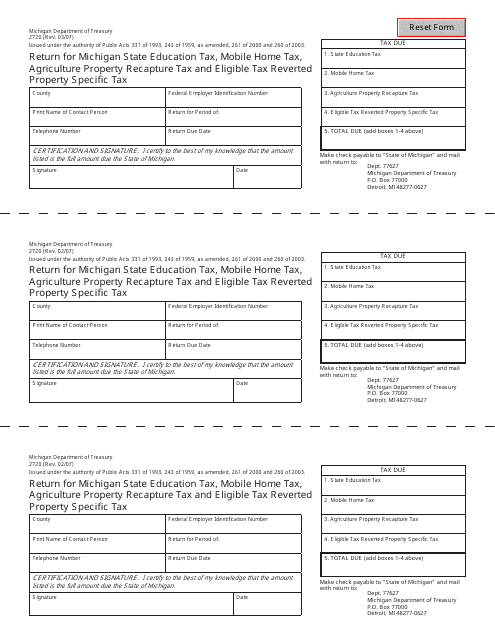

This form is used for reporting education tax, mobile home tax, agriculture property recapture tax, and eligible tax reverted property specific tax in the state of Michigan.

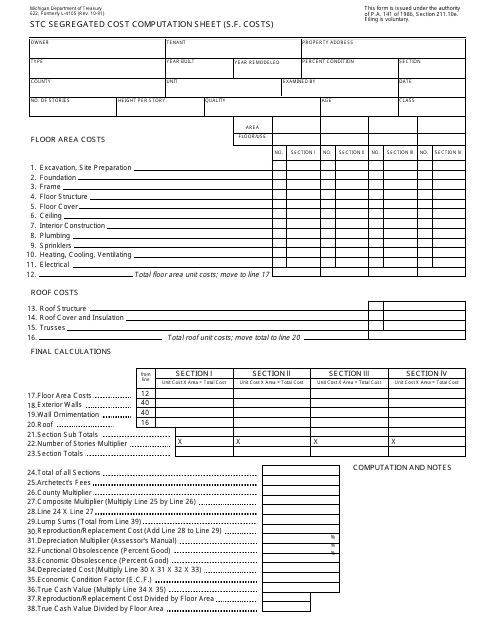

This document is used for calculating the segregated cost computation sheet for S.F. costs in the state of Michigan.

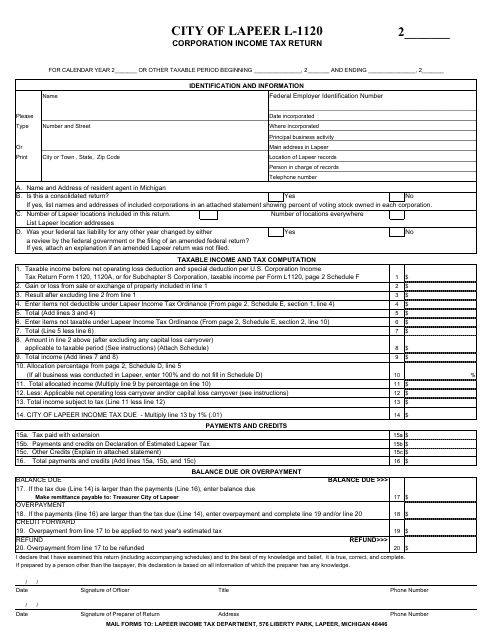

This form is used for filing corporation income tax return specifically for businesses located in the City of Lapeer, Michigan.

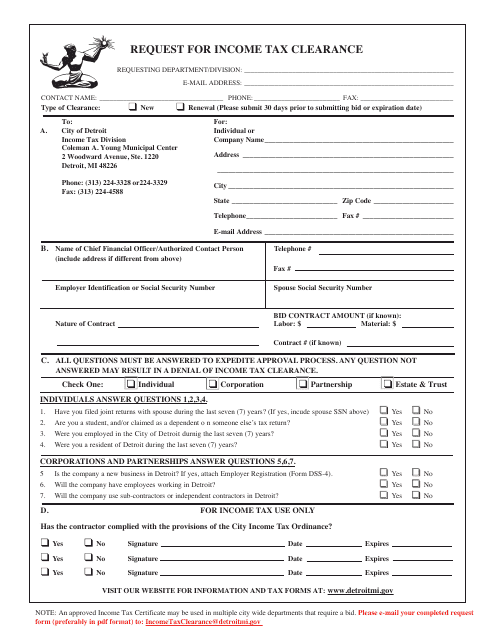

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

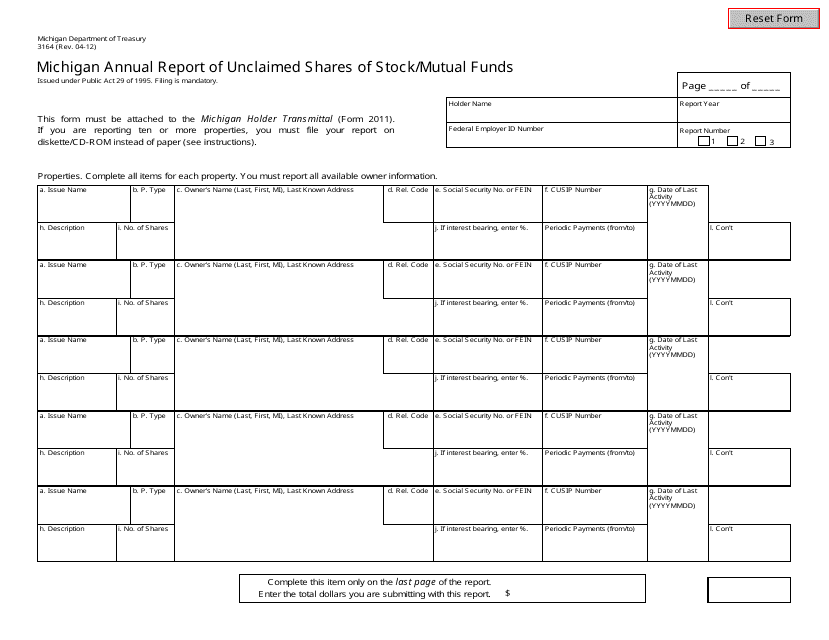

This document is used for reporting unclaimed shares of stock or mutual funds in the state of Michigan on an annual basis.

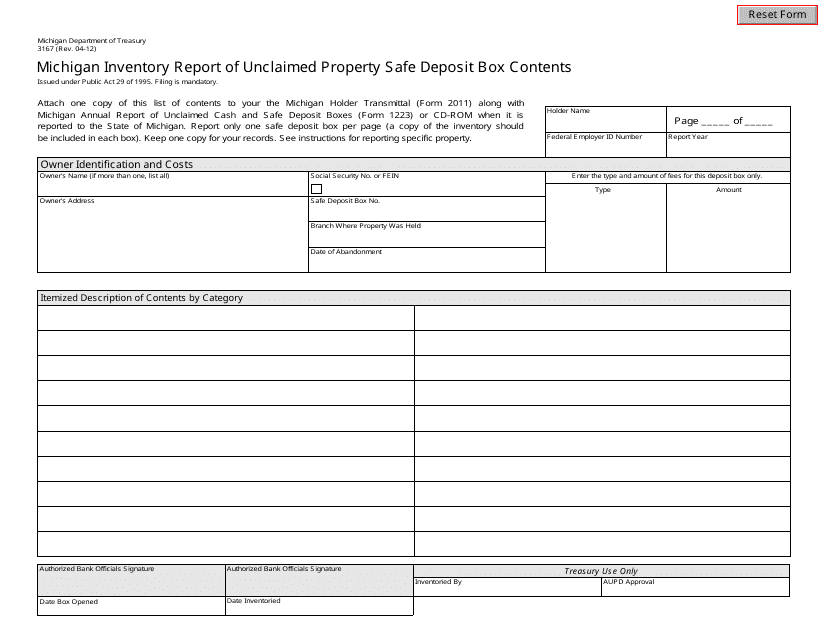

This Form is used for reporting and documenting the inventory of unclaimed property stored in safe deposit boxes in the state of Michigan.

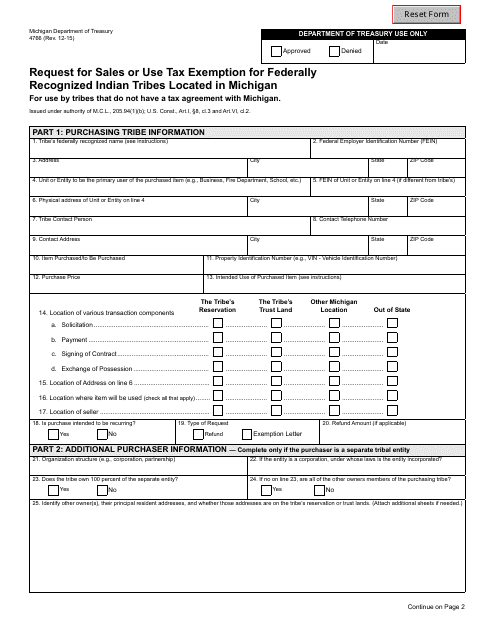

This form is used for requesting sales or use tax exemption for federally recognized Indian tribes located in Michigan.

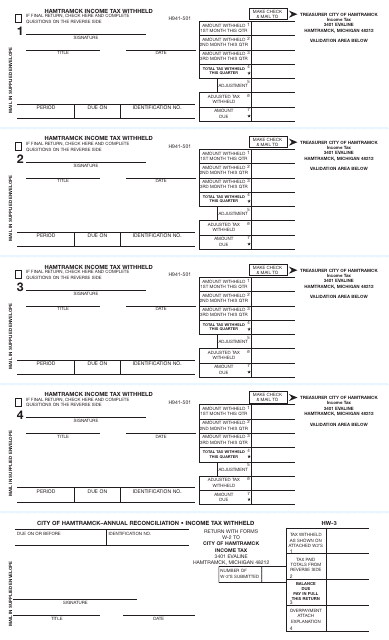

This Form is used for reporting income tax that has been withheld from wages in Hamtramck, Michigan.

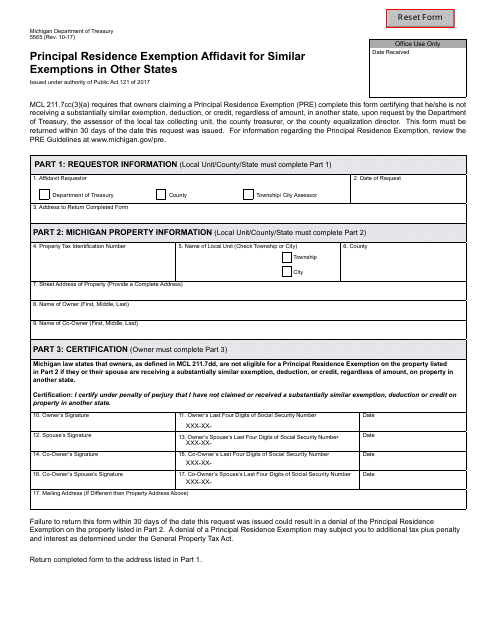

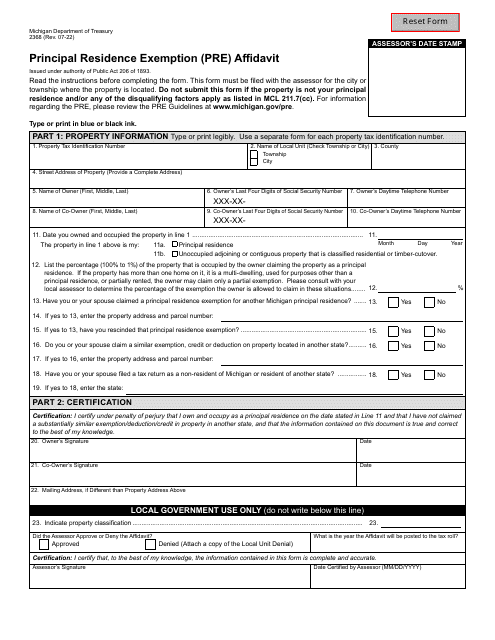

This document is used for claiming principal residence exemption in Michigan and exploring similar exemptions in other states.

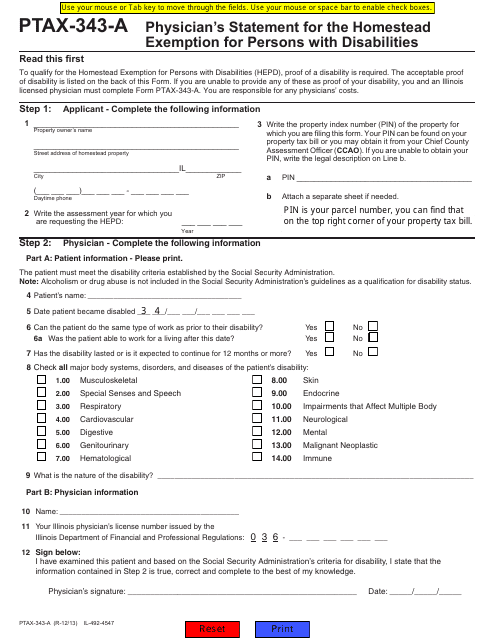

This form is used for individuals with disabilities in St. Clair County, Michigan, to apply for a homestead exemption. It requires a physician's statement to verify the disability.

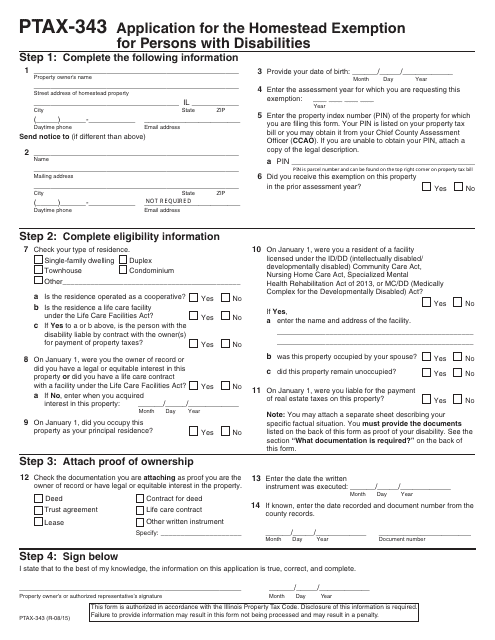

This form is used for applying for the Homestead Exemption for Persons With Disabilities in St. Clair County, Michigan. It is designed to provide tax relief for individuals who have a disability.

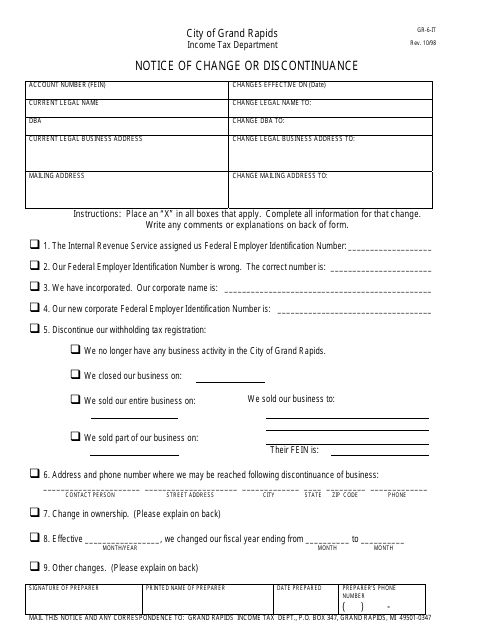

This form is used for notifying the City of Grand Rapids, Michigan of any changes or discontinuance in services.

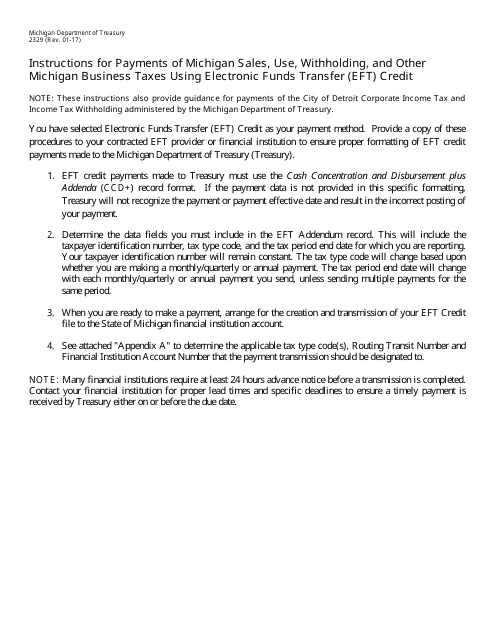

This form provides instructions for making electronic payments for various types of Michigan business taxes, including sales tax, use tax, withholding tax, and other taxes. It explains how to use the Electronic Funds Transfer (EFT) credit method for submitting these payments.

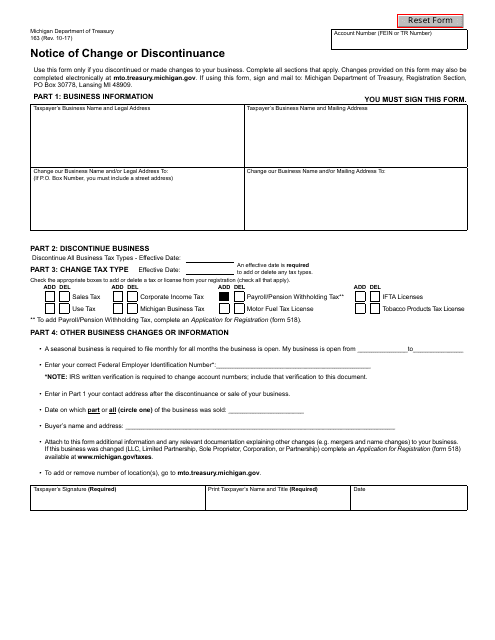

This is a Michigan legal document completed by a business representative to notify authorities about their business undergoing certain changes, sale, or discontinuance.

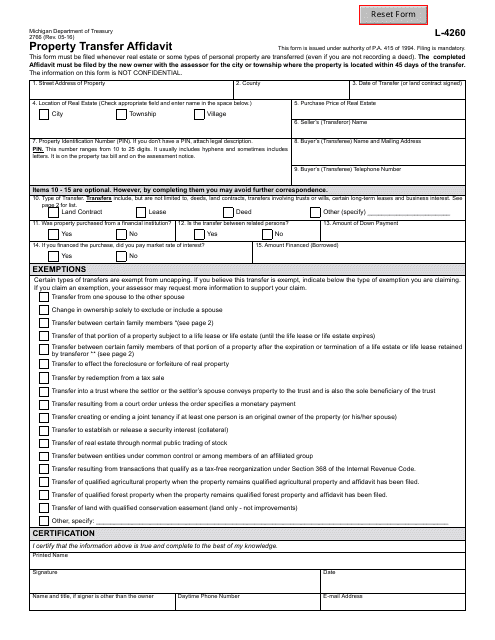

This form is used for reporting the transfer of property in the state of Michigan.

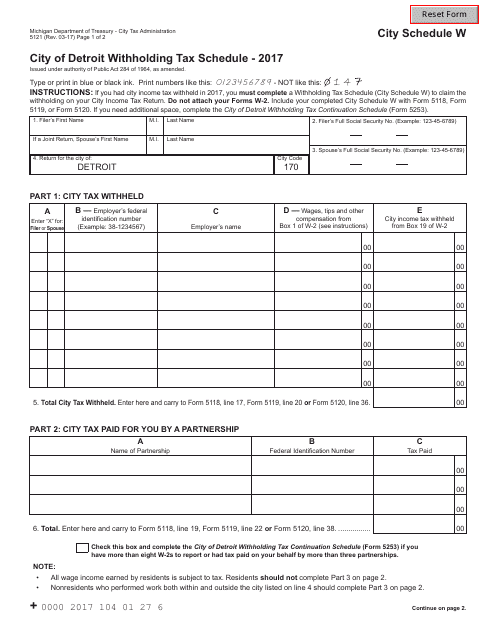

This form is used for reporting and calculating the withholding tax for City of Detroit residents in Michigan.

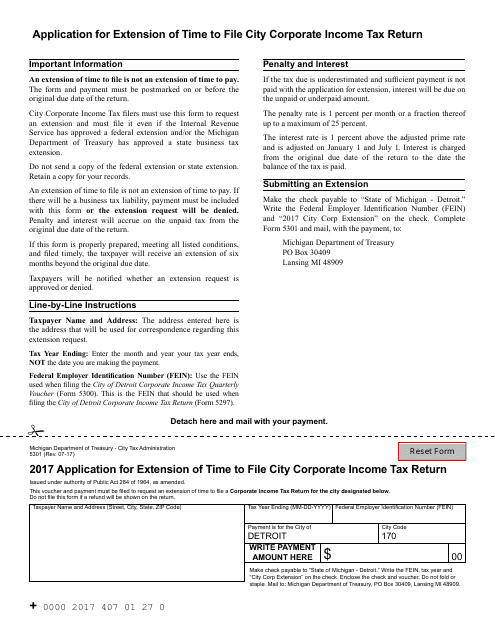

This document is for businesses in the City of Detroit, Michigan who need more time to file their city corporate income tax return.

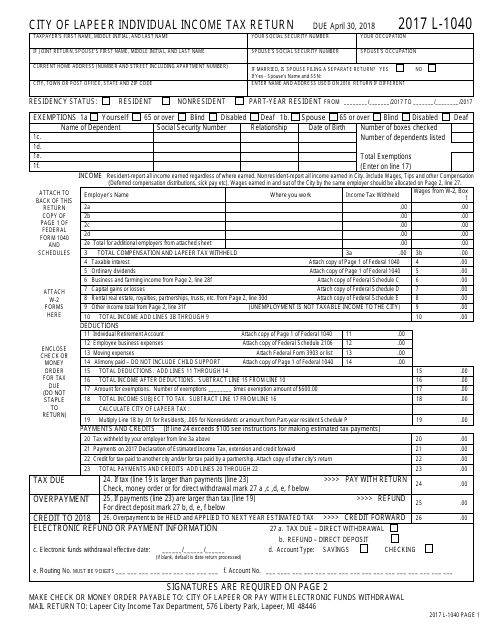

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

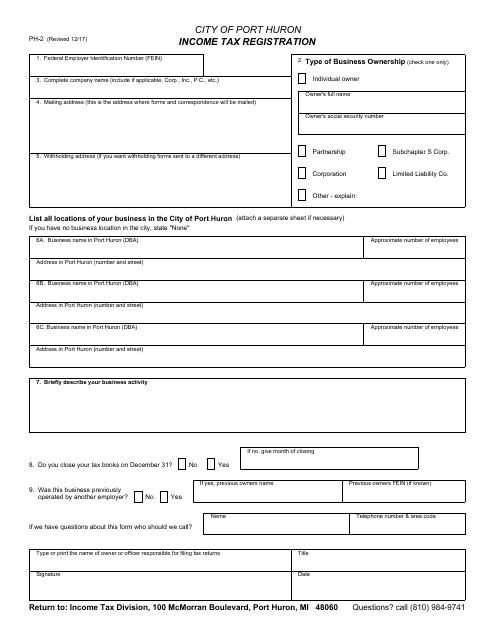

This Form is used for income tax registration with the City of Port Huron, Michigan. Registering for income tax is a requirement for individuals and businesses who earn income within the city limits of Port Huron.

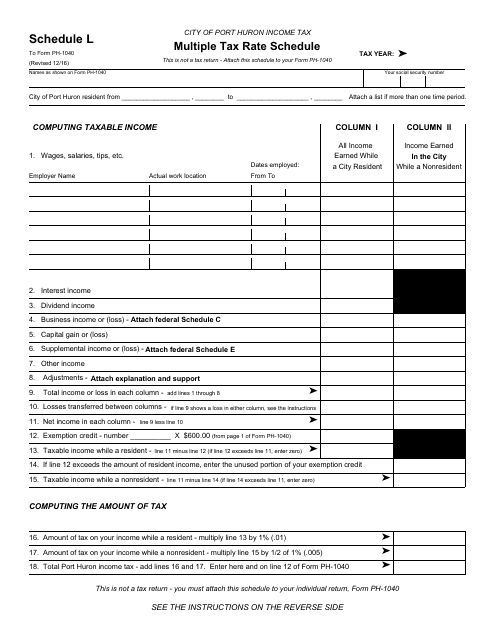

This form is used for determining the applicable tax rate for residents of the City of Port Huron, Michigan.

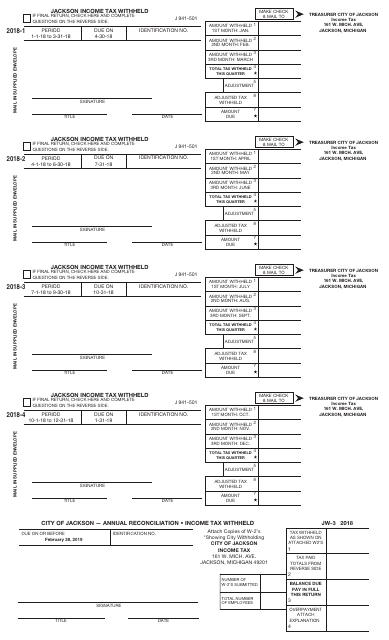

This form is used for reporting income tax withheld by employers in the City of Jackson, Michigan.

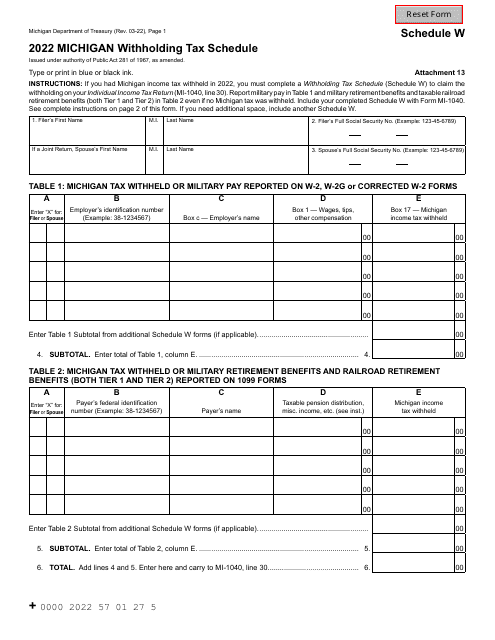

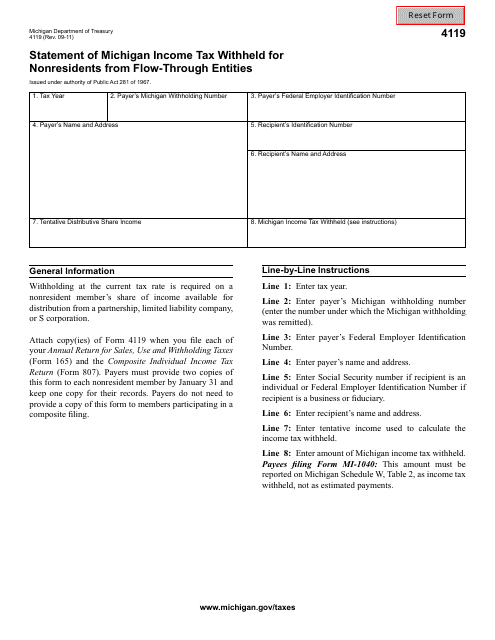

This Form is used for reporting income tax withheld from nonresidents in Michigan by flow-through entities.

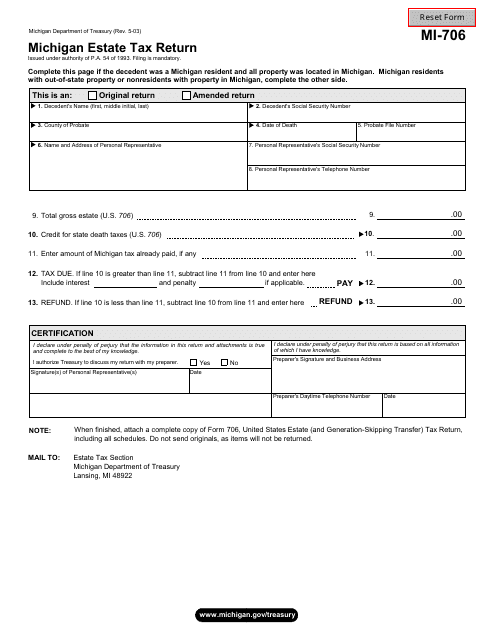

This form is used for filing the Michigan Estate Tax Return in the state of Michigan.

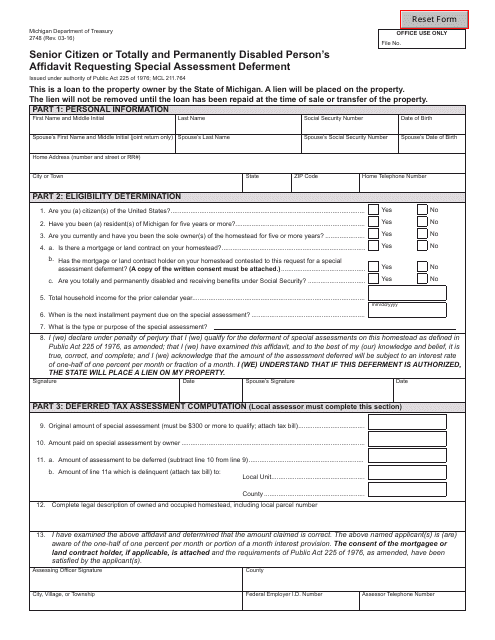

This form is used for senior citizens or individuals who are totally and permanently disabled to request special assessment deferment in the state of Michigan.