Massachusetts Department of Revenue Forms

The Massachusetts Department of Revenue is responsible for administering and enforcing the tax laws and regulations in the state of Massachusetts. They manage the collection of various taxes, including individual and corporate income taxes, sales and use taxes, and property taxes. They also provide guidance and assistance to taxpayers, process tax returns, and conduct audits to ensure compliance with tax laws.

Documents:

425

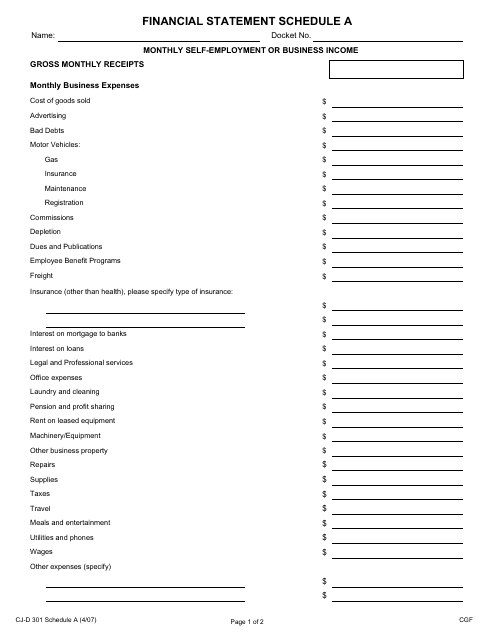

This form is used for preparing a schedule A financial statement in the state of Massachusetts. It is a template that helps individuals or businesses to organize and present their financial information.

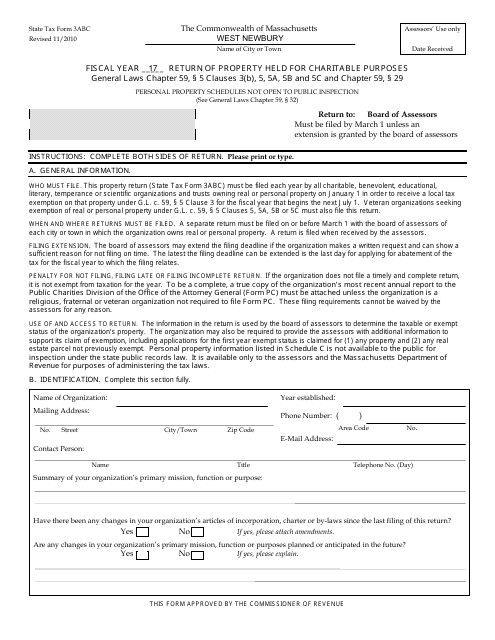

This form is used for submitting the Return of Property Held for Charitable Purposes in Massachusetts. It is required for organizations that hold property for charitable purposes in the state.

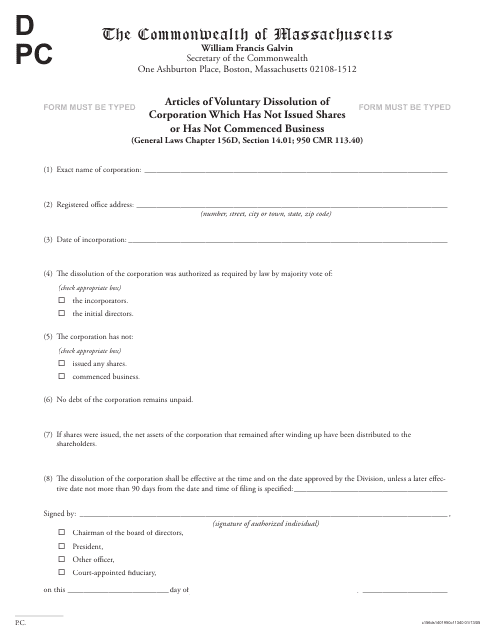

This document is used for voluntary dissolution of a corporation in Massachusetts that has not issued shares or started operating. It outlines the process and requirements for dissolving the corporation.

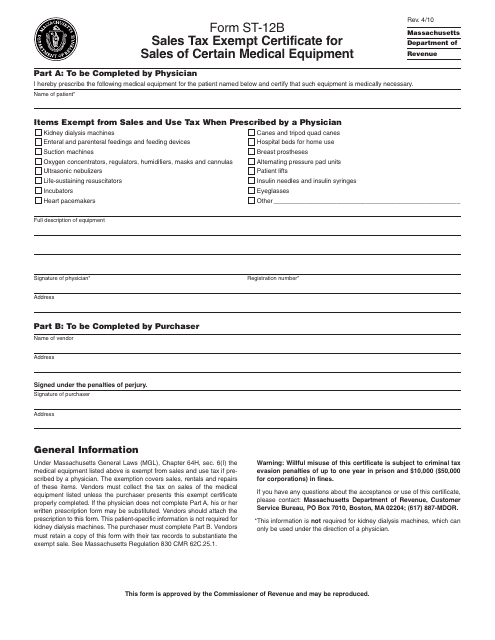

This form is used for applying for a sales tax exemption on the sales of certain medical equipment in Massachusetts.

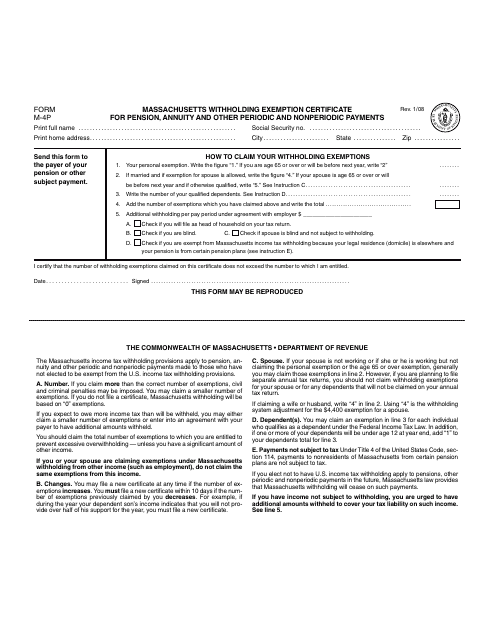

This Form is used for declaring withholding exemptions for pension, annuity, and other periodic and nonperiodic payments in Massachusetts.

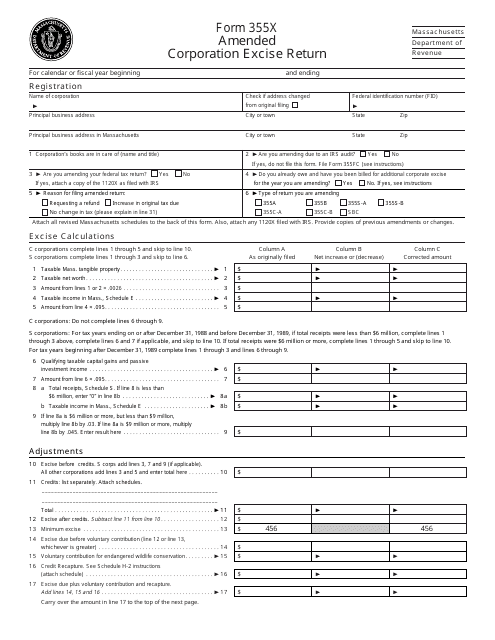

This form is used for filing an amended corporation excise return in the state of Massachusetts.

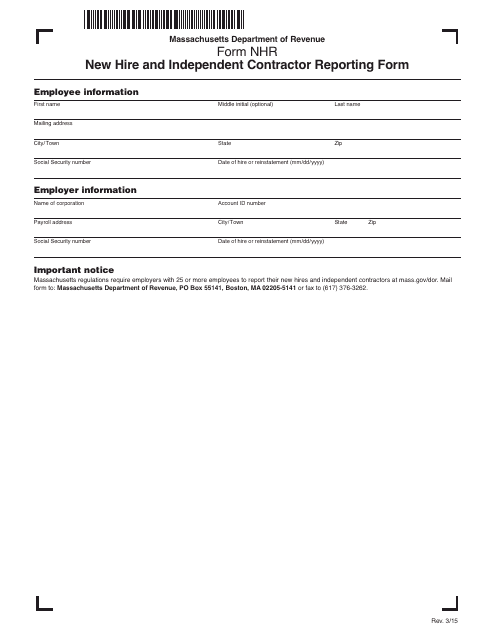

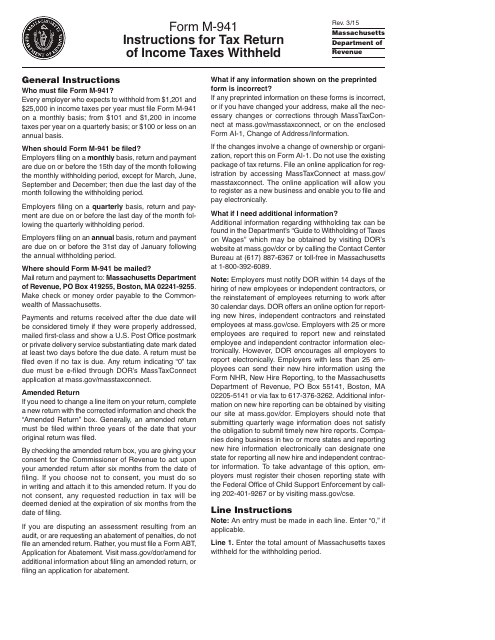

This Form is used for reporting new hires and independent contractors in Massachusetts.

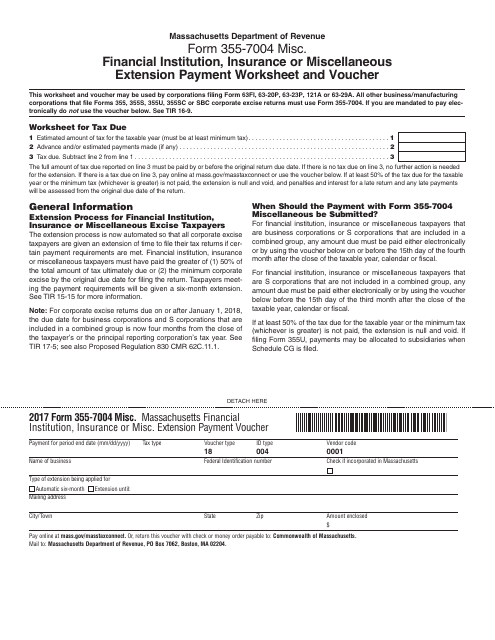

This form is used for making extension payments for financial institutions, insurance companies, or other miscellaneous entities in Massachusetts. It serves as a worksheet and voucher for making the payment.

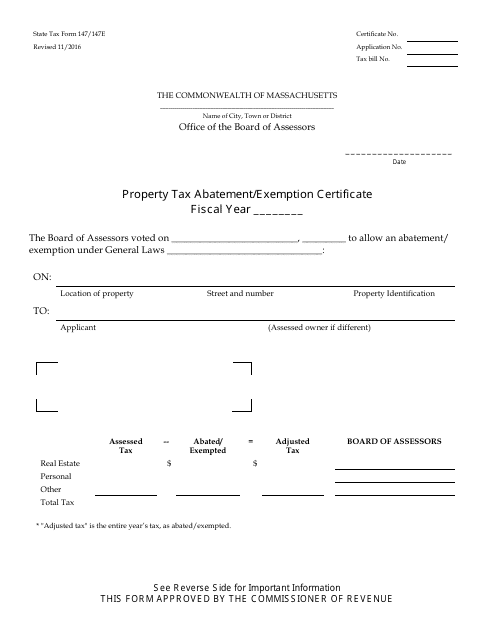

This form is used for requesting property tax abatement or exemption in Massachusetts. It is used to provide information about the property and the reason for seeking the abatement or exemption.

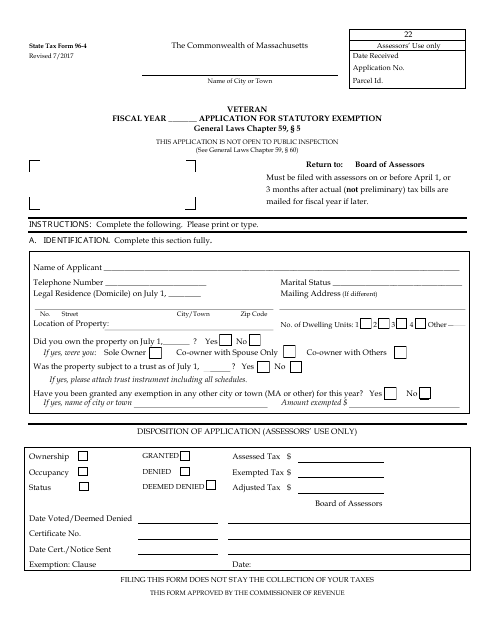

This form is used for veterans in Massachusetts to apply for a statutory exemption.

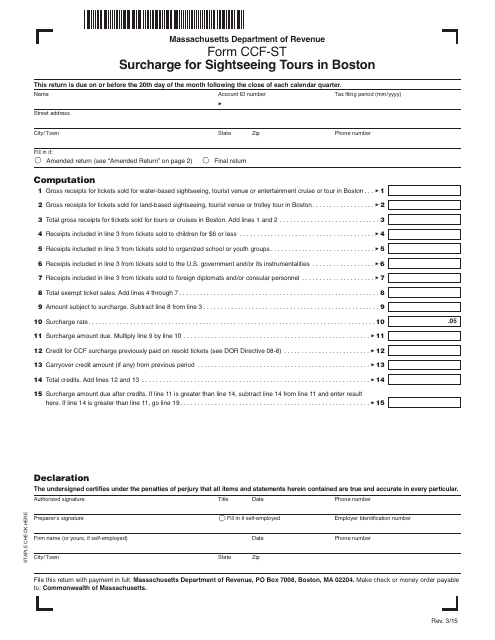

This Form is used for paying surcharges for sightseeing tours in Boston, Massachusetts.

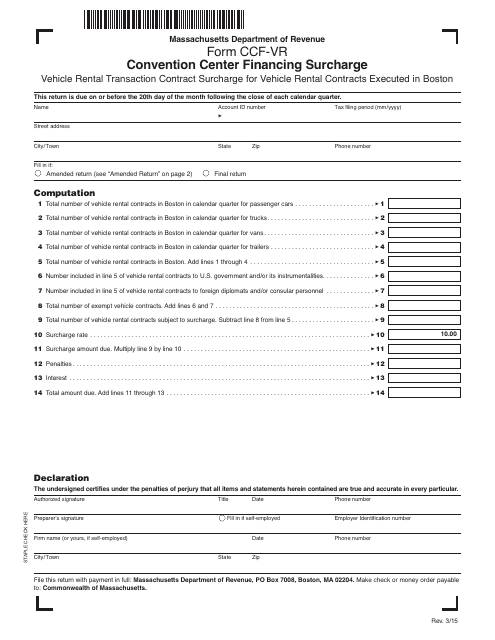

This form is used for the Convention Center Financing Surcharge in Massachusetts.

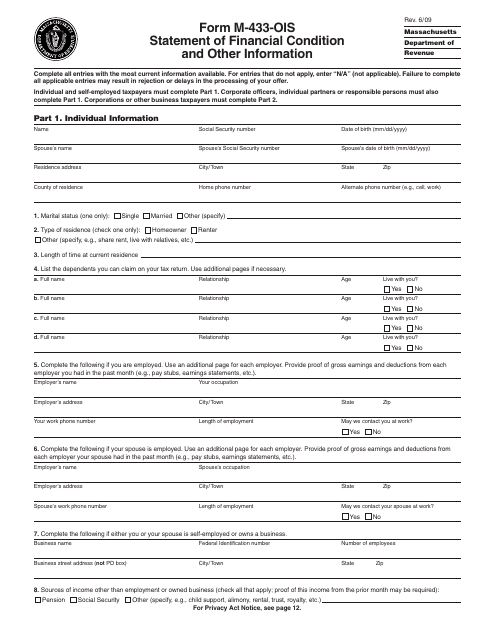

This form is used for individuals in Massachusetts to provide their financial information and other relevant details.

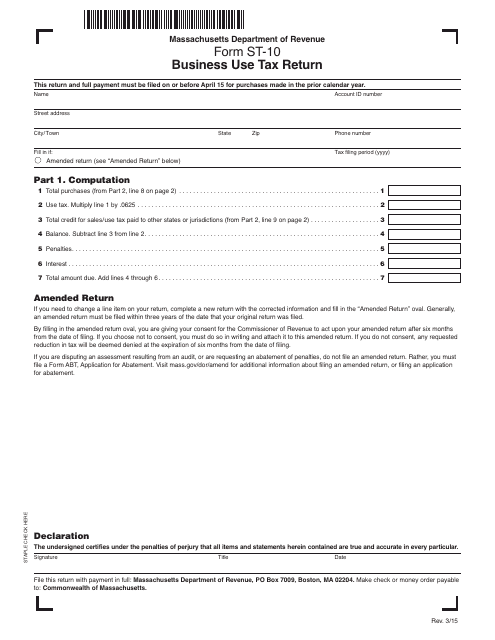

This form is used for reporting and paying business use tax in the state of Massachusetts.

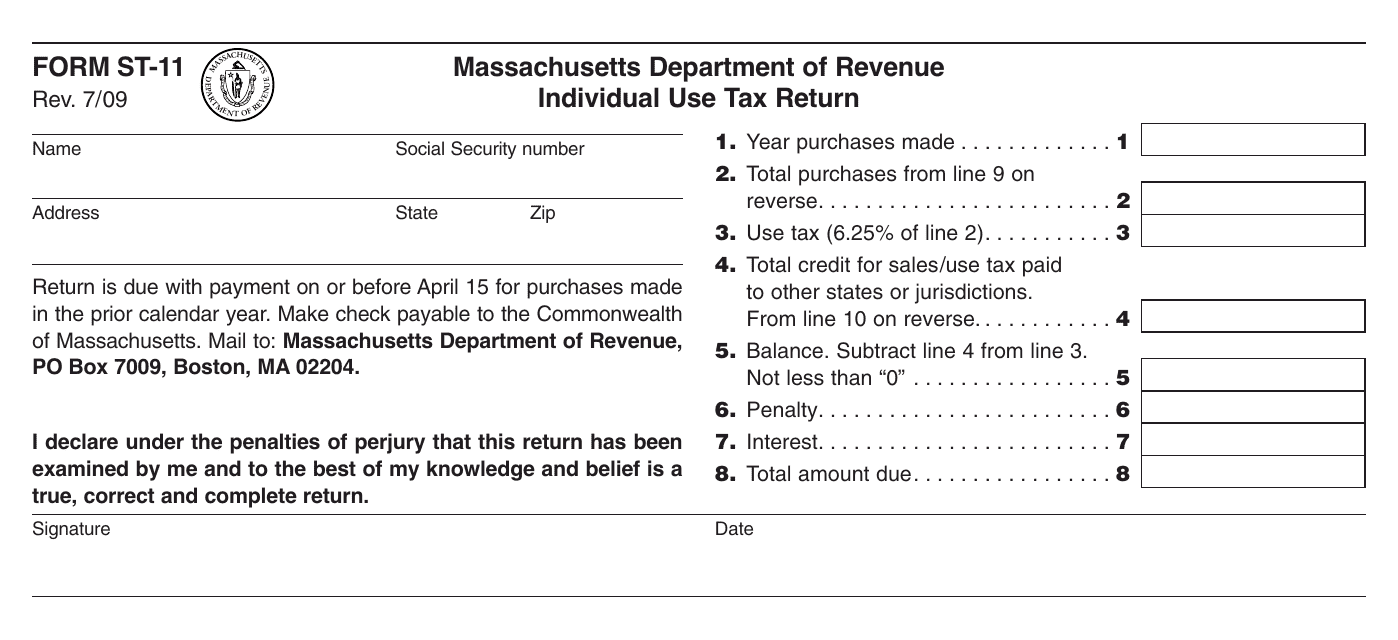

This form is used for reporting and paying use tax by individuals in Massachusetts. Use tax is a tax on goods purchased outside the state of Massachusetts for use within the state.

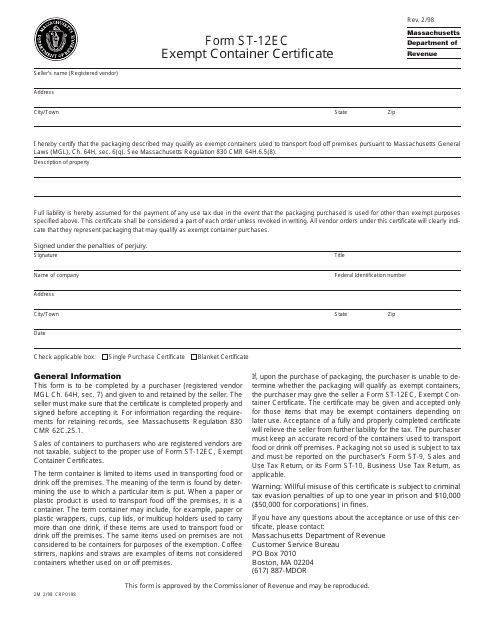

This form is used for obtaining an exempt container certificate in Massachusetts.

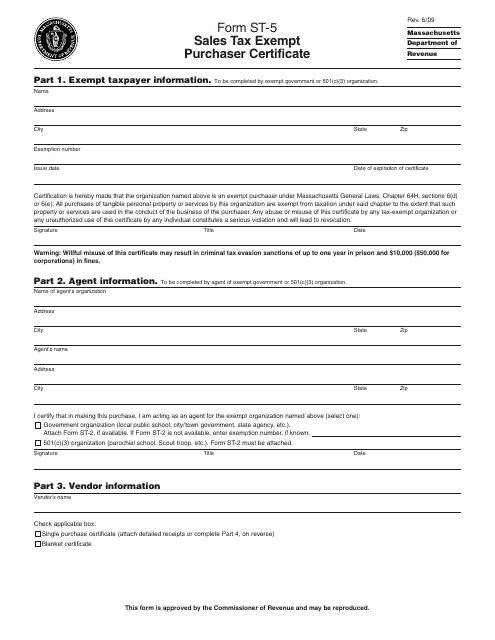

This form is used for Massachusetts purchasers to claim exemption from sales tax.

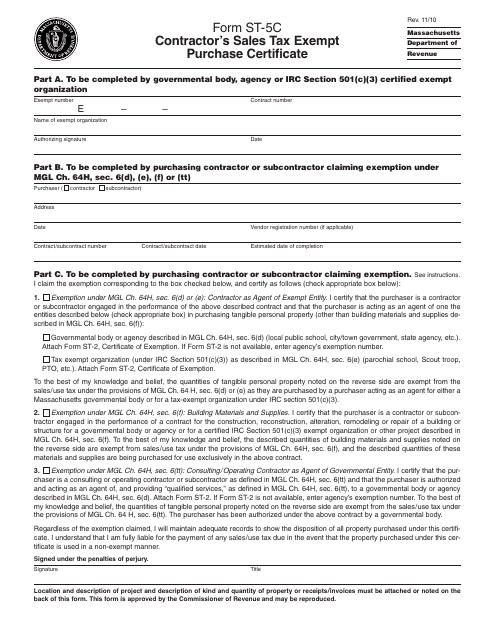

This form is used for contractors in Massachusetts to claim sales tax exemption on their purchases.

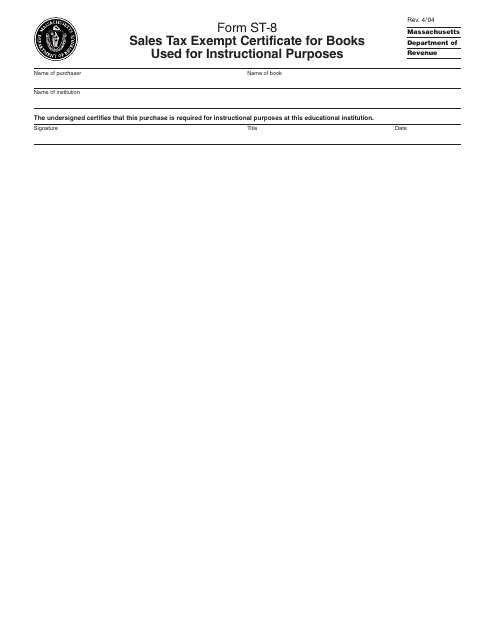

This form is used for claiming sales tax exemption on books used for educational purposes in Massachusetts.

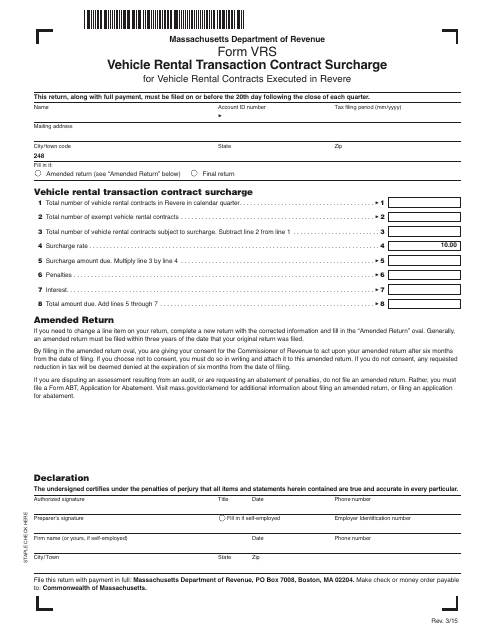

This form is used for adding a surcharge to a vehicle rental transaction contract in Massachusetts.

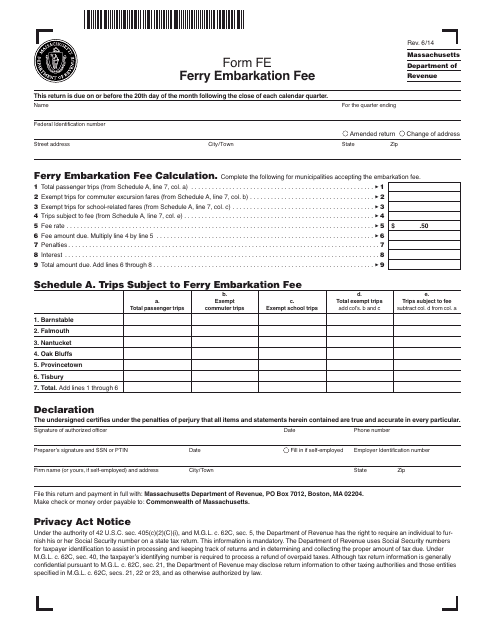

This form is used for paying the ferry embarkation fee in Massachusetts. It is required for anyone boarding a ferry in the state.

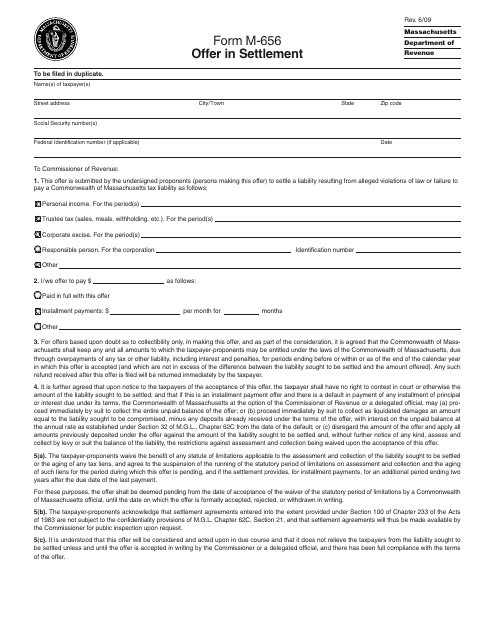

This form is used for making an offer in settlement in the state of Massachusetts.

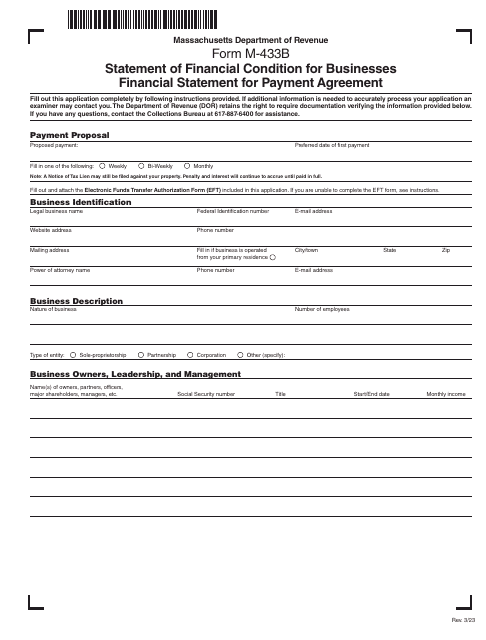

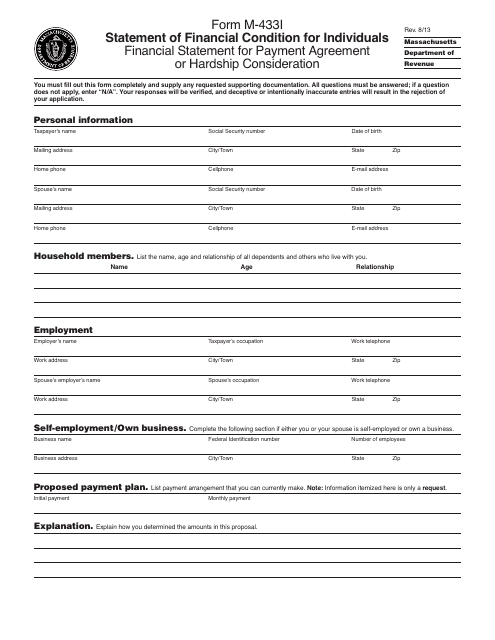

This form is used for individuals in Massachusetts to provide a statement of their financial condition. It includes information about income, expenses, assets, and liabilities. This document is important for assessing an individual's financial situation, especially in cases involving bankruptcy or debt repayment.

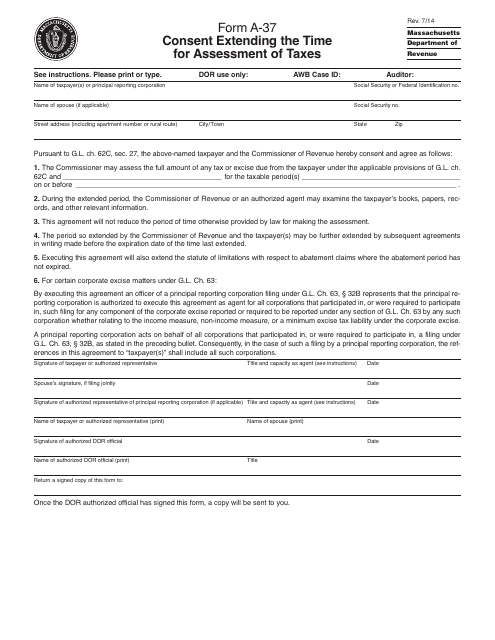

This form is used for requesting an extension of the time for assessment of taxes in Massachusetts.

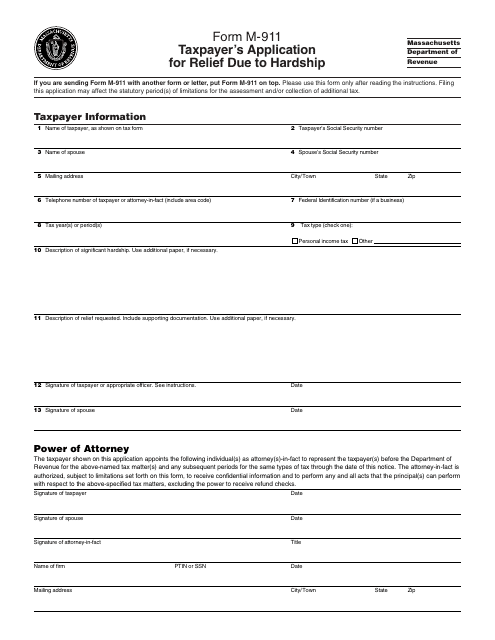

This form is used for Massachusetts taxpayers to apply for relief due to financial hardship.

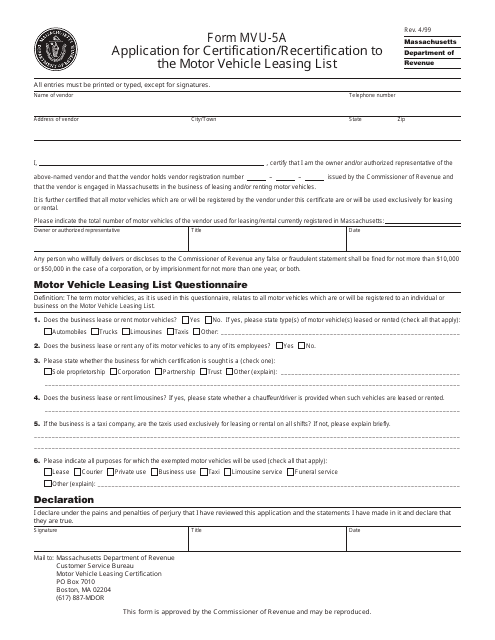

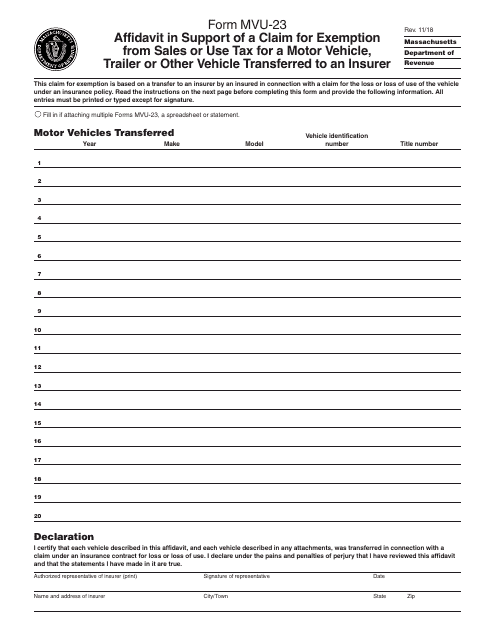

This form is used for applying for certification or recertification to the Motor Vehicle Leasing List in Massachusetts.

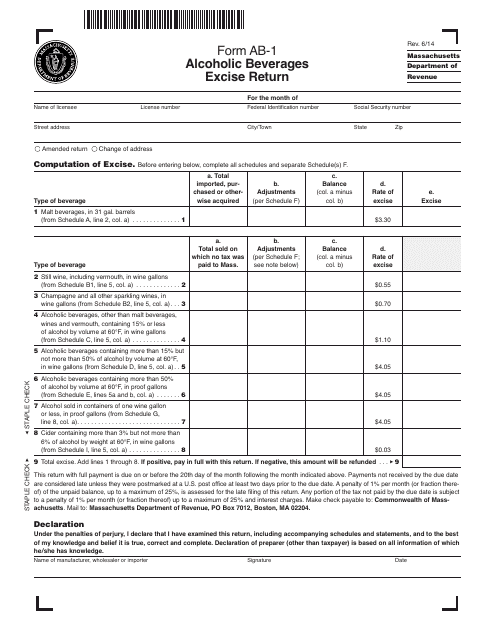

This form is used for submitting the Alcoholic Beverages Excise Return in Massachusetts.

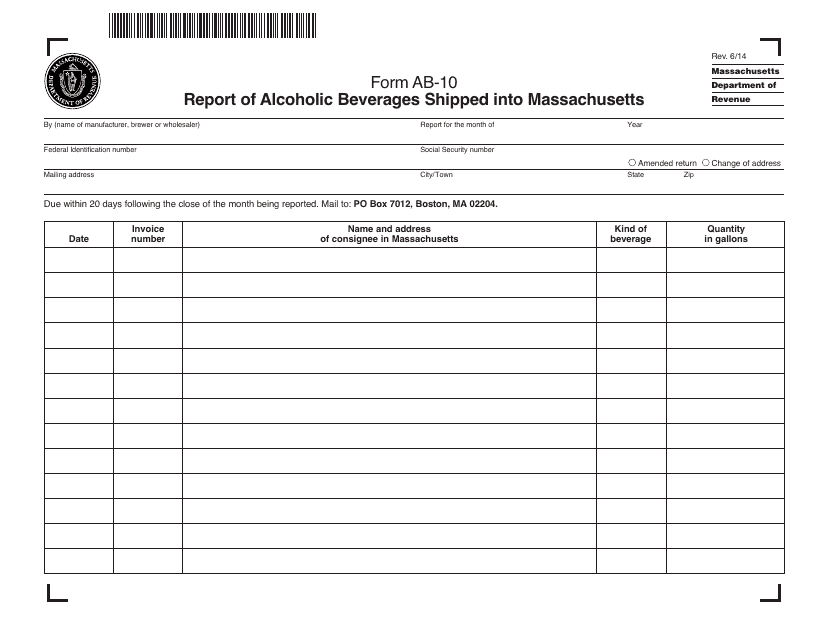

This document is used for reporting the shipment of alcoholic beverages into Massachusetts. It is required for businesses who transport alcohol into the state.

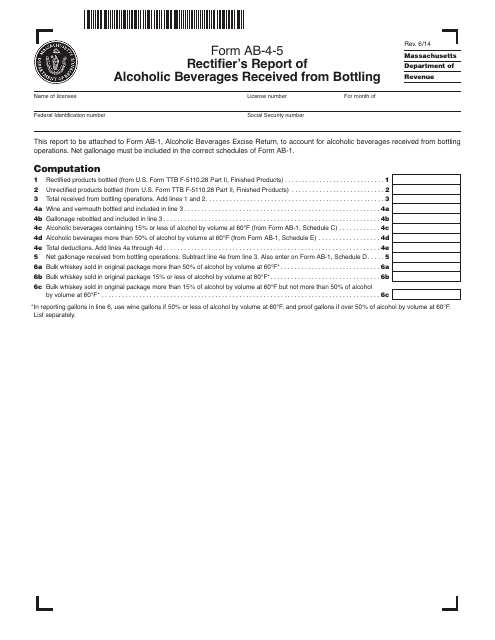

This Form is used for rectifiers in Massachusetts to report the receipt of alcoholic beverages from bottling companies.

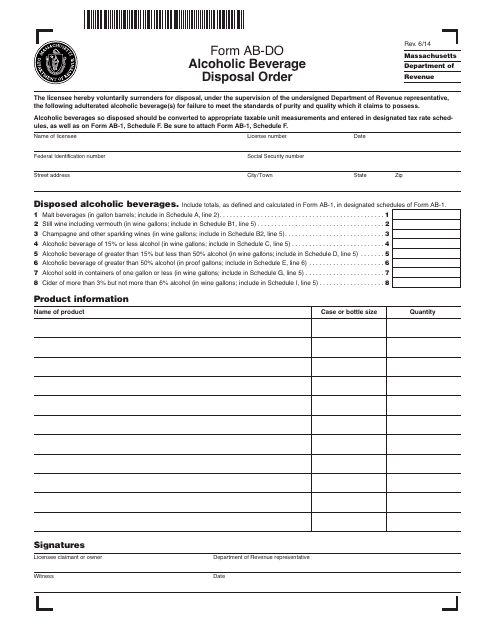

This form is used for requesting an alcoholic beverage disposal order in Massachusetts. It allows individuals or businesses to dispose of alcoholic beverages that are no longer usable or needed.

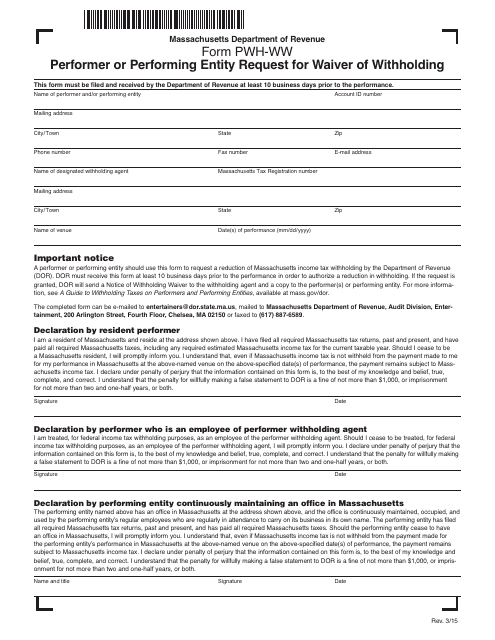

This Form is used for requesting a waiver of withholding in Massachusetts for performers or performing entities.

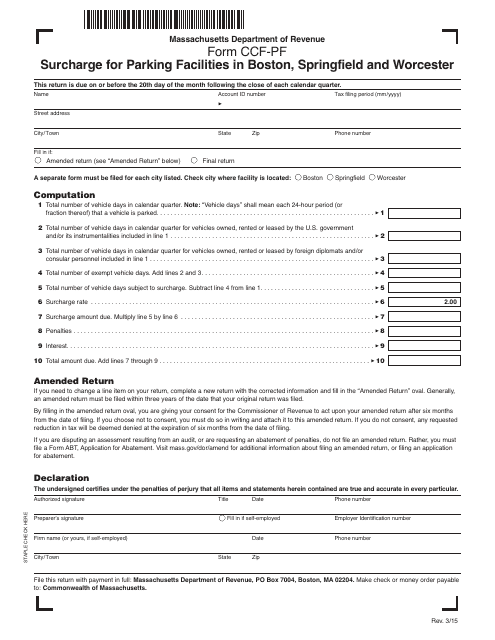

This form is used for paying surcharges for parking facilities in Boston, Springfield, and Worcester, Massachusetts.

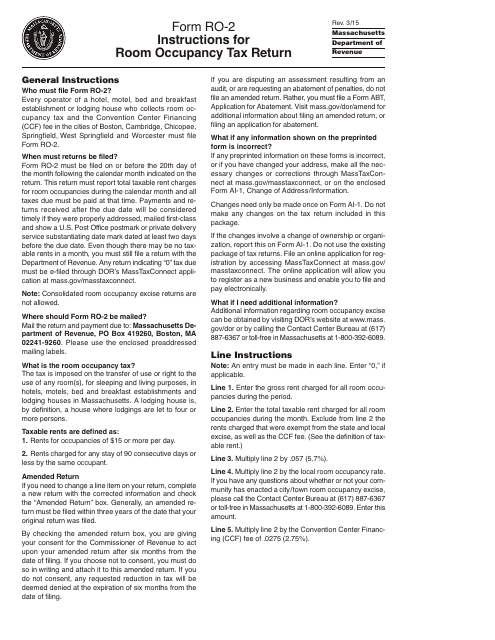

This Form is used for filing the Room Occupancy Tax Return in Massachusetts. It provides instructions on how to accurately complete and submit the form for reporting and paying the room occupancy tax.

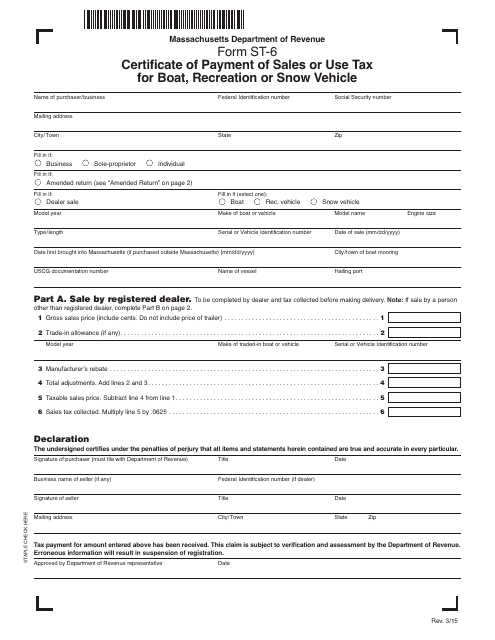

This Form is used for certifying the payment of sales or use tax for boat, recreation or snow vehicle in Massachusetts.