Maryland Department of Commerce Forms

The Maryland Department of Commerce is responsible for promoting economic growth in the state of Maryland. They work to attract businesses, support existing businesses, and create job opportunities. They provide various programs and services to assist businesses with financing, workforce development, export assistance, and more. Additionally, the department helps to market Maryland as a prime location for businesses to establish and expand their operations.

Documents:

43

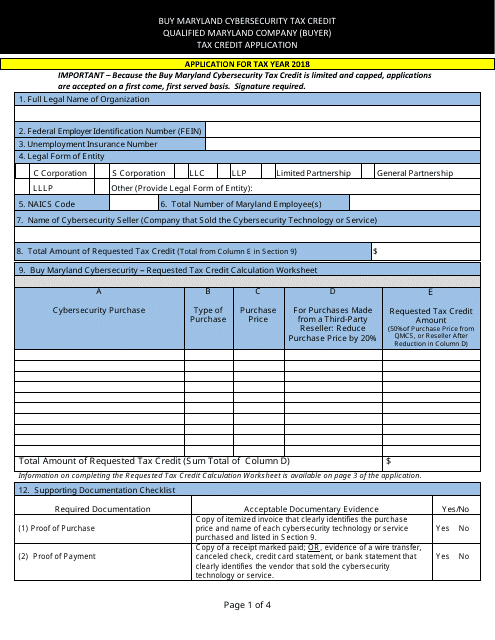

This form is used for applying for a tax credit as a qualified Maryland company buyer.

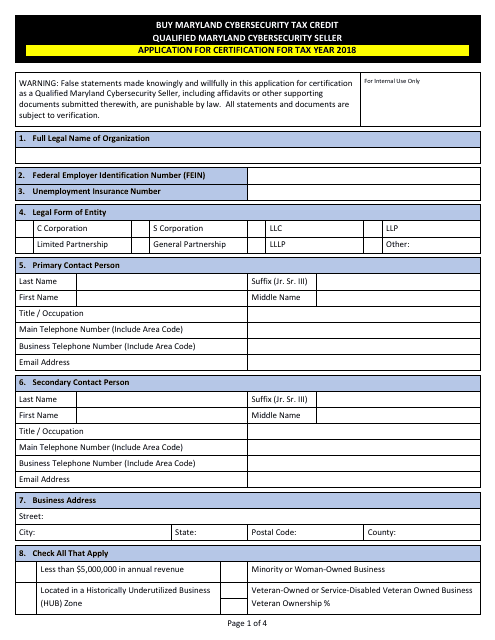

This Form is used for applying to become a certified cybersecurity seller in Maryland.

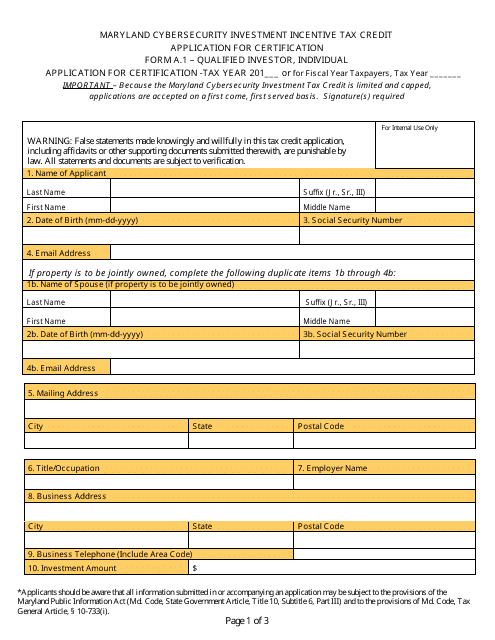

This Form is used for individuals in Maryland to apply for certification as a qualified investor for the Maryland Cybersecurity Investment Incentive Tax Credit.

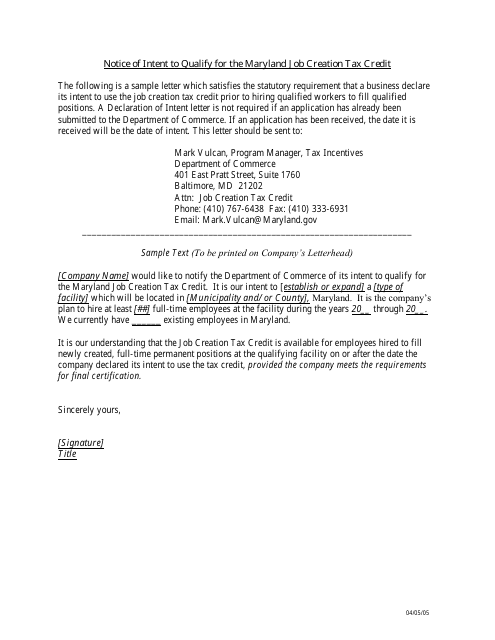

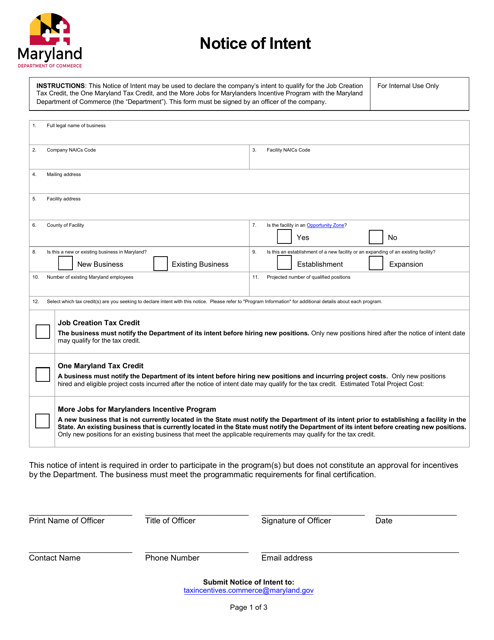

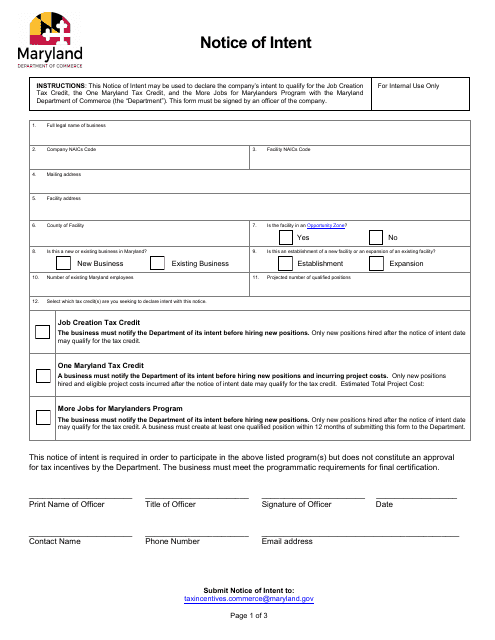

This document is used to notify the state of Maryland of your intent to qualify for the Job Creation Tax Credit.

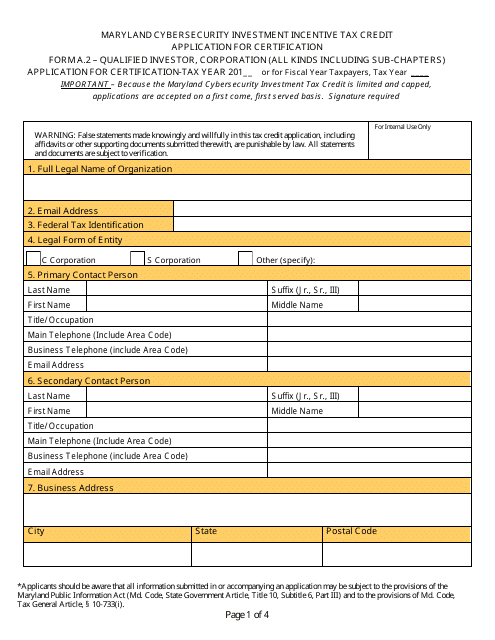

This Form is used for applying for certification as a qualified investor corporation in order to receive the Maryland Cybersecurity Investment Incentive Tax Credit.

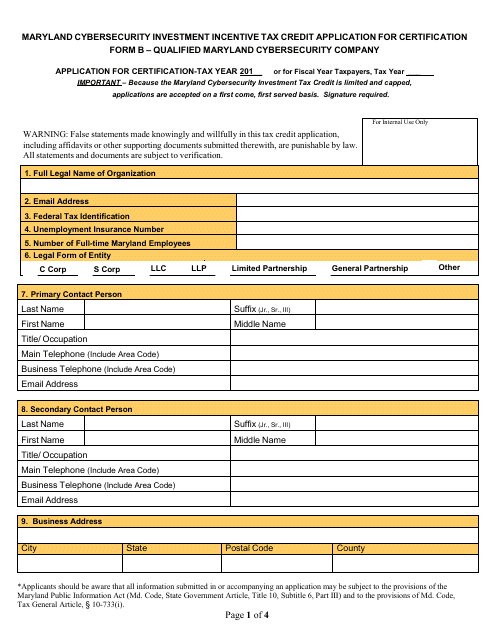

This form is used for applying for certification as a qualified Maryland cybersecurity company in order to be eligible for the Maryland Cybersecurity Investment Incentive Tax Credit.

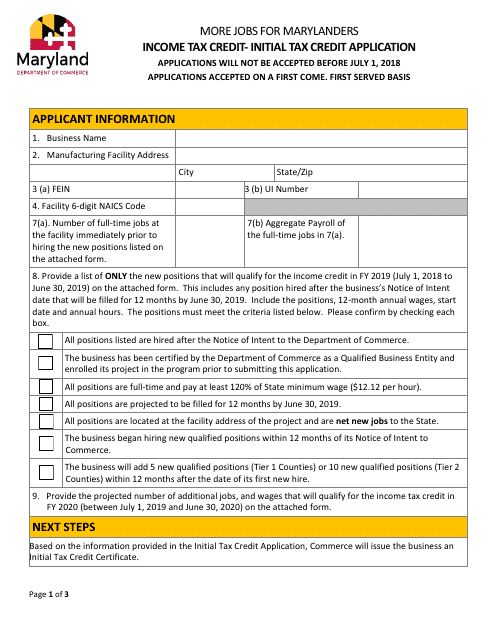

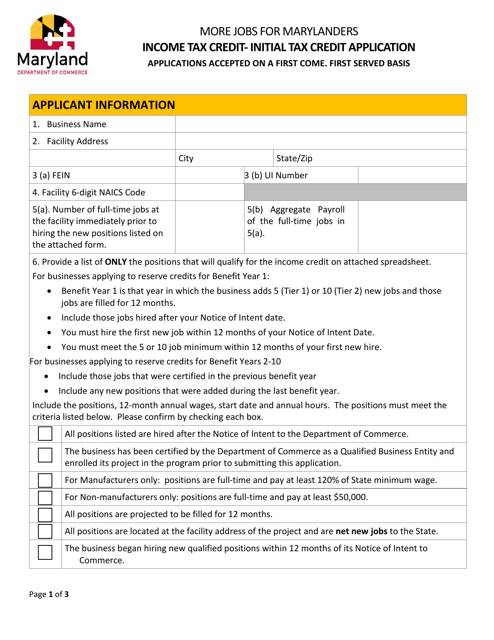

This Form is used for applying for the Initial Tax Credit in Maryland.

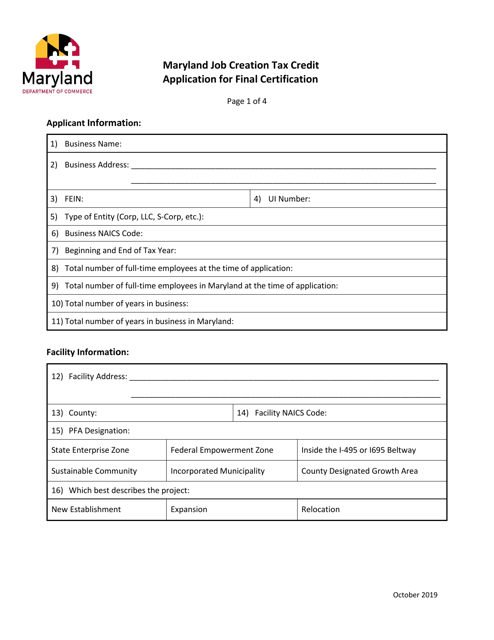

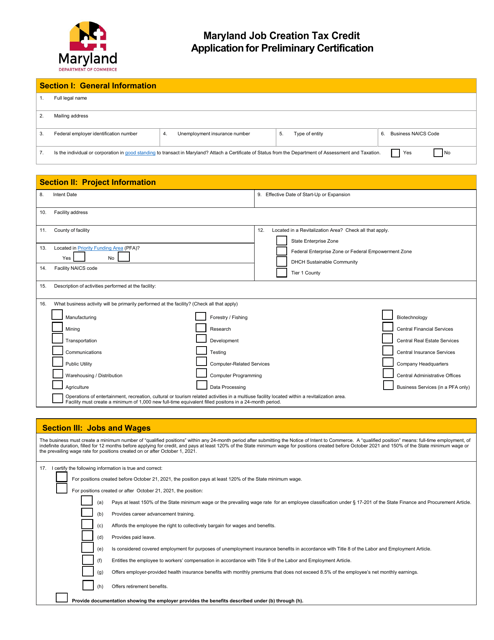

This form is used for applying for preliminary certification for the Maryland Job Creation Tax Credit in Maryland.

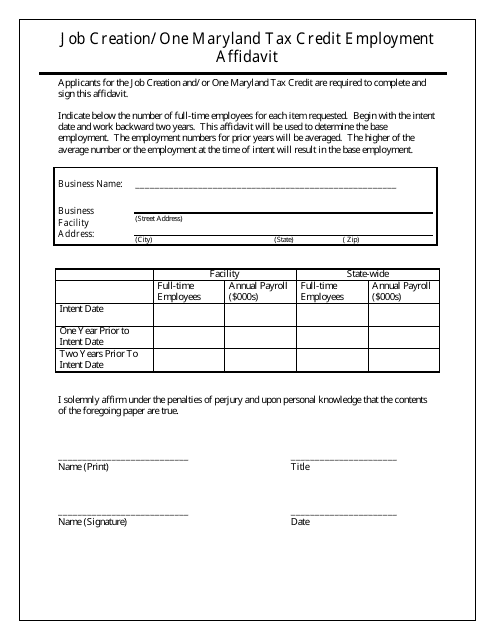

This Form is used for claiming the One Maryland Tax Credit Employment Affidavit, which encourages job creation in Maryland by providing tax credits to businesses that meet certain eligibility criteria.

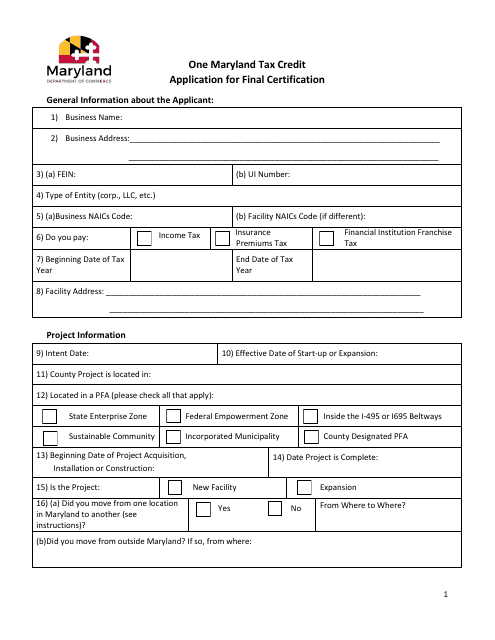

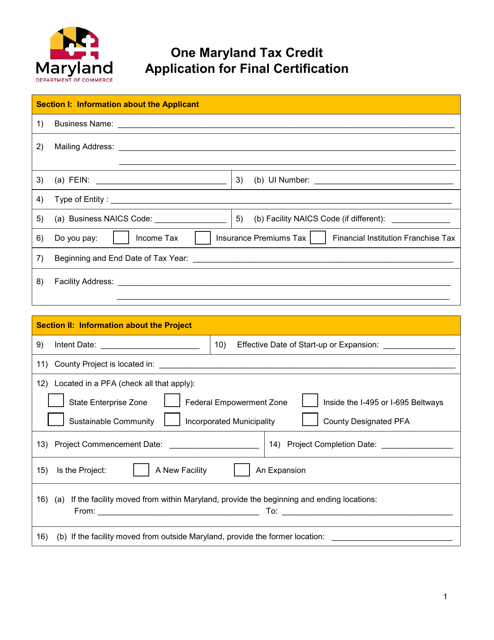

This application is for final certification for the One Maryland Tax Credit in Maryland.

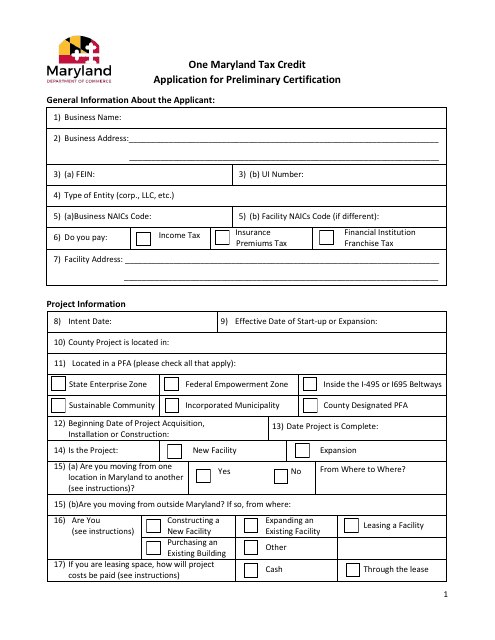

This form is used for applying for preliminary certification for the One Maryland Tax Credit in the state of Maryland. This tax credit is designed to incentivize businesses to create new jobs in certain designated growth areas within the state.

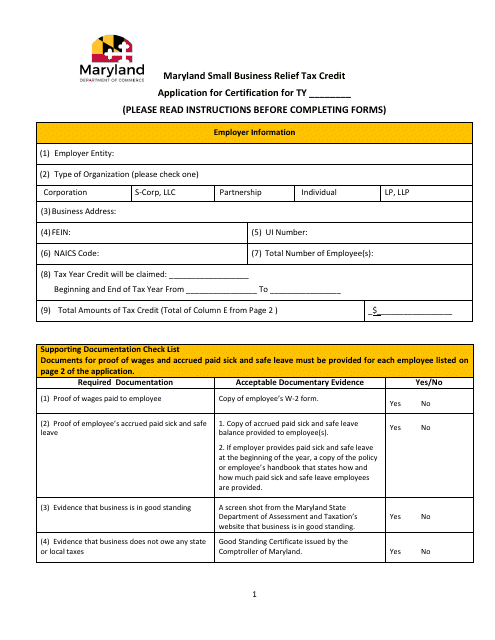

This document is an application for the Maryland Small Business Relief Tax Credit in the state of Maryland. It is used by small businesses to apply for certification and eligibility for the tax credit.

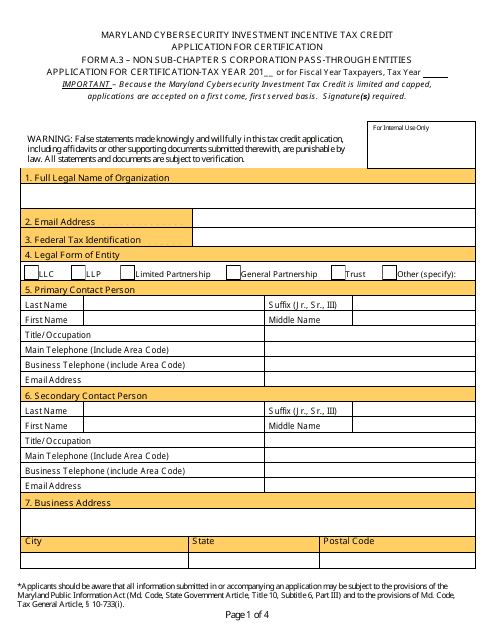

This Form is used for applying for certification as a non Sub-chapter S corporation pass-through entity for the Maryland Cybersecurity Investment Incentive Tax Credit.

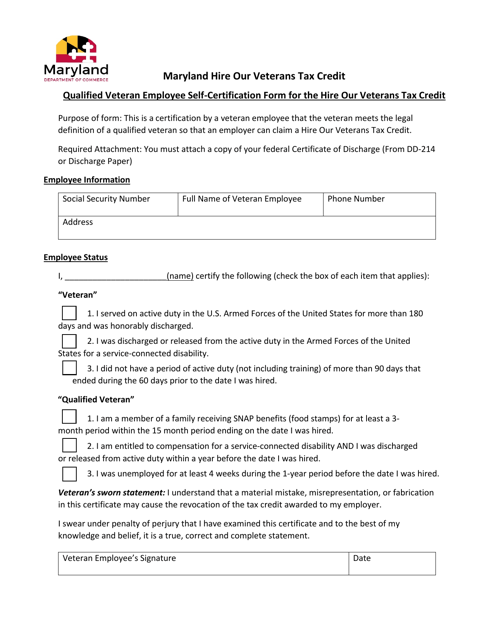

This document is for qualified veteran employees in Maryland to self-certify for the Hire Our Veterans Tax Credit.

This document is a Notice of Intent specific to the state of Maryland. It is used to inform a party's intention to take a particular action or pursue a particular course of action.

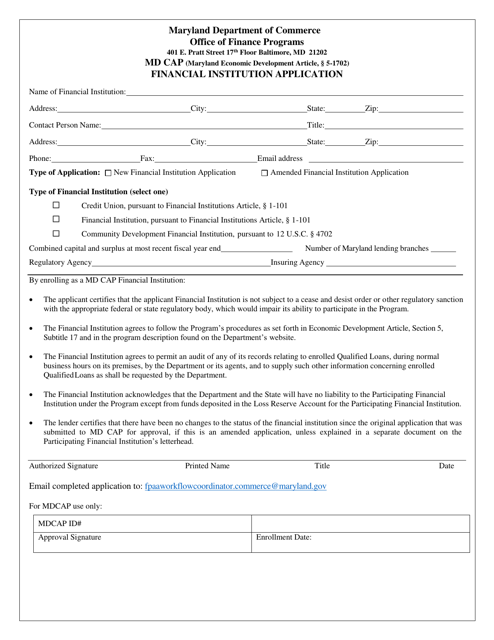

This document is used for applying to a financial institution in the state of Maryland.

This document is for applying for the More Jobs for Marylanders Income Tax Credit. This tax credit is aimed at businesses that create new jobs in Maryland.

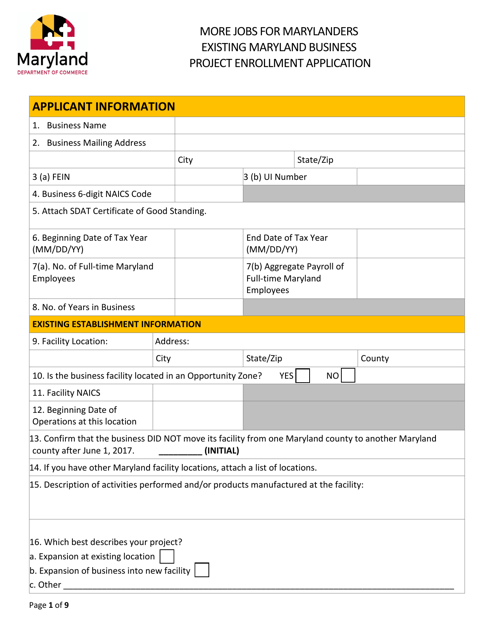

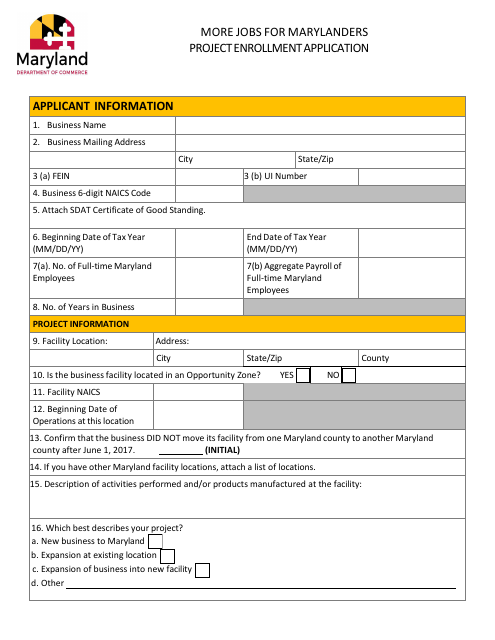

This document is used for enrolling existing Maryland businesses in the More Jobs for Marylanders Project.

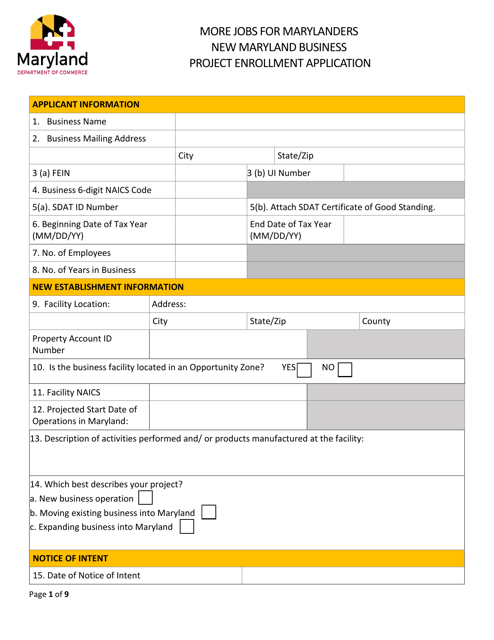

This document is an application for enrollment in the More Jobs for Marylanders Project, which is a program designed to encourage new businesses to start in Maryland and create more job opportunities.

This document is for applying for a tax credit in Maryland, specifically for final certification.

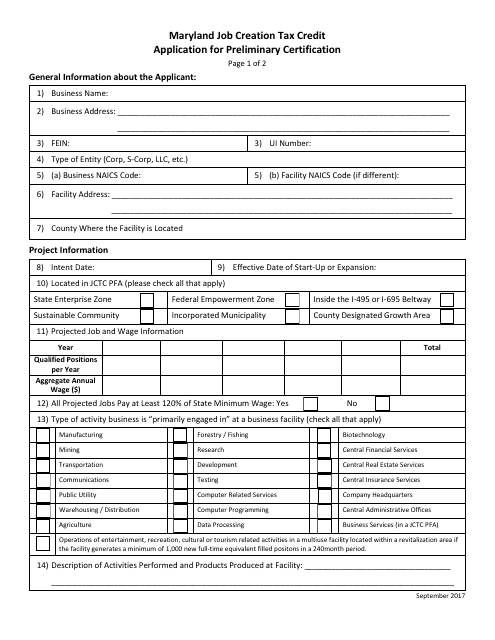

This Form is used for applying for preliminary certification for the Maryland Job Creation Tax Credit.

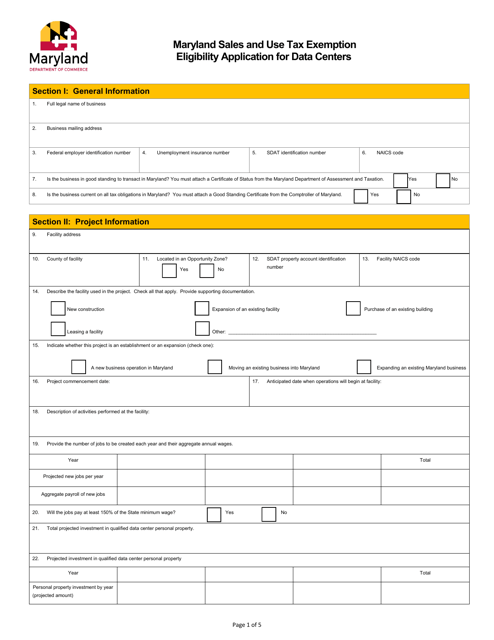

This form is used for applying for sales and use tax exemption eligibility for data centers in Maryland.

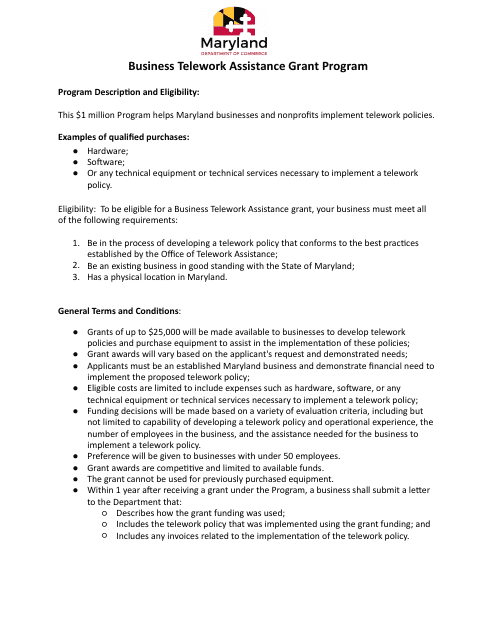

This document is an application form for the Business Telework Assistance Grant Program in the state of Maryland. Businesses can apply for this grant to receive financial assistance for implementing telework options for their employees.

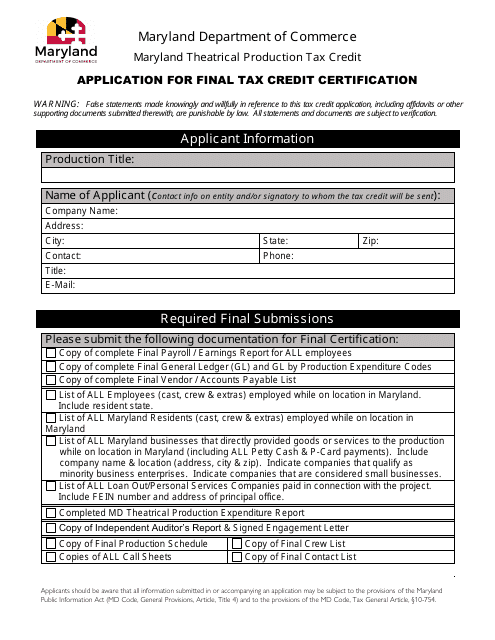

This form is used for applying for the Final Tax Credit Certification for the Maryland Theatrical Production Tax Credit in the state of Maryland.

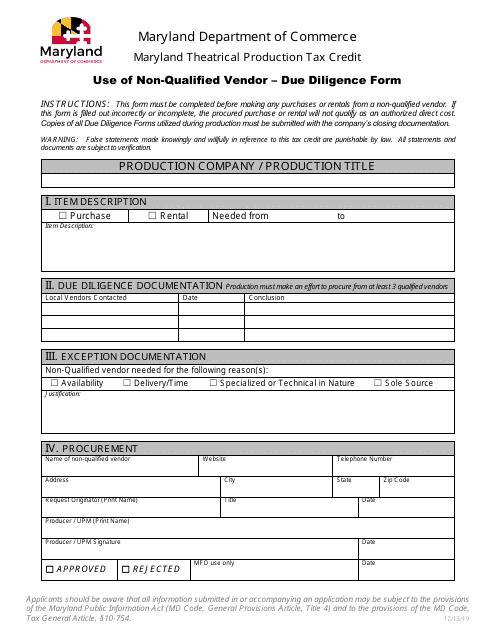

This form is used for conducting due diligence on non-qualified vendors involved in Maryland theatrical production tax credit applications. It helps ensure that vendors meet the eligibility criteria for the tax credit.

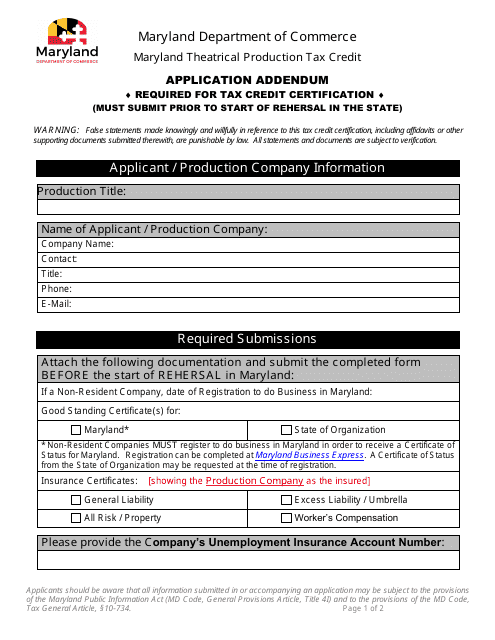

This document is an addendum to the application for the Maryland Theatrical Production Tax Credit in Maryland. It provides additional information or updates to the original application.

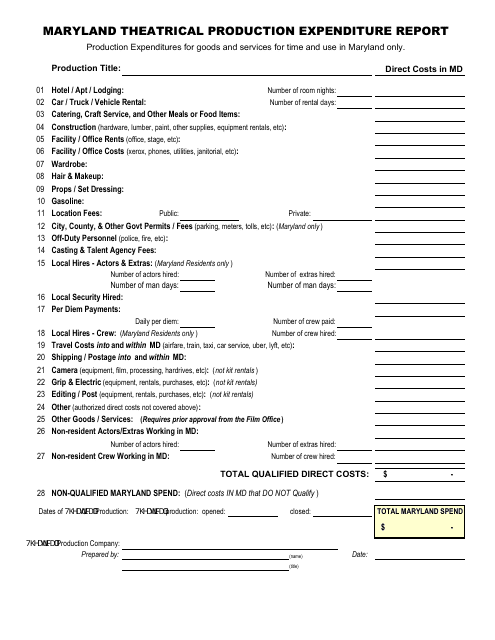

This document is used for reporting and tracking the expenditures of theatrical productions in the state of Maryland. It helps ensure transparency and accountability in the use of funds.

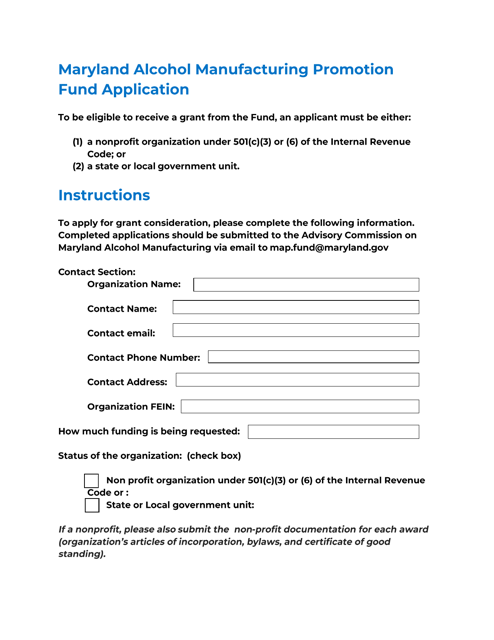

This form is used for applying to the Maryland Alcohol Manufacturing Promotion Fund, which aims to support businesses engaged in alcohol manufacturing in Maryland.

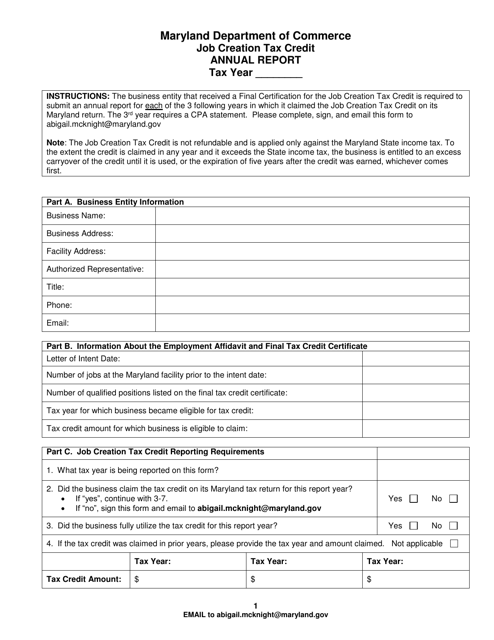

This document provides an annual report on the Job Creation Tax Credit in the state of Maryland. It highlights the progress and impact of the tax credit in promoting job creation and economic growth.

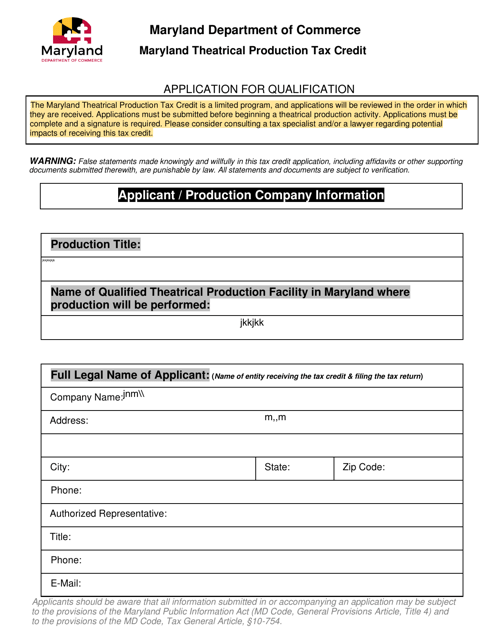

This document is an application for the Maryland Theatrical Production Tax Credit. It is used by theatrical production companies in Maryland to apply for a tax credit for their production expenses.

This form is used for enrolling in the More Jobs for Marylanders Project, a program aimed at creating more job opportunities in Maryland.