Maine Department of Administrative and Financial Services Forms

Documents:

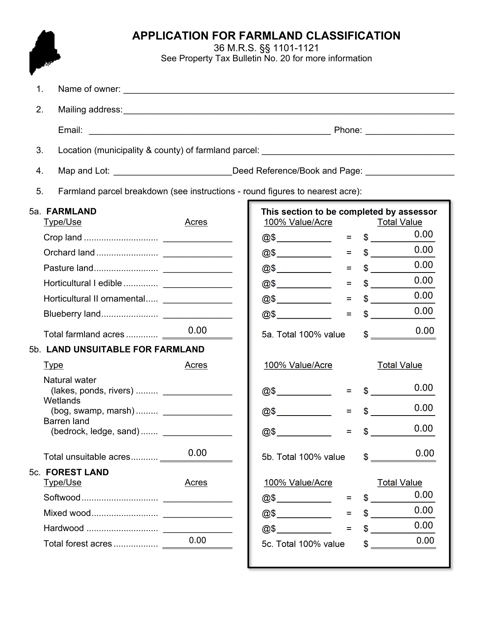

507

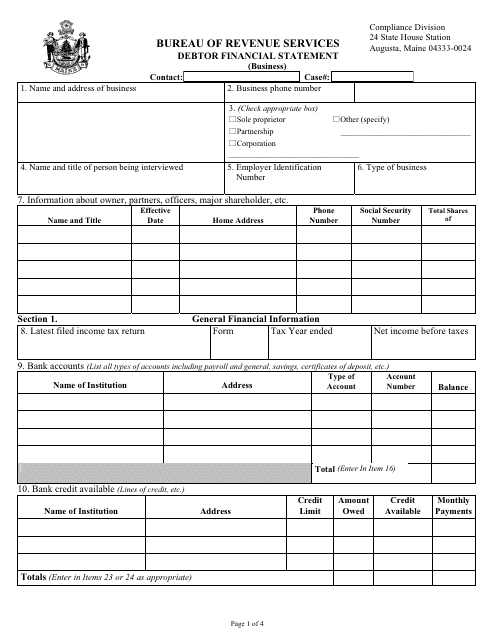

This document is used to collect financial information from a debtor in the state of Maine. It helps assess the debtor's ability to repay their debts.

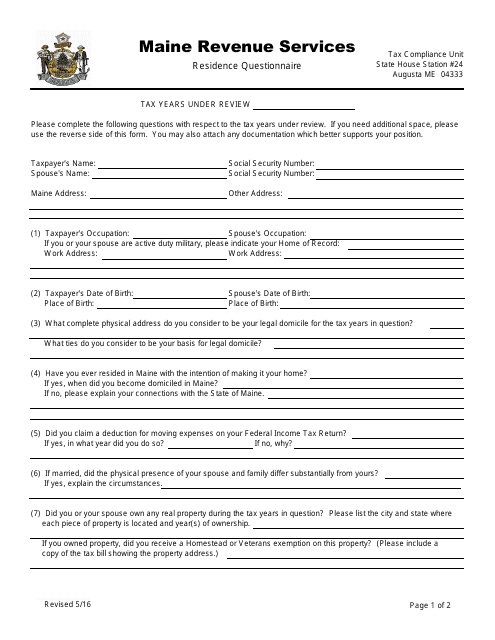

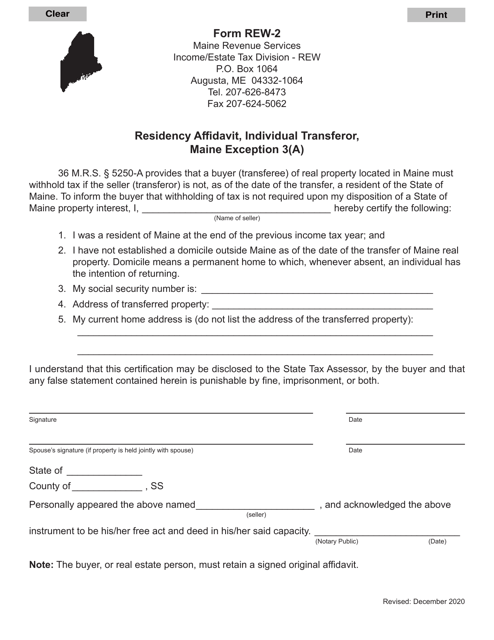

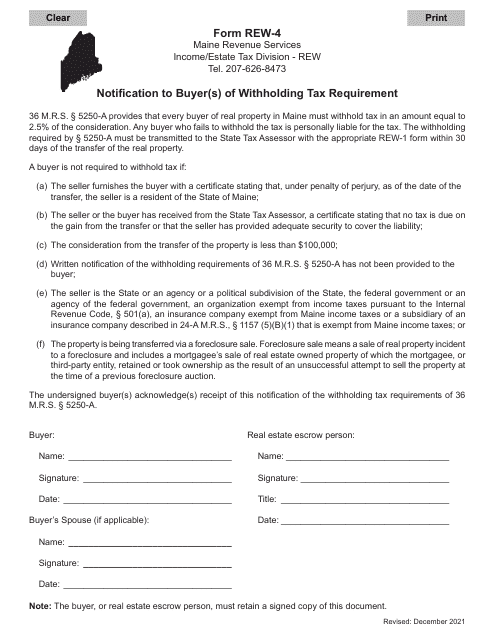

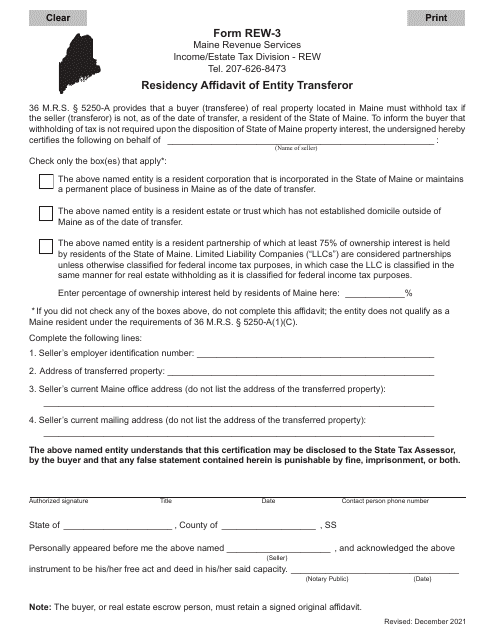

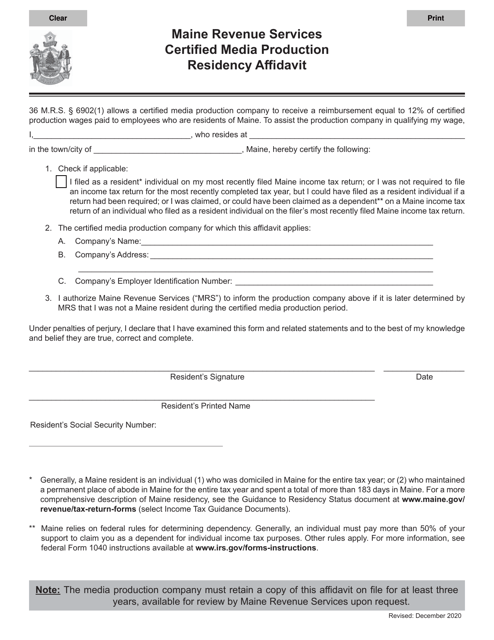

This Form is used for gathering information about a person's residence in the state of Maine. It includes questions about the individual's address, length of residency, and other details regarding their living situation in Maine.

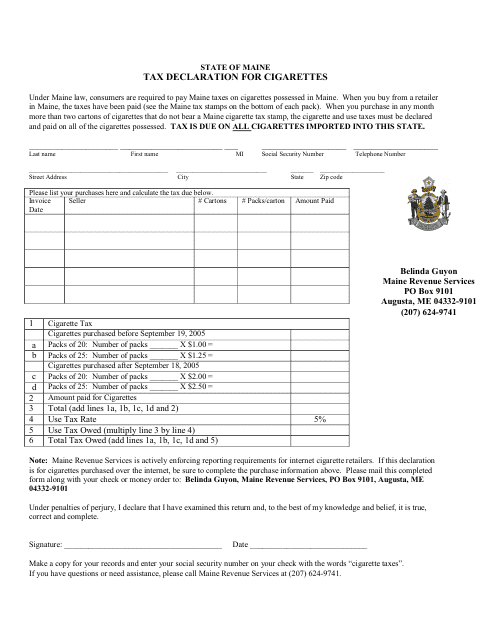

This Form is used for declaring and reporting taxes on cigarettes in the state of Maine.

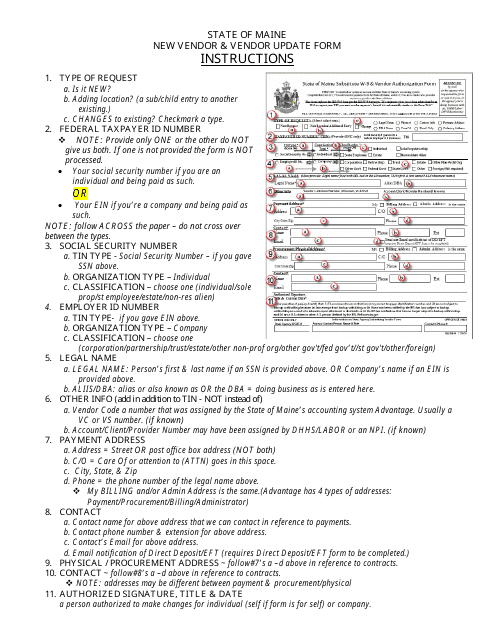

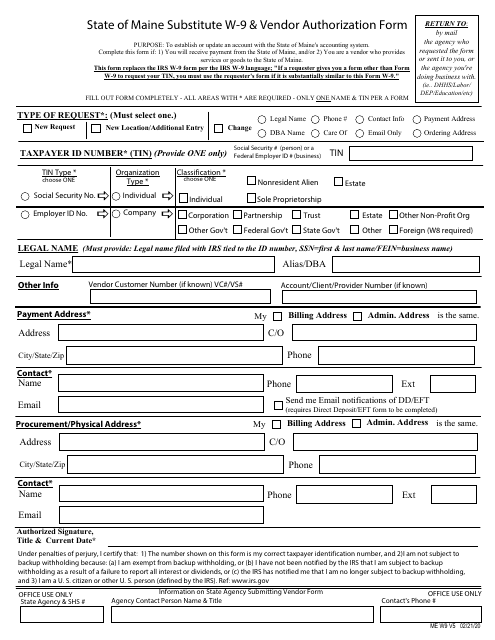

This document provides instructions for completing the Substitute W-9 & Vendor Authorization Form in the state of Maine. It explains how to fill out the form and provides guidance on any required supporting documentation.

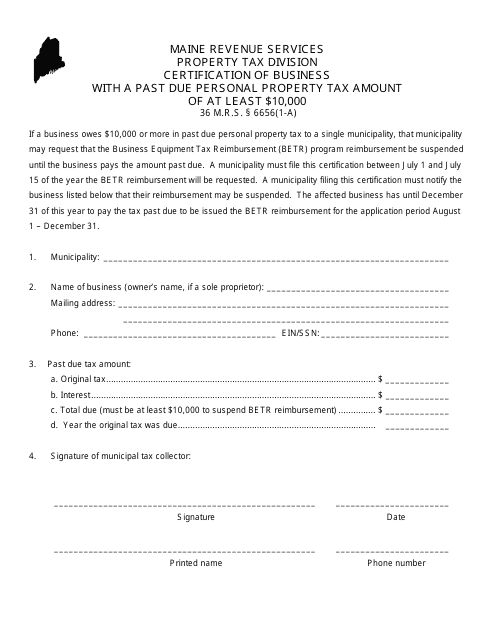

This document certifies a business with a past due personal property tax amount of at least $10,000 in the state of Maine.

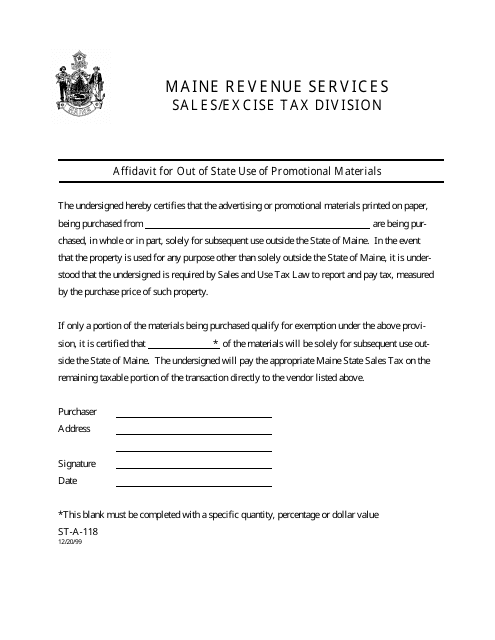

This form is used for individuals or businesses in Maine who want to use promotional materials out of state. The form allows them to provide an affidavit stating the details of their promotional activities outside of Maine.

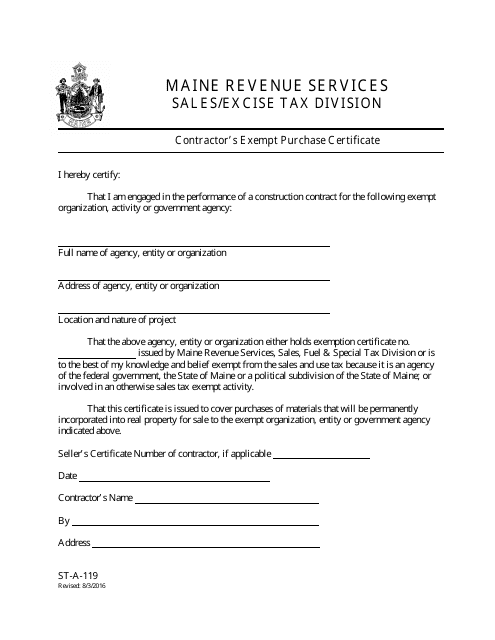

This form is used for contractors in Maine to claim exemption from sales tax when making purchases for use in a construction project.

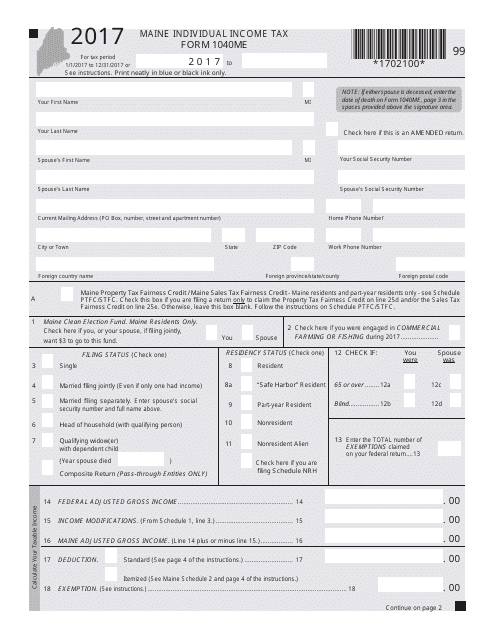

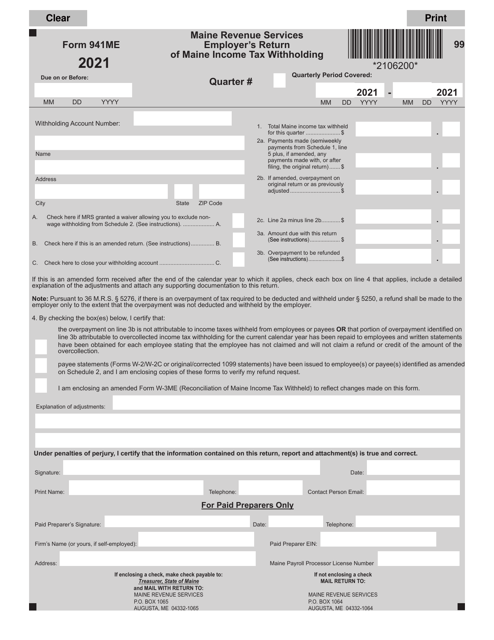

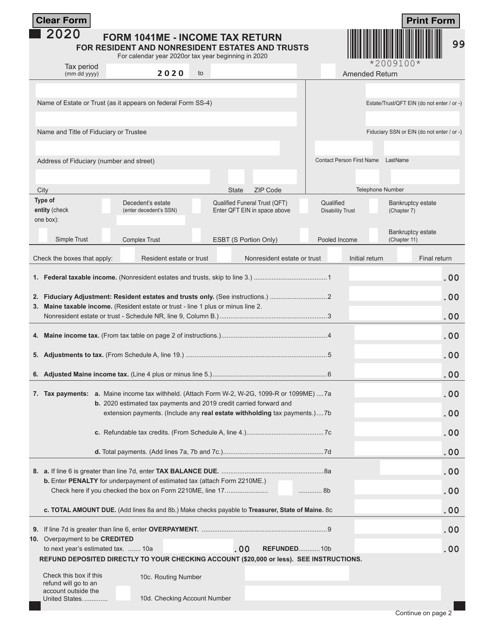

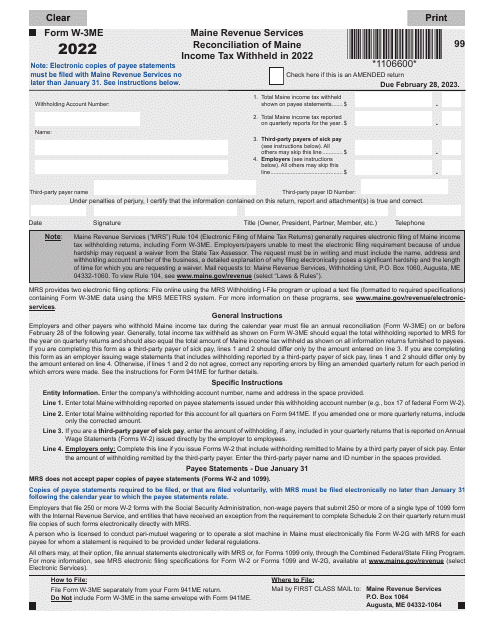

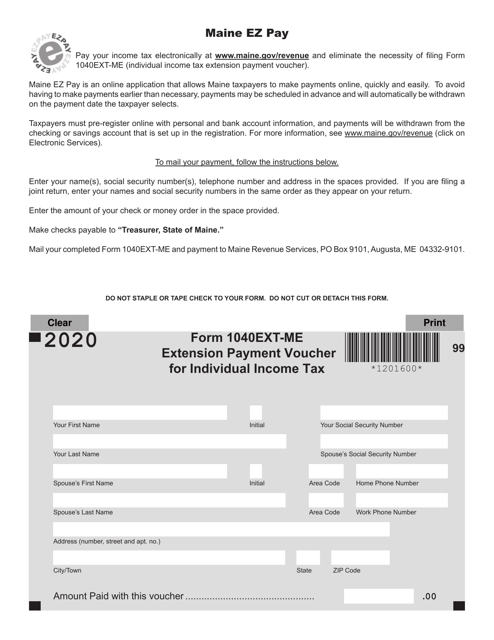

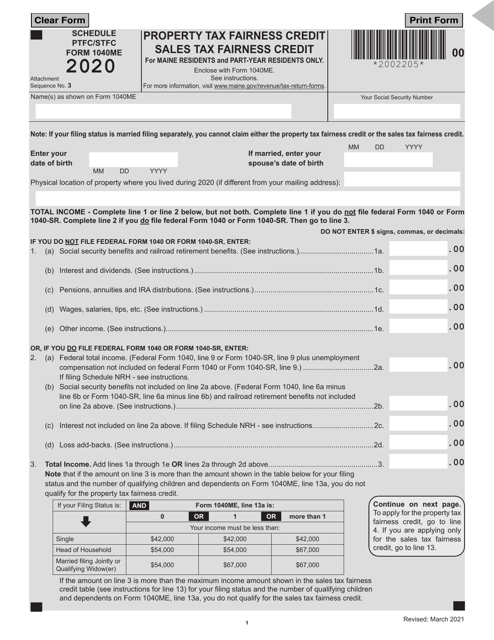

This Form is used for filing individual income tax in the state of Maine.

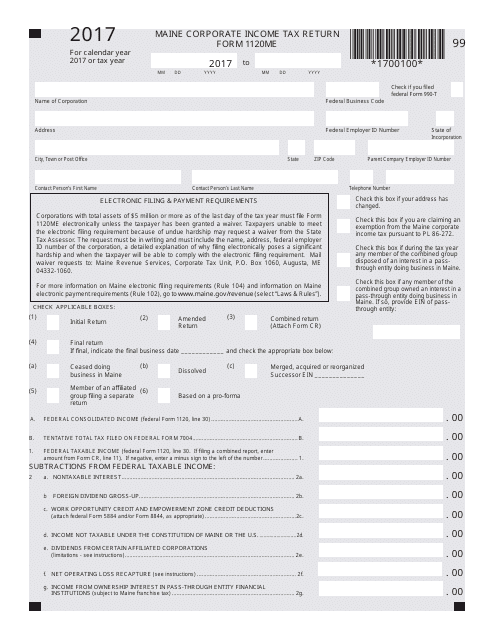

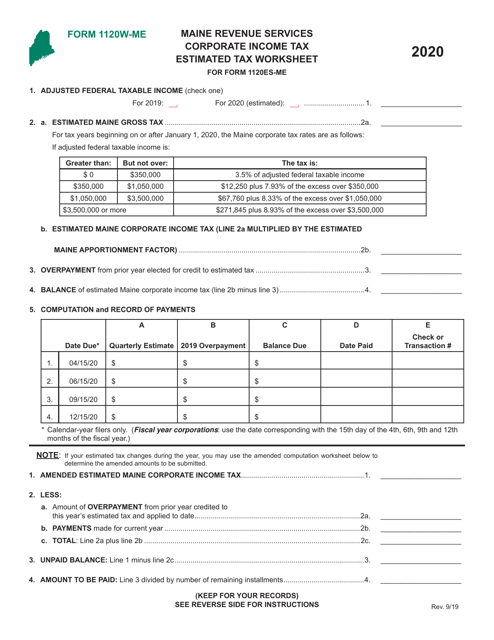

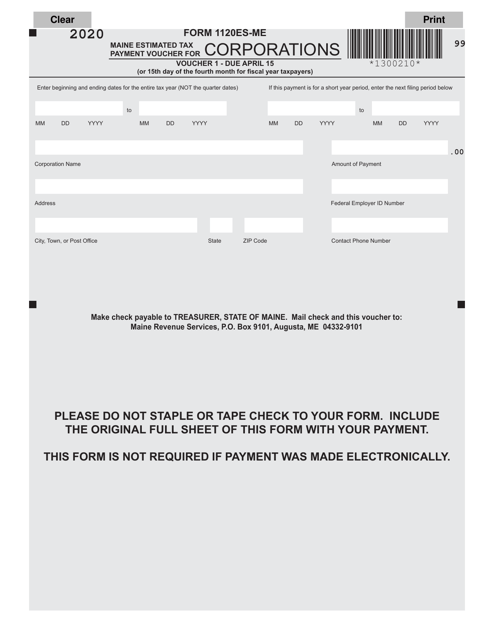

This form is used for filing the Maine Corporate Income Tax Return for businesses operating in Maine.

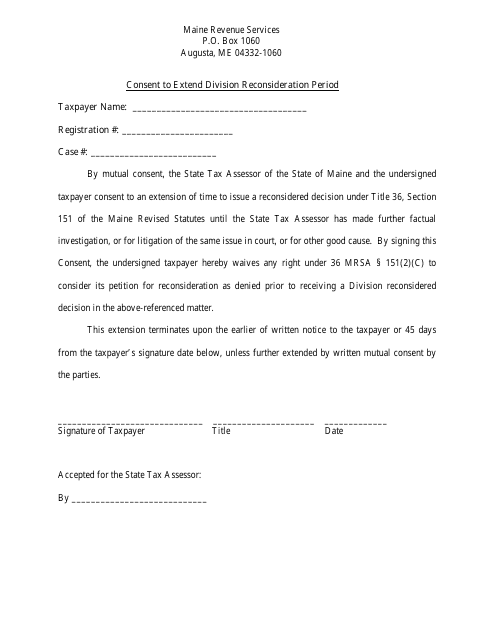

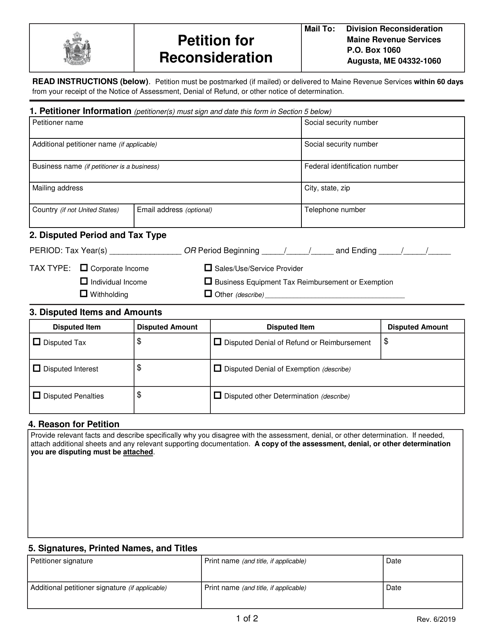

This document allows individuals in Maine to give consent to extend the division reconsideration period.

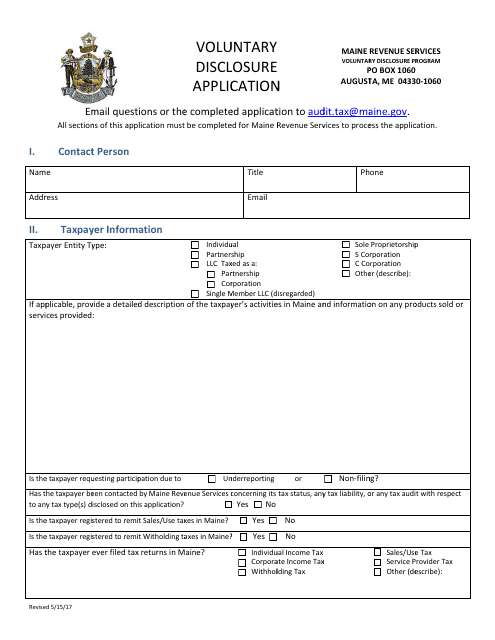

This form is used for the voluntary disclosure application in the state of Maine.

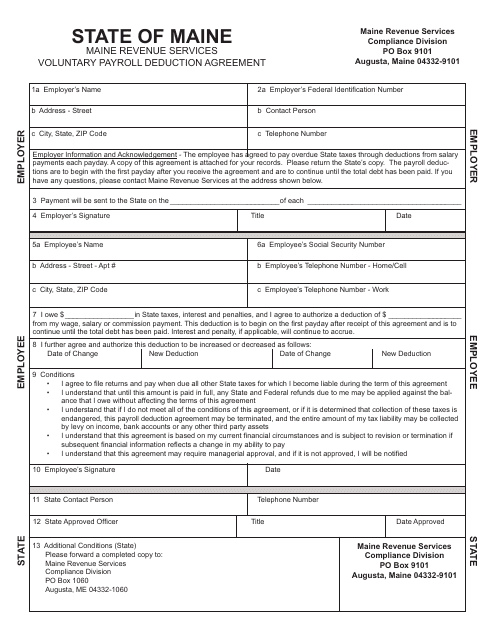

This Form is used for employees in Maine who want to voluntarily have deductions from their paycheck for various purposes such as retirement savings or charitable donations.

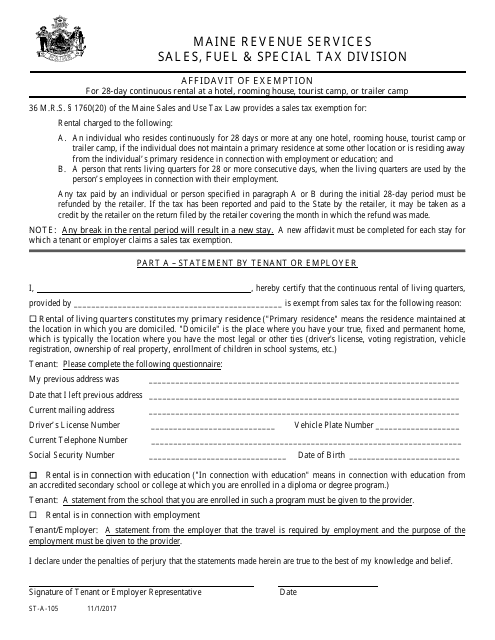

This Form is used for claiming exemption from the 28-day rental tax on accommodations in Maine.

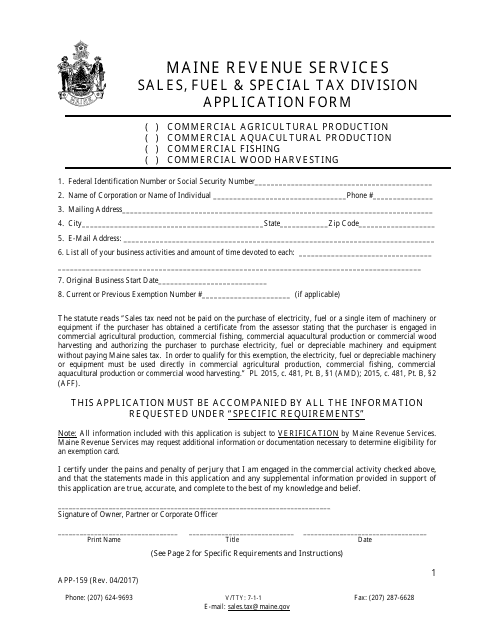

This form is used for applying for a combined commercial exemption in the state of Maine.

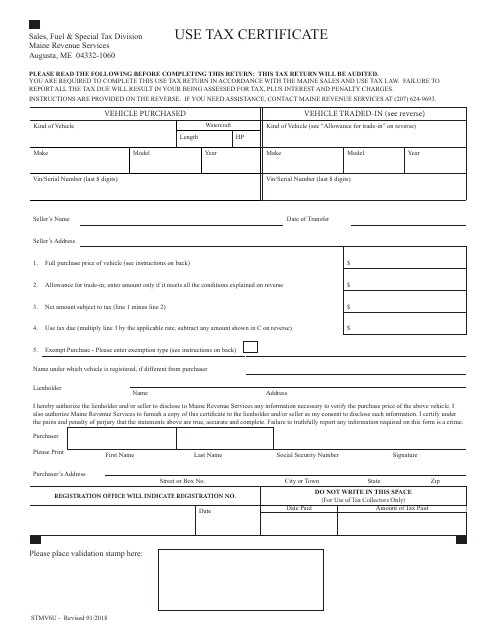

This form is used for certifying use tax payments in the state of Maine.

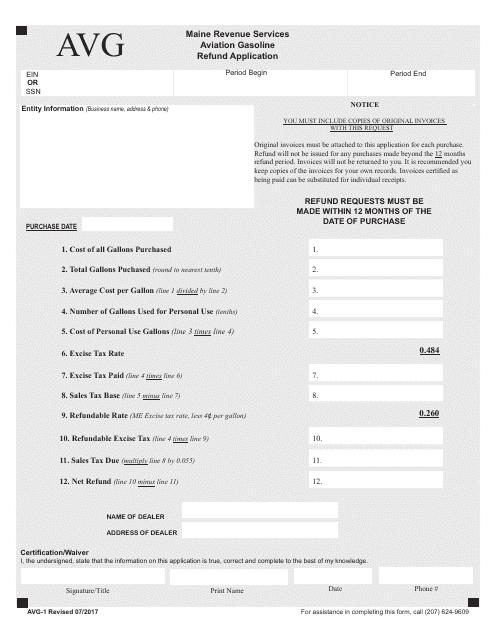

This Form is used for applying for a refund of aviation gasoline tax paid in the state of Maine.

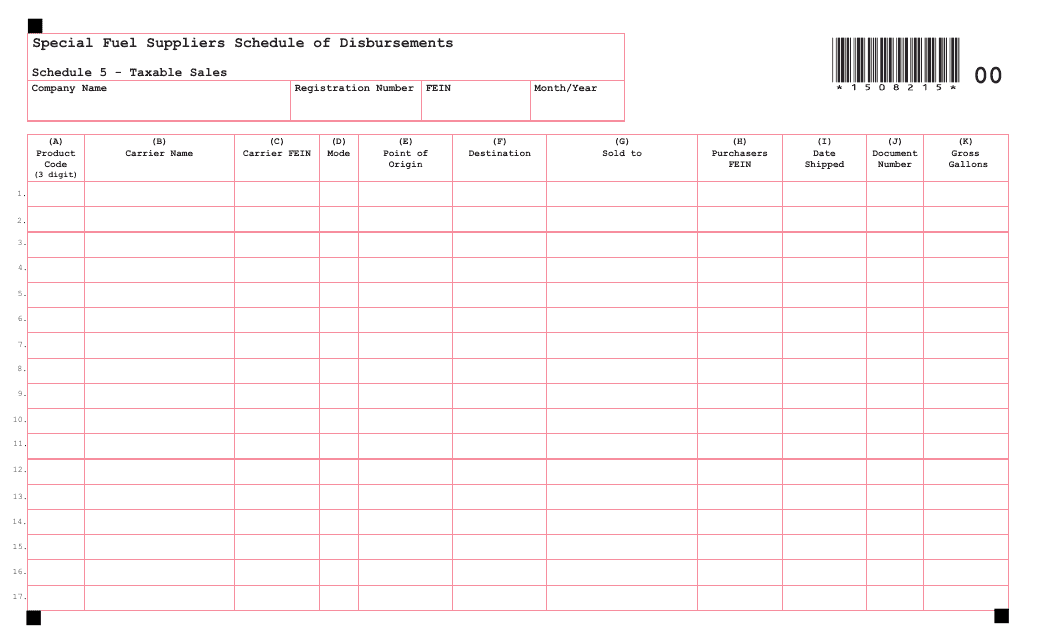

This document provides a schedule of disbursements for taxable sales of special fuel suppliers in the state of Maine.

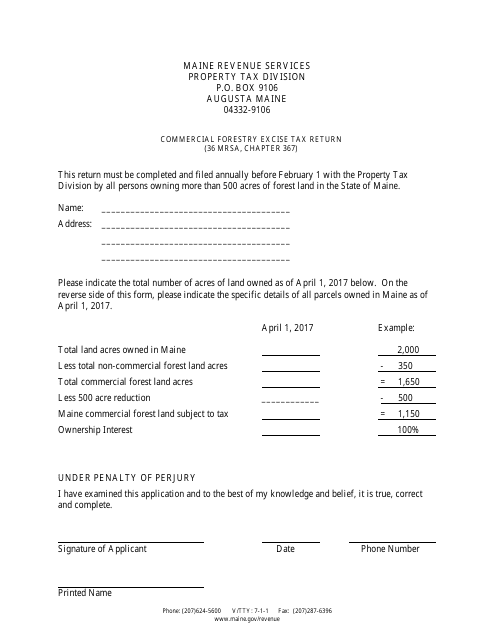

This form is used for filing the Commercial Forestry Excise Tax Return in the state of Maine.

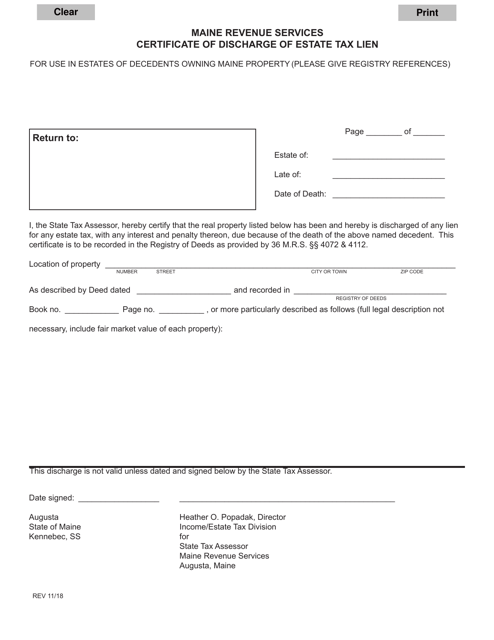

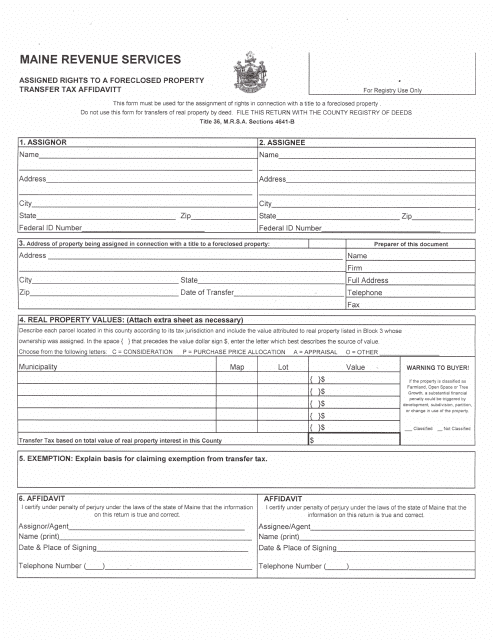

This document is used for transferring the rights to a foreclosed property and paying the transfer tax in the state of Maine.

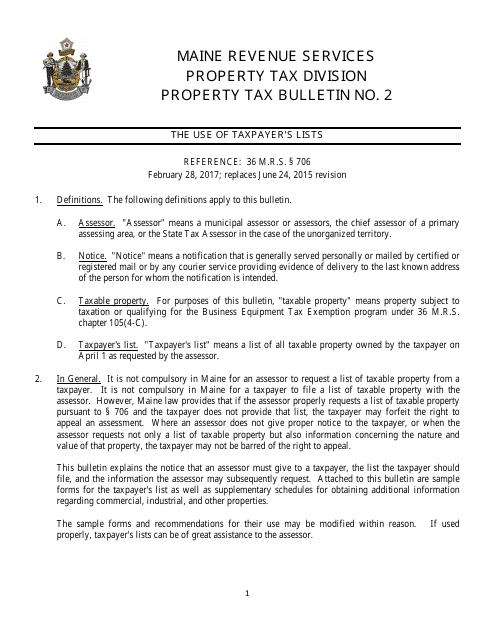

This document is a request for a list of taxable property in the state of Maine. It is used to gather information on properties that are subject to taxation.