Kansas Department of Revenue Forms

Documents:

645

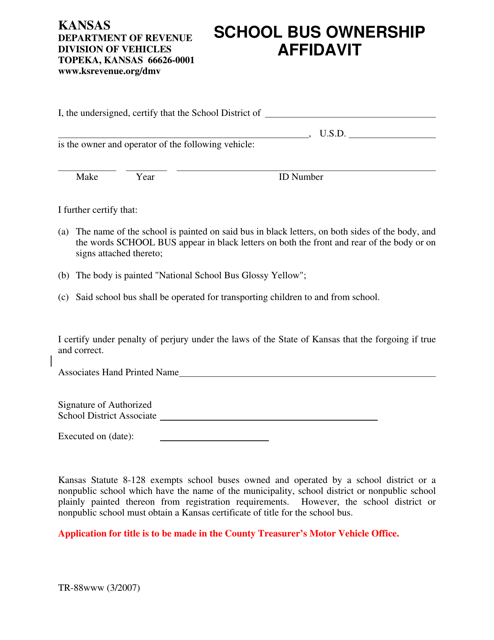

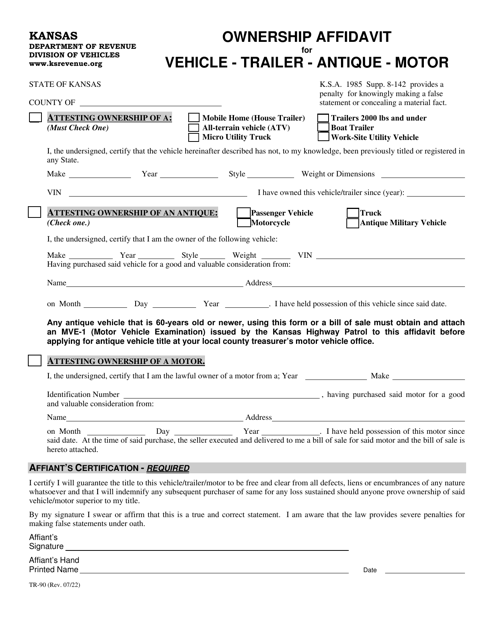

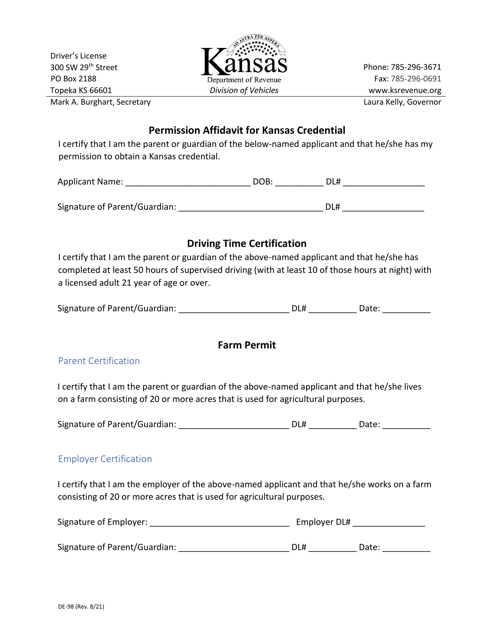

This form is used for school bus owners in Kansas to provide an affidavit of ownership.

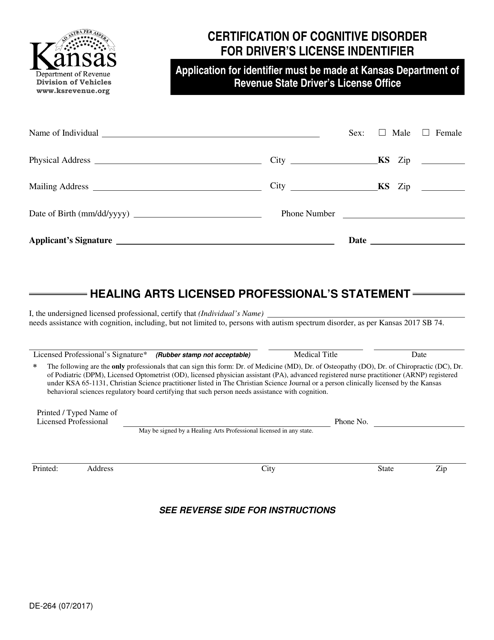

This form is used for certifying a cognitive disorder for a driver's license identifier in the state of Kansas.

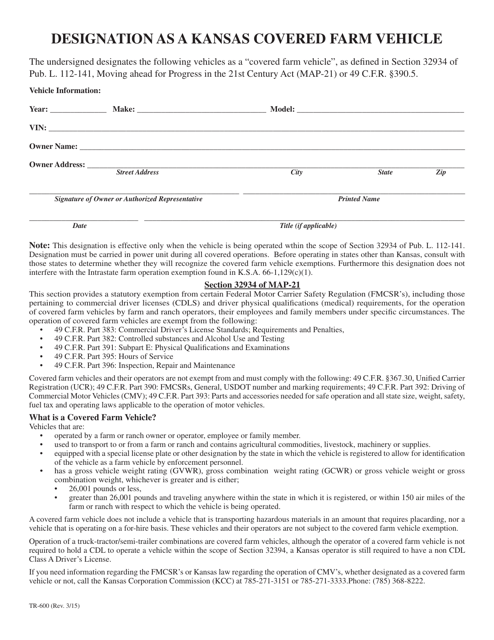

This Form is used for designating a covered farm vehicle in Kansas. It is required by the Kansas Department of Revenue for farmers who qualify for certain tax exemptions on their farm vehicles.

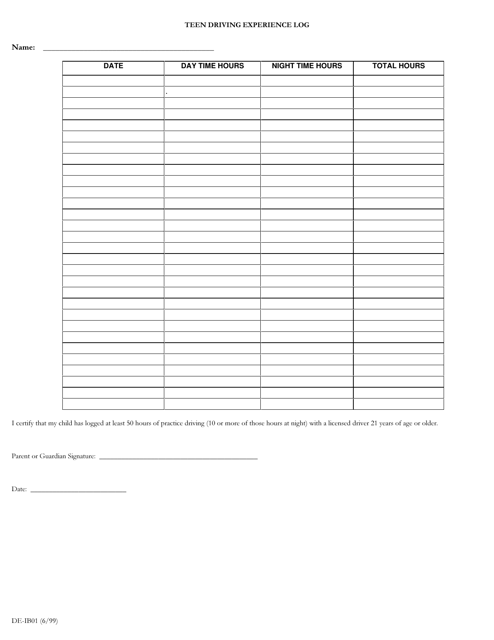

This form is used for logging the driving experience of teenage drivers in Kansas. It helps teenagers keep track of their driving hours, which is a requirement for obtaining a driver's license.

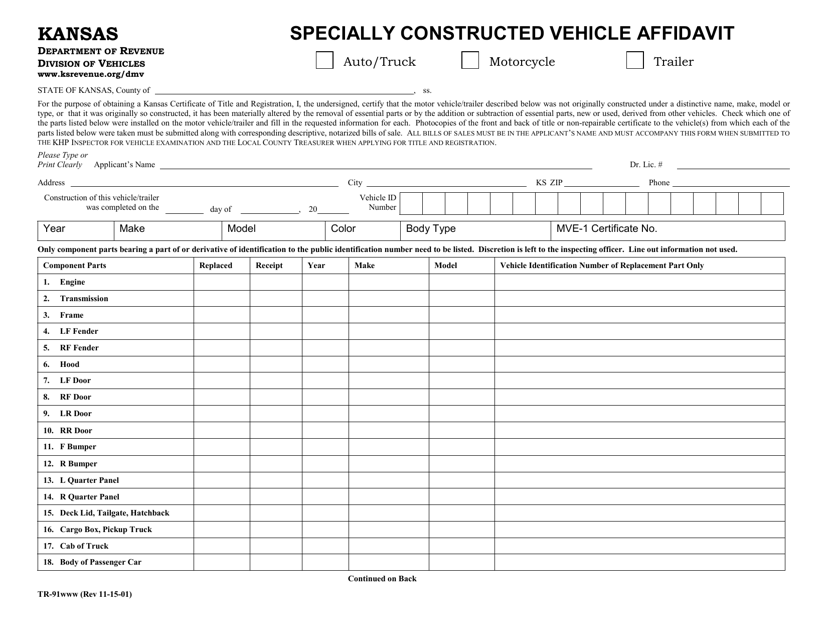

This form is used for submitting an affidavit for specially constructed vehicles in the state of Kansas.

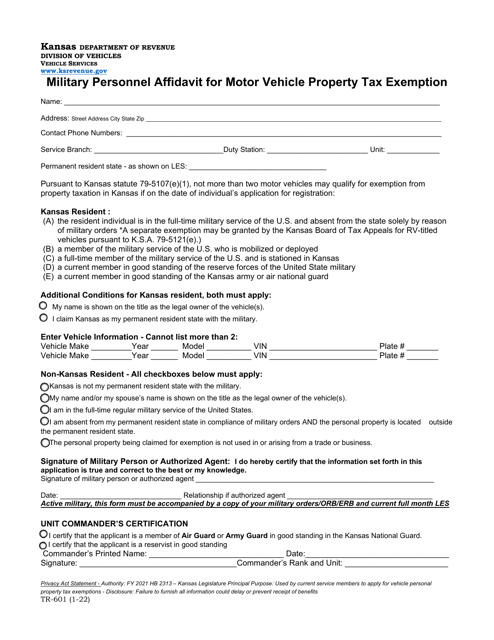

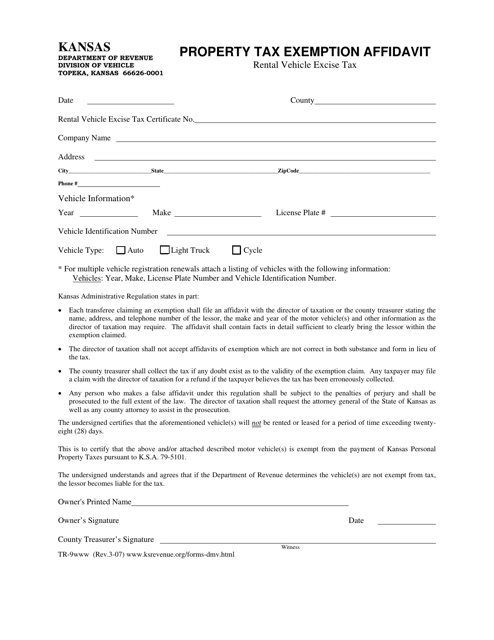

This form is used for claiming property tax exemption in the state of Kansas. It requires the completion of an affidavit to verify eligibility for the exemption.

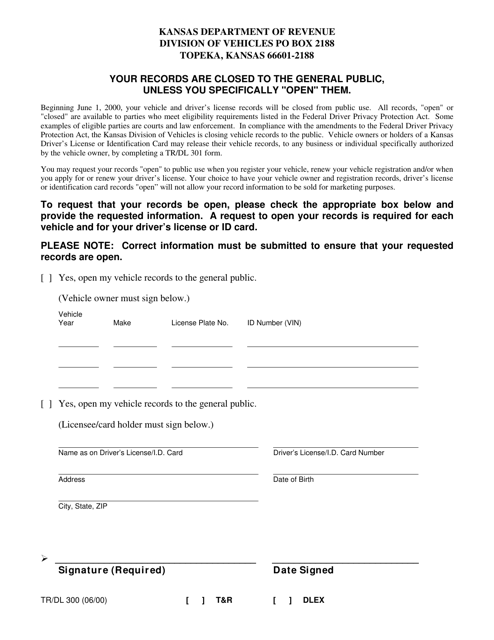

This form is used for opting in to receive vehicle records in Kansas.

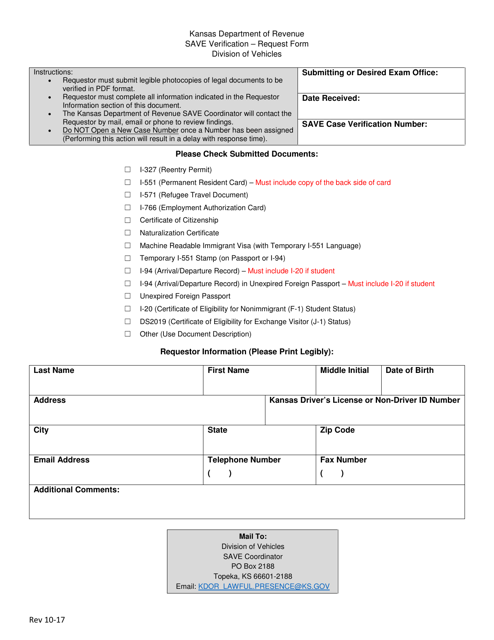

This type of document is a Save Verification Request Form specific to the state of Kansas. It is used for requesting verification of savings information.

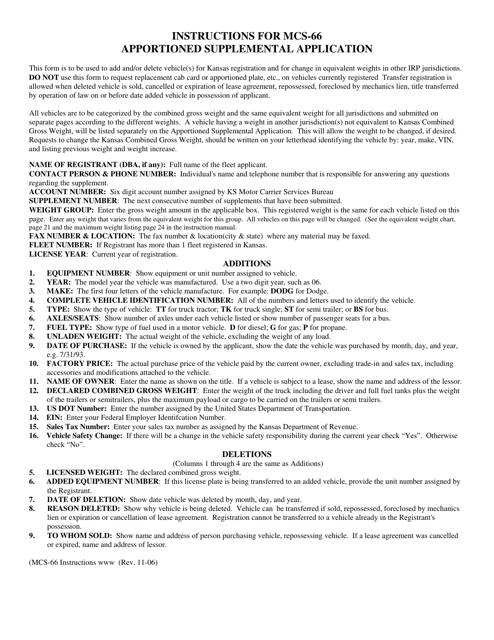

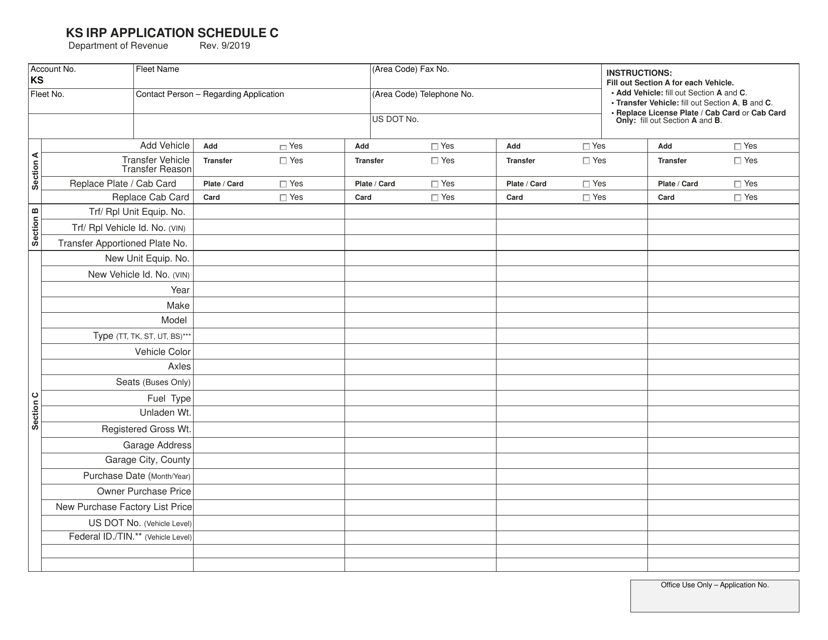

This document provides instructions for completing Form MCS-66 Schedule C Ks Irp Application for the state of Kansas. It guides individuals on how to accurately fill out the form to apply for the International Registration Plan (IRP) in Kansas.

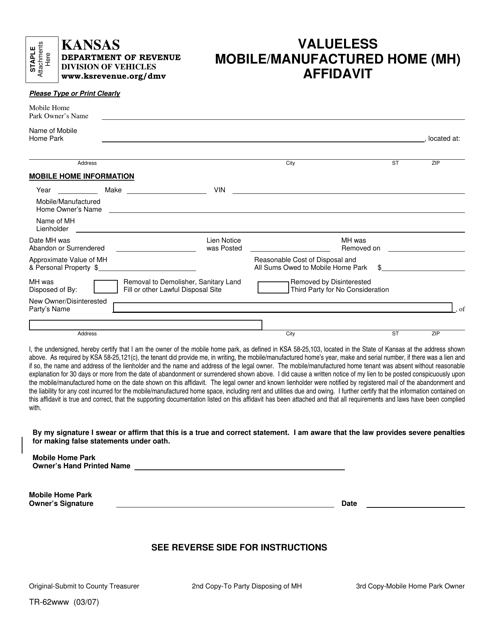

This form is used for declaring a mobile/manufactured home in Kansas as valueless.

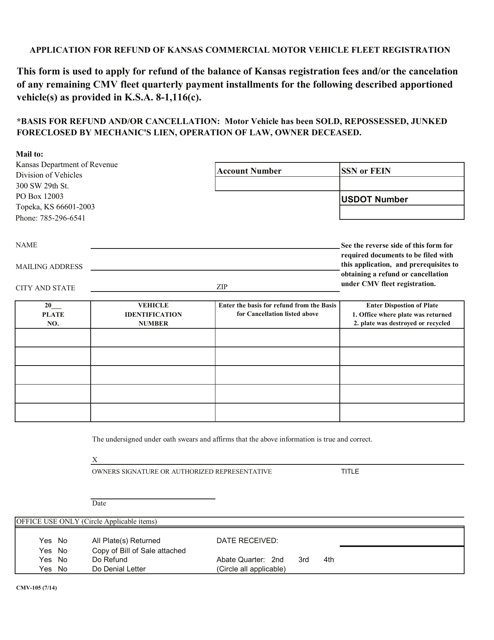

This Form is used for requesting a refund of Kansas commercial motor vehicle fleet registration fees.

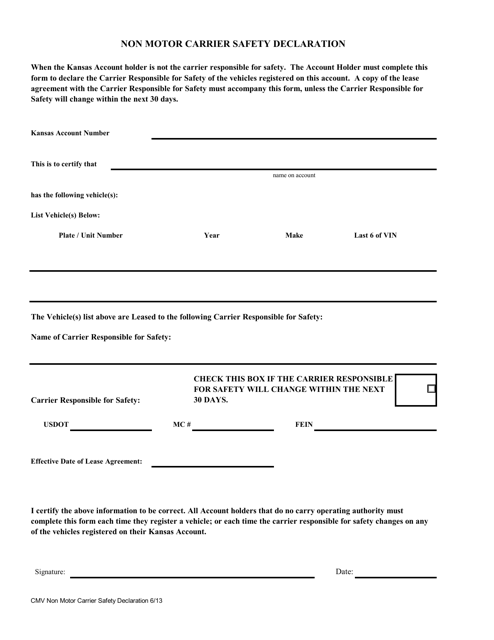

This document is used for declaring safety measures for non-motor carriers operating in Kansas.

This document is a form used for applying for an IRP (International Registration Plan) in the state of Kansas.

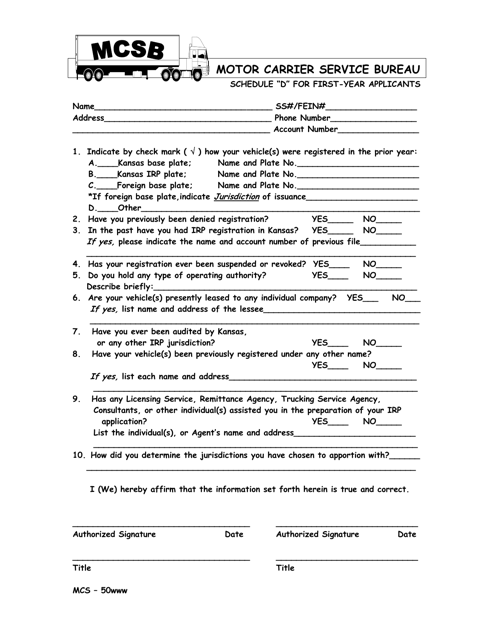

This form is used for first-year applicants in the state of Kansas to schedule their MCS-50 appointments. It is specifically for applicants applying for a motor carrier operating authority.

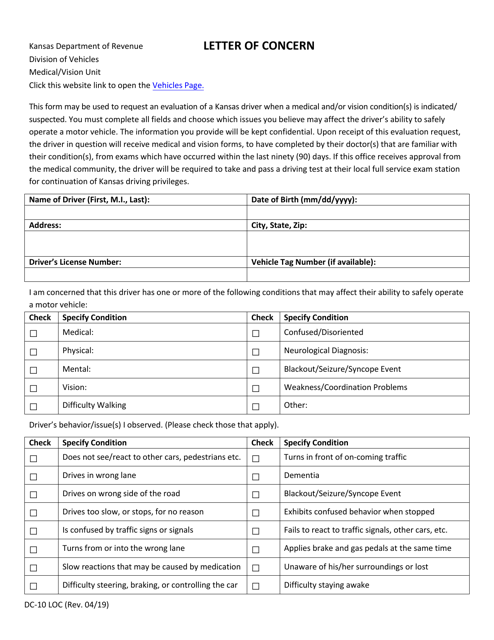

This Form is used for submitting a Letter of Concern to the Medical and Vision Unit in Kansas.

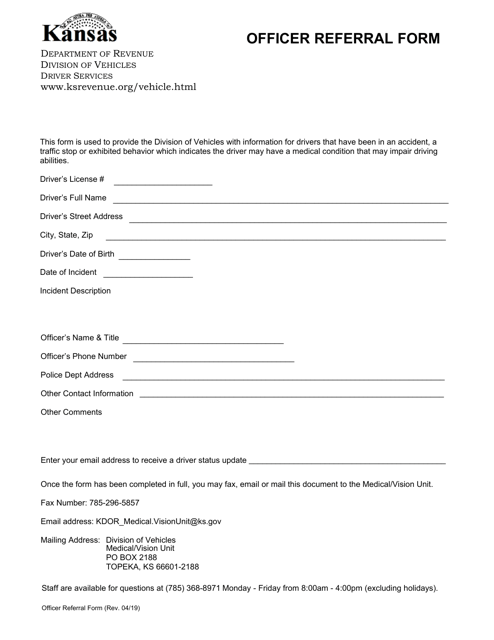

This Form is used for referring officers in Kansas for various reasons.

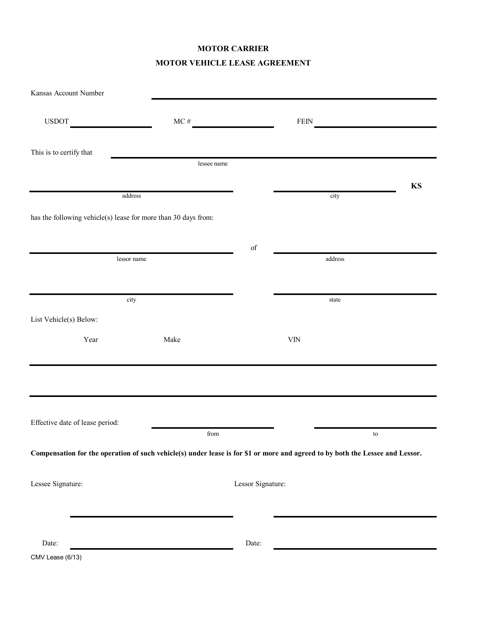

This Form is used for leasing a motor vehicle in the state of Kansas. It outlines the terms and conditions of the lease agreement between the lessor and lessee.

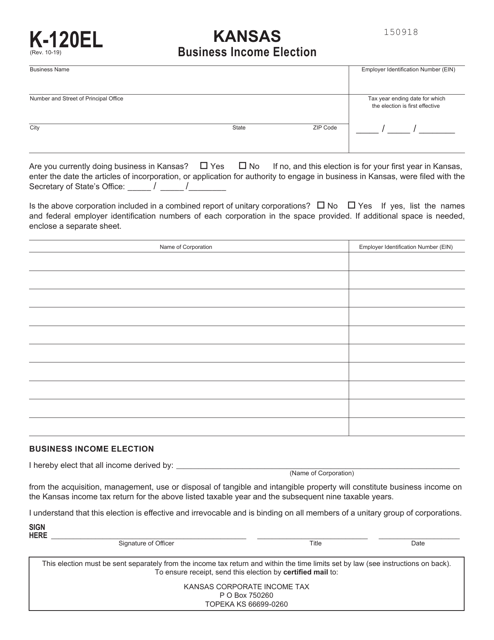

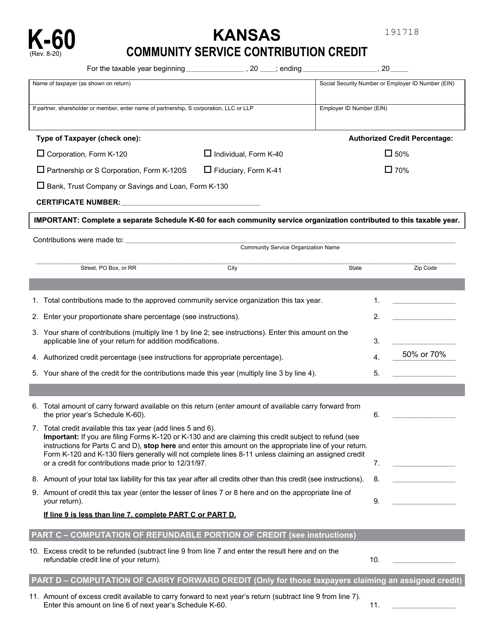

This form is used for electing the Kansas business income election.

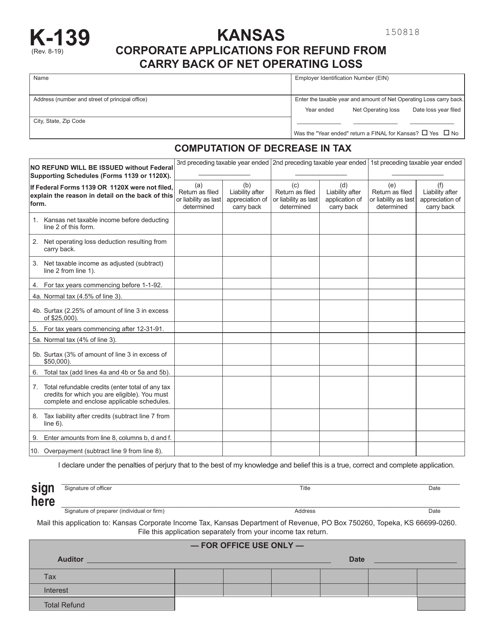

This form is used for Kansas corporations to apply for a refund by carrying back a net operating loss.

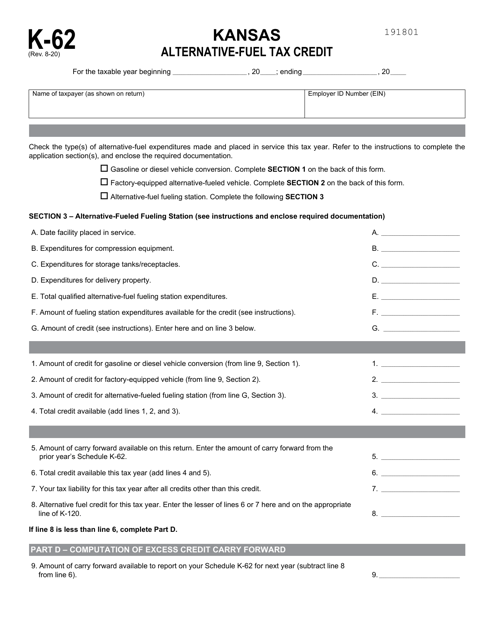

This document for claiming alternative-fuel tax credits in Kansas.

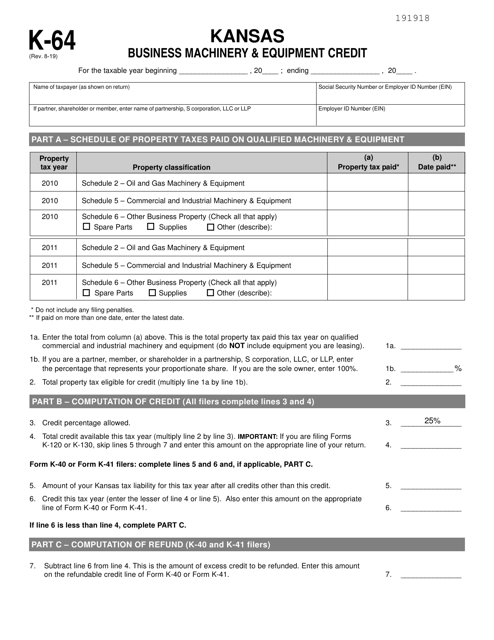

This form is used for claiming the Business Machinery & Equipment Credit in the state of Kansas. It allows business owners to receive a tax credit for purchasing machinery and equipment for their company.

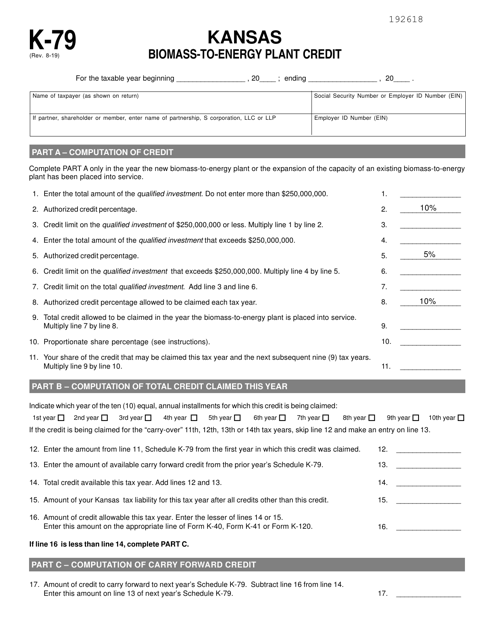

This document is used for claiming the Kansas Biomass-To-Energy Plant Credit in Kansas.

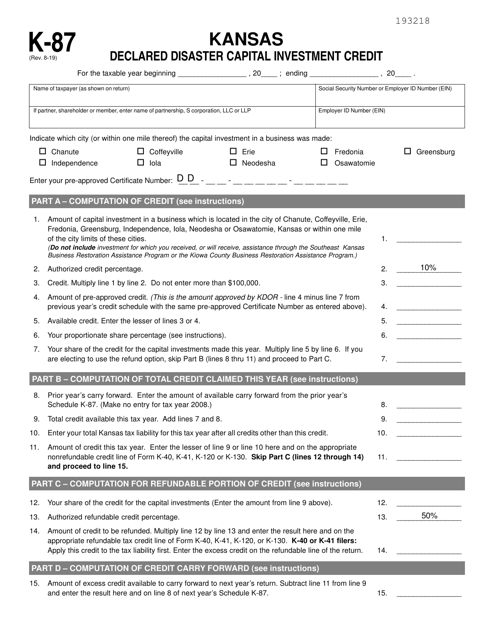

This form is used for claiming the Kansas Declared Disaster Capital Investment Credit in the state of Kansas. It allows businesses to receive a tax credit for capital investments made in areas that have been declared as disaster areas by the state.

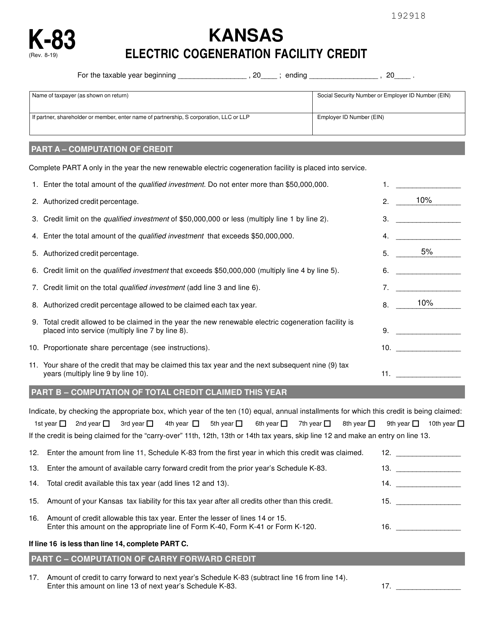

This type of document is used for claiming the Kansas Electric Cogeneration Facility Credit in the state of Kansas. It is a tax form specifically for businesses that generate electricity through cogeneration facilities in Kansas.

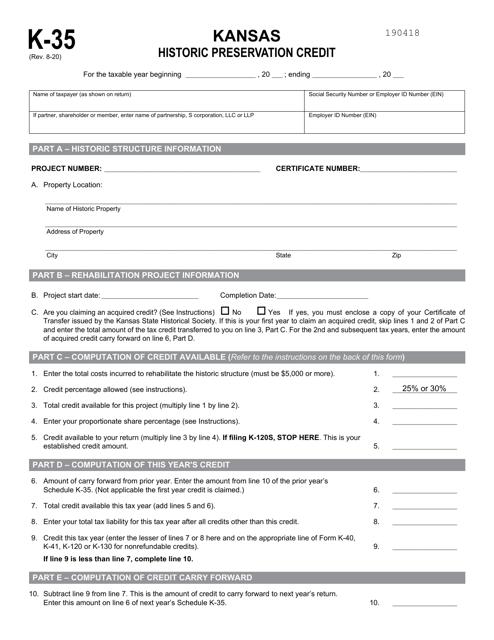

This form is used for claiming the Kansas Historic Preservation Credit in the state of Kansas. It is a tax credit available for eligible taxpayers who have made qualified expenditures for the rehabilitation and preservation of historic properties in the state.

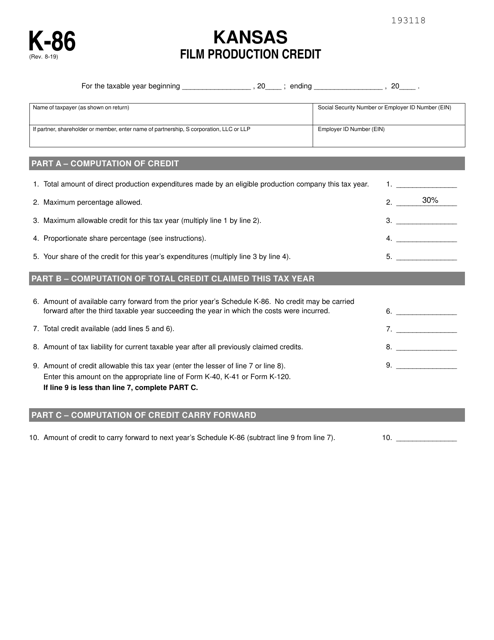

This document is used for claiming the Kansas film production credit in the state of Kansas.

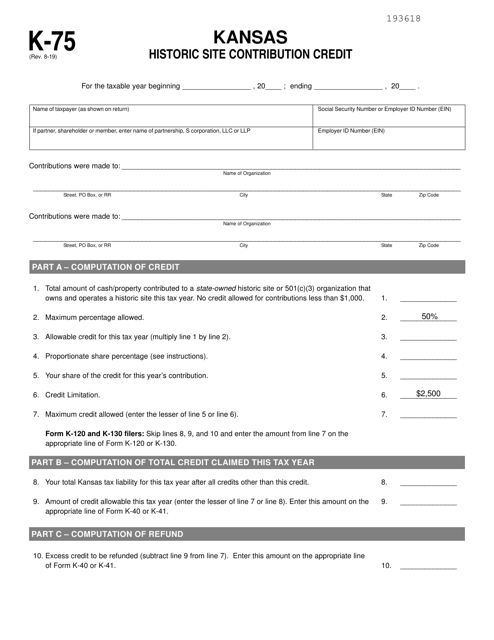

This document is used for claiming the Kansas Historic Site Contribution Credit in the state of Kansas. This credit is available for taxpayers who make contributions to qualified historic sites in Kansas.