Illinois Department of Revenue Forms

Documents:

857

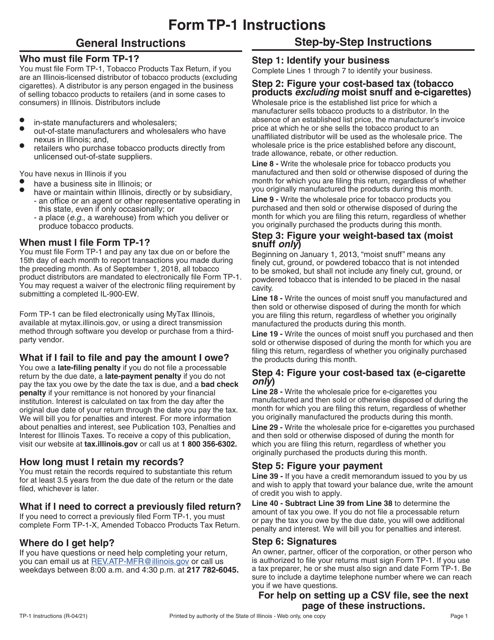

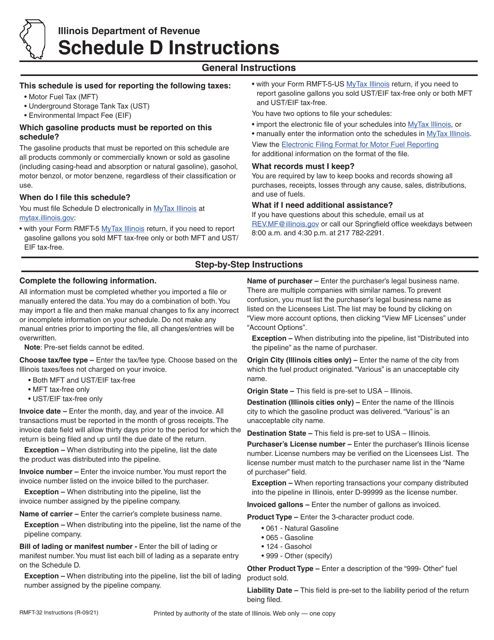

This document is used for reporting the tax- and fee-free distribution of gasoline products in Illinois to licensed distributors and receivers. It is called Schedule D Mft, Ust, and Eif Gasoline Products Sold and Distributed Tax- and Fee-Free in Illinois to Licensed Distributors and Receivers.

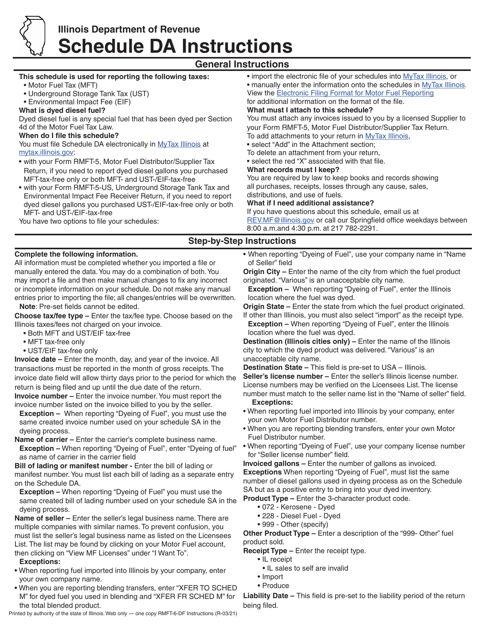

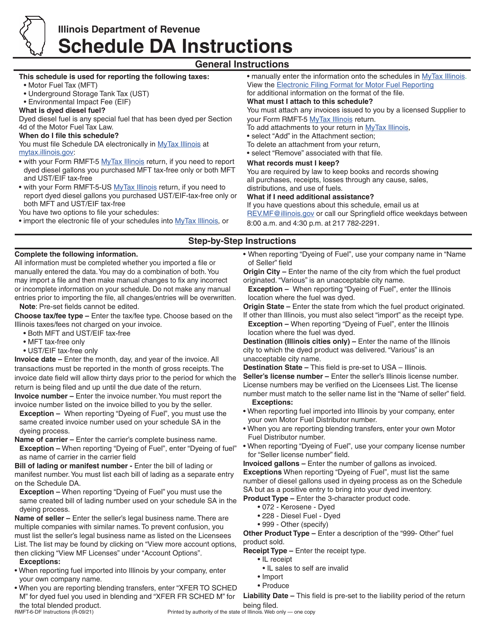

This document provides instructions for reporting Schedule DA Mft, Ust, and Eif Dyed Diesel Fuel produced, acquired, received, or transported into Illinois.

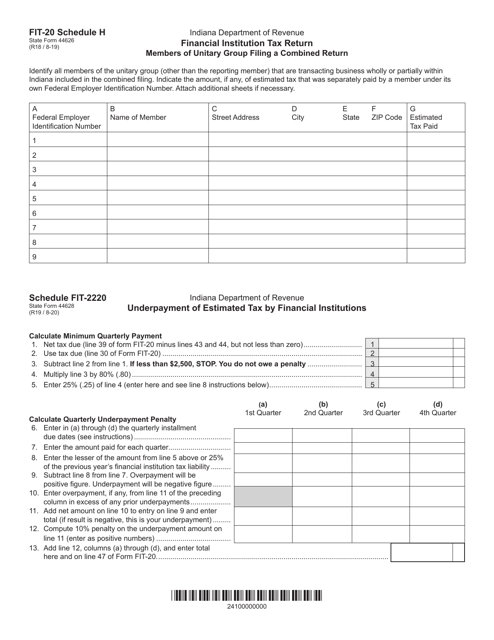

This form is used for members of a unitary group in Illinois who are filing a combined tax return and have underpaid their estimated tax.

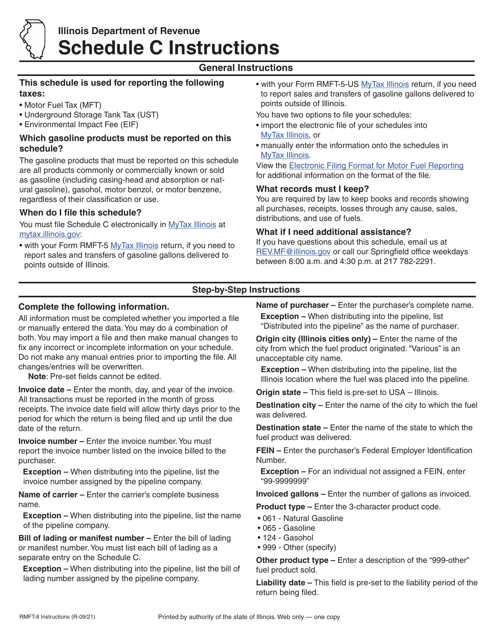

This type of document is used for reporting sales and transfers of gasoline products delivered to points outside of Illinois. The form is specifically for businesses in Illinois.

This Form is used for reporting the production, acquisition, receipt, or transportation of dyed diesel fuel in Illinois. It is required by the state of Illinois for compliance purposes.

This Form is used for reporting sales and transfers of gasoline products delivered to locations outside of Illinois. It is specifically designed for use in the state of Illinois.

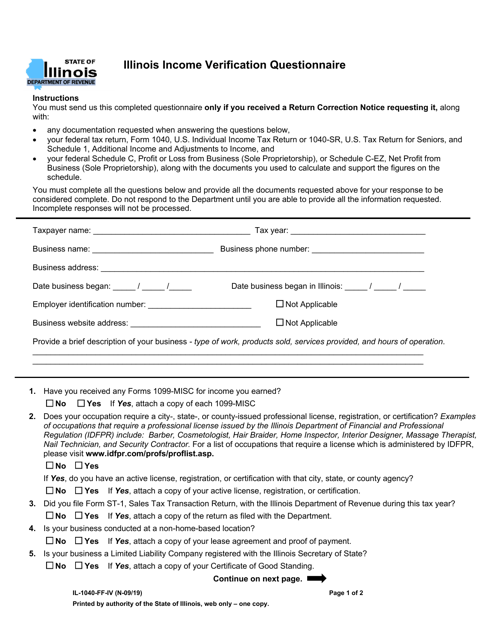

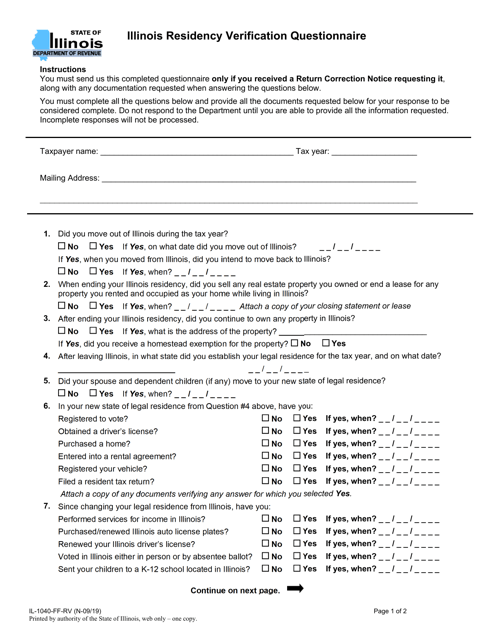

This form is used for Illinois residents to complete an income verification questionnaire for the IL-1040-FF-IV Illinois income tax return.

This form is used for verifying residency status in Illinois. It is specifically designed for individuals who are required to provide proof of residency when filing their Illinois state tax return.

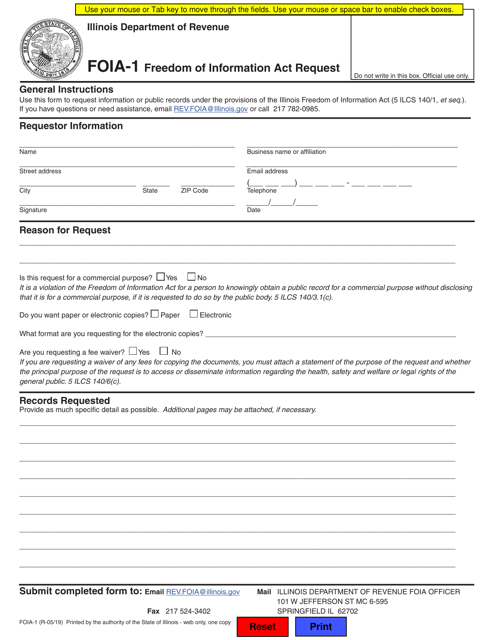

This Form is used for submitting a Freedom of Information Act (FOIA) request to the state of Illinois.