Illinois Department of Revenue Forms

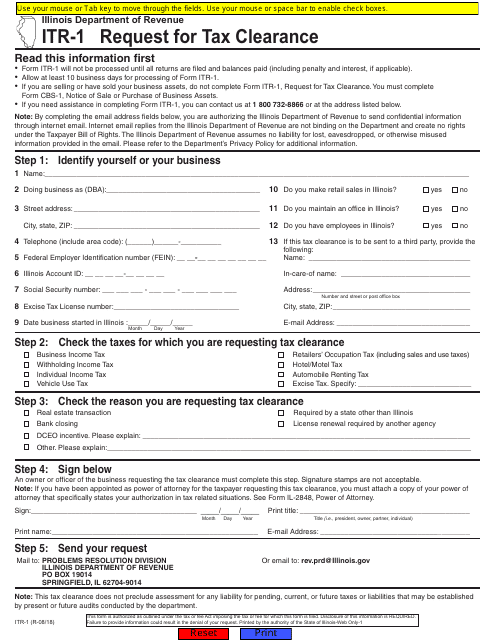

The Illinois Department of Revenue is responsible for administering and enforcing state tax laws and collecting taxes in the state of Illinois. They oversee the collection of income taxes, sales taxes, property taxes, and other forms of taxes. Additionally, they provide information and assistance to taxpayers regarding tax obligations and filing requirements.

Documents:

857

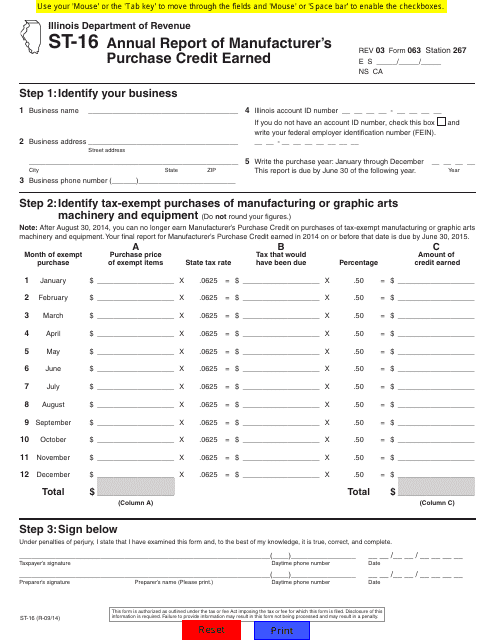

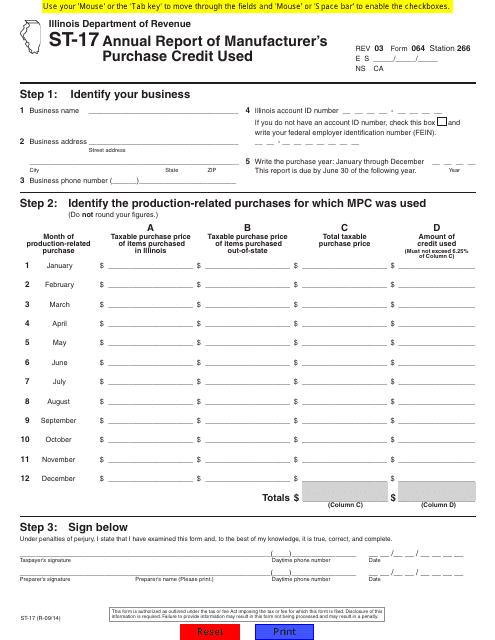

This form is used for reporting the annual purchase credit earned by manufacturers in Illinois.

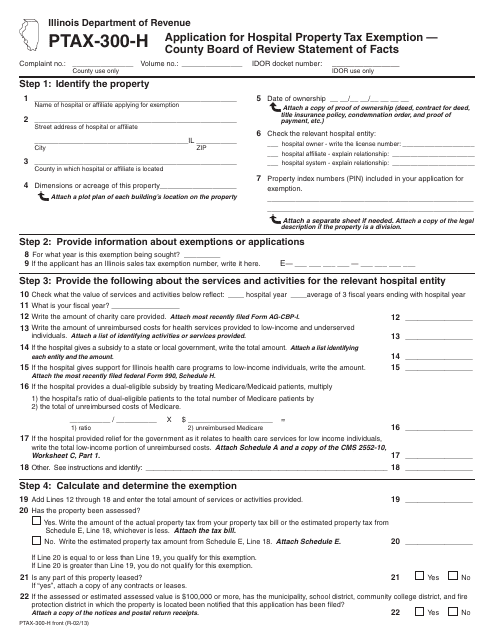

This form is used for applying for hospital property tax exemption in Illinois. It includes a statement of facts that must be submitted to the County Board of Review.

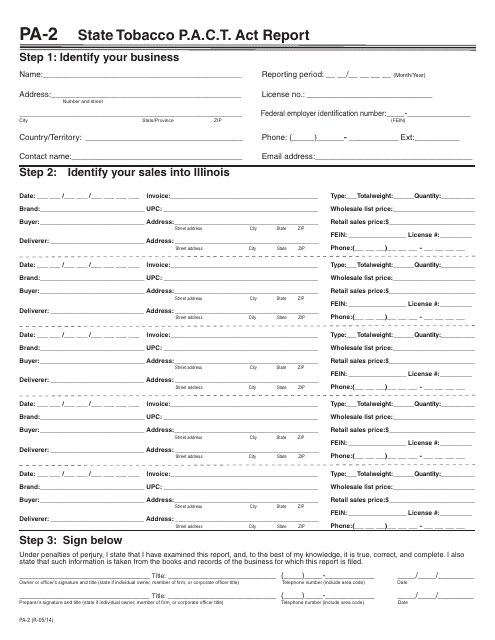

This form is used for submitting a State Tobacco P.A.C.T. Act report in the state of Illinois. It is a requirement for businesses involved in the sale of tobacco products to report their sales and shipments to comply with the P.A.C.T. Act.

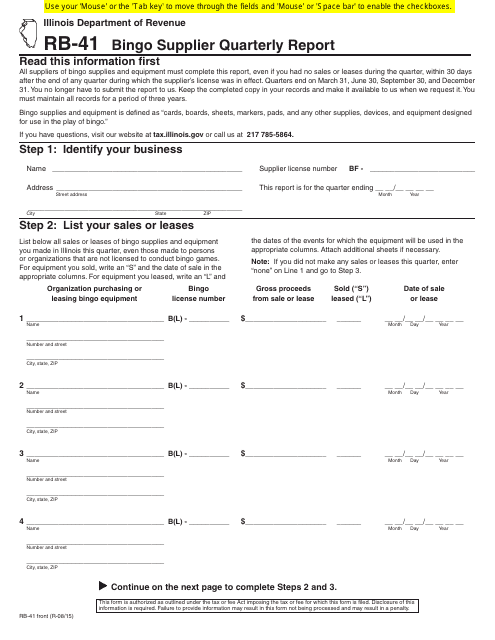

This form is used for reporting quarterly information by bingo suppliers in Illinois. It provides data on bingo activities and supplier operations for regulatory purposes.

This form is used for reporting the utilization of the Manufacturer's Purchase Credit in the state of Illinois on an annual basis.

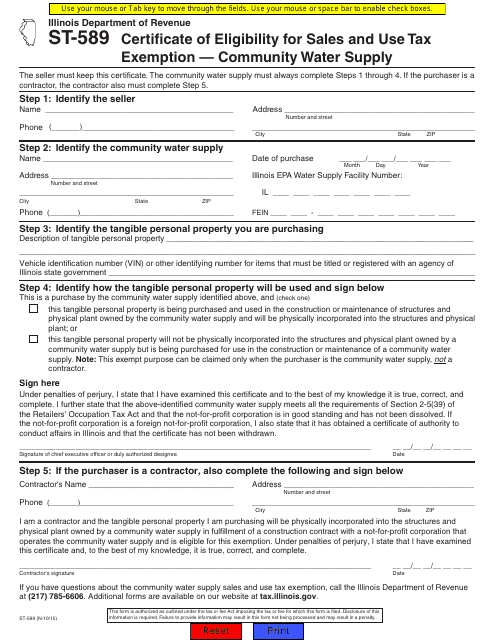

This form is used for applying for a certificate of eligibility for sales and use tax exemption for a community water supply in the state of Illinois.

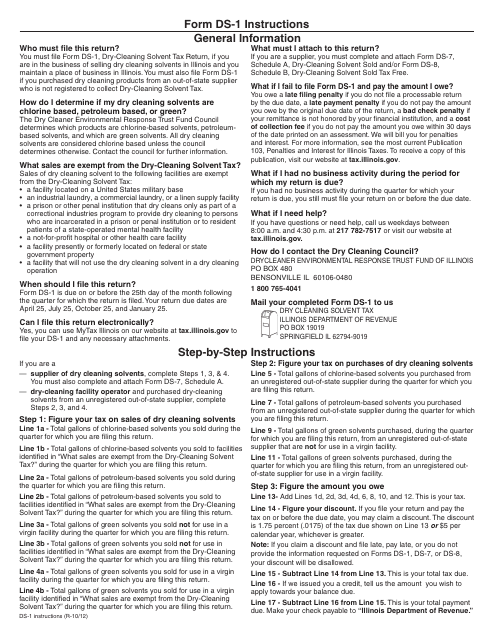

This Form is used for filing the Dry-Cleaning Solvent Tax Return in the state of Illinois. It provides instructions on how to report and pay the taxes on dry-cleaning solvents.

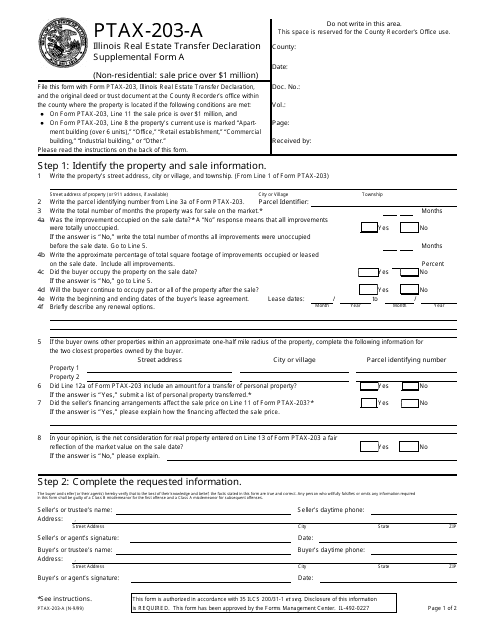

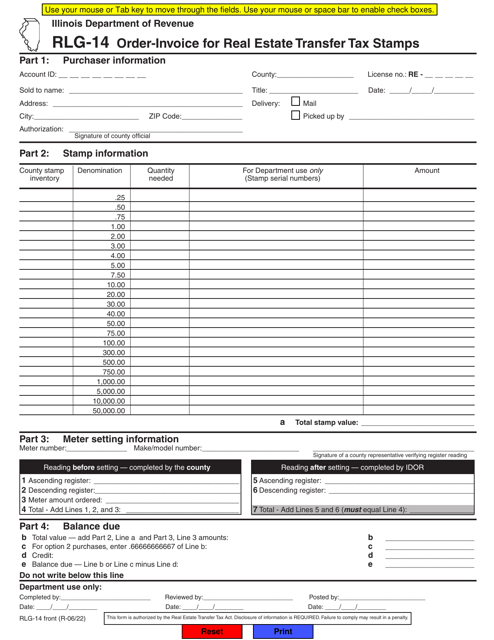

This Form is used for providing additional information for the Real Estate Transfer Declaration in Illinois.

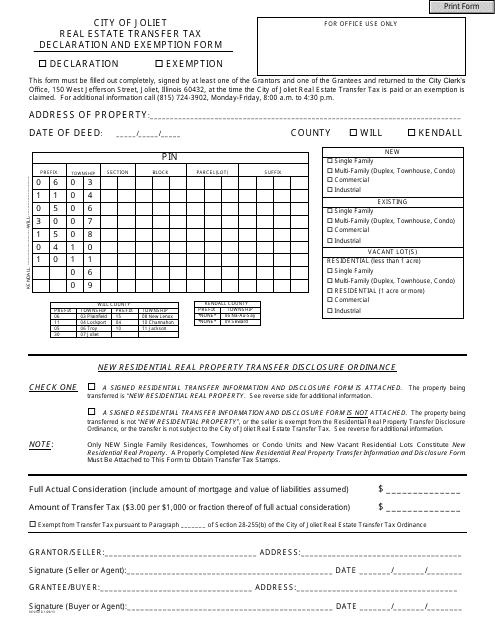

This document is used for declaring and seeking exemptions from real estate transfer taxes in the City of Joliet, Illinois.

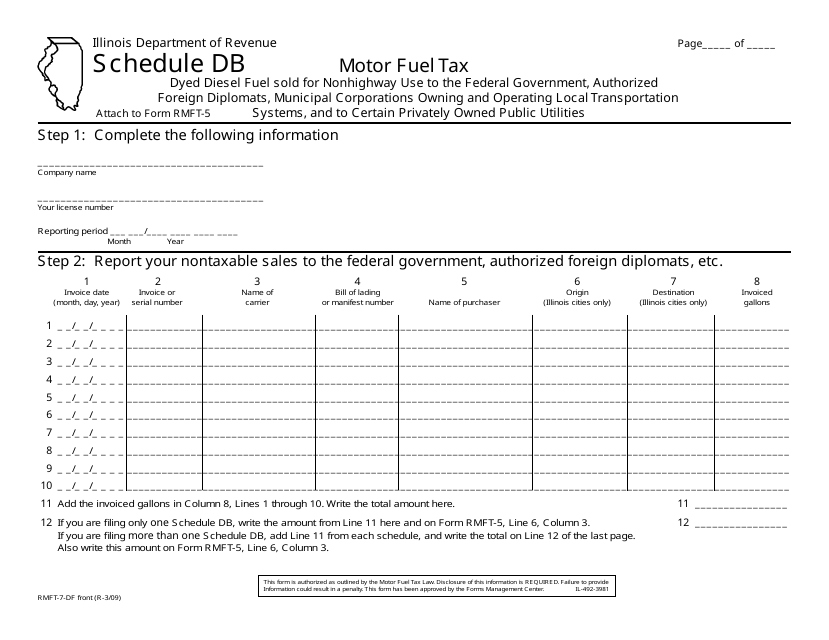

This form is used for reporting sales of dyed diesel fuel for nonhighway use to specific entities in Illinois, including the federal government, authorized foreign diplomats, municipal corporations operating local transportation systems, and certain privately owned public utilities.

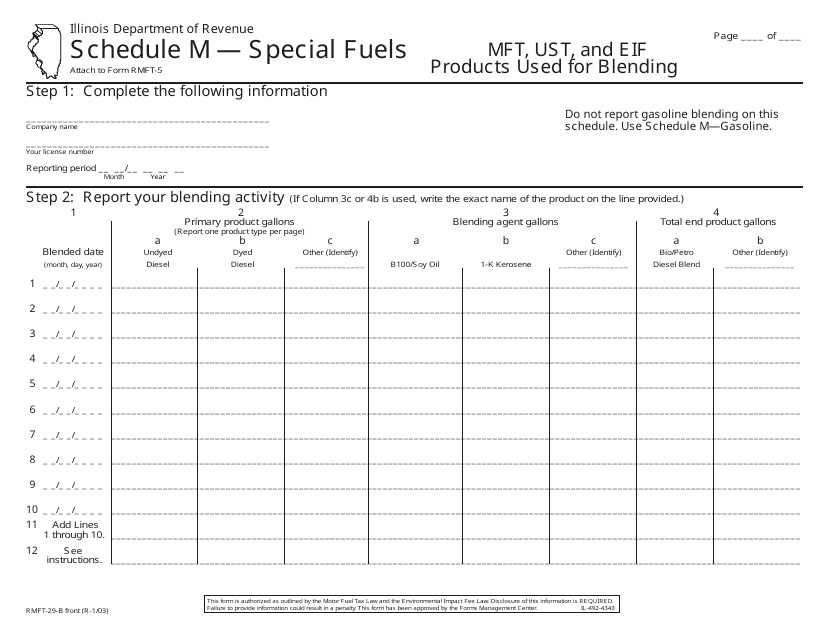

This Form is used for reporting special fuel usage in the state of Illinois.

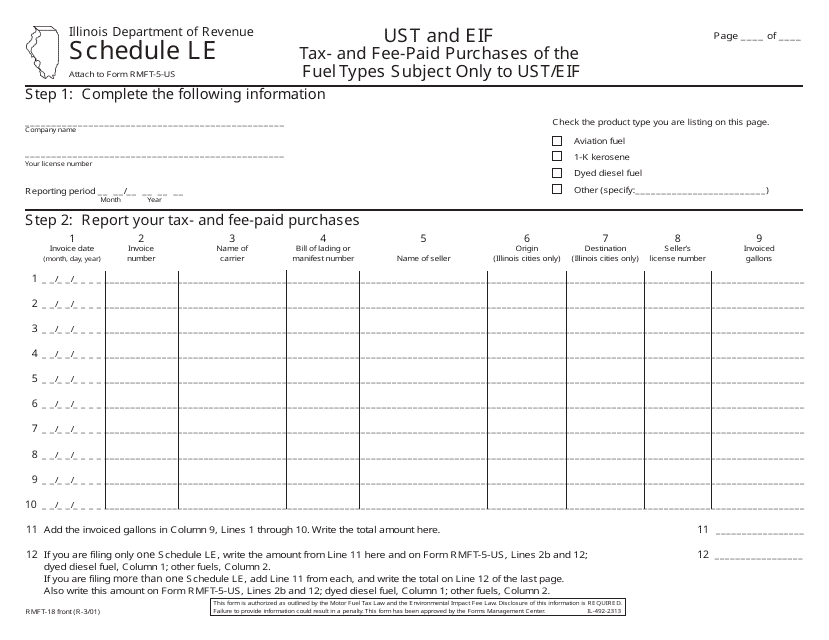

This Form is used for reporting tax and fee-paid purchases of fuel types subject to UST/EIF in Illinois.

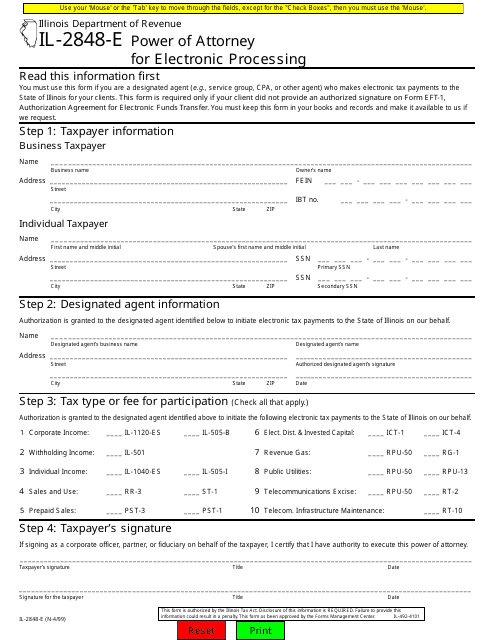

This document is used for granting power of attorney specifically for electronic processing in the state of Illinois.

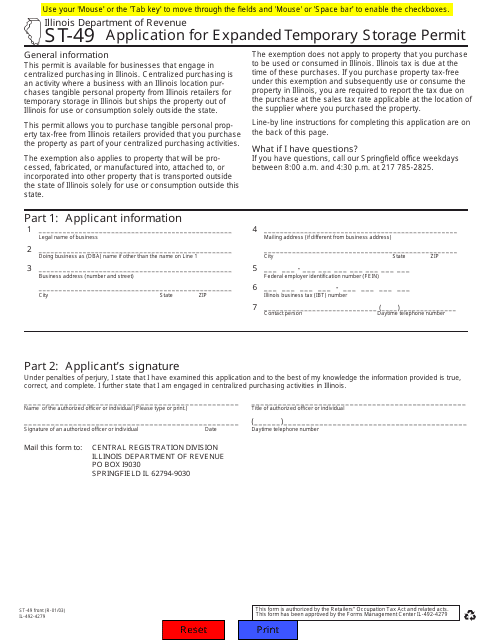

This form is used for applying for an Expanded Temporary Storage Permit in Illinois.

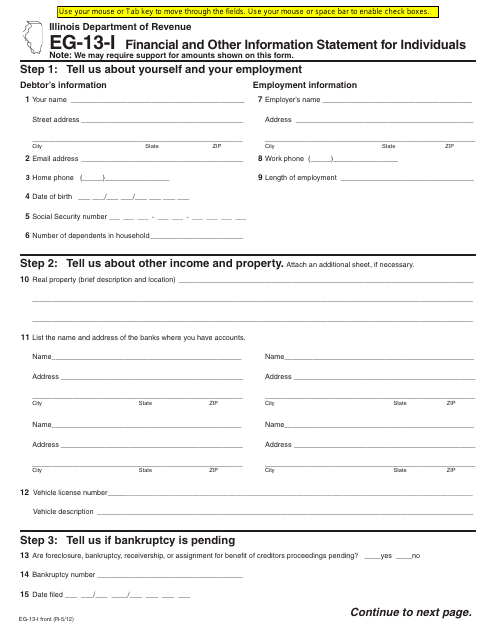

This form is used for providing financial and other information for individual residents of Illinois. It is used to gather details about the person's financial situation and other relevant information.

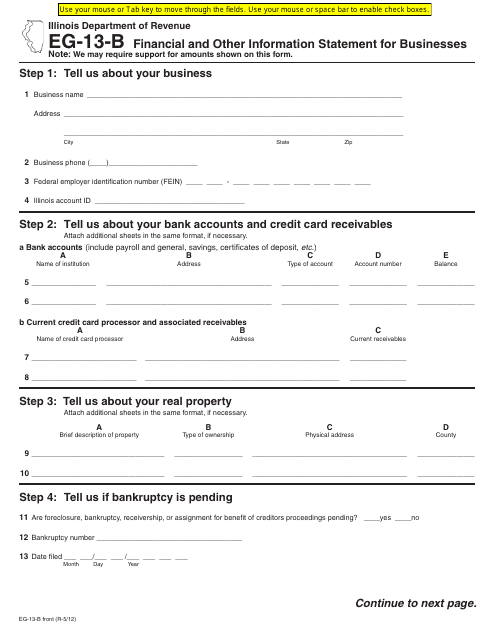

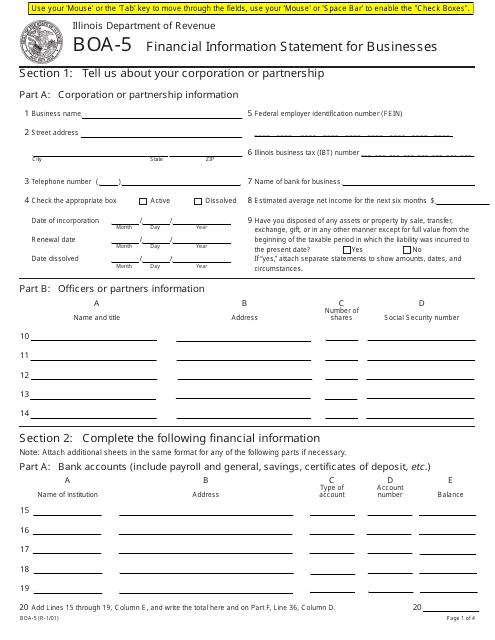

This form is used for businesses in Illinois to provide financial and other information.

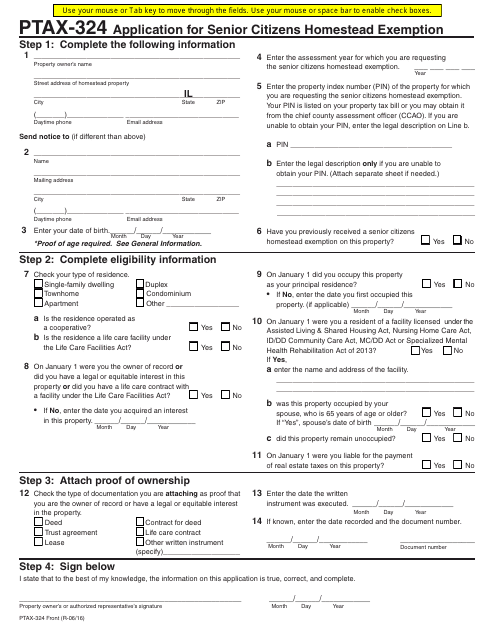

This form is used for applying for the Senior Citizens Homestead Exemption in Illinois.

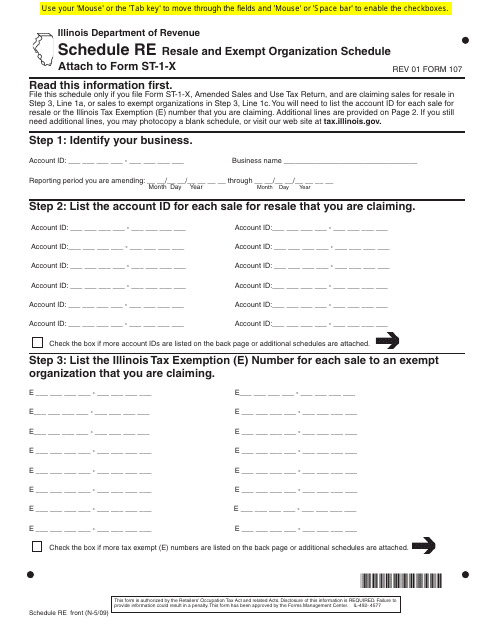

This form is used for reporting the resale and exempt organization schedule for businesses in Illinois. It is necessary for businesses to accurately report their sales and exemptions for tax purposes.

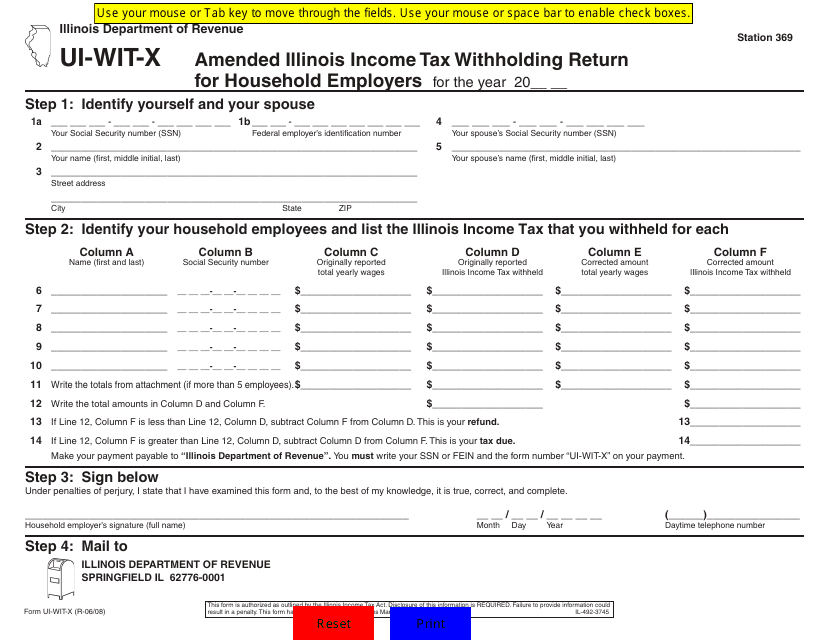

This form is used for Illinois household employers to amend their income tax withholding return for household employees.

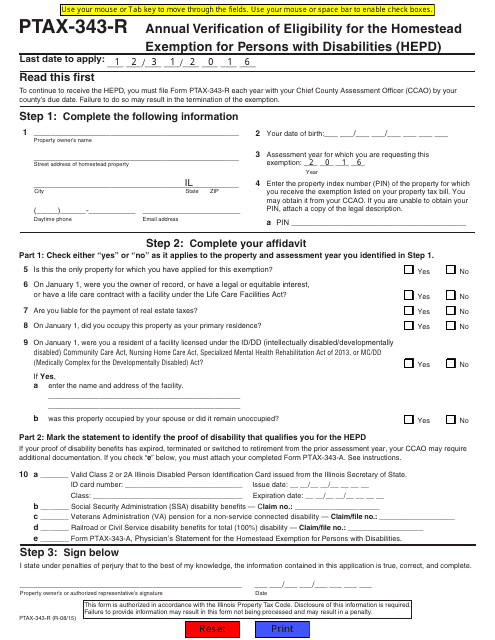

This form is used for annual verification of eligibility for the Homestead Exemption for Persons with Disabilities (HEPD) in Illinois.

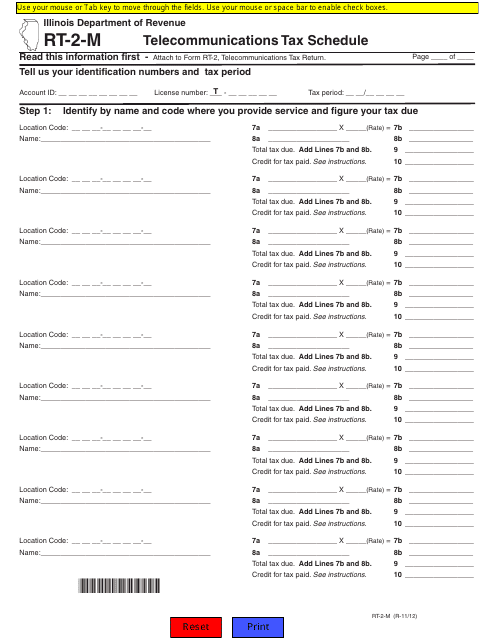

This form is used for reporting telecommunications taxes in the state of Illinois.

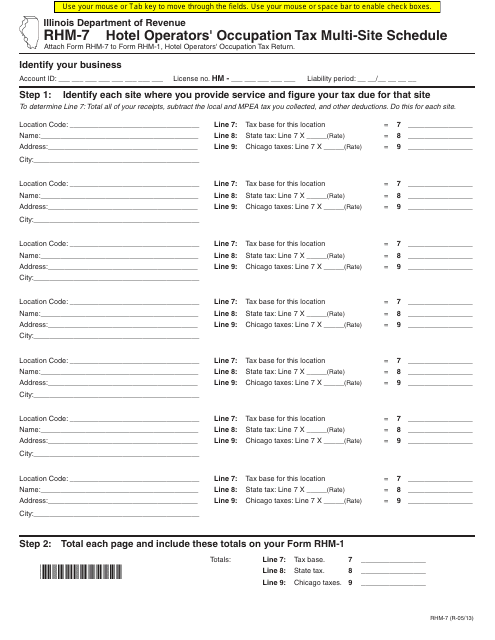

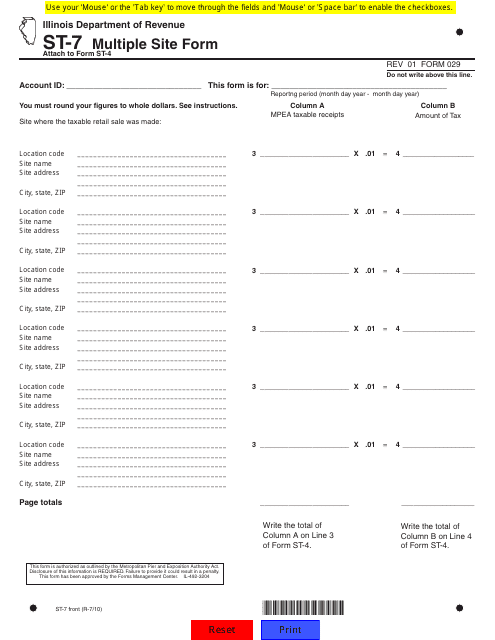

This form is used for reporting hotel operators' occupation tax for multiple hotel locations in Illinois.

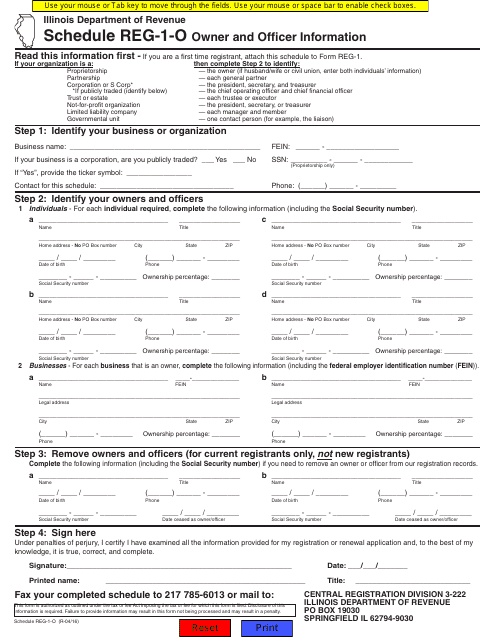

This document is used to provide information about the owners and officers of a business in the state of Illinois. It is used for tax purposes and helps the state keep track of who is in charge of a company.

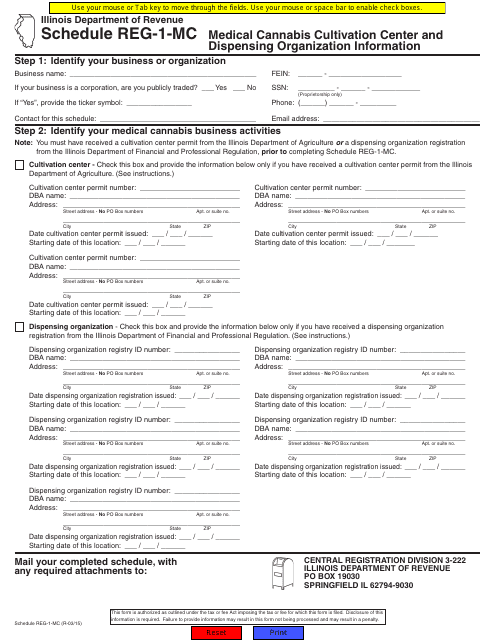

This document is for providing information about medical cannabis cultivation centers and dispensing organizations in Illinois.

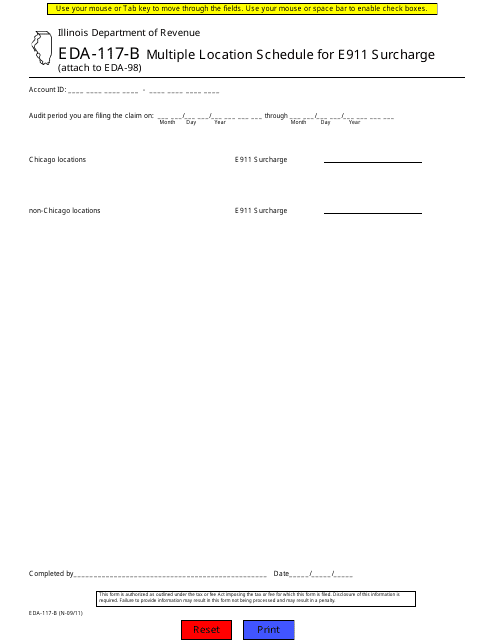

This form is used for reporting multiple locations for E911 surcharge in Illinois.

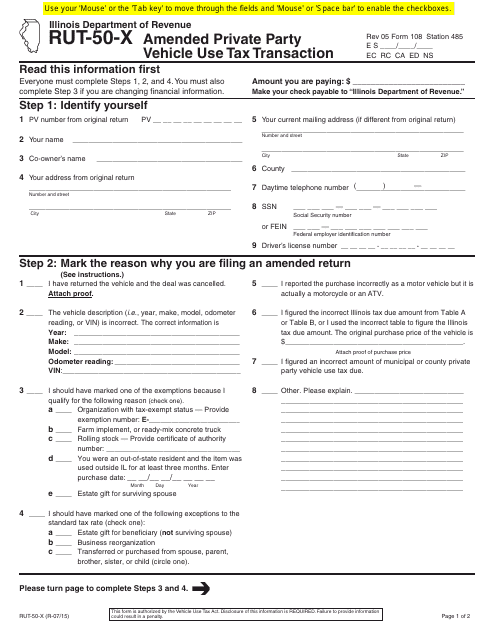

This form is used for reporting an amended private party vehicle use tax transaction in Illinois.

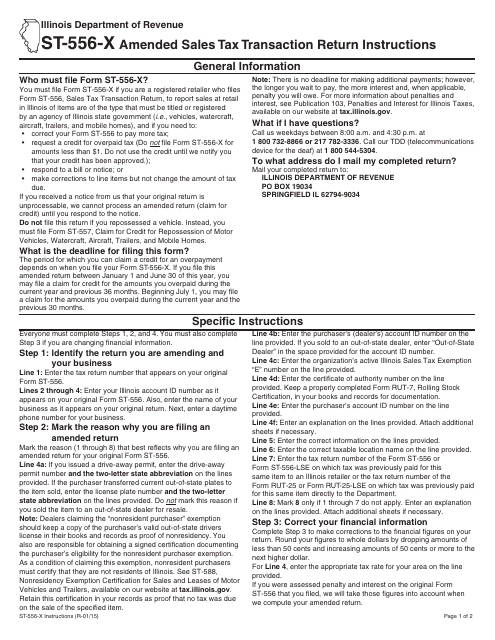

This document is used for filing an amended sales tax transaction return in the state of Illinois. It provides instructions on how to correct any errors or omissions on the original return.

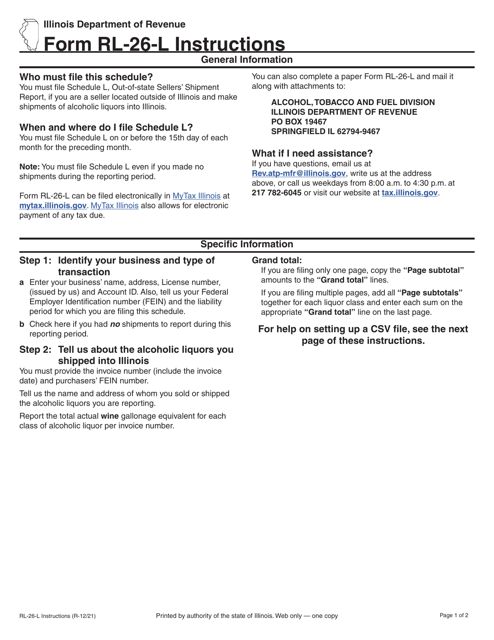

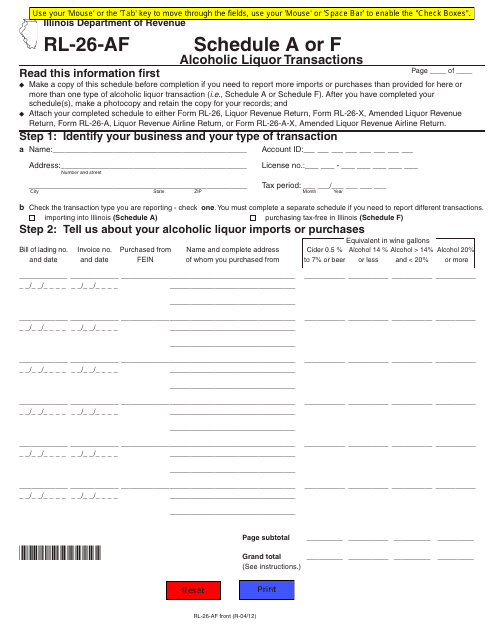

This form is used for reporting alcoholic liquor transactions in Illinois.

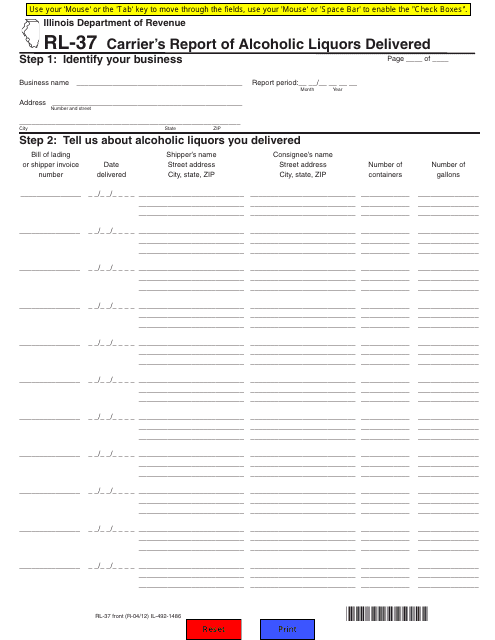

This form is used for Illinois carriers to report the delivery of alcoholic liquors. It is a required document for compliance purposes.

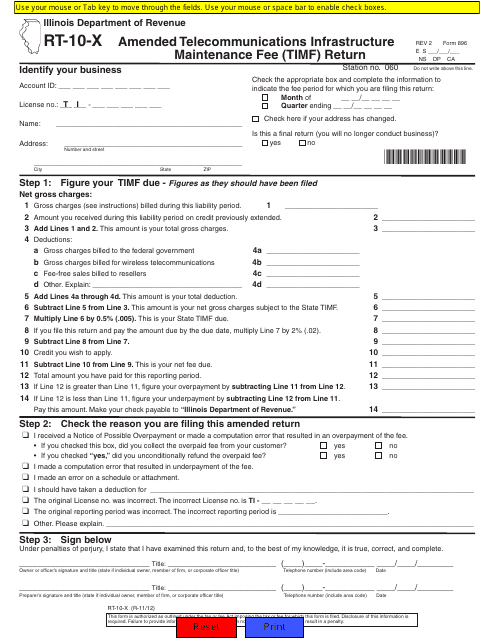

This Form is used for filing an amended return for the Telecommunications Infrastructure Maintenance Fee (TIMF) in Illinois. It is designated as Form RT-10-X (896).

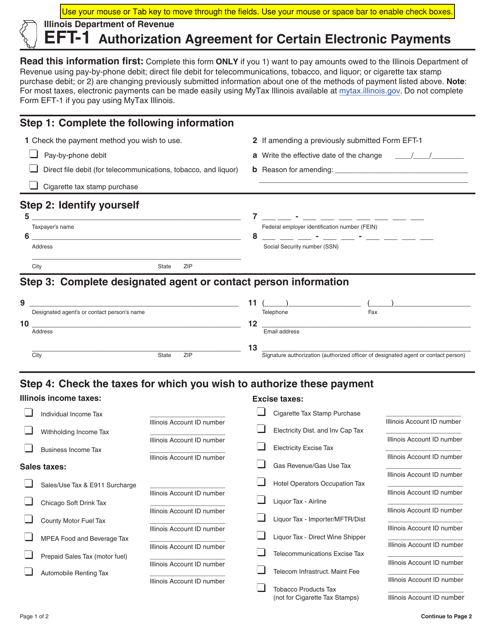

This form is used for providing financial information for businesses in Illinois.

This form is used for reporting multiple sites in the state of Illinois. It helps businesses accurately report their sales and use tax liabilities for different locations within the state.

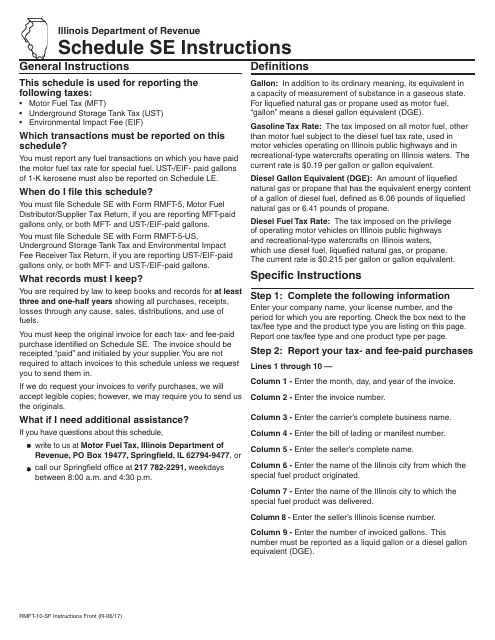

This document provides instructions for Form RMFT-10-SF Schedule SE. It pertains to tax and fee-paid purchases of undyed fuels at the diesel fuel tax rate in Illinois.

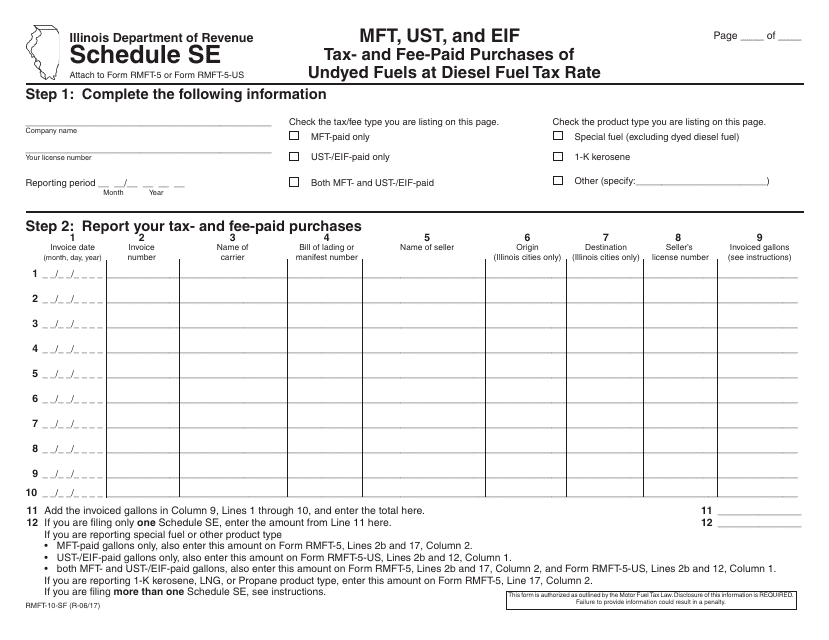

This form is used for reporting tax- and fee-paid purchases of undyed fuels at the diesel fuel tax rate in Illinois.