Hawaii Department of Taxation Forms

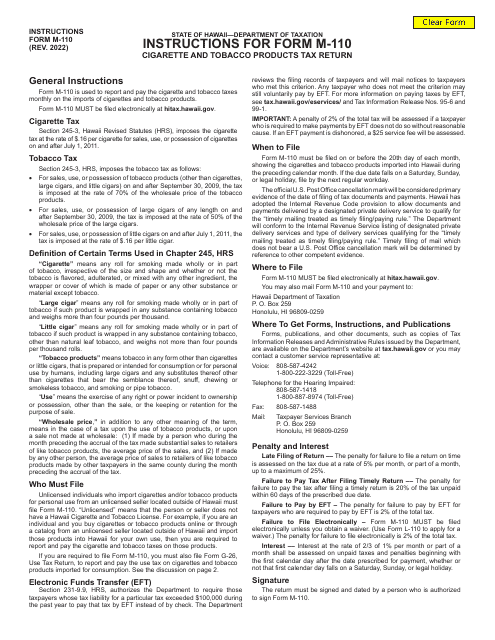

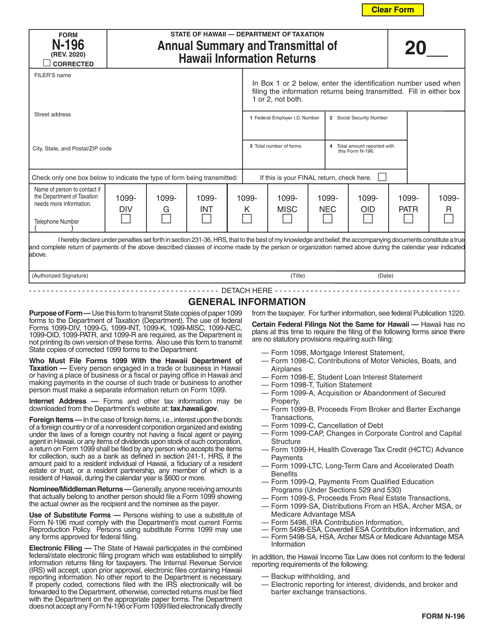

The Hawaii Department of Taxation is responsible for administering and enforcing tax laws in the state of Hawaii. Their main role is to collect taxes, provide taxpayer assistance, and ensure compliance with tax laws. They manage various types of taxes, including income tax, general excise tax, property tax, and transient accommodations tax. Additionally, they provide guidance and resources to help individuals and businesses understand their tax obligations and file their tax returns accurately.

Documents:

824

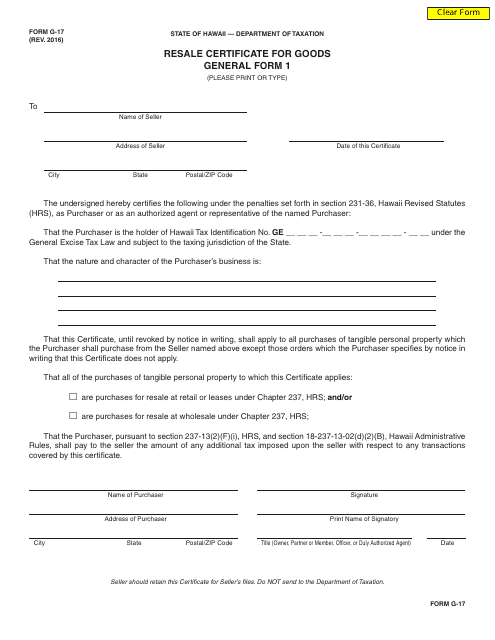

This form is used for applying for a resale certificate for goods in the state of Hawaii. It allows businesses to purchase goods for resale without paying sales tax.

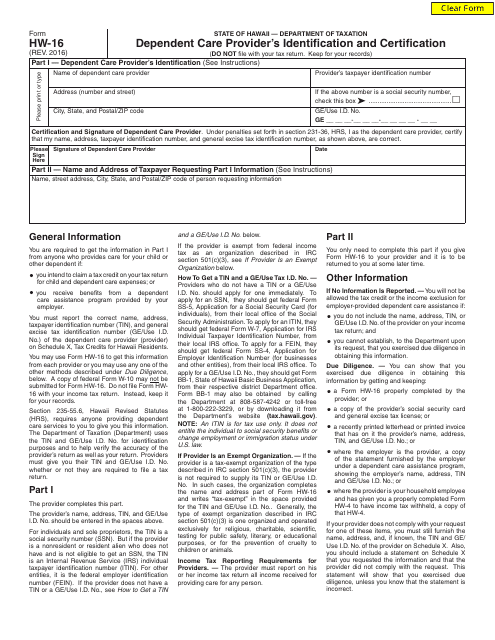

This Form is used for identifying and certifying a dependent care provider in Hawaii.

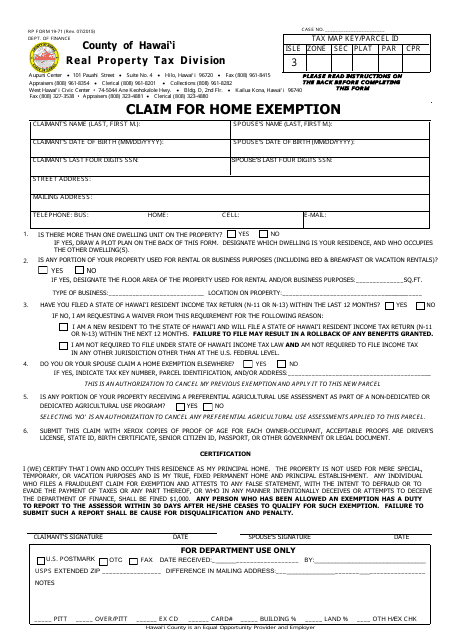

This form is used for claiming a home exemption in the County of Hawai'i, Hawaii. It allows residents to apply for a tax exemption on their primary residence.

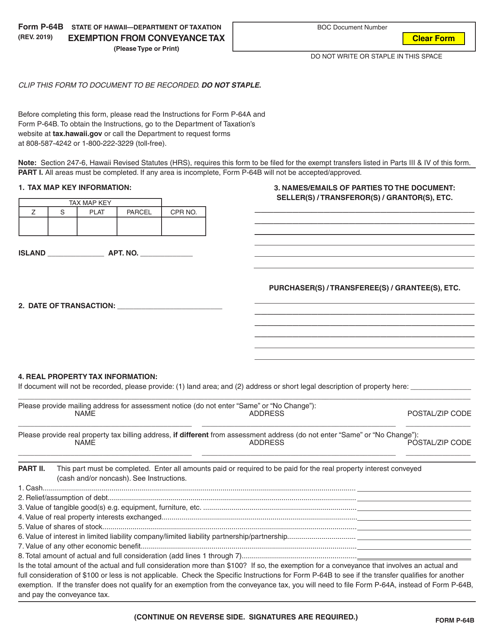

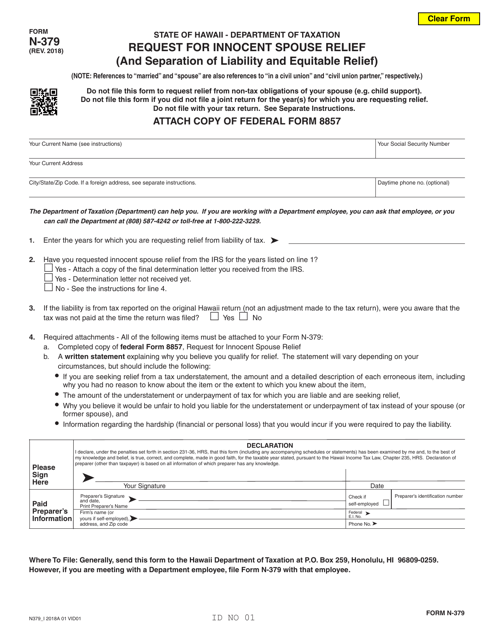

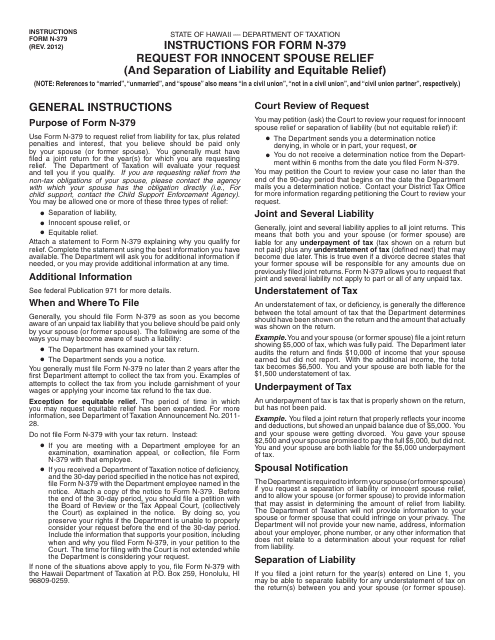

This Form is used for requesting innocent spouse relief in the state of Hawaii. It provides instructions on how to apply for relief from joint tax liability when a spouse or former spouse believes they should not be held responsible for the other spouse's tax obligations.

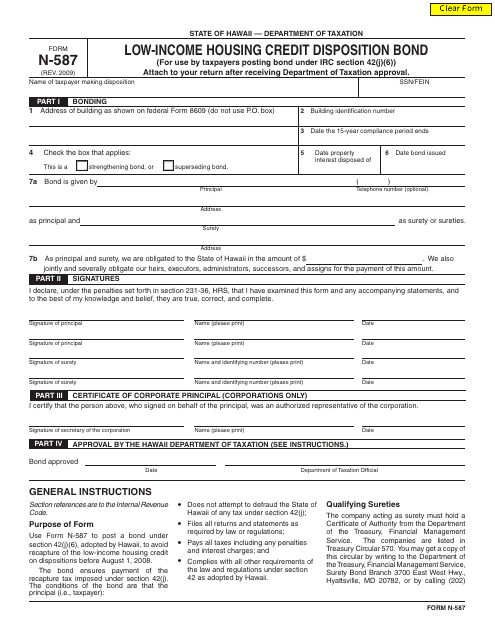

This Form is used for low-income housing credit disposition bond in Hawaii. It helps individuals and organizations in Hawaii to claim tax credits for Low-Income Housing projects.

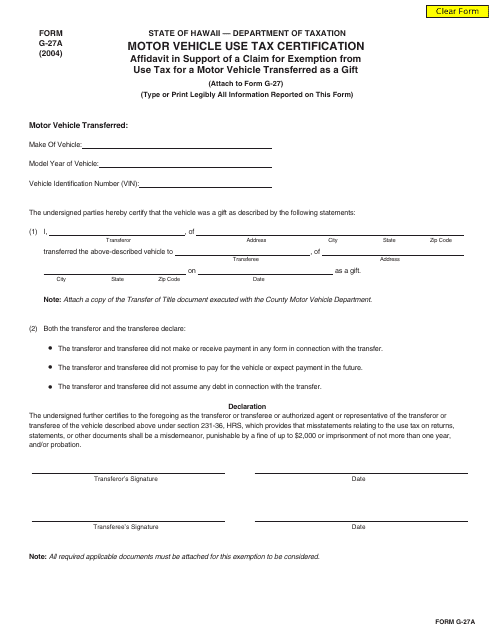

This document is used for claiming an exemption from motor vehicle use tax in Hawaii when transferring a vehicle as a gift.

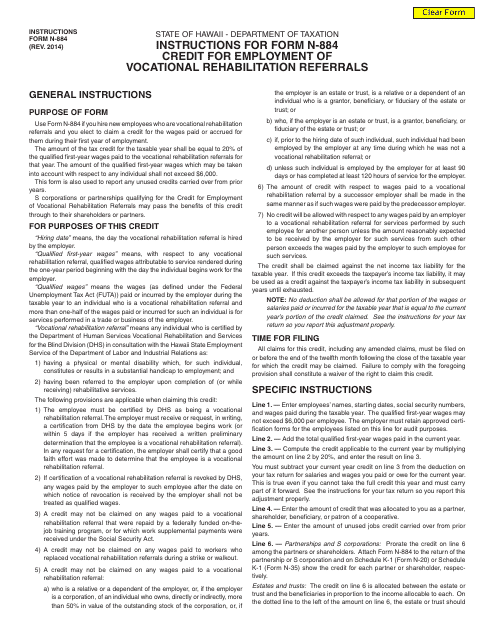

This Form is used to claim the credit for employing vocational rehabilitation referrals in Hawaii. It provides instructions on how to properly fill out and submit Form N-884.

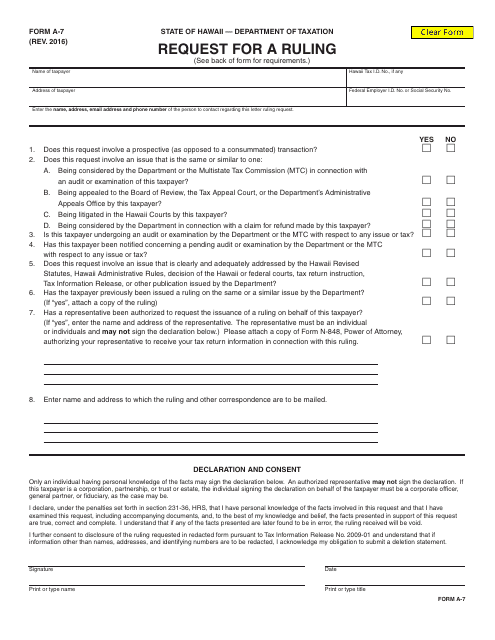

This form is used for requesting a ruling in the state of Hawaii.

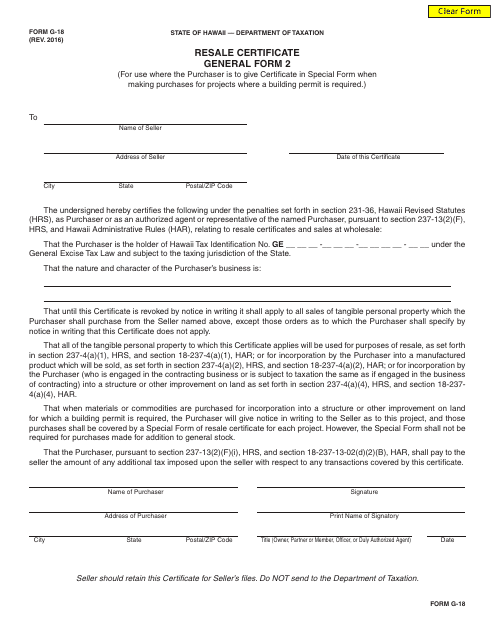

This form is used for applying for a resale certificate in Hawaii. It is a general form that allows businesses to make tax-exempt purchases for resale purposes.