Georgia Department of Revenue Forms

The Georgia Department of Revenue is responsible for administering and enforcing tax laws and regulations in the state of Georgia. They oversee the collection of various taxes, such as income tax, sales and use tax, motor fuel tax, property tax, and more. The department also provides taxpayer assistance and education, processes tax returns and refunds, and ensures compliance with state tax laws.

Documents:

120

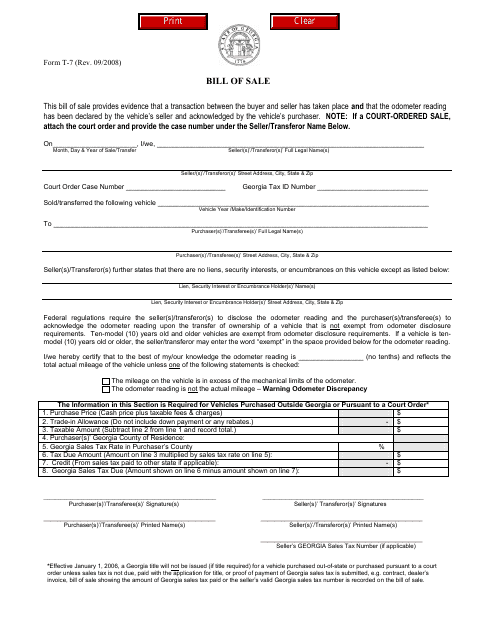

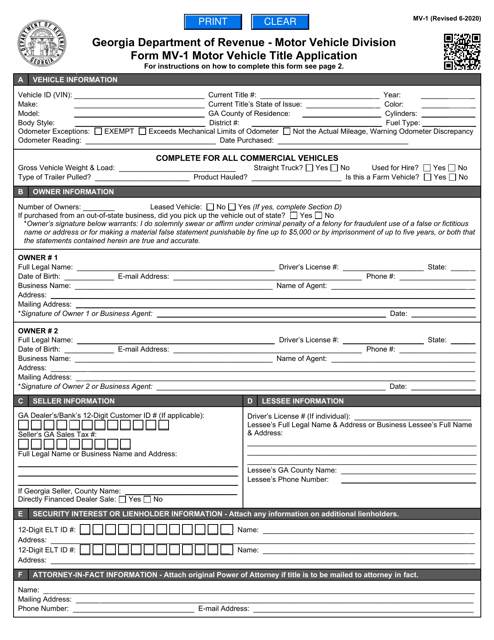

Use this form to document the details of a motor vehicle. These details include the vehicle's odometer mileage, title, and other important information required to sell a vehicle in Georgia. This document can be used as proof of sale, as it is a legal agreement between the buyer and the seller.

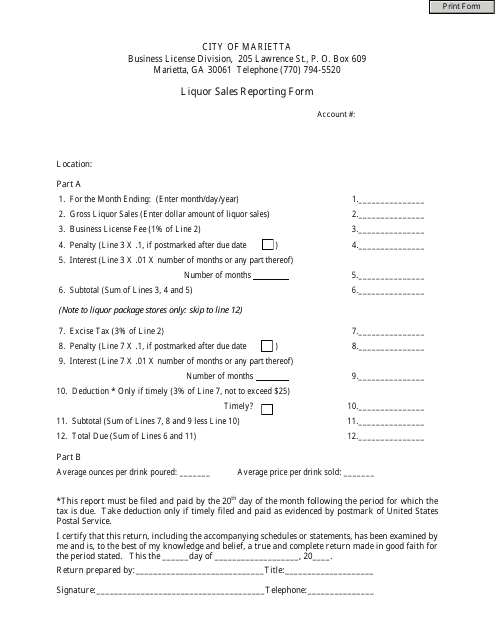

This Form is used for reporting liquor sales in the City of Marietta, Georgia, United States. It is required by the city to track and monitor liquor sales within its jurisdiction.

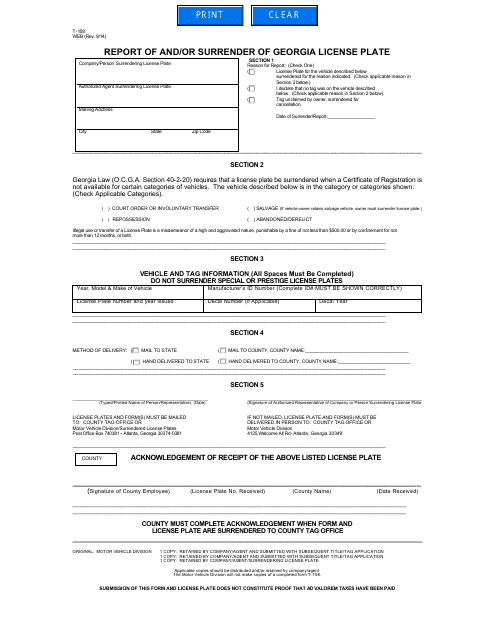

This form is used for reporting the loss or surrendering of a Georgia license plate in the state of Georgia, United States.

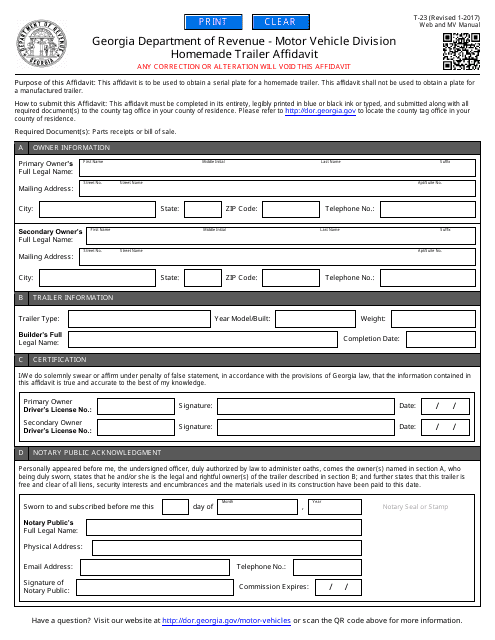

This form is used for declaring that a homemade trailer meets the necessary requirements for registration in the state of Georgia.

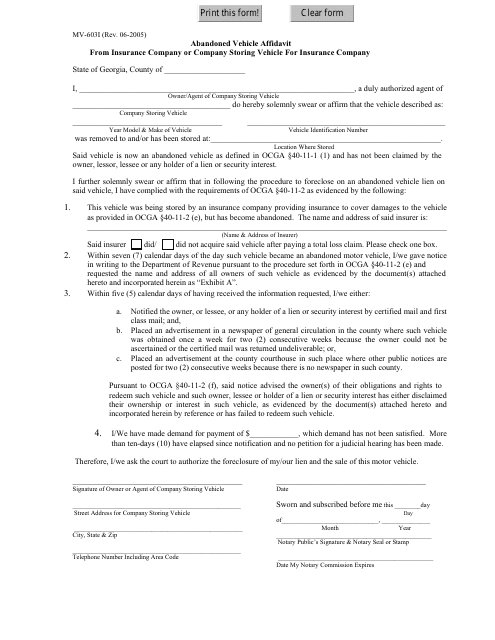

This form is used for insurance companies or companies storing vehicles for insurance companies in Georgia to file an abandoned vehicle affidavit.

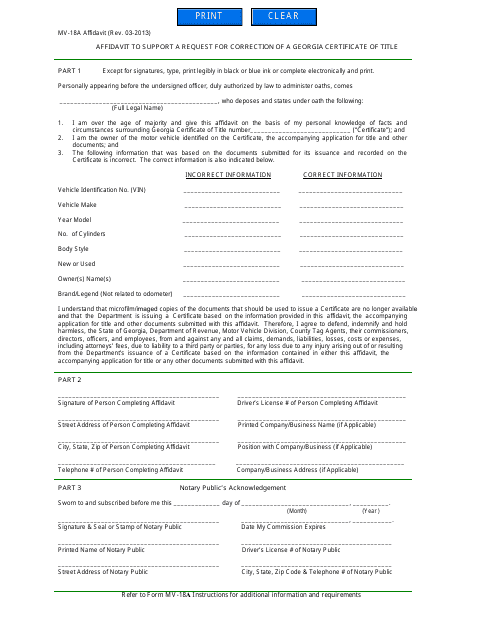

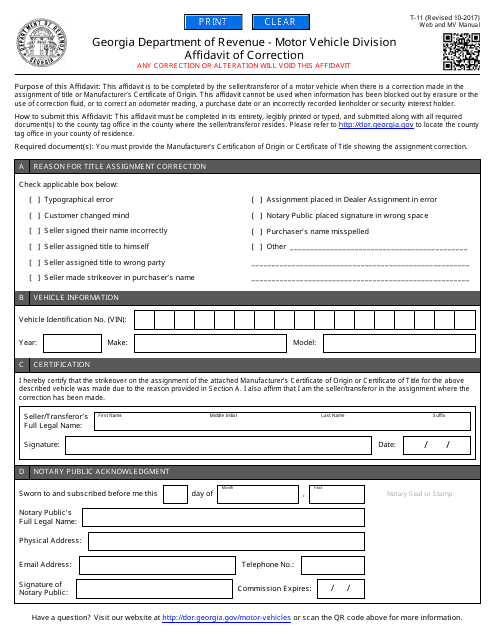

This document is used for submitting an affidavit to support a request for correction of a Georgia Certificate of Title in Georgia.

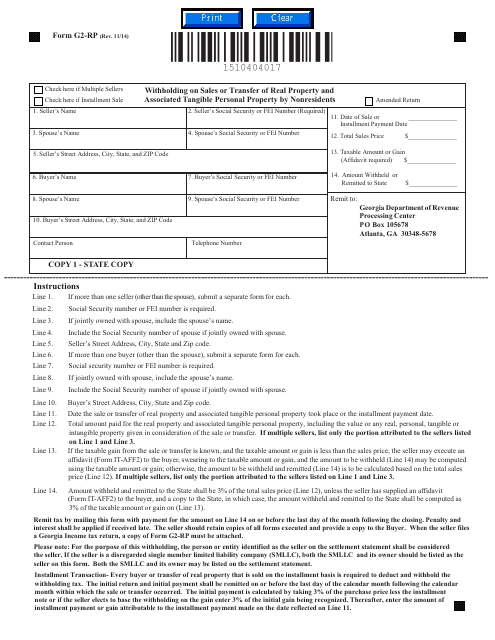

This form is used for reporting and withholding taxes on the sale or transfer of real property and associated tangible personal property by nonresidents in the state of Georgia, United States.

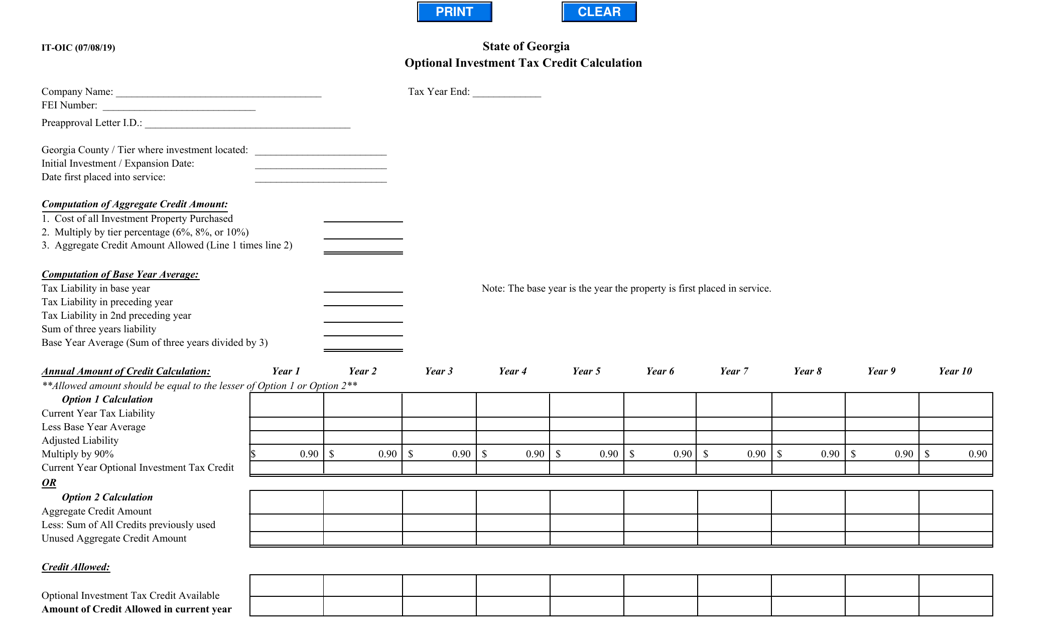

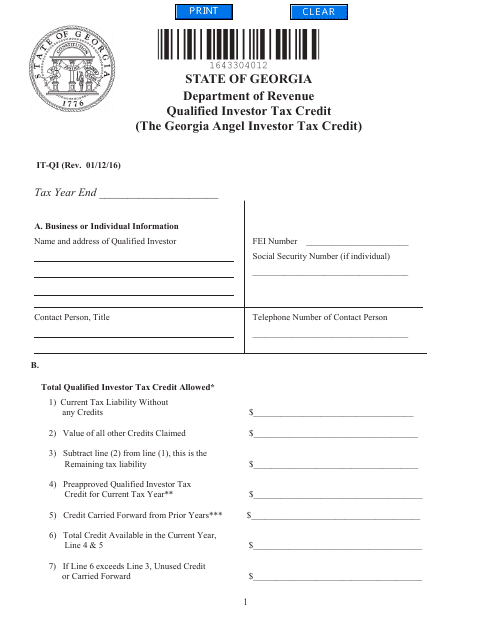

This form is used for claiming the Qualified Investor Tax Credit in the state of Georgia. Residents who meet the qualifying criteria can use this form to claim a tax credit for investing in certain businesses or projects.

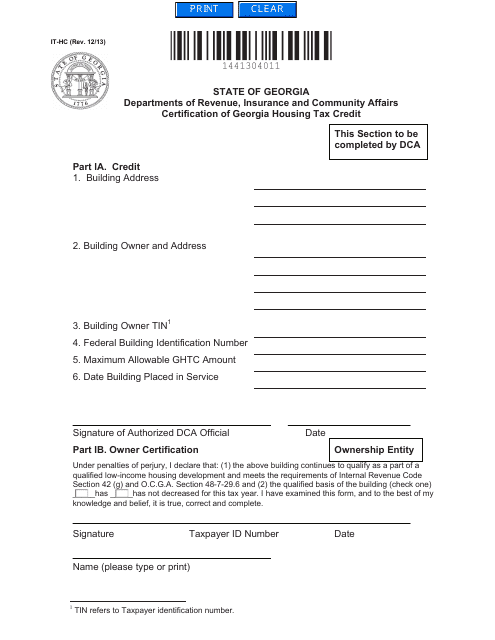

This Form is used for certification of Georgia Housing Tax Credit for properties located in Georgia (United States).

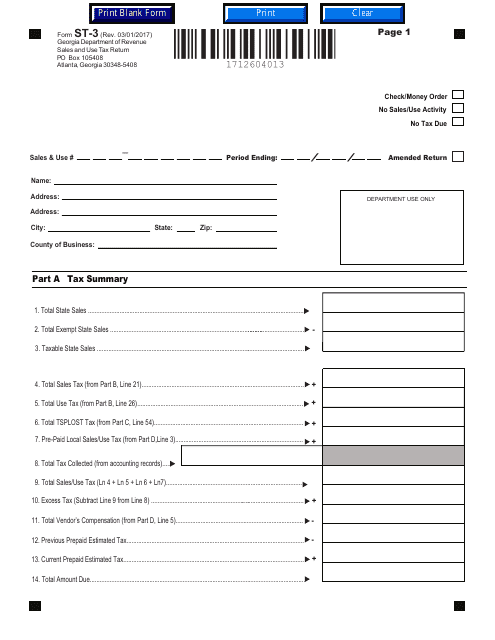

Georgia-registered organizations may use this form to report the sales and use tax they owe in the state of Georgia.

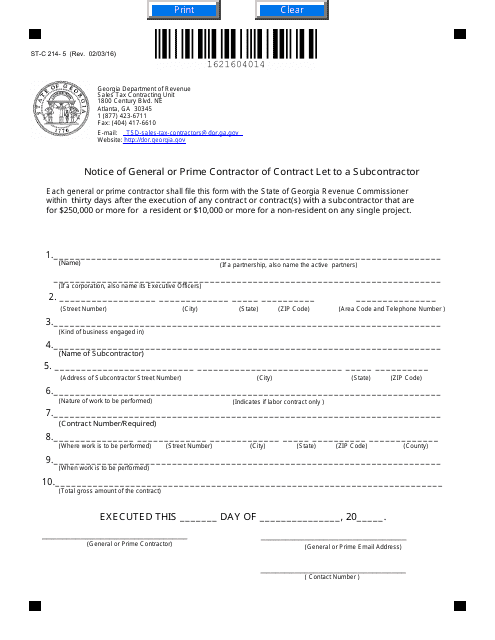

This form is used for notifying the general or prime contractor of a contract that has been awarded to a subcontractor in the state of Georgia.

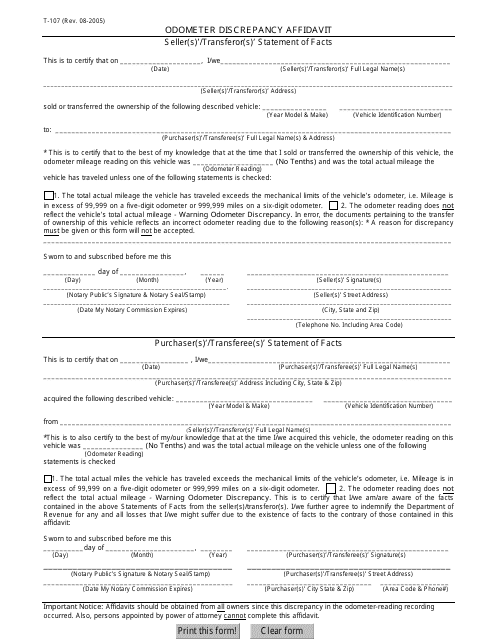

This document is used for sellers or transferors in the state of Georgia to provide a statement of facts regarding an odometer discrepancy. The T-107 Odometer Discrepancy Affidavit helps to resolve any discrepancies in the recorded mileage of a vehicle.

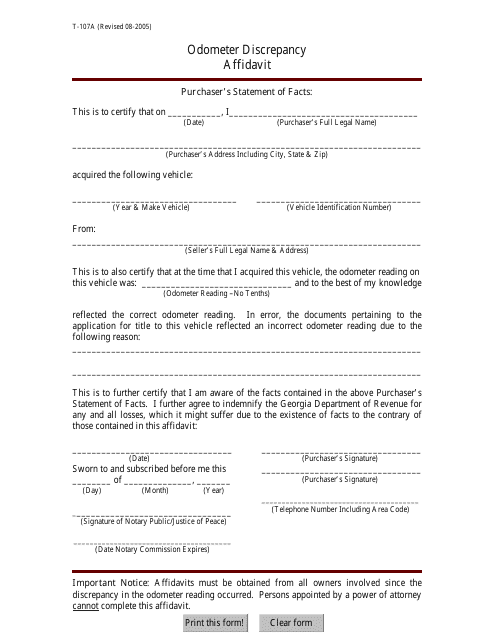

This Form is used for reporting an odometer discrepancy in Georgia. It is an affidavit that provides details about the mileage discrepancy on a vehicle.

This form is used for correcting errors on a title or registration document in the state of Georgia, United States.

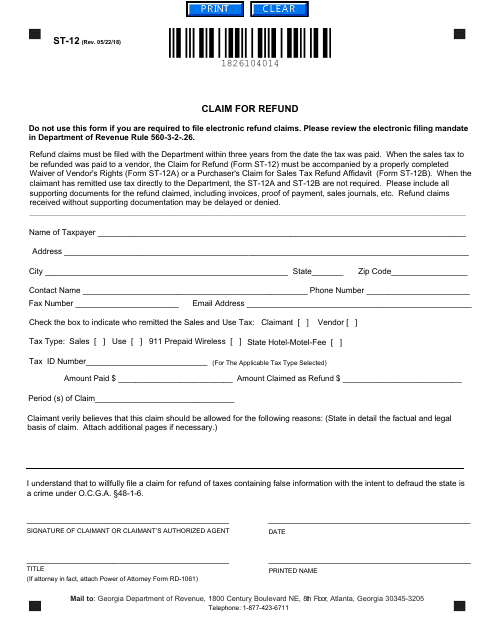

This Form is used for claiming a refund in the state of Georgia, United States.

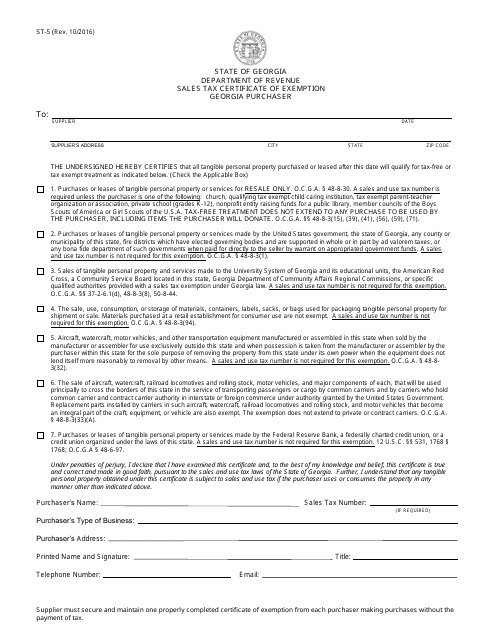

This is a legal document needed to gain tax exemption for the purpose of product resale in the state of Georgia.

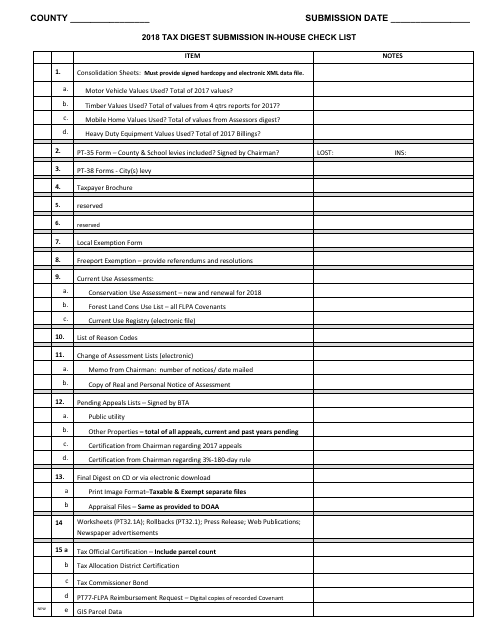

This checklist is used for submitting the tax digest in-house in the state of Georgia, United States. It provides a comprehensive list of items to be reviewed and included when submitting the tax digest.

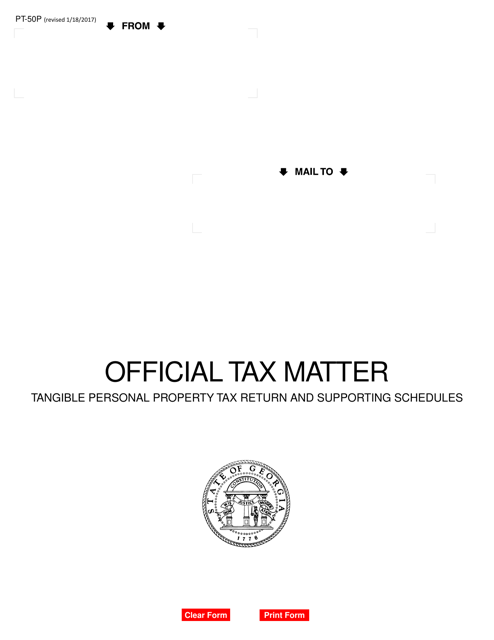

This form is used for reporting tangible personal property for taxation purposes in the state of Georgia, United States.

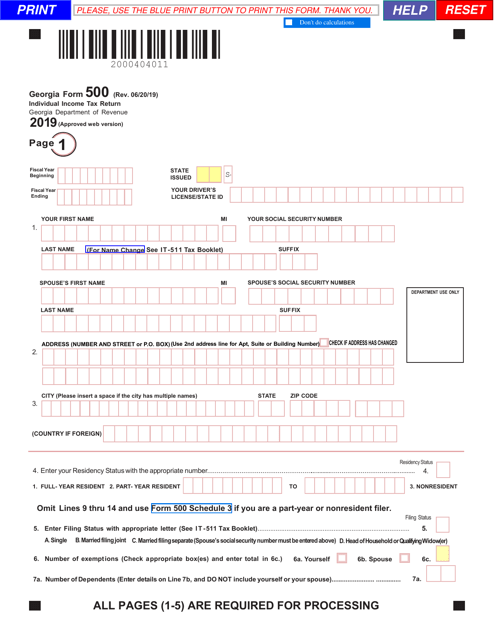

This Form is used for filing individual income tax returns in the state of Georgia.

Georgia vehicle owners may fill in this legal document to apply for a new certificate of title.

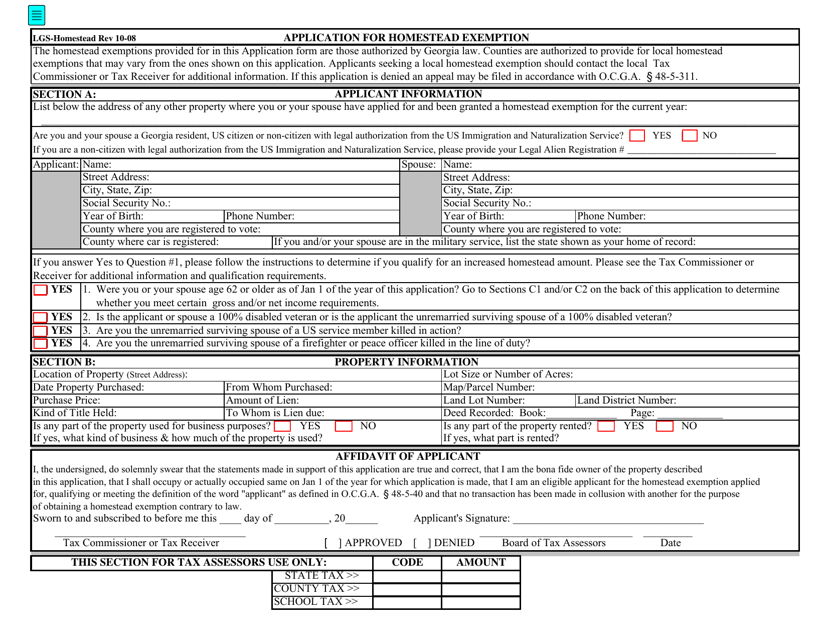

This document is used for applying for a Homestead Exemption in Georgia, United States. It is a form that homeowners can complete to potentially receive tax benefits for their primary residence.

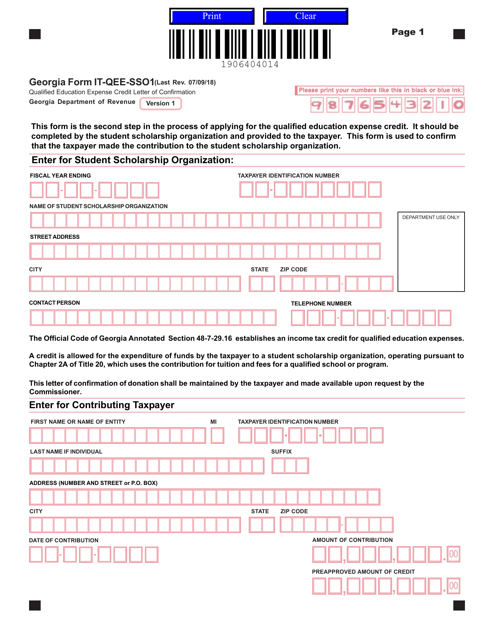

Form IT-QEE-SSO1 Qualified Education Expense Credit Letter of Confirmation - Georgia (United States)

This form is used for confirming qualified education expenses for tax credits in Georgia. It is used to provide proof of expenses incurred for educational purposes.

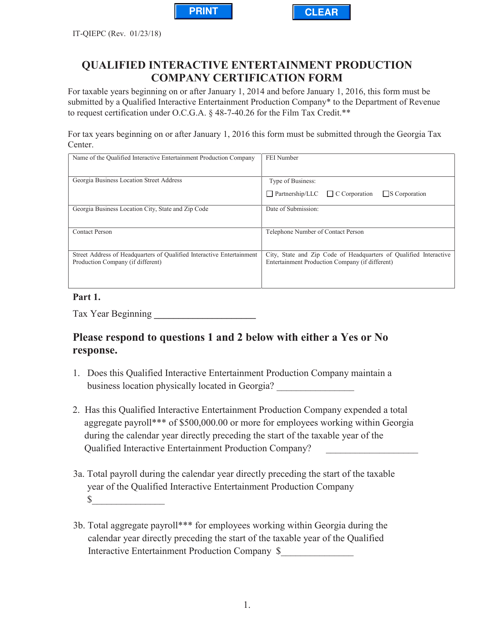

This form is used for obtaining certification as a Qualified Interactive Entertainment Production Company in Georgia, United States. It is required for companies involved in producing interactive entertainment content.

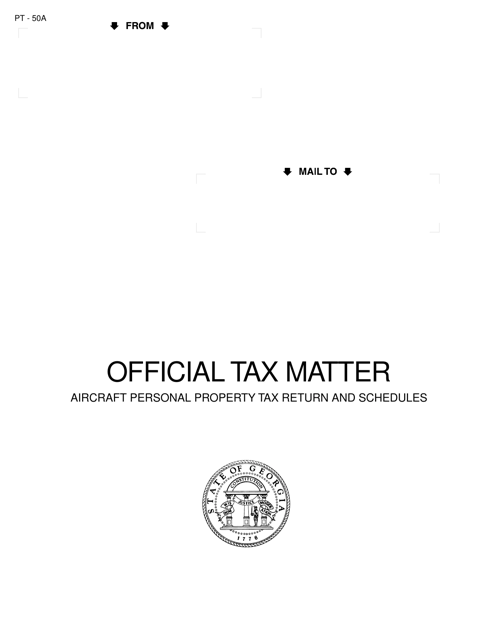

This form is used for reporting and paying taxes on personal property related to aircraft in Georgia. It includes various schedules to provide detailed information about the aircraft and its value.

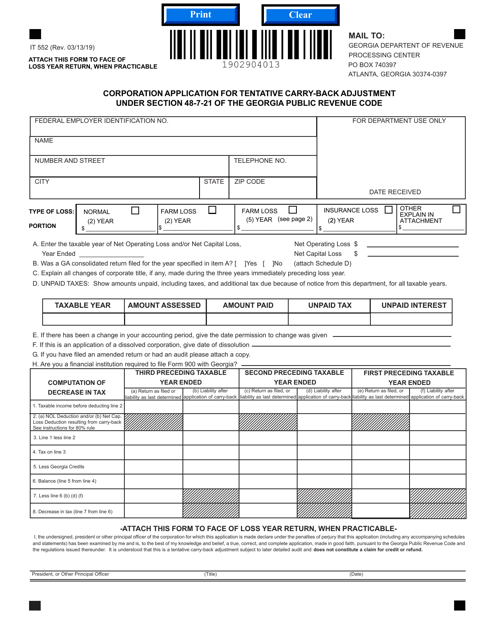

This form is used for corporations to apply for a tentative carry-back adjustment under Section 48-7-2 1 of the Georgia Public Revenue Code in Georgia.

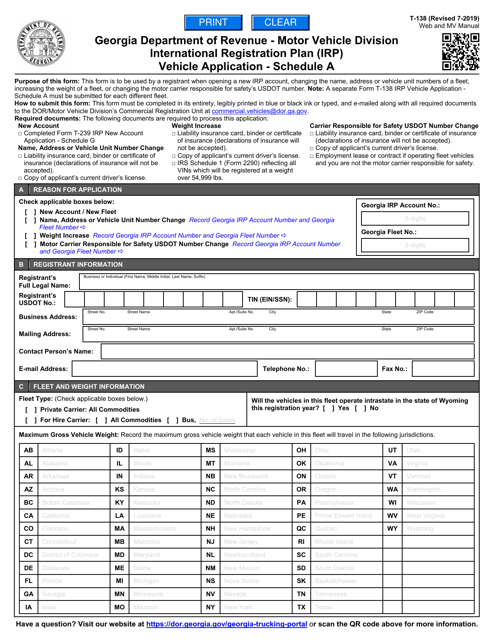

This form is used for registering international vehicles under the International Registration Plan (IRP) in the state of Georgia, United States.

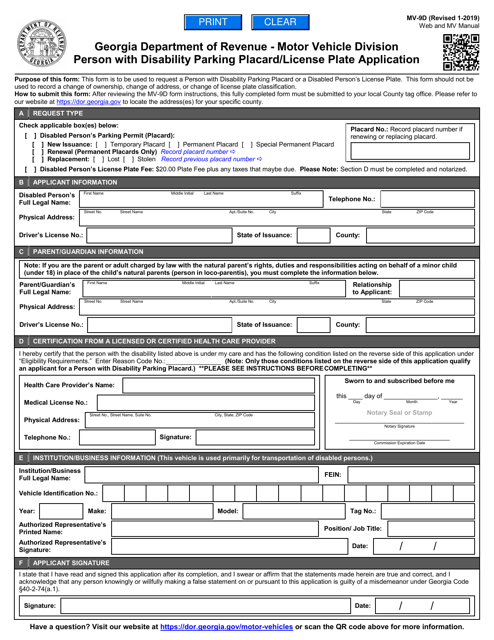

This Form is used for applying for a Person With Disability Parking Placard or License Plate in the state of Georgia, United States.

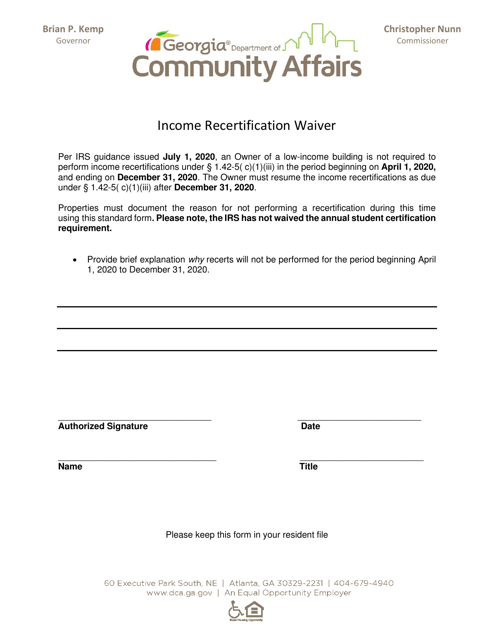

This form is used for waiving the requirement of income recertification in the state of Georgia, United States.

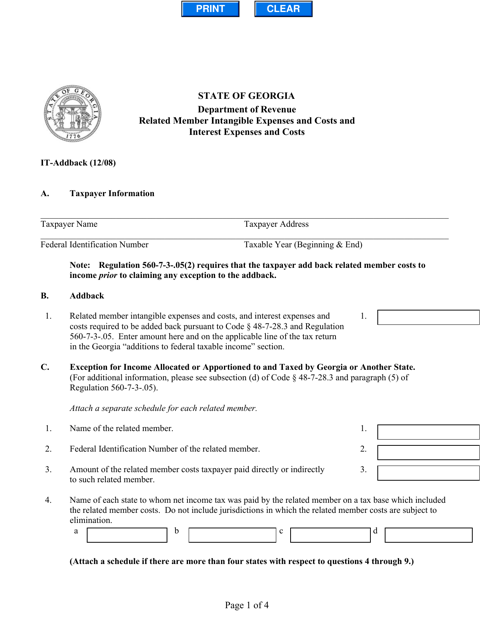

This Form is used for reporting intangible expenses and costs, as well as interest expenses and costs for related members in Georgia.

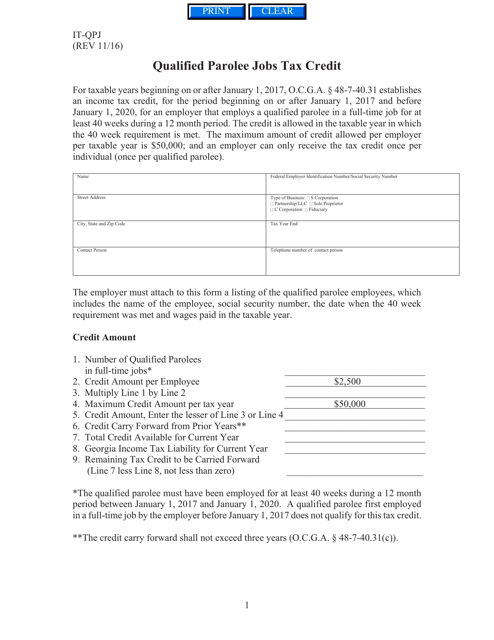

This Form is used for claiming the Qualified Parolee Jobs Tax Credit in Georgia.

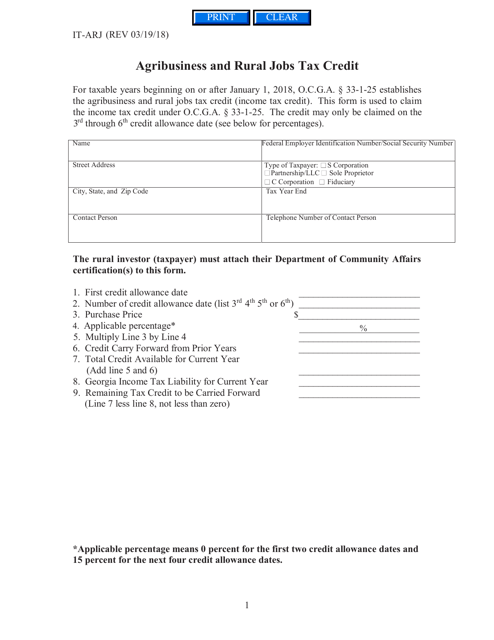

This Form is used for claiming the Agribusiness and Rural Jobs Tax Credit in the state of Georgia, United States.

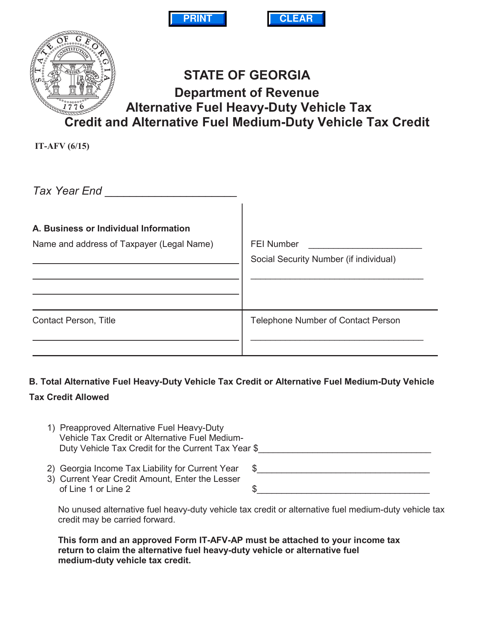

This form is used for claiming tax credits for alternative fuel heavy-duty vehicles and alternative fuel medium-duty vehicles in the state of Georgia.