Florida Department of Revenue Forms

The Florida Department of Revenue is responsible for administering and enforcing the state's tax laws and regulations. Their main purpose is to collect taxes, such as sales tax, corporate income tax, and fuel tax, and ensure compliance with these tax regulations. They also oversee various tax-related programs and assist taxpayers in understanding their tax obligations. Additionally, the department is responsible for administering and enforcing certain non-tax-related programs, such as child support enforcement.

Documents:

473

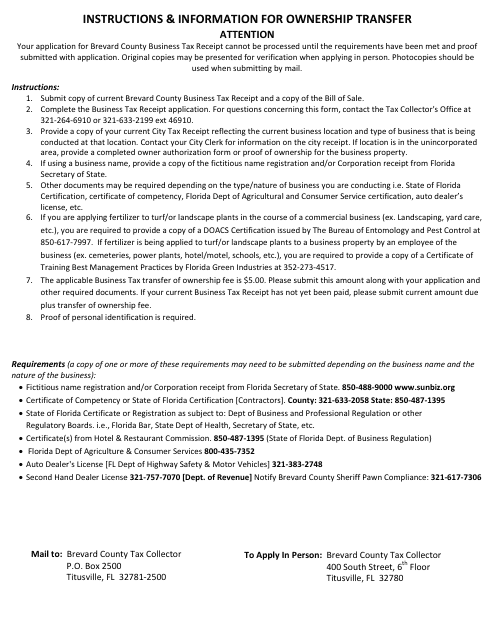

This Form is used for applying for a Business Tax Receipt in Brevard County, Florida.

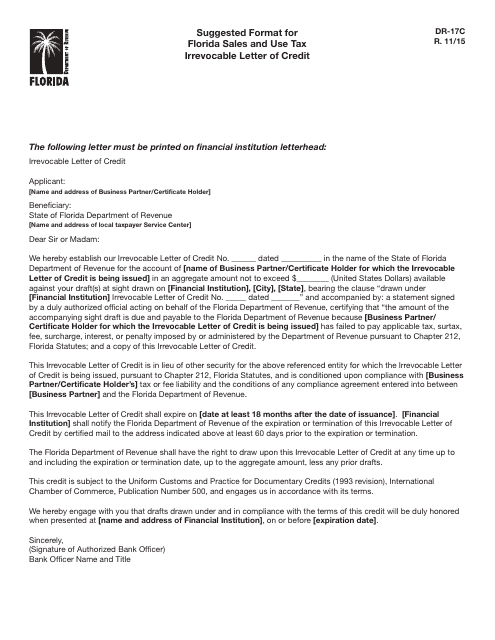

This form is used for providing a suggested format for a Florida Sales and Use Tax Irrevocable Letter of Credit. It is specific to the state of Florida.

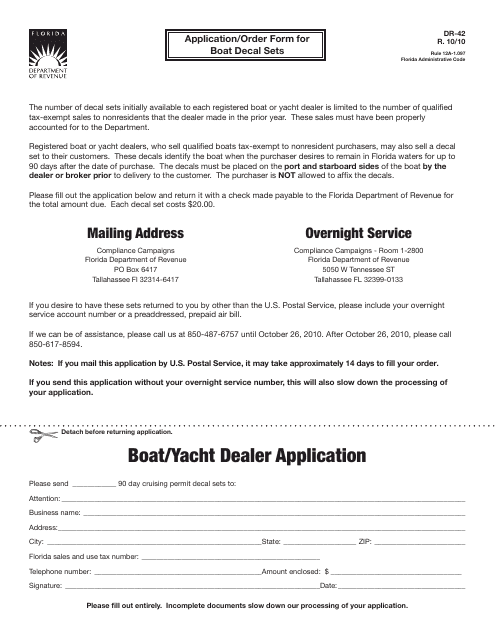

This form is used for applying and ordering boat decal sets in the state of Florida.

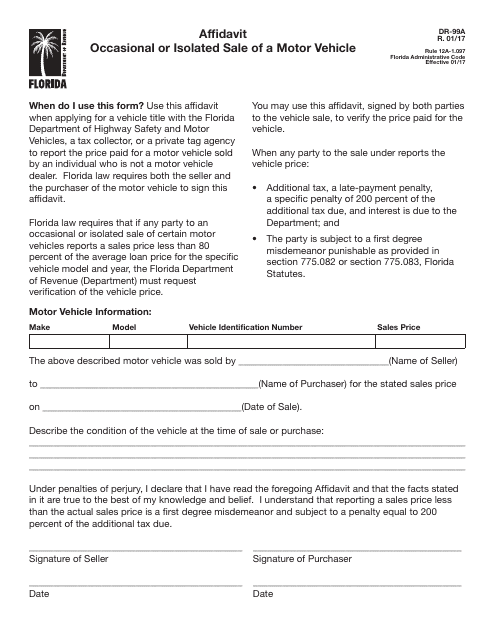

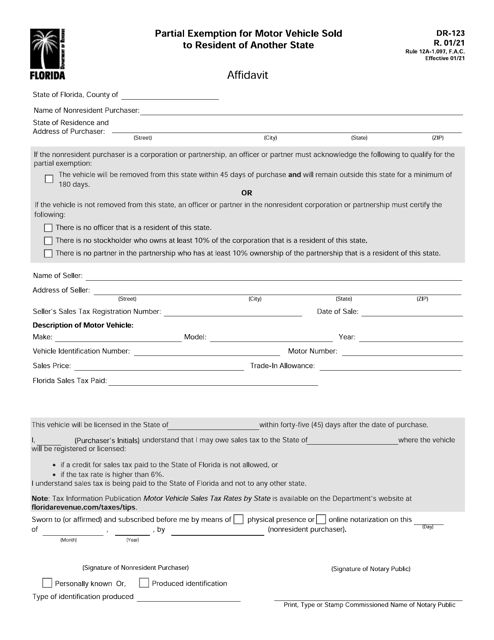

This form is used for reporting the occasional or isolated sale of a motor vehicle in Florida.

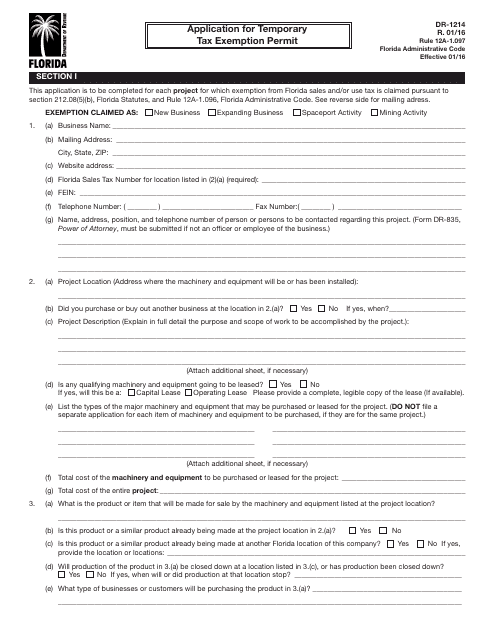

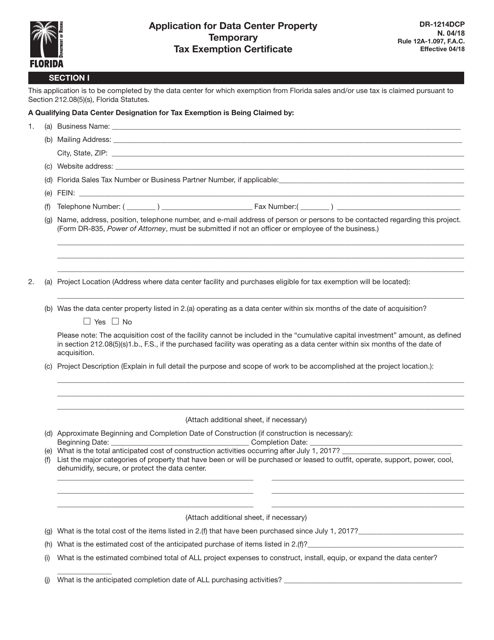

This Form is used for applying for a temporary tax exemption permit in the state of Florida.

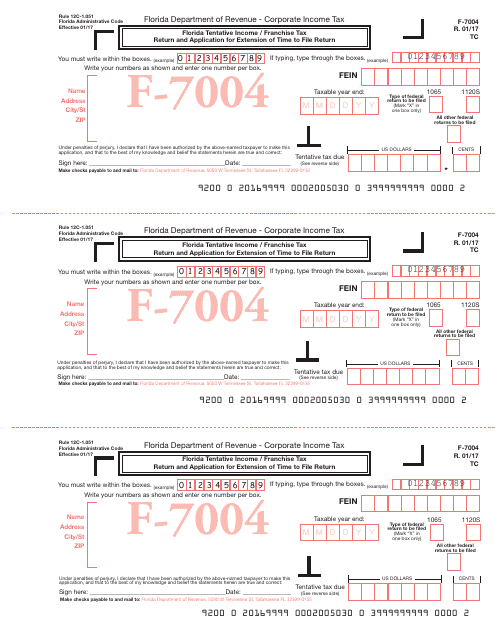

This Form is used for filing the Florida Tentative Income/Franchise Tax Return and applying for an extension of time to file the return in Florida.

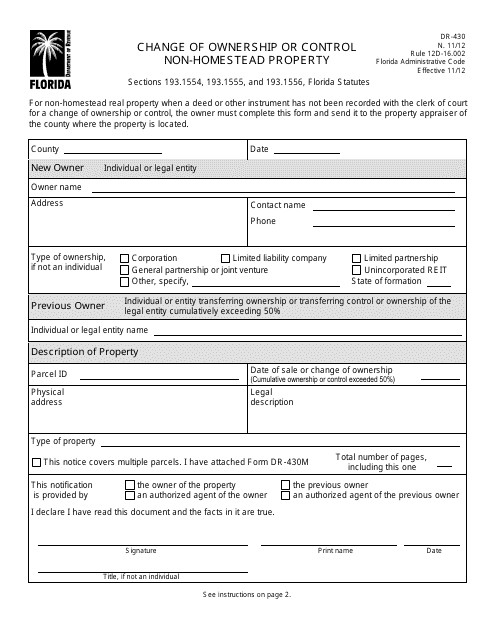

This form is used for changing the ownership or control of non-homestead property in Florida.

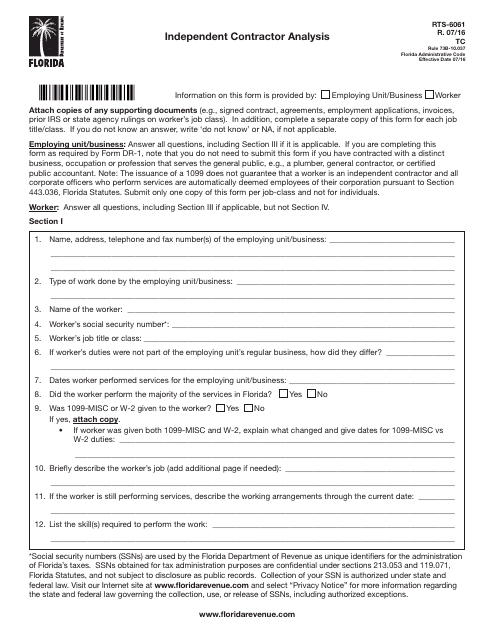

This form is used for conducting an independent contractor analysis in the state of Florida.

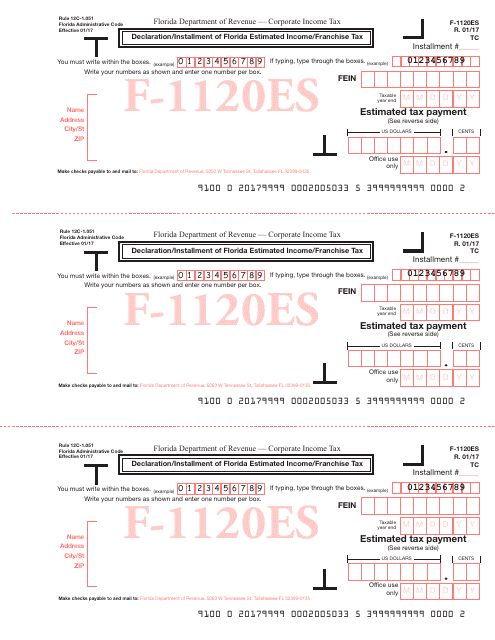

This Form is used for declaring and making installment payments of estimated income/franchise tax in Florida.

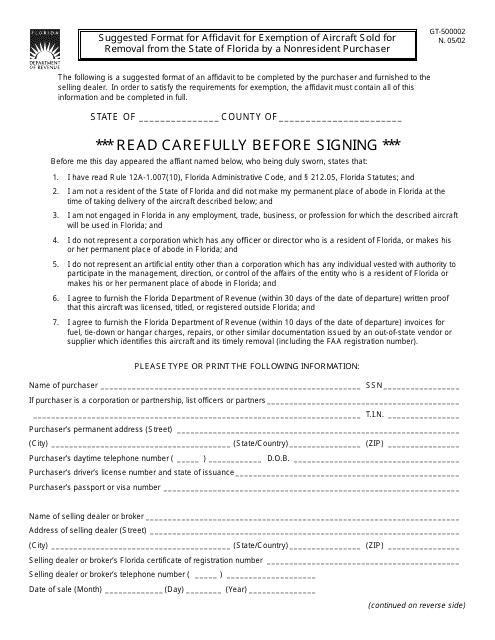

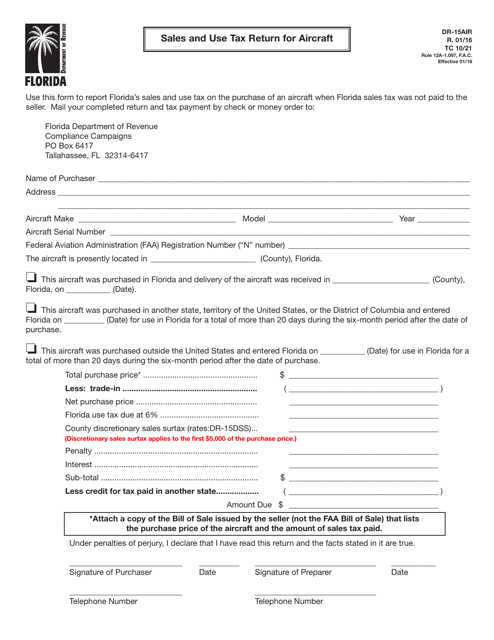

This form is used for creating an affidavit to claim exemption from aircraft sales tax for out-of-state buyers in Florida.

This Form is used for applying for a local business tax receipt in Osceola County, Florida.

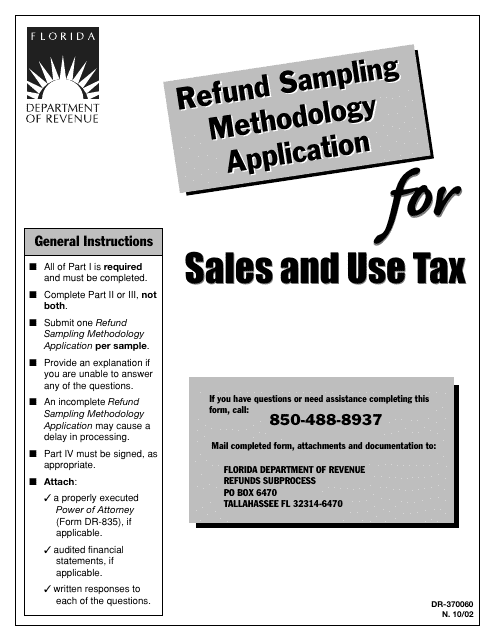

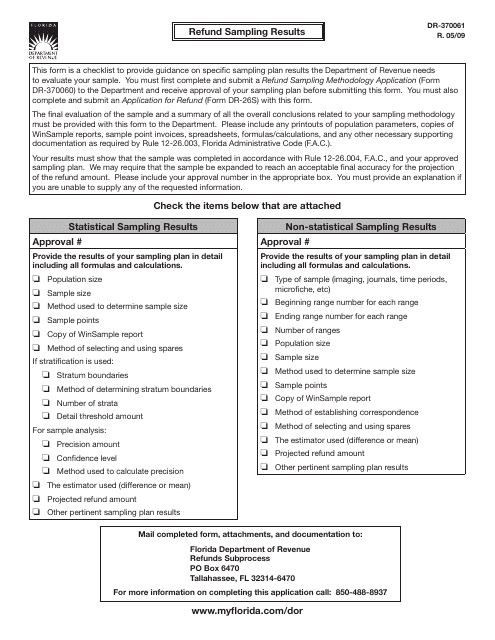

This Form is used for applying for a refund of sales and use tax in Florida. It specifically pertains to the sampling methodology that will be used to determine the amount of the refund.

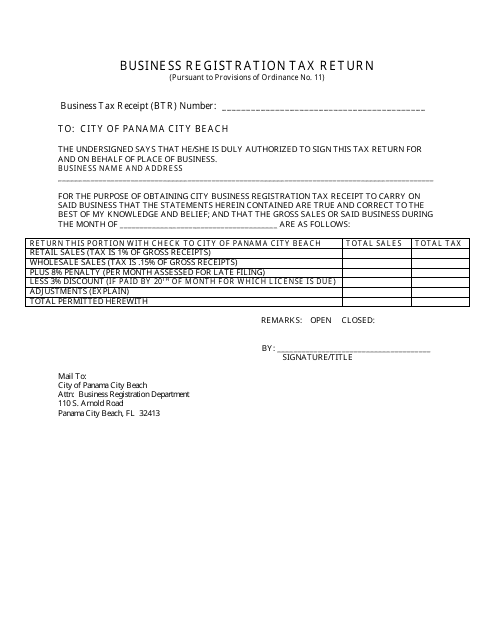

This form is used for registering a business and filing tax returns in the City of Panama City Beach, Florida.

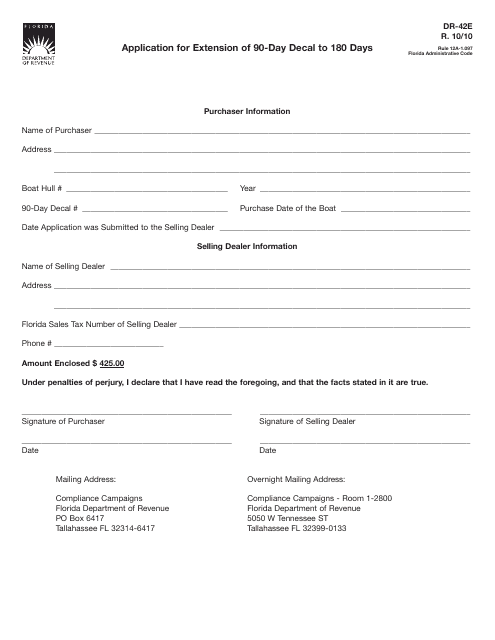

This form is used for applying for an extension of the 90-day decal in Florida, allowing it to be valid for 180 days.

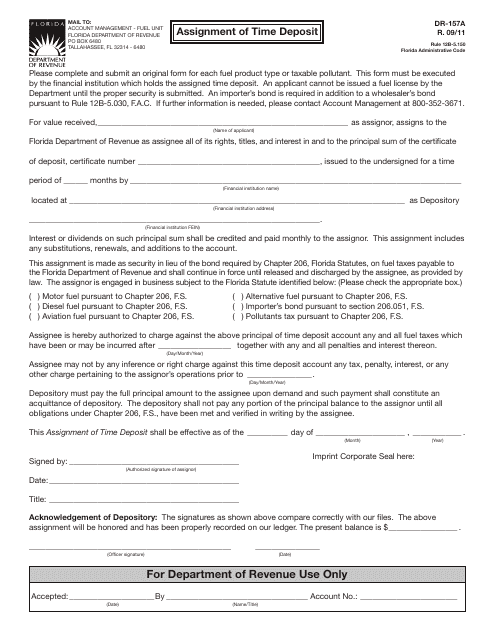

This form is used for assigning a time deposit in the state of Florida.

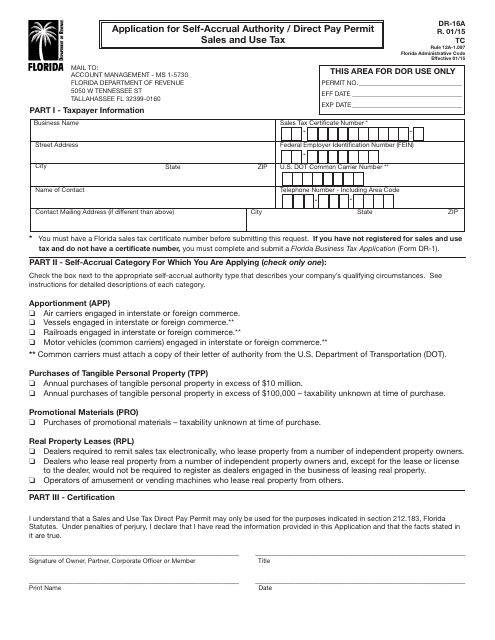

This Form is used for applying for self-accrual authority or a direct pay permit for sales and use tax in Florida.

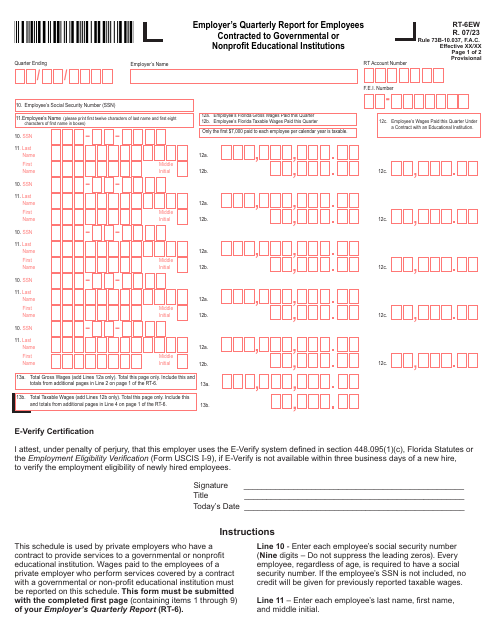

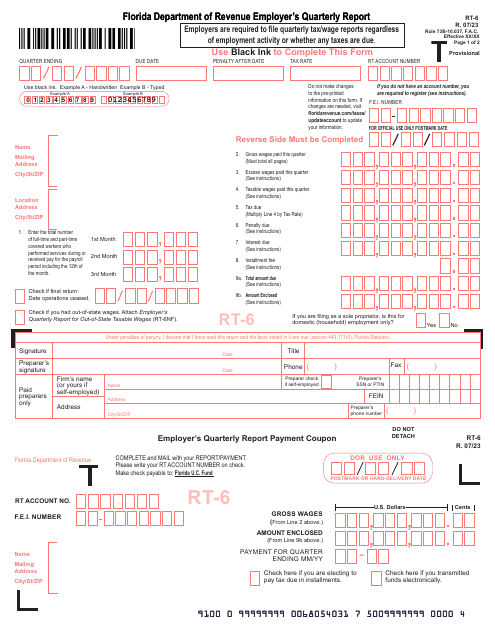

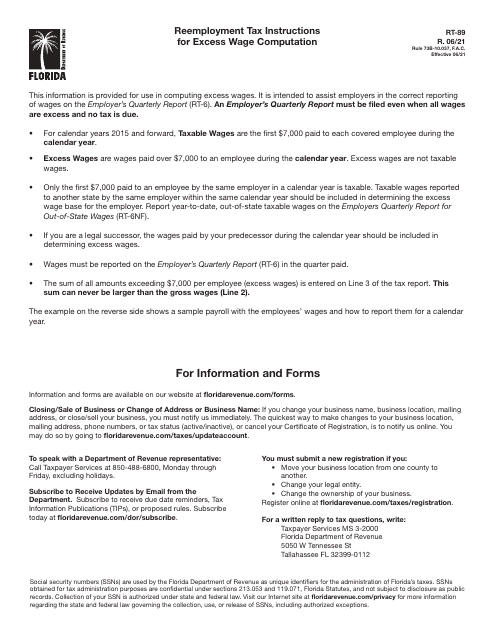

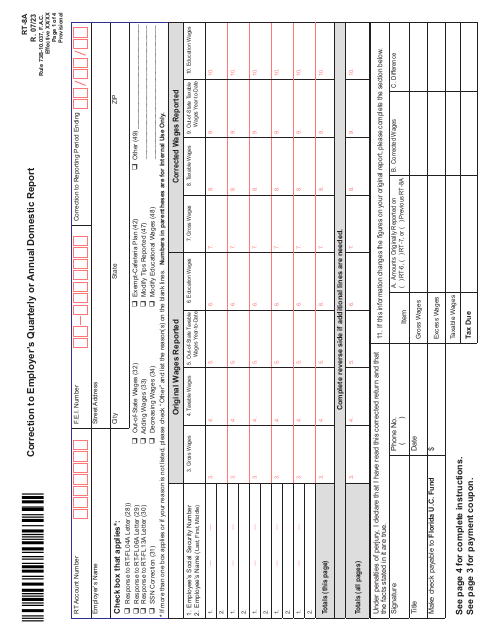

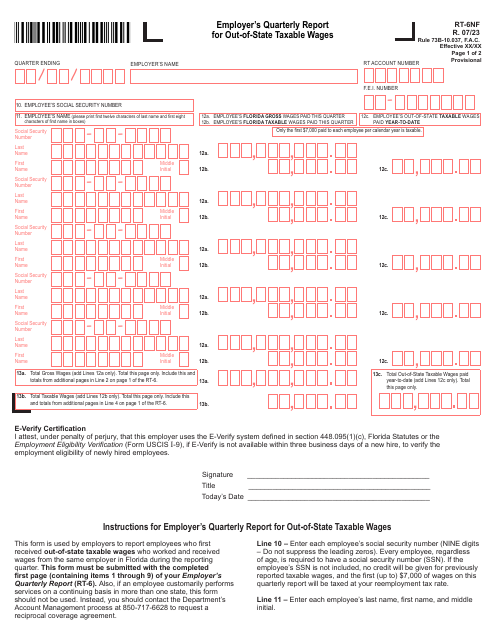

This is a legal document used to inform the Florida Department of Revenue (DOR) about the total number of all employees who performed services or received pay, their gross, excess, and taxable wages.

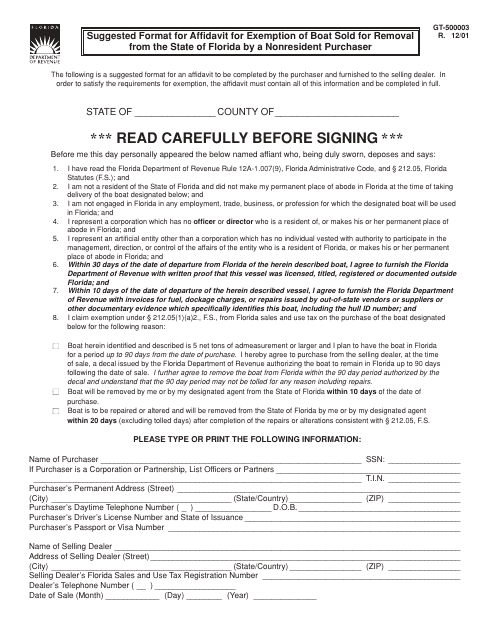

This form is used for providing a suggested format for an affidavit for exemption of a boat sold for removal from the state of Florida by a nonresident purchaser.

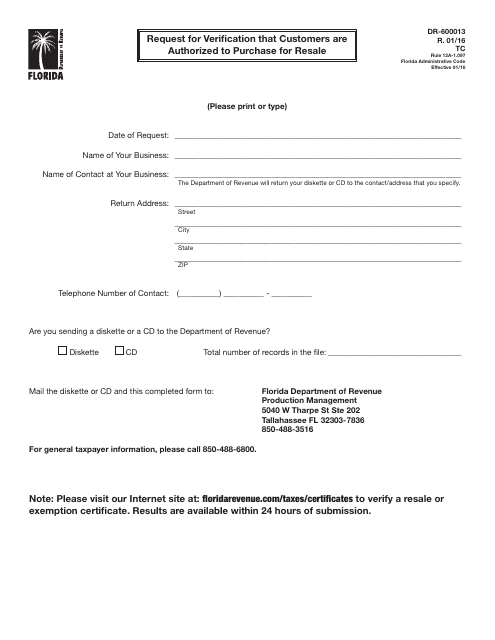

This Form is used for requesting verification that customers in Florida are authorized to purchase items for resale.

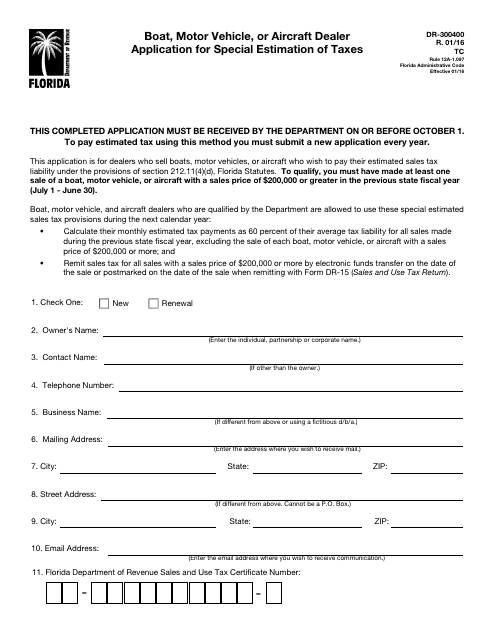

This Form is used for dealers in Florida to apply for a special estimation of taxes for boats, motor vehicles, or aircrafts.

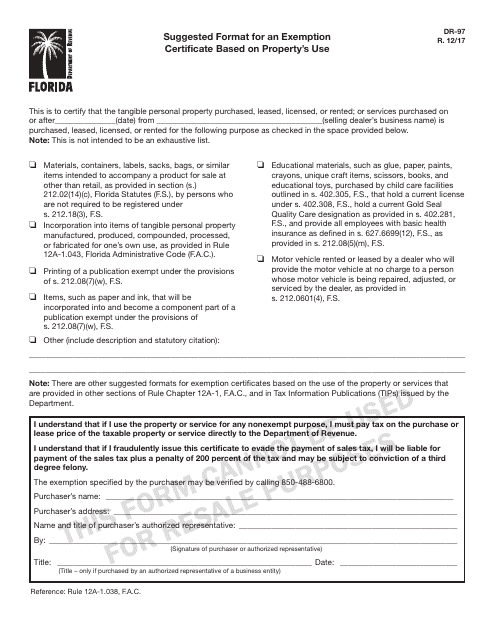

This Form is used for providing a suggested format for an exemption certificate based on the property's use in Florida.

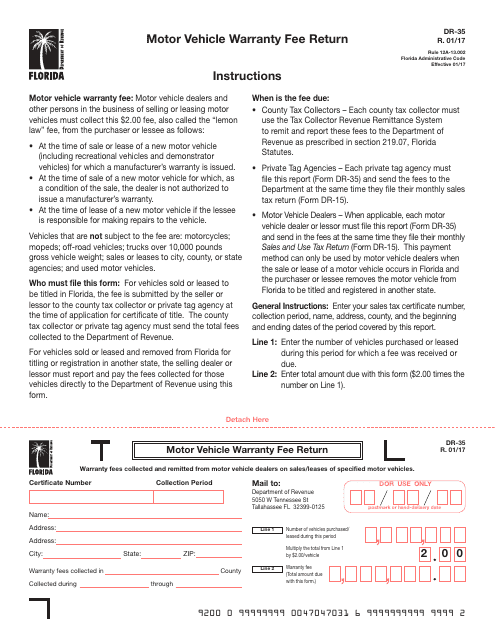

This Form is used for filing the Motor Vehicle Warranty Fee Return in Florida. It is necessary for businesses engaged in the sale of motor vehicles to submit this form and pay the required warranty fee.

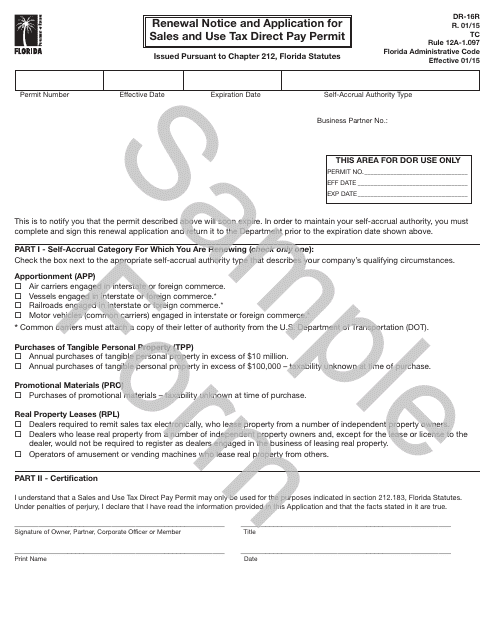

This Form is used for renewing and applying for a Sales and Use Tax Direct Pay Permit in Florida.

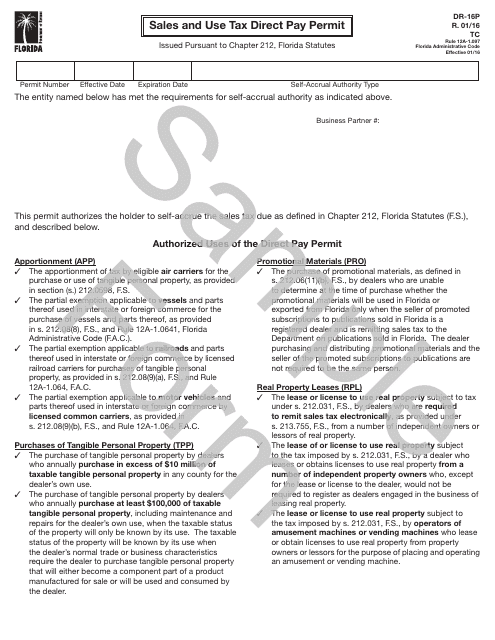

This Form is used for applying for a Sales and Use Tax Direct Pay Permit in the state of Florida. This permit allows businesses to pay sales and use tax directly to the Florida Department of Revenue instead of paying sales tax to their vendors.

This form is used to report the refund sampling results for businesses in the state of Florida.