Delaware Department of Finance Forms

The Delaware Department of Finance is responsible for managing the financial operations of the State of Delaware. They are responsible for collecting taxes, managing state revenues, and overseeing financial policies and procedures. The department also provides services such as processing tax returns, issuing tax refunds, and managing various state funds. Additionally, they may provide financial guidance and assistance to businesses and individuals in Delaware.

Documents:

12

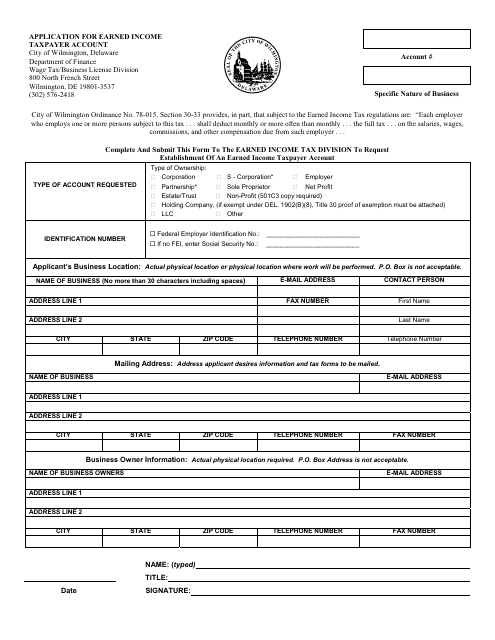

This form is used for applying for an Earned Income Taxpayer Account in the City of Wilmington, Delaware.

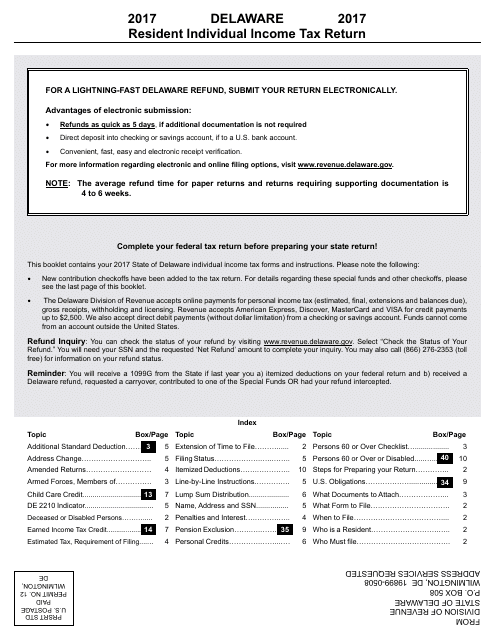

This Form is used for reporting and paying individual income taxes for residents of Delaware.

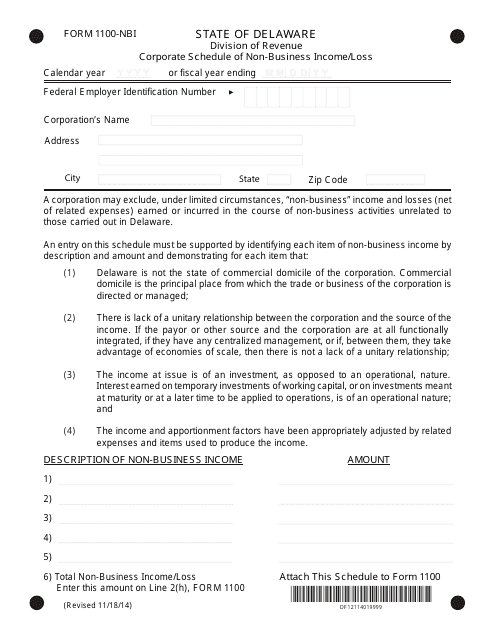

This form is used for reporting non-business income or loss for corporations in Delaware.

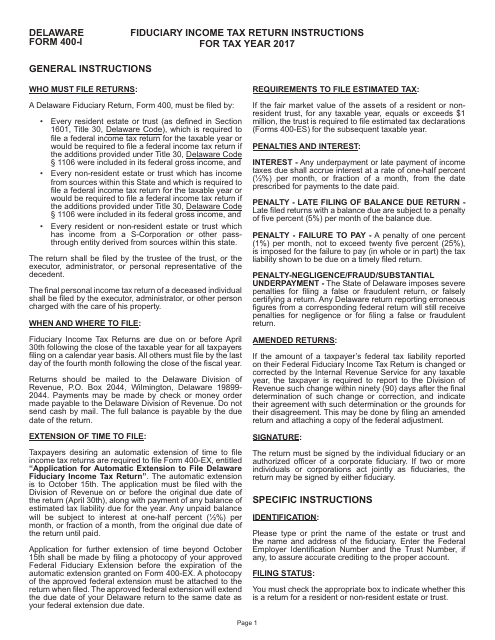

This Form is used for filing the Fiduciary Income Tax Return in the state of Delaware. It provides instructions on how to report income, deductions, and credits for trusts and estates.

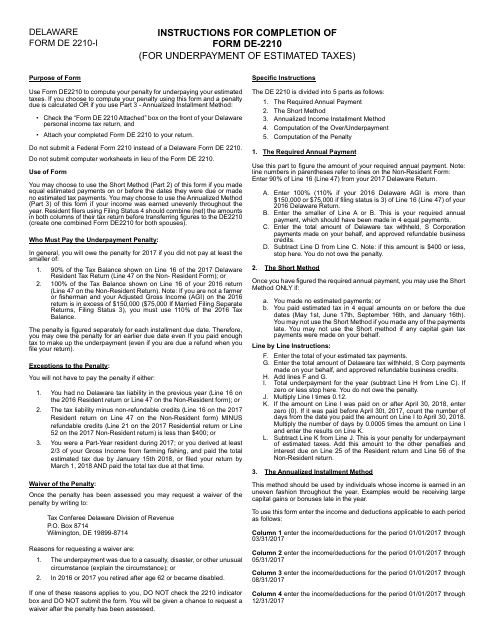

This document provides instructions for completing Form DE-2210, which is used in Delaware to report underpayment of estimated taxes. The form is used to calculate and report any penalties or interest owed for not paying enough estimated taxes throughout the year.

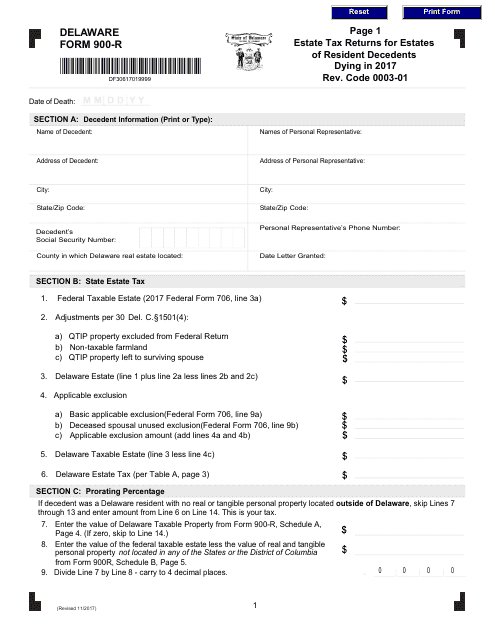

This Form is used for filing estate tax returns for the estates of resident decedents who passed away in 2017 in Delaware.

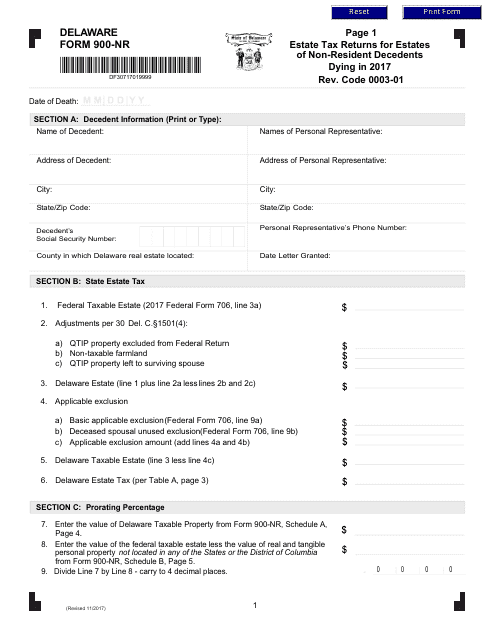

This form is used for filing estate tax returns for non-resident decedents who passed away in 2017 in Delaware.

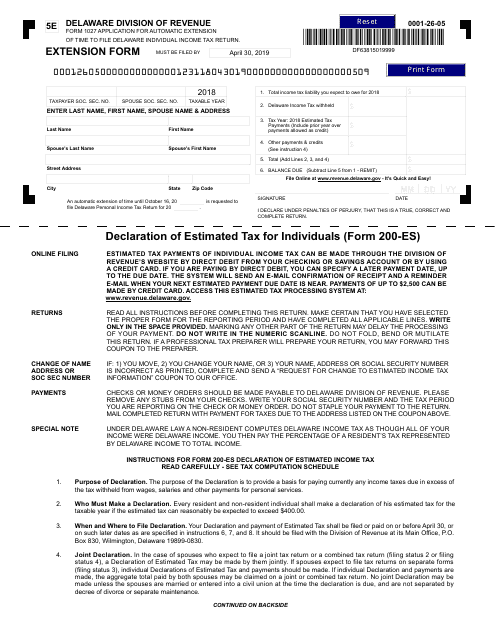

This Form is used for requesting an extension for filing Delaware Estimated Income Tax Return for Individuals in Delaware.

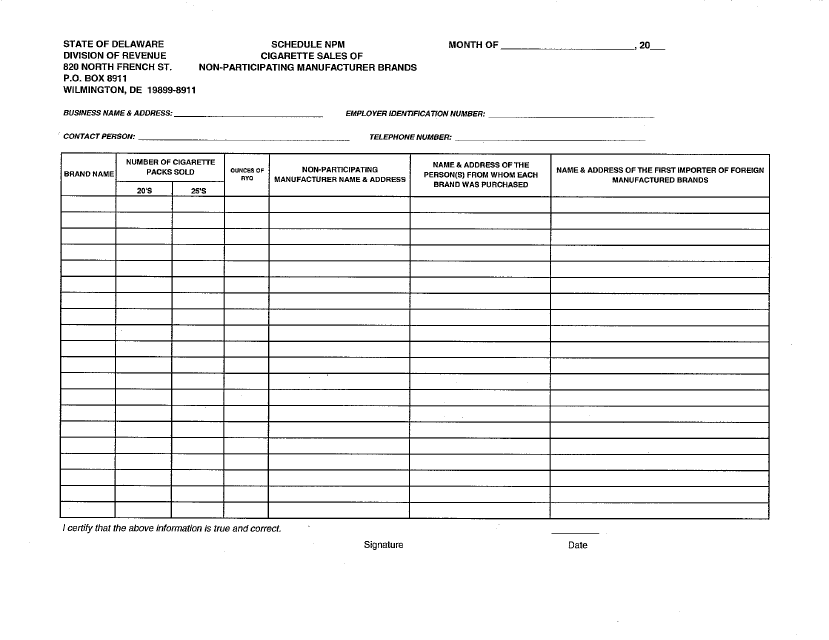

This document is used for scheduling the sales of non-participating manufacturer (NPM) cigarette brands in the state of Delaware.

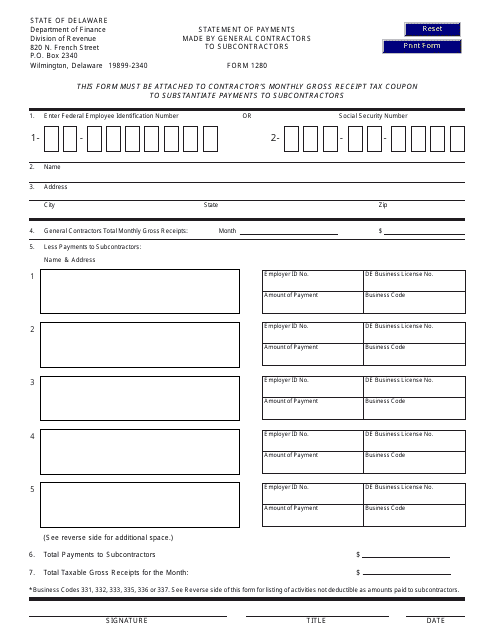

This form is used for reporting payments made by general contractors to subcontractors in the state of Delaware.