Connecticut Department of Revenue Services Forms

The Connecticut Department of Revenue Services (DRS) is responsible for administering and enforcing various tax laws and regulations in the state of Connecticut. It is responsible for collecting taxes, processing tax returns, and enforcing compliance with state tax laws. The DRS also provides taxpayer assistance and education to help individuals and businesses understand and meet their tax obligations in Connecticut.

Documents:

561

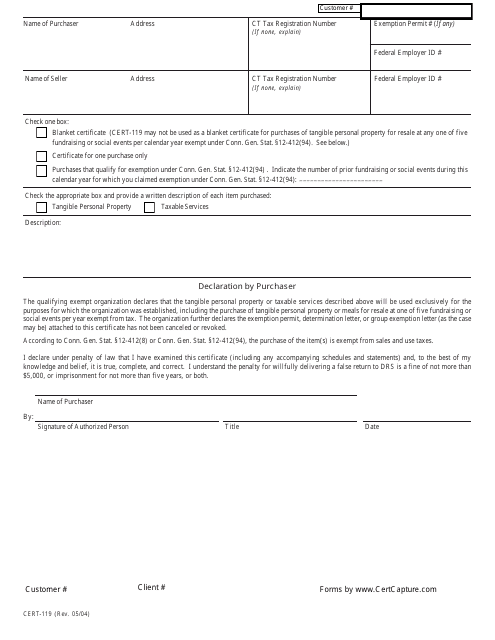

This form is used for reporting purchases of tangible personal property and services by qualifying exempt organizations in Connecticut.

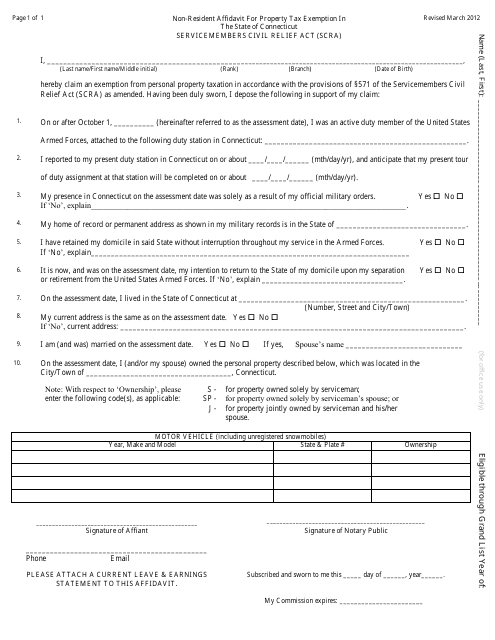

This document is a template for a non-resident affidavit that can be used to apply for property tax exemption in the state of Connecticut under the Service Members Civil Relief Act (SCRA).

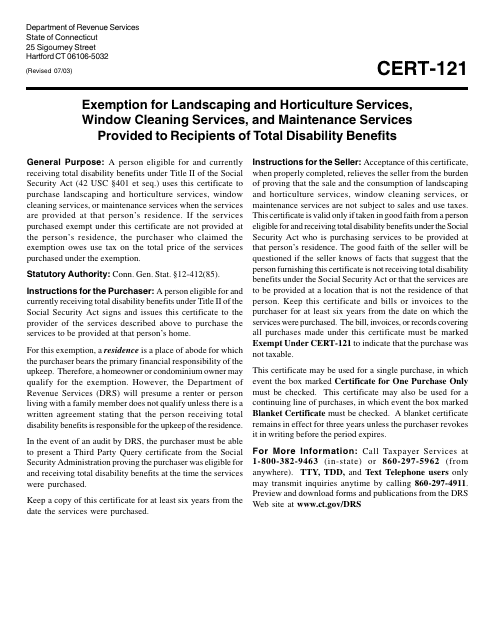

This Form is used for claiming exemption for landscaping, horticulture, window cleaning, and maintenance services provided to individuals receiving total disability benefits in Connecticut.

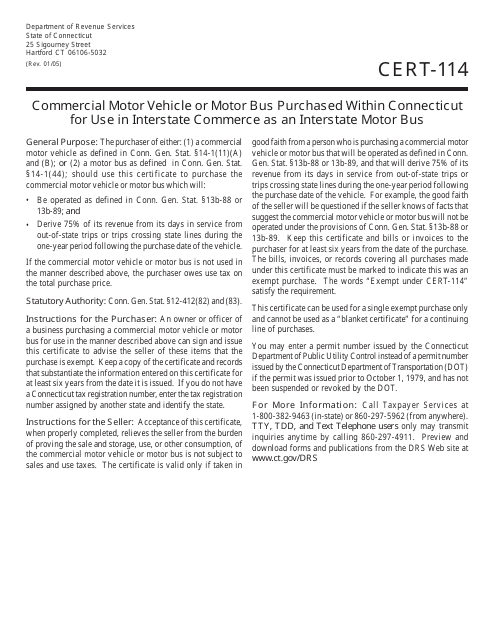

This form is used for registering a commercial motor vehicle or motor bus that was purchased within Connecticut and will be used for interstate commerce as an interstate motor bus.

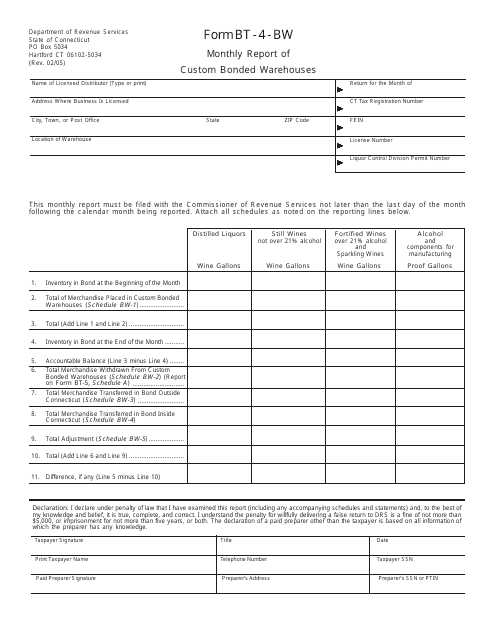

This form is used for submitting monthly reports of custom bonded warehouses in Connecticut.

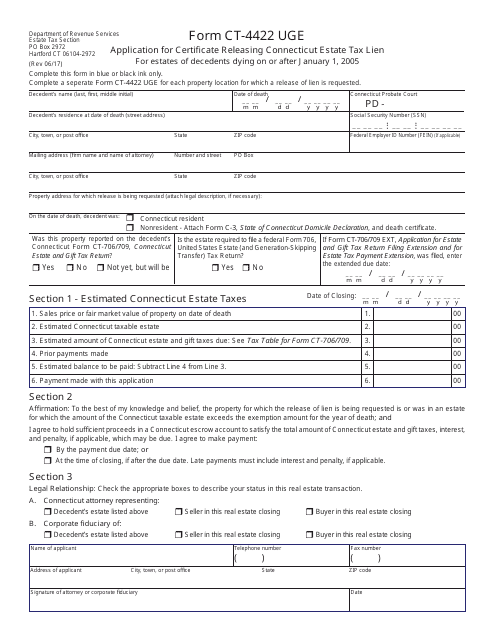

This form is used for applying to release the Connecticut estate tax lien for estates of deceased individuals who passed away on or after January 1, 2005.

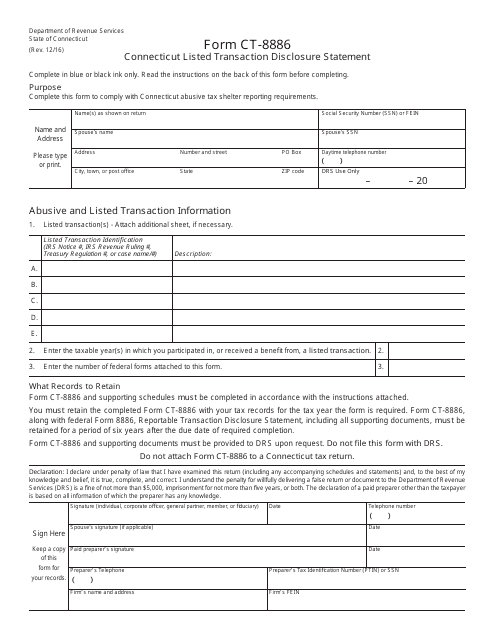

This Form is used for disclosing listed transactions in Connecticut.

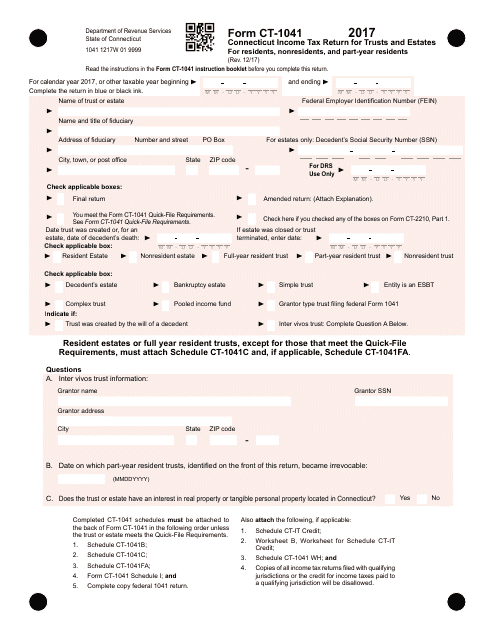

This Form is used for filing Connecticut state income tax return for trusts and estates. It is applicable for residents, nonresidents, and part-year residents in Connecticut.

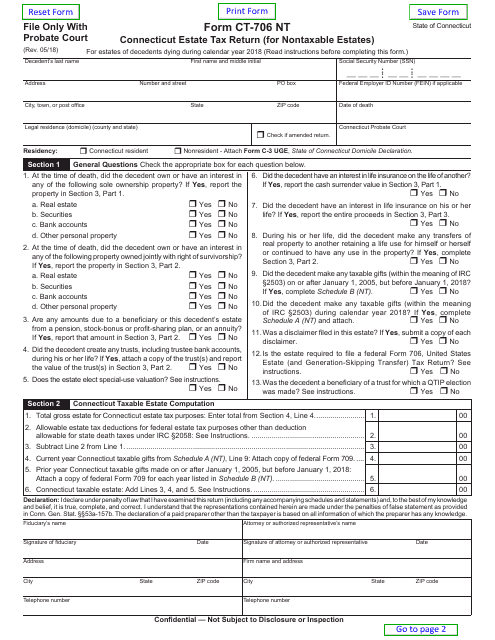

This Form is used for filing the Connecticut Estate Tax Return for nontaxable estates in Connecticut.

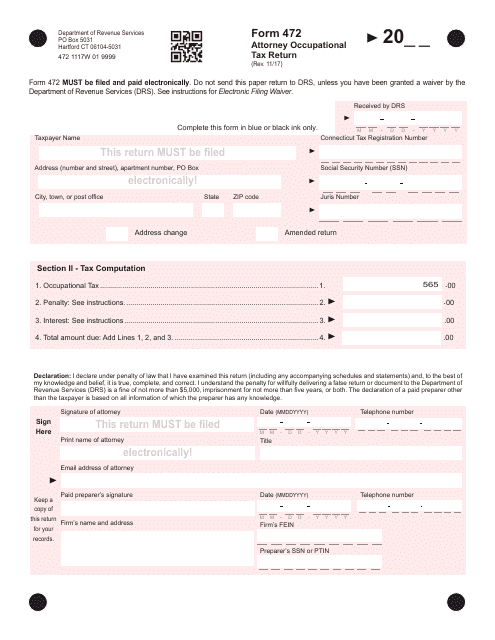

This Form is used for reporting and paying the occupational tax for attorneys in Connecticut. It is required by the state government for attorneys practicing in the state.

This Form is used for claiming sales and use tax exemption on purchases made by qualifying governmental agencies in Connecticut.

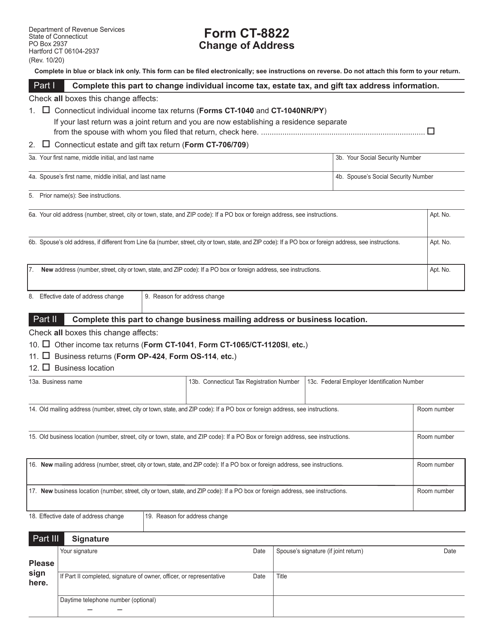

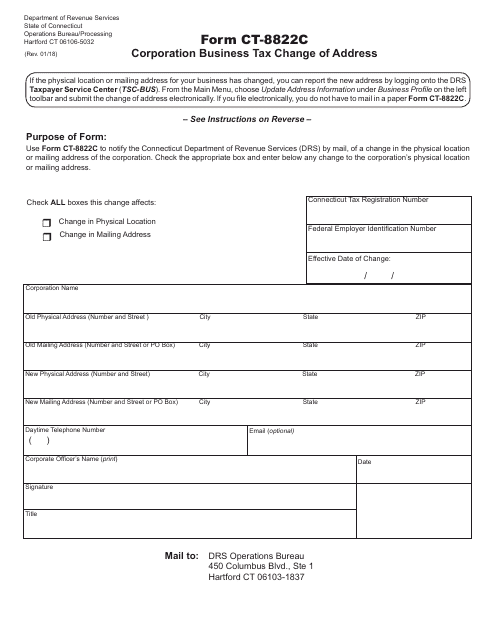

This Form is used for corporations to notify the state of Connecticut about changes in their business address for tax purposes.

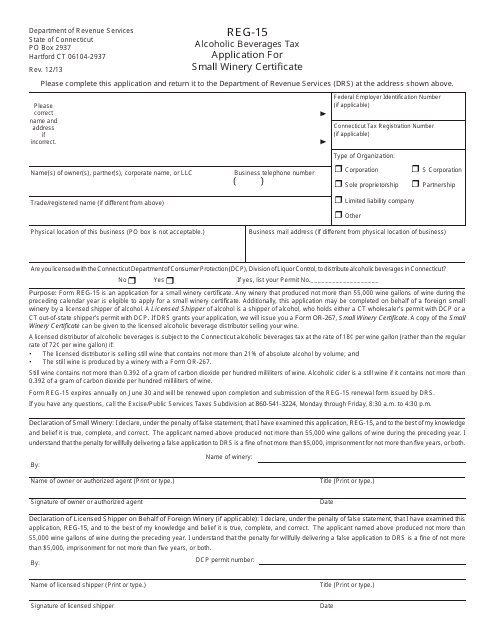

This form is used for small wineries in Connecticut to apply for a certificate related to the alcoholic beverages tax.

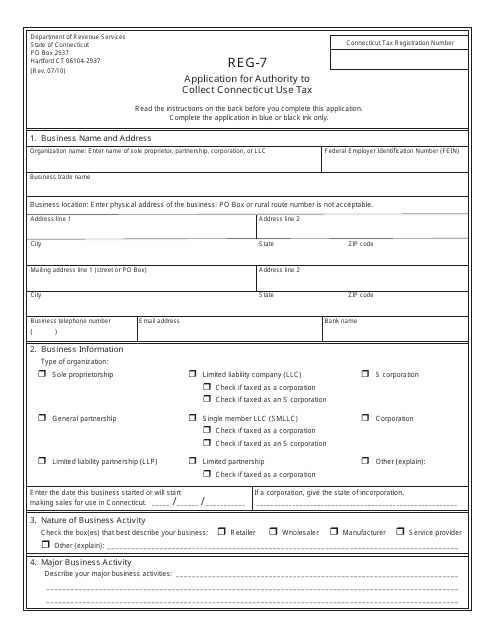

This form is used for individuals or businesses to apply for the authority to collect Connecticut Use Tax in the state of Connecticut.

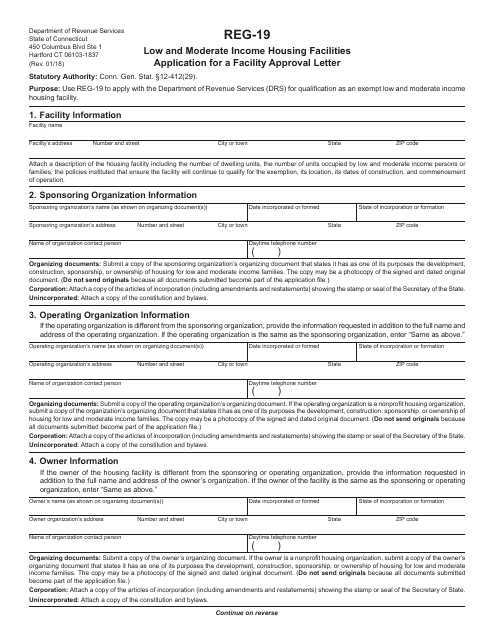

This Form is used for low and moderate income housing facilities in Connecticut to apply for a Facility Approval Letter. The form helps in ensuring that housing facilities meet the necessary requirements for providing affordable housing options.

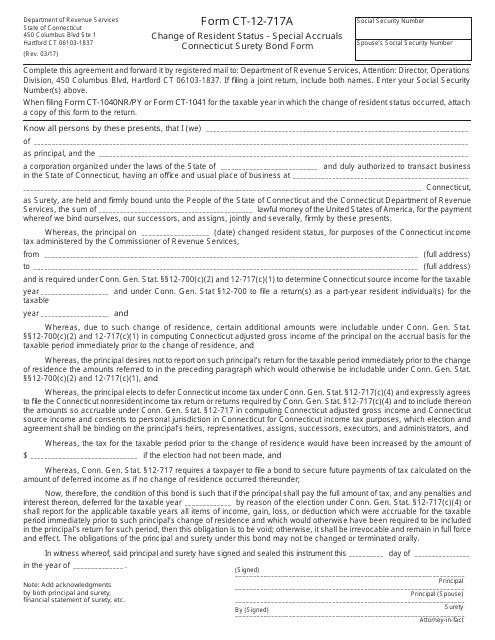

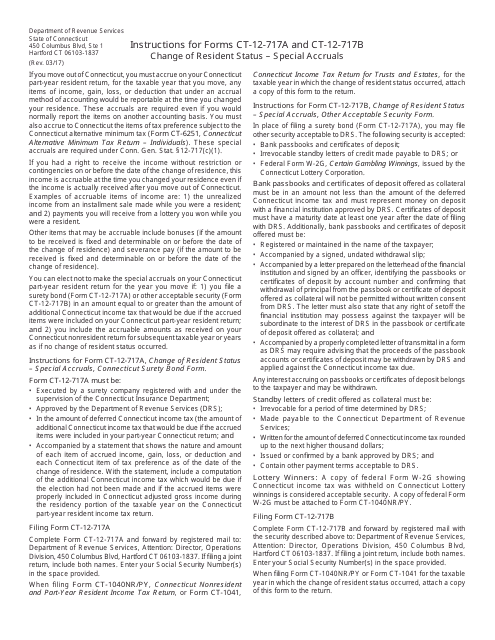

This Form is used for changing resident status and special accruals in Connecticut. It also includes the Connecticut Surety Bond Form.

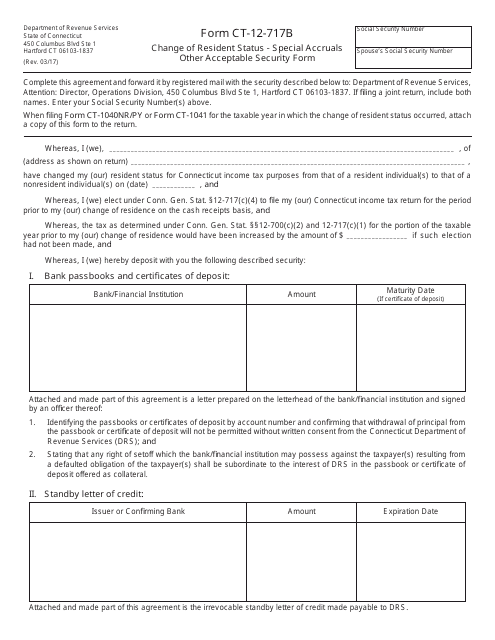

This form is used for changing resident status and reporting other acceptable securities in Connecticut.

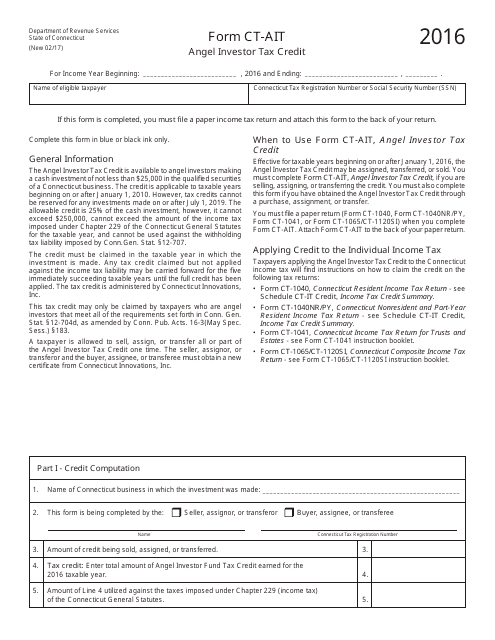

This form is used for claiming the Angel Investor Tax Credit in the state of Connecticut.

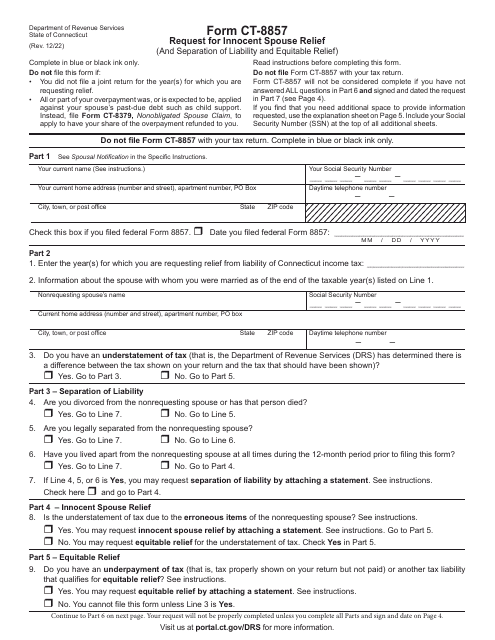

This Form is used for making changes in resident status and reporting special accruals in the state of Connecticut.

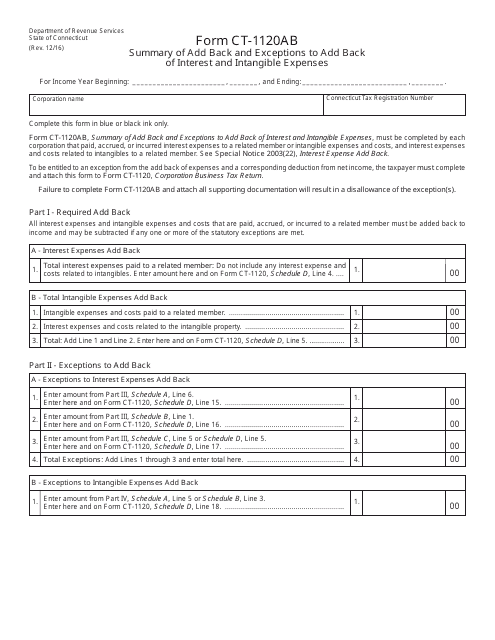

This form is used for summarizing the add back and exceptions to add back of interest and intangible expenses in Connecticut.

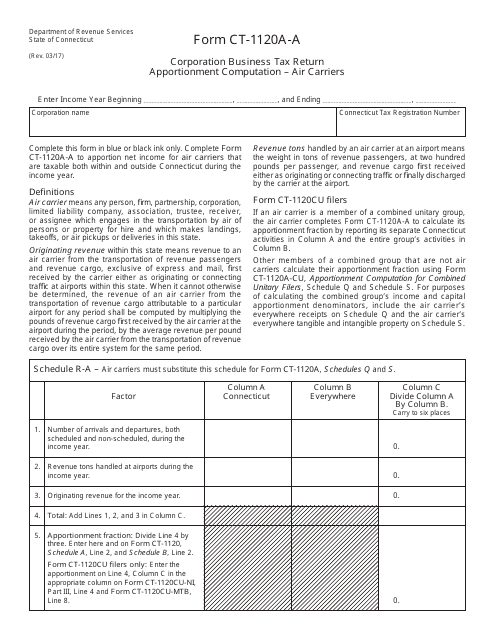

This form is used by air carriers in Connecticut to calculate the apportionment of their corporation business tax return.

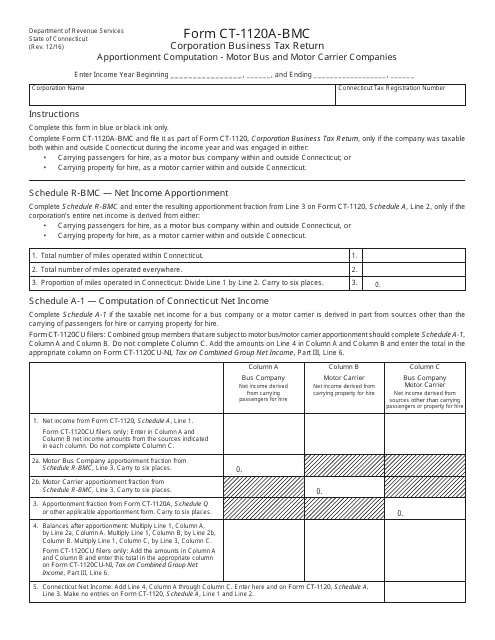

This form is used for BMC Corporation business tax return in Connecticut. It specifically focuses on apportionment computation for motor bus and motor carrier companies.

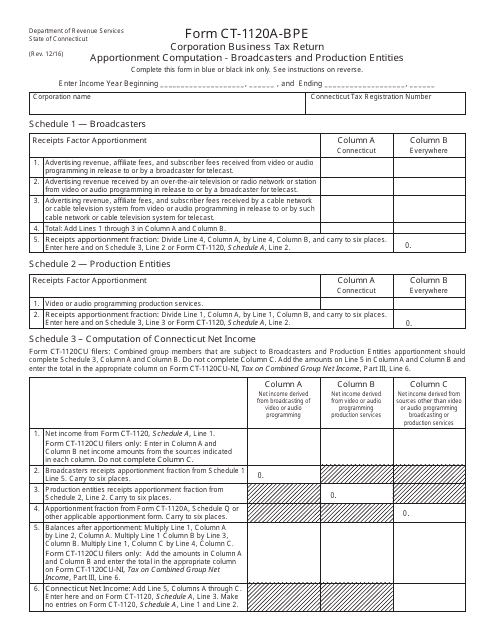

This document is used for Corporation Business Tax Return for broadcasters and production entities in Connecticut. It is specifically for apportionment computation.

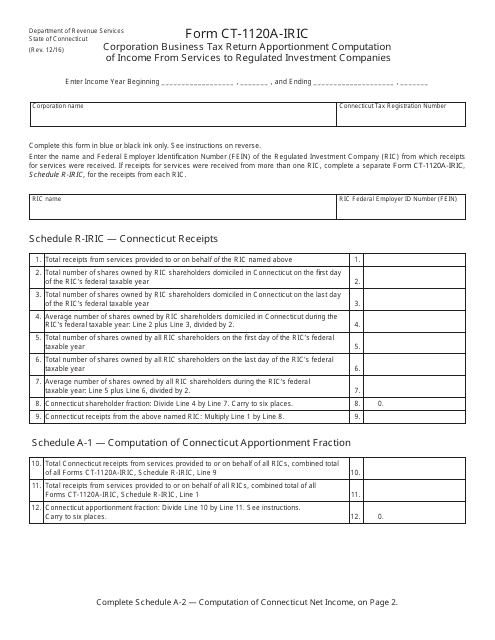

This form is used by corporations in Connecticut to calculate the apportionment of income from services to regulated investment companies for the purpose of filing their business tax return.