Connecticut Department of Labor Forms

The Connecticut Department of Labor is responsible for ensuring the welfare and rights of workers in the state of Connecticut. It administers various programs and services related to employment, including unemployment insurance, job training and placement, occupational safety and health, and wage and hour regulations. The department also provides resources and assistance to both job seekers and employers in Connecticut.

Documents:

45

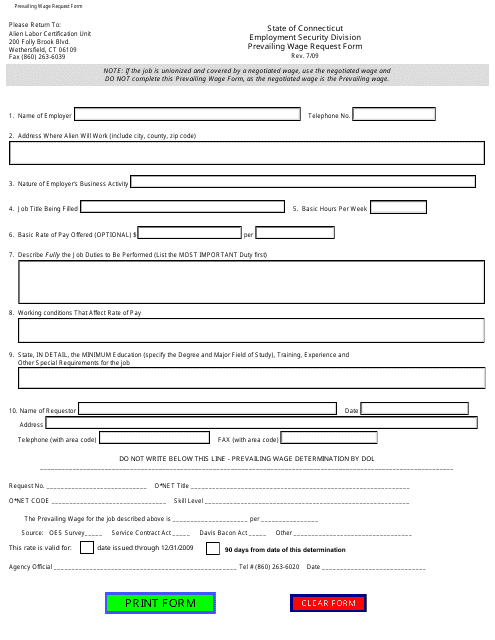

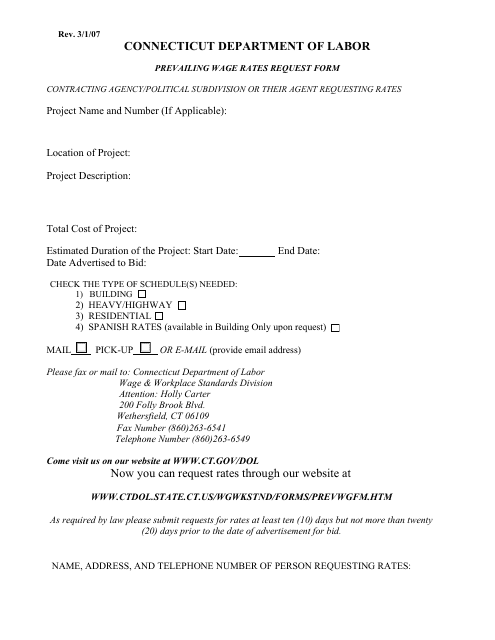

This Form is used for requesting prevailing wage information in the state of Connecticut.

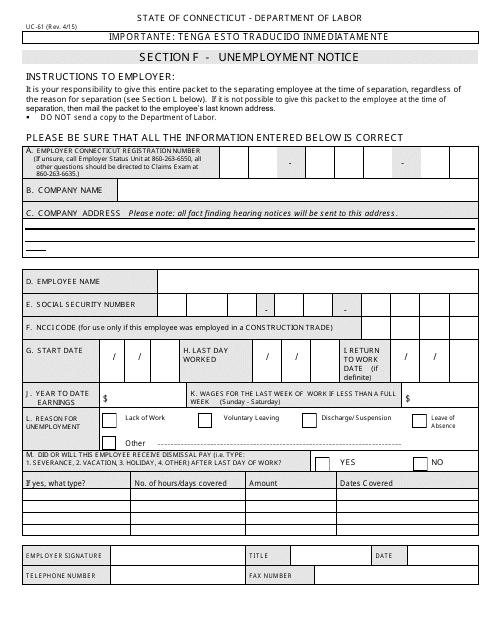

This form is used for filing an Unemployment Separation Notice in the state of Connecticut. It is a document that notifies the unemployment office about the separation of an employee from their job.

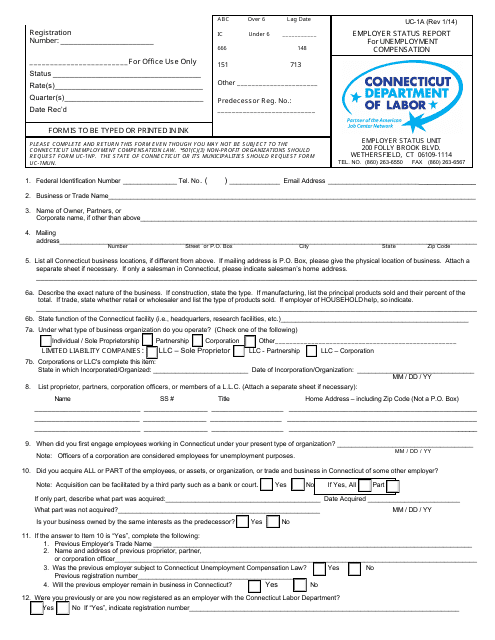

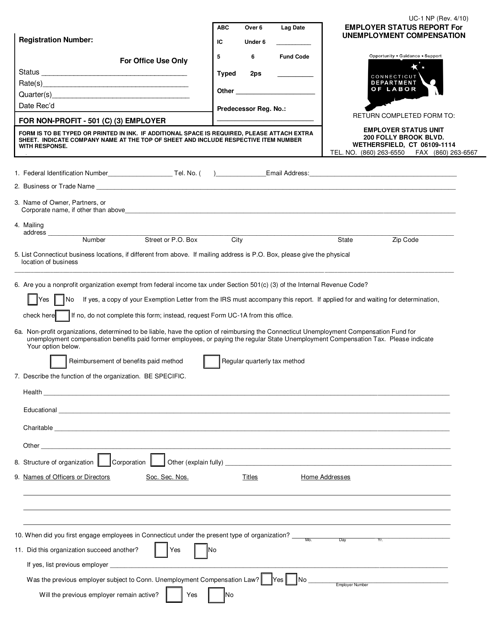

This form is used for employers in Connecticut to provide a status report for unemployment compensation.

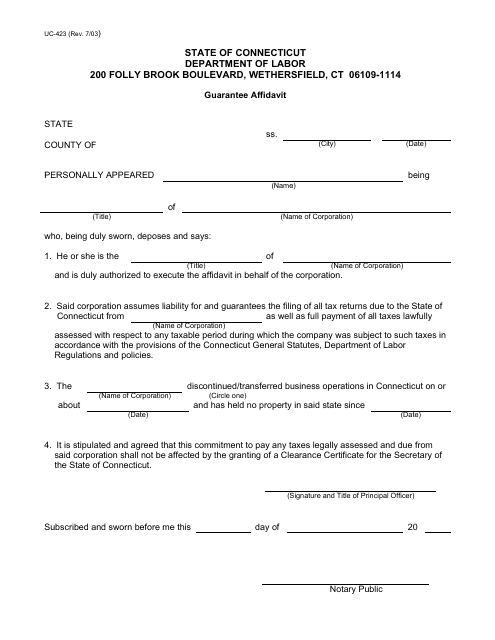

This form is used for filing a guarantee affidavit in the state of Connecticut.

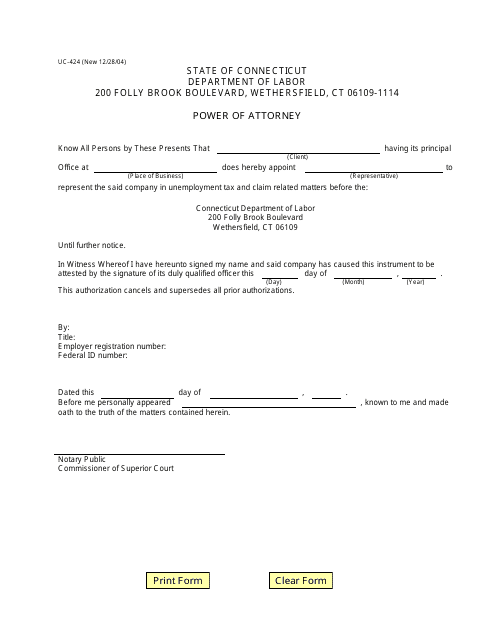

This Form is used for granting someone the power to act on your behalf in legal matters in the state of Connecticut.

This document is used to request the prevailing wage rates in the state of Connecticut. It is helpful for contractors and employers to determine the fair wages for certain occupations.

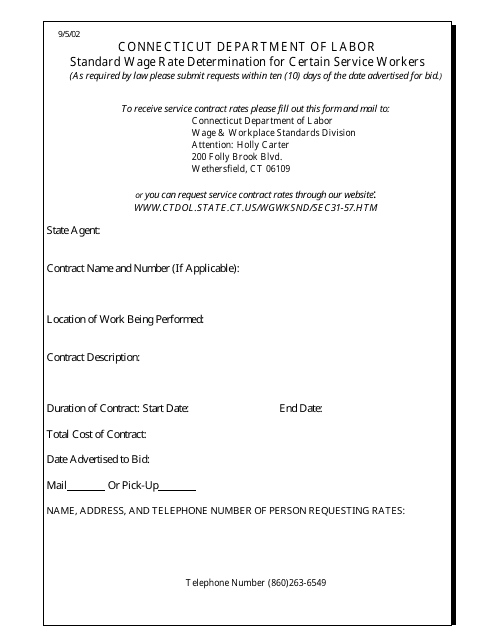

This document outlines the standard wage rates for certain service workers in the state of Connecticut. It provides guidelines for employers and employees regarding minimum wages and wage rates for specific occupations.

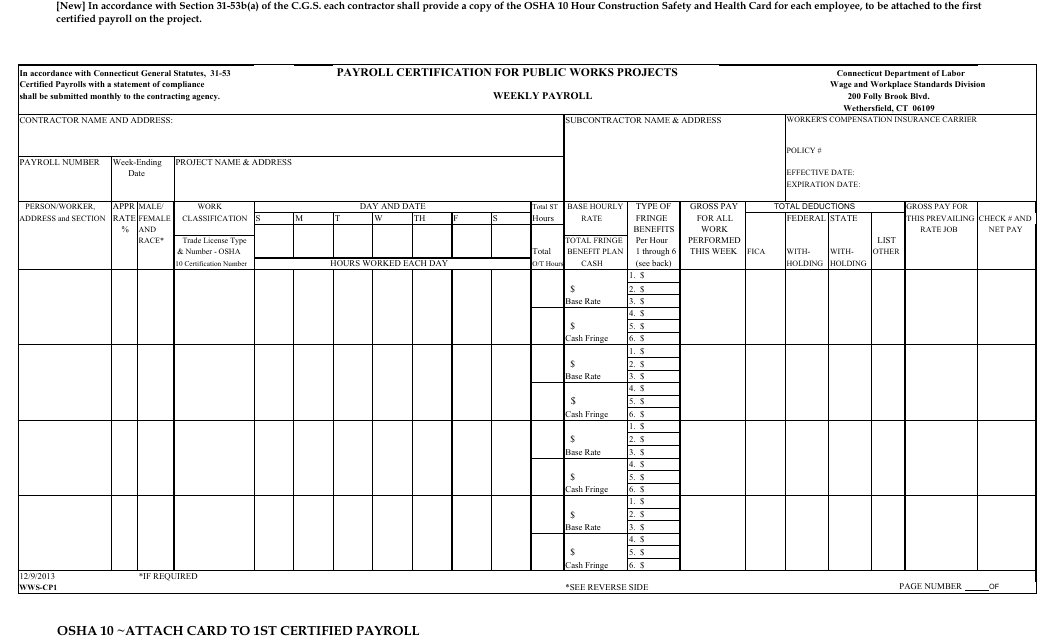

This form is used for payroll certification on public works projects in Connecticut.

This document is used for certification of contracting agencies in the state of Connecticut. It ensures that the agency meets certain requirements and is eligible to enter into contracts with the government.

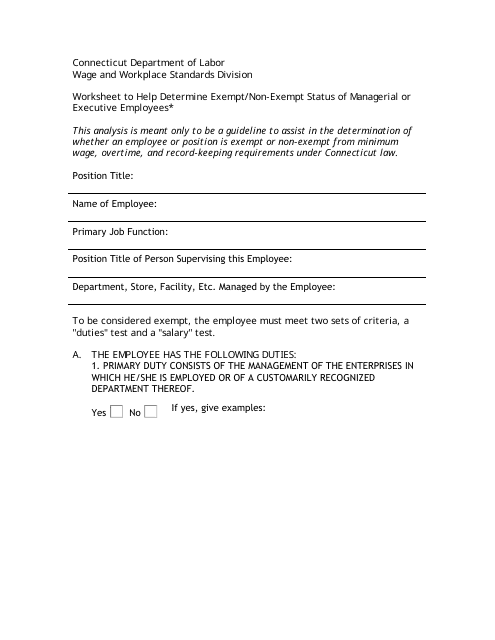

This form is used for determining whether managerial or executive employees in Connecticut are exempt or non-exempt for certain labor laws.

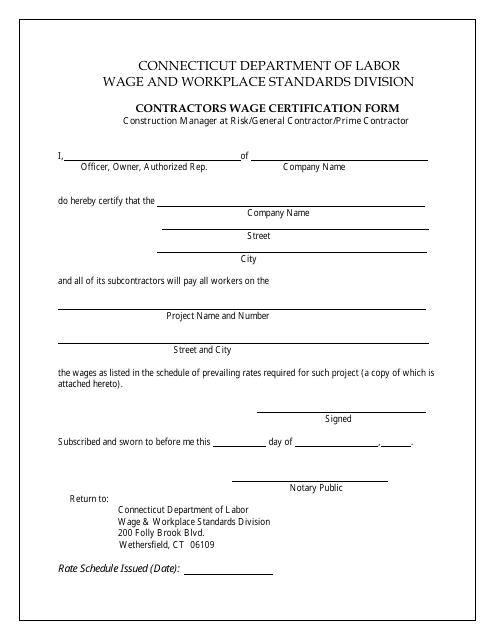

This form is used for contractors to certify wages in Connecticut for construction projects under the management of a construction manager at risk, general contractor, or prime contractor. It ensures compliance with labor regulations and provides a record of wages paid to workers.

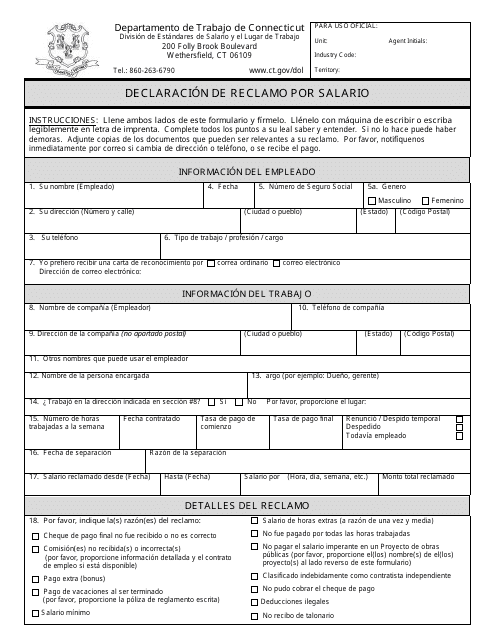

This form is used for filing a wage claim in Connecticut to report unpaid wages. It is in Spanish.

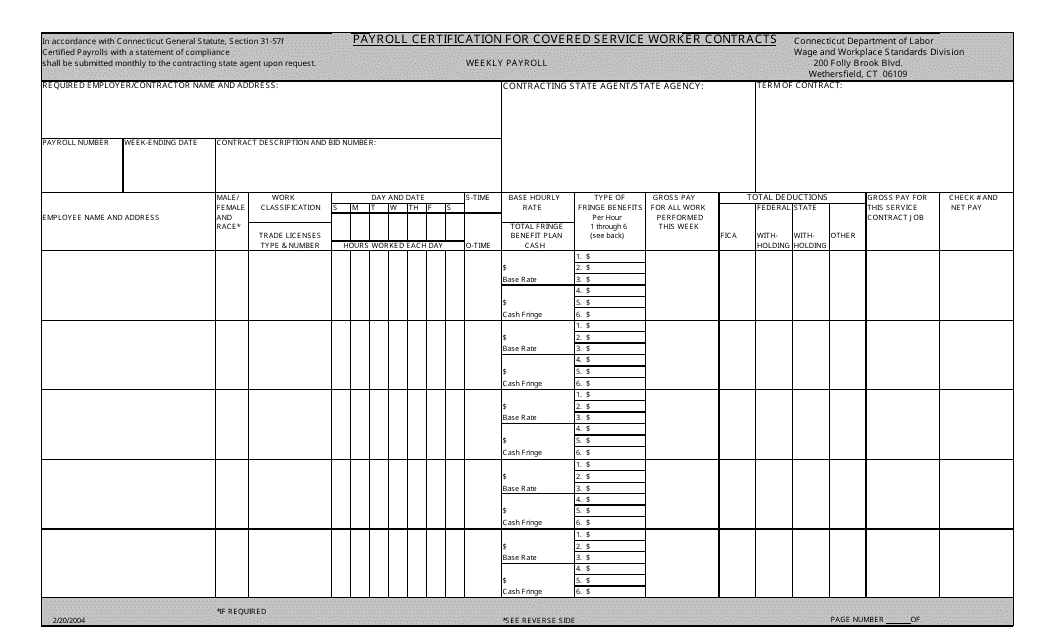

This document certifies payroll for covered service worker contracts in Connecticut. It ensures compliance with state regulations on service worker wages.

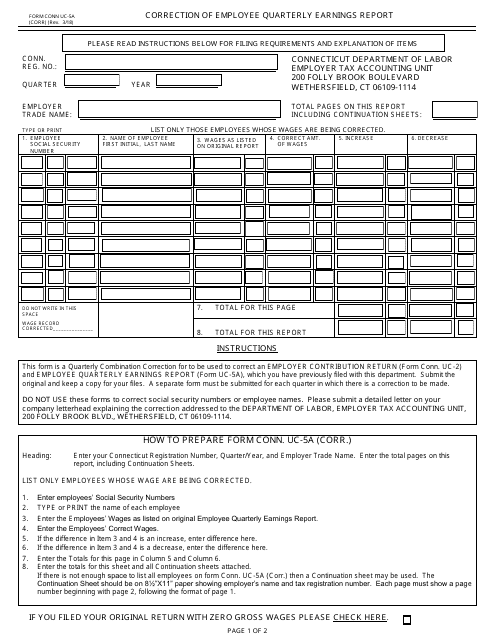

This Form is used for correcting the employee quarterly earnings report in Connecticut.

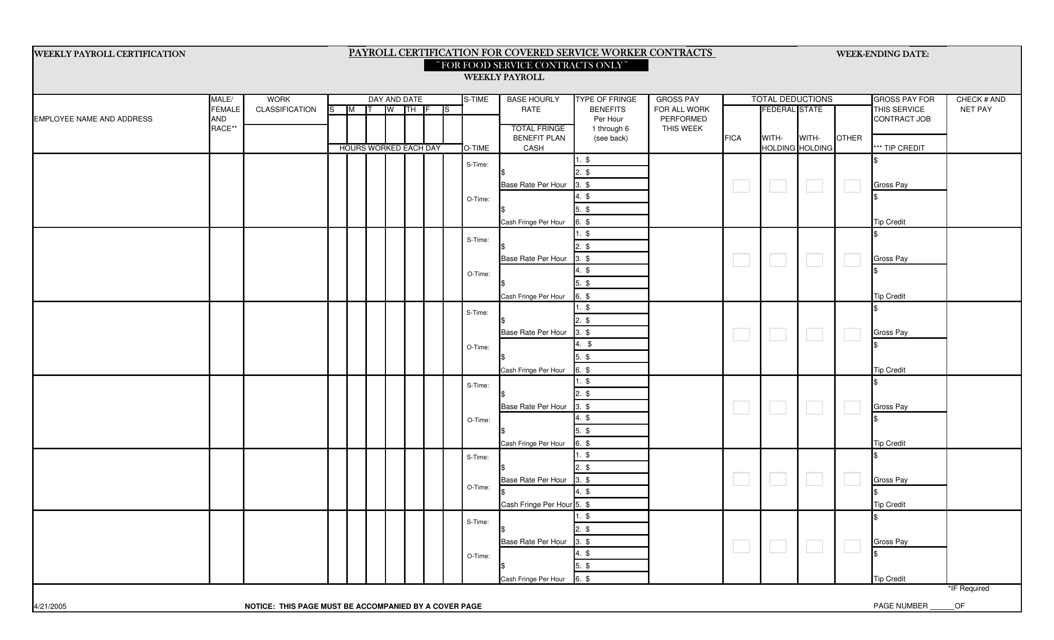

This form is used for weekly payroll certification for covered service worker contracts specifically for food service contracts in Connecticut.

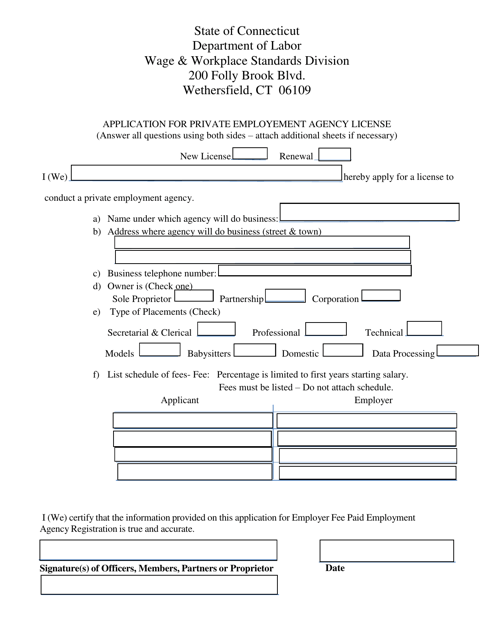

This document is for obtaining a license to operate a private employment agency in the state of Connecticut. It is used to apply for permission to offer employment services to individuals and businesses in the private sector.

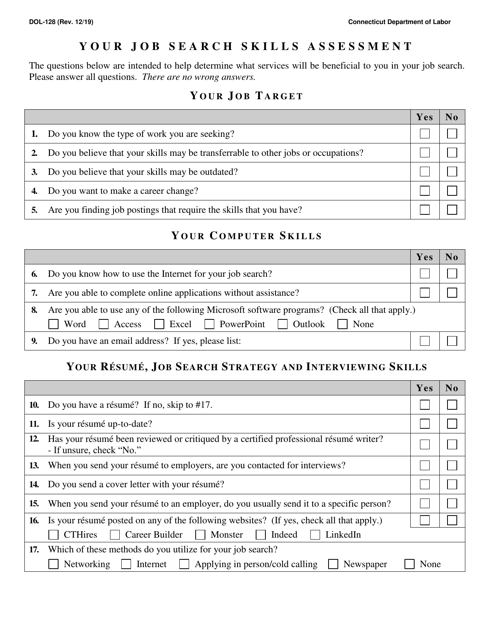

This Form is used for assessing job search skills in the state of Connecticut.

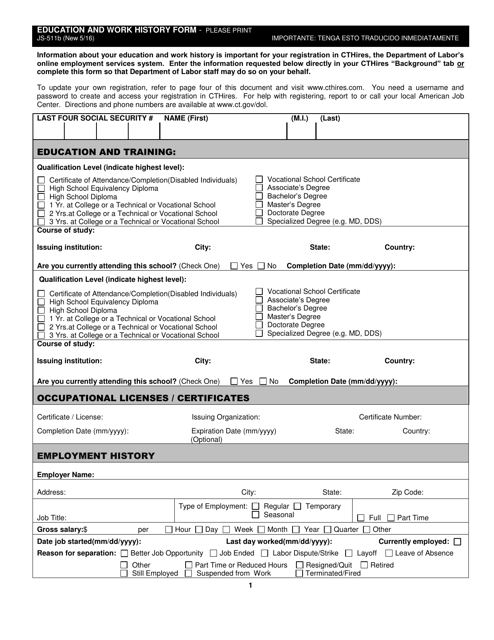

This Form is used for providing education and work history information in the state of Connecticut.

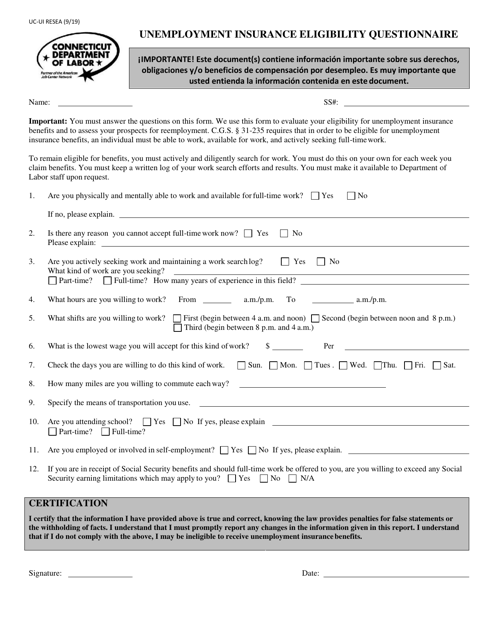

This Form is used for the UC-UI RESEA Unemployment Insurance Eligibility Questionnaire in Connecticut. It is used to assess eligibility for unemployment insurance benefits and gather information from applicants.

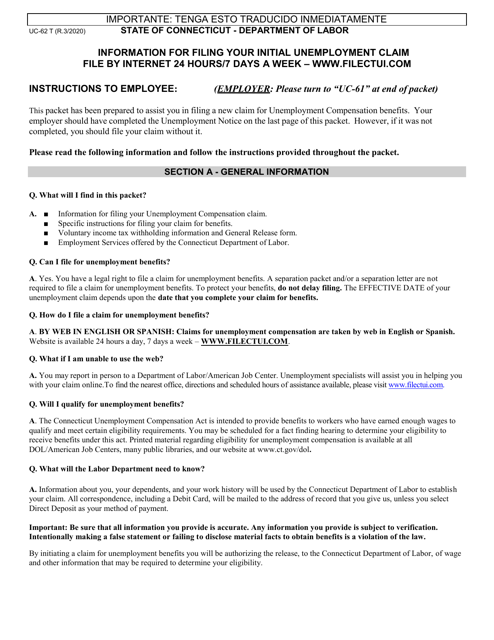

This document is for individuals who have been separated from their employment in the state of Connecticut and are filing for unemployment benefits. The UC-62 T form is part of the Unemployment Separation Package and must be completed to initiate the claims process.

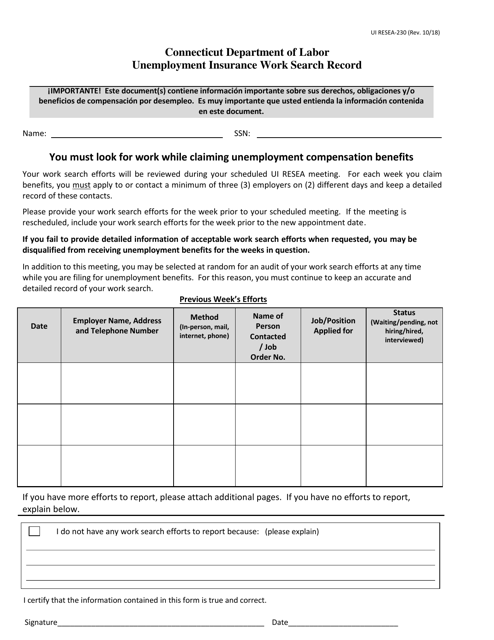

This Form is used for recording work search activities while collecting unemployment insurance in the state of Connecticut. It is important for individuals to keep a record of their job search efforts to maintain eligibility for unemployment benefits.

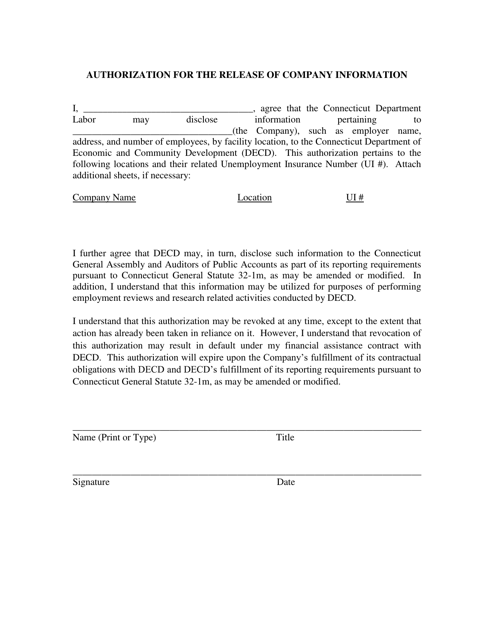

This form authorizes the release of company information in the state of Connecticut.

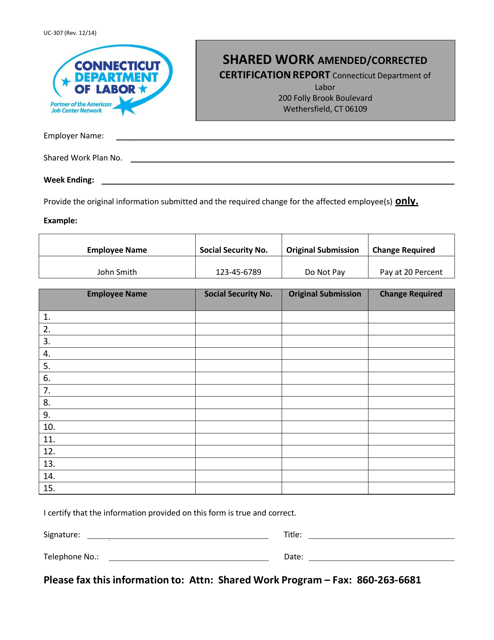

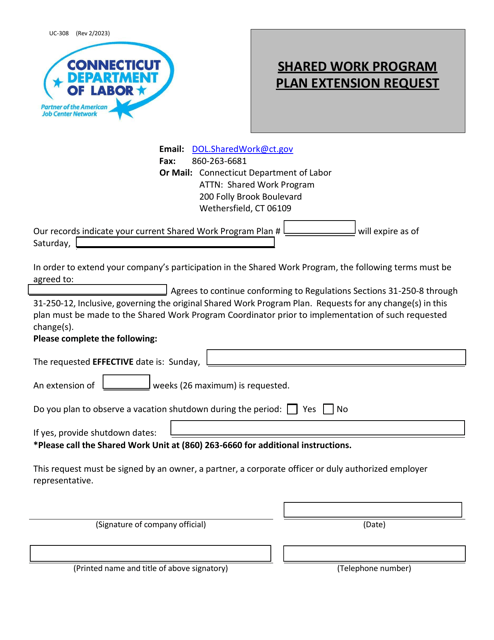

This form is used for submitting an amended or corrected certification report for the Shared Work program in Connecticut.

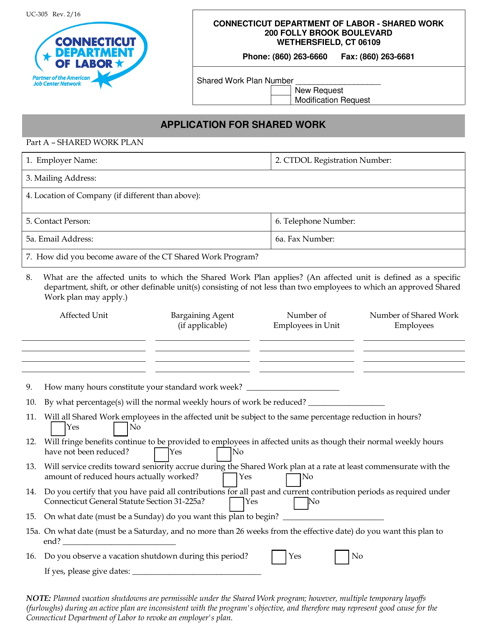

This form is used for applying for the Shared Work program in Connecticut. Shared Work allows eligible employers to reduce hours and wages for a group of employees instead of implementing layoffs.

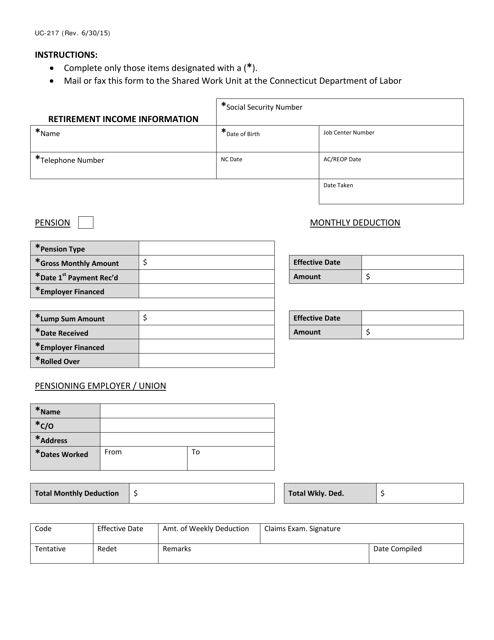

This Form is used for providing retirement income information in the state of Connecticut.

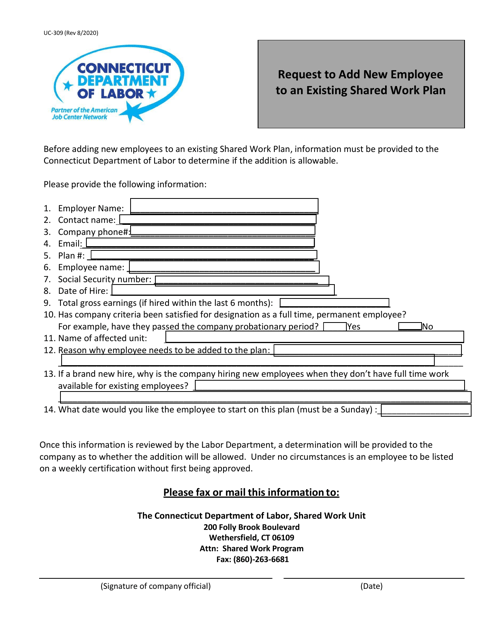

This form is used for Connecticut employers who want to add a new employee to an existing shared work plan. Shared work plans allow employers to reduce the work hours of their employees during a temporary slowdown, while the employees receive partial unemployment benefits to help make up for the lost wages.

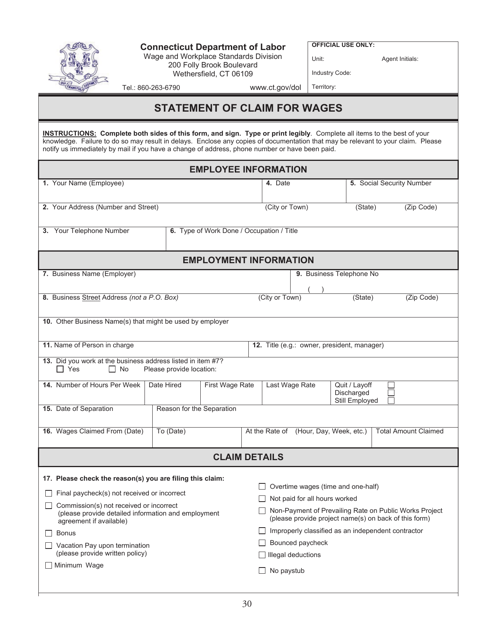

This Form is used for filing a claim for unpaid wages in the state of Connecticut. The Form WCA-1 allows employees to seek compensation for wages that have not been paid by their employer.

This form is used for employers in Connecticut to report their status for unemployment compensation.

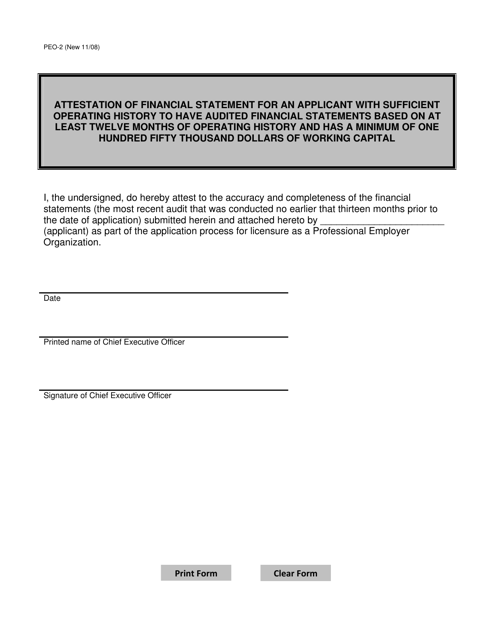

This form is used for attesting the financial statement of an applicant in Connecticut who has a sufficient operating history with audited financial statements based on at least twelve months of operating history and a minimum of one hundred fifty thousand dollars of working capital.

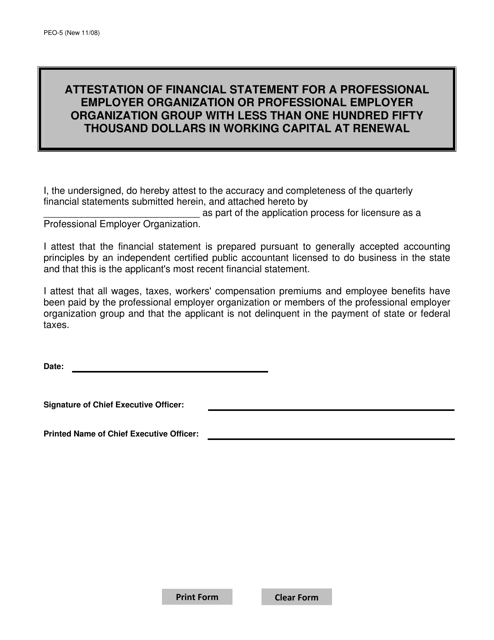

This form is used for professional employer organizations or professional employer organization groups in Connecticut with less than $150,000 in working capital to attest their financial statements at renewal.

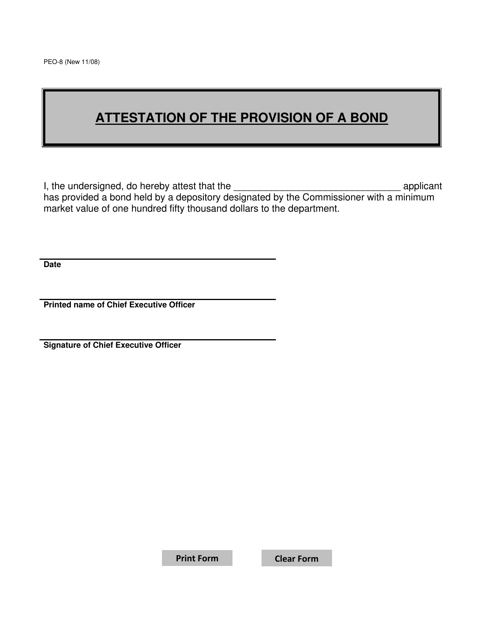

This form is used for attesting the provision of a bond in the state of Connecticut.

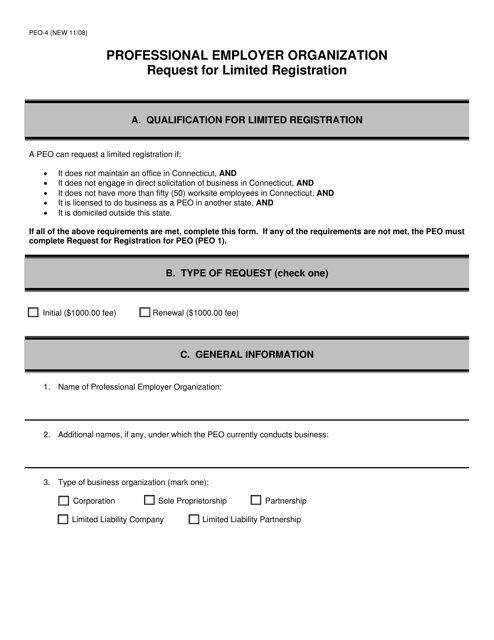

This form is used for requesting limited registration as a Professional Employer Organization (PEO) in the state of Connecticut.

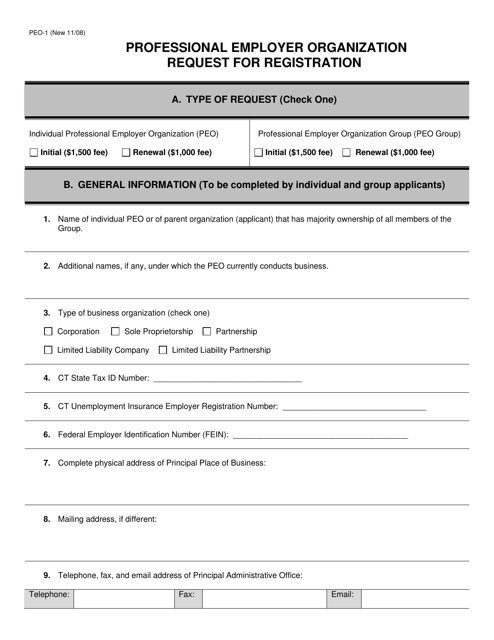

This Form is used for requesting registration as a Professional Employer Organization (PEO) in the state of Connecticut.

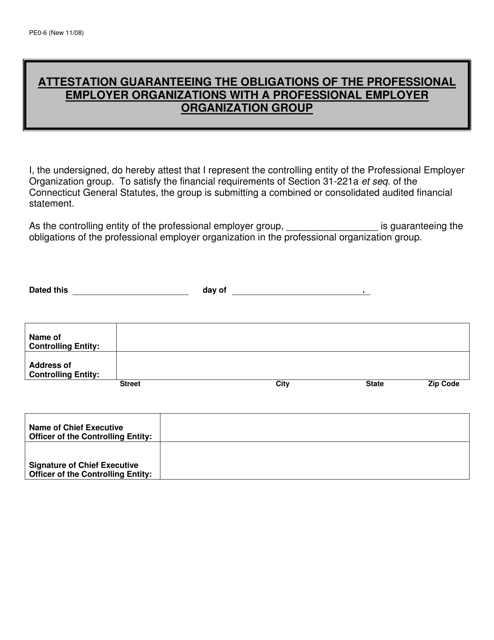

This form is used for attestation guaranteeing the obligations of Professional Employer Organizations (PEOs) with a Professional Employer Organization Group in Connecticut.

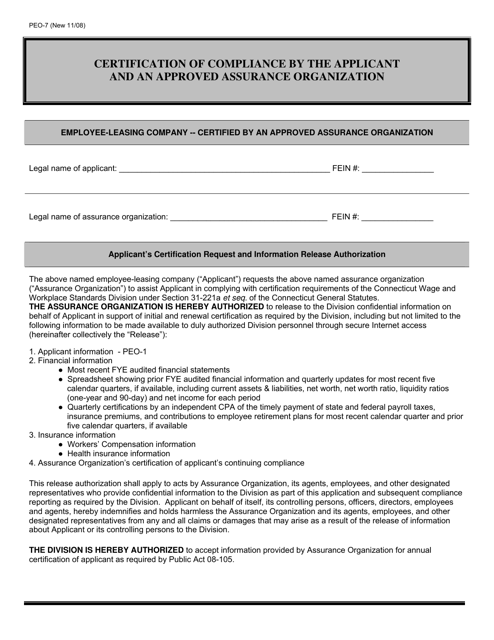

This form is used for certification of compliance by the applicant and an approved assurance organization in the state of Connecticut.

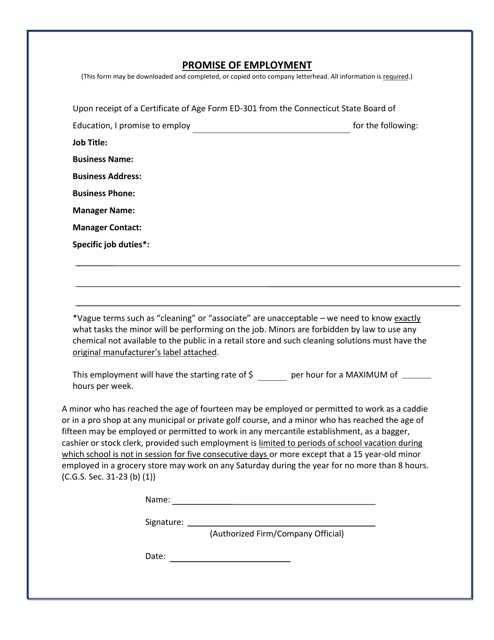

This document is a promise of employment in the state of Connecticut. It outlines the terms and conditions of the job offer and serves as a formal agreement between the employer and the employee.