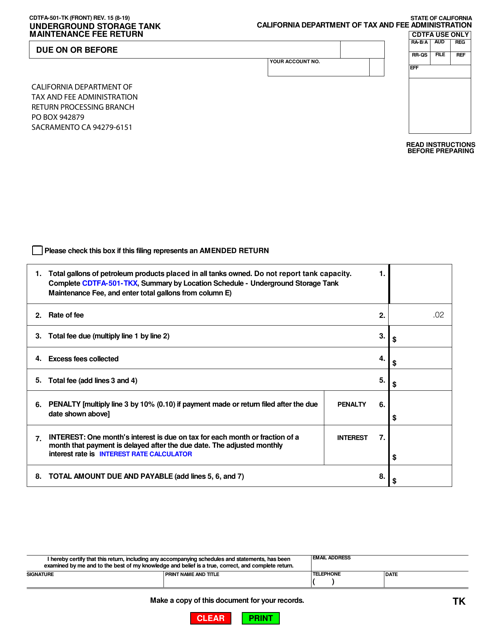

California Department of Tax and Fee Administration Forms

The California Department of Tax and Fee Administration (CDTFA) is responsible for administering various tax and fee programs in the state of California. Their main purpose is to collect and enforce the collection of taxes and fees that are necessary to fund various state government programs and services. The CDTFA ensures compliance with tax and fee laws, issues licenses and permits, processes tax returns, and provides assistance and support to taxpayers in meeting their tax obligations.

Documents:

417

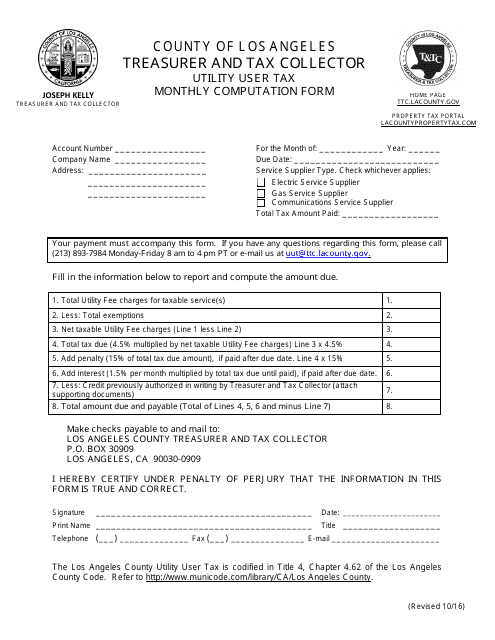

This document is used for calculating the monthly utility user tax in Los Angeles County, California. It is necessary for individuals and businesses to pay this tax based on their utility usage.

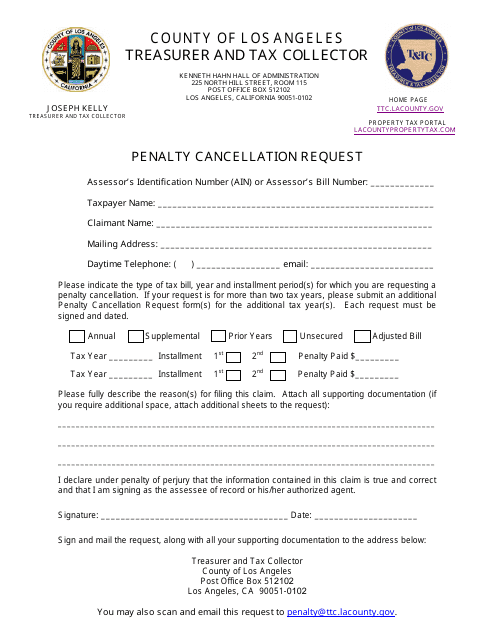

This type of document is used for requesting the cancellation of penalties in Los Angeles County, California.

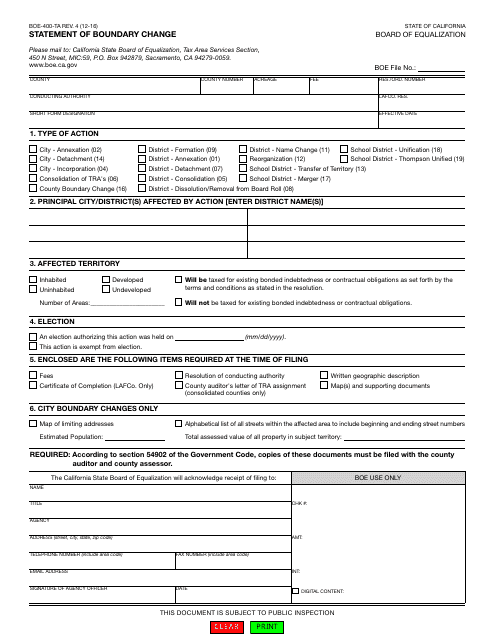

This form is used for reporting boundary changes in California.

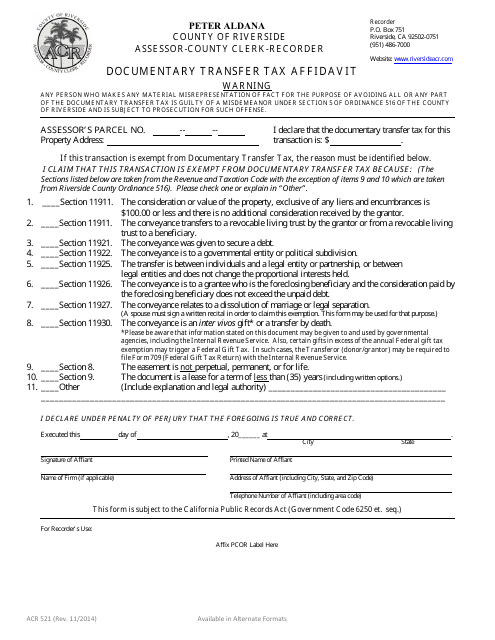

This Form is used for filing a Documentary Transfer Tax Affidavit in Riverside County, California. It is required when transferring real property and helps the county assess the appropriate transfer tax.

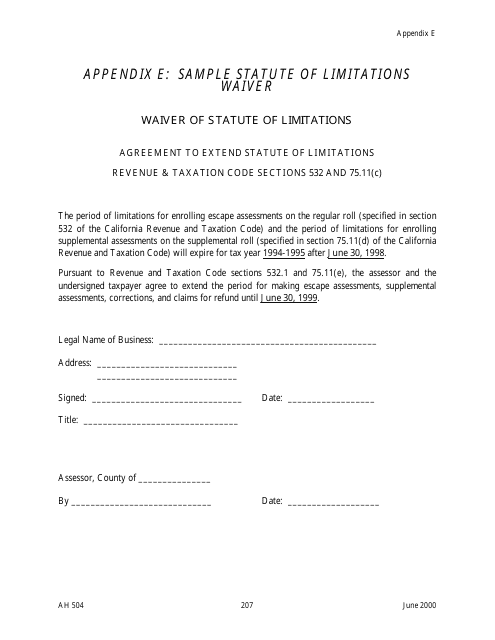

This document is a sample statute of limitations waiver form for use in California. It is used to waive the time limit within which a legal claim or lawsuit can be brought.

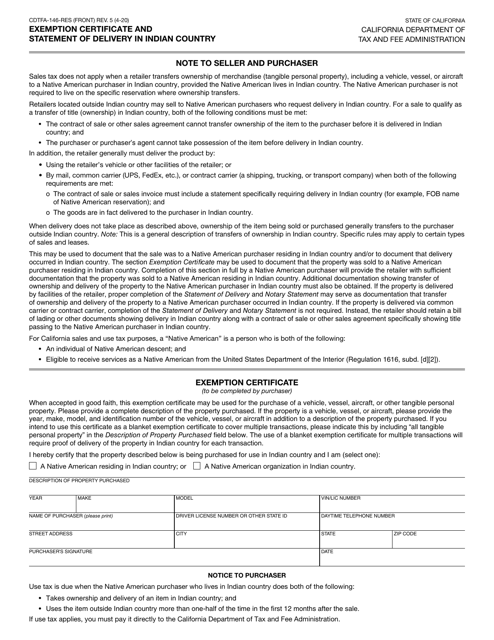

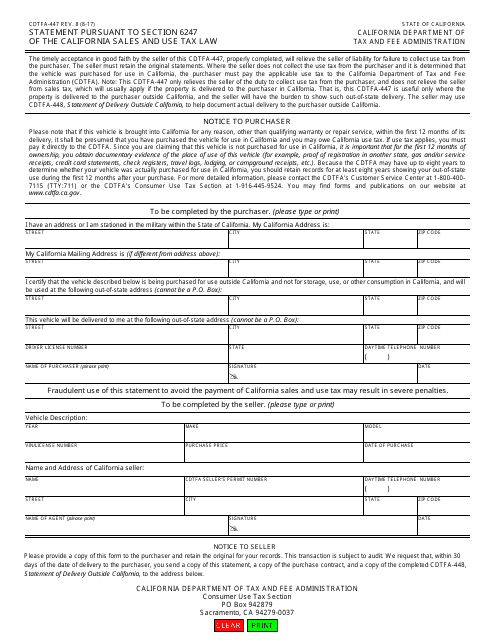

This Form is used for submitting a statement required by Section 6247 of the California Sales and Use Tax Law. It pertains to the calculation and reporting of sales and use taxes in the state of California.

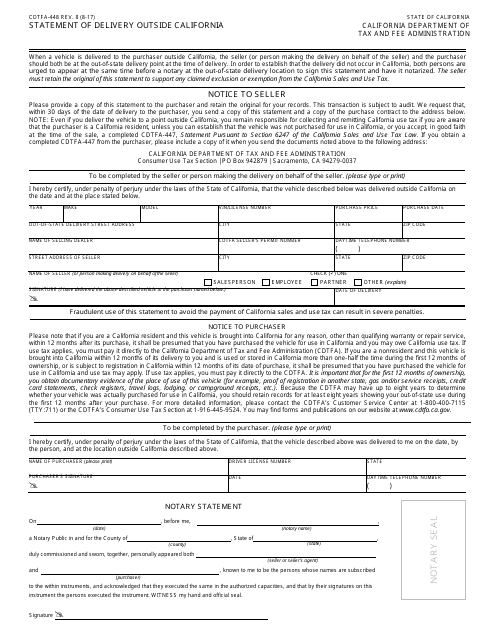

This Form is used for reporting deliveries that occur outside of California by California businesses.

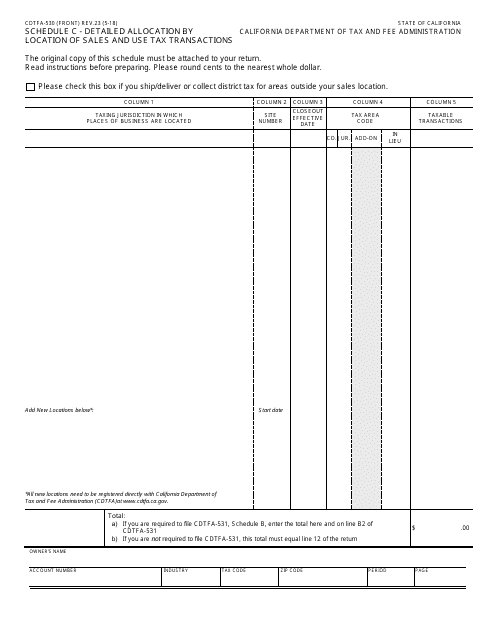

This form is used for providing a detailed allocation of sales and use tax transactions by location in the state of California.

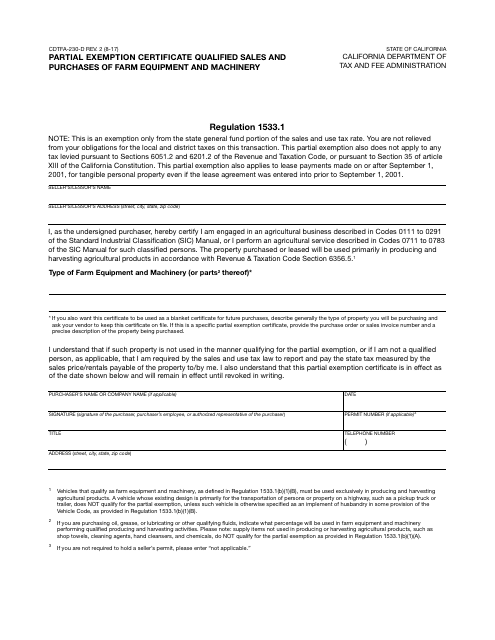

This form is used for claiming partial exemption on sales and purchases of farm equipment and machinery in California.

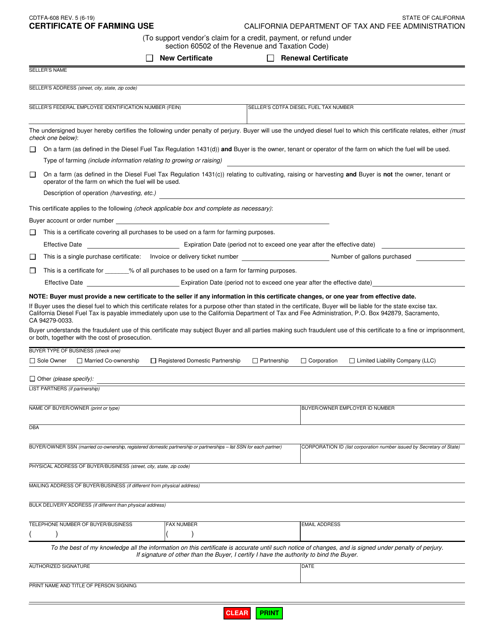

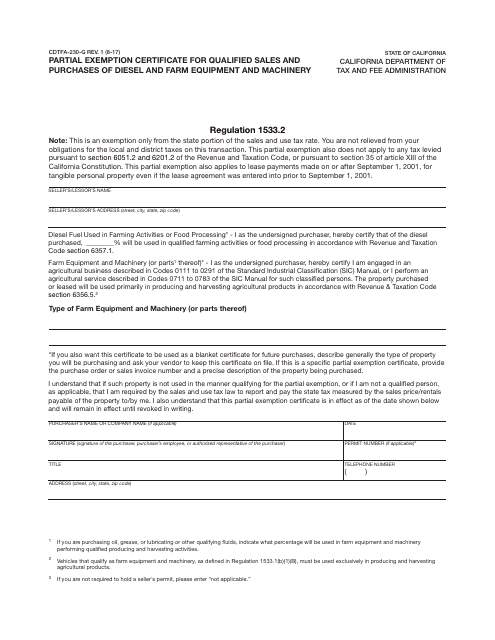

This form is used for claiming a partial exemption on sales and purchases of diesel and farm equipment and machinery in California. It allows businesses to reduce the amount of sales and use tax they owe on these eligible items.

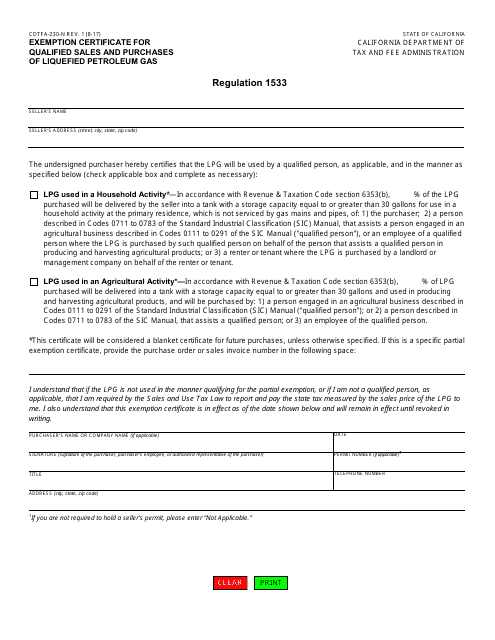

This form is used for claiming exemption from sales and purchases of Liquefied Petroleum Gas in California. By submitting this form, qualified individuals and businesses can avoid paying sales tax on such transactions.

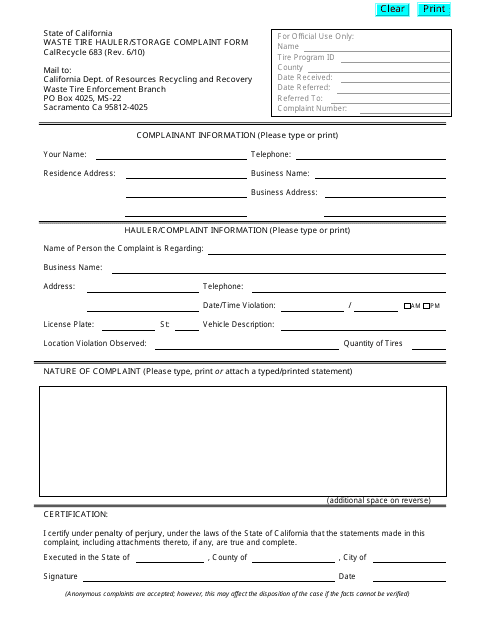

This form is used for filing a complaint related to waste tire haulers or storage in California.

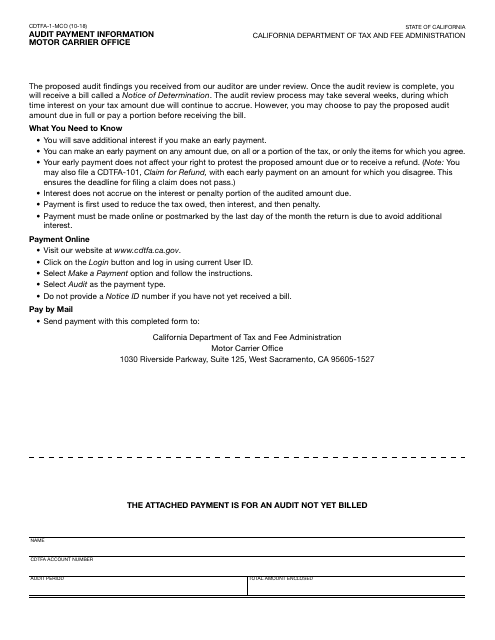

This form is used for providing payment information for an audit conducted by the Motor Carrier Office in California.

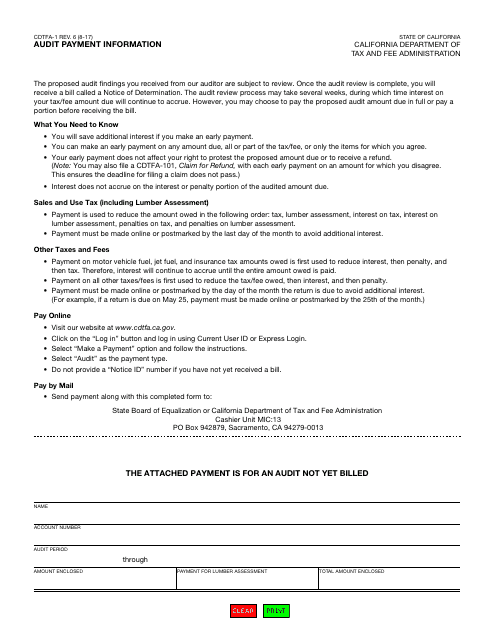

This Form is used for providing audit payment information to the California Department of Tax and Fee Administration (CDTFA).

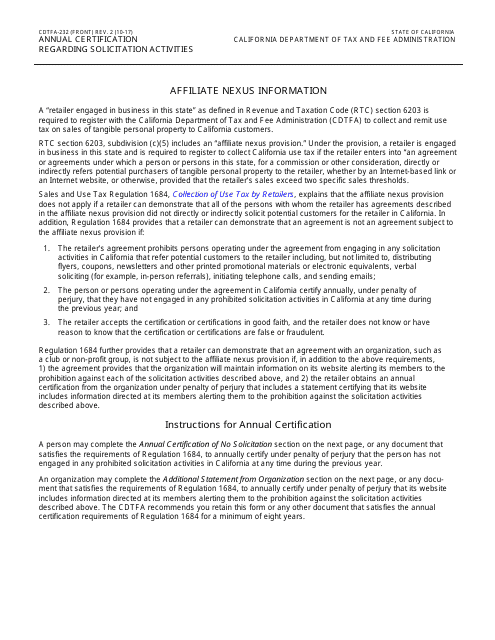

This Form is used for the Annual Certification Regarding Solicitation Activities in California. It is a document that businesses use to certify their compliance with state regulations regarding solicitation activities.

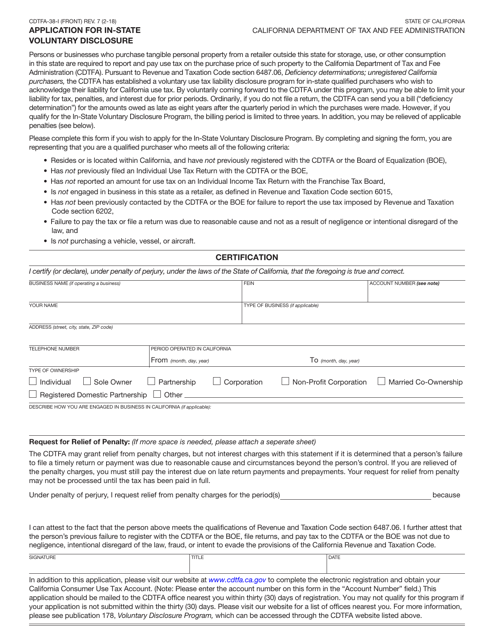

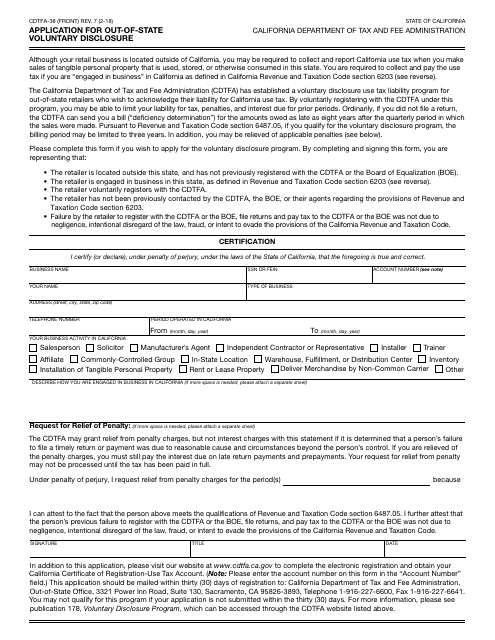

This Form is used for applying for out-of-state voluntary disclosure in California.

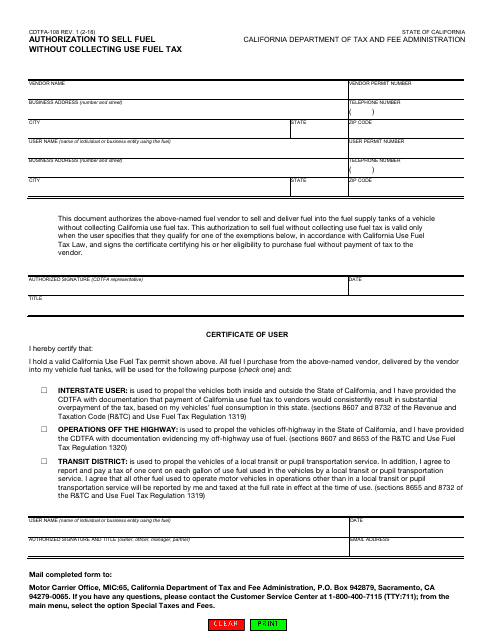

This document is used in California to apply for authorization to sell fuel without collecting the use fuel tax.

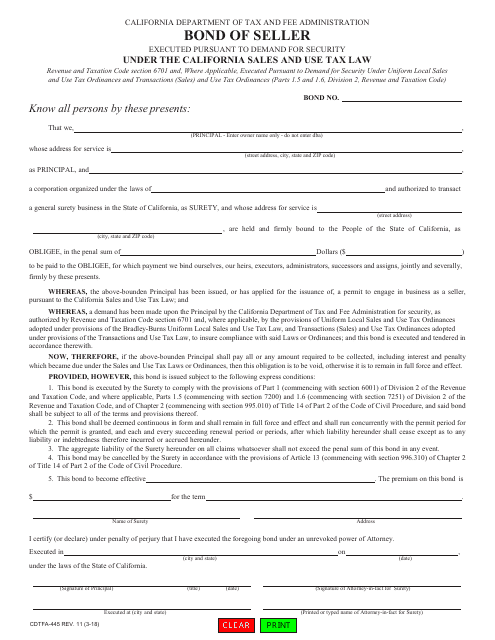

This form is used for sellers in California to obtain a bond as a requirement for certain business activities.

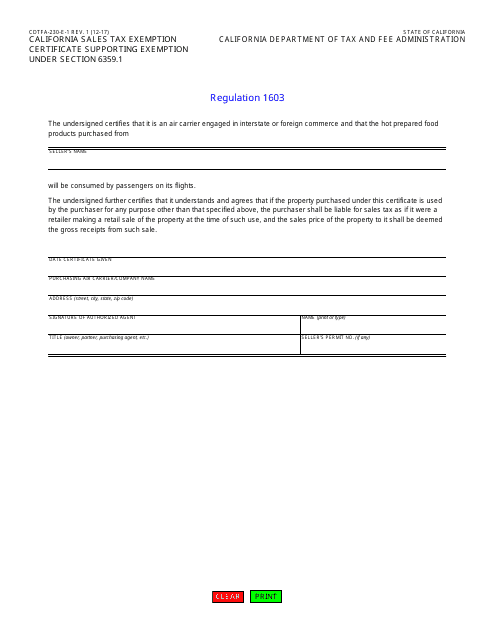

This form is used for requesting a sales tax exemption in California under Section 6359.1. It is used to support the exemption claim and provide documentation for the exemption.

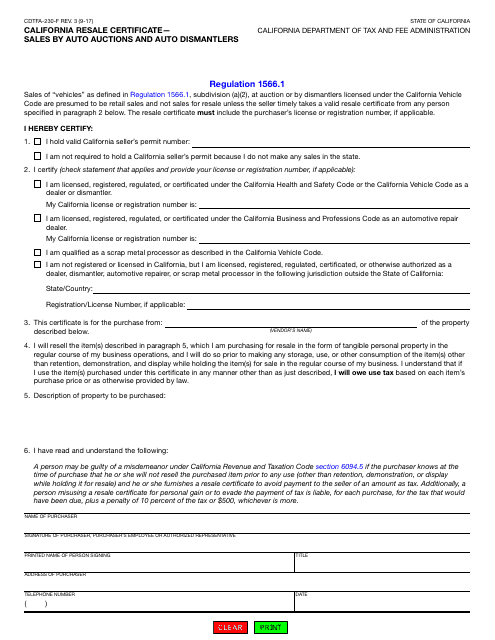

This form is used for California auto auctions and auto dismantlers to certify their eligibility for tax exemptions on sales made for resale purposes.

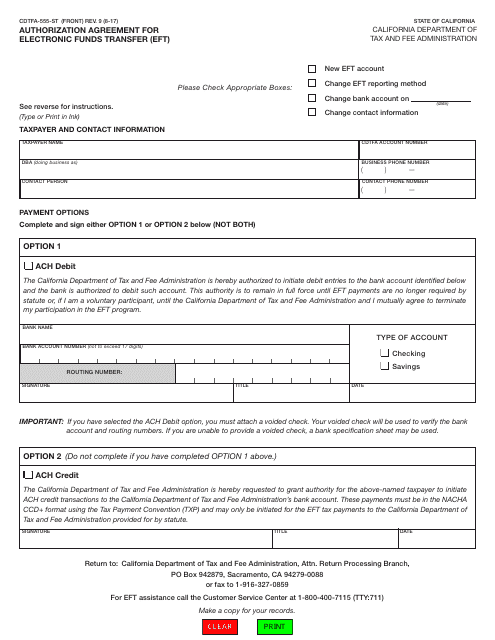

This form is used for authorizing electronic funds transfer (EFT) in California.

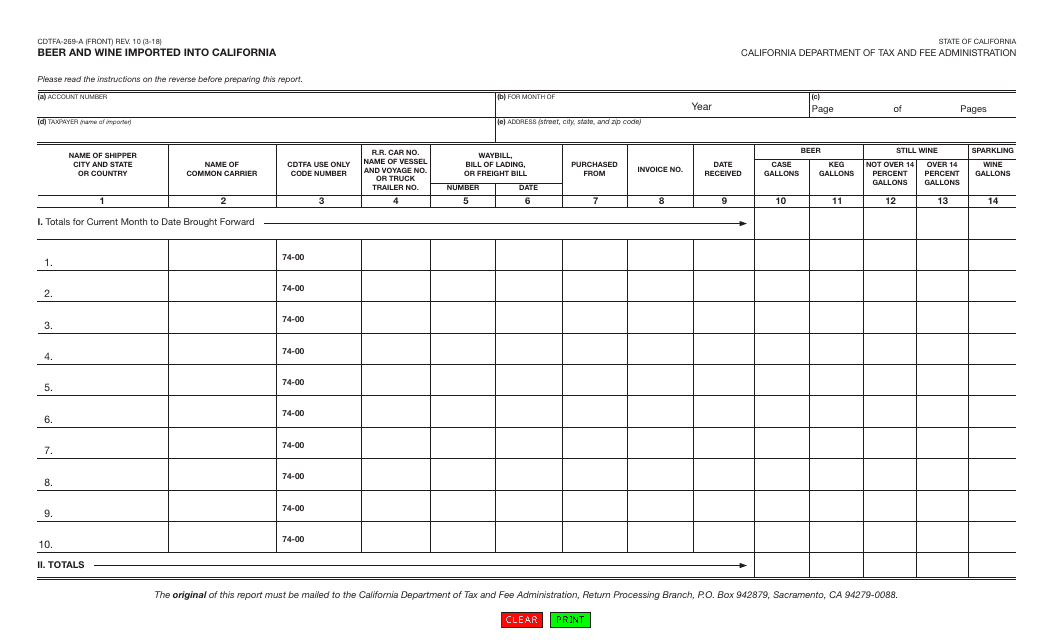

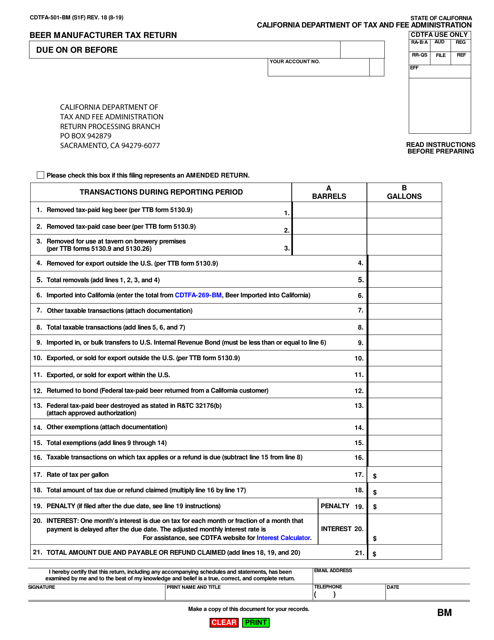

This form is used for reporting the importation of beer and wine into California. It is required by the California Department of Tax and Fee Administration (CDTFA). The form helps track and monitor the importation of alcoholic beverages in the state.

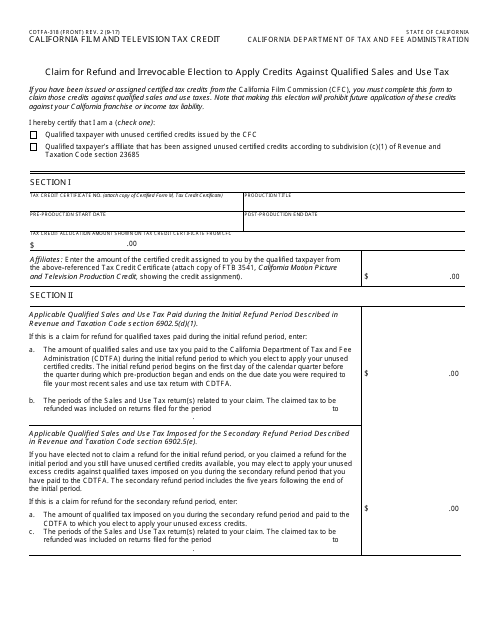

This form is used for applying for the California Film and Television Tax Credit in California.

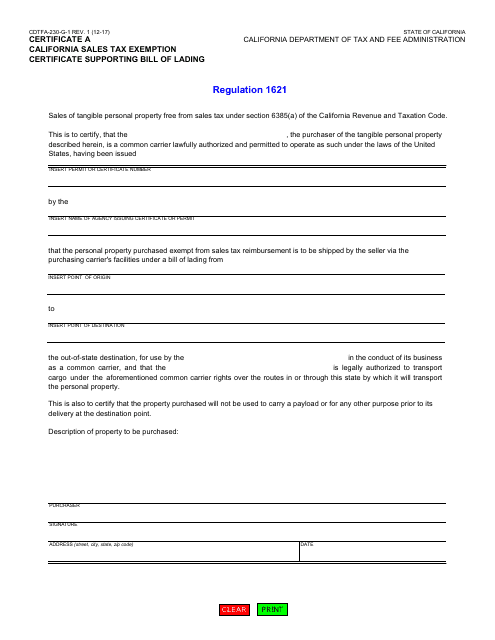

This Form is used for claiming sales tax exemption in California with the supporting document - Bill of Lading.

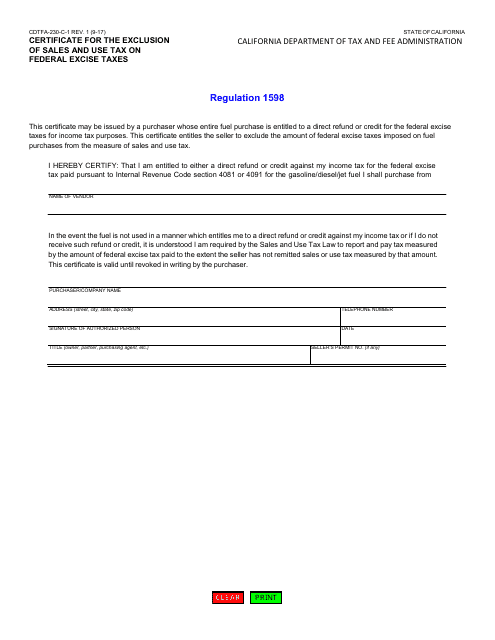

This form is used for certifying the exclusion of sales and use tax on federal excise taxes in California.

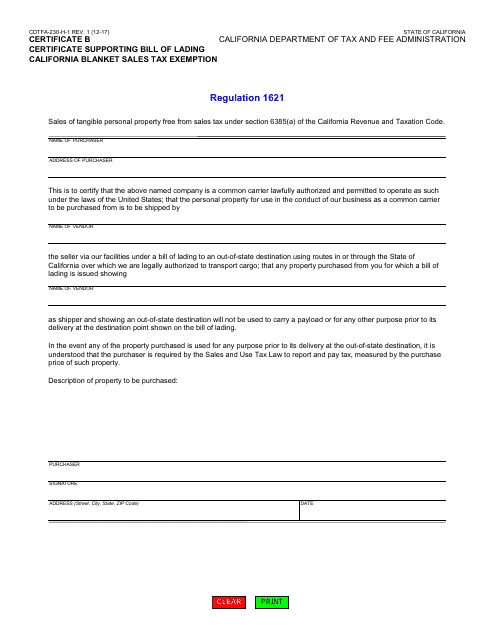

This form is used for requesting a Certificate B Certificate Supporting Bill of Lading. It is specifically for claiming a blanket sales tax exemption in California.