Arizona Department of Revenue Forms

The Arizona Department of Revenue (ADOR) is responsible for administering and enforcing Arizona's tax laws. Their main purpose is to collect state taxes, including income tax, sales tax, and property tax, and ensure compliance with state tax regulations. They also provide taxpayer assistance and education, process tax returns, and distribute tax refunds.

Documents:

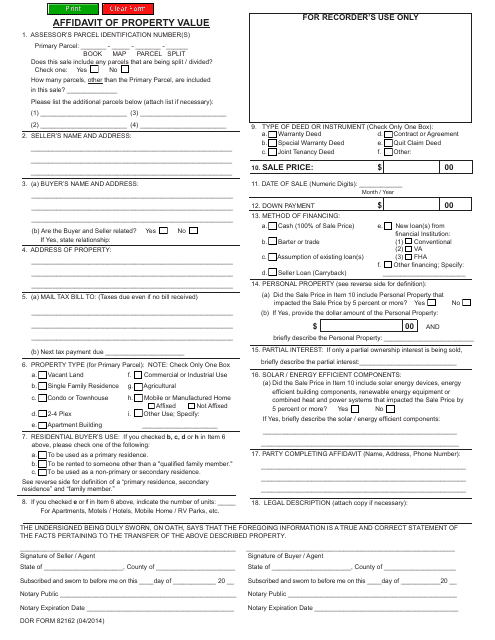

626

This form is used for declaring the value of property in the state of Arizona. It is an affidavit that provides information about the property and its estimated value.

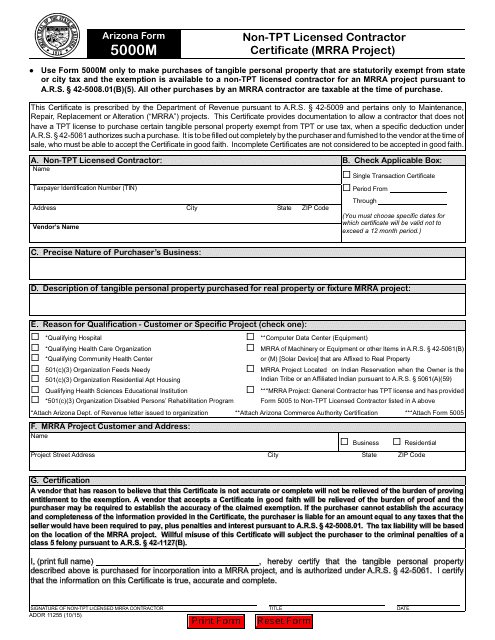

This form is used for obtaining a non-transaction privilege tax (TPT) certificate for licensed contractors in Arizona working on a Multi-Rate Realty Assessment (MRRA) project.

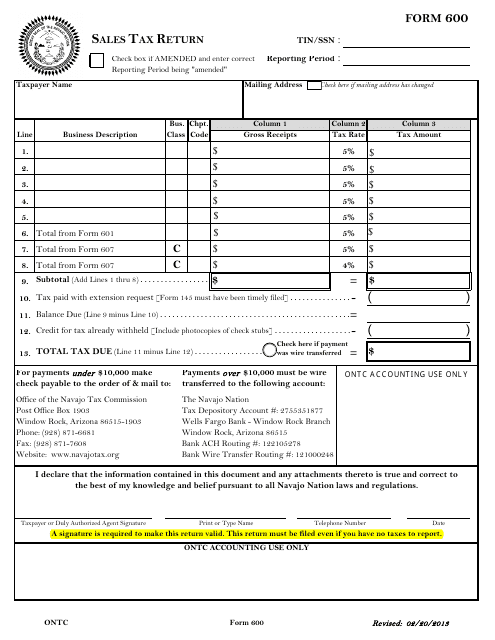

This form is used for reporting sales tax returns specifically for businesses operating on the Navajo Nation in Arizona.

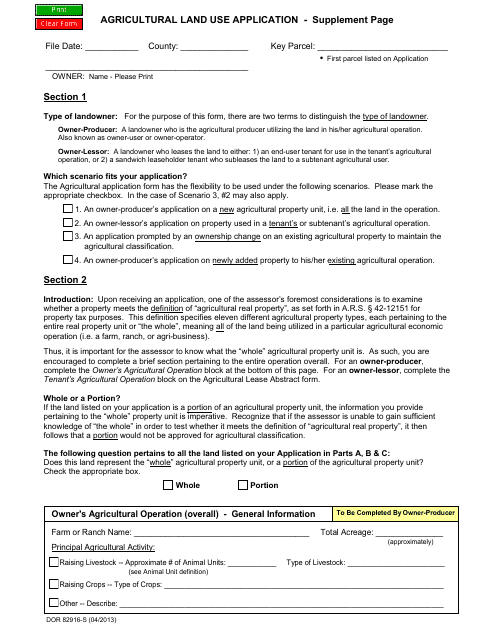

This form is used for submitting a supplementary page for an Agricultural Land Use Application in Arizona. It allows applicants to provide additional information about their agricultural land use.

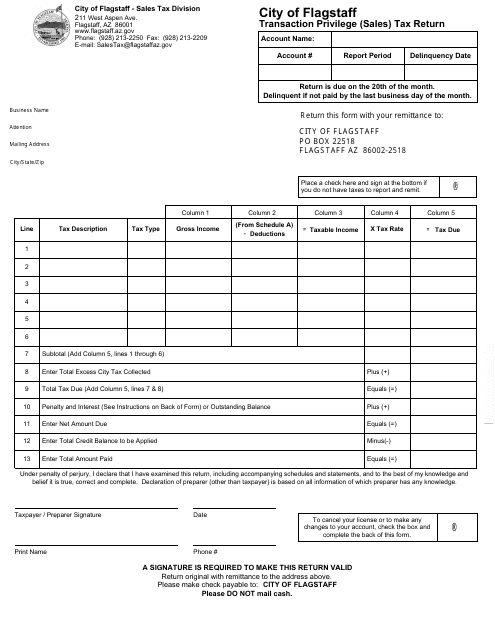

This document is used for filing sales tax returns with the City of Flagstaff, Arizona.

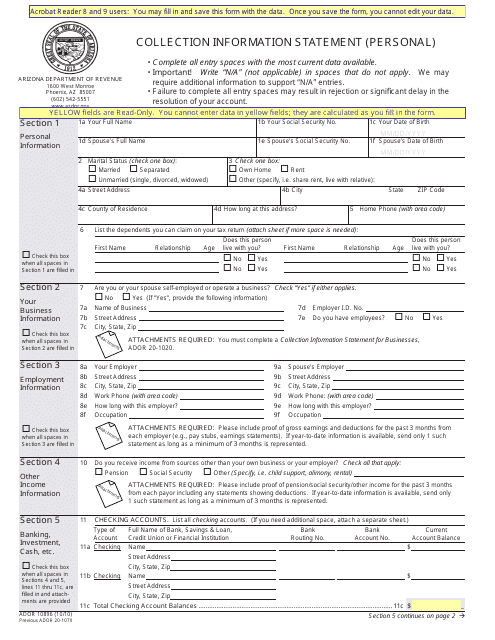

This Form is used for providing personal financial information to the Arizona Department of Revenue.

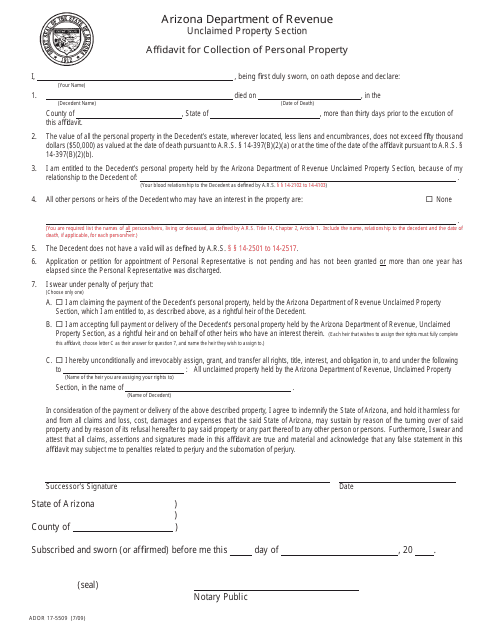

This form is used for the collection of personal property in Arizona. It allows individuals to make an affidavit for the collection of personal property.

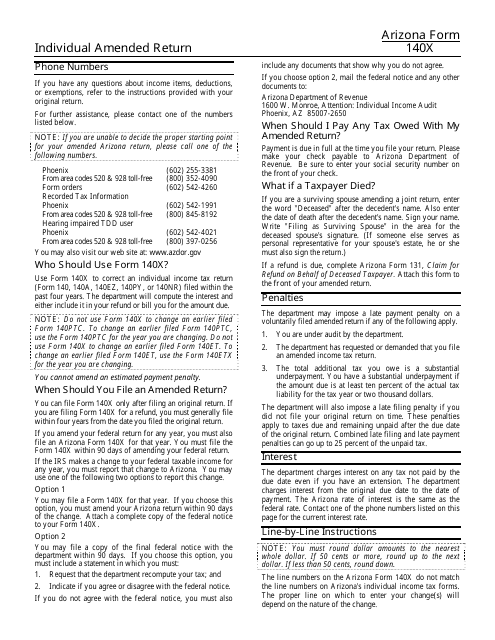

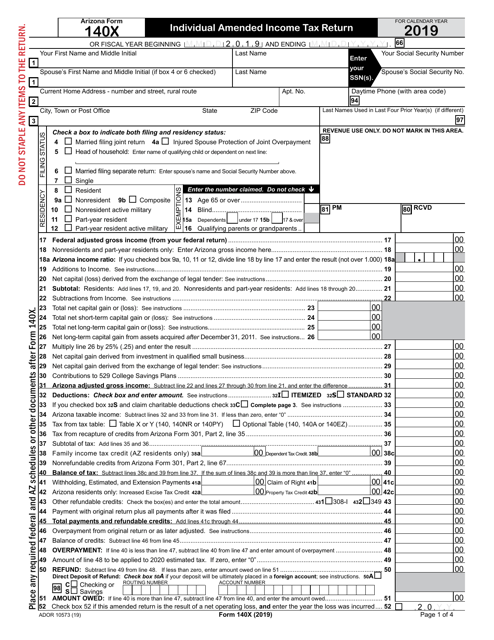

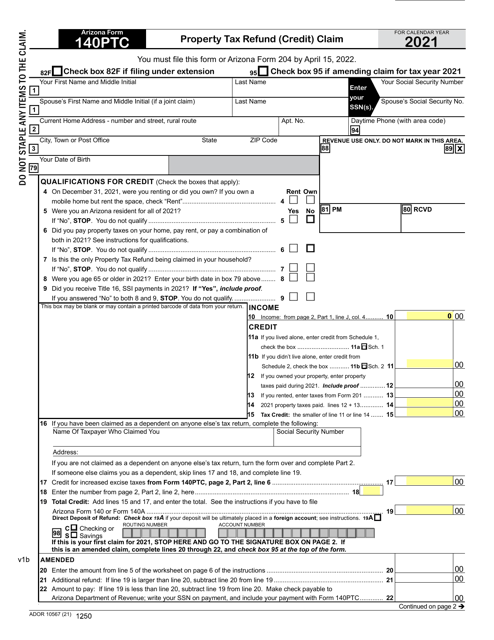

This Form is used for filing an amended individual tax return in the state of Arizona. It allows taxpayers to make corrections or updates to their previously filed Form 140.

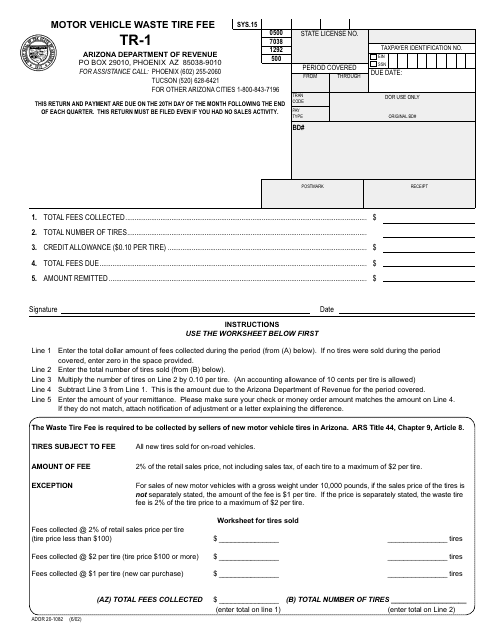

This form is used for reporting and paying the Motor Vehicle Waste Tire Fee in Arizona. It helps businesses and individuals comply with state regulations and contribute to tire recycling efforts.

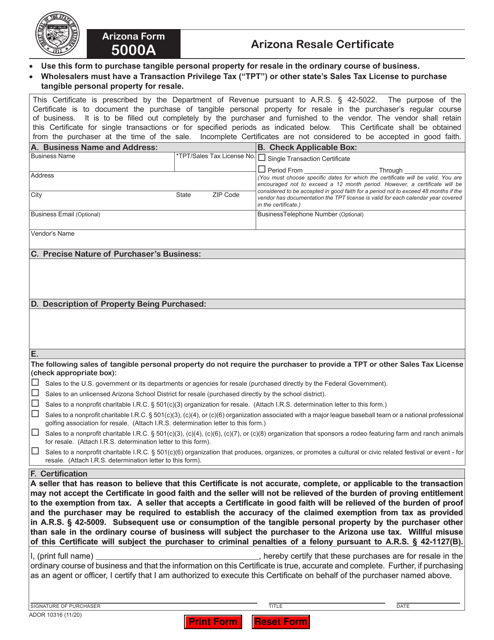

This form is released by Arizona's Department of Revenue and is supposed to be completely filled out and signed by a purchaser, and provided to a seller in order to document the purchase of a physical piece of personal property for resale.

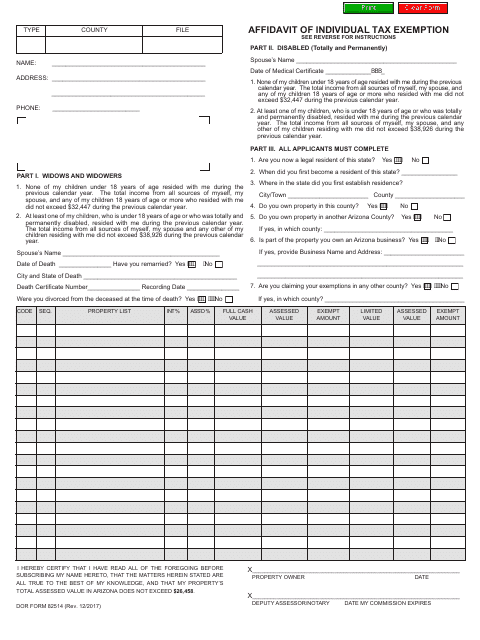

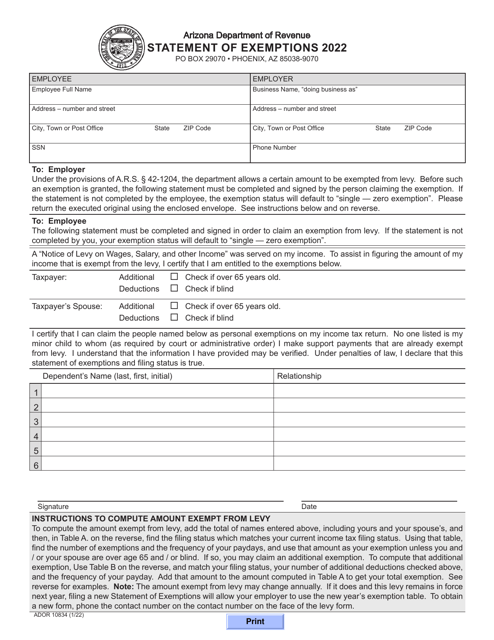

This form is used for individuals in Arizona to claim a tax exemption.

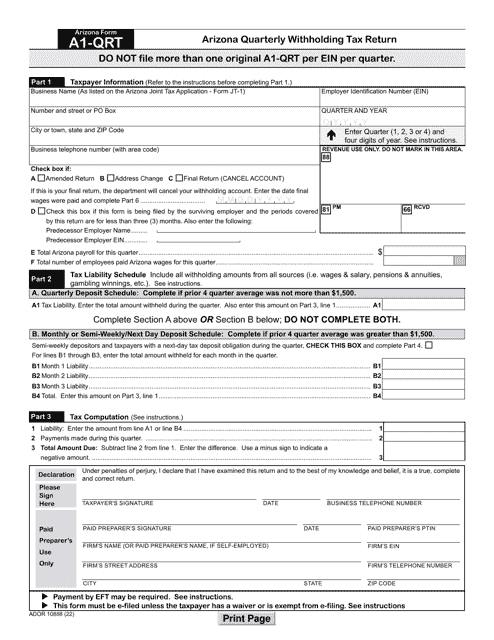

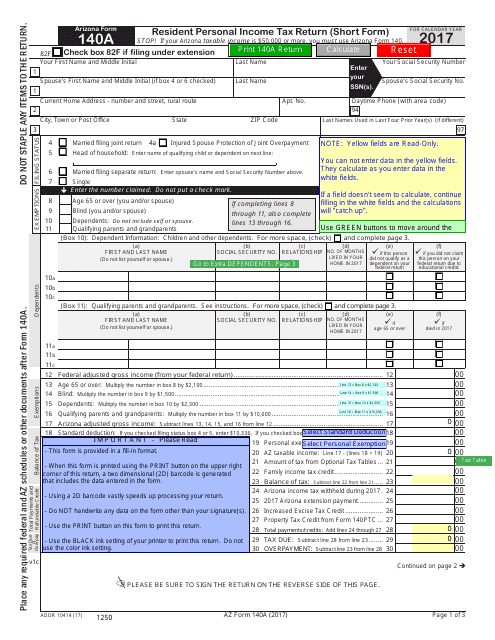

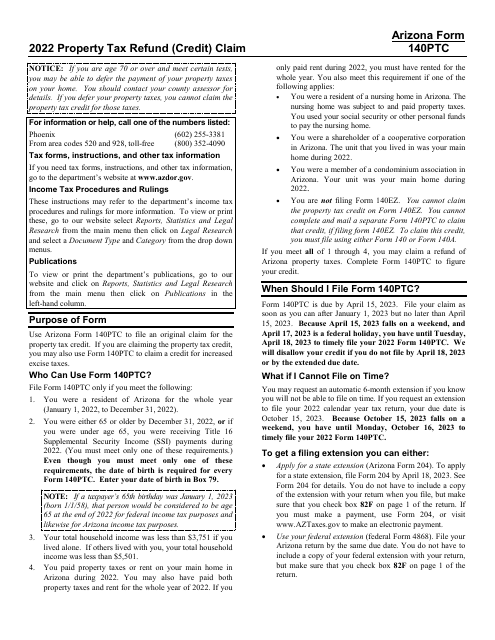

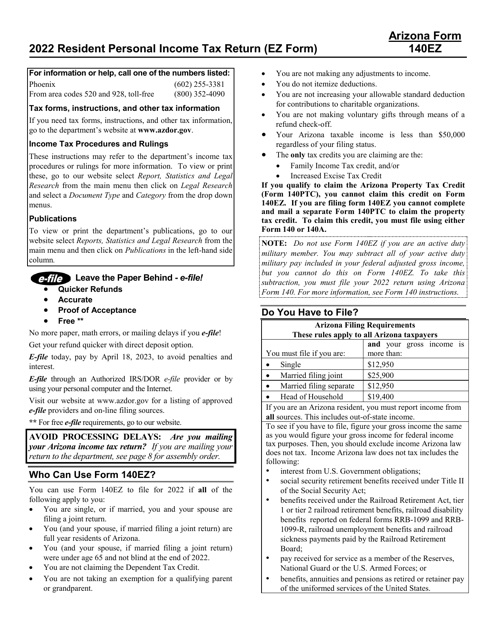

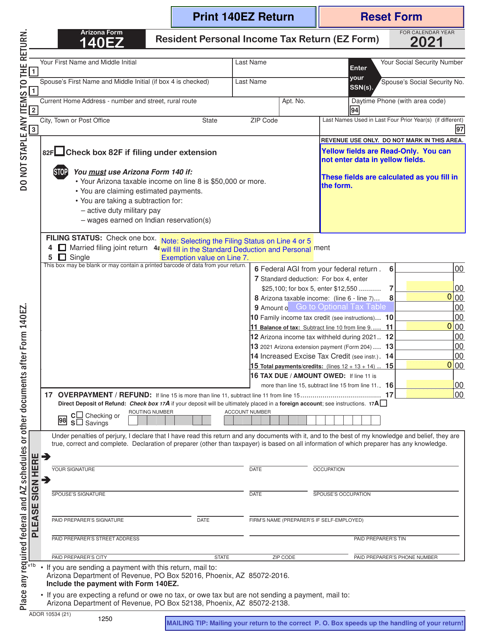

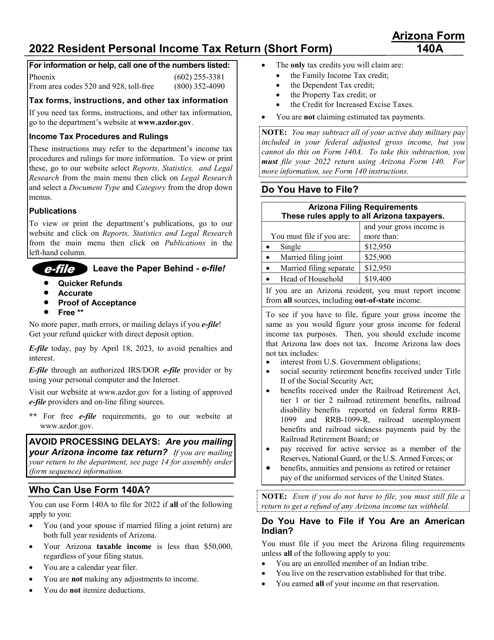

This Form is used for Arizona residents to file their personal income taxes using the short form.

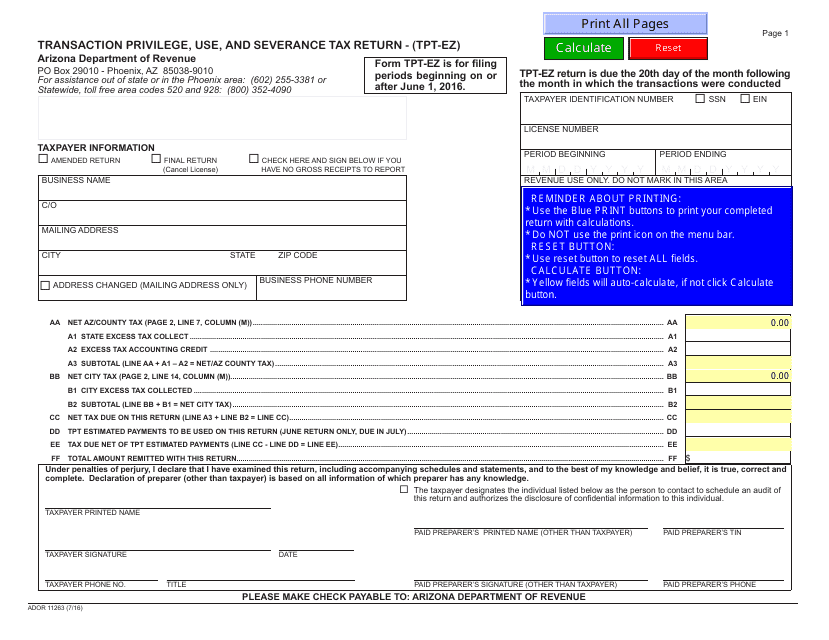

This form is used for reporting transaction privilege, use, and severance taxes in Arizona. It is commonly known as the TPT-EZ form.

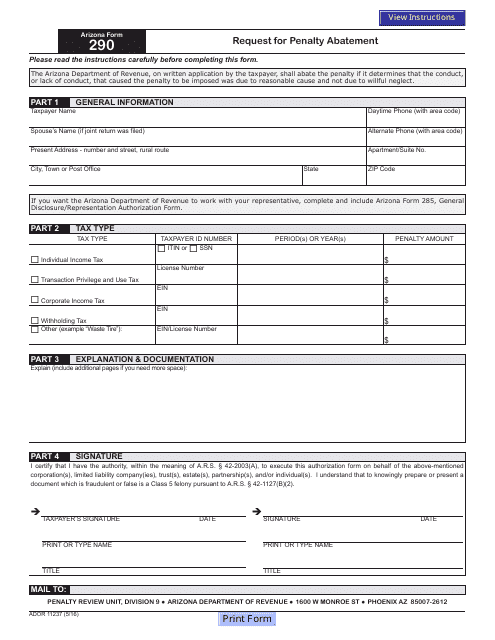

This Form is used for requesting penalty abatement in the state of Arizona.

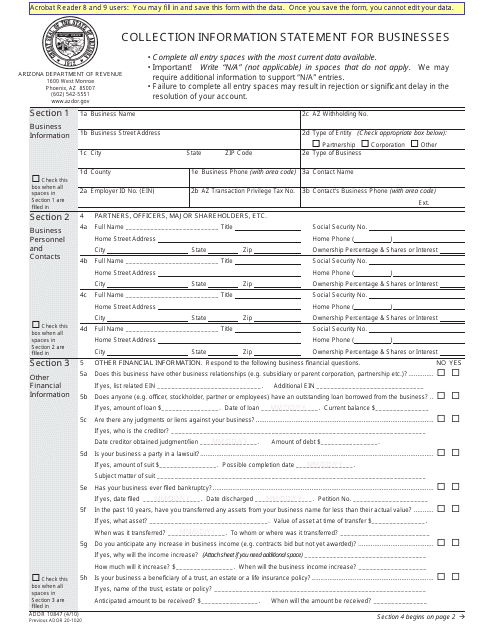

This form is used for businesses in Arizona to provide collection information to the Arizona Department of Revenue.

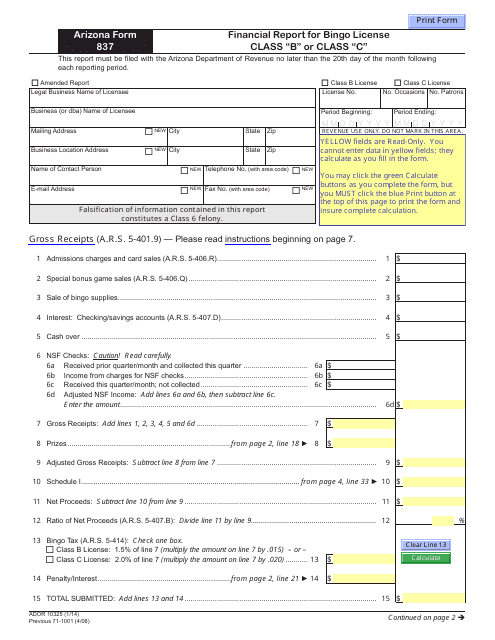

This form is used for submitting a financial report for a bingo license of Class "b" or Class "c" in the state of Arizona.

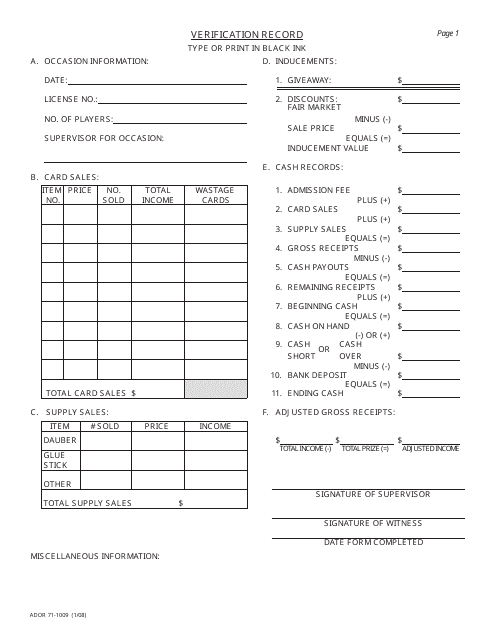

This form is used for maintaining a record of bingo game verification in Arizona.

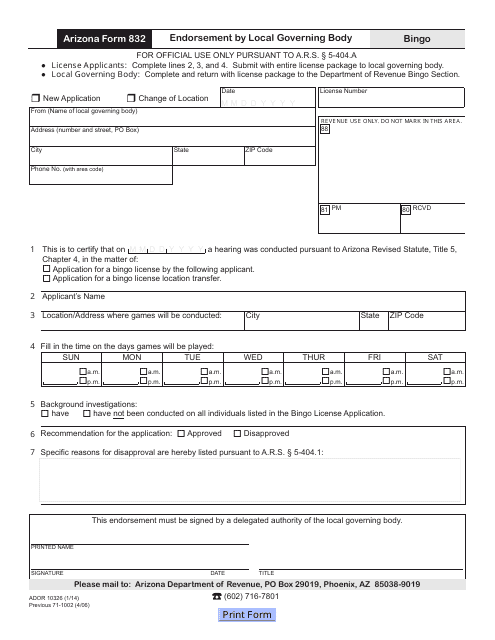

This form is used for getting endorsement by the local governing body in Arizona.

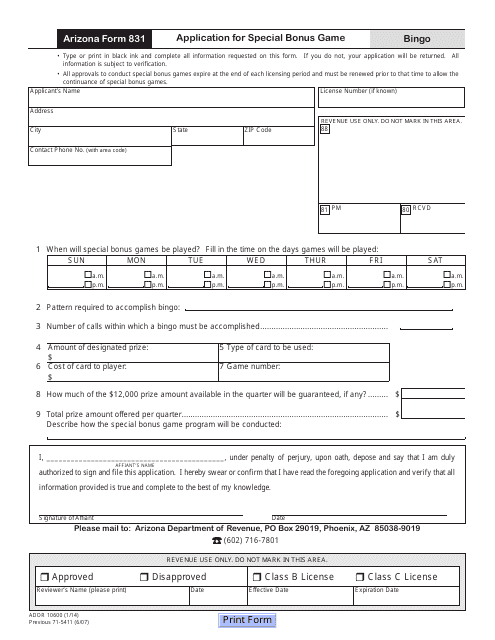

This Form is used for applying for the Special Bonus Game in Arizona. It is specifically for Arizona residents.

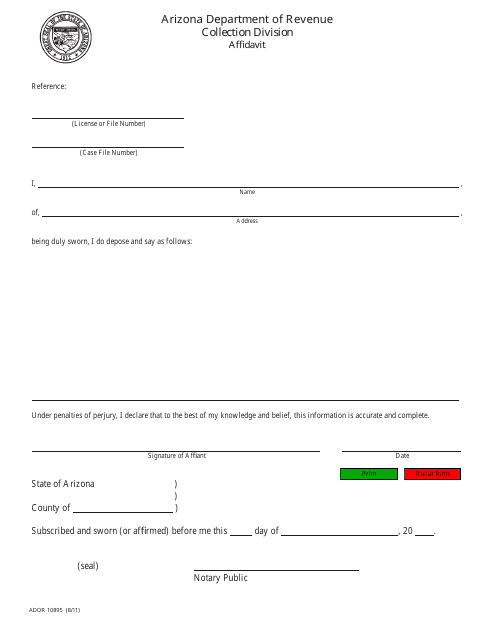

This form is used for submitting an affidavit with notary to the Collection Division in Arizona.

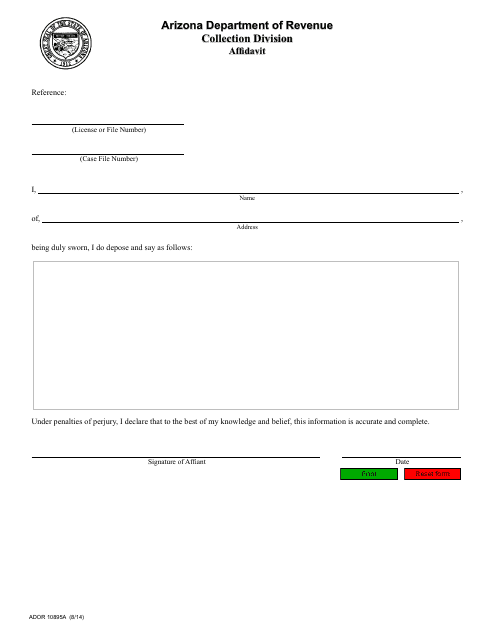

This form is used for submitting an affidavit without the need for a notary public in the state of Arizona.

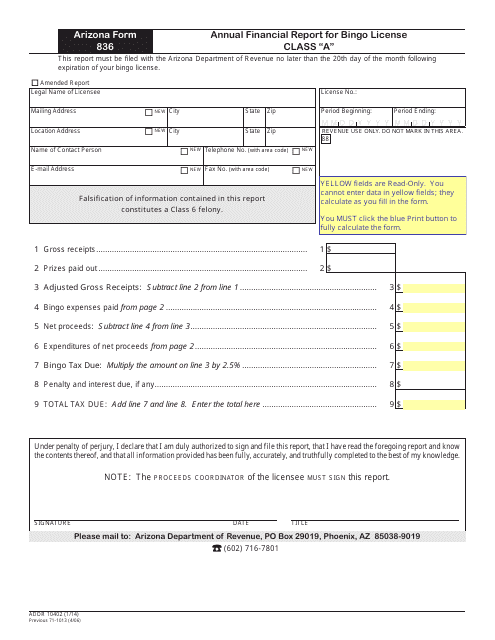

This document is for submitting the Annual Financial Report for Bingo License Class "a" in Arizona.

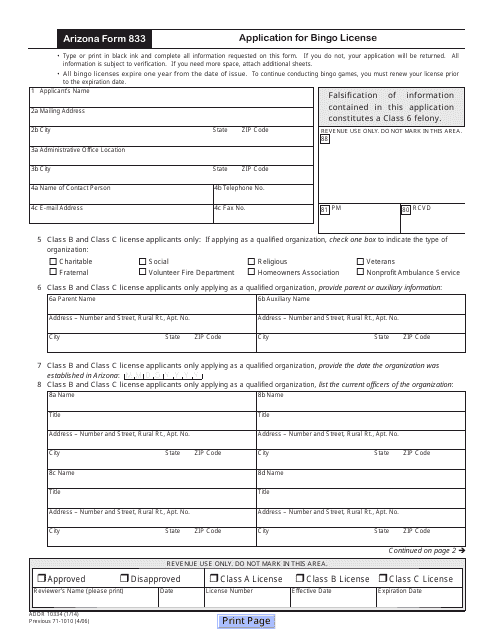

This Form is used for applying for a bingo license in the state of Arizona.

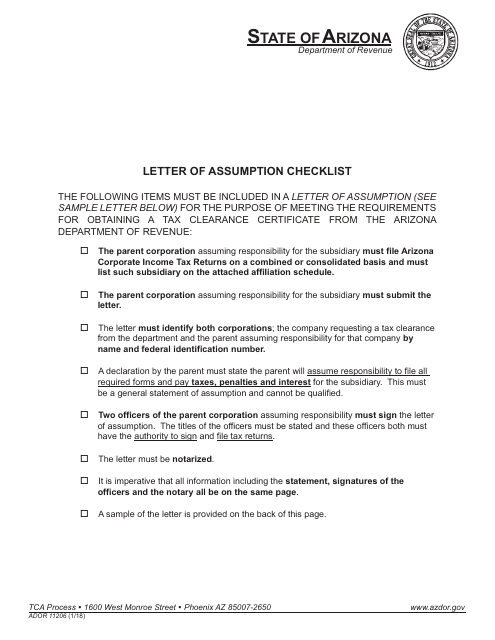

This form is used for providing a letter of assumption in the state of Arizona.

This form is used for submitting an offer-in-compromise to the Arizona Department of Revenue. It allows taxpayers to propose a settlement for their outstanding tax liabilities with the state of Arizona.

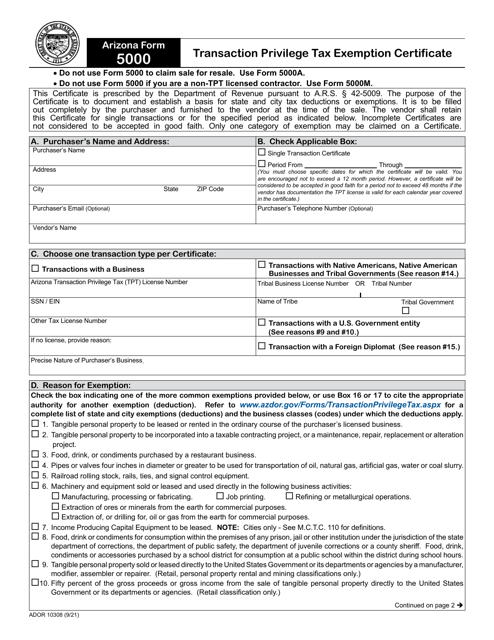

Transaction privilege tax (TPT) is a sales tax levied by the state of Arizona on vendors for the ability to conduct business in the state and this is a document that establishes the basis for state exceptions.

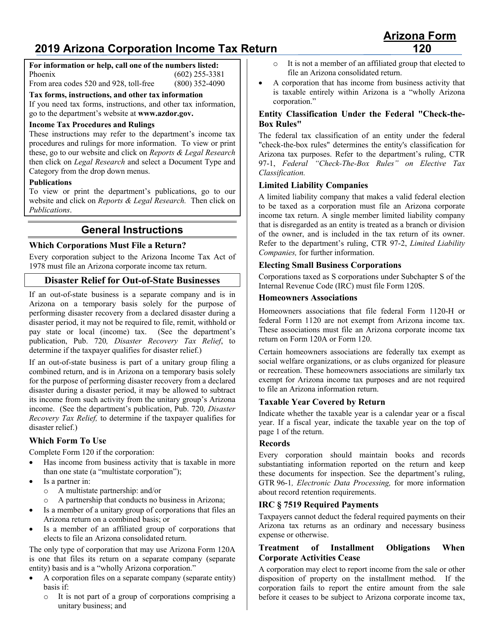

This Form is used for filing the Arizona Corporation Income Tax Return for businesses in Arizona. It provides instructions on how to properly fill out the form and comply with Arizona tax laws.