Alaska Department of Revenue Forms

The Alaska Department of Revenue is responsible for managing and administering various tax programs in the state of Alaska. Its main function is to collect and enforce the collection of taxes, such as income tax, property tax, motor fuel tax, and sales tax. The department also oversees the distribution of revenue to various government agencies and manages the Permanent Fund Dividend program, which provides an annual payment to eligible Alaskan residents.

Documents:

7

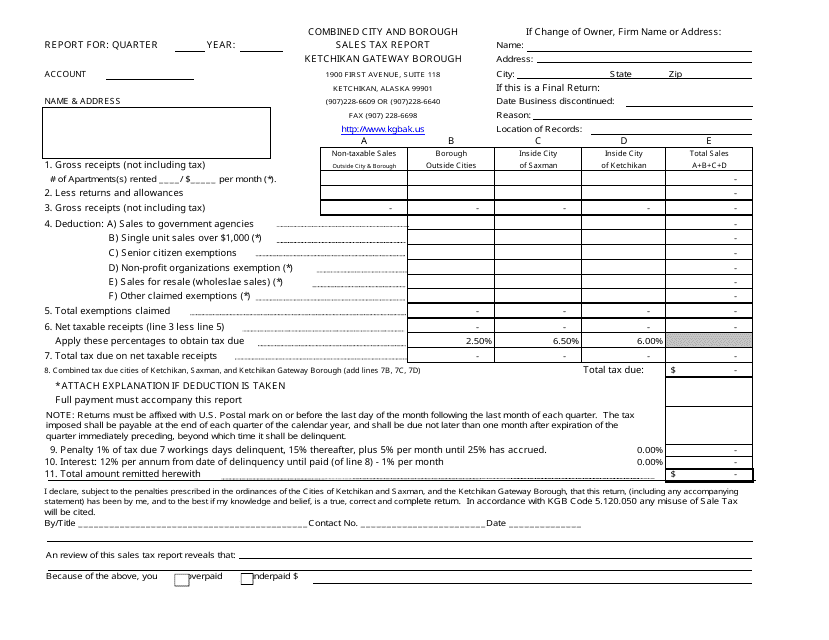

This document is a combined sales tax report for the Ketchikan Gateway Borough in Alaska. It includes information on the sales tax collected from both the city and borough within the area.

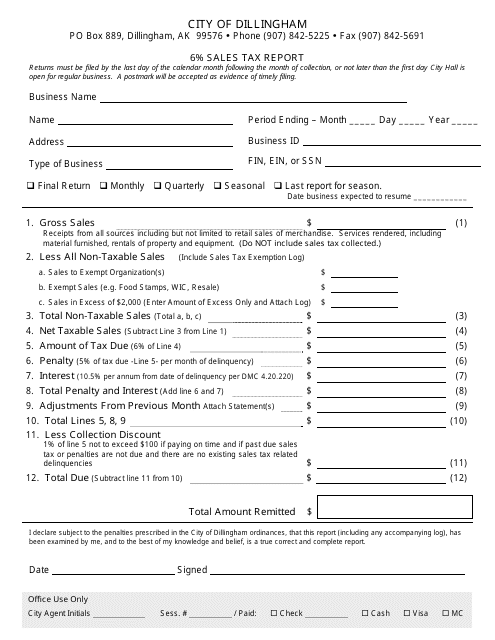

This form is used for reporting sales tax in Dillingham, Alaska. Businesses are required to fill out this form to show their sales tax amount, which is typically 6% of their total sales.

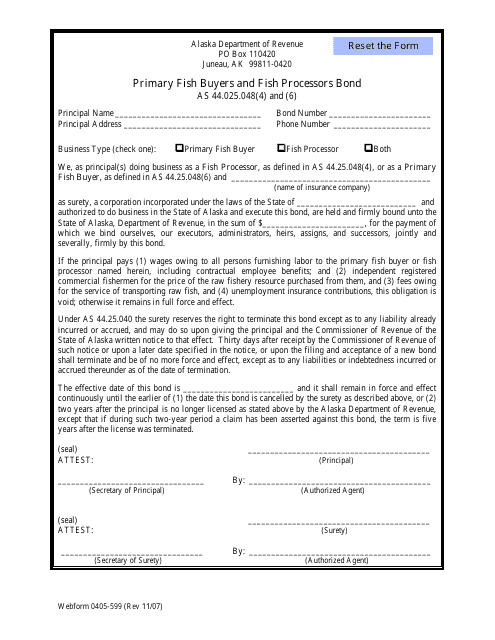

This form is used for obtaining a bond for primary fish buyers and fish processors in Alaska. It is a requirement for those involved in the fishing industry to ensure compliance with regulations and protect the interests of stakeholders.

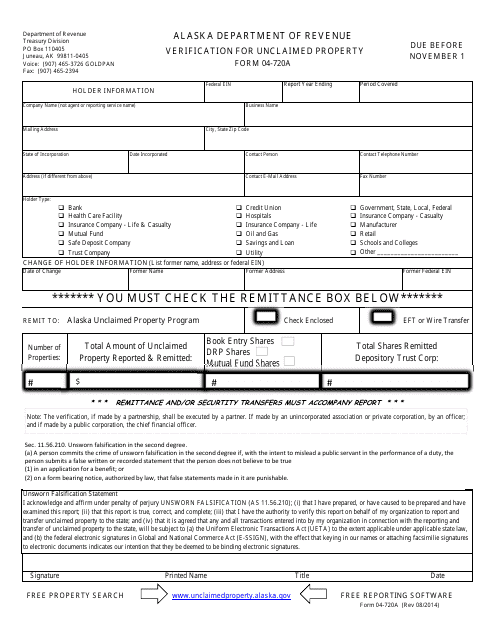

This Form is used for verifying unclaimed property in the state of Alaska. It helps individuals or organizations claim their property that has been deemed unclaimed.

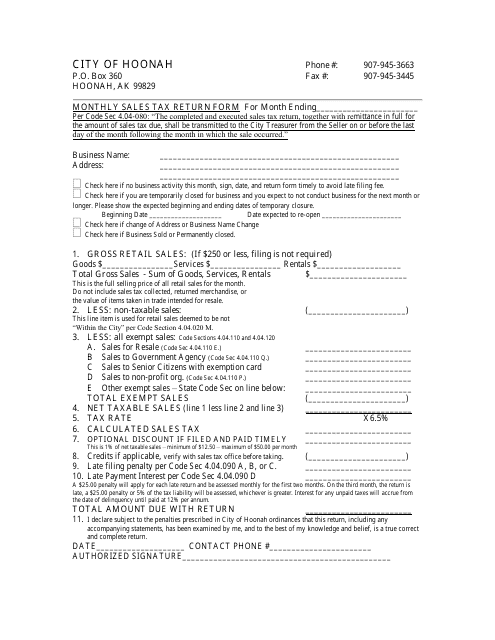

This form is used for reporting and paying monthly sales tax to the City of Hoonah, Alaska.

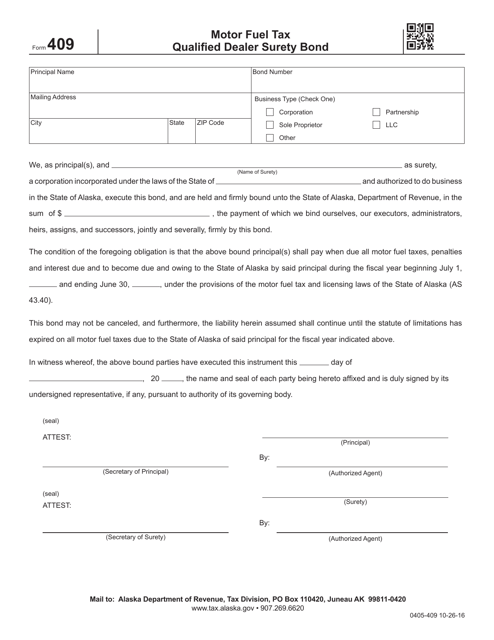

This form is used for obtaining a surety bond for motor fuel tax dealers in Alaska.

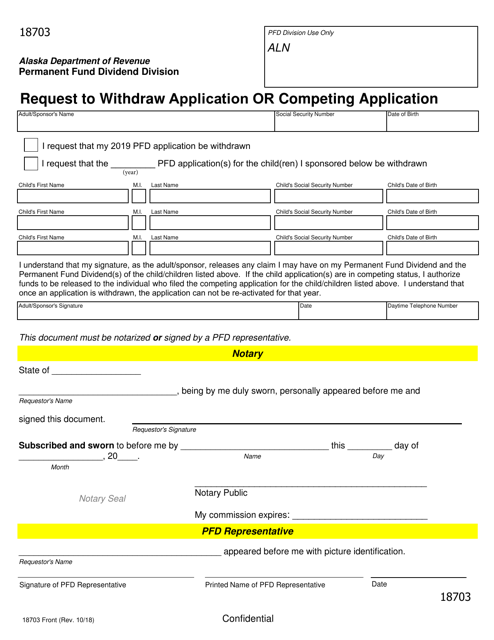

This form is used for requesting the withdrawal of an application or competing application in the state of Alaska.