Alabama Department of Revenue Forms

Documents:

587

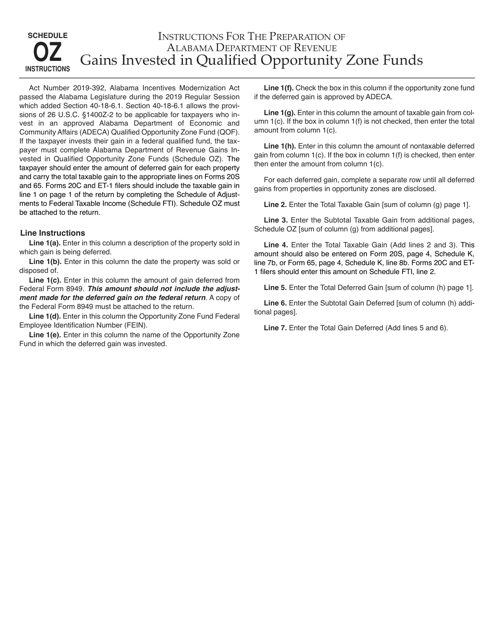

This document provides instructions on how to report gains invested in Qualified Opportunity Zone Funds in the state of Alabama.

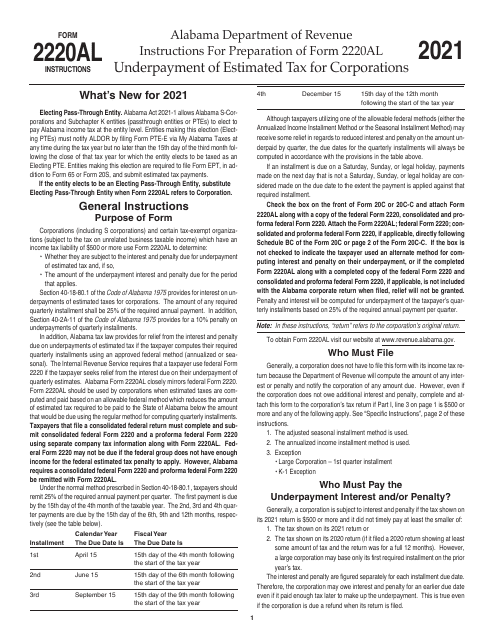

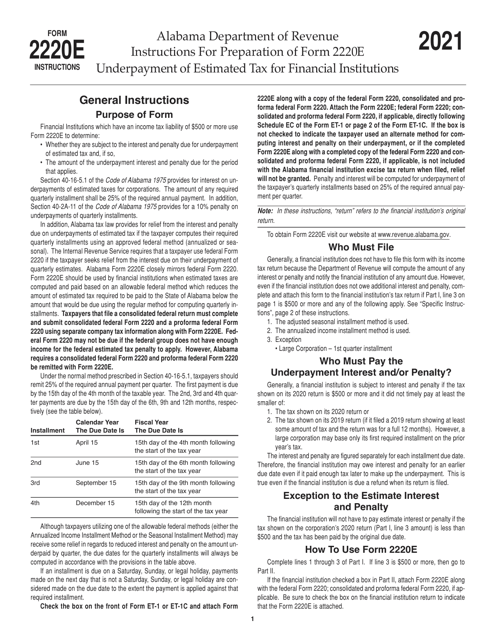

Instructions for Form 2220E Underpayment of Estimated Tax for Financial Institutions - Alabama, 2021

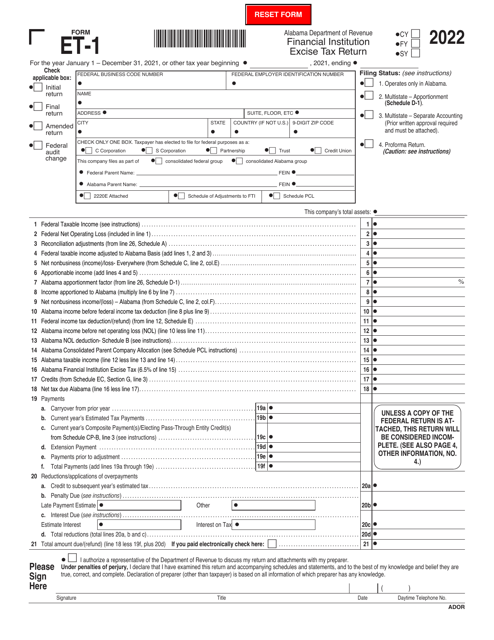

This Form is used for financial institutions in Alabama to report and calculate their underpayment of estimated tax.

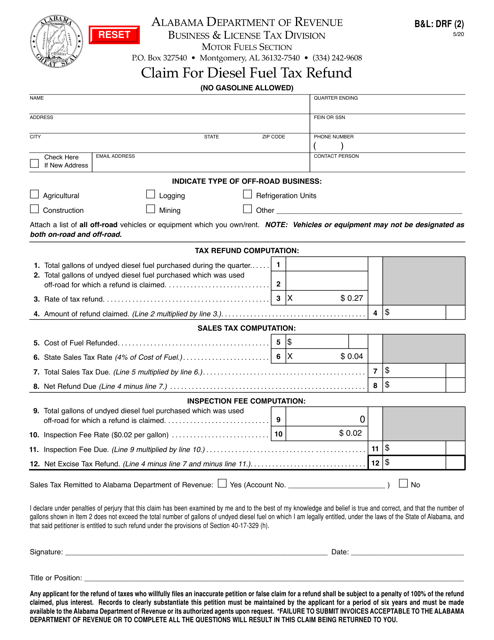

This form is used for claiming a refund on diesel fuel tax paid in the state of Alabama.

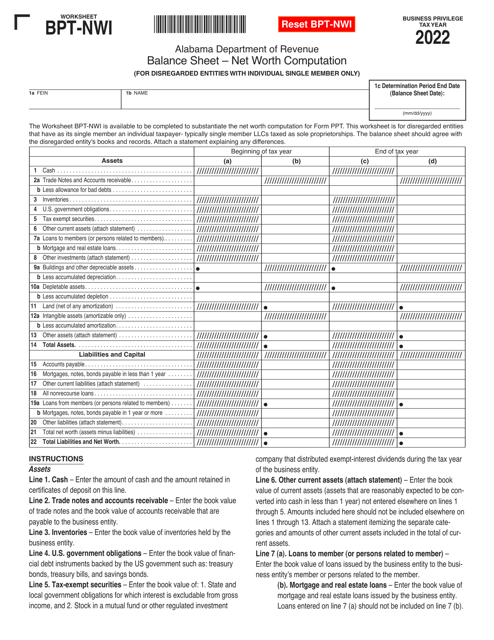

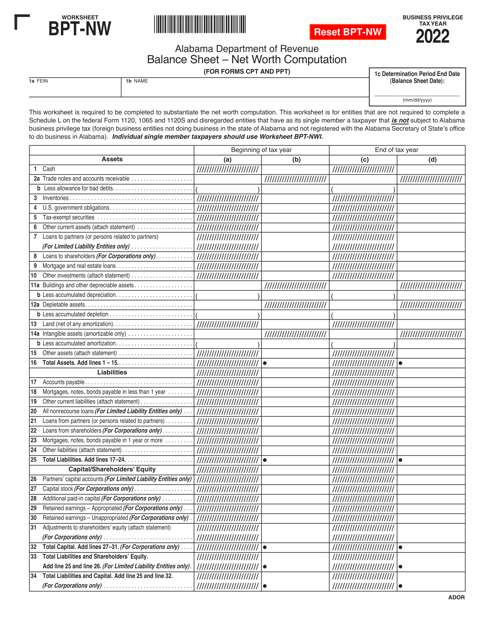

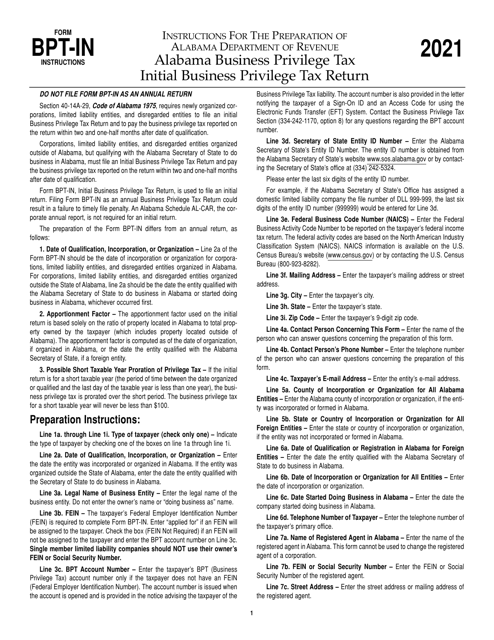

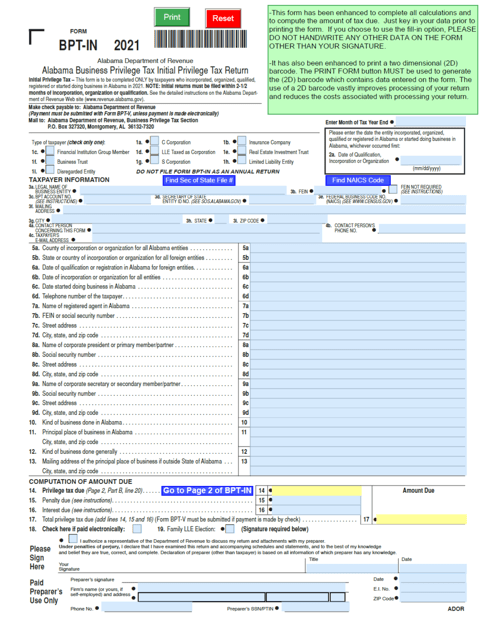

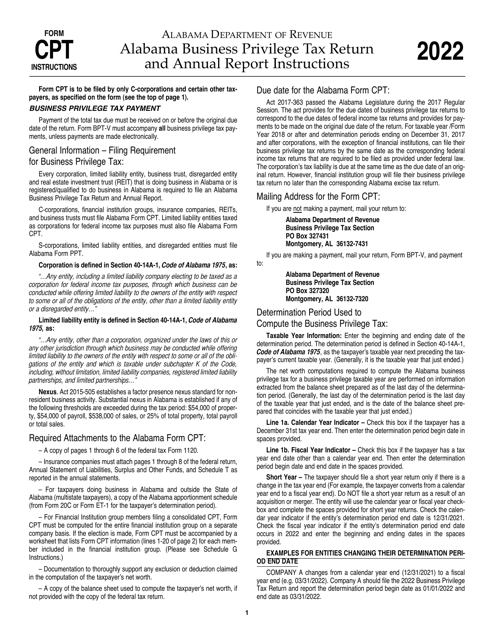

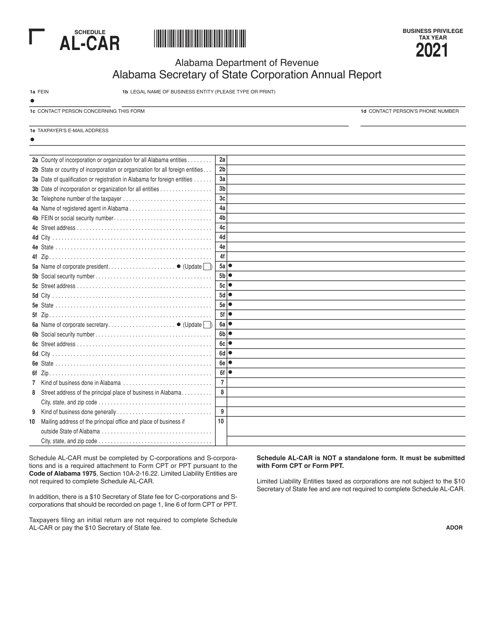

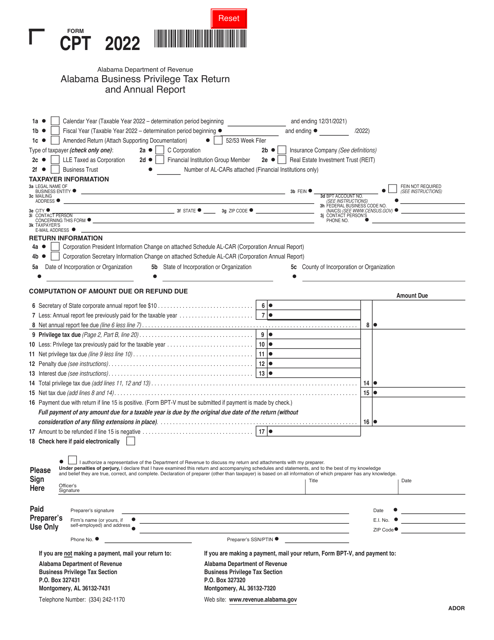

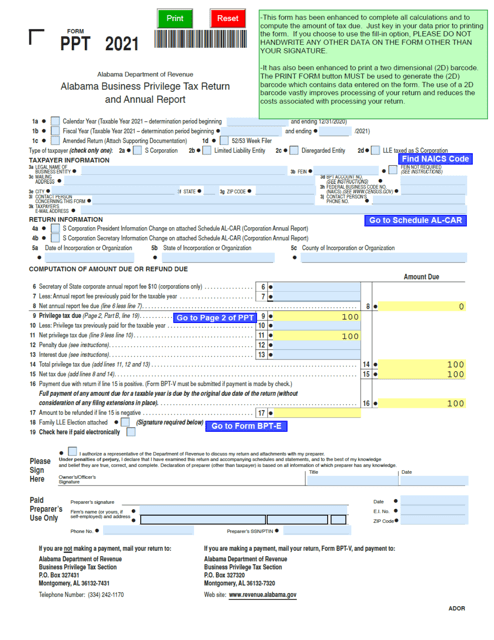

This Form is used for filing the yearly Business Privilege Tax Return and Annual Report for businesses in Alabama.

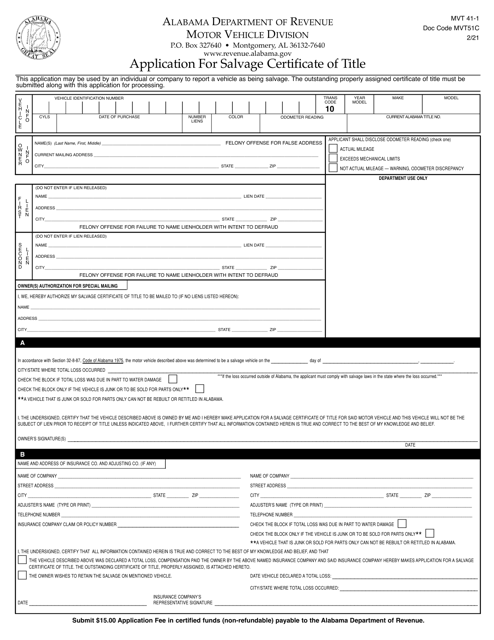

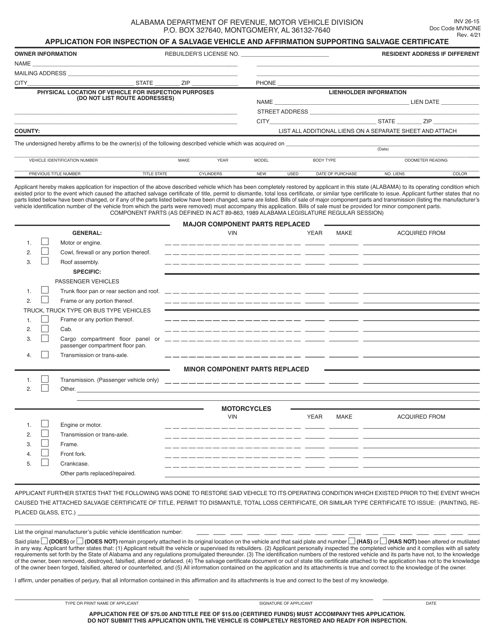

This form is used for applying for a salvage certificate of title in Alabama for a salvaged vehicle.

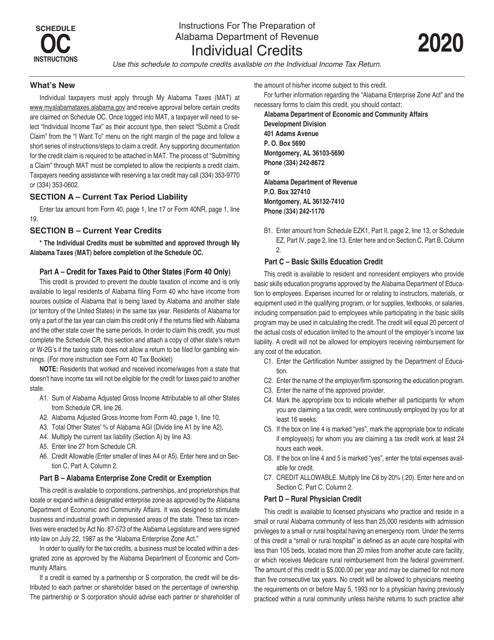

This Form is used for reporting other available credits in Alabama for individuals filing Form 40 or 40NR. It provides instructions on how to claim credits such as the Adoption Tax Credit, Instalment Use Tax Credit, and more.