Alabama Department of Revenue Forms

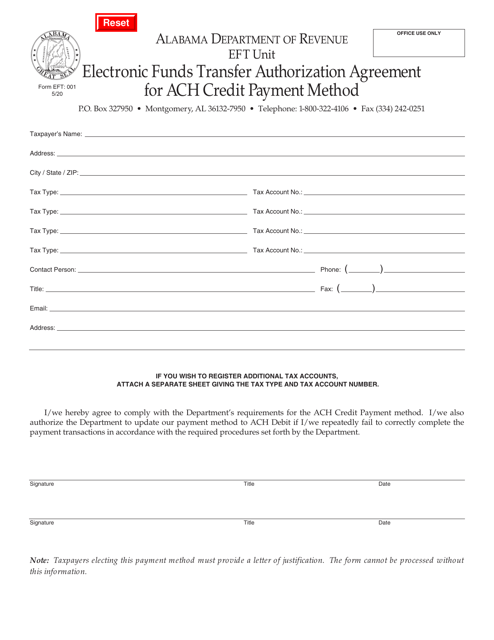

The Alabama Department of Revenue is responsible for administering and enforcing tax laws in the state of Alabama. They collect various taxes, including individual and corporate income taxes, sales and use taxes, property taxes, and motor vehicle taxes. The department also provides assistance and guidance to taxpayers regarding tax compliance and offers online services for filing taxes and making payments.

Documents:

587

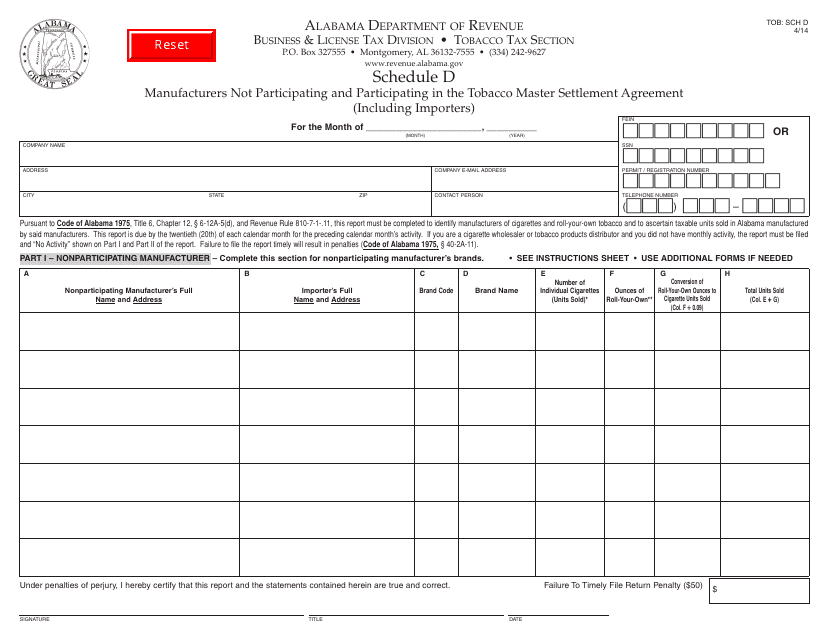

This document identifies manufacturers in Alabama that are not part of the Tobacco Master Settlement Agreement.

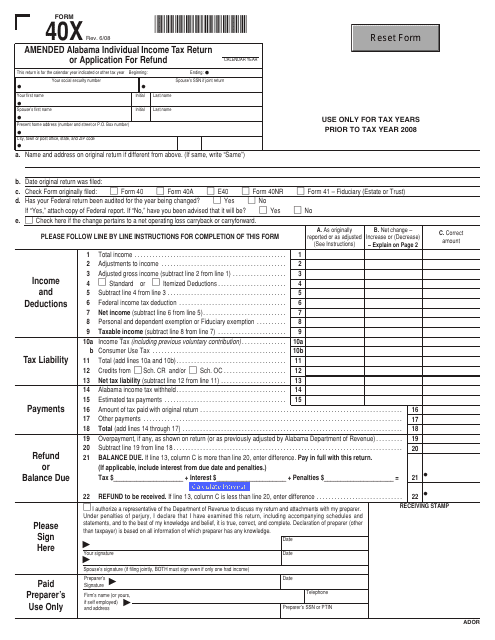

This form is used for filing an amended Alabama Individual Income Tax Return or applying for a refund in the state of Alabama.

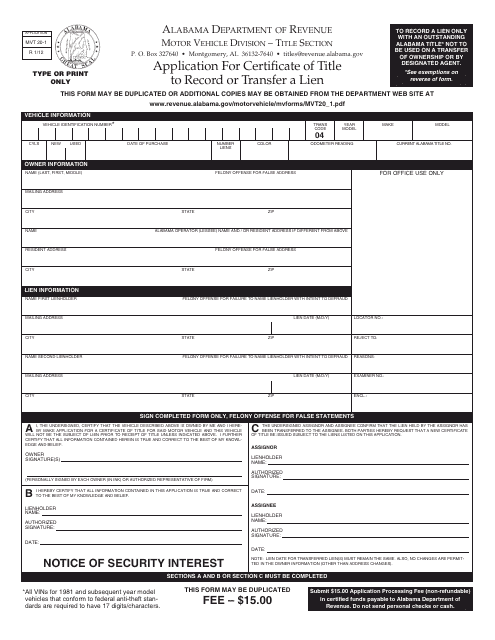

This form is used for applying for a certificate of title in Alabama, in order to record or transfer a lien on a vehicle.

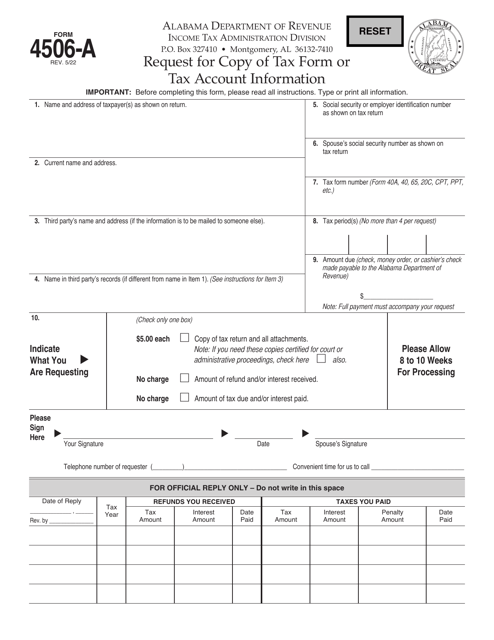

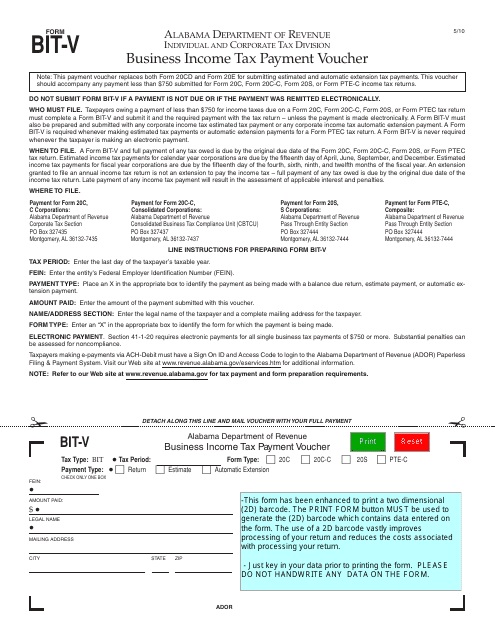

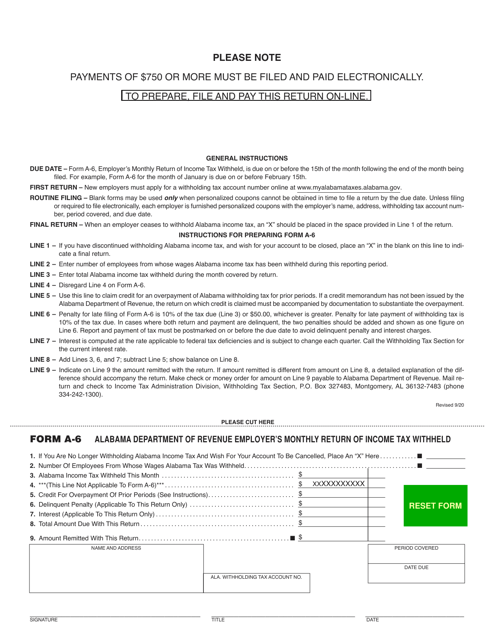

This Form is used for submitting business income tax payment in the state of Alabama.

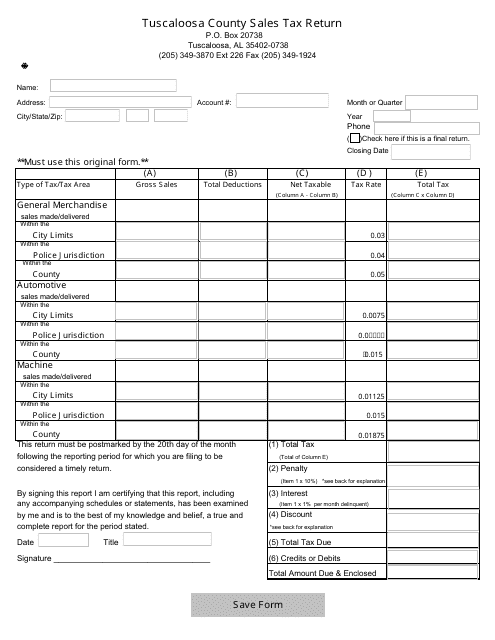

This form is used for submitting sales tax returns to the City of Tuscaloosa, Alabama.

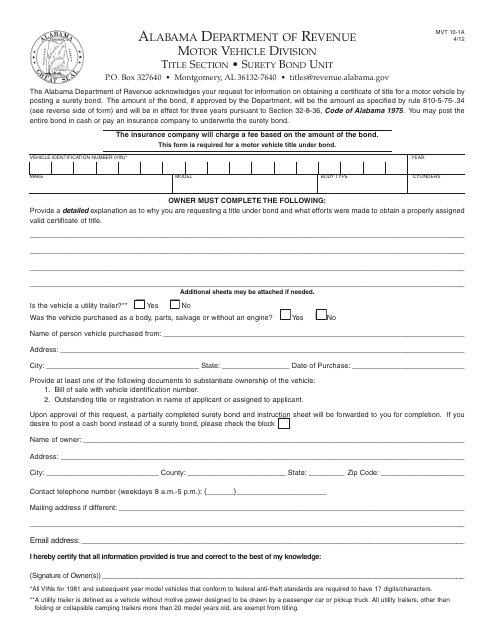

This form is used for requesting a surety bond in Alabama.

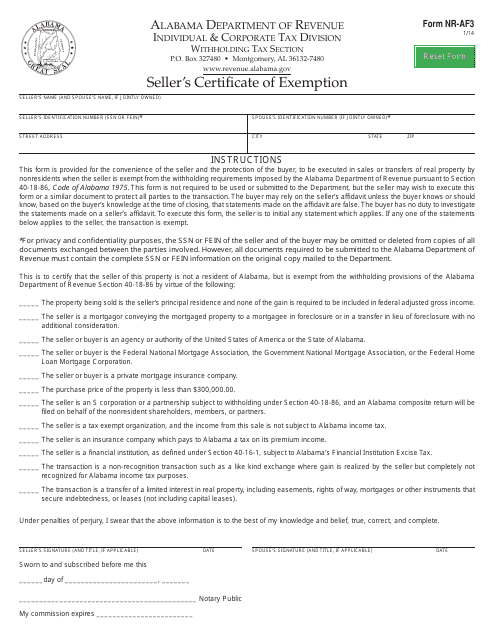

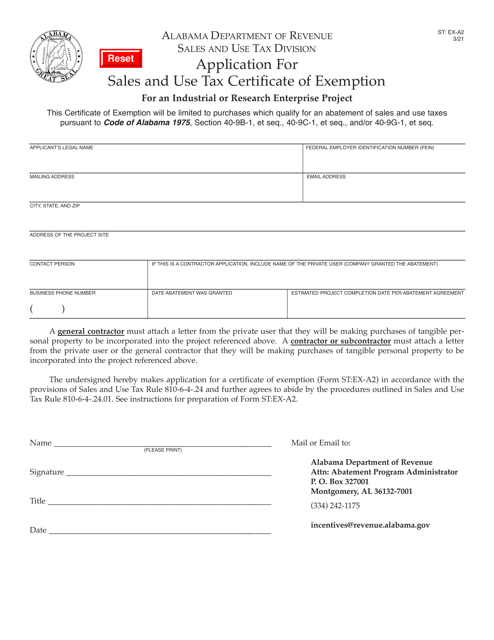

This form is used for sellers in Alabama to provide a certificate of exemption for certain transactions.

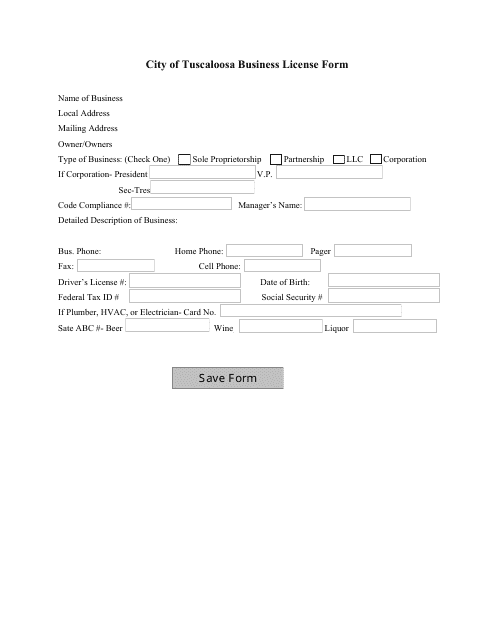

This form is used for obtaining a business license in the City of Tuscaloosa, Alabama.

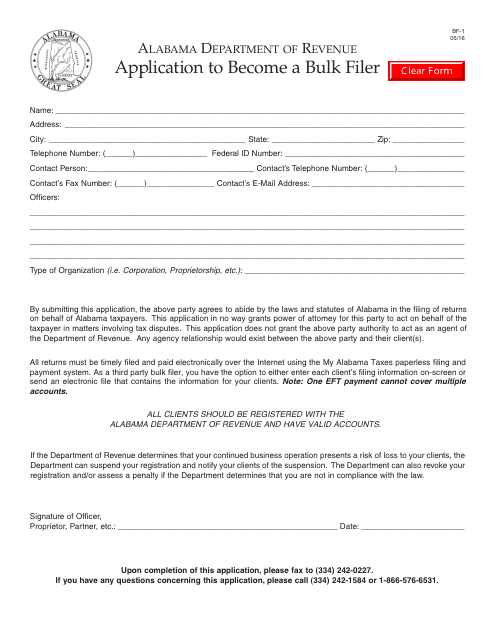

This form is used to apply for bulk filer status in Alabama.

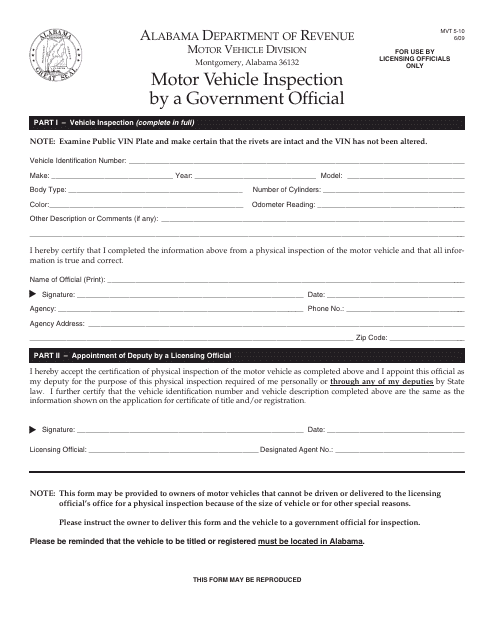

This form is used for motor vehicle inspections conducted by a government official in the state of Alabama.

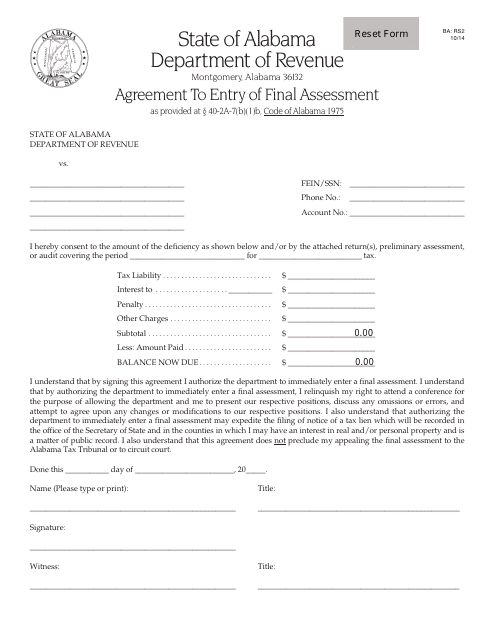

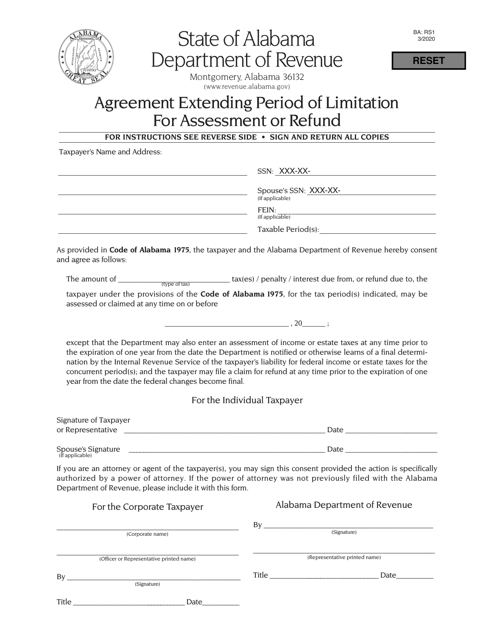

This form is used for entering the final assessment agreement in Alabama.

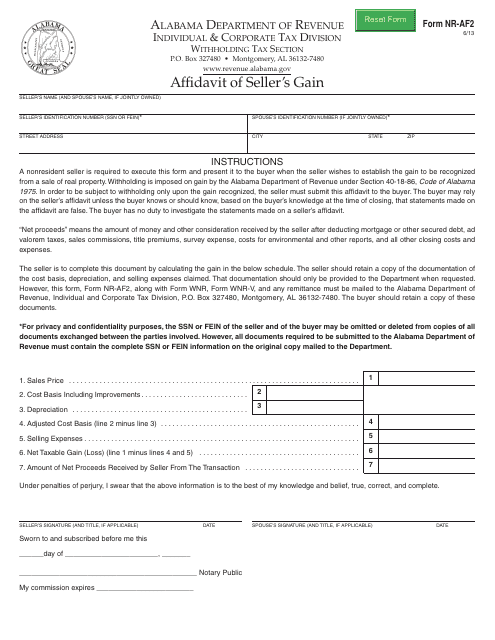

This form is used for sellers in Alabama to declare and affirm their gains from a transaction.

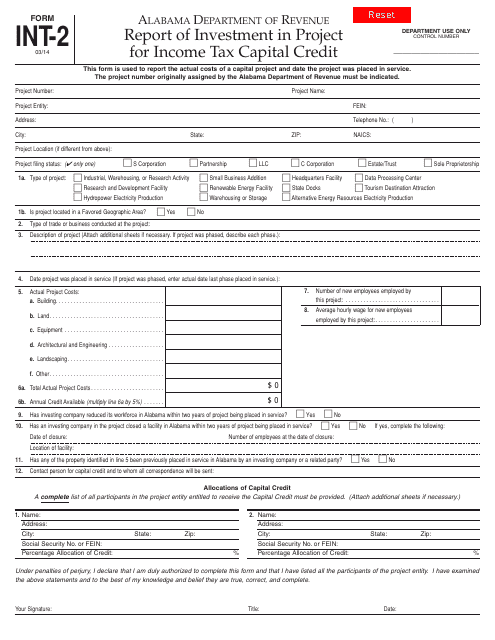

This form is used for reporting investments made in a project to claim income tax capital credit in Alabama.

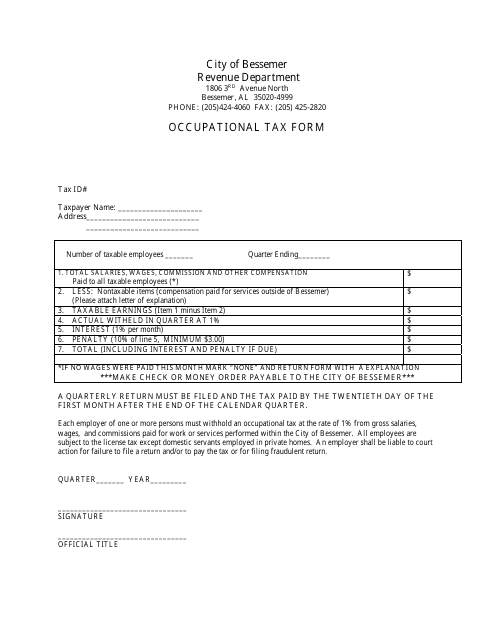

This Form is used for paying occupational taxes to the City of Bessemer, Alabama.

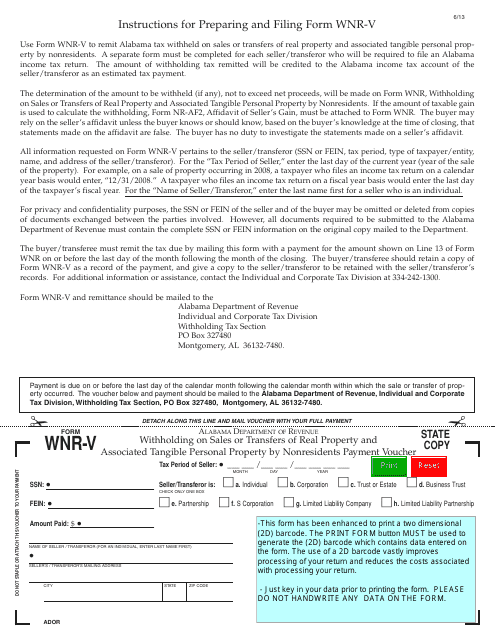

This form is used for making payment vouchers for nonresidents who are withholding on sales or transfers of real property and associated tangible personal property in Alabama.

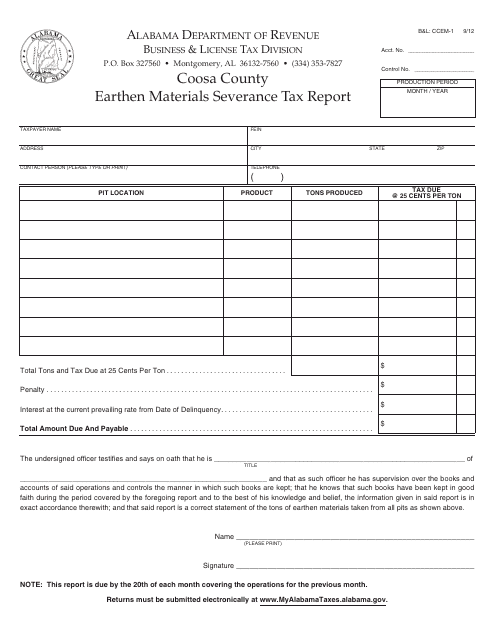

This form is used for reporting the severance tax on earthen materials in Coosa County, Alabama.

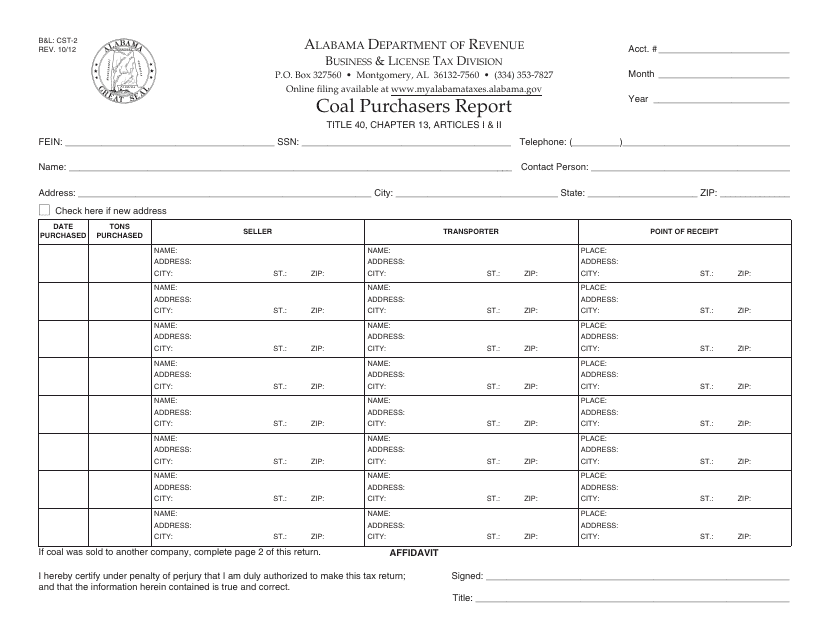

This document is used for reporting coal purchases in Alabama.

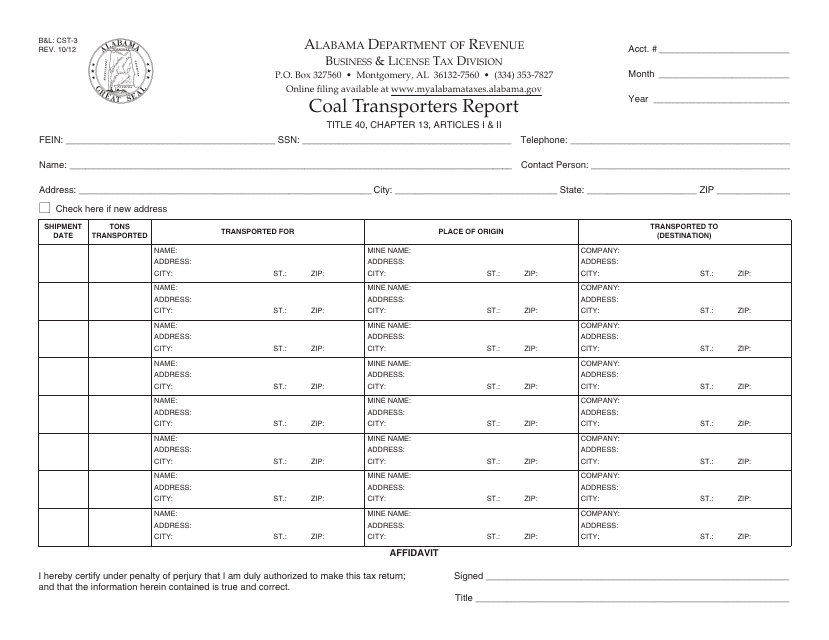

This Form is used for coal transporters to report their activities in Alabama.

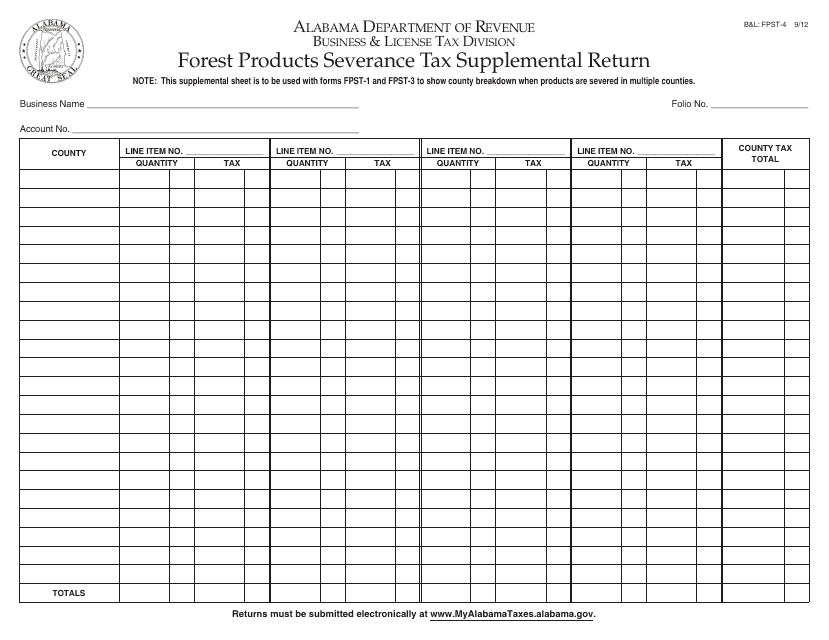

This Form is used for reporting supplemental information for the Forest Products Severance Tax in Alabama.

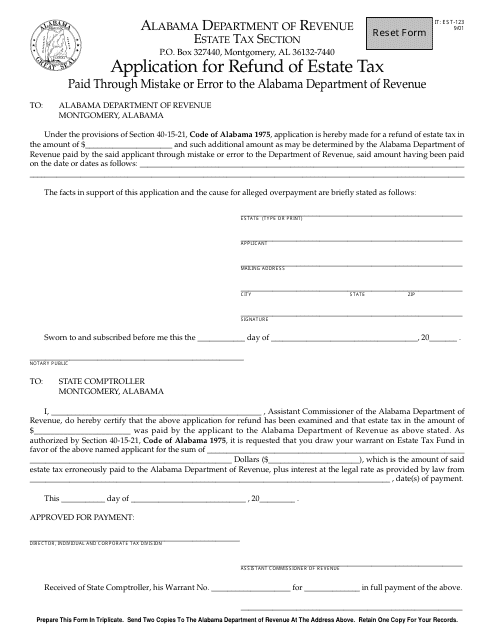

This form is used for filing an application to claim a refund for estate tax paid in Alabama.

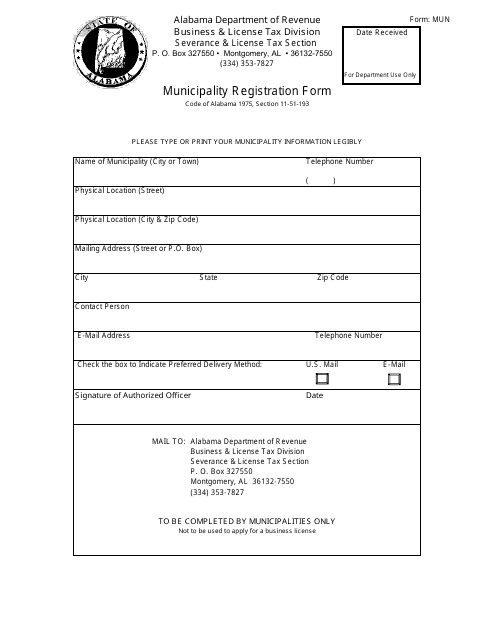

This Form is used for registering a municipality in the state of Alabama.

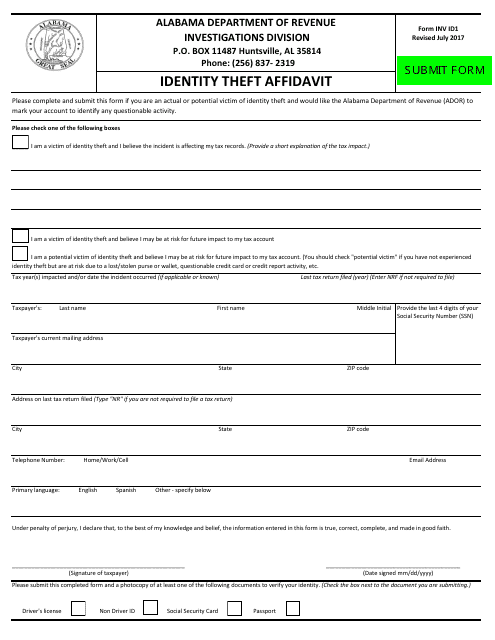

This document is used to report identity theft in the state of Alabama.

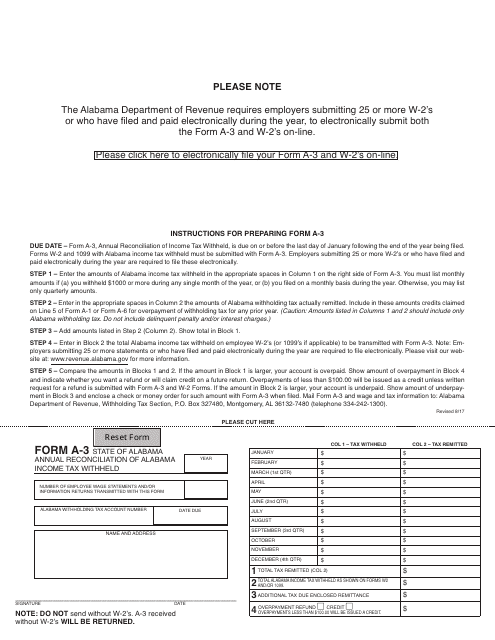

This form is used for the annual reconciliation of Alabama income tax withheld in the state of Alabama.

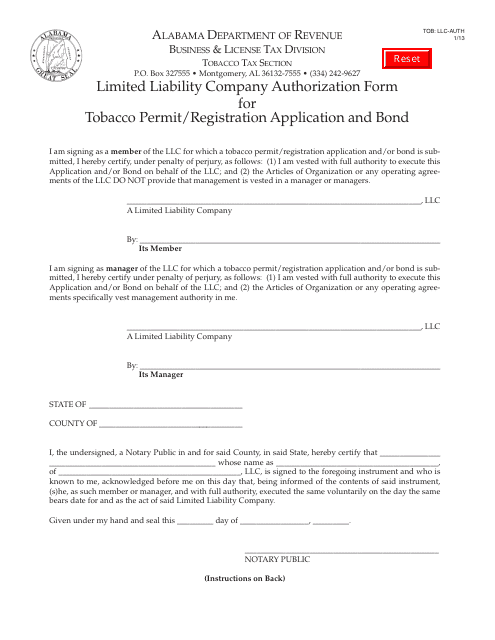

This form is used for obtaining a tobacco permit/registration and posting a bond for limited liability companies (LLC) in Alabama.

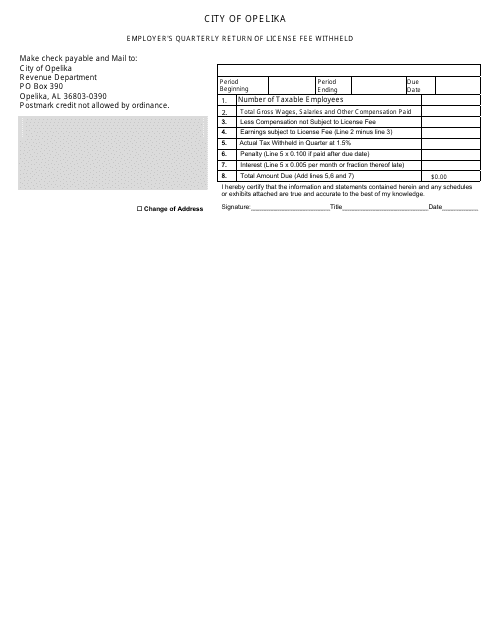

This type of document is used for reporting and submitting the license fees withheld by employers to the City of Opelika, Alabama on a quarterly basis.

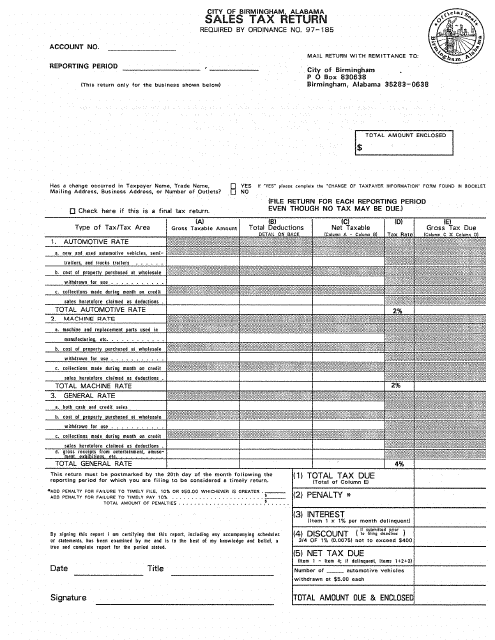

This Form is used for submitting sales tax returns to the City of Birmingham, Alabama.

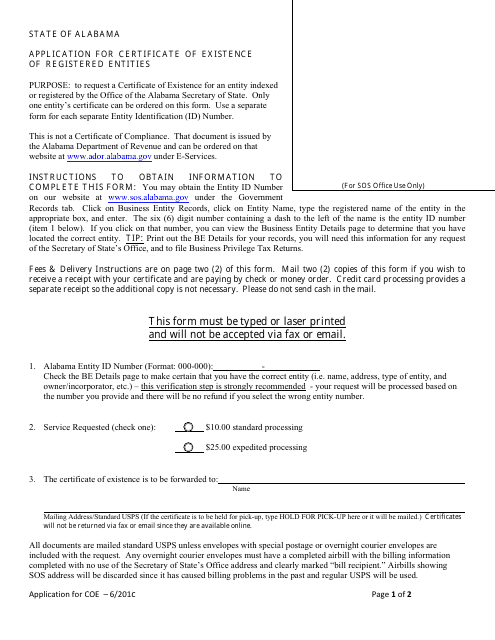

This form is used for requesting a Certificate of Existence for registered entities in Alabama, confirming their legal status.

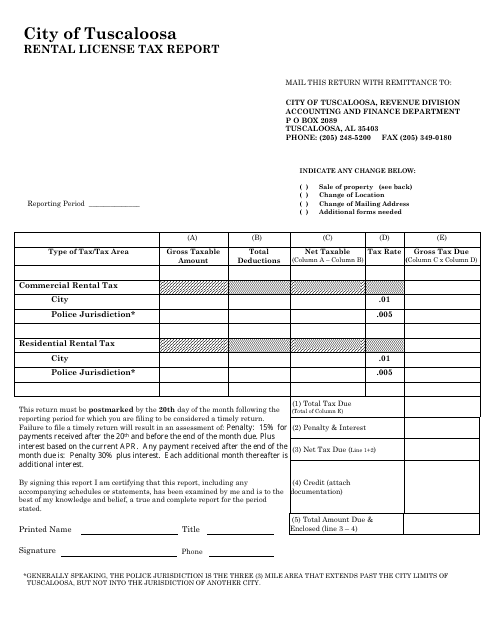

This document is a rental license tax report form specific to the City of Tuscaloosa, Alabama. It is used by rental property owners to report and pay taxes related to their rental income in the city.

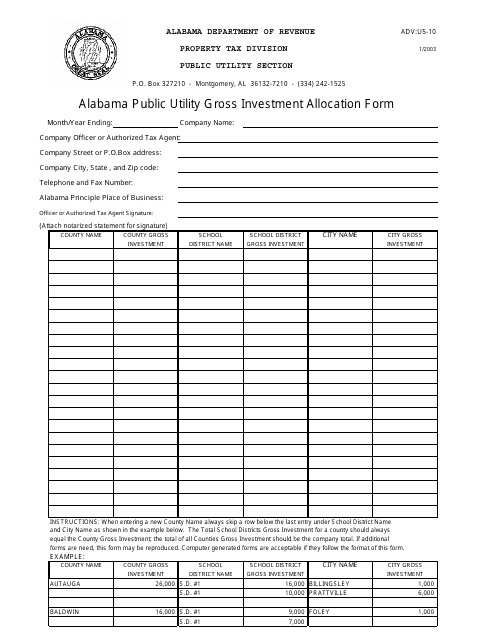

This document is used for the allocation of gross investments in Alabama public utility companies.

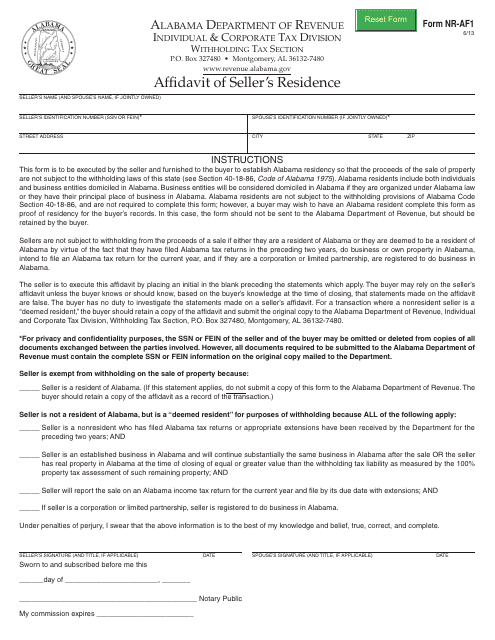

This form is used for sellers in Alabama to provide an affidavit of their residence.

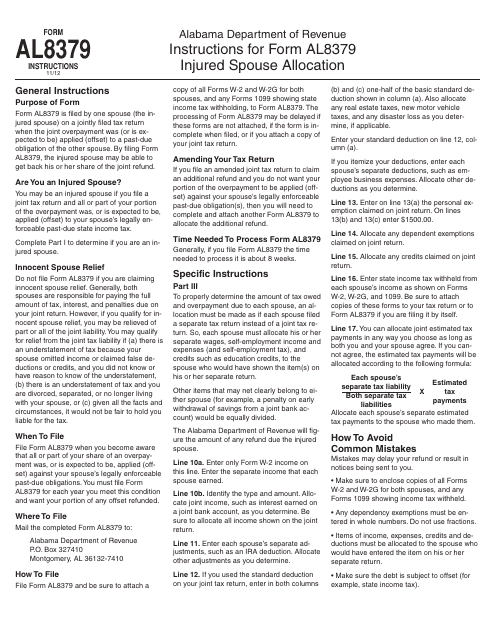

This Form is used for allocating the income and tax liability of a joint tax return when one spouse has outstanding debts or obligations. It is specifically for residents of Alabama.

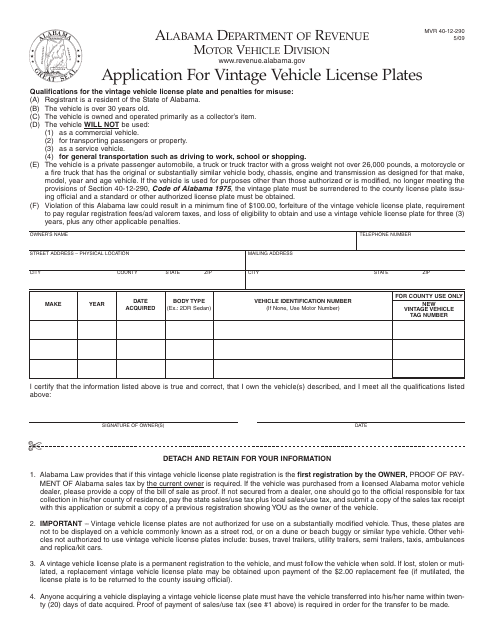

This form is used for applying for vintage vehicle license plates in the state of Alabama.

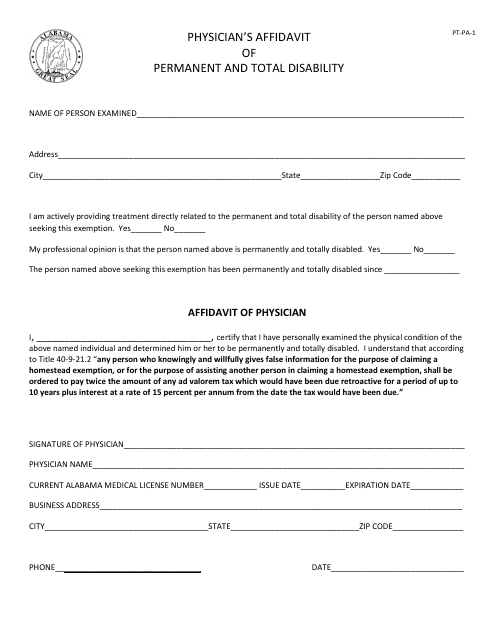

This Form is used for physicians in Alabama to provide an affidavit proving permanent and total disability.

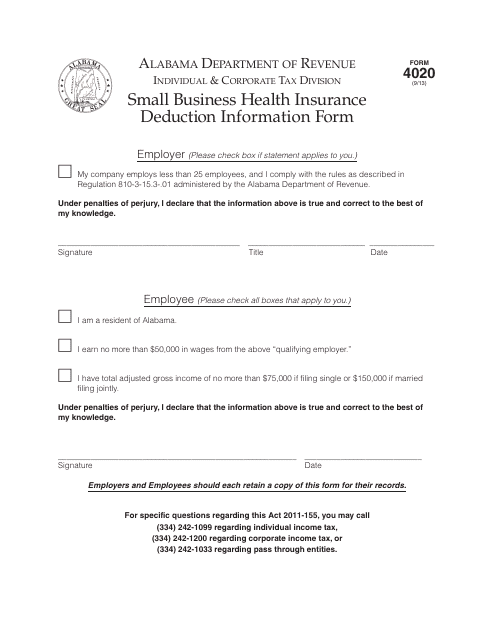

This Form is used for providing information about the small business health insurance deduction in the state of Alabama.

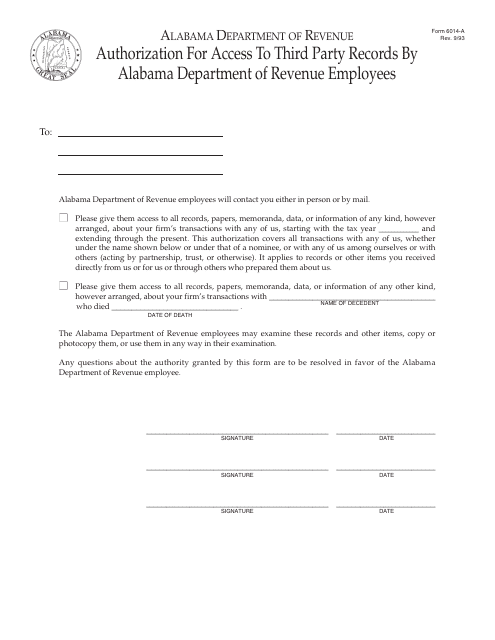

This form is used for granting authorization to Alabama Department of Revenue employees to access third-party records.