Fill and Sign North Dakota Legal Forms

Documents:

3703

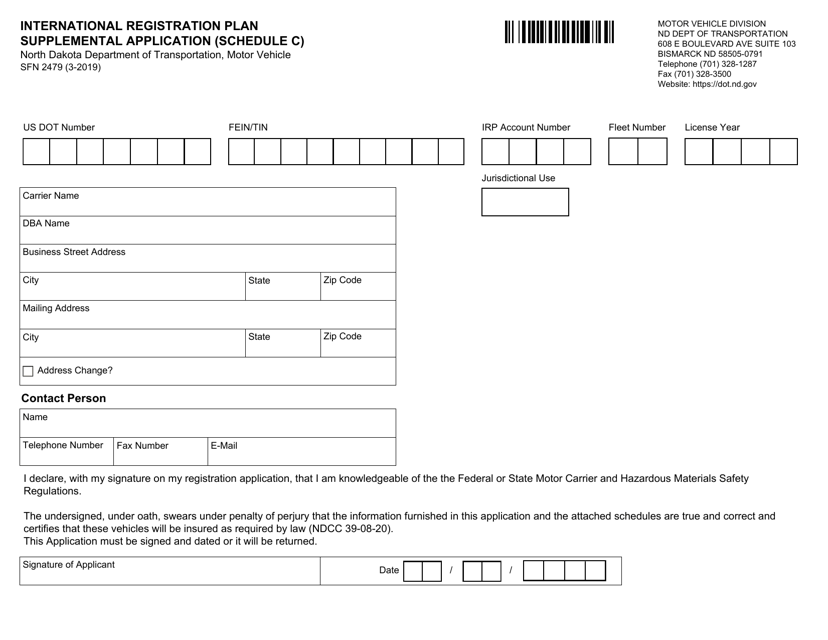

This form is used for a supplemental application to the International Registration Plan in North Dakota. It is specifically for Schedule C.

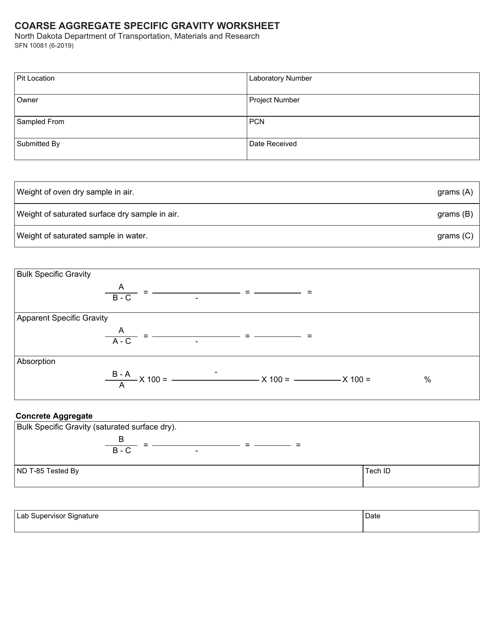

This form is used for calculating the specific gravity of coarse aggregates in North Dakota.

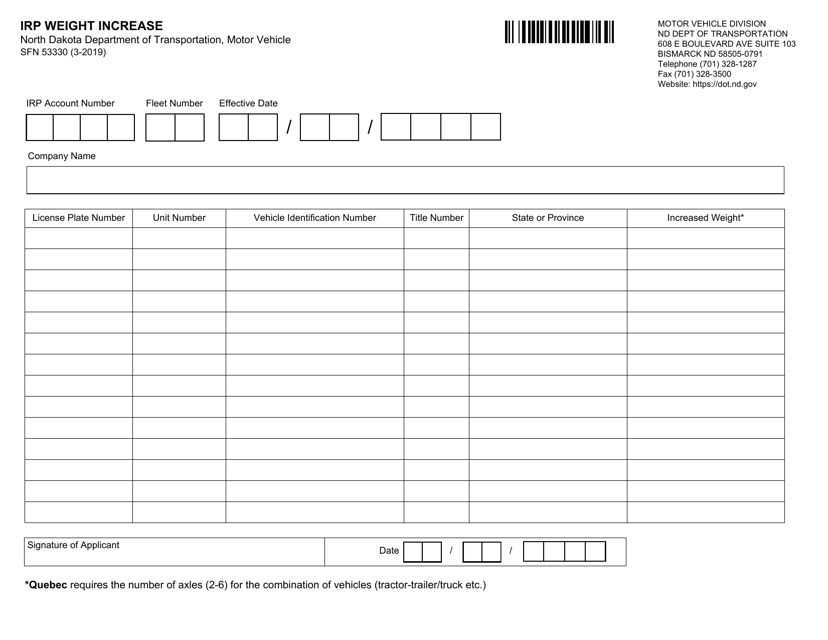

This Form is used for requesting an IRP weight increase in North Dakota.

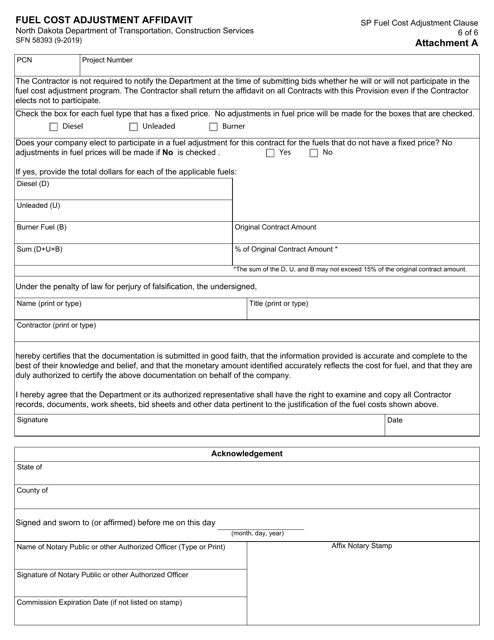

This Form is used for submitting a Fuel Cost Adjustment Affidavit in North Dakota.

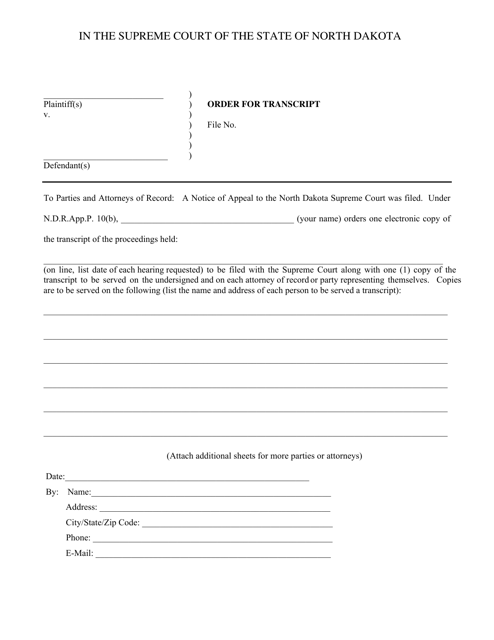

This document allows you to request a transcript from a school or educational institution in North Dakota. It is commonly used for academic or employment purposes.

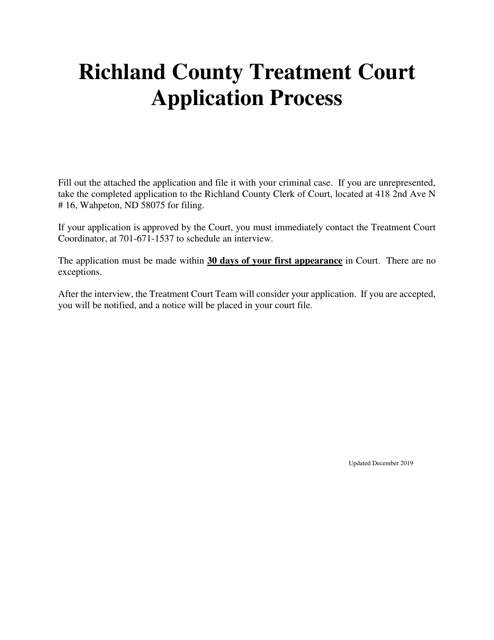

This Form is used for applying to participate in the Treatment Court Program in Richland County, North Dakota. This program is designed to assist individuals in overcoming substance abuse and related issues through comprehensive treatment and therapy.

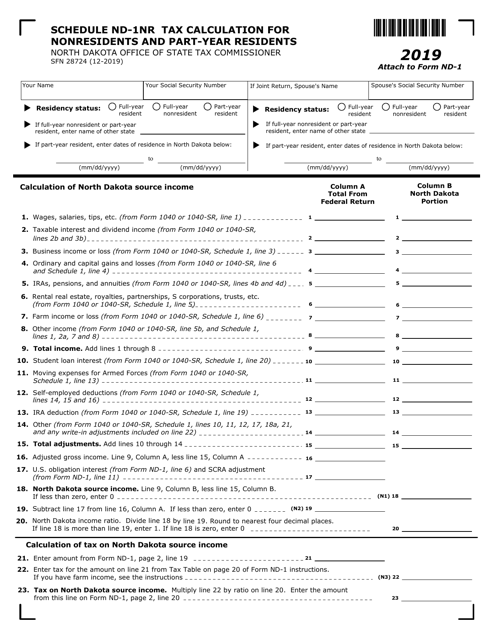

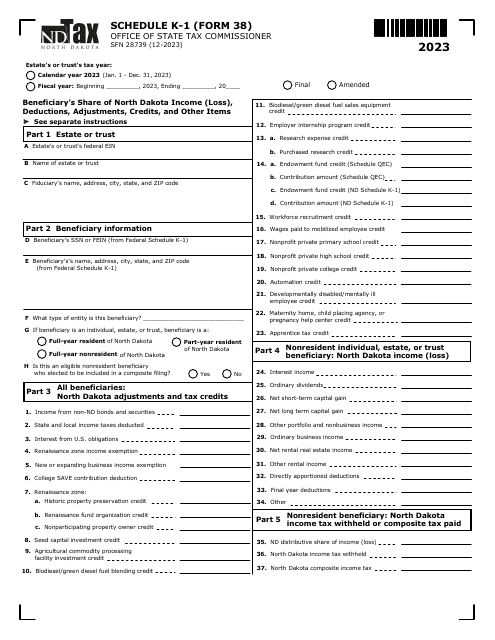

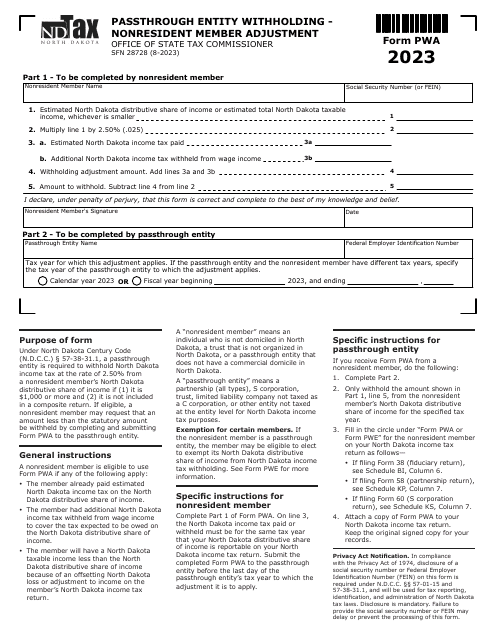

This form is used for calculating taxes for nonresidents and part-year residents in North Dakota.

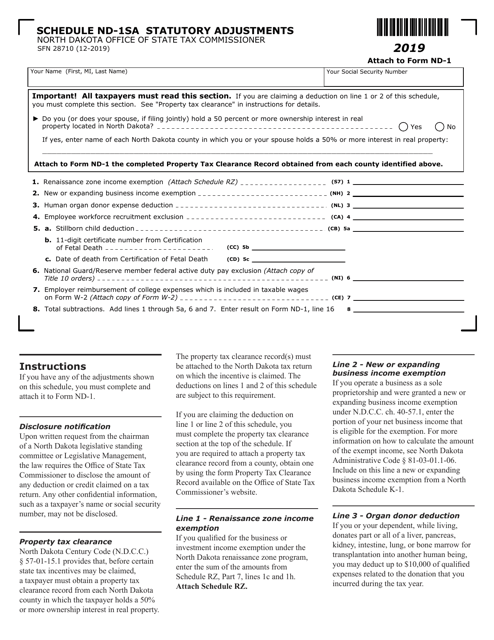

This document is used for reporting statutory adjustments on your North Dakota state tax return. It is an additional schedule that accompanies Form ND-1.

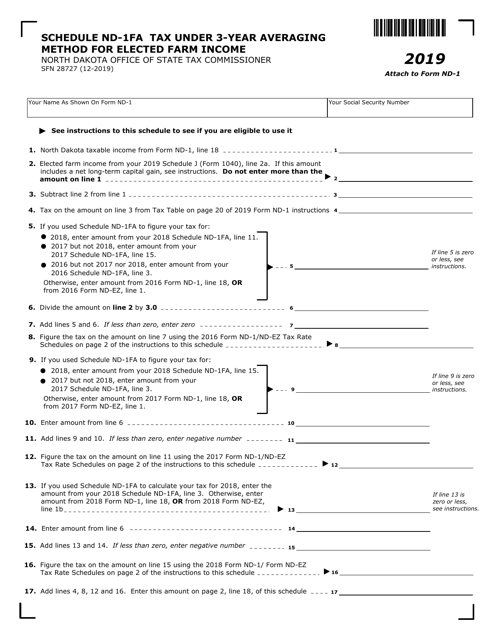

This form is used for calculating farm income using a 3-year averaging method in North Dakota.

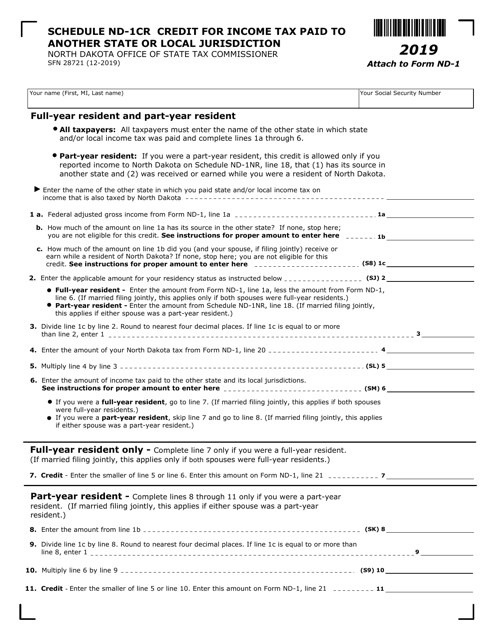

This Form is used for residents of North Dakota to claim a credit for income taxes paid to another state.

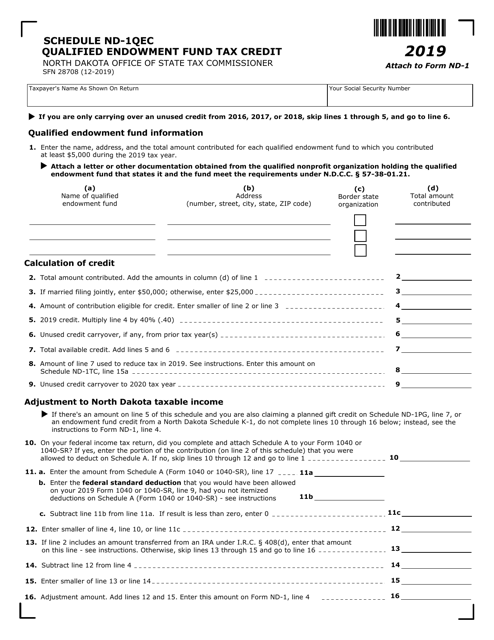

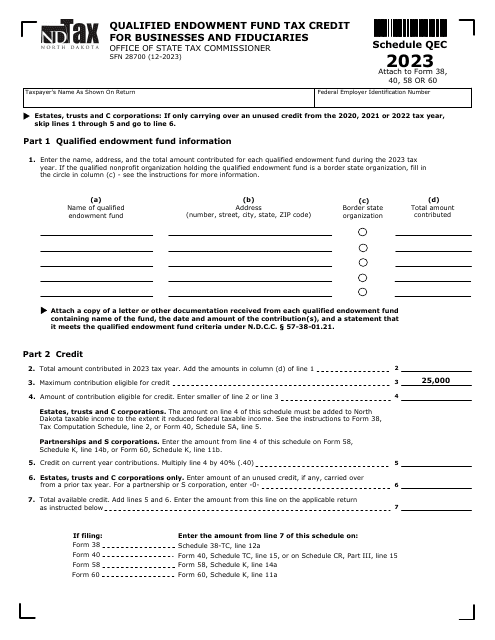

This form is used for claiming the qualified endowment fund tax credit in North Dakota.

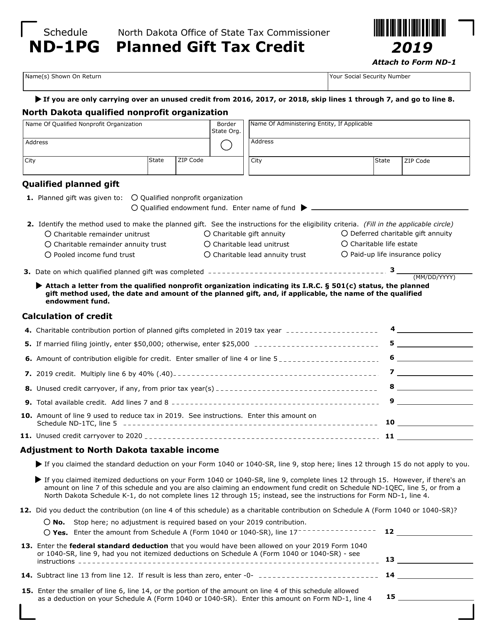

This form is used for claiming a tax credit for planned gifts in North Dakota.

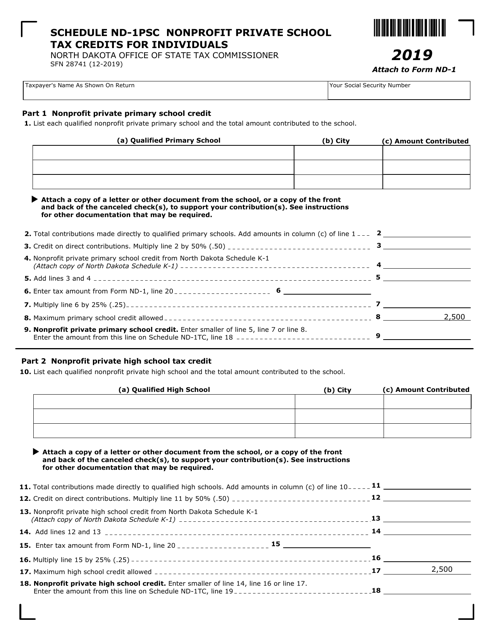

This form is used for claiming nonprofit private school tax credits for individuals in North Dakota.

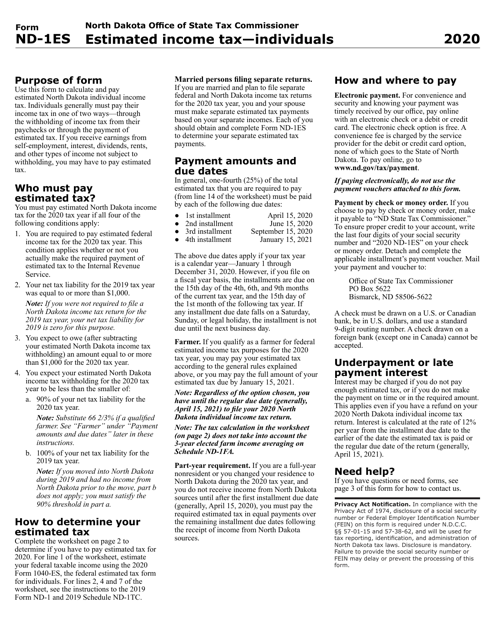

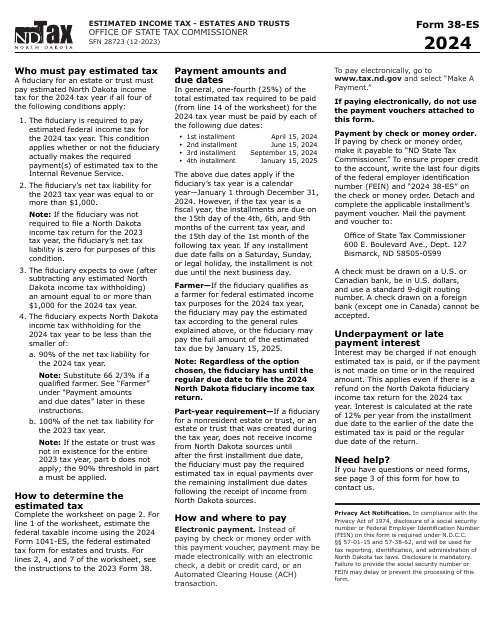

This Form is used for individuals in North Dakota to calculate and pay their estimated state income taxes.

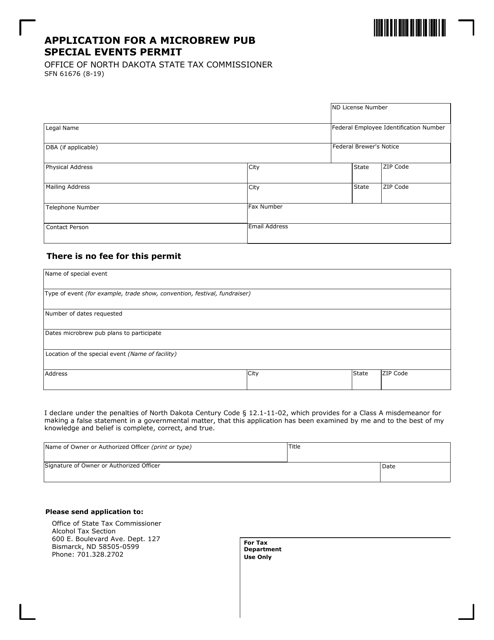

This form is used for applying for a special events permit for a microbrew pub in North Dakota.

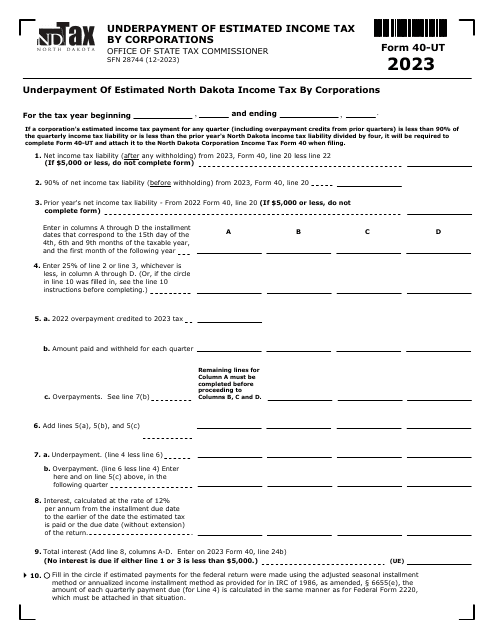

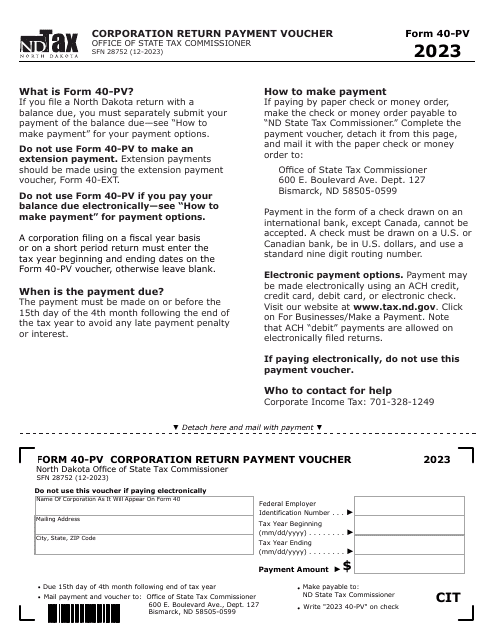

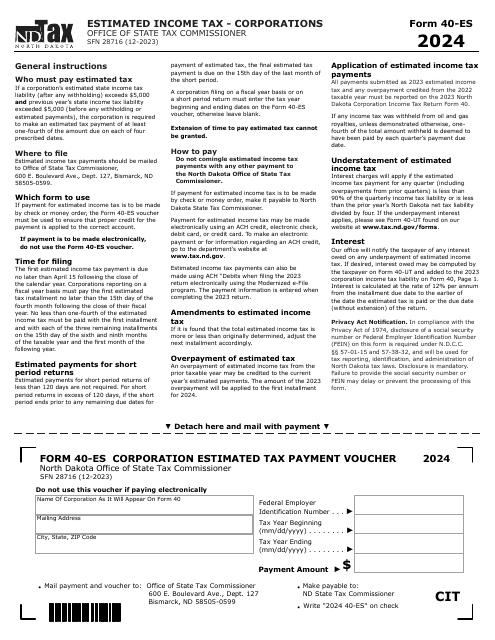

This Form is used for filing the Corporation Income Tax Return for businesses operating in North Dakota. It provides instructions and guidelines on how to accurately report income, deductions, and credits to calculate the tax liability for the corporation.