Fill and Sign North Dakota Legal Forms

Documents:

3703

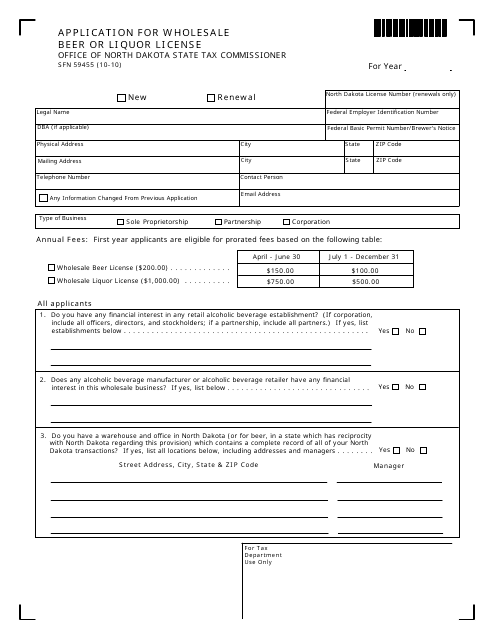

This Form is used for applying for a wholesale beer or liquor license in North Dakota.

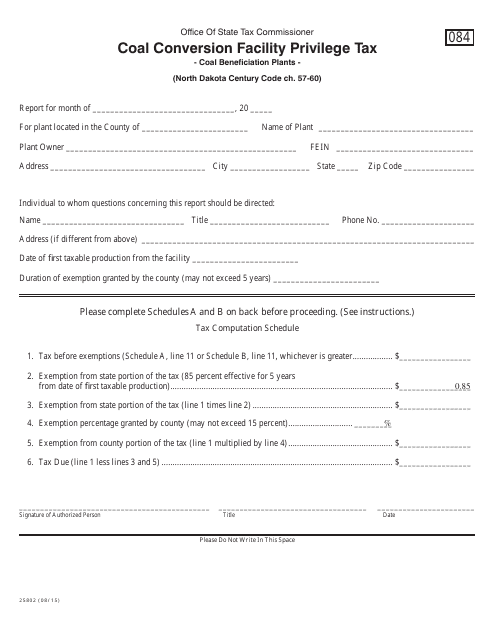

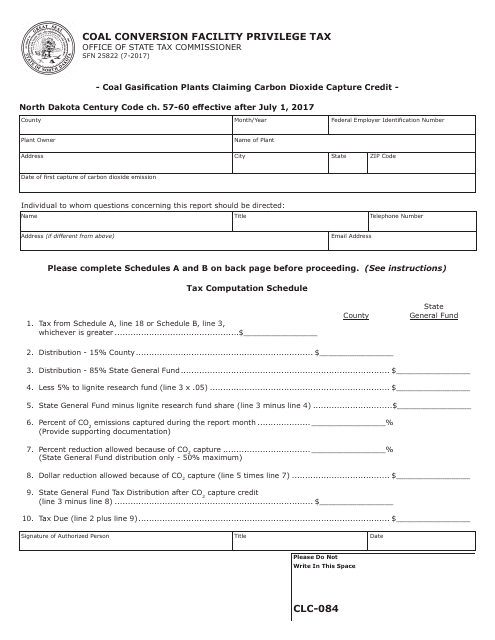

This form is used for reporting and paying the Coal Conversion Facility Privilege Tax in North Dakota.

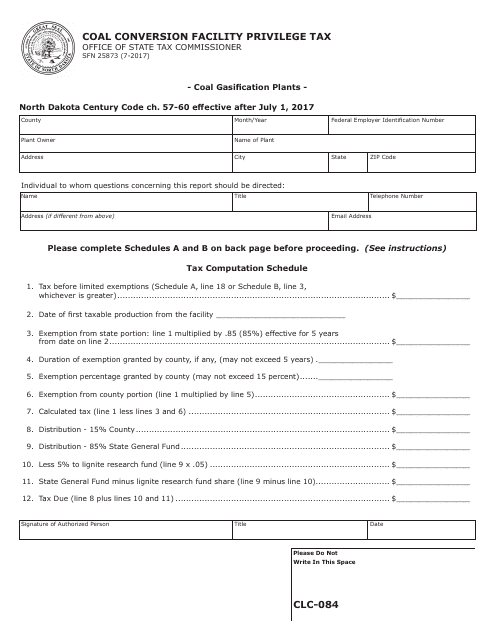

This Form is used for reporting and paying the Coal Conversion Facility Privilege Tax for Coal Gasification Plants in North Dakota.

This form is used for coal gasification plants in North Dakota to claim the carbon dioxide capture credit and privilege tax related to coal conversion facilities.

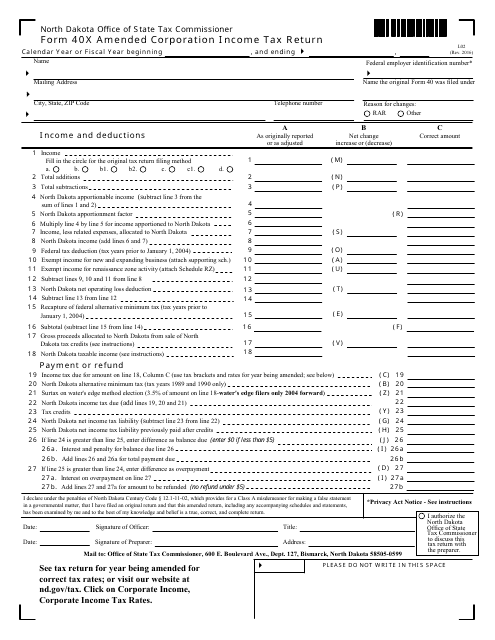

This document is used for filing an amended corporation income tax return in North Dakota. It is the Form L02 (40X).

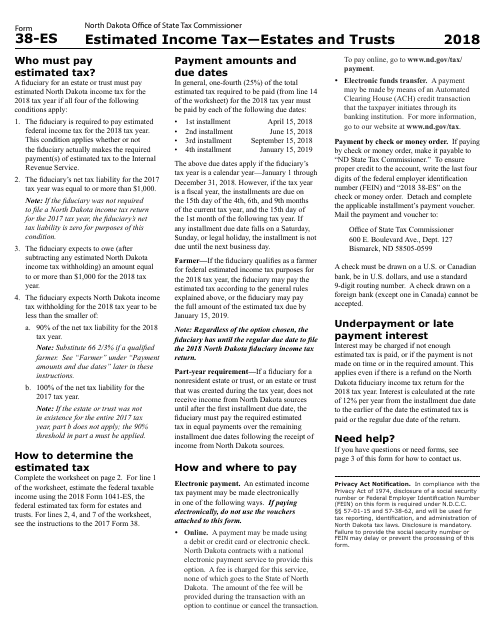

This Form is used for estimating income tax for estates and trusts in North Dakota.

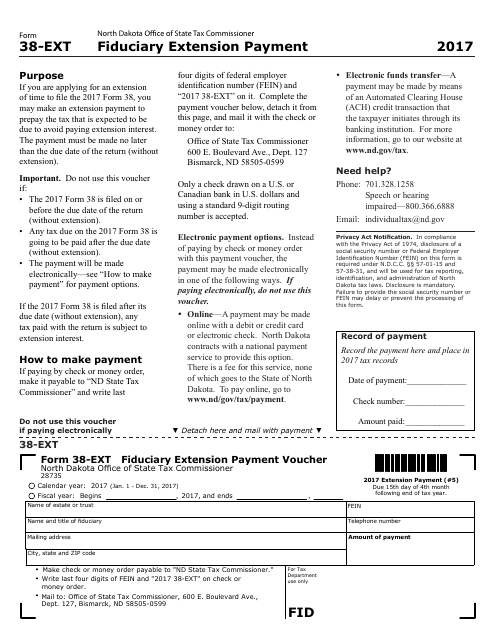

This Form is used for making an extension payment as a fiduciary in North Dakota.

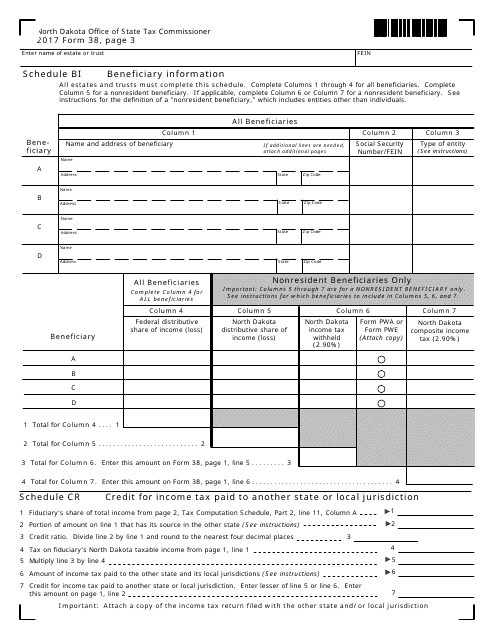

This form is used for providing beneficiary information in North Dakota.

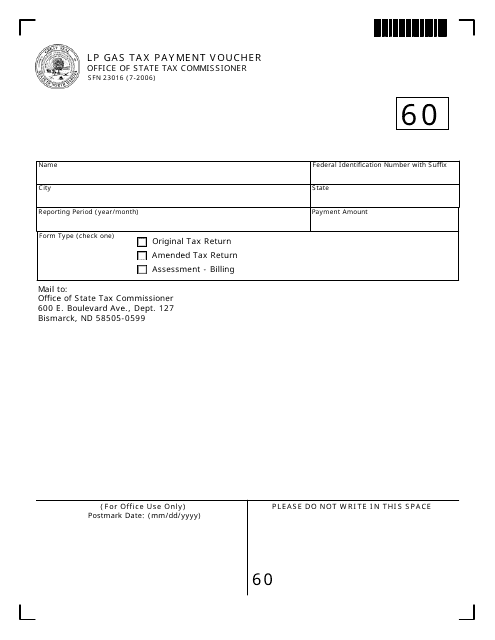

This form is used for making LP gas tax payments in North Dakota.

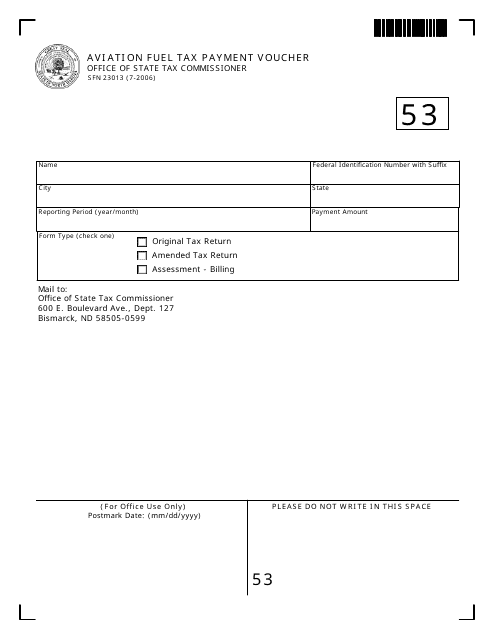

This Form is used for paying aviation fuel tax in North Dakota.

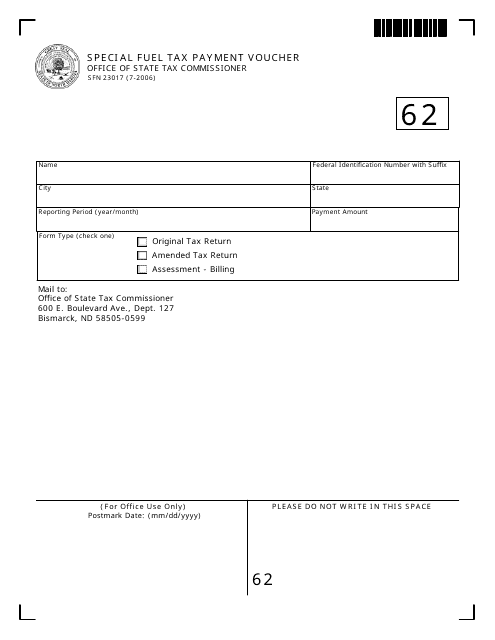

This form is used for making special fuel tax payments in North Dakota.

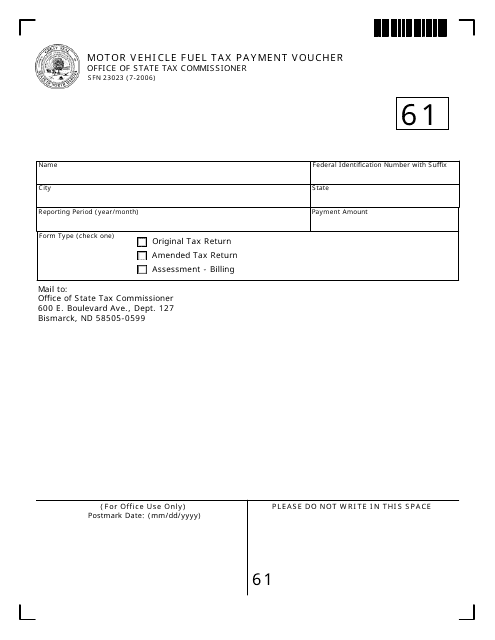

This form is used for submitting motor vehicle fuel tax payments in North Dakota.

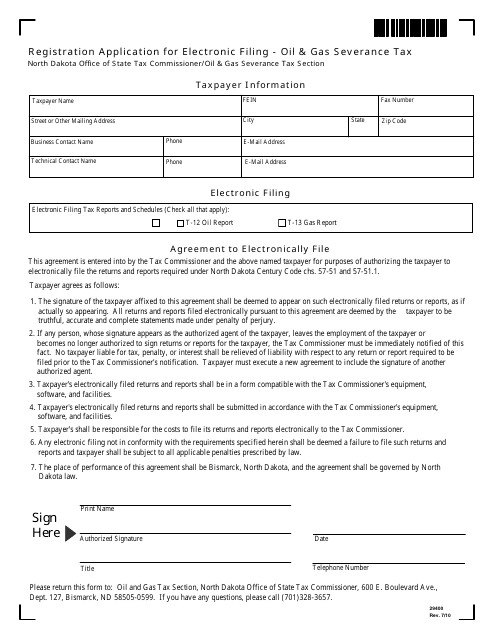

This Form is used for registering electronic filing of oil & gas severance tax in North Dakota.

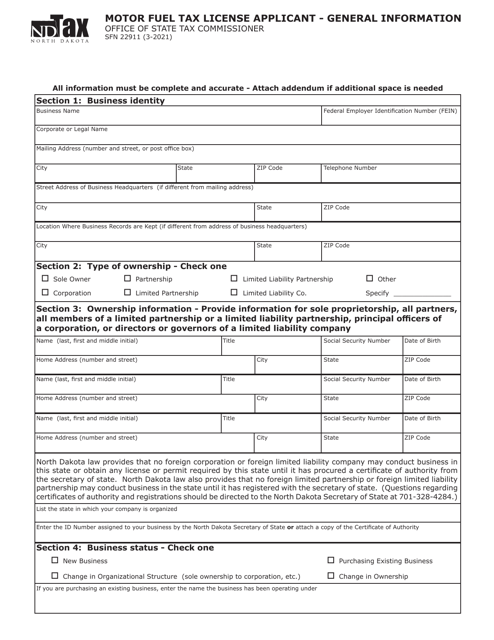

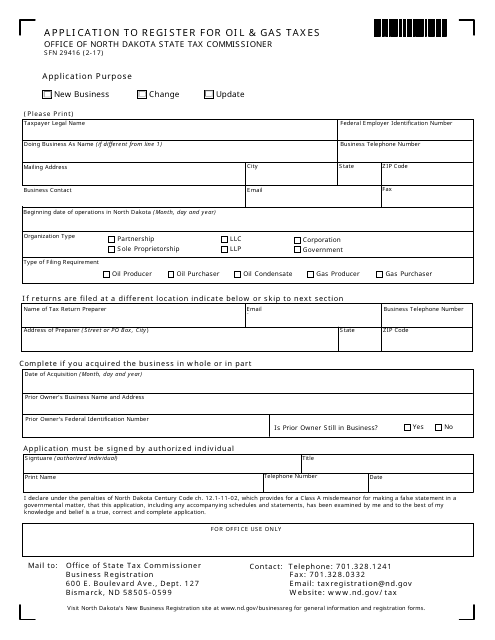

This form is used for registering for oil and gas taxes in North Dakota.

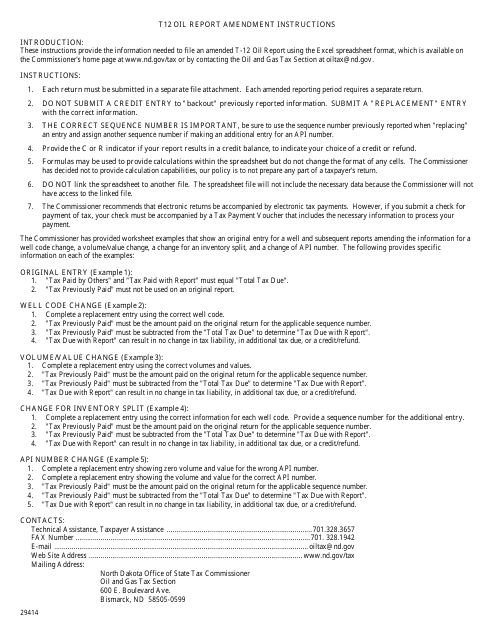

This Form is used for reporting amendments to oil reports in North Dakota. It provides instructions on how to correctly fill out and submit the Form T12 Oil Report Amendment.

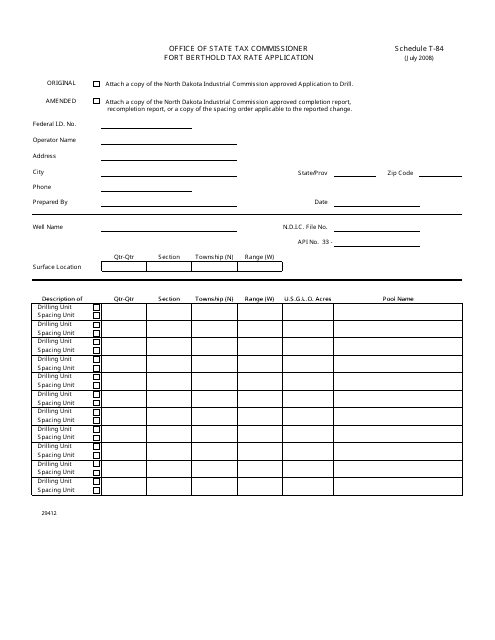

This document is used to apply for tax rates in Fort Berthold, North Dakota for Schedule T-84.

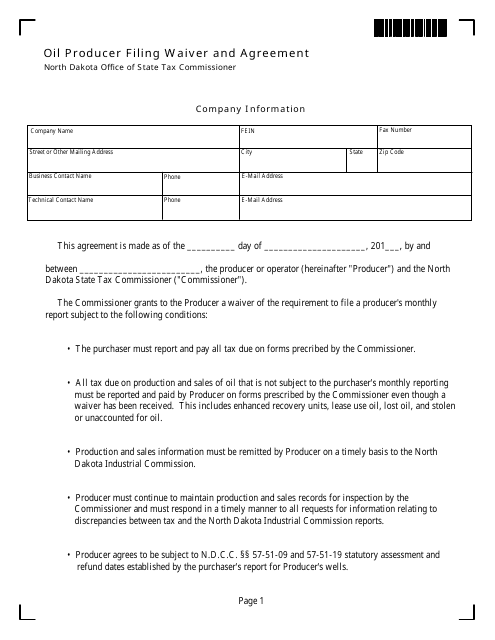

This Form is used for oil producers in North Dakota to file a waiver and agreement.

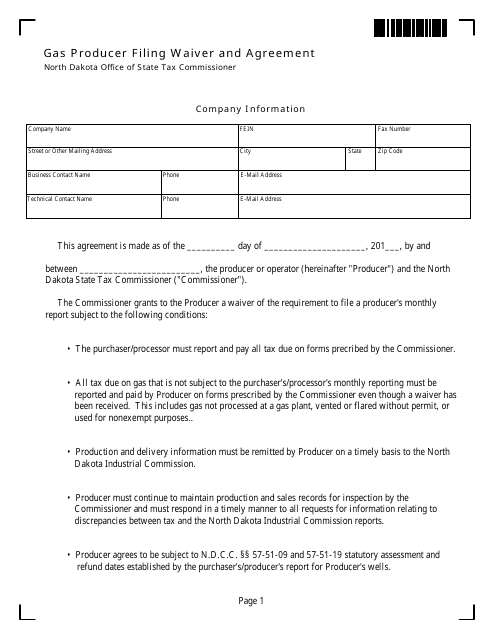

This Form is used for gas producers in North Dakota to file a waiver and agreement.

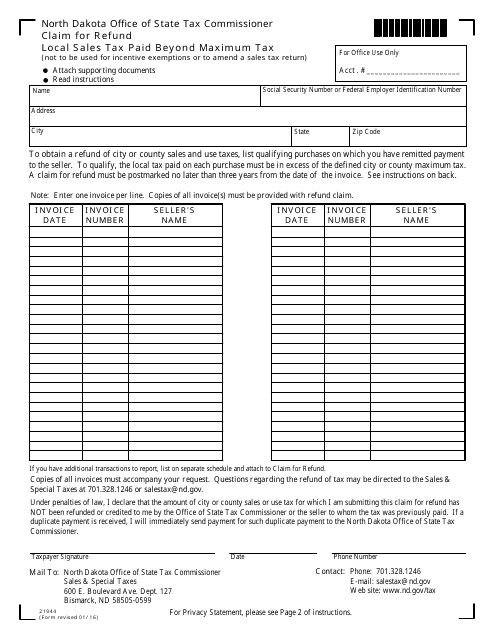

This Form is used for claiming a refund on local sales tax paid beyond the maximum tax amount in North Dakota.

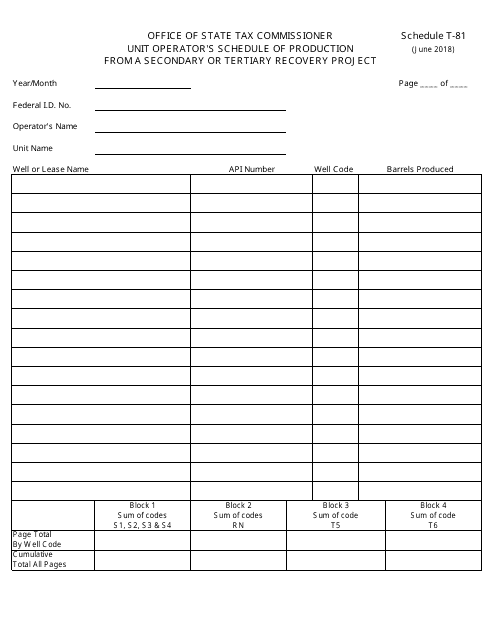

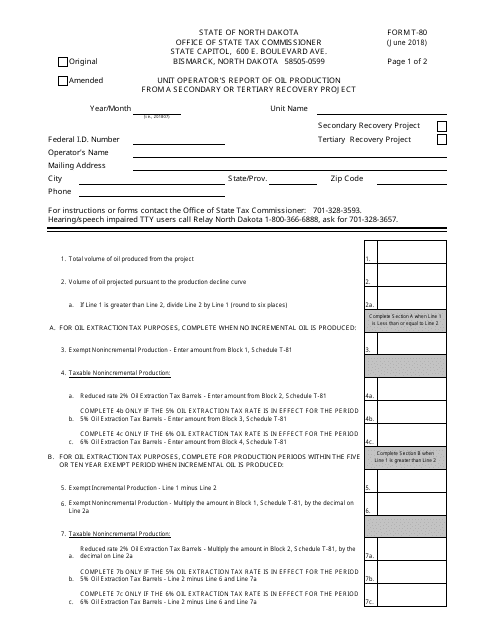

This form is used for reporting the production from a secondary or tertiary recovery project in North Dakota. It is specifically designed for unit operators to submit their schedule of production.

This document provides instructions for reporting oil and gas taxes specifically for the Fort Berthold Reservation in North Dakota. It guides individuals or businesses on how to properly report and pay taxes related to oil and gas operations on the reservation.

This document provides instructions on how to file and pay oil and gas taxes in North Dakota. It includes information on reporting requirements, deadlines, and payment methods.

This form is used for reporting oil production from secondary or tertiary recovery projects in North Dakota.

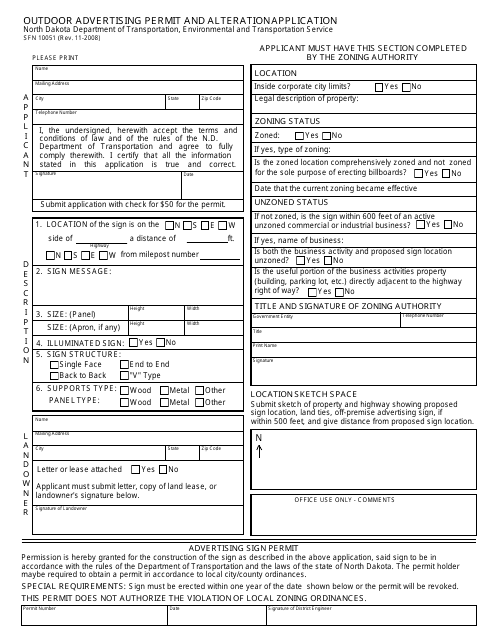

This form is used for applying for an outdoor advertising permit and making alterations to existing advertisements in North Dakota.

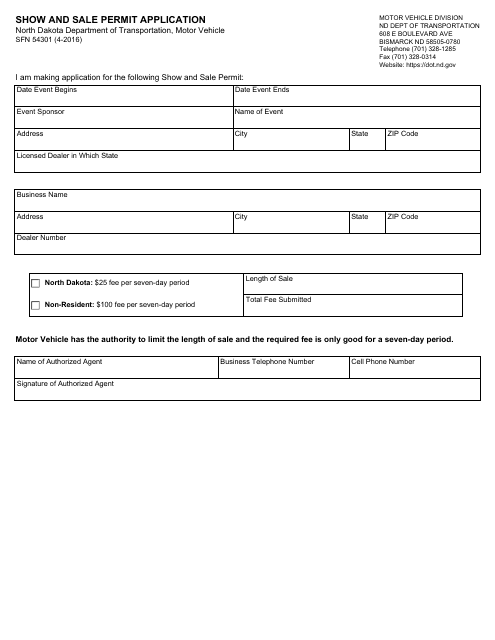

This form is used for applying for a Show and Sale Permit in North Dakota.

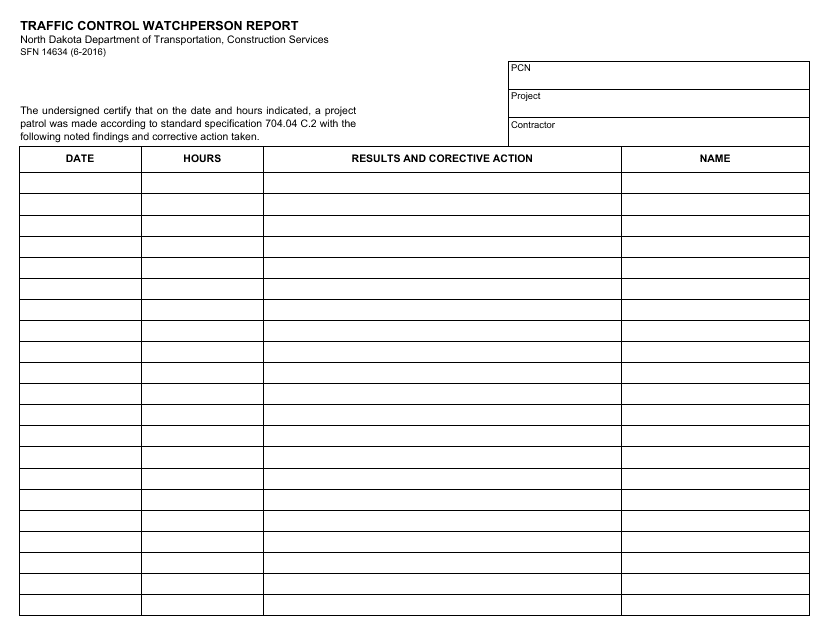

This form is used for reporting the activities of a traffic control watchperson in North Dakota.

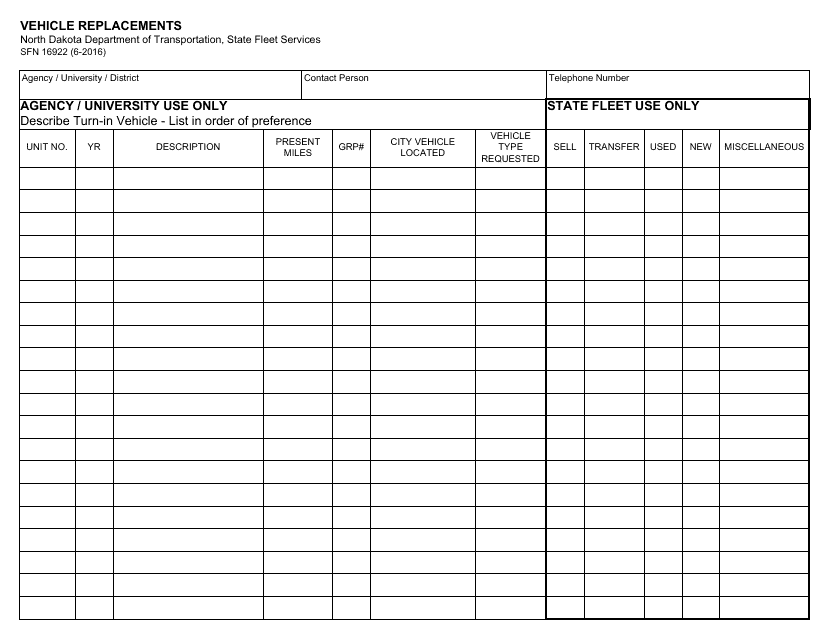

This form is used for requesting vehicle replacements in the state of North Dakota. It is used to assess eligibility and process the replacement of vehicles.

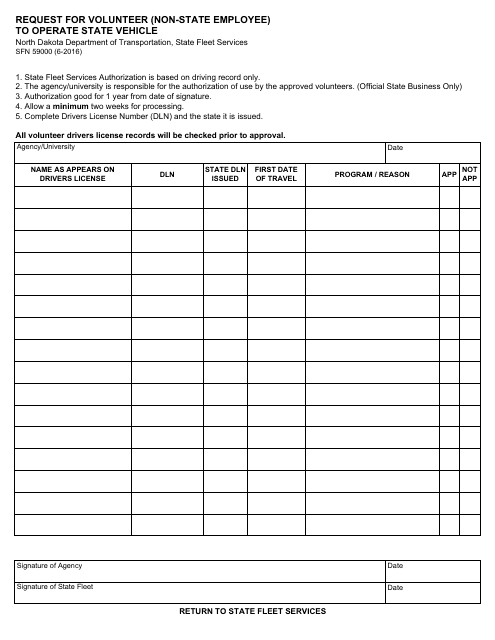

This form is used for individuals who are not state employees in North Dakota to request permission to operate a state vehicle as a volunteer.

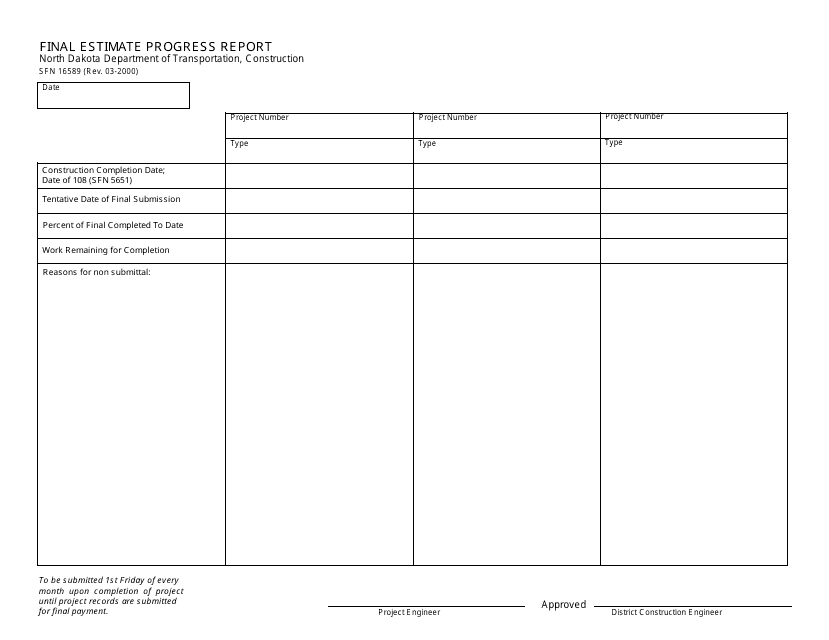

This form is used for submitting the final estimate progress report in North Dakota. It is a document that provides an update on the progress of a project and the estimated completion costs.

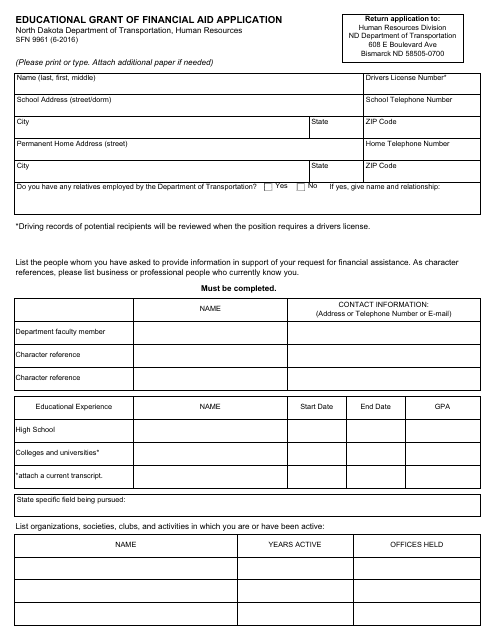

This form is used for applying for educational grants or financial aid in North Dakota.

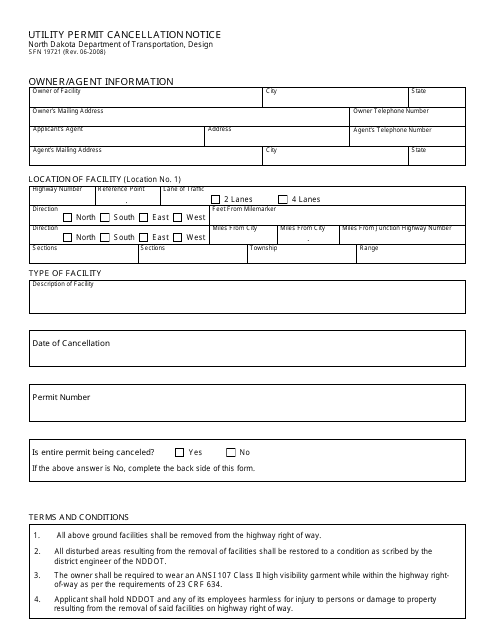

This form is used for notifying the cancellation of a utility permit in North Dakota.

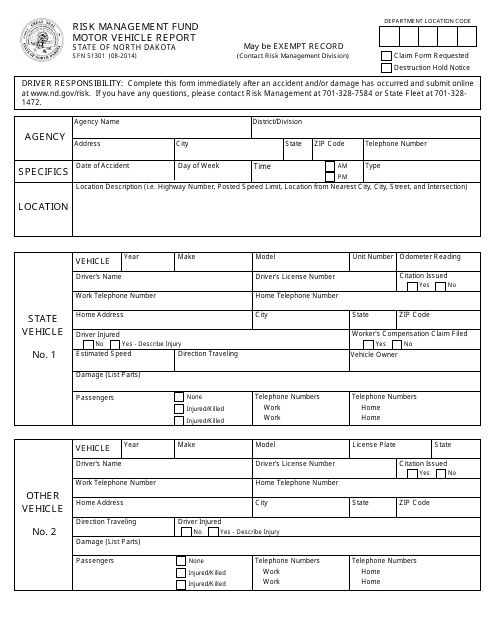

This form is used for reporting motor vehicle incidents to the Risk Management Fund in North Dakota.

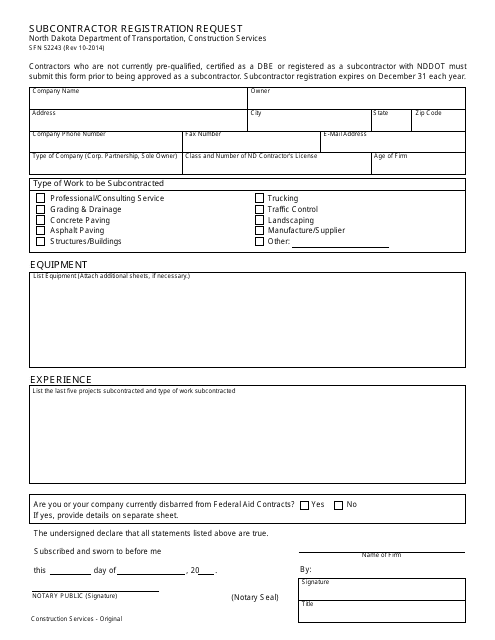

This form is used for subcontractors to register their request in North Dakota.