Fill and Sign Hawaii Legal Forms

Documents:

2783

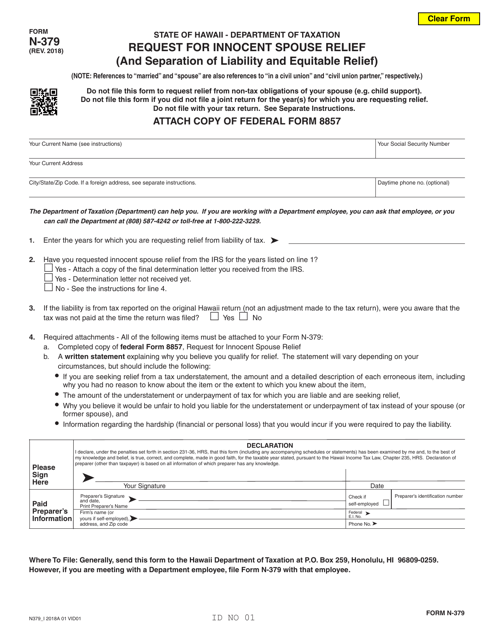

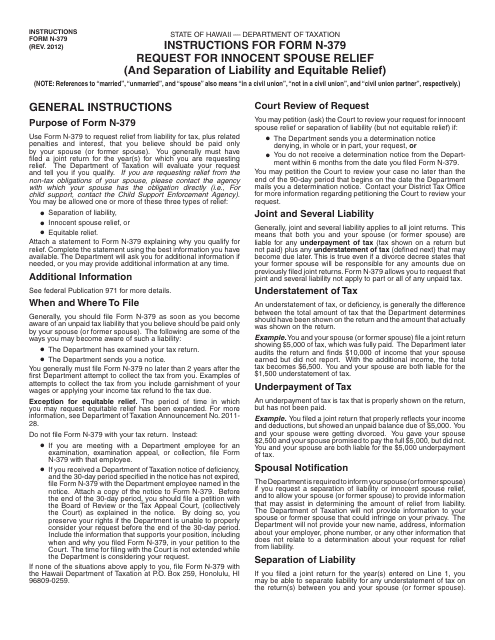

This Form is used for requesting innocent spouse relief in the state of Hawaii. It provides instructions on how to apply for relief from joint tax liability when a spouse or former spouse believes they should not be held responsible for the other spouse's tax obligations.

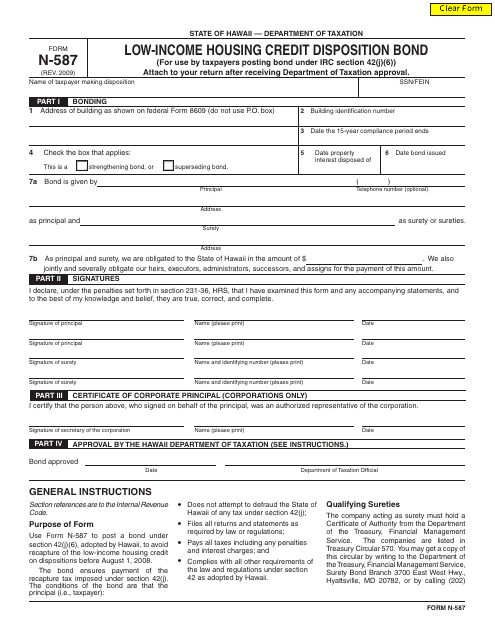

This Form is used for low-income housing credit disposition bond in Hawaii. It helps individuals and organizations in Hawaii to claim tax credits for Low-Income Housing projects.

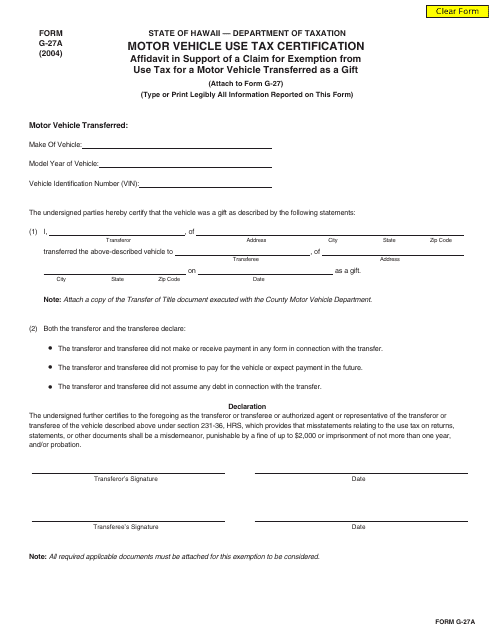

This document is used for claiming an exemption from motor vehicle use tax in Hawaii when transferring a vehicle as a gift.

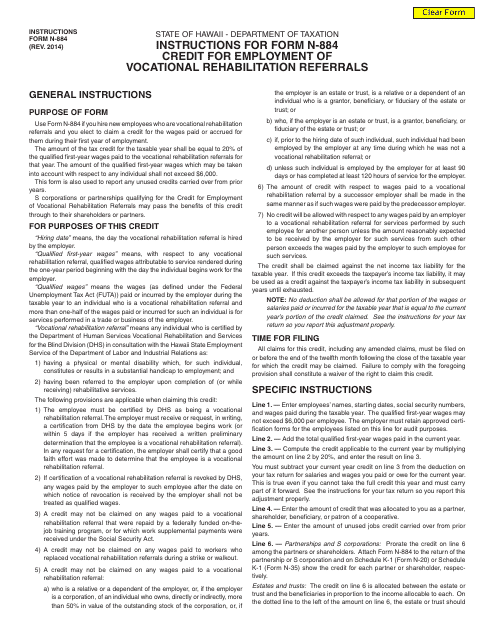

This Form is used to claim the credit for employing vocational rehabilitation referrals in Hawaii. It provides instructions on how to properly fill out and submit Form N-884.

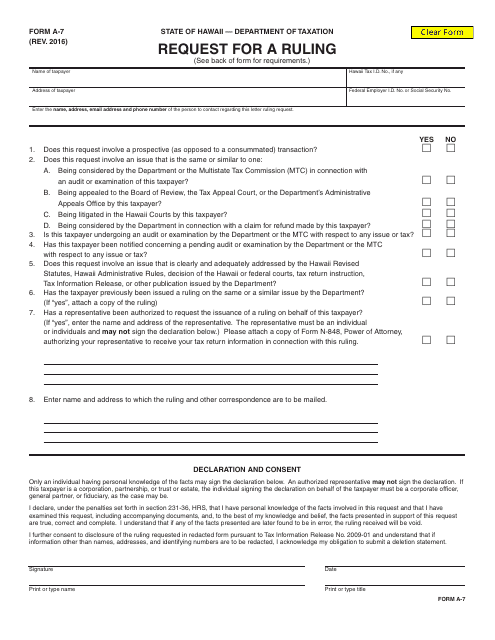

This form is used for requesting a ruling in the state of Hawaii.

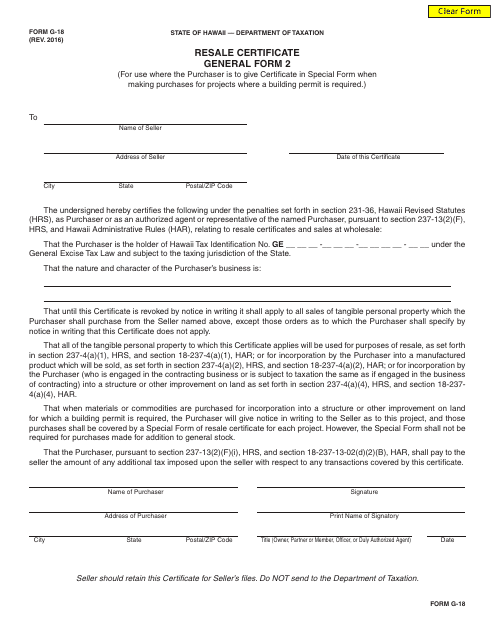

This form is used for applying for a resale certificate in Hawaii. It is a general form that allows businesses to make tax-exempt purchases for resale purposes.

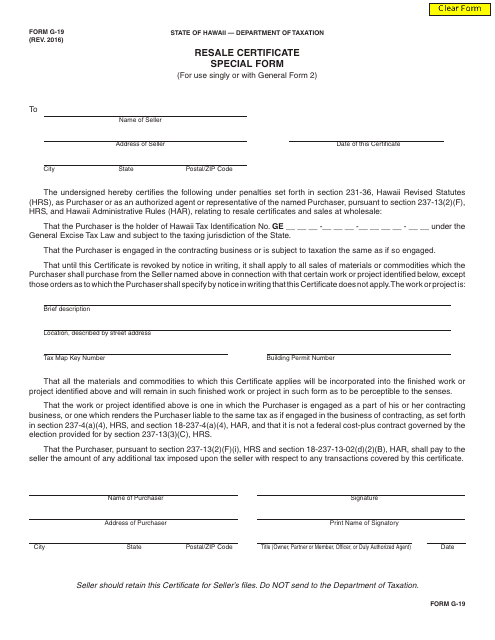

This form is used for filing a resale certificate in Hawaii for special situations. It allows businesses to make tax-exempt purchases for resale purposes.

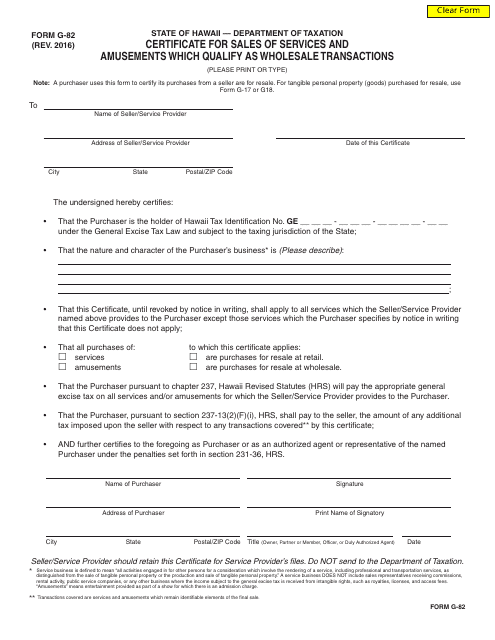

This Form is used for certifying sales of goods, services, and amusements that qualify for the phased-in wholesale deduction in Hawaii.