Fill and Sign Maine Legal Forms

Documents:

2481

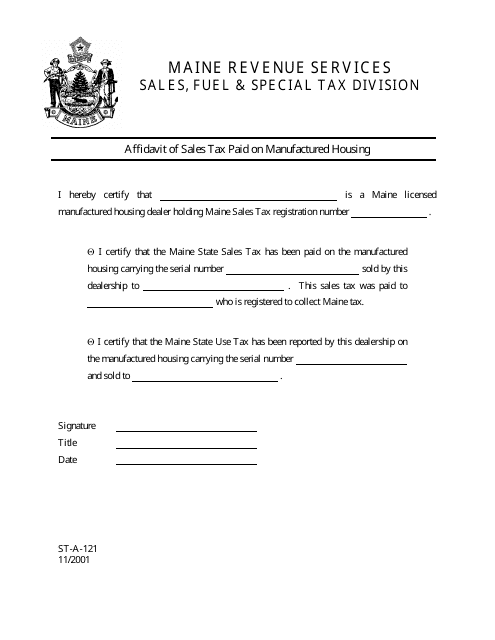

This Form is used for declaring the sales tax paid on manufactured housing in the state of Maine.

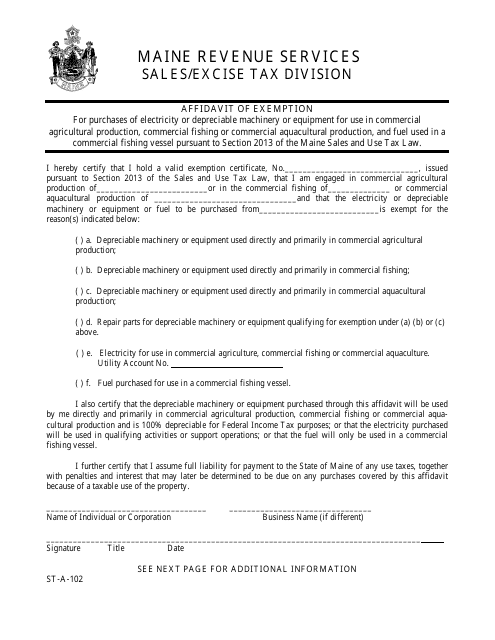

This form is used for filing an affidavit of exemption in the state of Maine. It is a document that allows individuals to claim exemption from certain requirements or obligations.

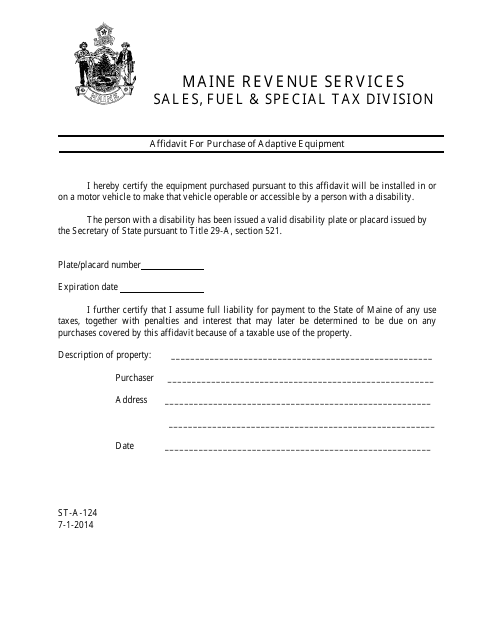

This form is used for submitting an affidavit when purchasing adaptive equipment in the state of Maine.

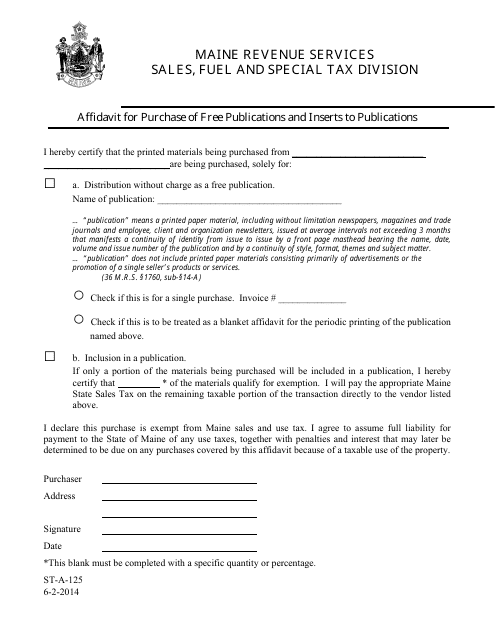

This Form is used for filing an affidavit for the purchase of free publications and inserts to publications in the state of Maine.

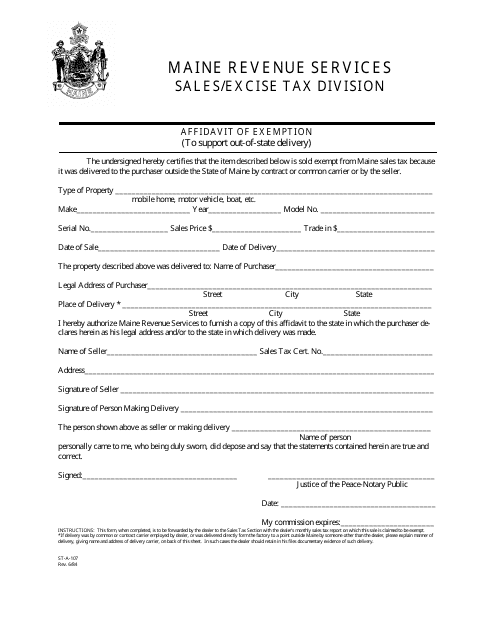

This document is used for claiming an exemption from sales tax for out-of-state deliveries in Maine.

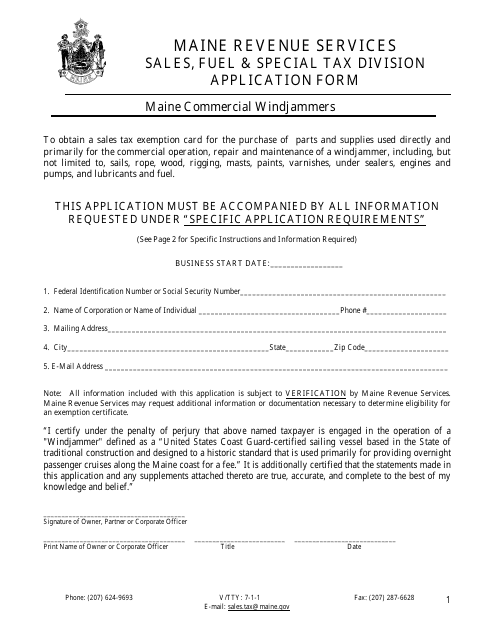

This form is used for applying for an exemption for Maine Commercial Windjammers in Maine.

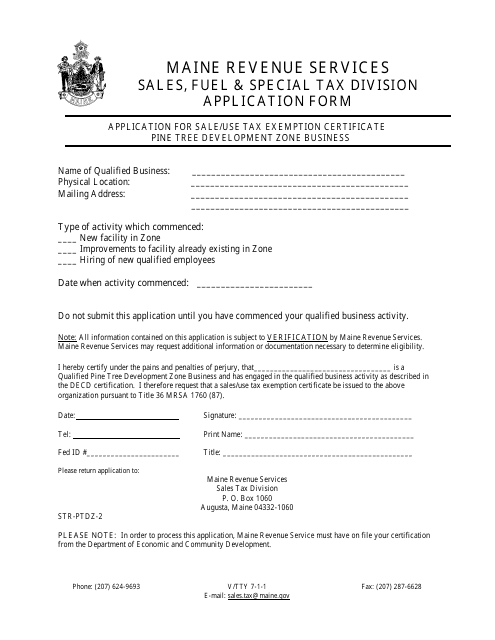

This form is used for applying for a Sale/Use Tax Exemption Certificate for Pine Tree Development Zone businesses in Maine.

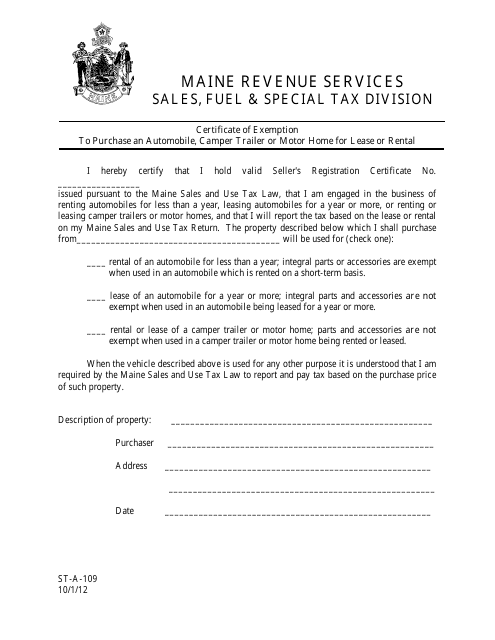

This form is used for obtaining a certificate of exemption to purchase an automobile, camper trailer, or motor home for lease or rental purposes in the state of Maine.

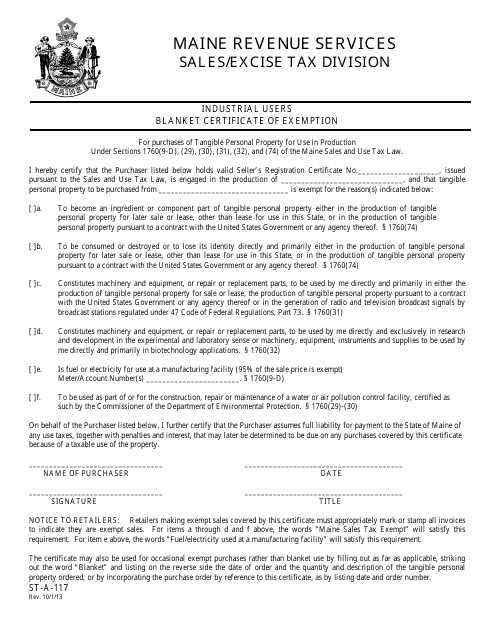

This Form is used for Industrial Users to claim exemption from certain taxes in the state of Maine.

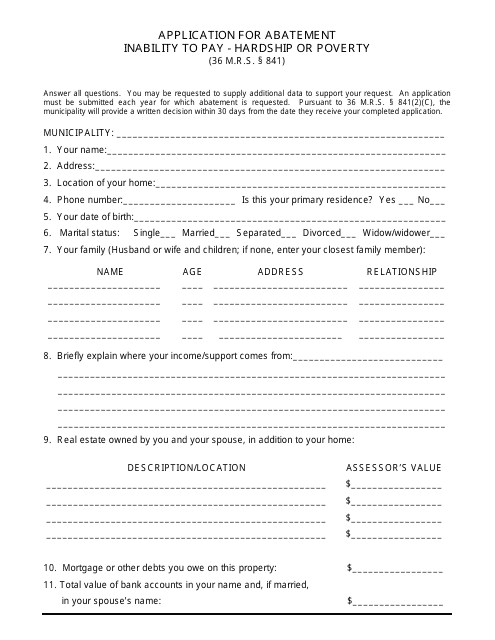

This Form is used for requesting a reduction or elimination of taxes owed to the State of Maine due to financial hardship or poverty.

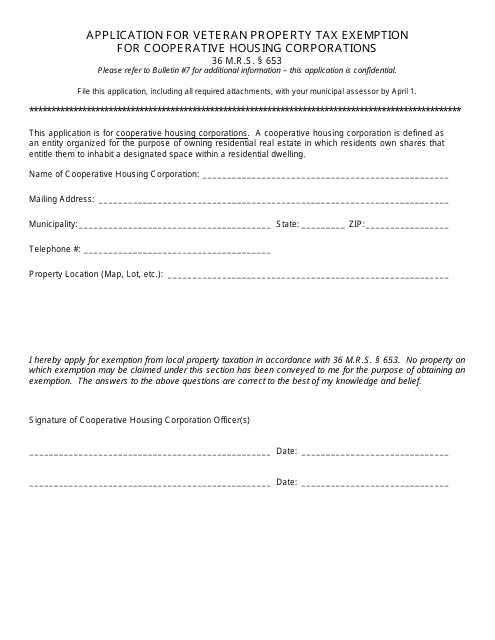

This form is used for applying for a property tax exemption for veteran residents of cooperative housing corporations in the state of Maine.

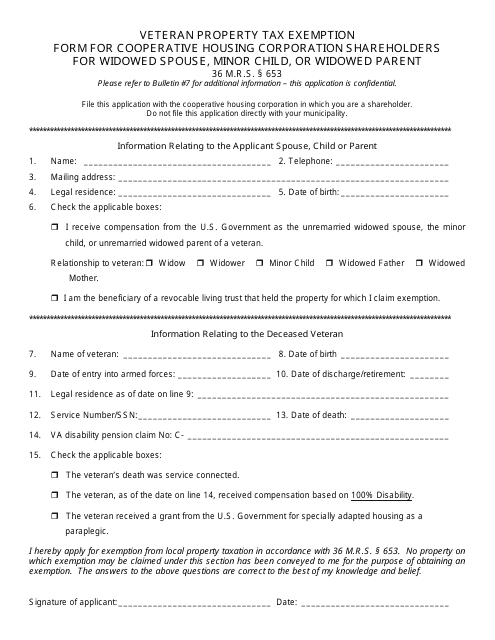

This Form is used for claiming property tax exemption for widowed spouses, minor children, or widowed parents who are shareholders of cooperative housing corporations in Maine.

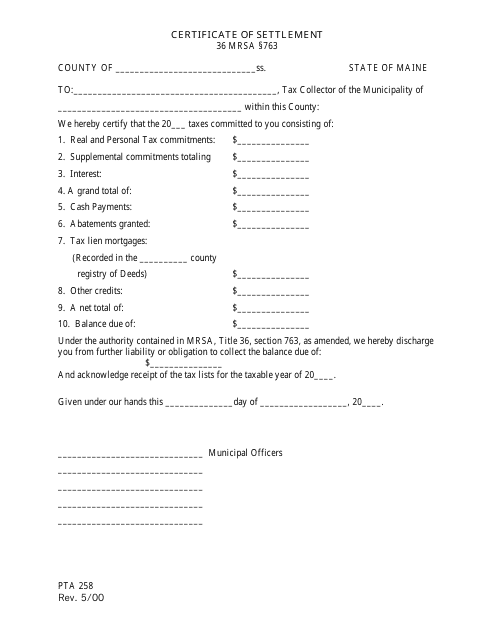

This form is used for applying for a Certificate of Settlement in the state of Maine. It is required in order to finalize the settlement of a legal case.

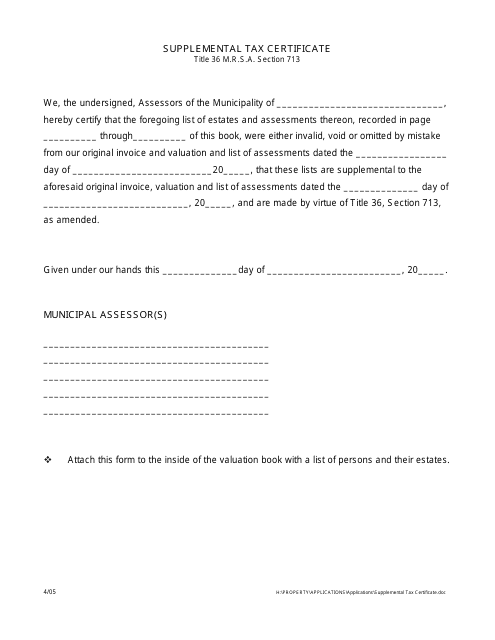

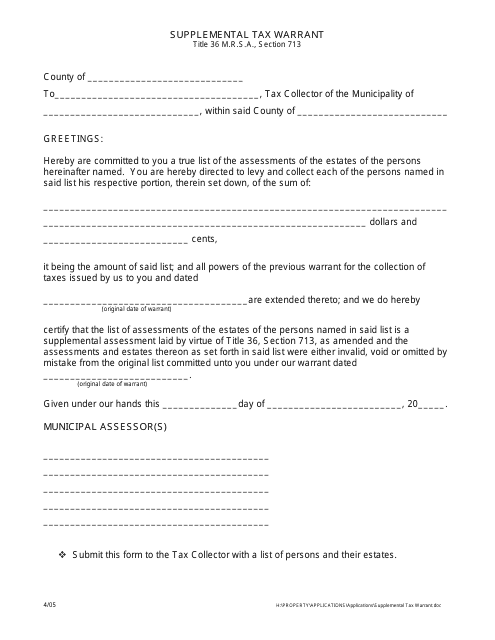

This type of document is used for reporting supplemental taxes in the state of Maine.

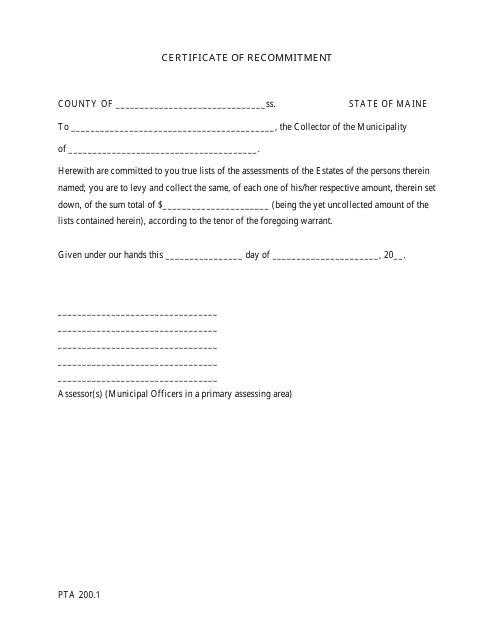

This document is a supplemental form used for tax warrants in the state of Maine. It provides additional information or updates to an existing tax warrant filing.

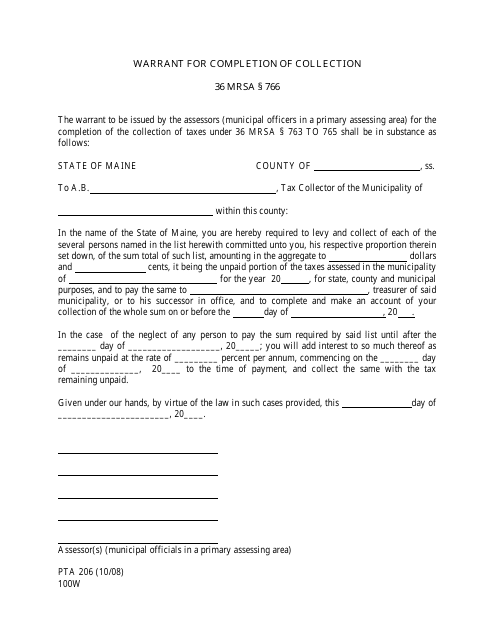

This form is used for obtaining a warrant to complete the collection process in the state of Maine. It helps to authorize the collection of outstanding debts or taxes by legal means.

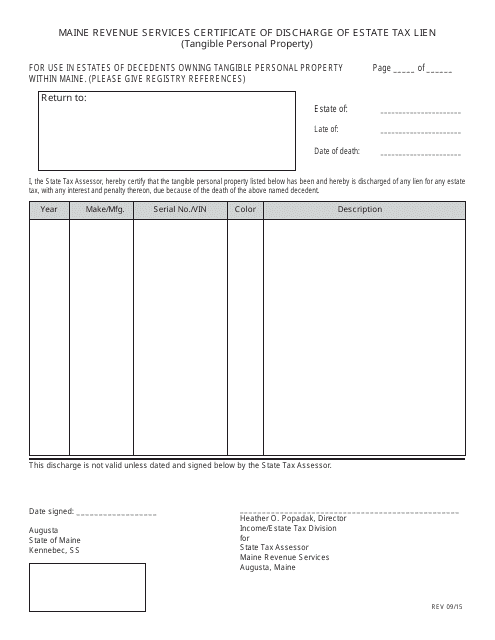

This type of document is used to discharge the estate tax lien on tangible personal property in the state of Maine.

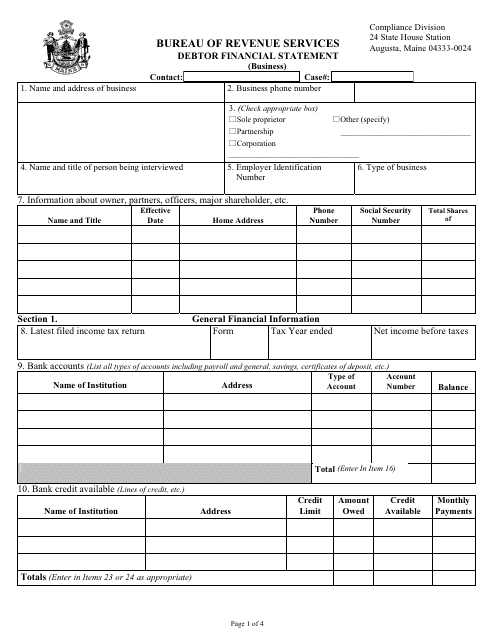

This document is used to collect financial information from a debtor in the state of Maine. It helps assess the debtor's ability to repay their debts.

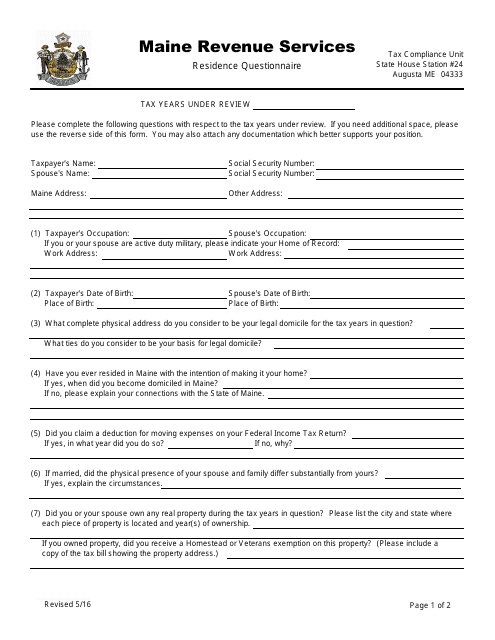

This Form is used for gathering information about a person's residence in the state of Maine. It includes questions about the individual's address, length of residency, and other details regarding their living situation in Maine.

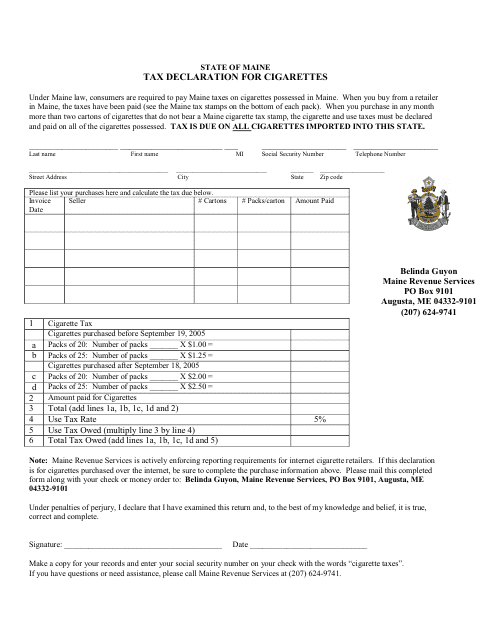

This Form is used for declaring and reporting taxes on cigarettes in the state of Maine.

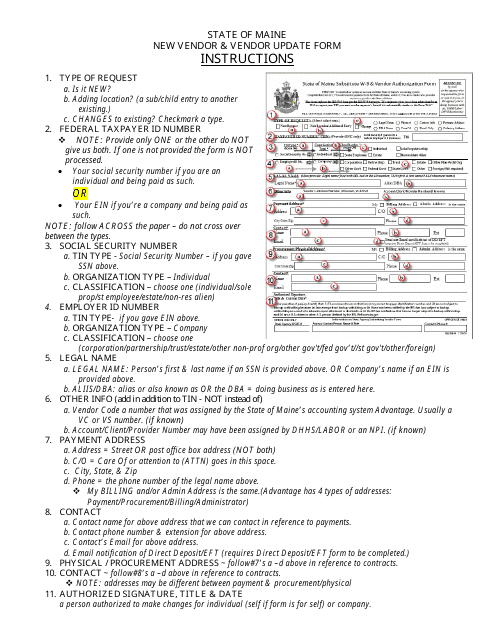

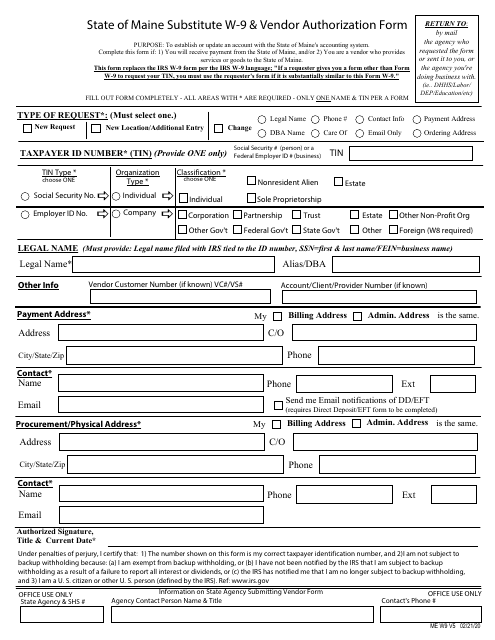

This document provides instructions for completing the Substitute W-9 & Vendor Authorization Form in the state of Maine. It explains how to fill out the form and provides guidance on any required supporting documentation.

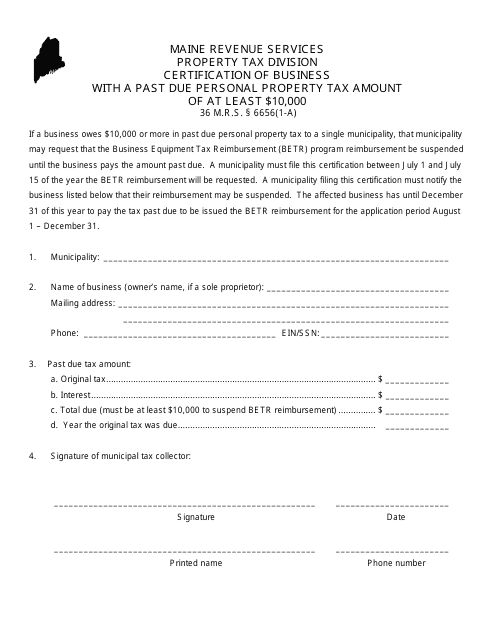

This document certifies a business with a past due personal property tax amount of at least $10,000 in the state of Maine.

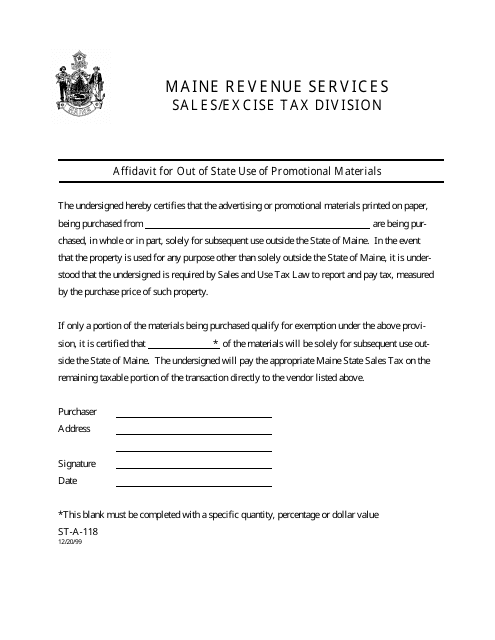

This form is used for individuals or businesses in Maine who want to use promotional materials out of state. The form allows them to provide an affidavit stating the details of their promotional activities outside of Maine.

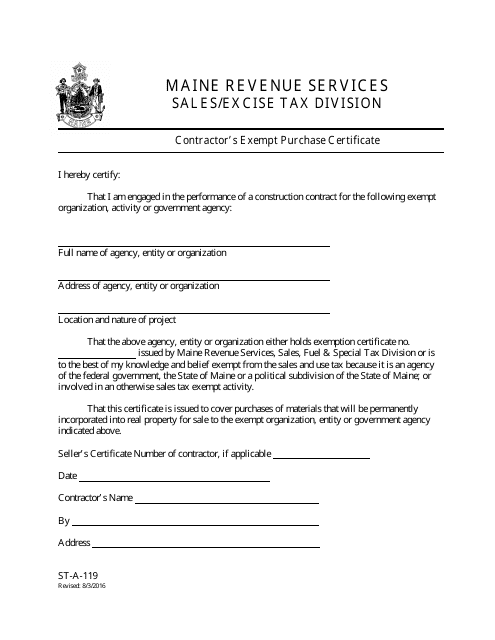

This form is used for contractors in Maine to claim exemption from sales tax when making purchases for use in a construction project.

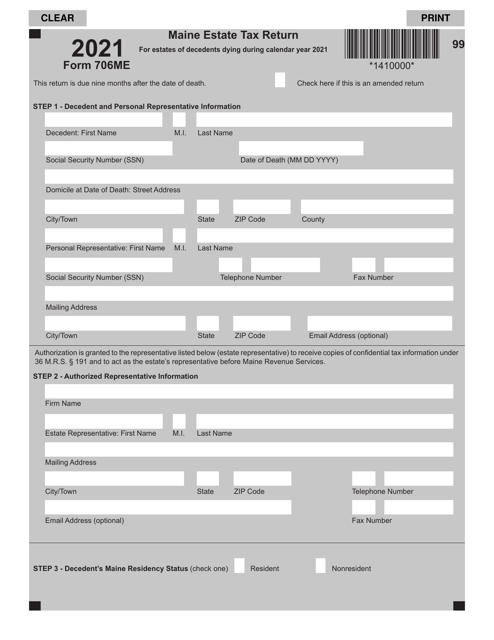

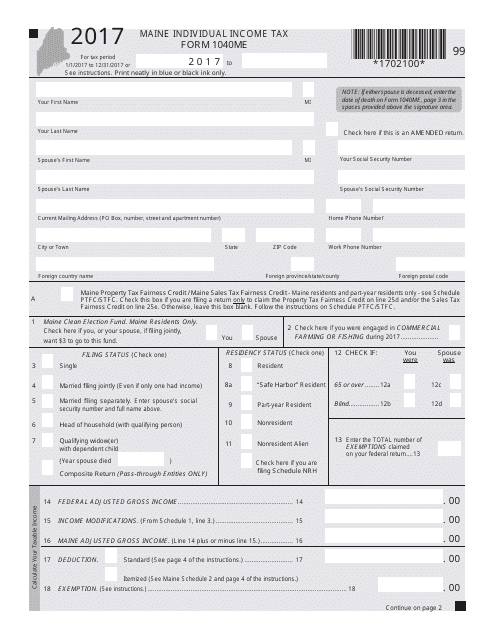

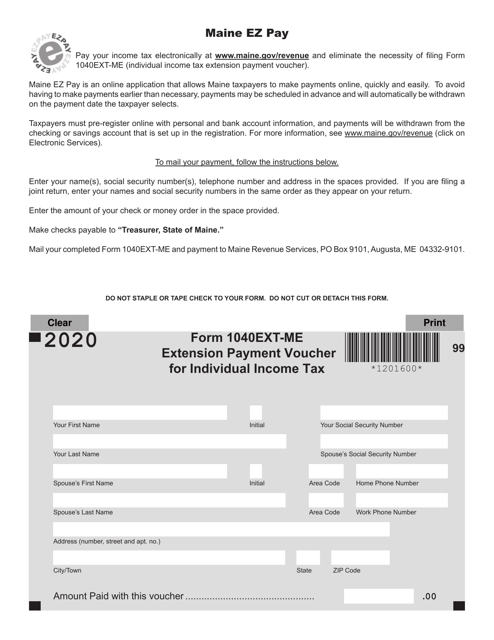

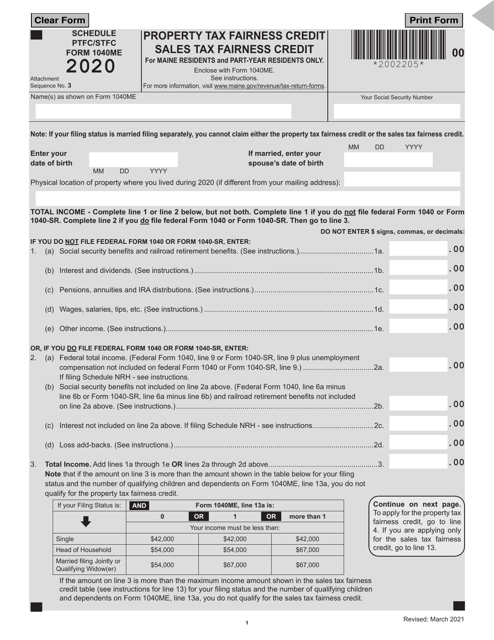

This Form is used for filing individual income tax in the state of Maine.

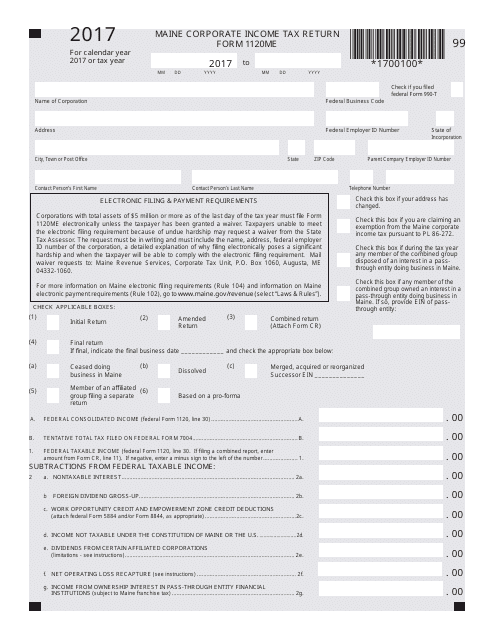

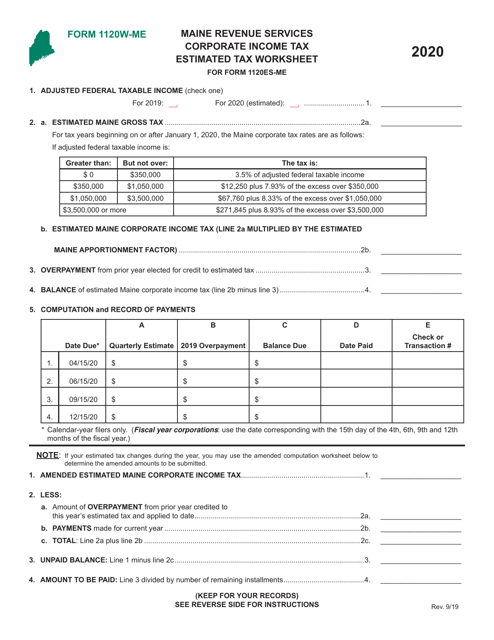

This form is used for filing the Maine Corporate Income Tax Return for businesses operating in Maine.

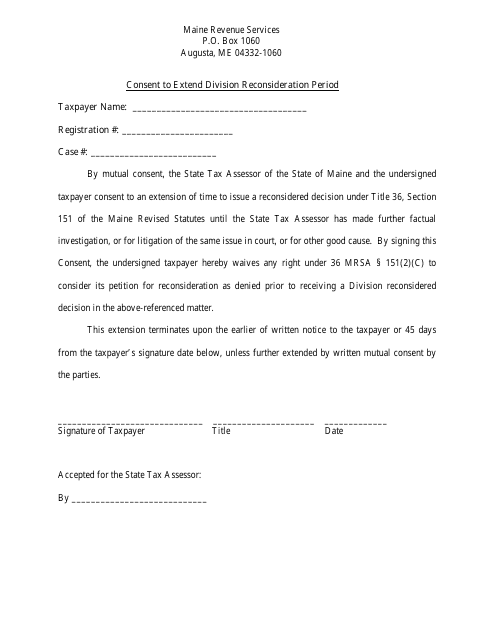

This document allows individuals in Maine to give consent to extend the division reconsideration period.

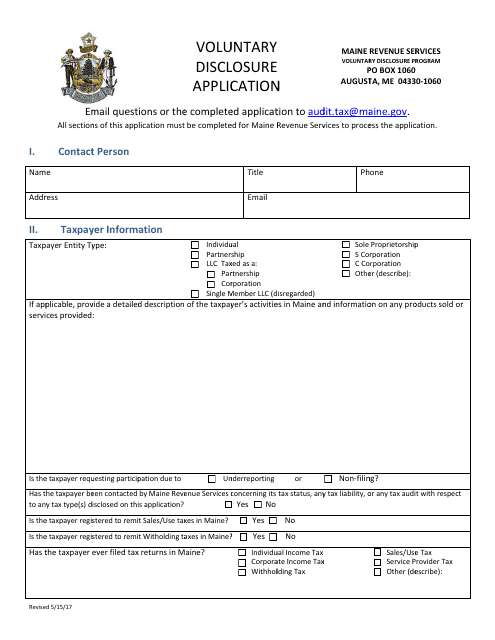

This form is used for the voluntary disclosure application in the state of Maine.