Fill and Sign DD 2058 Forms

What Is DD Form 2058 Series?

DD Form 2058, 2058-1, and 2058-2 are residence- and pay-related documents used by the Defense Finance and Accounting Service (DFAS) of the Department of Defense (DoD) . Form DD 2058 is used to record cases of change of residency. The DD 2058-1 and 2058-2 are used by service members in order to legally avoid state income tax withholding on their military pay.

-

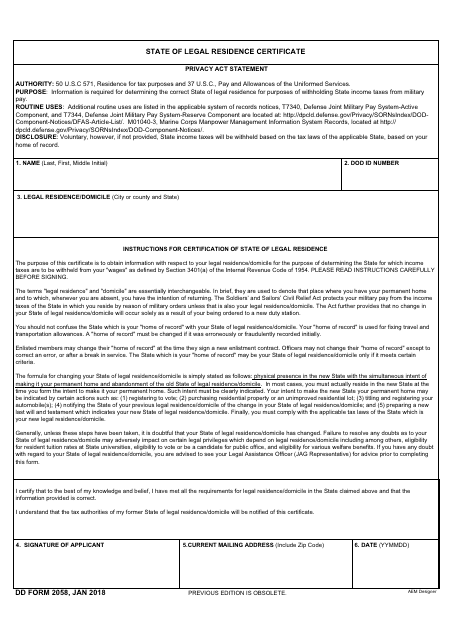

DD Form 2058, State of Legal Residence Certificate, is used for determining and declaring legal residency for purposes of withholding state income taxes from the military pay. This form denotes the place where the service members have their permanent home and where they plan to return. The intent to become a permanent resident within a state can and should be proven by at least one of the following:

- Having ownership of property within the state;

- Registering a vehicle;

- Obtaining a driver’s license through the DMV;

- Registering to vote or voting.

-

Some states may exclude some or all income tax from military pay. DD Form 2058-1, State Income Tax Exemption Test Certificate, is completed if the service member is a resident of a state that allows exemptions from an income tax for service members. The filed and signed DD Form 2058-1 must be turned in at S-1. Residents of applicable states must spend no less than 30 days in their state of residence during the tax year to be considered a resident of that state for all tax purposes.

-

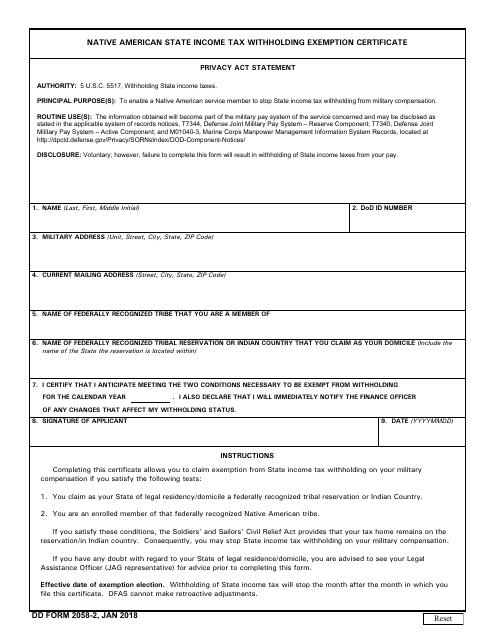

DD Form 2058-2, Native American State Income Tax Withholding Exemption Certificate, enables Native-American service members to stop their state income tax withholding from their military pay. All enrolled members of federally recognized Native American tribes are subject to income tax exemptions if their state of legal residence is a federally-recognized tribal reservation or an Indian country.

Documents:

2

This is a document used by Native American service men and service women to claim state income tax exemption on their military pay.

This form collects information in order to determine the correct State of legal residence for purposes of withholding State income taxes from military pay.