Fill and Sign Wisconsin Legal Forms

Documents:

5190

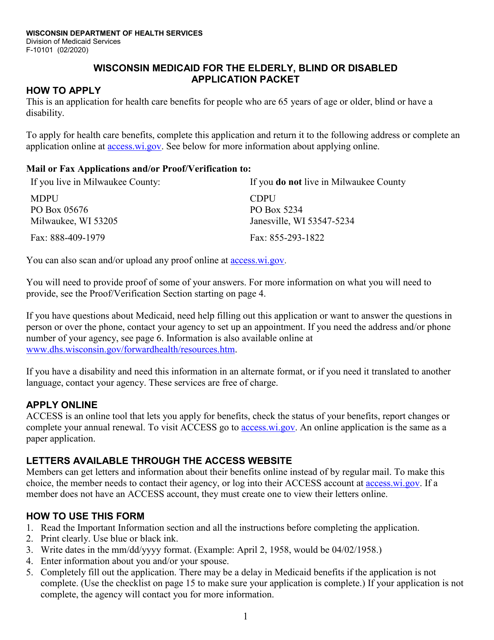

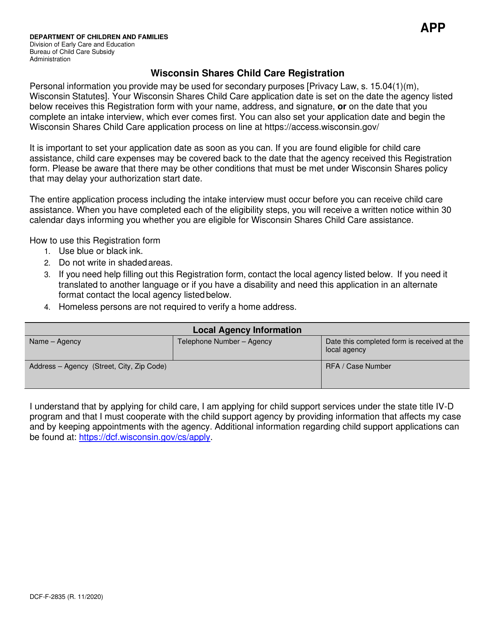

This Form is used for applying for Wisconsin Medicaid benefits for the elderly, blind or disabled individuals. This document contains the application packet required for submitting an application.

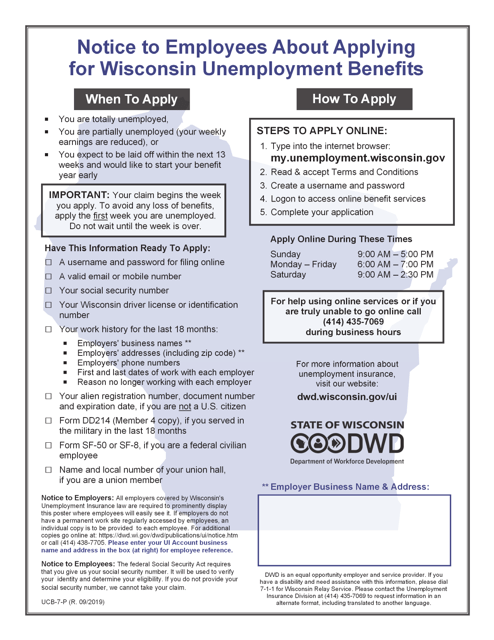

This form is used for informing employees in Wisconsin about the process of applying for unemployment benefits. It provides important information and instructions on how to file a claim.

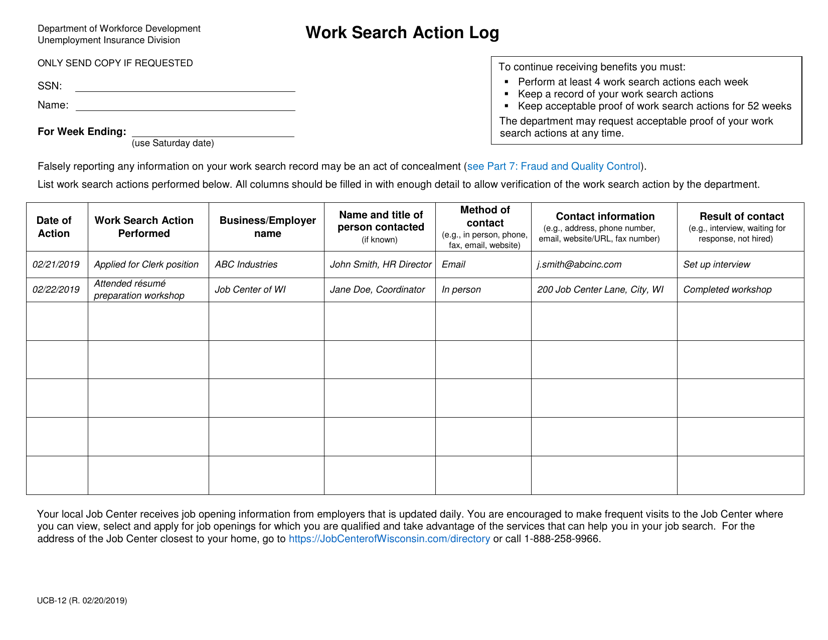

This form is used for logging work search actions in the state of Wisconsin. It is used to document activities related to job search efforts.

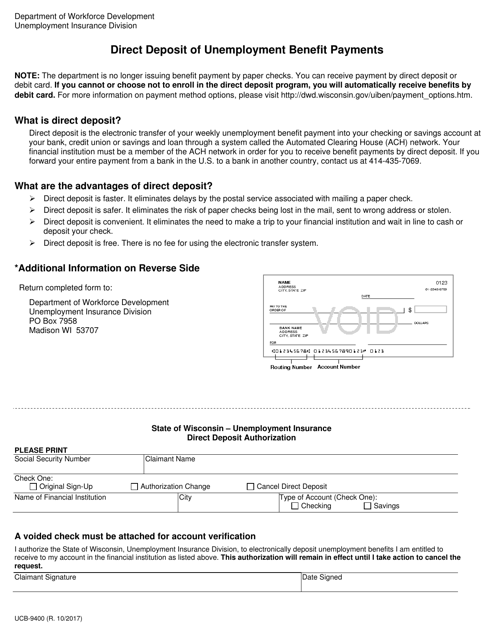

This form is used for authorizing direct deposit of funds into a bank account for residents in Wisconsin. It is a convenient way to receive payments electronically.

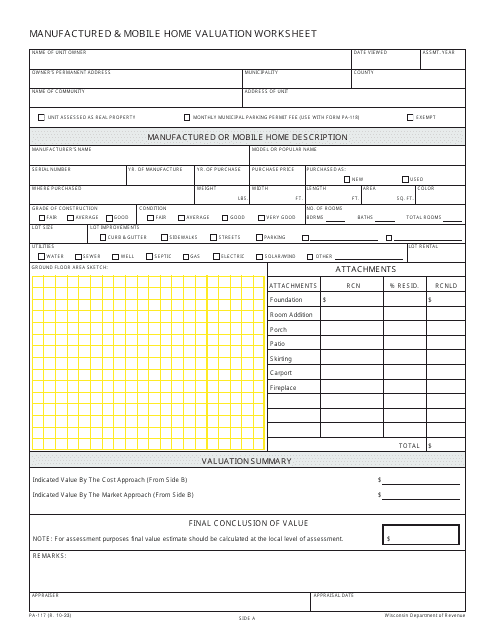

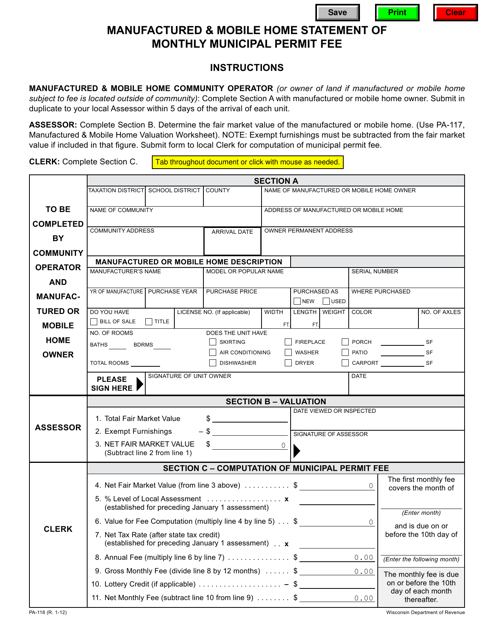

This form is used for reporting the monthly municipal permit fee for manufactured and mobile homes in Wisconsin.

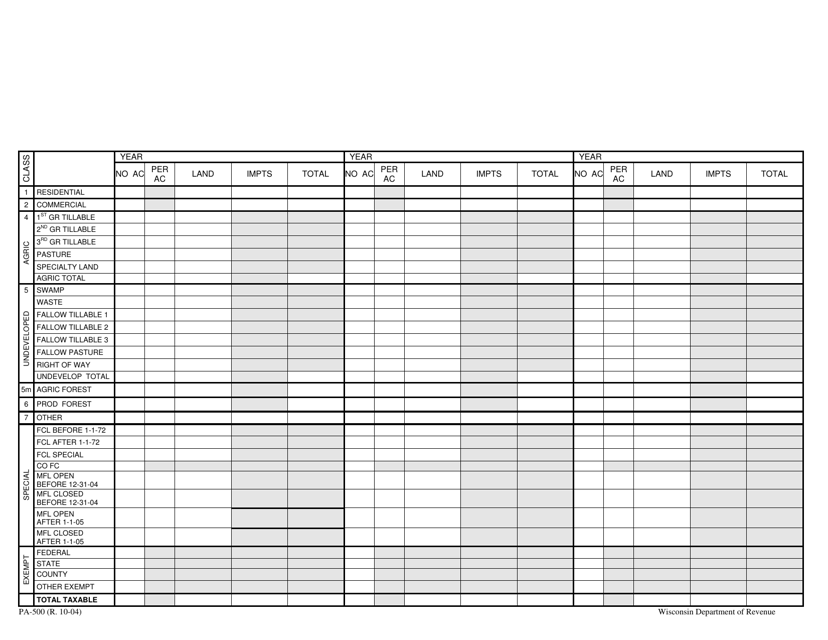

This form is used for recording residential property details in the state of Wisconsin. It allows property owners to provide information such as property address, size, and value to the relevant authorities.

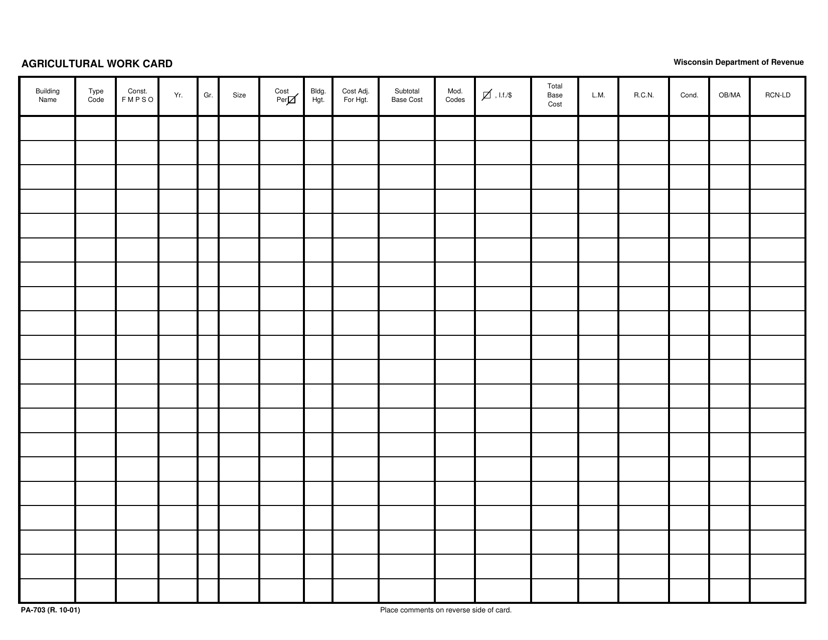

This document is for obtaining an Agricultural Work Card in Wisconsin. It is required for individuals working in the agricultural industry.

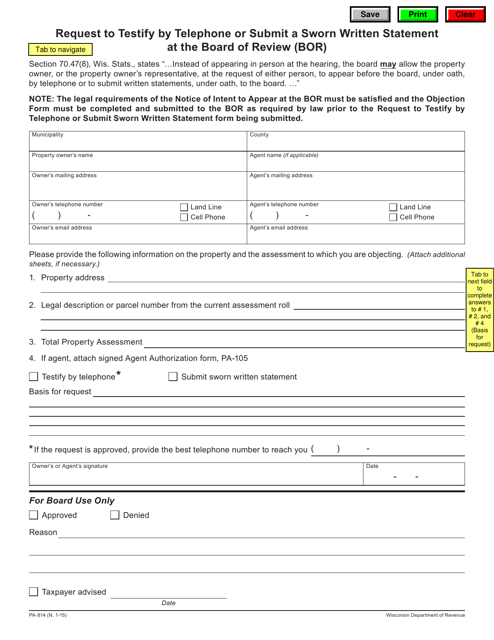

This form is used for requesting to testify by telephone or submit a sworn written statement at the Board of Review (BOR) in Wisconsin.

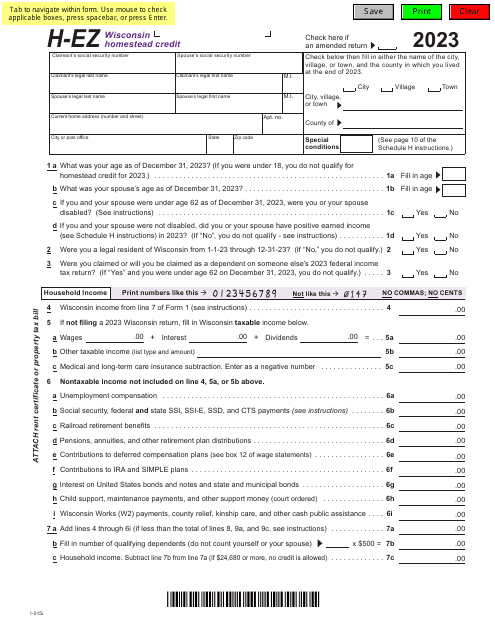

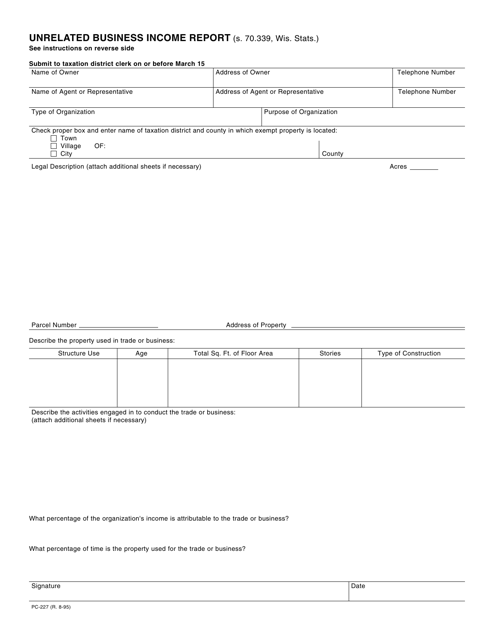

This Form is used for reporting unrelated business income in the state of Wisconsin.

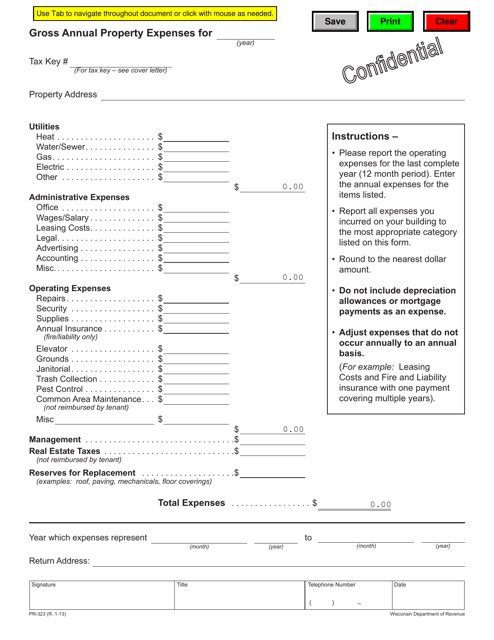

This form is used for reporting the gross annual property expenses in the state of Wisconsin.

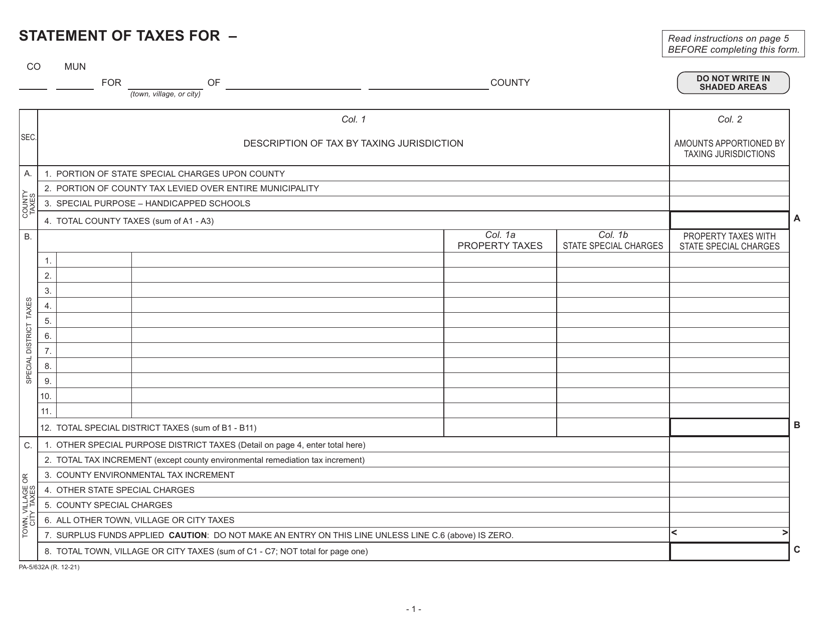

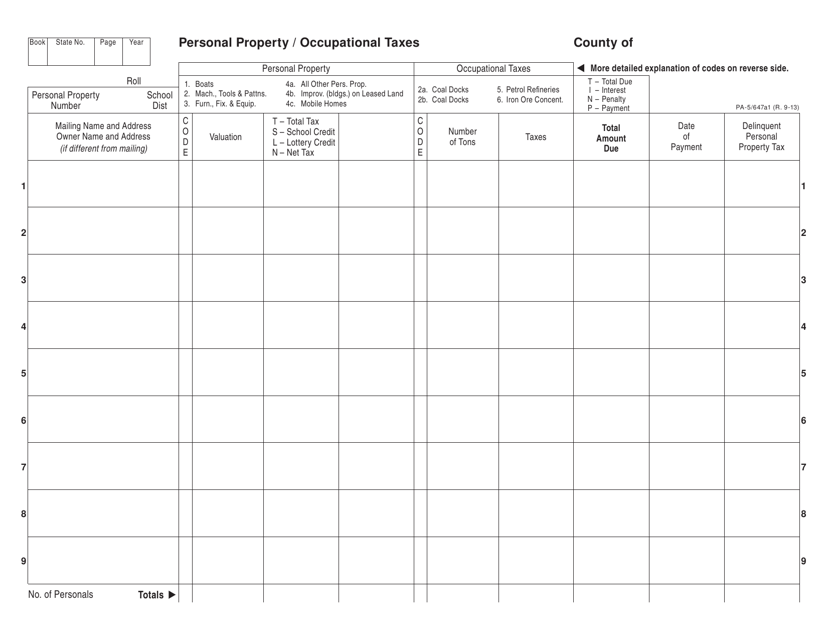

This form is used for reporting personal property and occupational taxes in the state of Wisconsin.

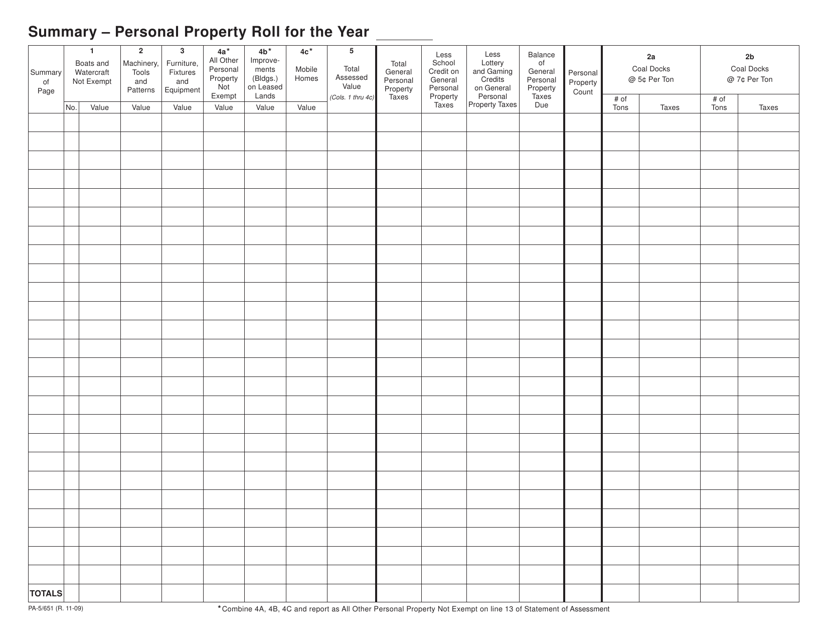

This Form PA-5/651 is used for reporting personal property in Wisconsin. It is used to create a personal property roll for tax assessment purposes.

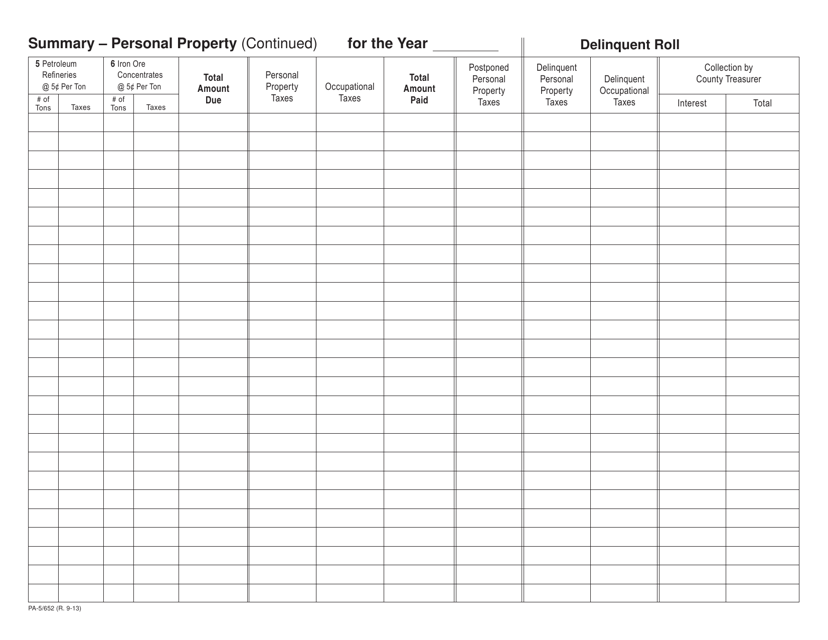

This form is used for reporting personal property in the state of Wisconsin. It is a continuation of the previous form PA-5-652.

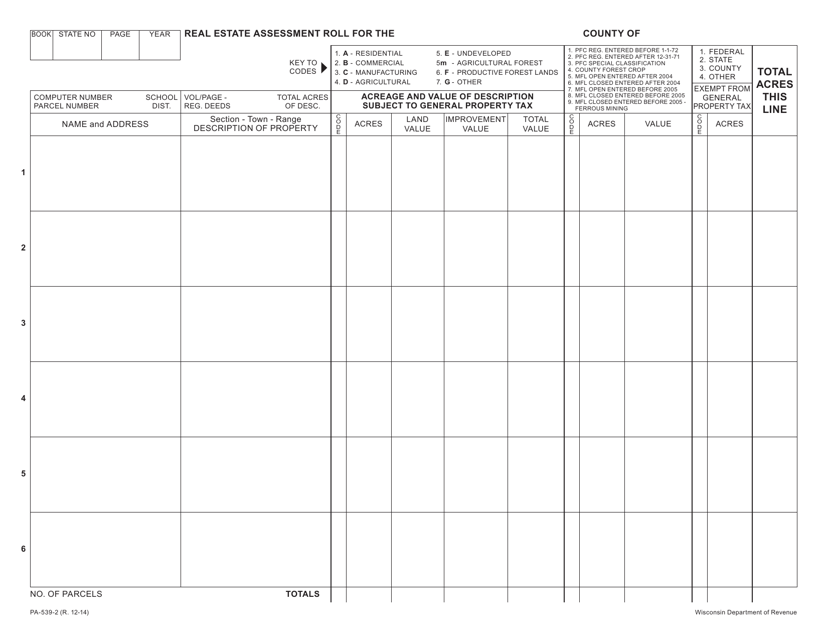

This form is used for accessing the real estate assessment roll in Wisconsin. It provides information about the assessed value of a property for tax purposes.

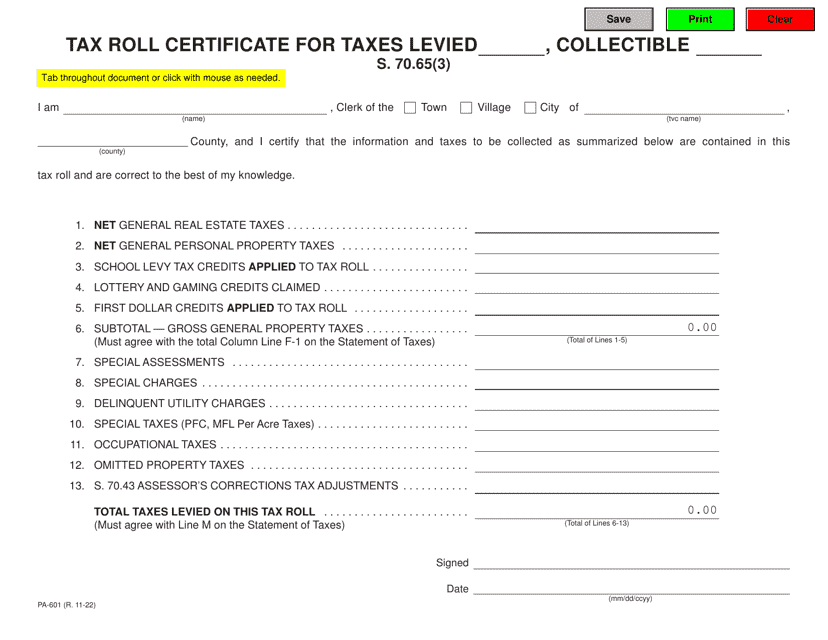

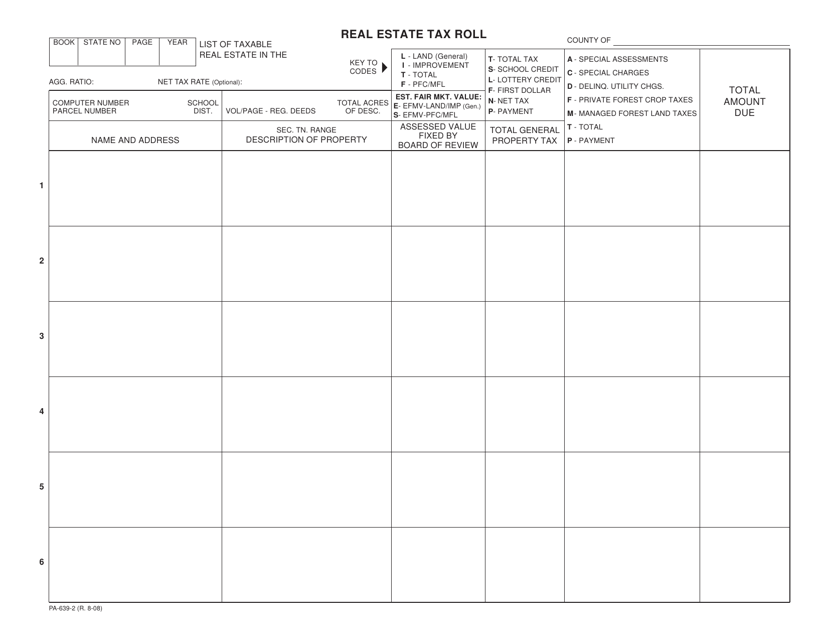

This Form is used for reporting real estate tax roll information in the state of Wisconsin.

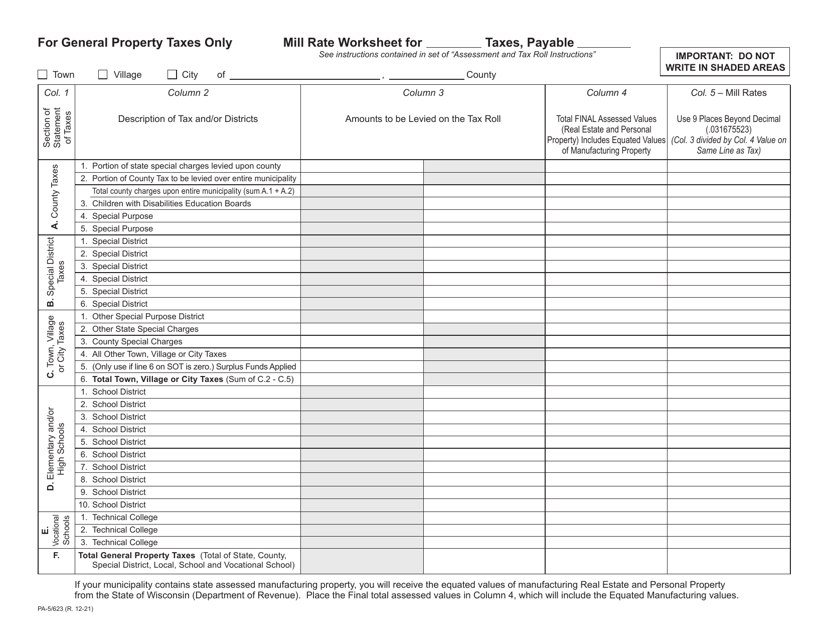

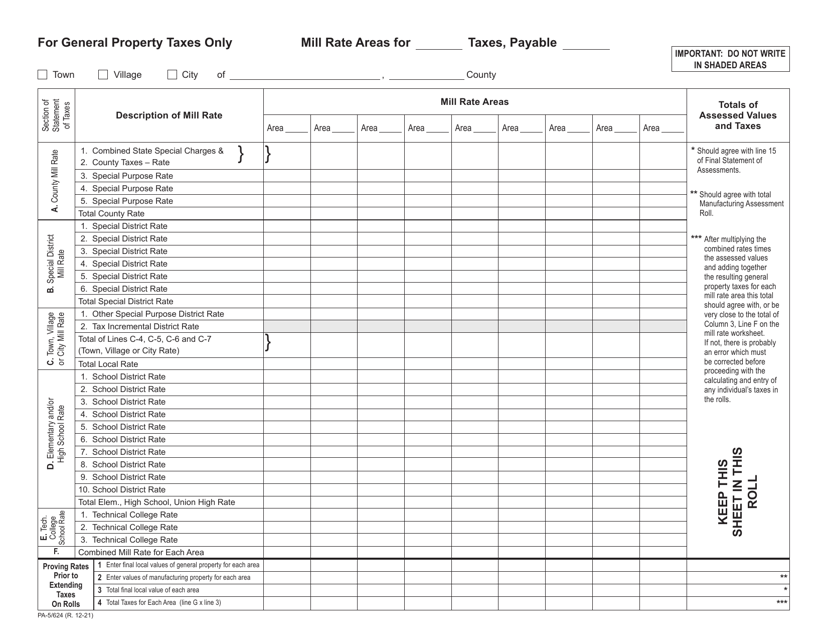

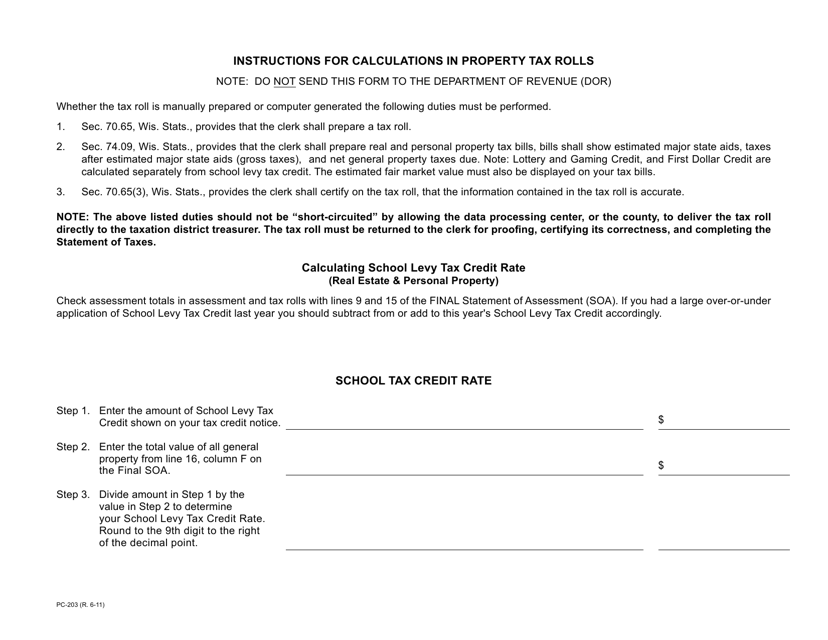

This document provides instructions for calculating property tax rolls in Wisconsin using Form PC-203. It guides individuals in understanding the calculations involved in determining property taxes.

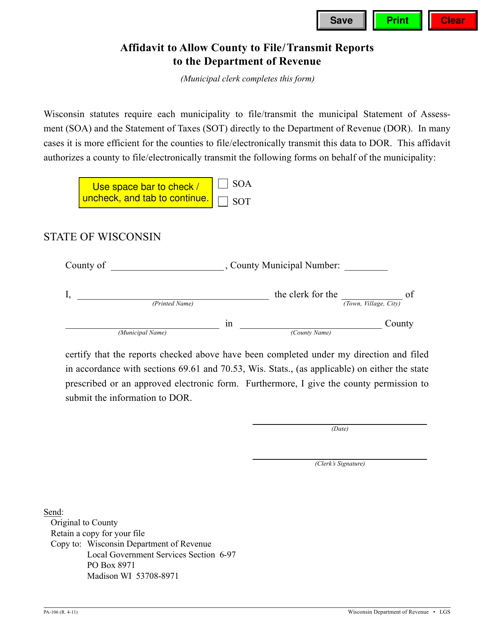

This form is used for the Affidavit to Allow County to File/Transmit Reports to the Department of Revenue in the state of Wisconsin. It allows the county to submit reports on behalf of its residents to the Department of Revenue.

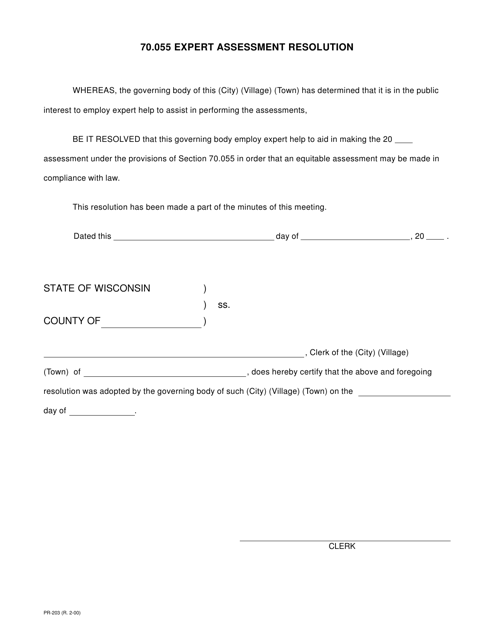

This document is a form used in Wisconsin for expert assessment resolution. It is used to facilitate the evaluation and resolution of disputes involving expert assessments.

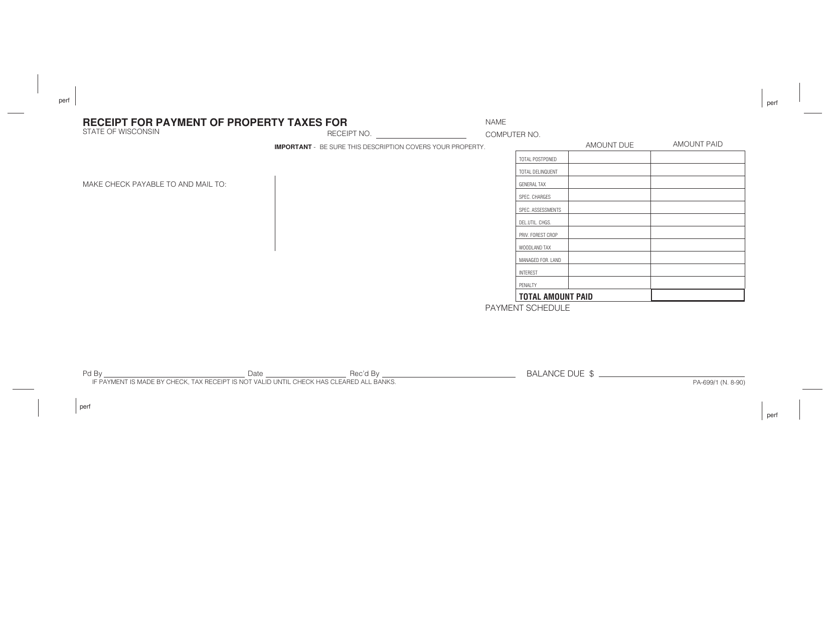

This form is used for providing a receipt for payment of property taxes in Wisconsin.

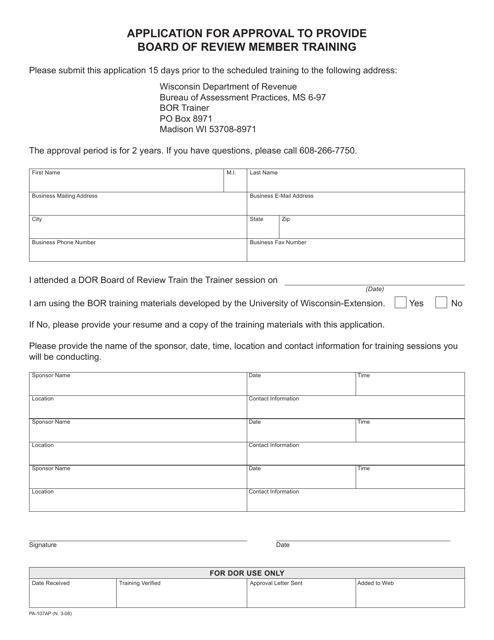

This form is used for applying to provide training to Board of Review members in Wisconsin.

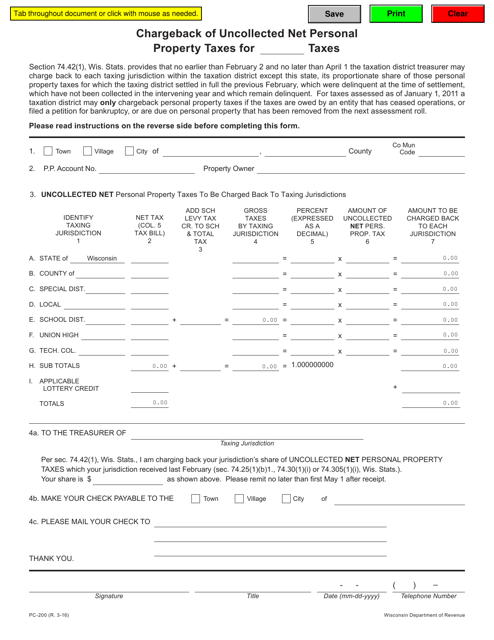

This Form is used for requesting a chargeback of uncollected net personal property taxes in the state of Wisconsin.

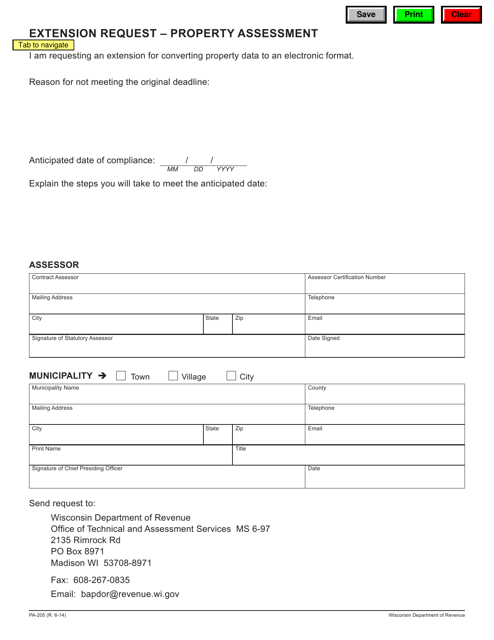

This Form is used for requesting an extension for property assessment in Wisconsin.

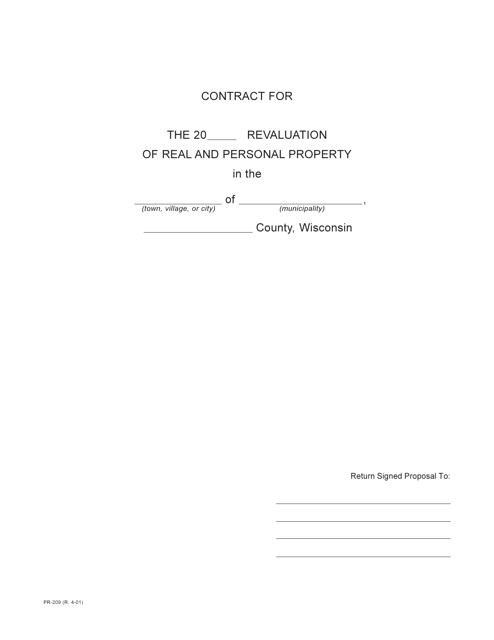

This Form is used for creating a contract for revaluation in the state of Wisconsin.

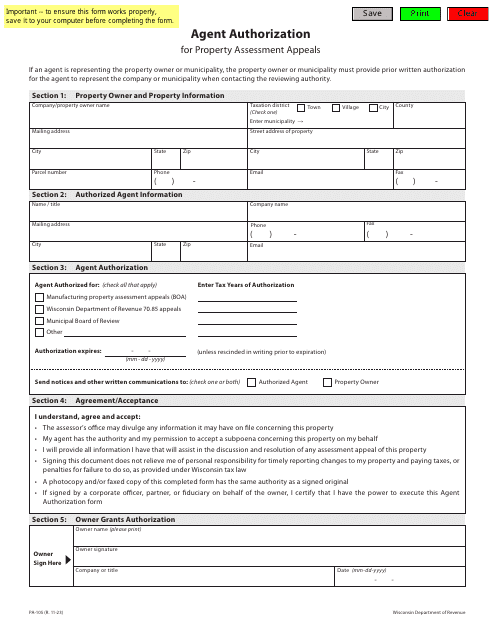

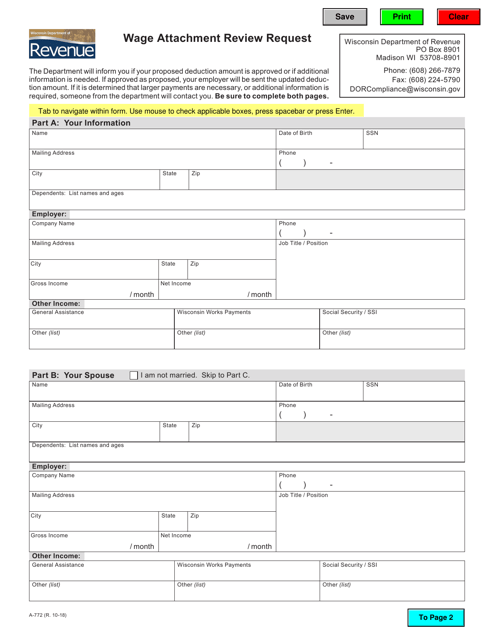

This Form is used for requesting a review of a wage attachment in Wisconsin.

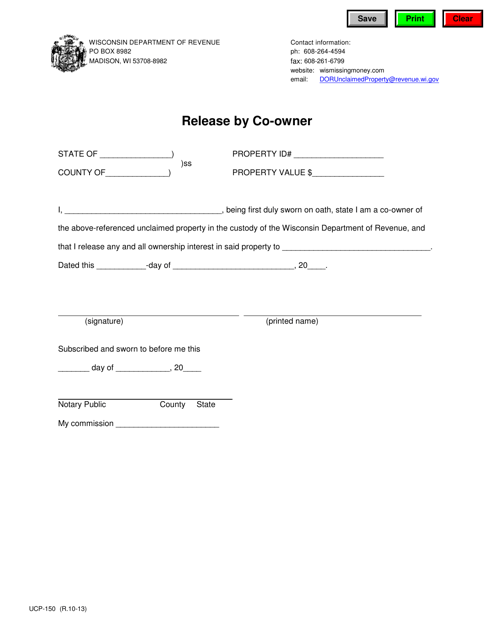

This form is used for releasing ownership rights by a co-owner in the state of Wisconsin.