Fill and Sign Wisconsin Legal Forms

Documents:

5190

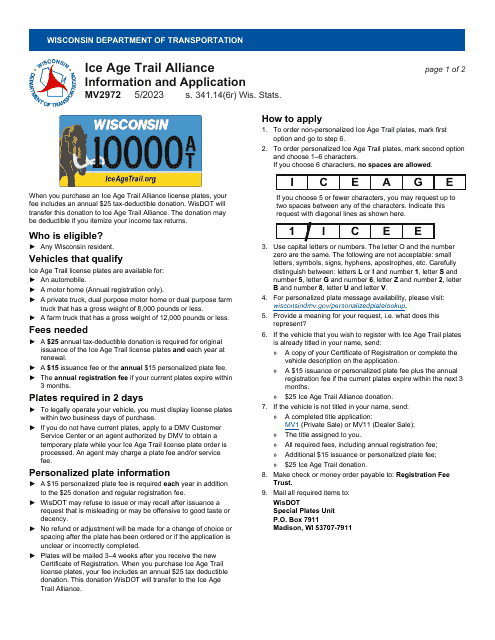

This form is used for applying for the ICE Age Trail Alliance License Plate in Wisconsin.

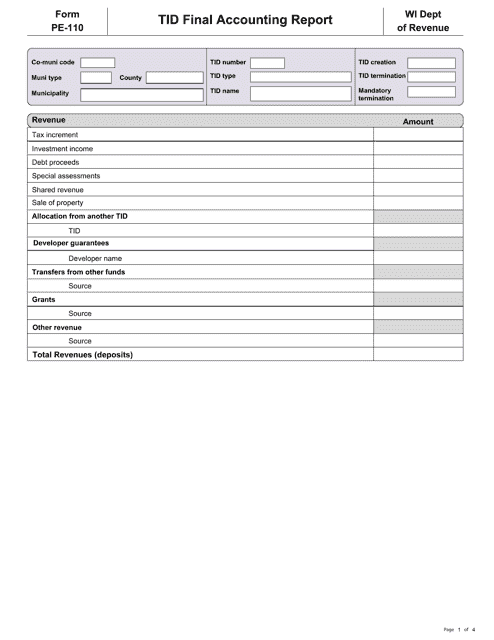

This form is used for submitting a final accounting report in the state of Wisconsin. It is known as Form PE-110 TID.

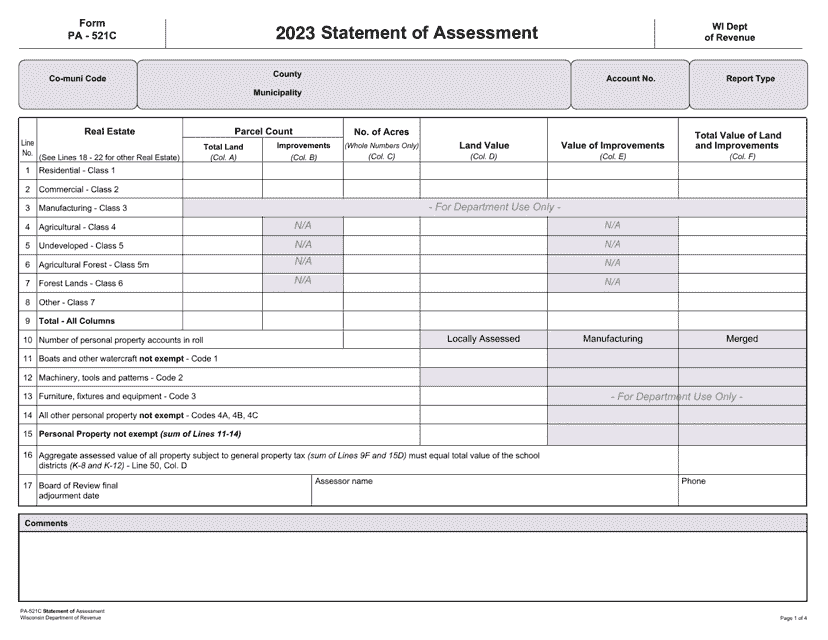

This form is used for filing a statement of assessment in the state of Wisconsin. It is used to report the assessed value of real or personal property for tax purposes.

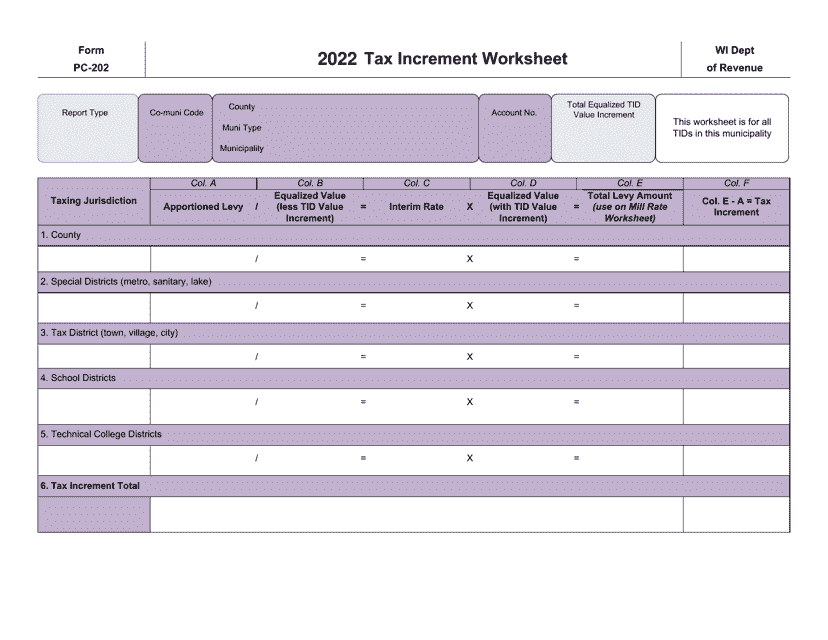

This Form is used for calculating tax increment in the state of Wisconsin.

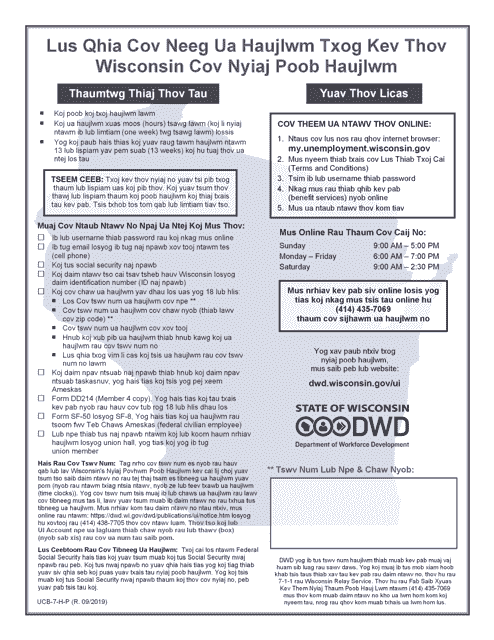

This type of document provides Hmong employees in Wisconsin with information about applying for unemployment benefits.

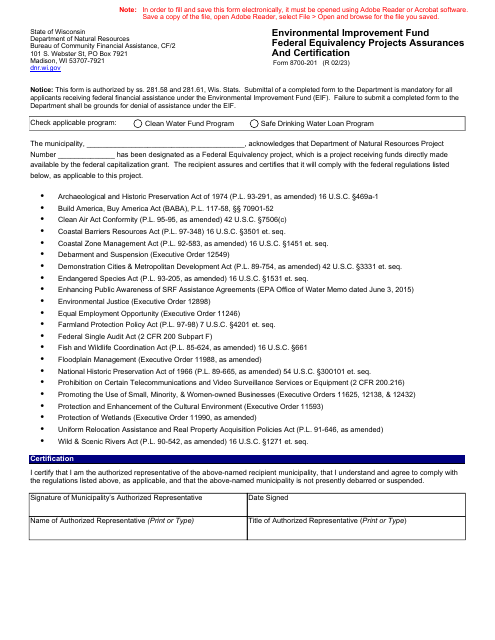

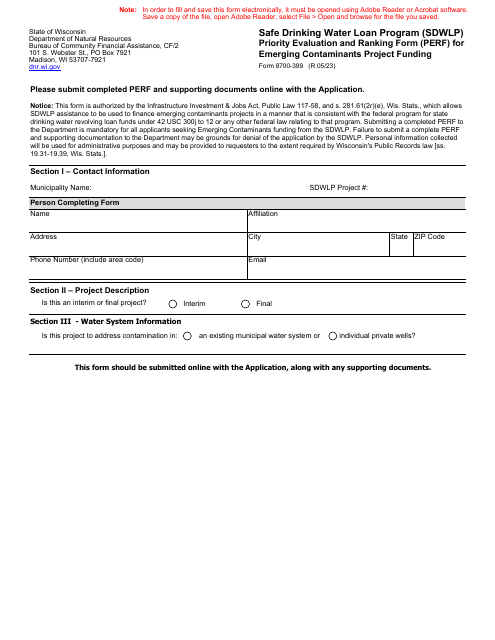

This form is used for evaluating and ranking emerging contaminants project funding applications under the Safe Drinking Water Loan Program in Wisconsin.

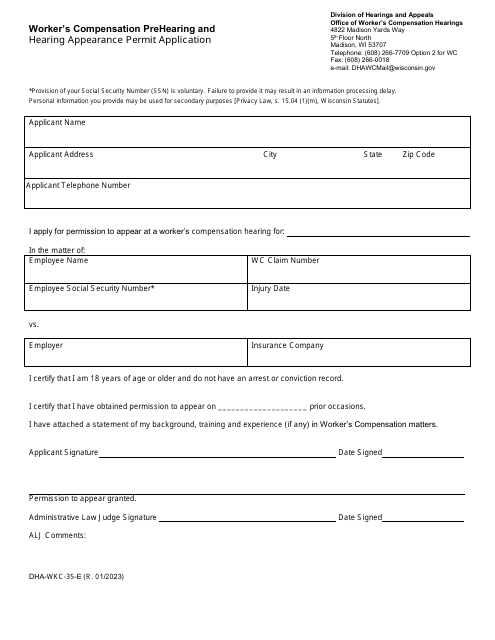

This form is used for applying for a Worker's Compensation Prehearing and Hearing Appearance Permit in Wisconsin.

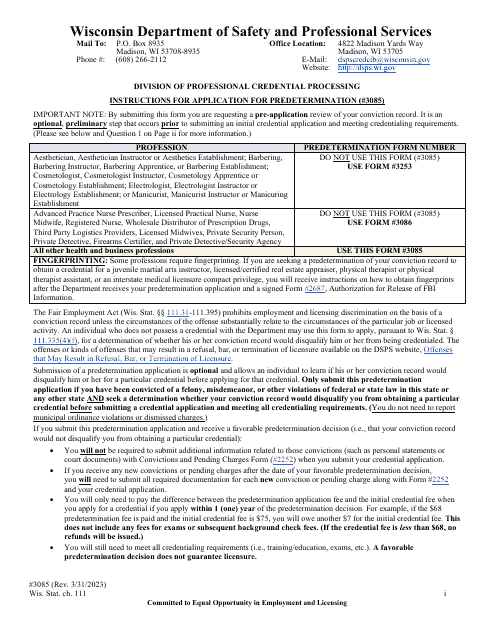

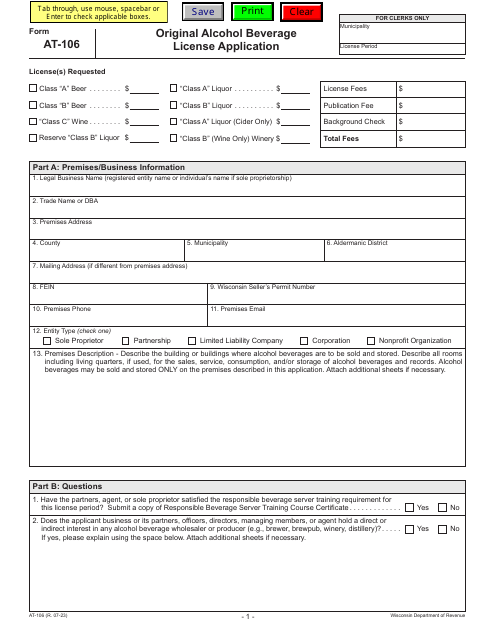

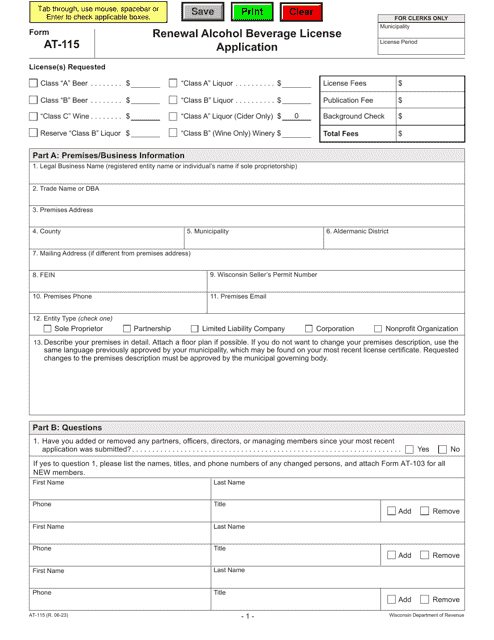

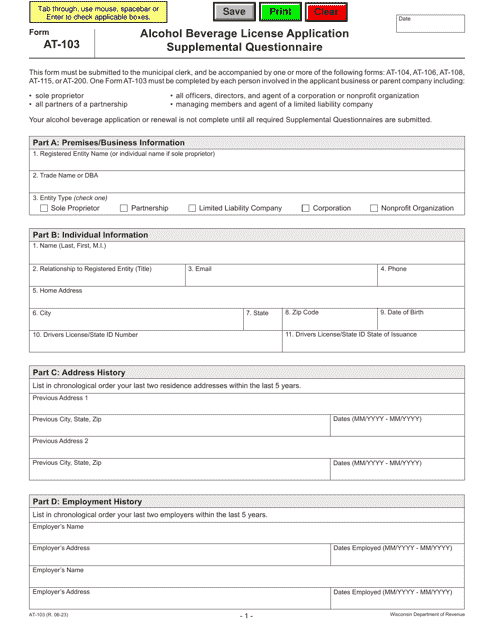

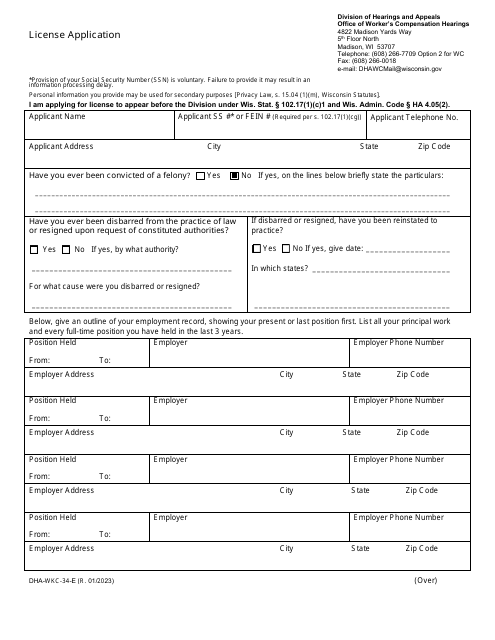

This Form is used for applying for a license in the state of Wisconsin.

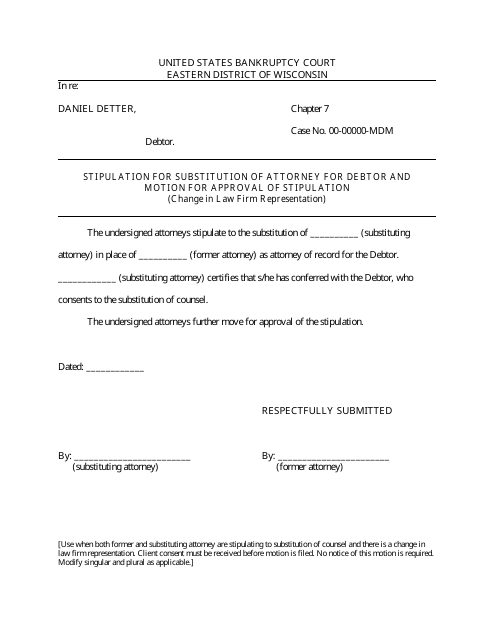

This document is used for requesting approval to substitute the attorney representing the debtor in a legal case in Wisconsin due to a change in law firm representation.

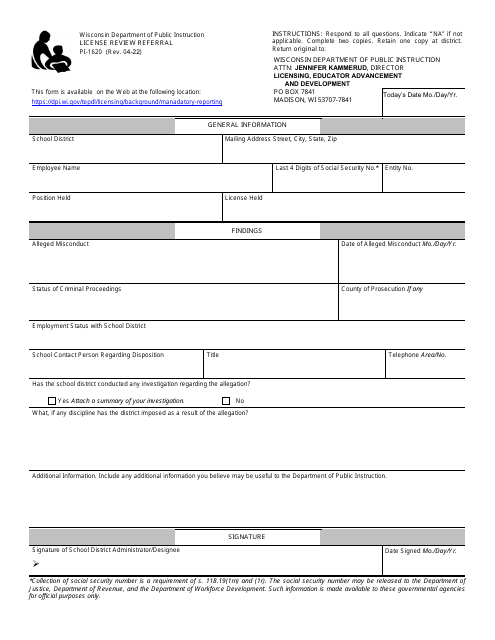

This Form is used for the license review referral process in the state of Wisconsin. It is used to refer a license application to the appropriate authorities for review and approval.

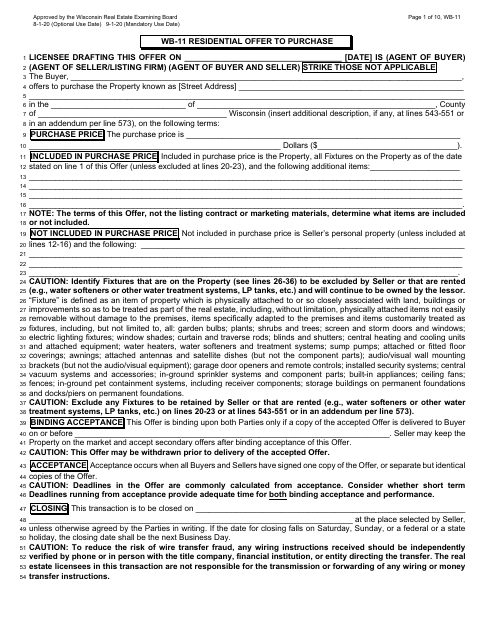

This document is used for submitting a residential offer to purchase a property in the state of Wisconsin.

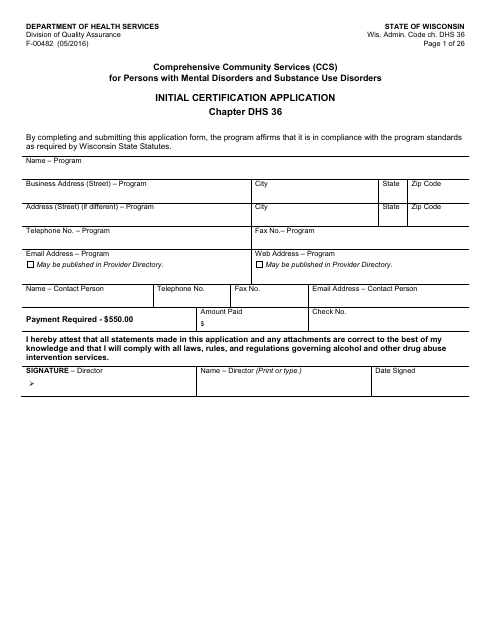

This document is used for service providers in Wisconsin seeking initial certification to offer Comprehensive Community Services (CCS). It includes individuals with mental disorders and substance use disorders, as per regulations outlined in Chapter DHS 36.

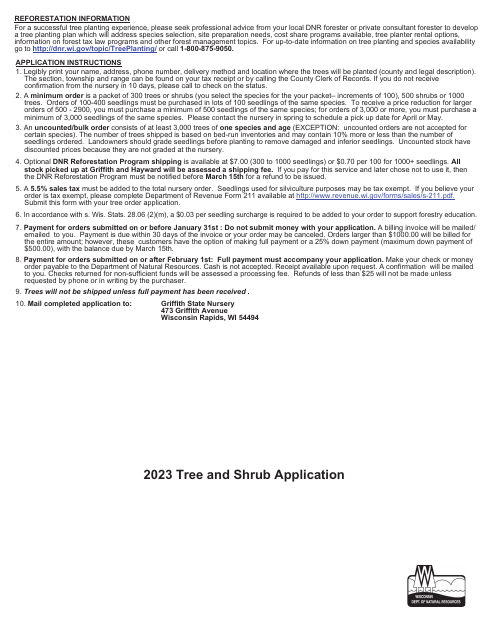

This form is used in Wisconsin to record the application of treatments to trees and shrubs, aimed at maintaining plant health and controlling pests or diseases. It's an important part of environmental and botanical management.

This form is used by residents of Wisconsin who wish to delegate power of attorney for financial and property decisions. It provides legal permission for a trusted individual to manage financial and property affairs in the event of incapacitation.

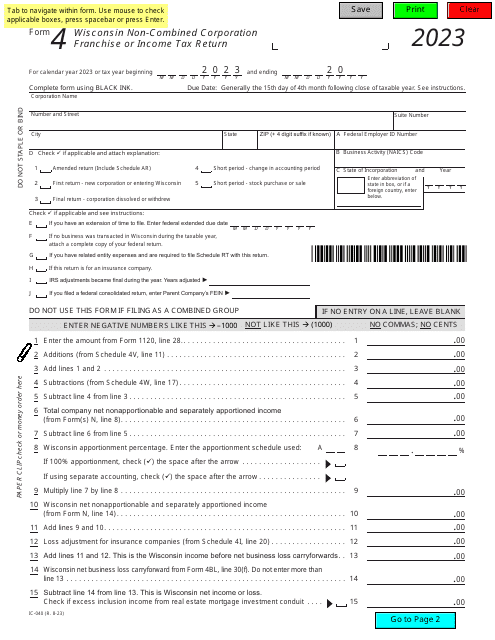

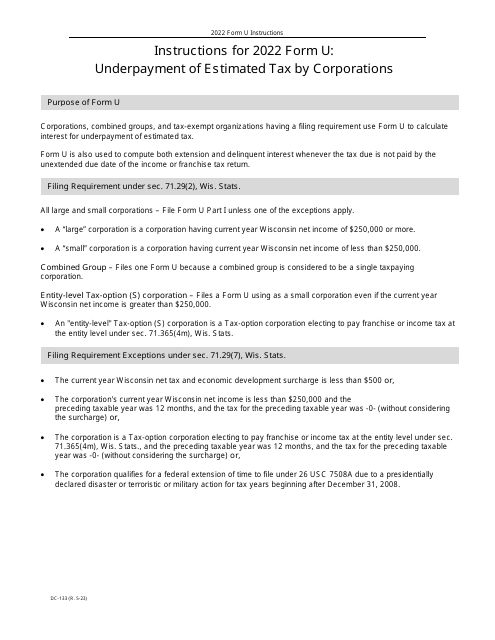

This form is used for reporting any underpayment of estimated tax by corporations in the state of Wisconsin. It provides instructions on how to calculate and report the underpayment.

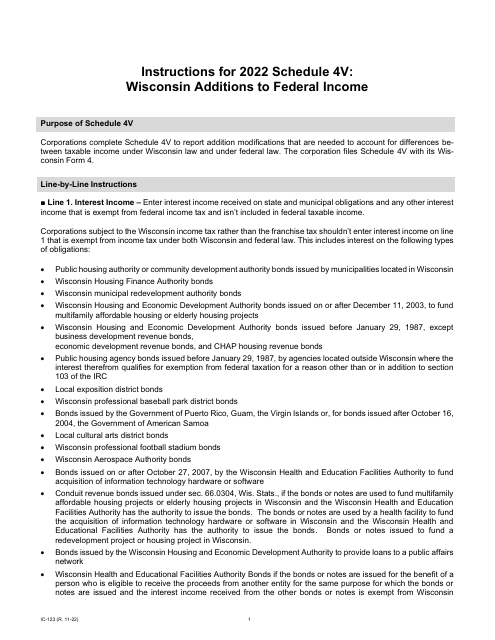

This form is used for reporting additions to your federal income for tax purposes in the state of Wisconsin. It is specifically for residents of Wisconsin who need to report these additions on their state tax return.