Fill and Sign Iowa Legal Forms

Documents:

2760

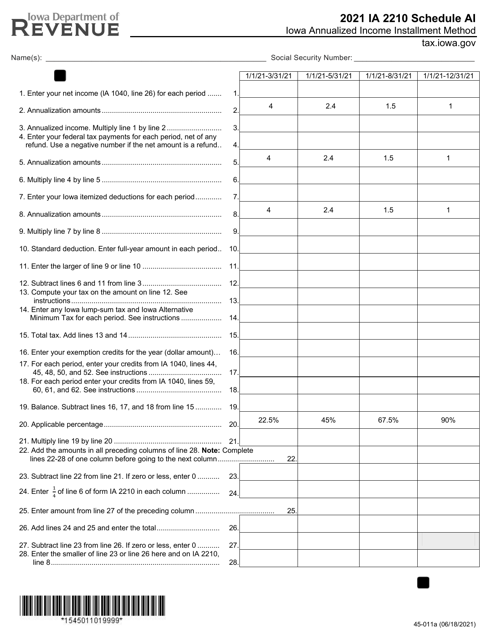

This Form is used for calculating and reporting Iowa state income tax using the Annualized Income Installment Method in Iowa.

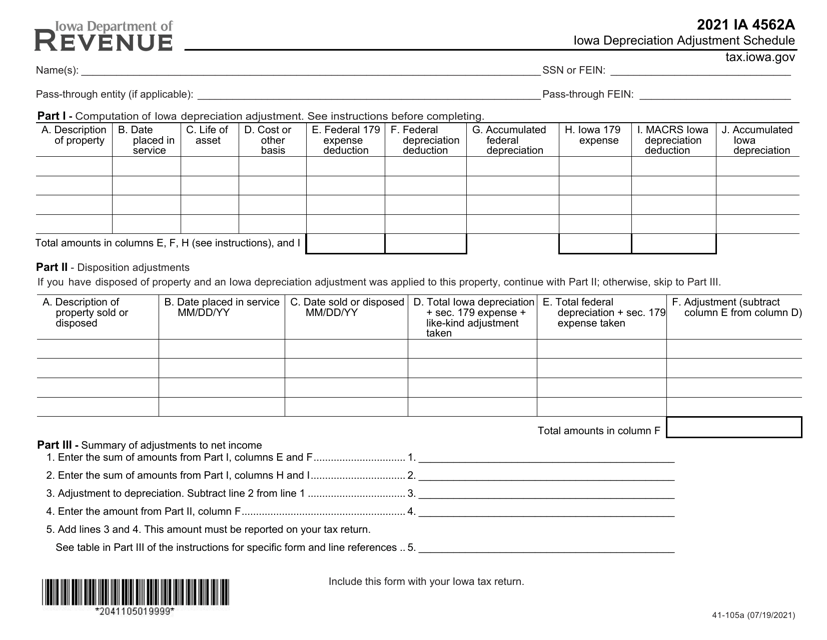

This form is used for making depreciation adjustments in the state of Iowa. It is specific to Iowa and is used to calculate and document accumulated depreciation.

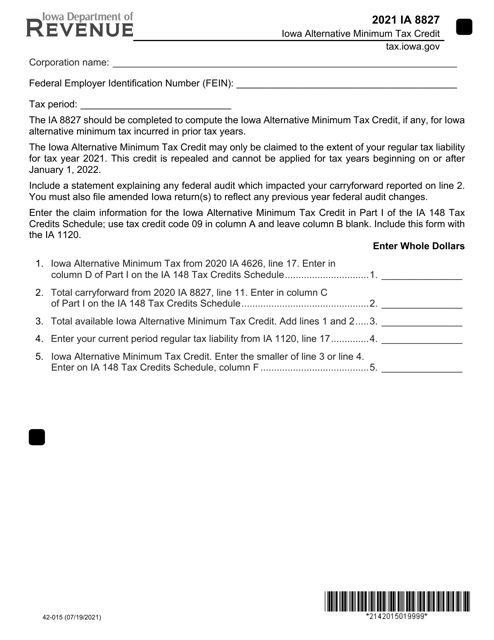

This form is used for claiming the Corporate Iowa Alternative Minimum Tax Credit in Iowa.

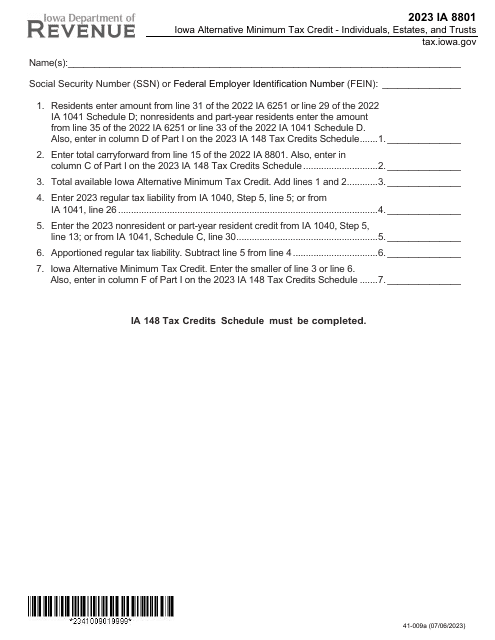

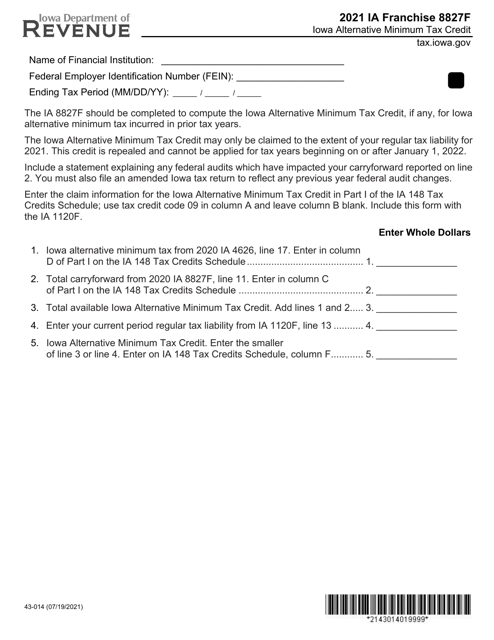

This form is used for claiming the Iowa Alternative Minimum Tax Credit in Iowa.

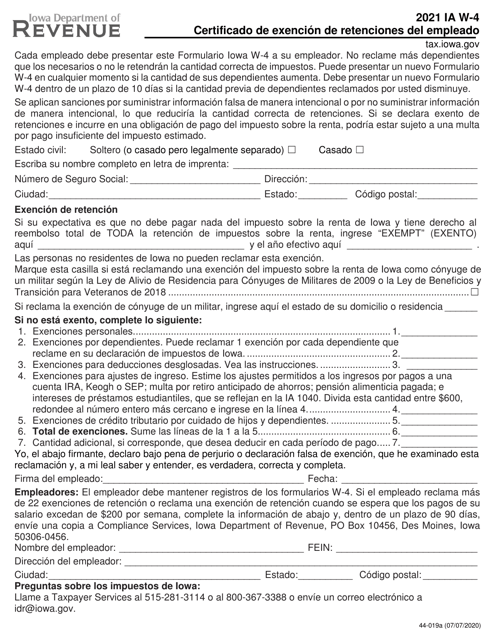

This type of document is used for certifying employee exemptions from withholding taxes and reporting employee information in Iowa. (Spanish version)

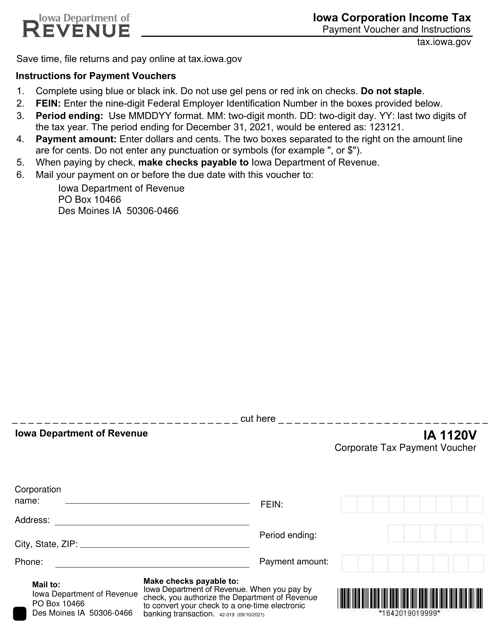

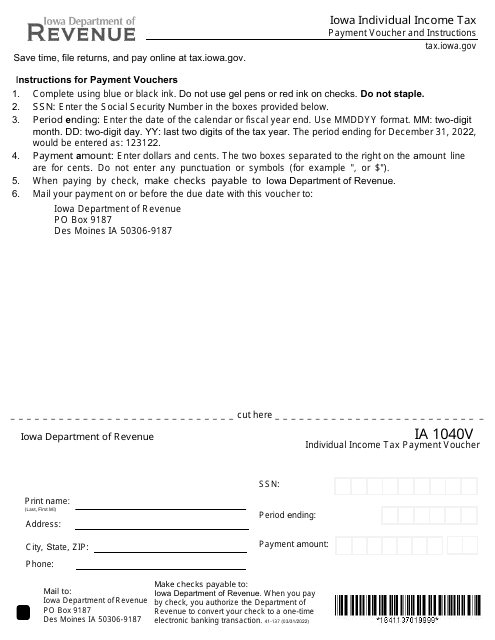

This document is a payment voucher used for corporations in Iowa to pay their income tax.