Fringe Benefit Form Templates

Documents:

26

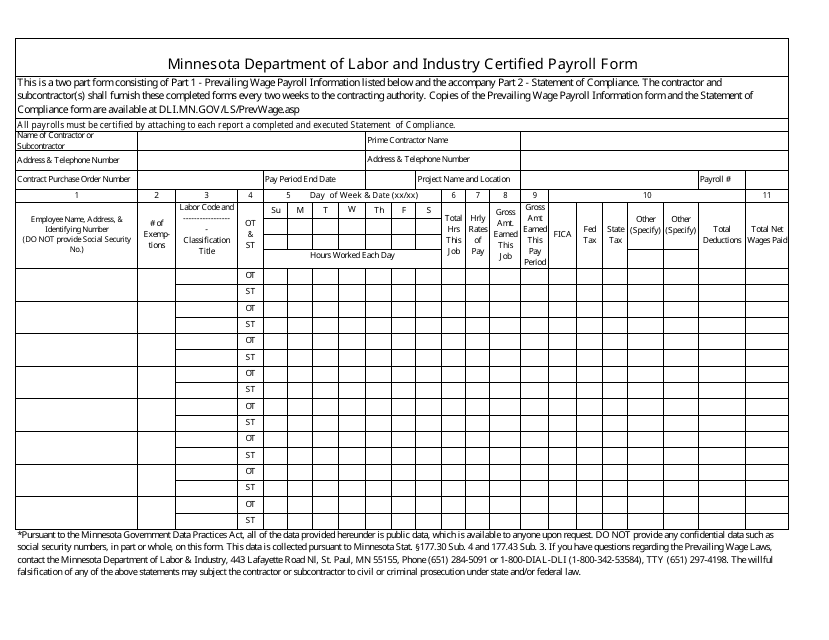

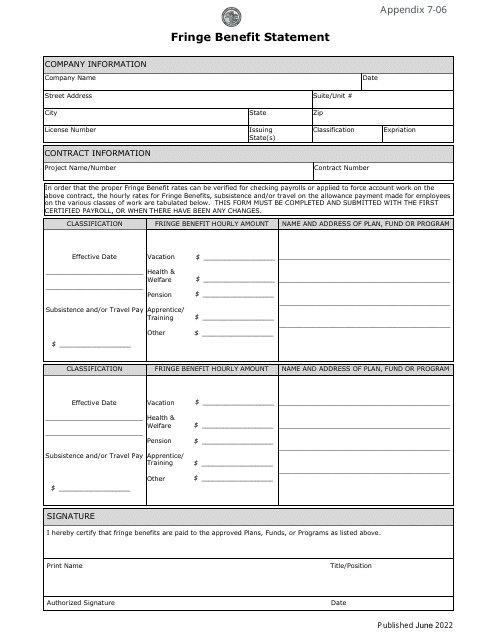

This Form is used for certified payroll reporting in the state of Minnesota. It helps ensure that contractors and subcontractors on public works projects comply with prevailing wage laws.

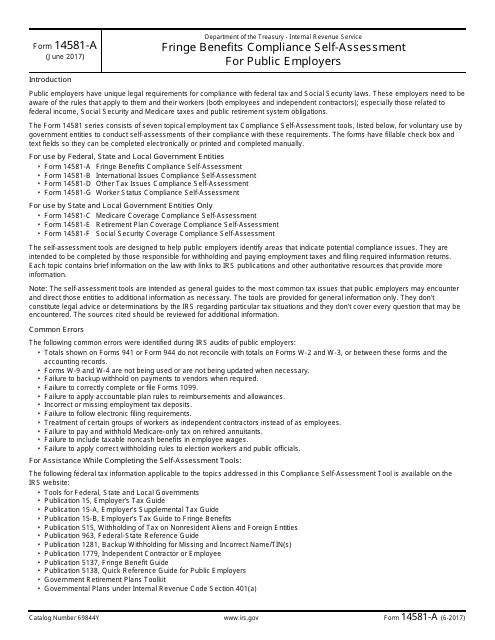

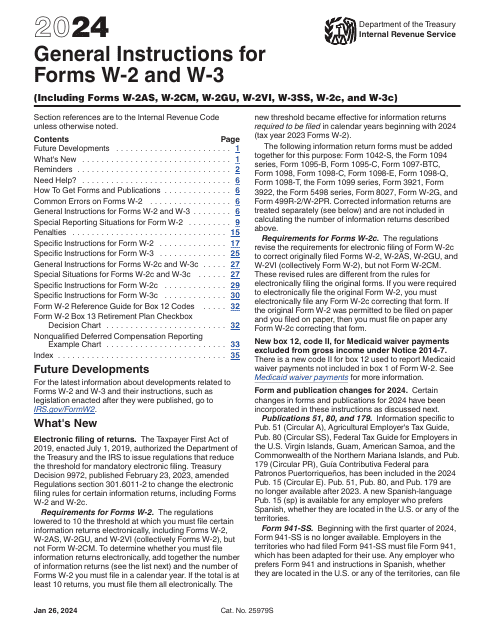

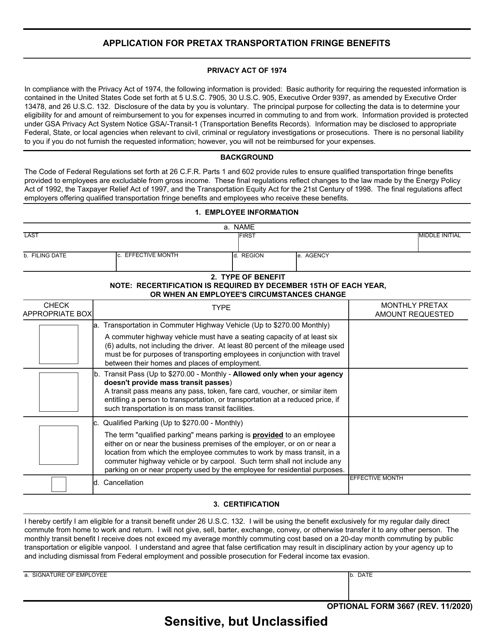

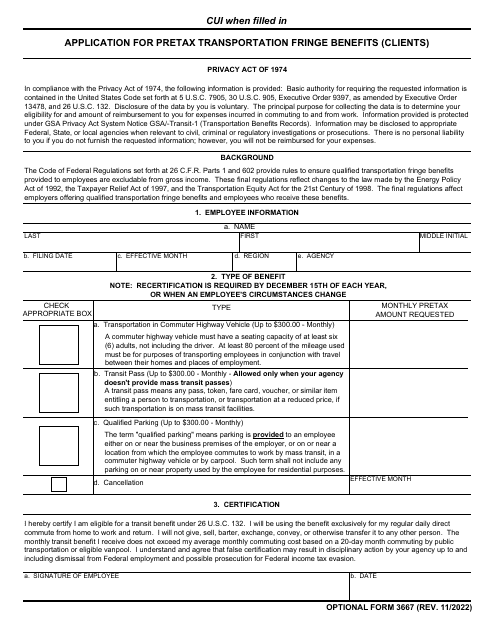

This Form is used for public employers to self-assess their compliance with fringe benefits regulations set by the IRS.

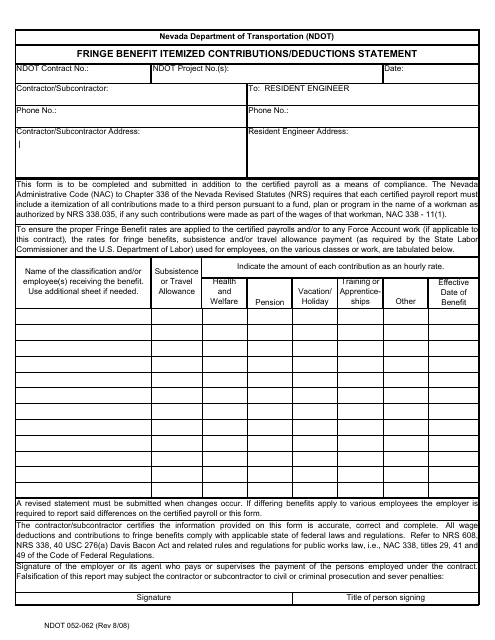

This Form is used for reporting fringe benefit itemized contributions and deductions in Nevada.

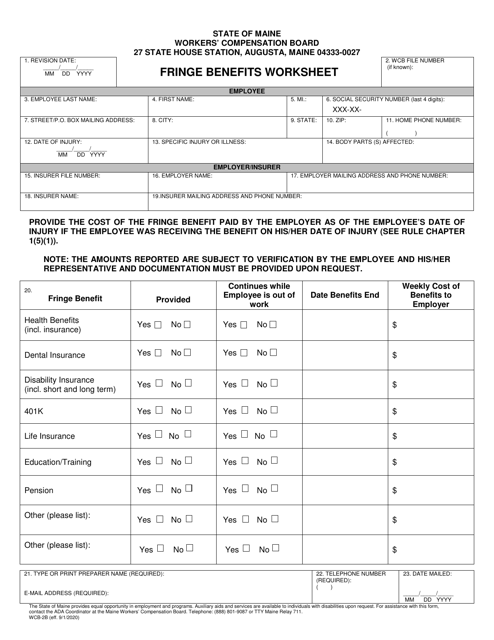

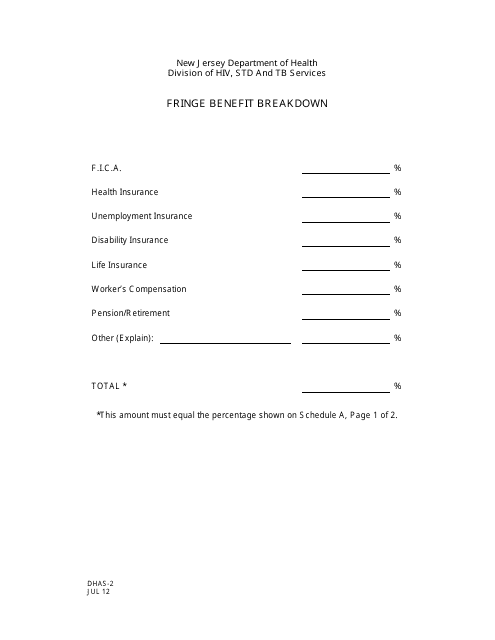

This form is used for reporting and providing a breakdown of fringe benefits in the state of New Jersey. It helps in understanding the various types of fringe benefits provided by an employer to their employees.

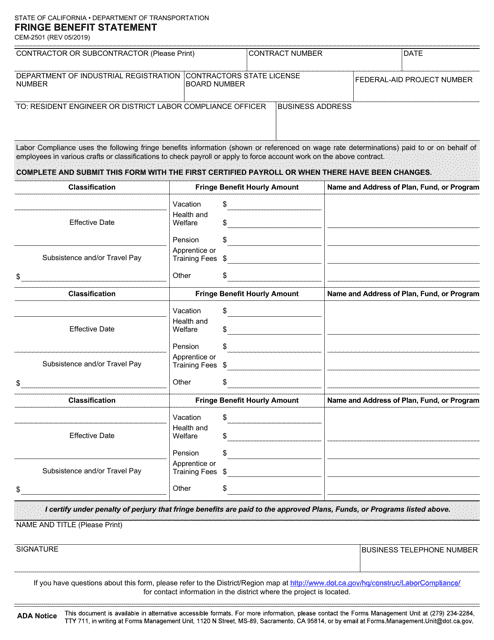

This document is used to report the fringe benefits provided to contractors in the state of Nevada.

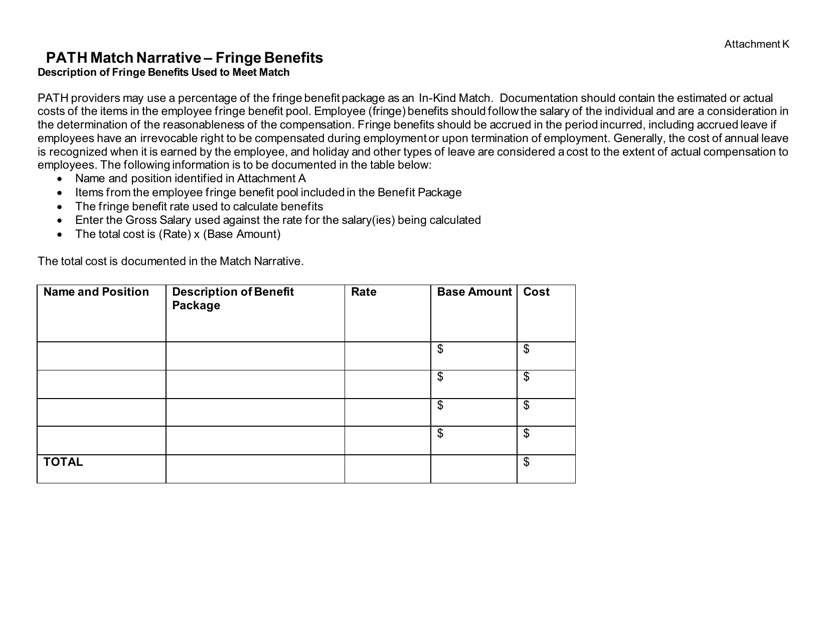

This document provides a narrative explanation of the path match for fringe benefits in the state of North Carolina. It outlines the guidelines and requirements for determining eligibility and calculating fringe benefits for employees.

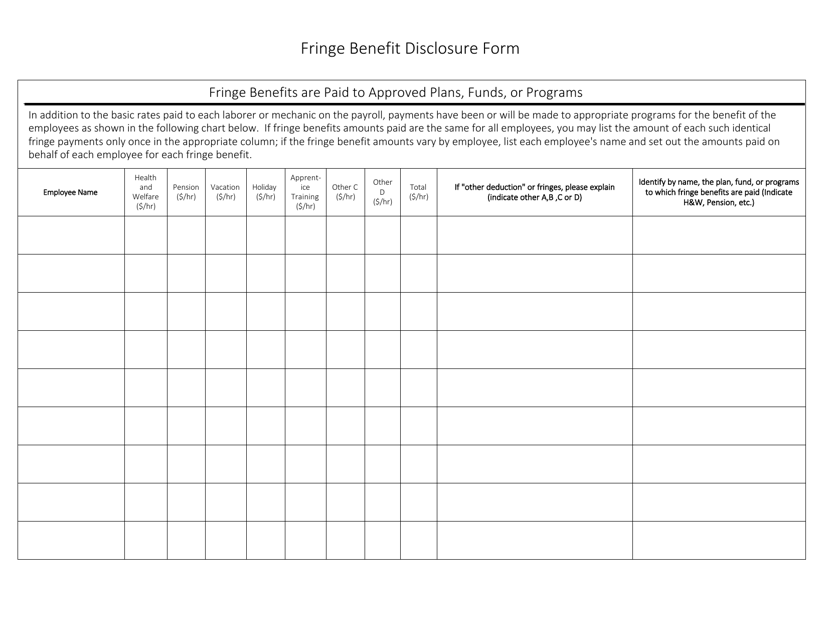

This Form is used for disclosing fringe benefits in the state of Missouri. It provides information about the benefits employees receive from their employers, including health insurance, retirement plans, and other perks.

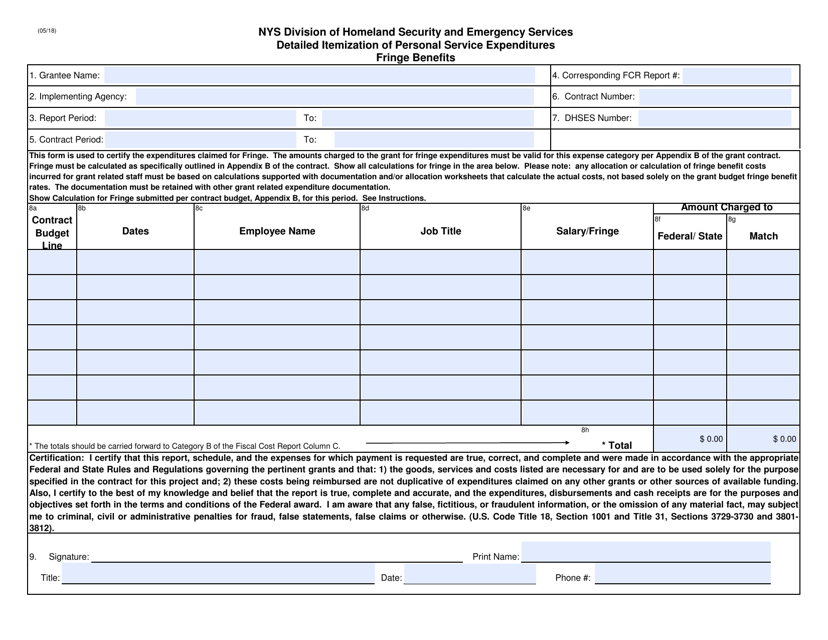

This document provides a detailed breakdown of personal service expenditures, including fringe benefits, specifically for individuals residing in New York.

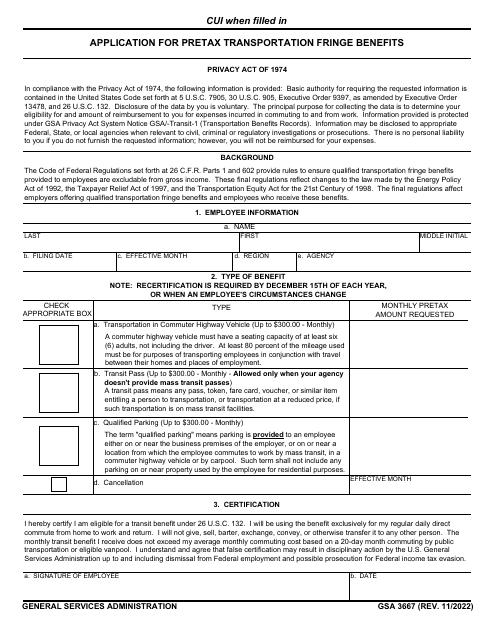

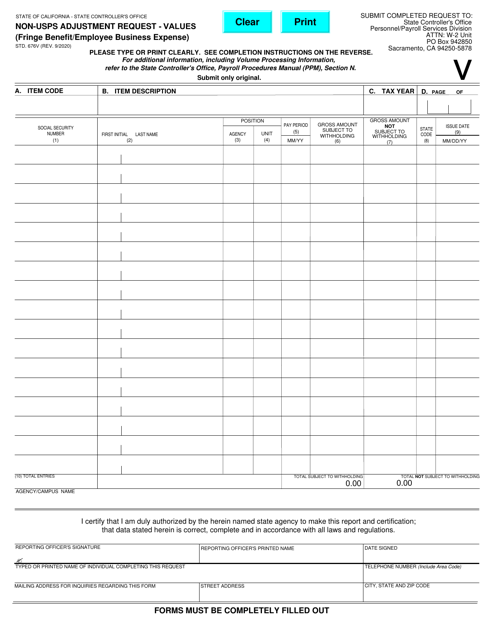

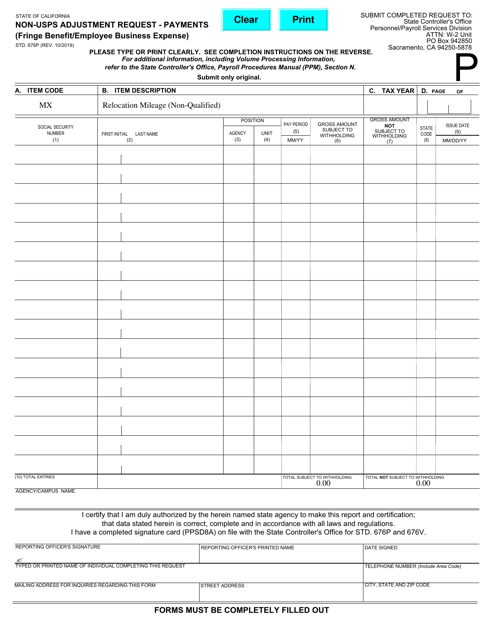

This form is used for making non-USPS adjustment requests regarding fringe benefits or employee business expenses in the state of California.

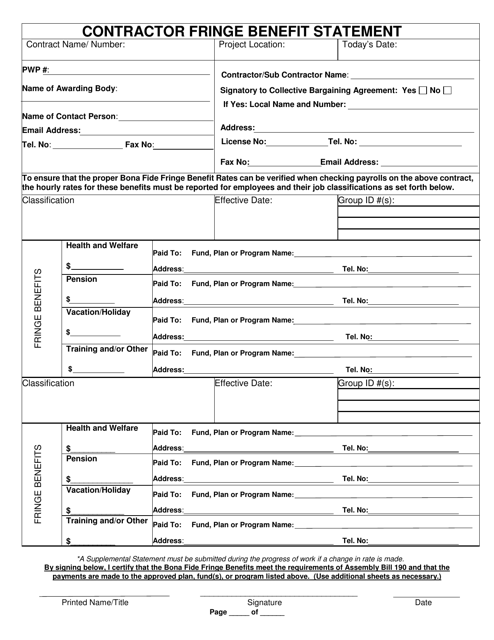

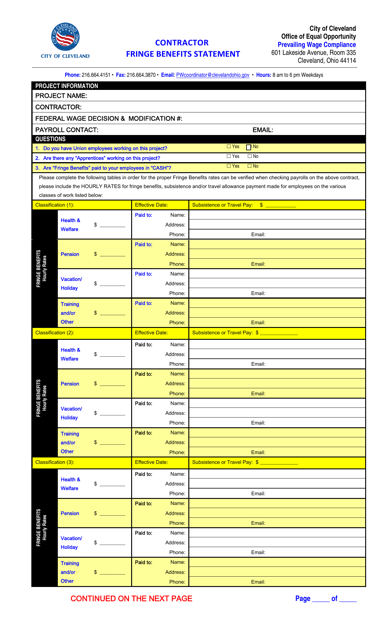

This form is used for contractors to report fringe benefits provided to employees for projects with the City of Cleveland, Ohio.

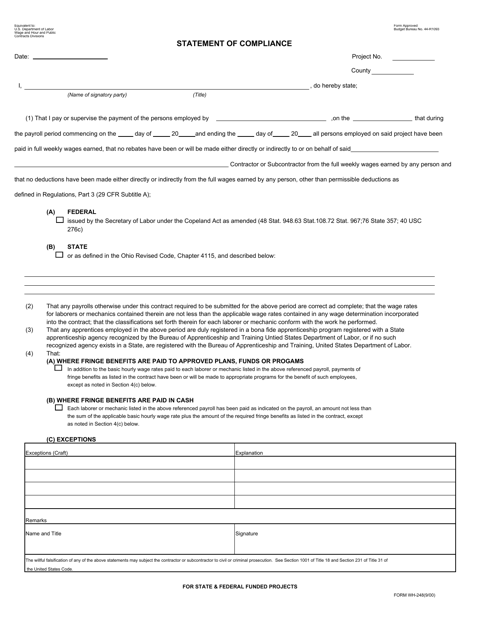

This form is used for reporting the compliance of fringe benefits by employers in the City of Cleveland, Ohio.

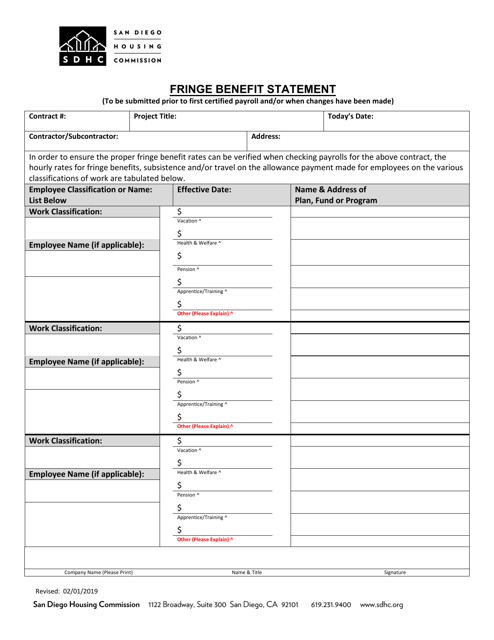

This document provides a statement of fringe benefits offered by the City of San Diego, California to its employees. It outlines the various benefits and perks employees can expect to receive as part of their compensation package.

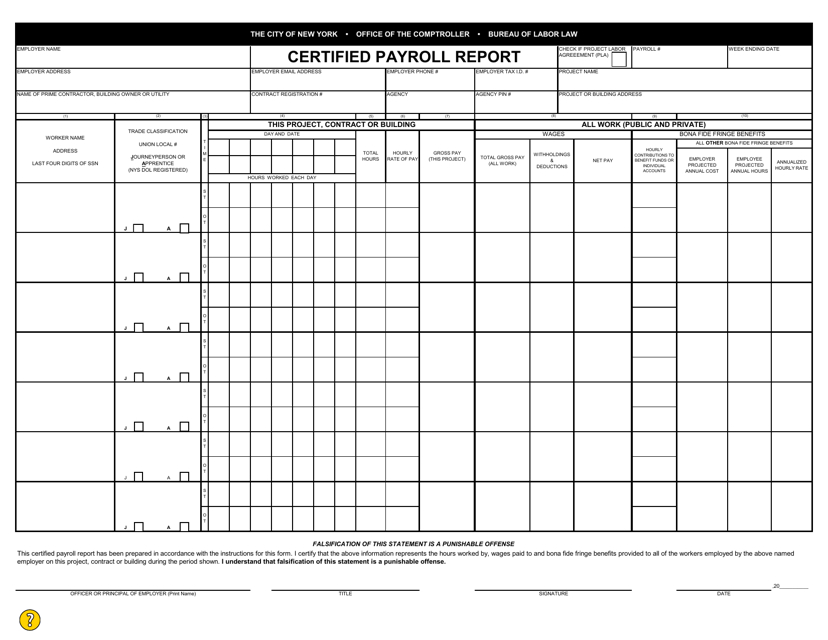

This document is used to report and certify payroll information for construction projects in New York City. It ensures that workers are paid the correct prevailing wage rates and helps to enforce labor laws.

This form is used for requesting adjustments to payments related to fringe benefits or employee business expenses in California.

This document is used for reporting fringe benefits received through the Community Development Block Grant Program in California.