New Employee Tax Forms and Templates

New Employee Tax Forms are used to gather important tax-related information from newly hired employees. These forms help employers withhold the correct amount of federal, state, and local taxes from an employee's wages. The information collected on these forms includes the employee's Social Security number, filing status, and allowances claimed, among other details. This ensures that employers are able to accurately calculate the amount of taxes to withhold from an employee's paycheck, and also helps employees meet their tax obligations.

Documents:

1

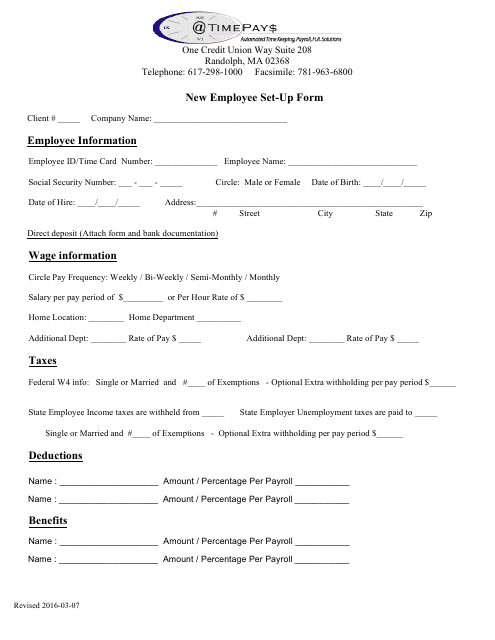

This document is for setting up new employees in the Timepays system in Massachusetts. It includes necessary information for the employee's profile and payroll setup.