Canadian Tax Forms and Templates

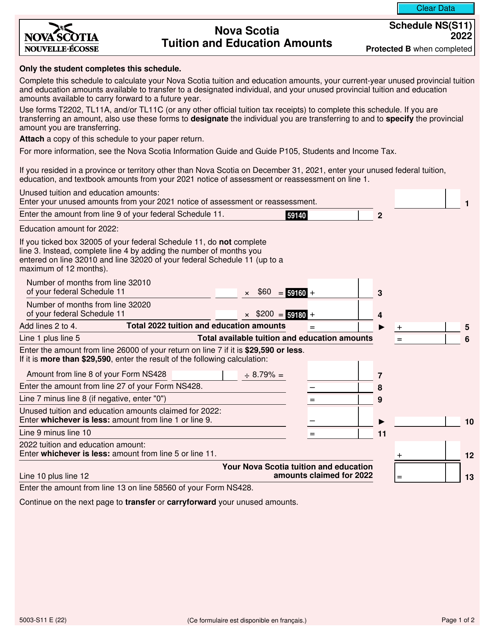

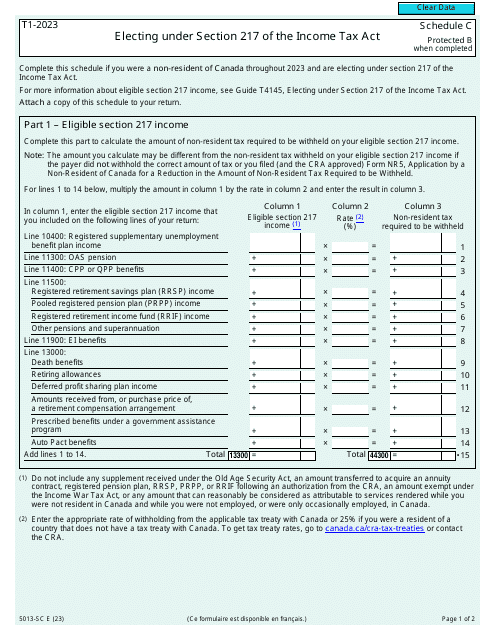

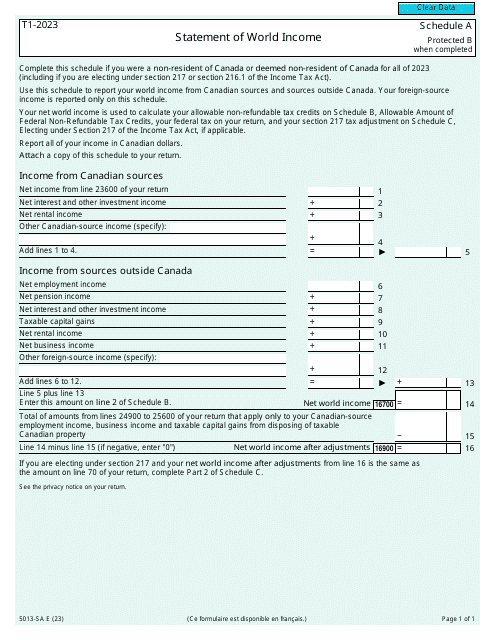

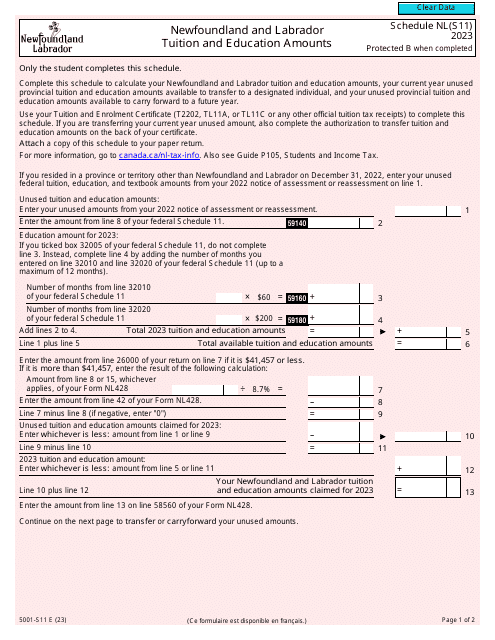

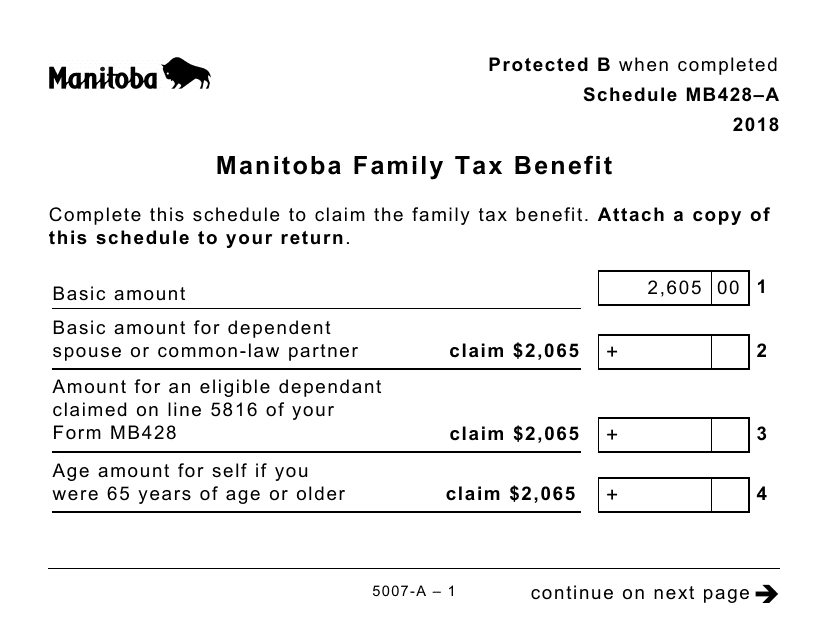

Canadian Tax Forms are used to report income, claim deductions and credits, and calculate and pay taxes to the Canadian government. These forms are required to be filed by individuals and businesses in Canada in order to fulfill their tax obligations. The forms help individuals and businesses accurately report their income and expenses, claim applicable tax deductions and credits, and calculate the amount of taxes owed or refunds due.

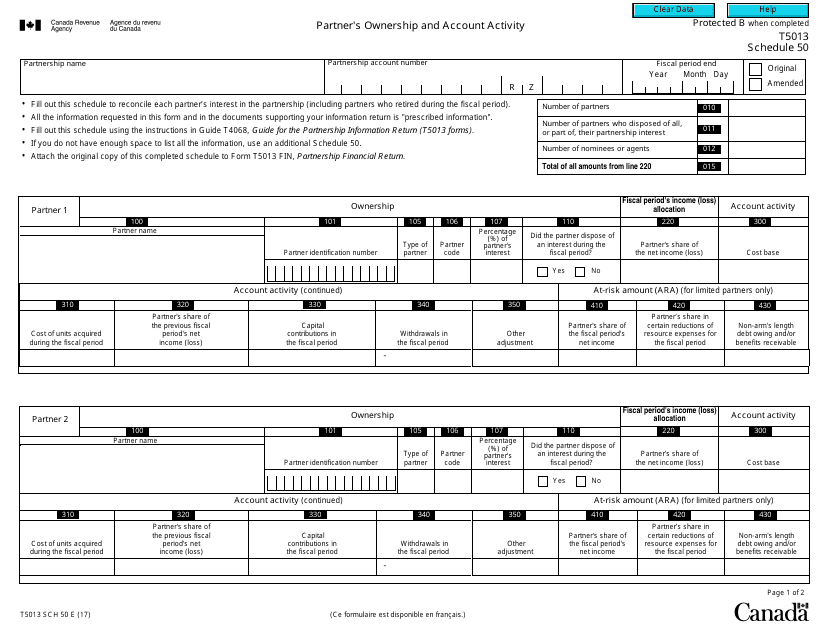

Documents:

321

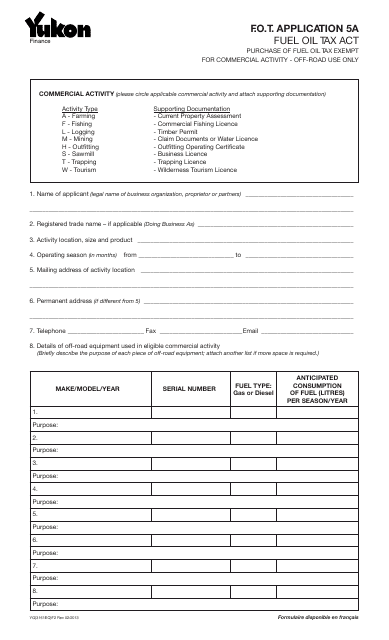

This form is used for applying for Fuel Oil Tax in Yukon, Canada.

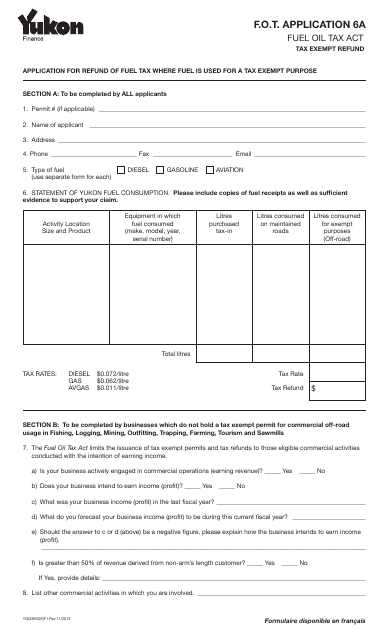

This form is used for applying for Fuel Oil Tax refund in Yukon, Canada.

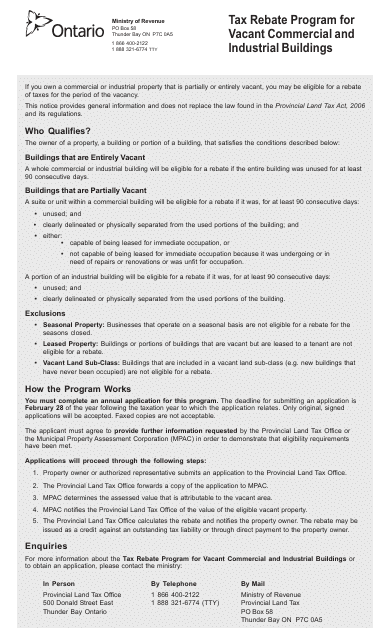

This document is an application for tax rebates available for vacant commercial and industrial buildings under Section 8 of the Provincial Land Tax Act in Ontario, Canada.

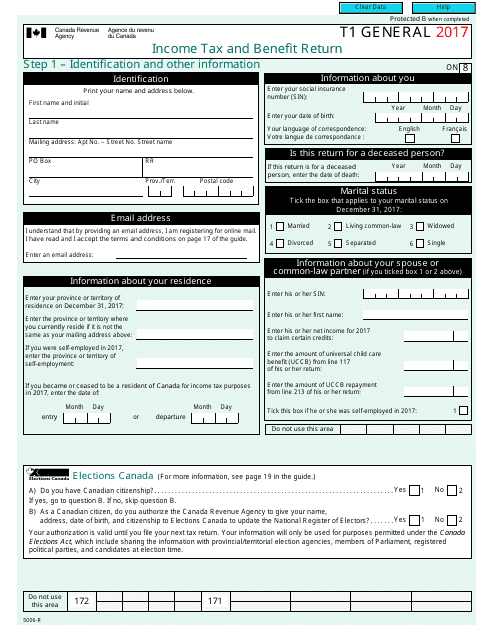

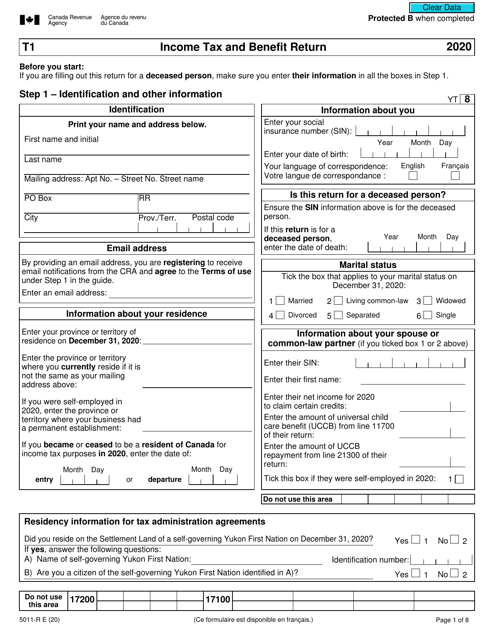

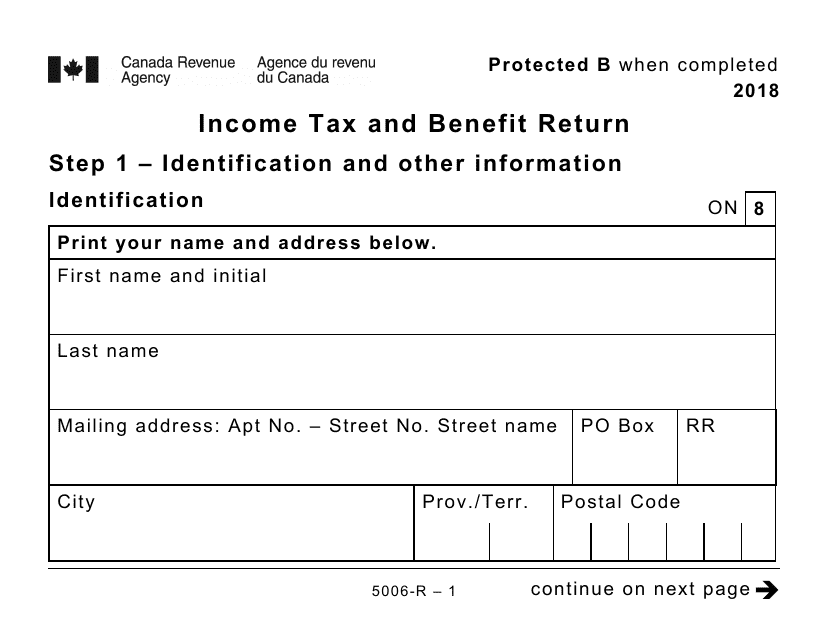

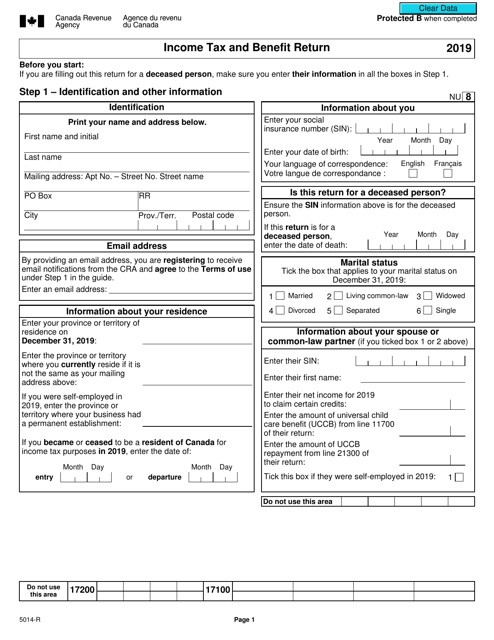

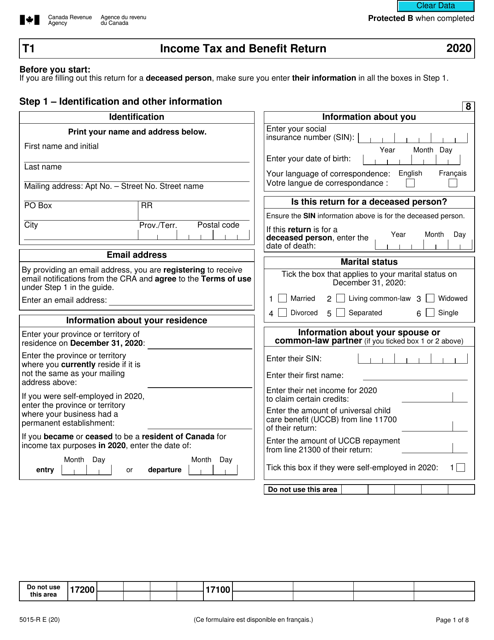

Canadian residents may use this official statement to report their income tax and list all sources of their personal income.

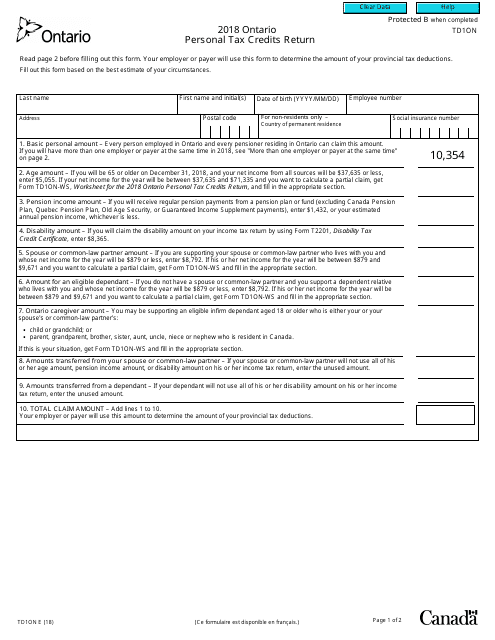

This form is used for reporting personal tax credits and deductions in the province of Ontario, Canada. It is specifically meant for individuals who reside in Ontario and want to claim tax credits that are unique to the province.

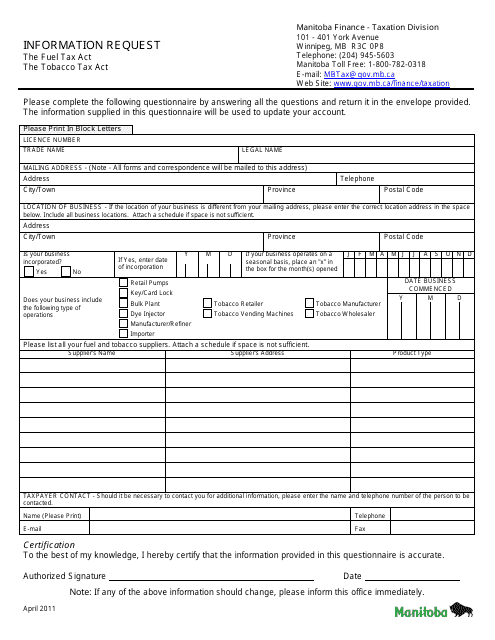

This document is a request for information specifically related to the province of Manitoba, Canada.

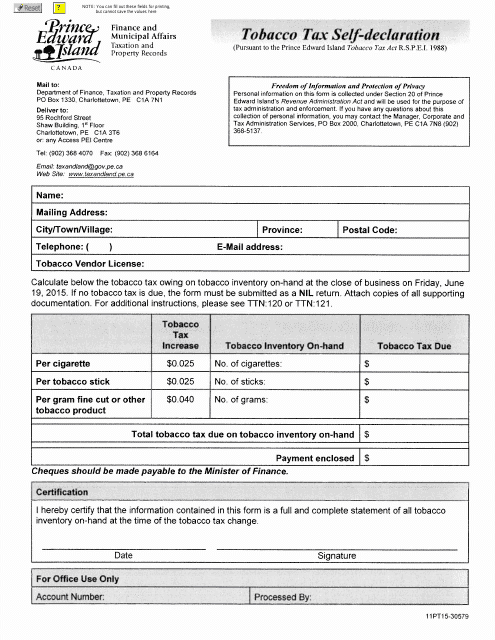

This form is used for individuals and businesses in Prince Edward Island, Canada to self-declare their tobacco taxes.

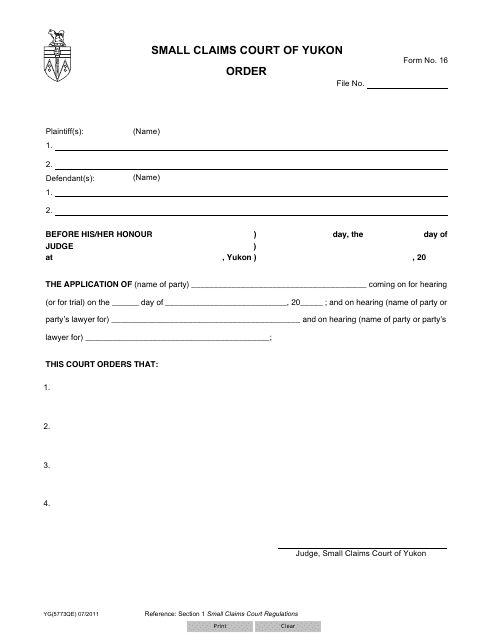

This Form is used for ordering a Form 16 (YG5773) in Yukon, Canada.

This form is used for filing income tax and benefit returns in Canada. It is specifically designed and formatted for individuals who require a larger print size for easier readability.

This Form is used for reporting income, claiming deductions and credits, and calculating tax liability for individuals in Canada. It is specifically designed for those who require a large print format.

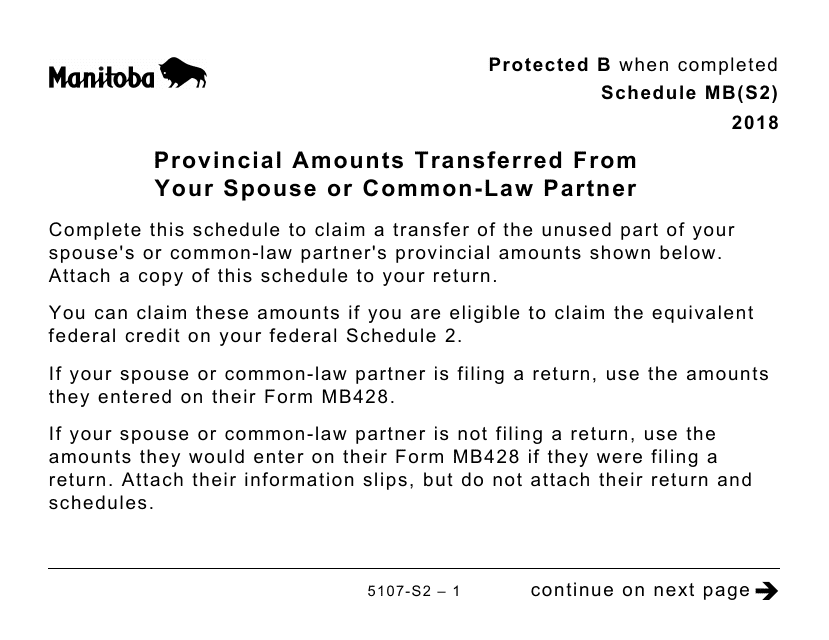

This form is used for reporting the provincial amounts transferred from your spouse or common-law partner on your Canadian tax return. It is in large print format for easier reading.

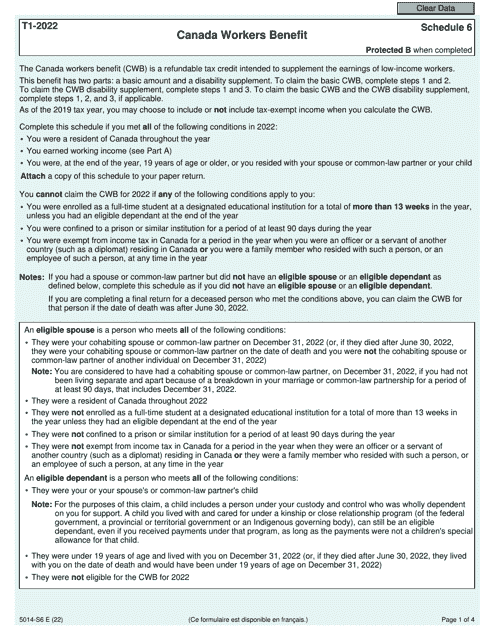

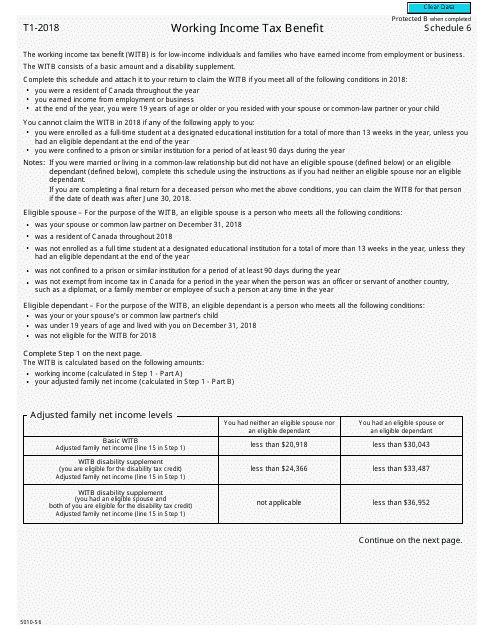

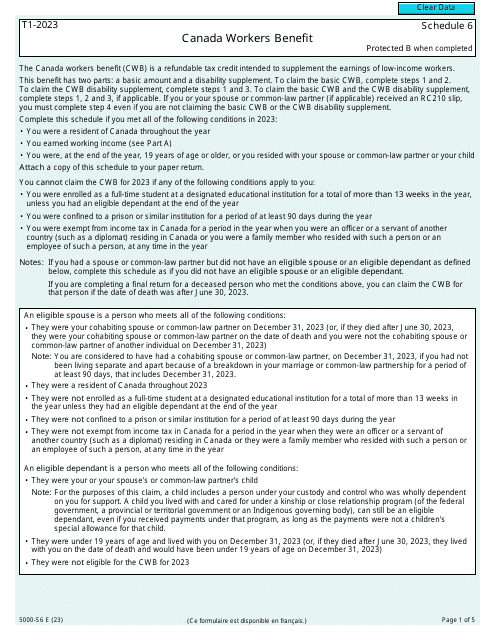

This form is used for reporting the Working Income Tax Benefit in Canada.

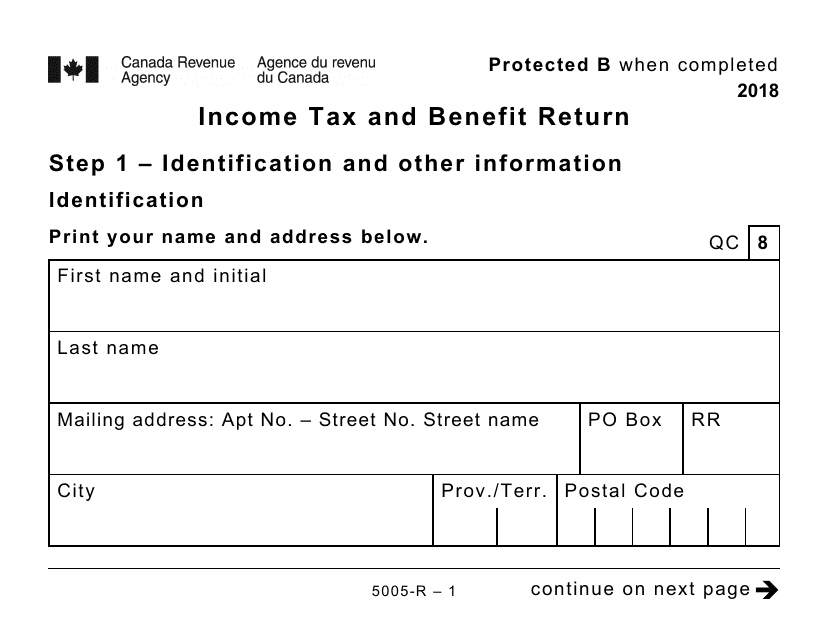

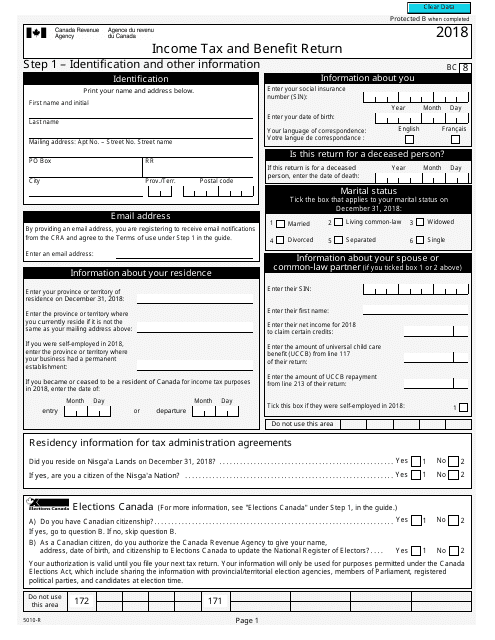

This form is used for filing income taxes and reporting benefits in Canada.

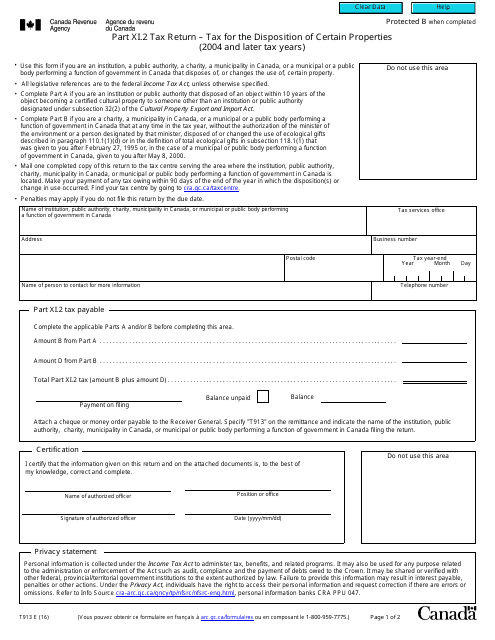

This Form is used for reporting tax on the sale of certain properties in Canada for the tax years 2004 and later.

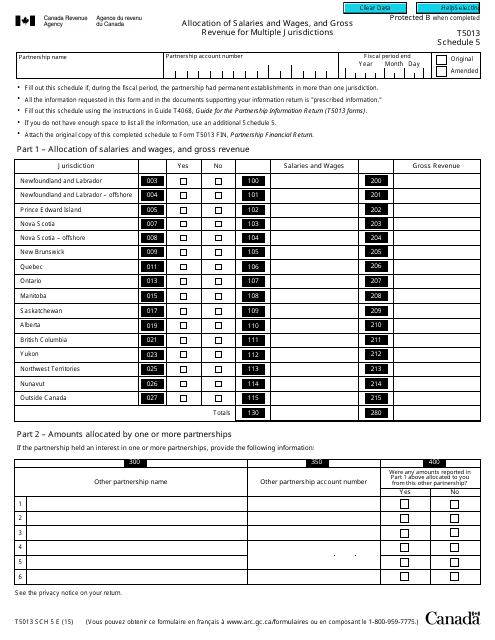

This form is used for allocating salaries, wages, and gross revenue for multiple jurisdictions in Canada.

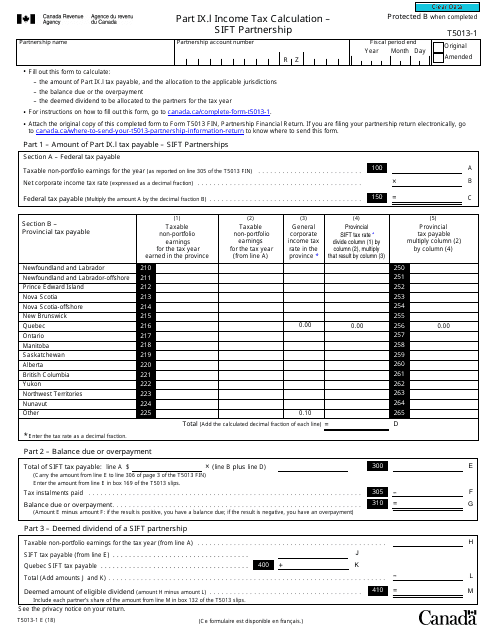

This form is used for calculating the income tax for a Sift Partnership in Canada.

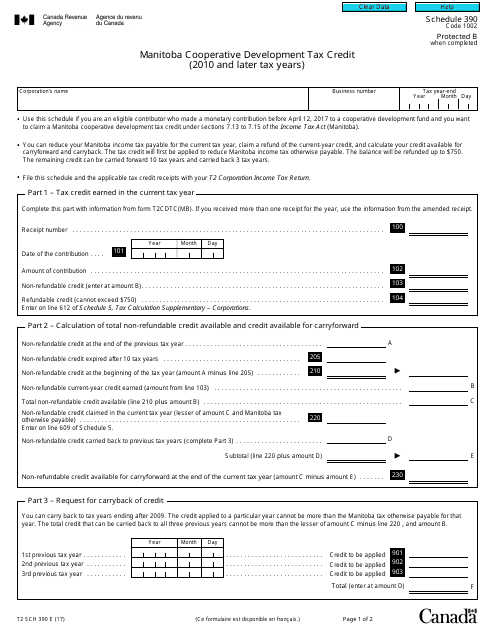

Form T2 Schedule 390 Manitoba Cooperative Development Tax Credit (2010 and Later Tax Years) - Canada

This form is used for claiming the Manitoba Cooperative Development Tax Credit in Canada for tax years 2010 and later.

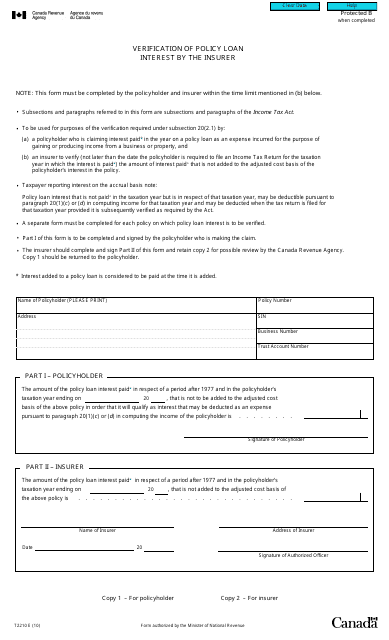

This form is used for verifying policy loan interest by the insurer in Canada. It ensures transparency and accuracy in reporting policy loan interest to the tax authorities.

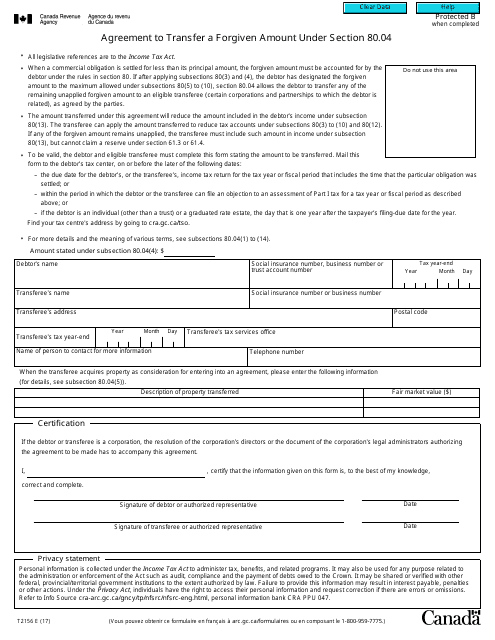

This form is used for transferring a forgiven amount under Section 80.04 in Canada.