State Tax Forms and Templates

Documents:

933

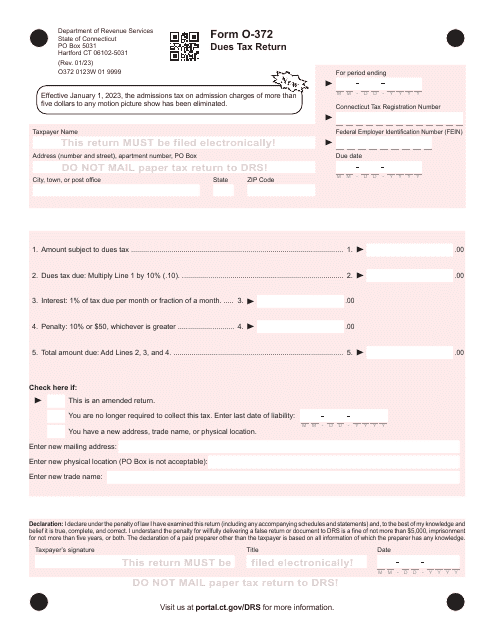

This form is used for reporting and paying dues taxes in the state of Connecticut. It is used by individuals and businesses to fulfill their tax obligations related to dues payments.

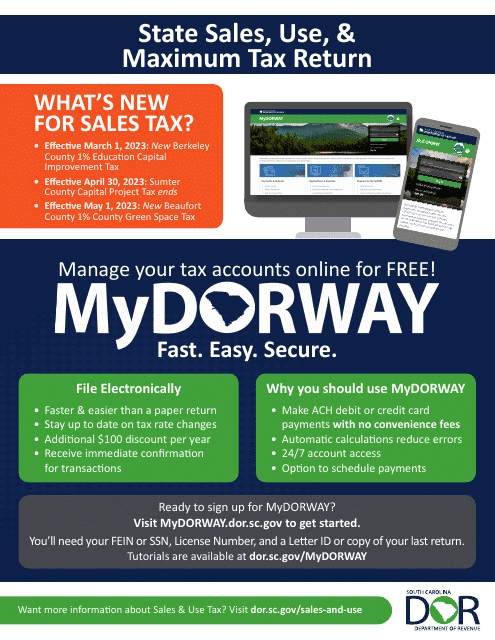

This form is used for filing sales, use, and maximum tax returns in the state of South Carolina. It is necessary for businesses and individuals to report their sales and use tax liabilities to the South Carolina Department of Revenue.

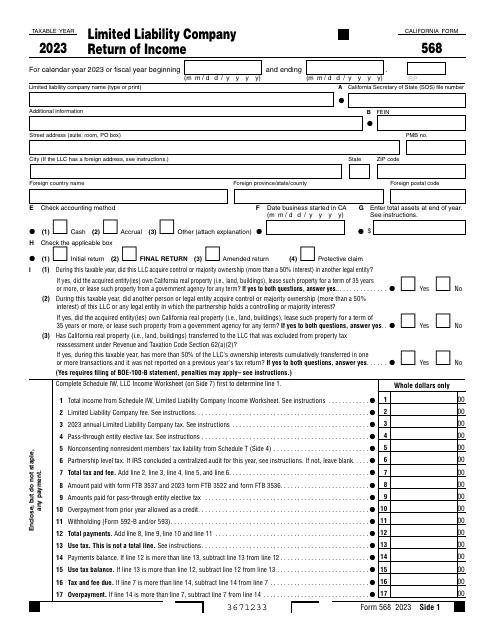

This document is supposed to be filled out only by a Limited Liability Company (LLC) classified as a Partnership. They should use this form as an income tax return that should be filed every year.

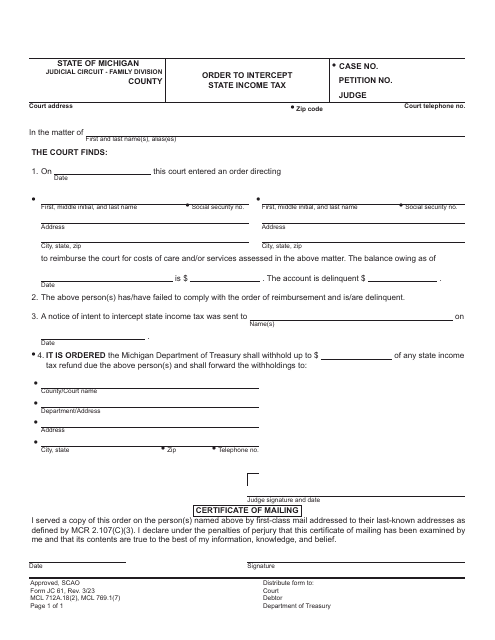

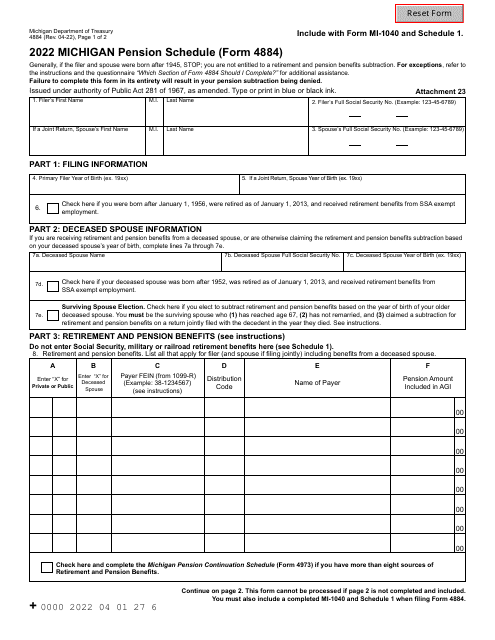

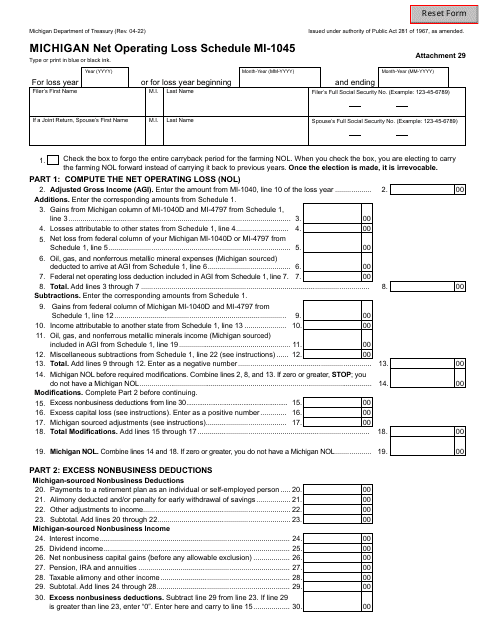

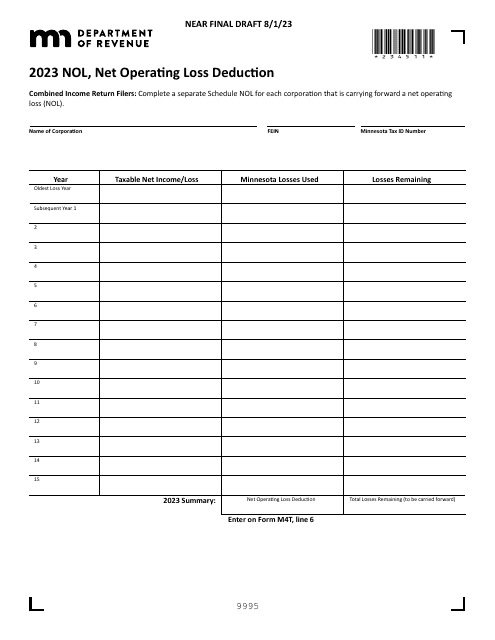

This Form is used for reporting net operating losses in the state of Michigan. It helps individuals and businesses calculate and claim any losses incurred in their operations for tax purposes.

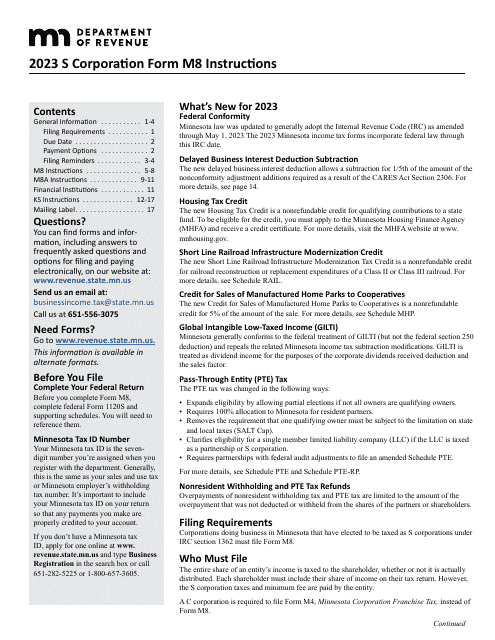

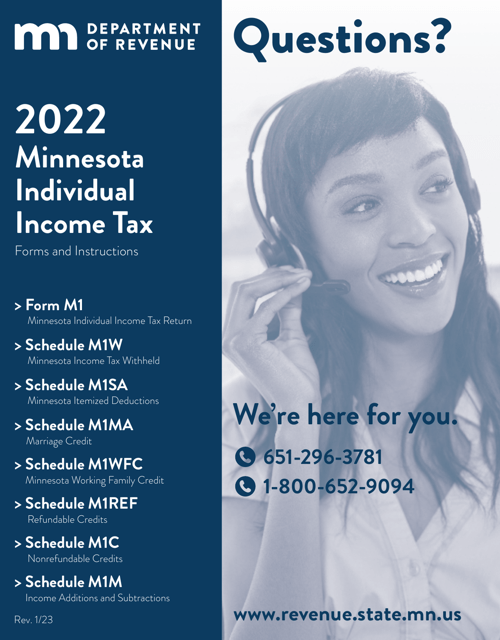

This document provides instructions for various schedules/forms used in Minnesota state tax filing. It includes M1 Schedule M1M, M1MA, M1REF, M1SA, M1W, and M1WFC.

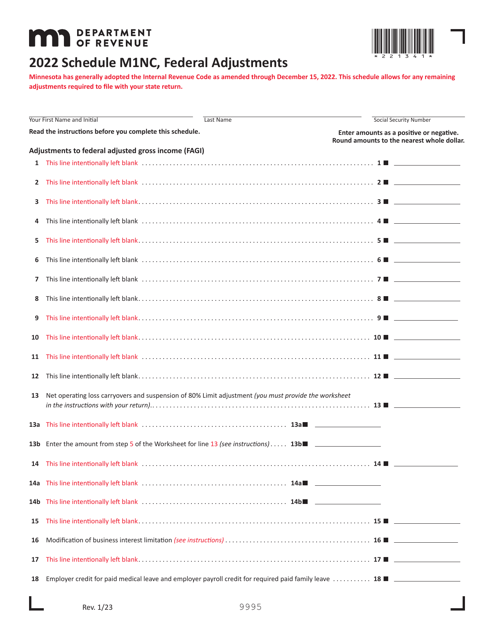

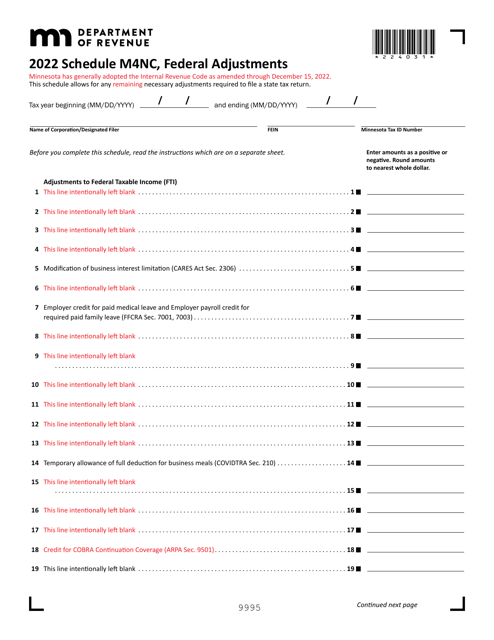

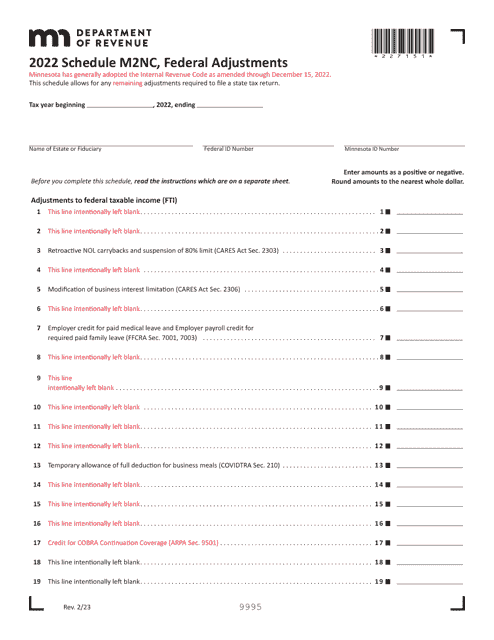

This document is used for reporting federal adjustments made by Minnesota residents for their state tax return.

This document is used for making federal adjustments to your Minnesota state income tax return. It helps calculate any differences between your federal and state tax obligations in Minnesota.

This document is used for reporting federal adjustments on your Minnesota state tax return. It helps ensure that you are accurately reporting your income and deductions for state tax purposes.

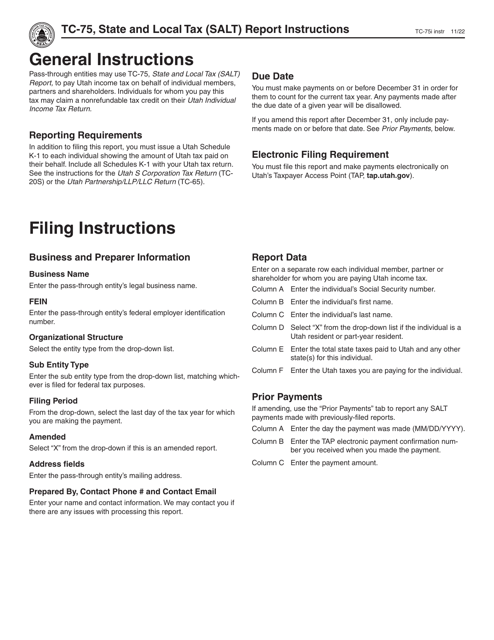

This Form is used for reporting state and local taxes in Utah. It provides instructions on how to accurately complete the TC-75 State and Local Tax Report.

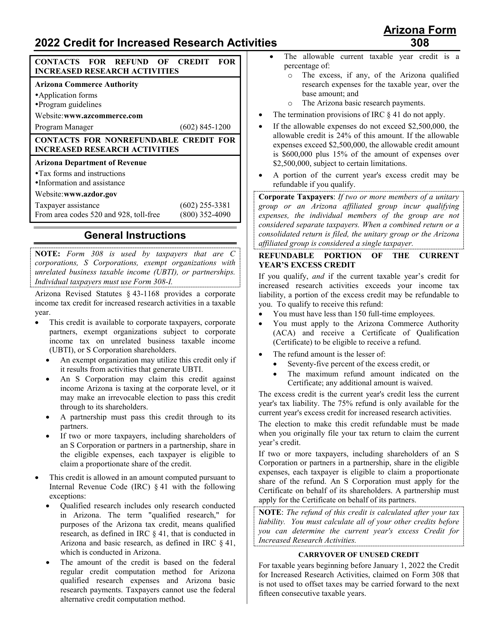

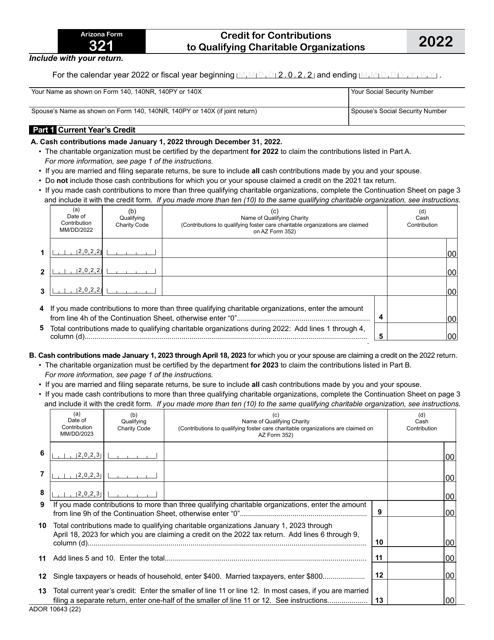

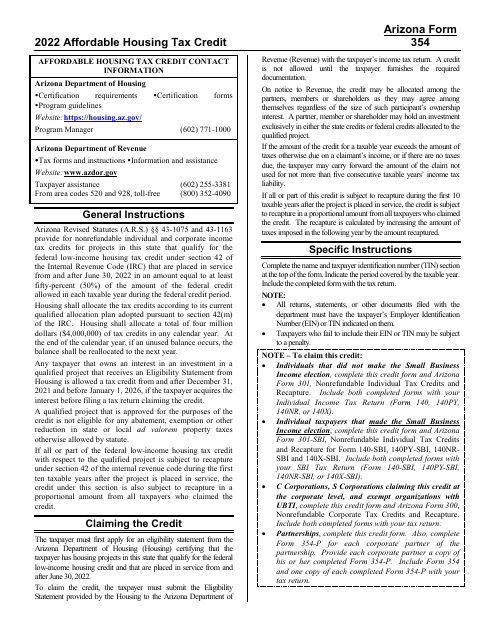

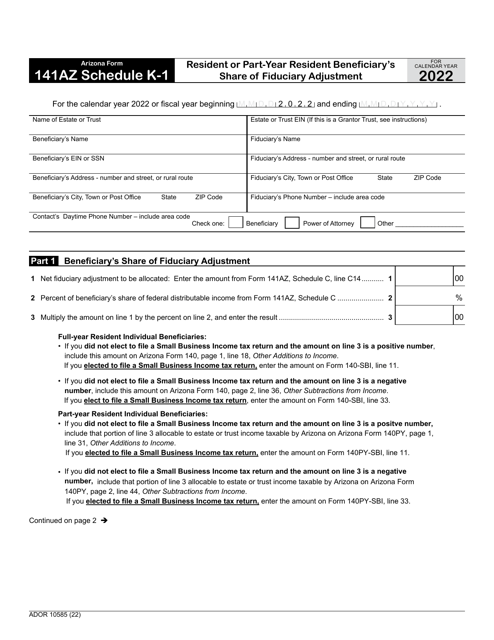

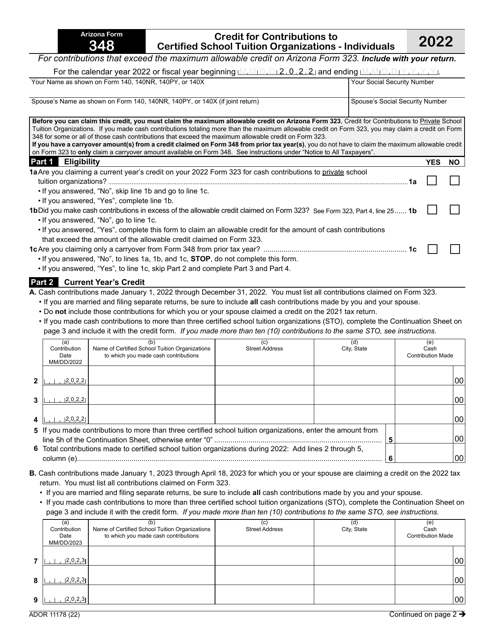

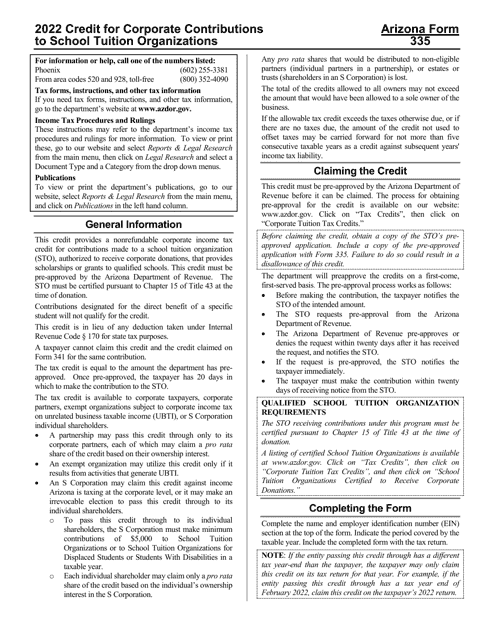

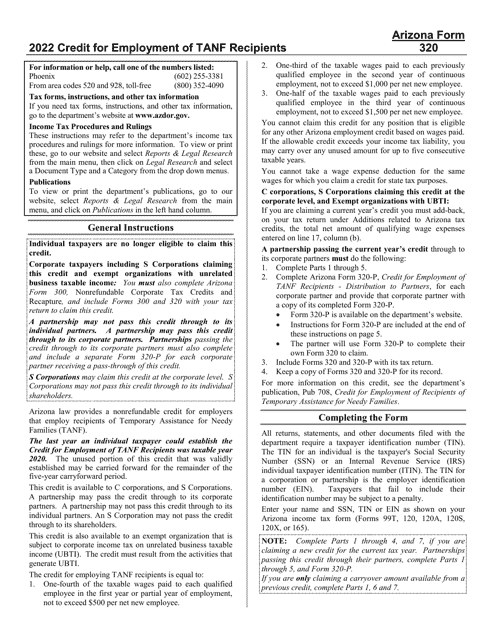

This document provides instructions for various Arizona tax forms including Form 354, Form 354-P, and Form 354-S. It includes information on how to fill out these forms correctly for tax purposes in Arizona.