State Tax Forms and Templates

Documents:

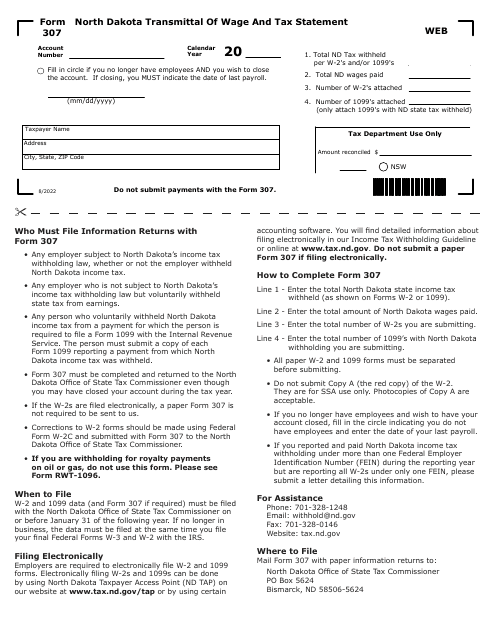

933

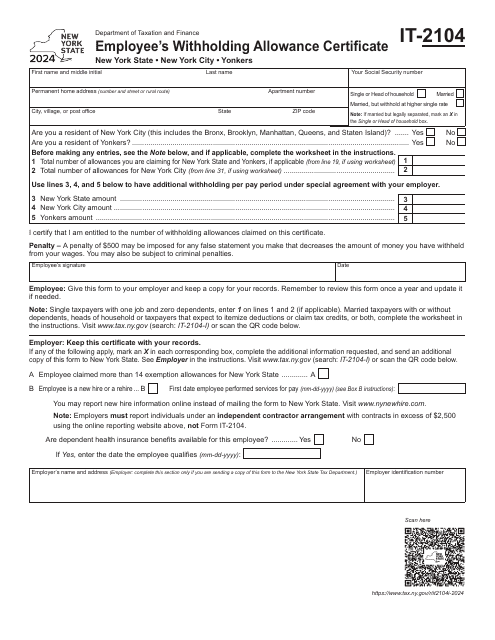

Use this application to specify how much tax needs to be withheld from an employee's pay. It is supposed to be filled out by an individual who works in New York State (New York City and Yonkers) and given to their employer.

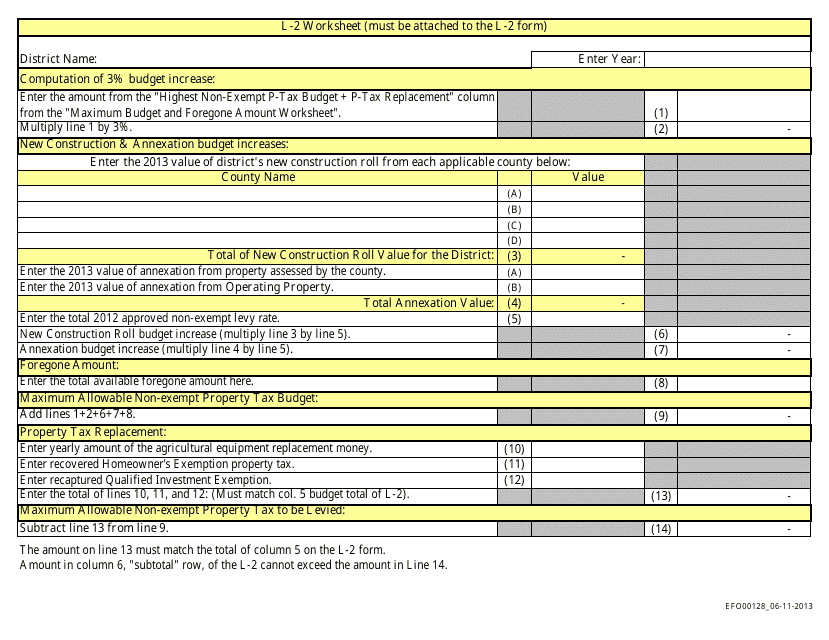

This Form is used for completing the L-2 worksheet in Idaho. It is used for recording and calculating financial information for tax purposes.

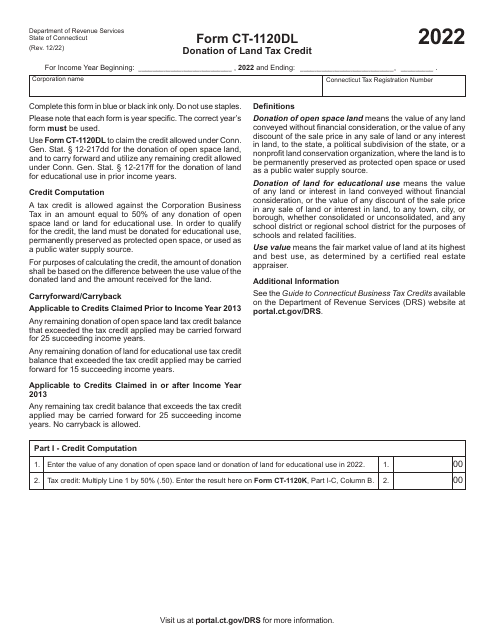

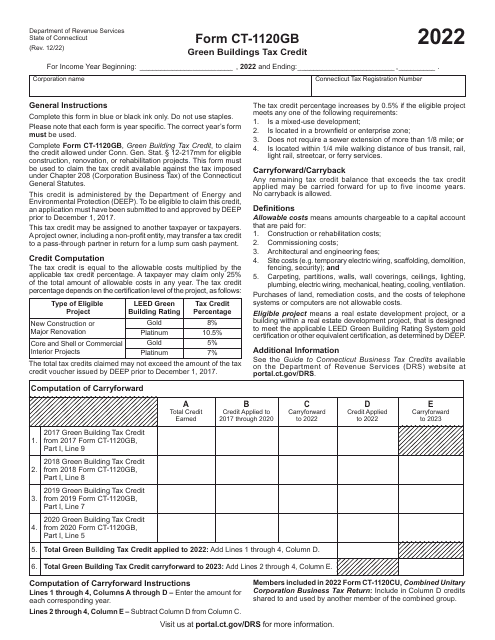

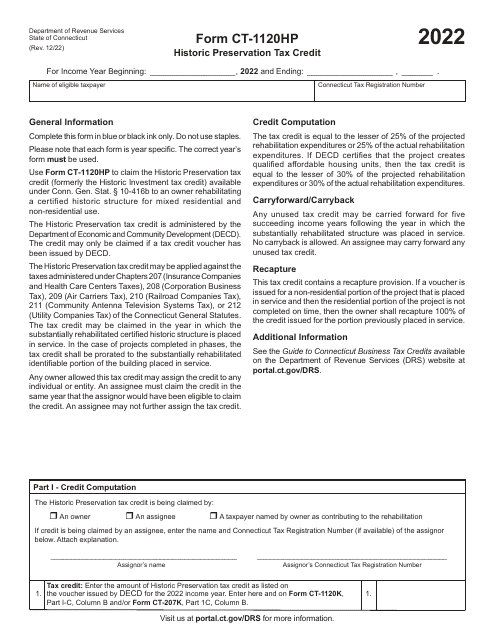

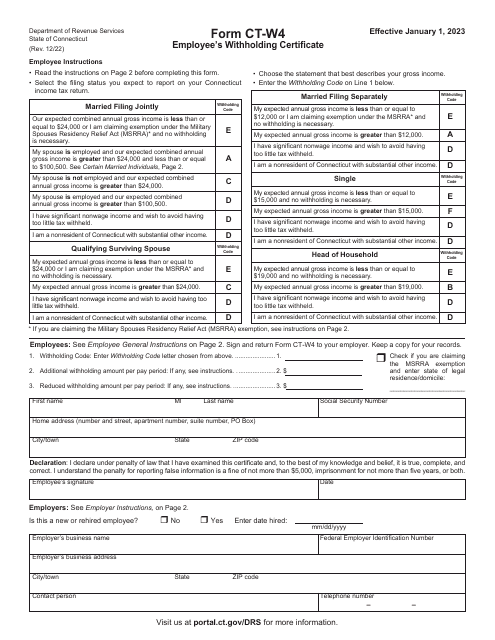

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.

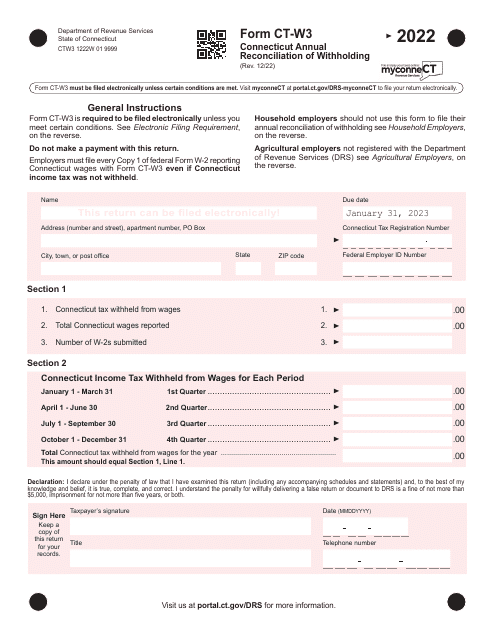

This Form is used for reporting annual withholding tax reconciliations in Connecticut.

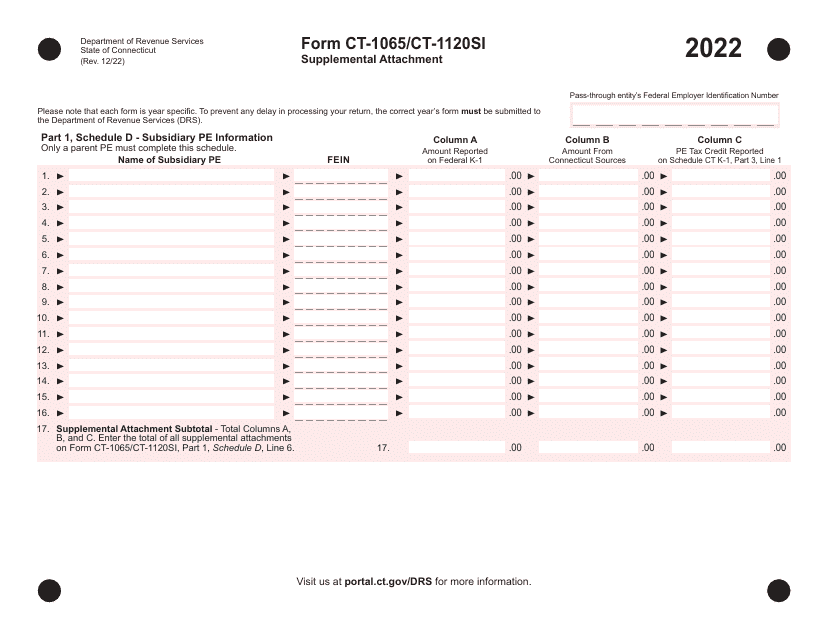

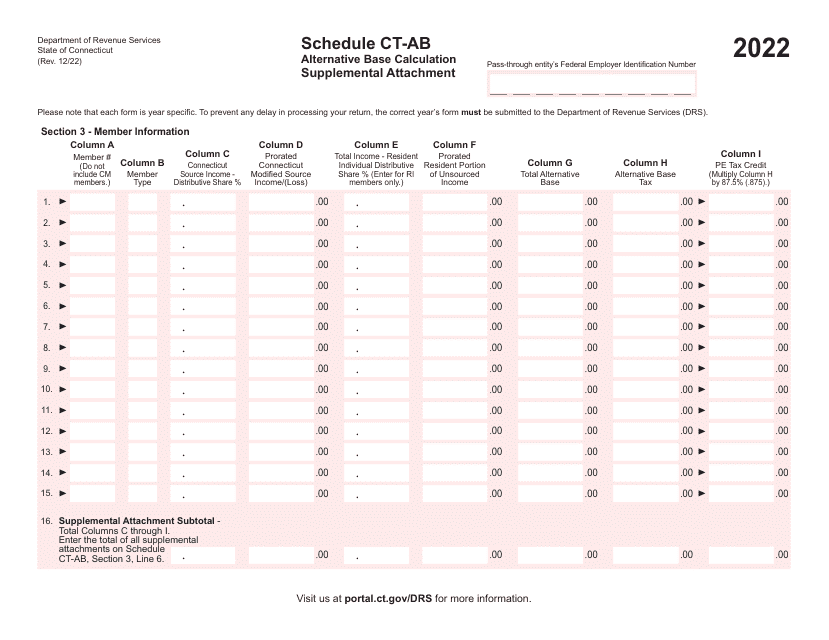

This document is used for submitting a supplemental attachment for the Alternative Base Calculation (CT-AB) in Connecticut. It provides additional information to support the alternative base calculation.

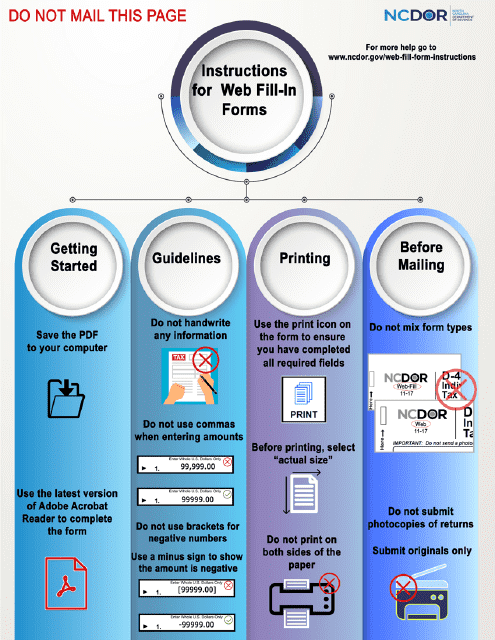

This Form is used for residents of North Carolina to file their state income tax return and claim deductions, credits, and exemptions. The D-400TC Schedule A, AM, PN, PN-1, S are additional schedules that may be necessary depending on your specific tax situation.