District of Columbia Tax Forms and Templates

District of Columbia Tax Forms are used to report and pay taxes to the government of the District of Columbia. These forms are necessary for individuals and businesses who are residents of or have income or business activities in the District of Columbia. The tax forms ensure compliance with the tax laws and regulations of the District of Columbia and help individuals and businesses accurately calculate and pay their tax liabilities.

Documents:

2

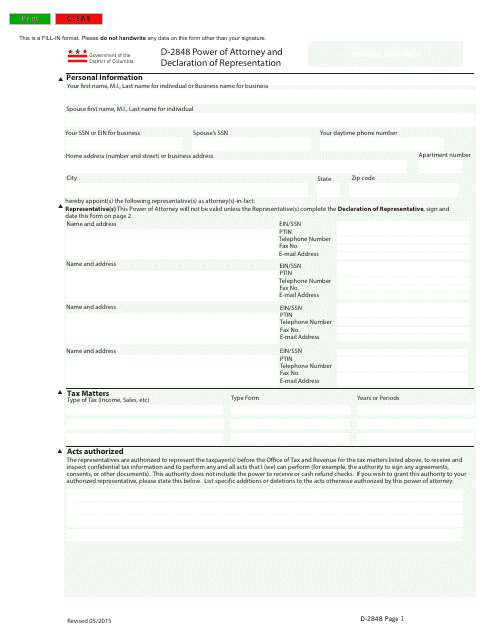

This form is used for granting someone the power of attorney and declaring representation in Washington, D.C.

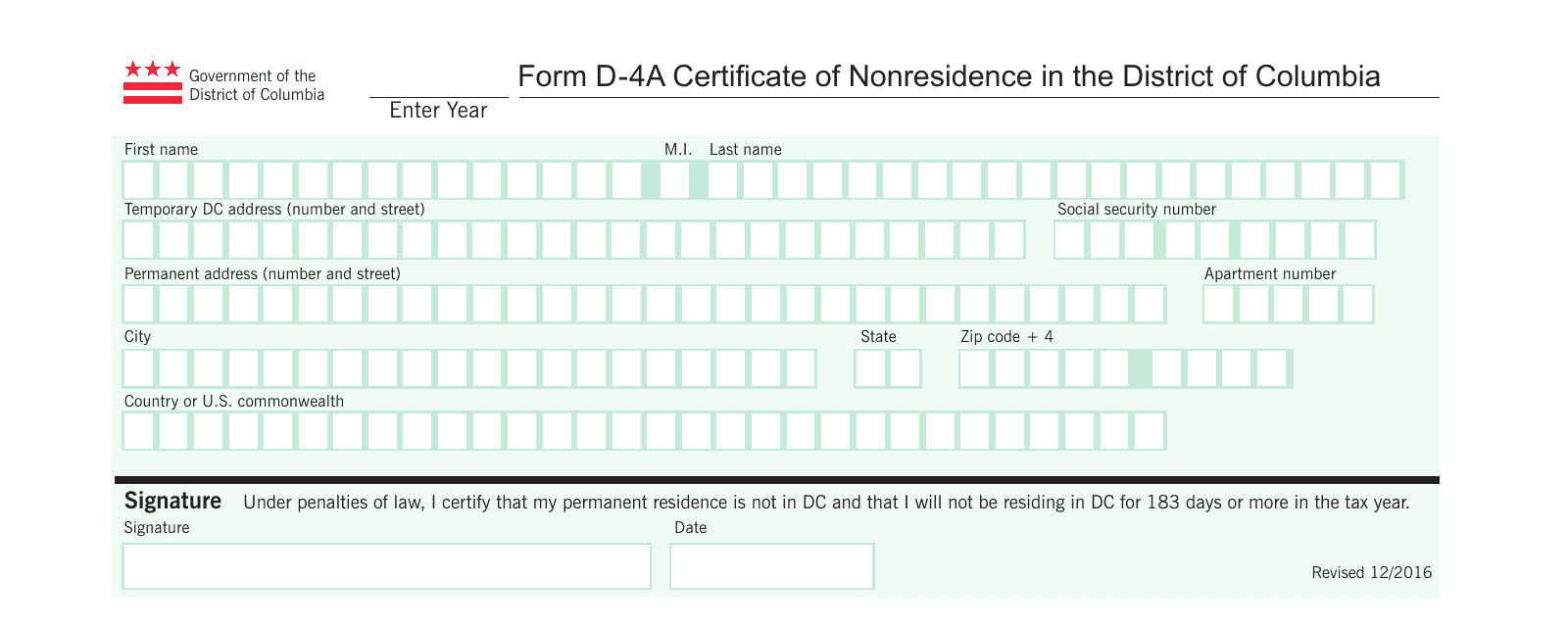

This Form is used for declaring nonresidence status in the District of Columbia for tax purposes.