Loan Approval Form Templates

Documents:

41

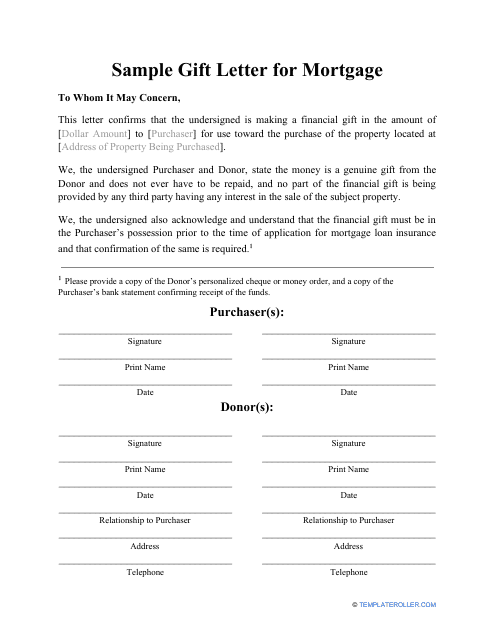

Use this sample letter to confirm that you are making a gift of money to another individual who will use it for a mortgage.

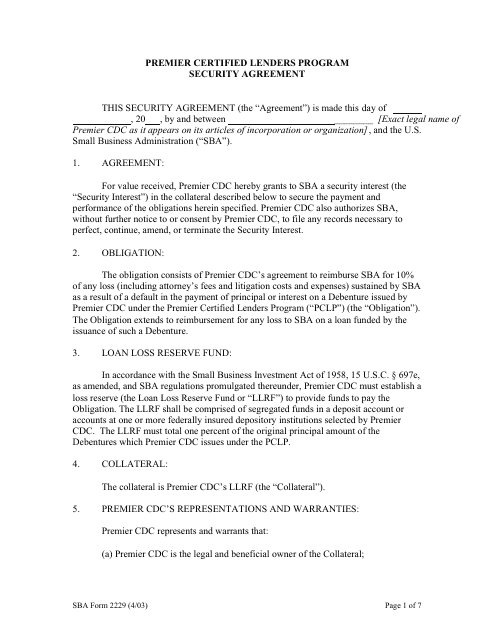

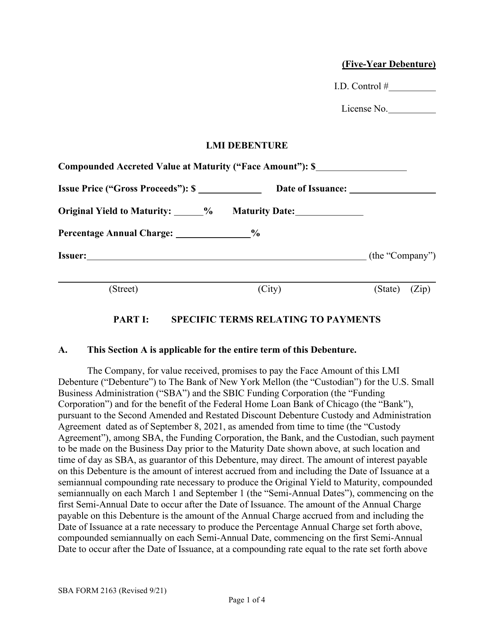

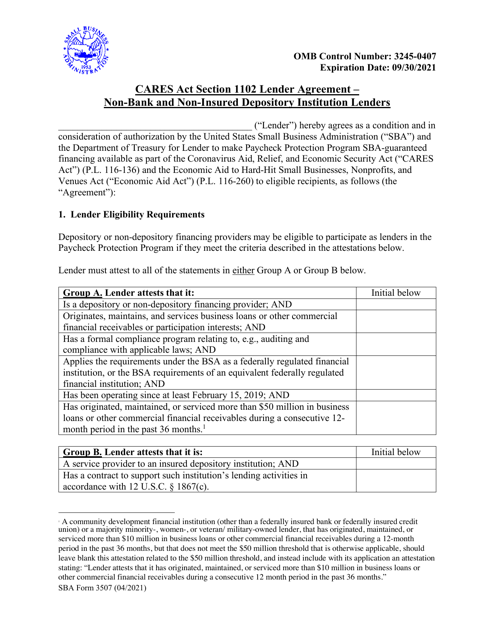

This type of document is a security agreement used in the Premier Certified Lenders Program of the Small Business Administration (SBA).

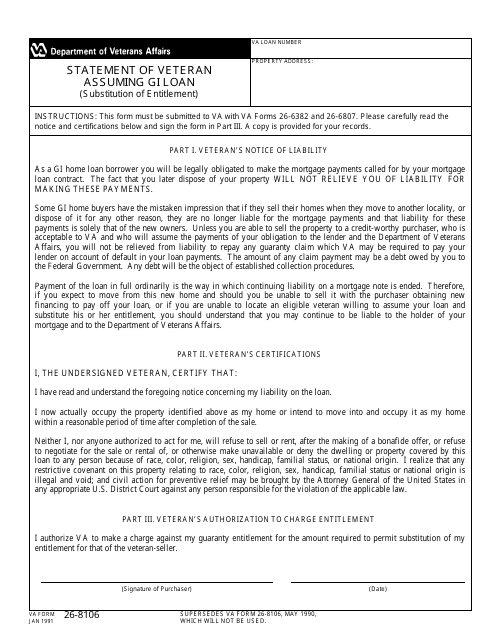

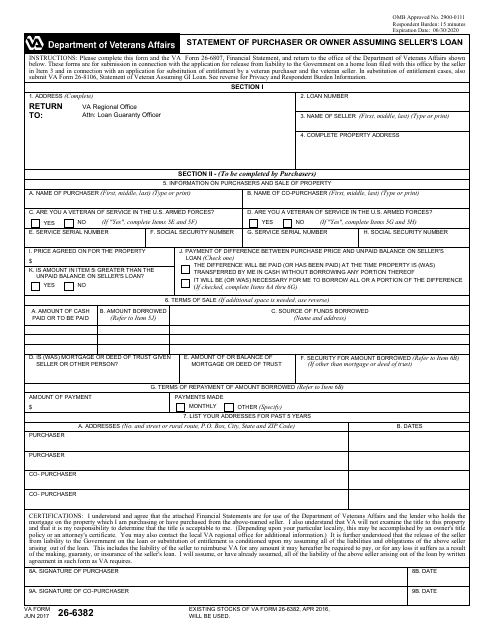

This Form is used for veterans assuming GI loans to provide a statement confirming their intention to assume the loan.

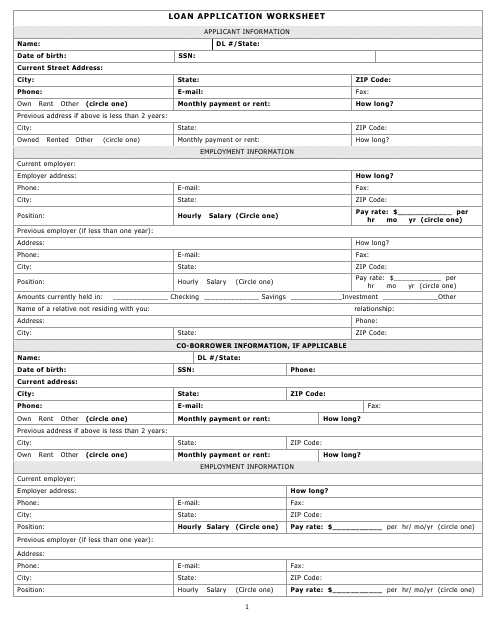

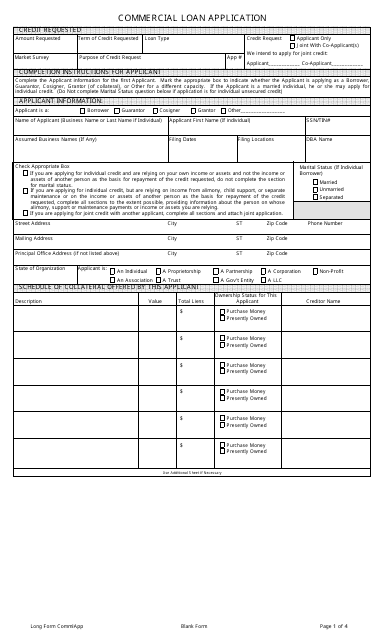

This Form is used for applying for a commercial loan in the United States. It collects important information about the borrower's business and financials.

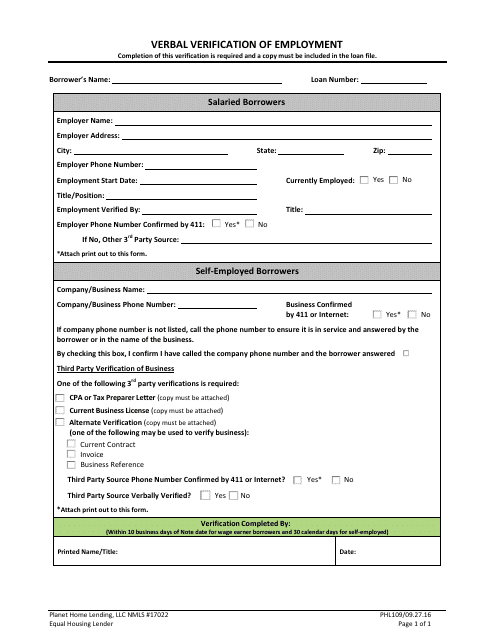

This Form is used for verifying employment information of Planet Home Lending applicants verbally.

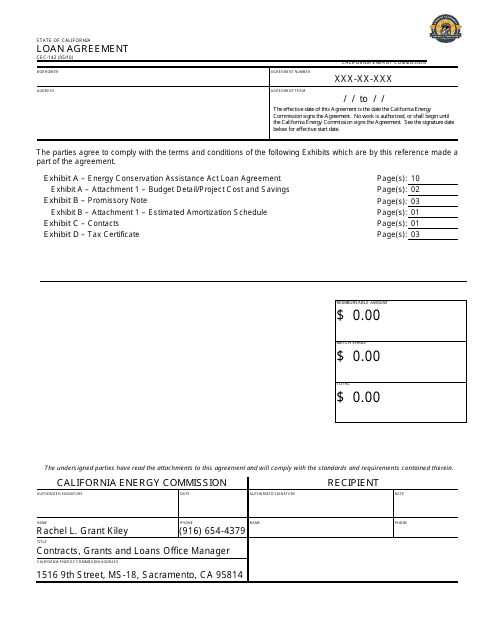

This form is used for creating a loan agreement in the state of California. It outlines the terms and conditions of the loan, including the amount borrowed, interest rates, and repayment terms.

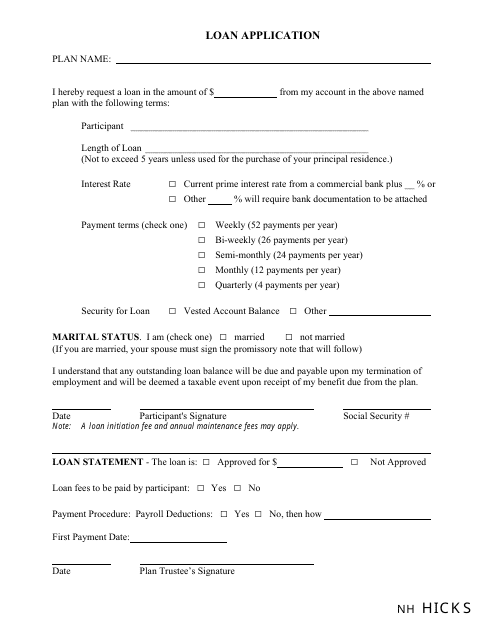

This Form is used for applying for a loan from Nh Hicks. It is a document that collects the necessary information and details for the loan application process.

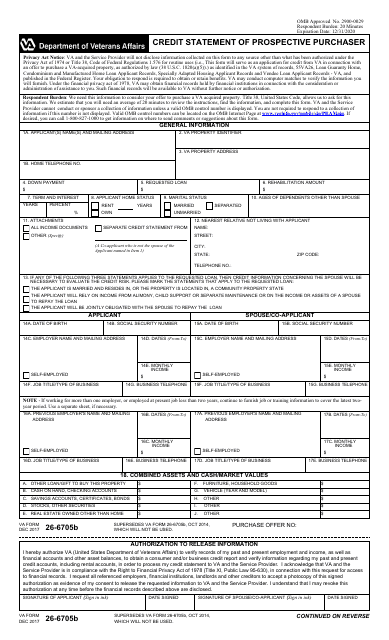

This type of document, VA Form 26-6705b, is used for providing a credit statement for a prospective purchaser. It is used in the context of a VA loan, which is a home loan guaranteed by the U.S. Department of Veterans Affairs.

This Form is used for buyers or owners who are assuming the seller's loan.

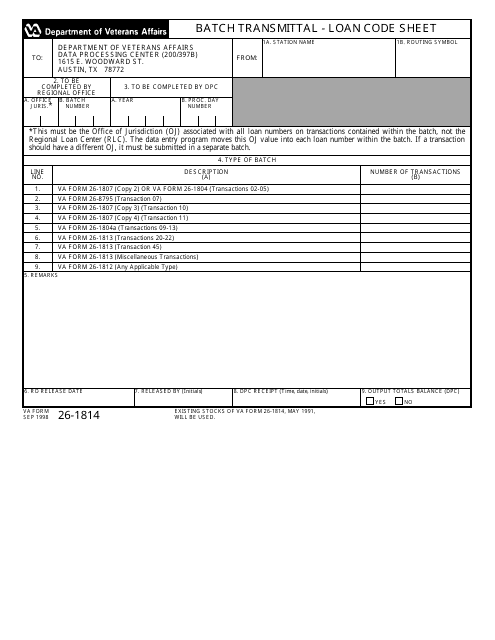

This document is used for transmitting batches of loan code sheets to the Department of Veterans Affairs (VA). It helps streamline the process of submitting loan codes for various VA loan programs.

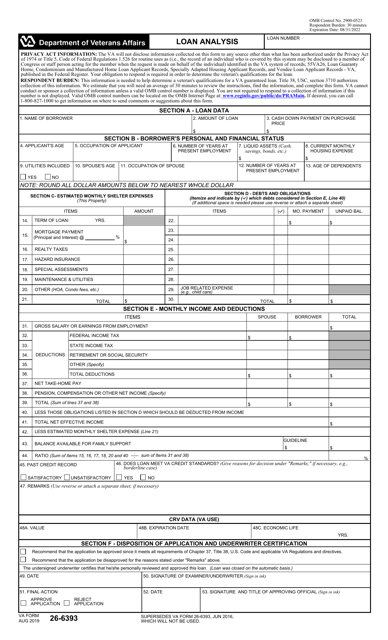

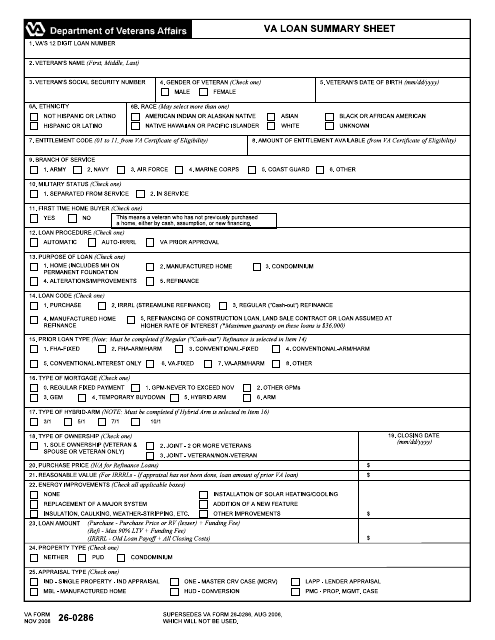

This document provides a summary of information related to a VA loan. It is used to summarize important details of a VA loan application.

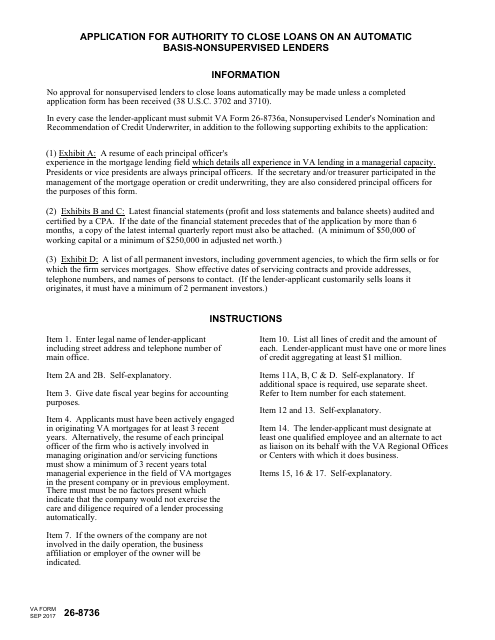

This Form is used for non-supervised lenders to apply for authority to close loans on an automatic basis.

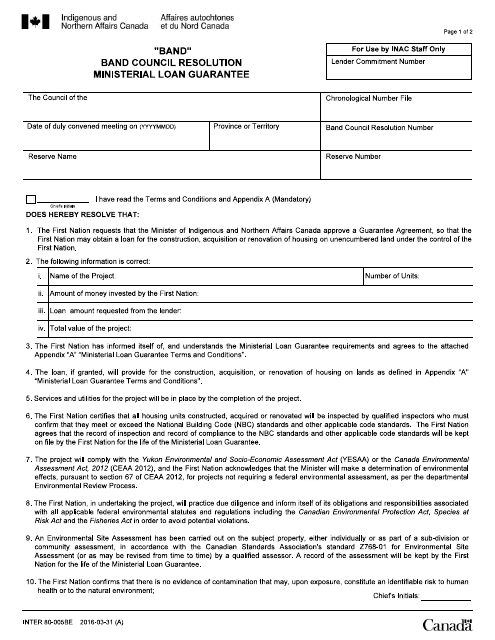

This Form is used for a Band Council Resolution in Canada to obtain a Ministerial Loan Guarantee.

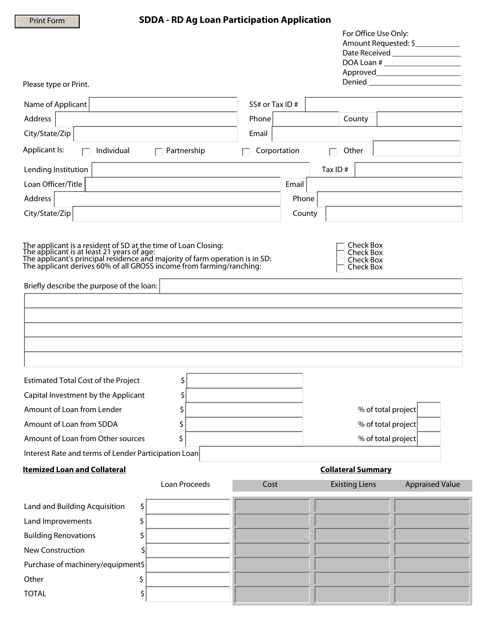

This form is used for applying for a loan participation program in South Dakota specifically for agricultural purposes.

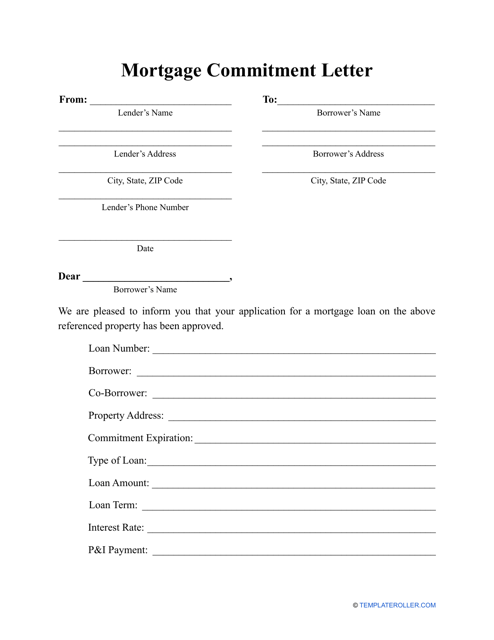

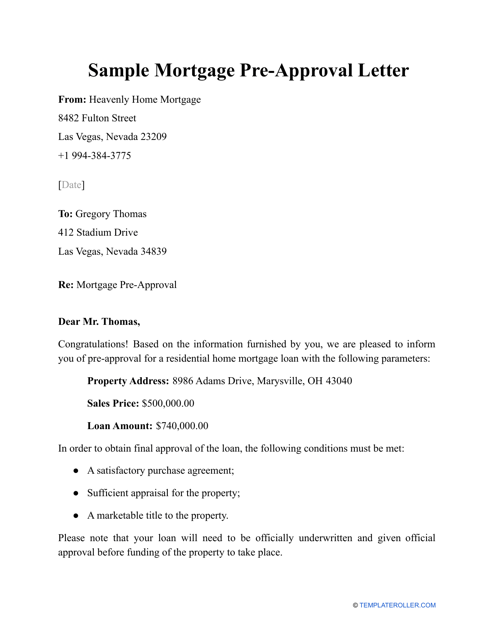

This letter is sent to the borrower after their mortgage application is accepted.

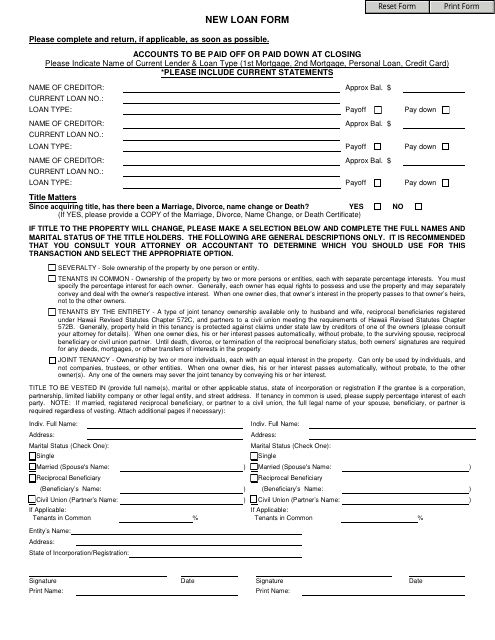

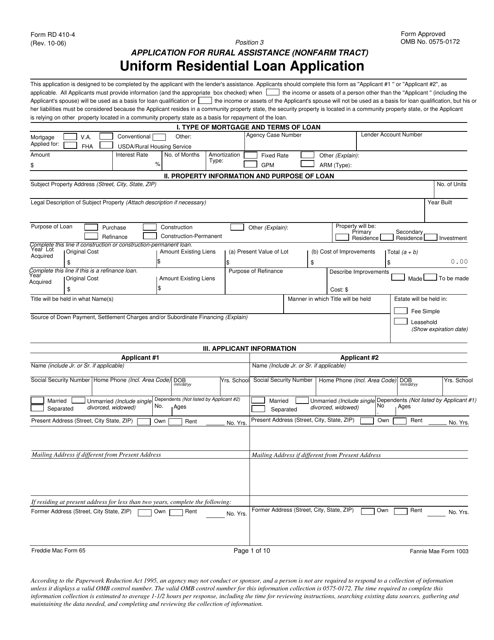

This document is used for applying for a residential loan.

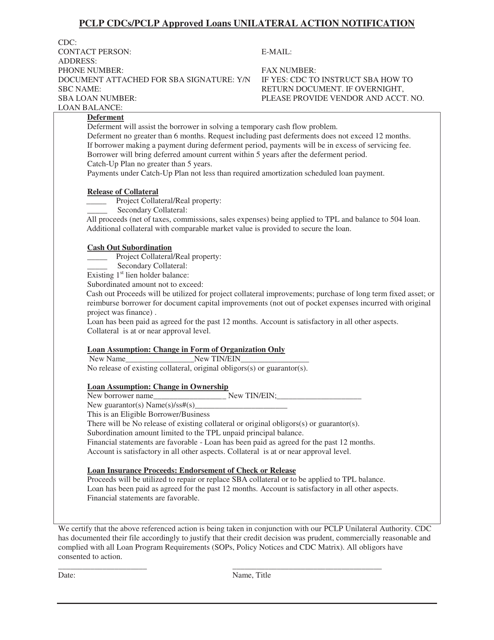

This document is for notifying individuals about unilateral actions taken in regards to PCLP CDCs/PCLP approved loans.

This document explores the impact of student debt on the ability to buy a house. It discusses how student loans can affect financial stability and the challenges that arise when trying to qualify for a mortgage.

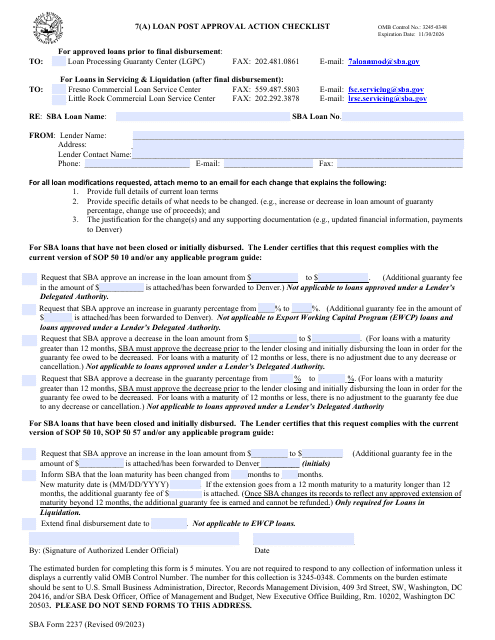

Use this form if you are a lender to notify the SBA of the following actions conducted after the loan was approved: closing the loan, changes in the borrower's legal or business name, and the like.

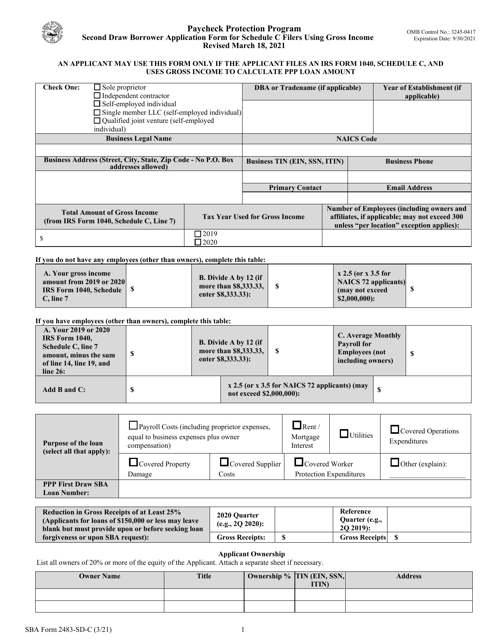

This form is used for small business owners who file their taxes with a Schedule C form and are applying for a second draw loan through the Small Business Administration. The form specifically caters to those who calculate eligibility based on gross income.

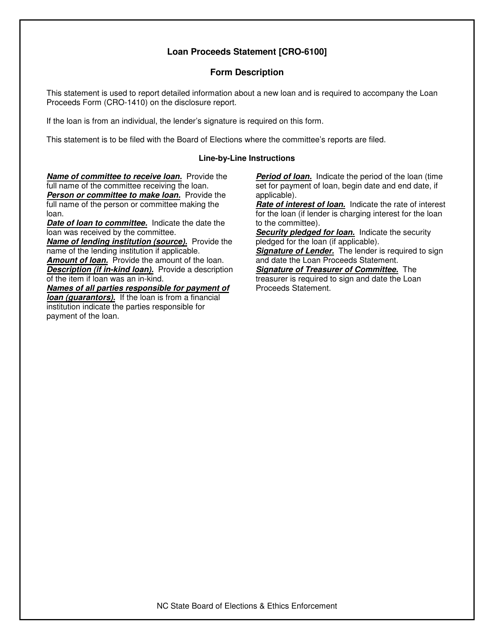

This form is used to provide instructions for completing Form CRO-6100 Loan Proceeds Statement in North Carolina. It provides guidance on how to accurately report loan proceeds for various purposes.

This letter can be used as a reference to show that a customer has maintained a good credit history and has saved the necessary funds that will later help them qualify for a mortgage loan.

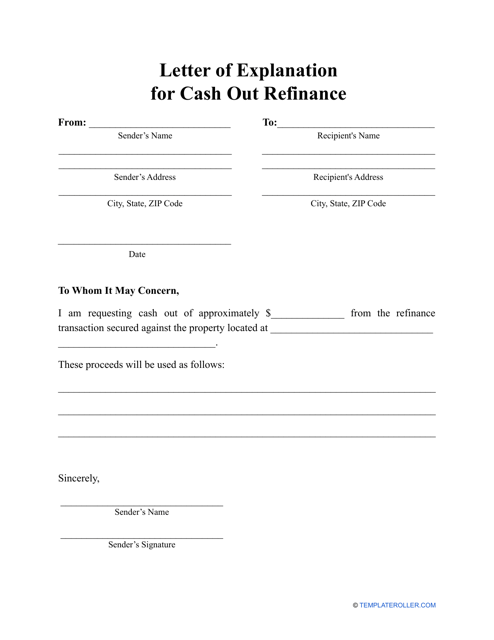

Individuals can use this type of letter when they want to explain to their potential lender why they need cash out refinancing.

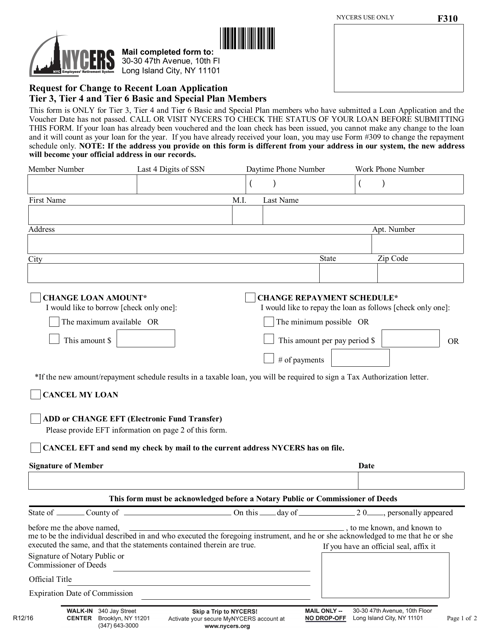

This Form is used for requesting a change to a recent loan application for Tier 3, Tier 4, and Tier 6 Basic and Special Plan Members in New York City.

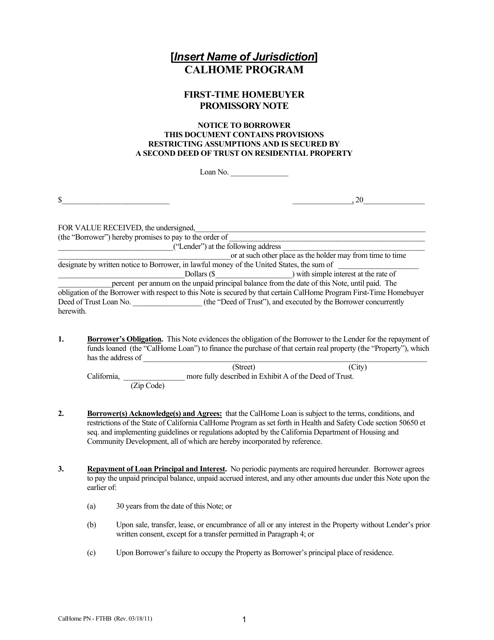

This document is for first-time homebuyers participating in the CalHome Program in California. It is a promissory note that outlines the terms of the loan, repayment schedule, and other details related to the home purchase.

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.

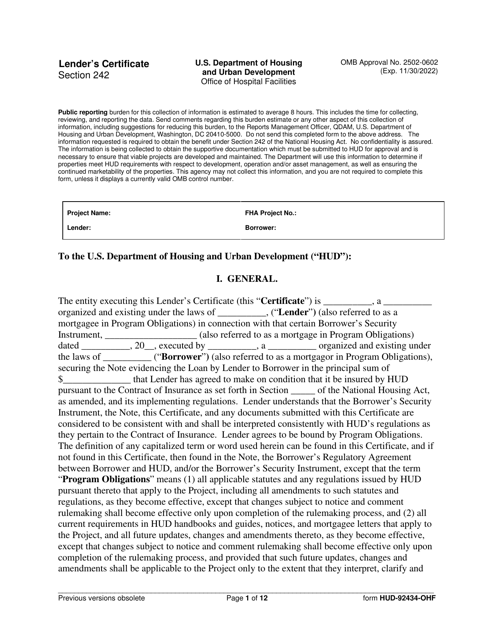

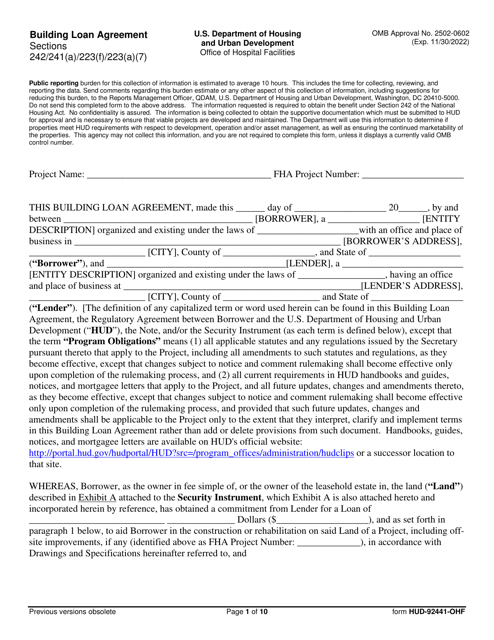

This document is a Building Loan Agreement form (Form HUD-92441-OHF) used by the U.S. Department of Housing and Urban Development (HUD) for financing the construction or rehabilitation of affordable housing projects.

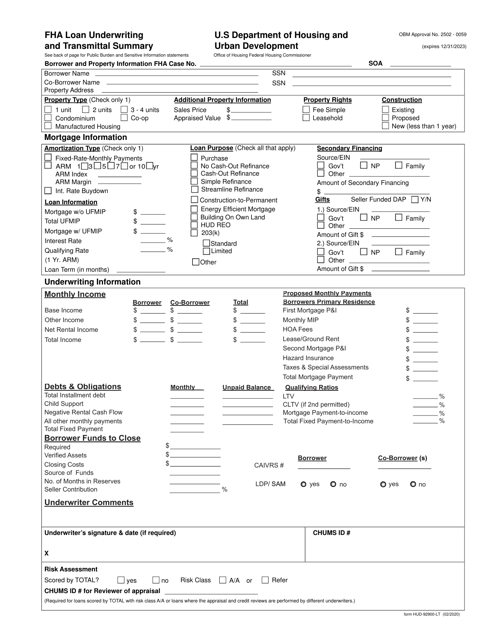

This form is used for summarizing and transmitting the underwriting information for an FHA loan.

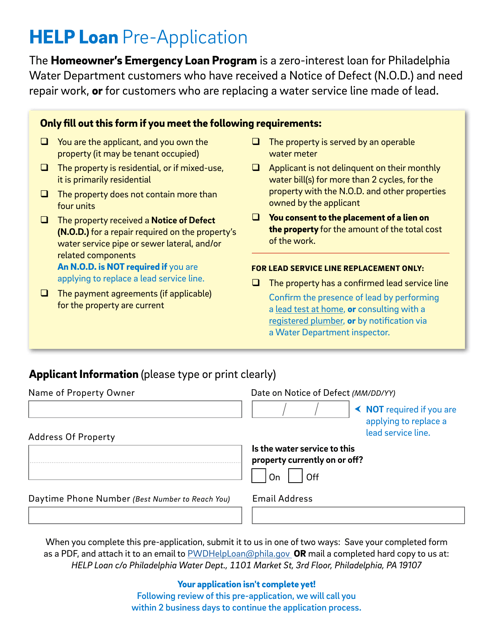

This document is a pre-application form for a loan assistance program offered by the City of Philadelphia in Pennsylvania. It helps residents of Philadelphia apply for financial assistance for various purposes, such as home repairs or small business development.

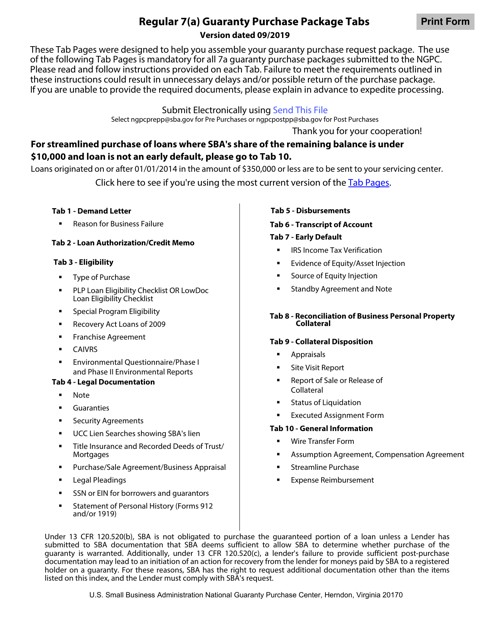

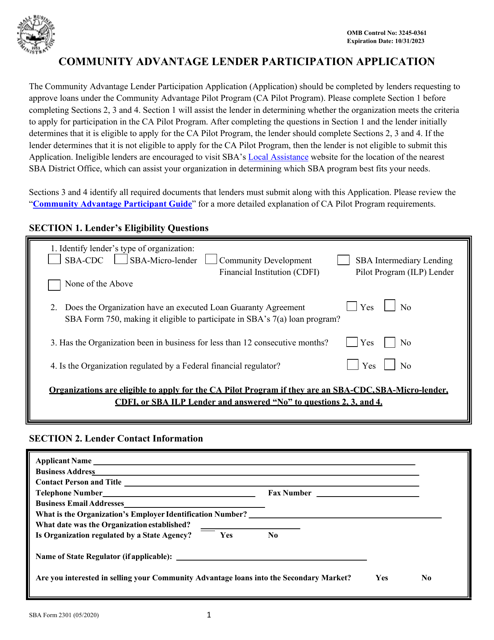

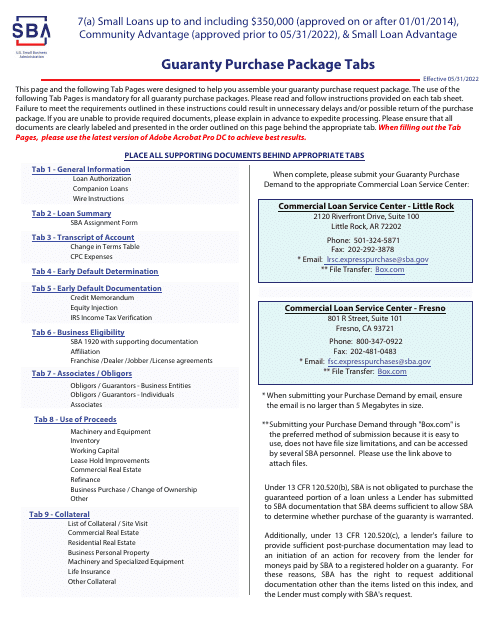

This document includes tabs for different types of small loans, including the 7(A) Small Loans, Community Advantage, and Small Loan Advantage. It provides information on the guarantee purchase package for loans approved on or after January 1, 2014, and for Community Advantage loans approved prior to May 31, 2022.

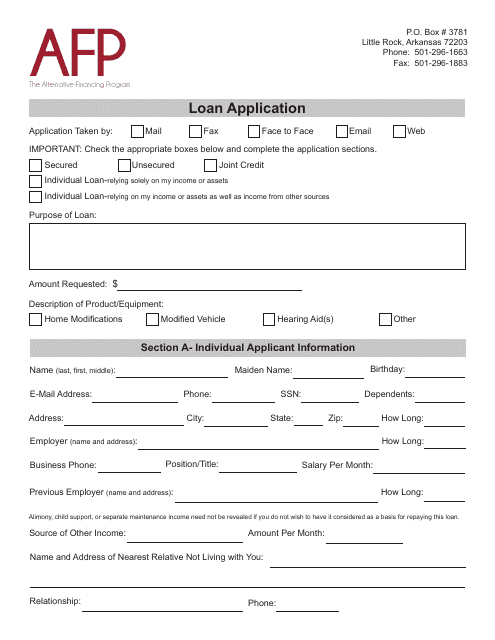

This document is used for applying for a loan through the Alternative Financing Program in the state of Arkansas.