Oil and Gas Documents Templates

Documents:

207

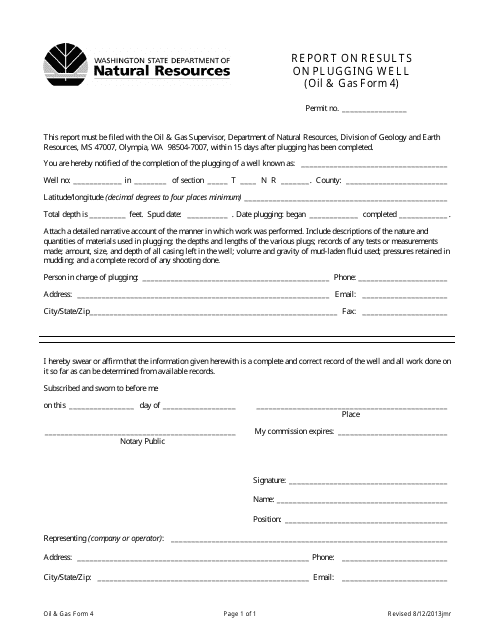

This Form is used for reporting on the results of plugging a well in the oil and gas industry in Washington state.

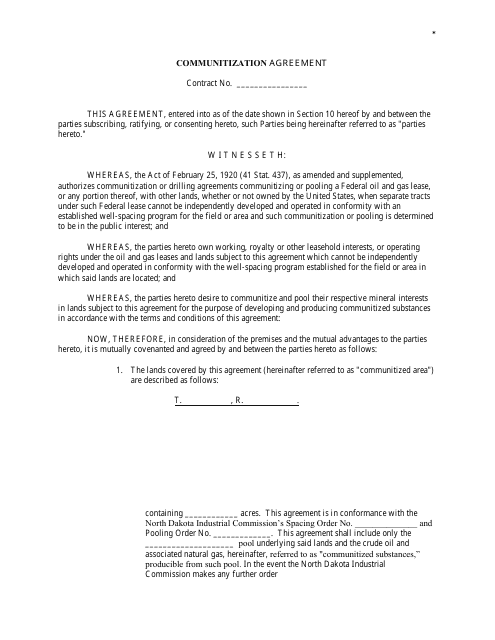

This document is a template that outlines the terms and conditions for a communitization agreement between parties. It establishes the joint development and sharing of resources in a specific geographic area.

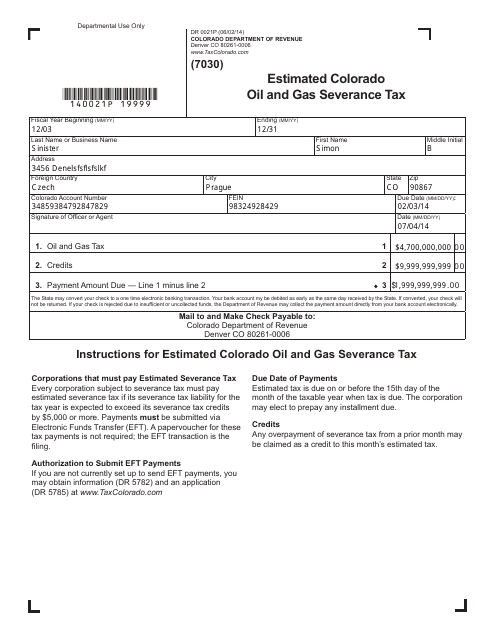

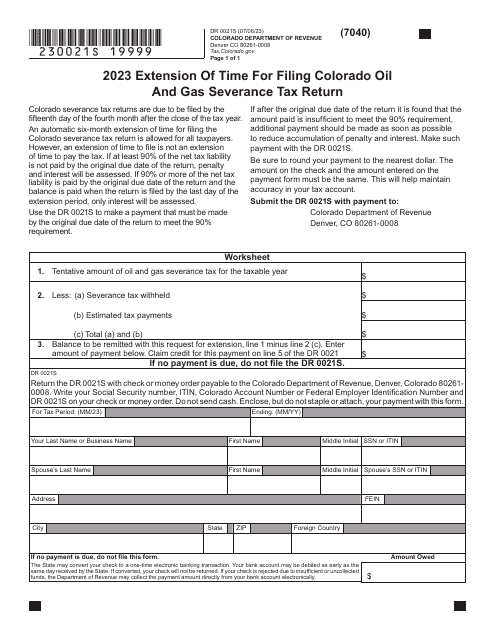

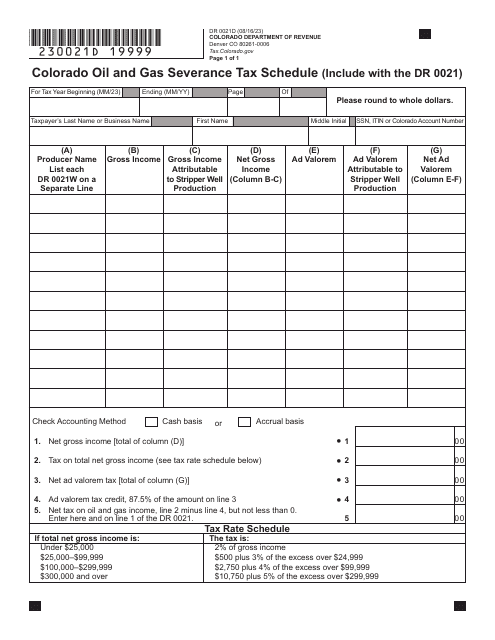

This Form is used for estimating the Colorado Oil and Gas Severance Tax for the state of Colorado.

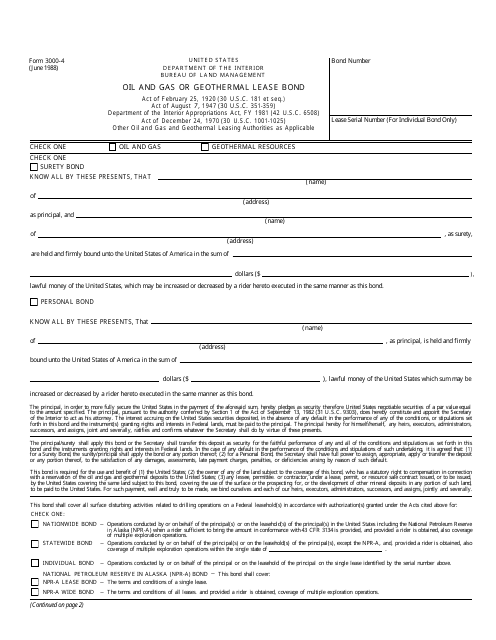

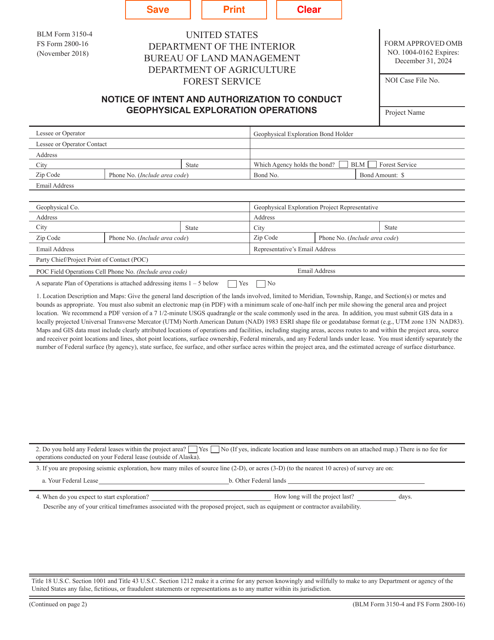

This form is used for obtaining a bond for oil and gas or geothermal leases on public lands. It ensures that the lease operator will meet their obligations and responsibilities.

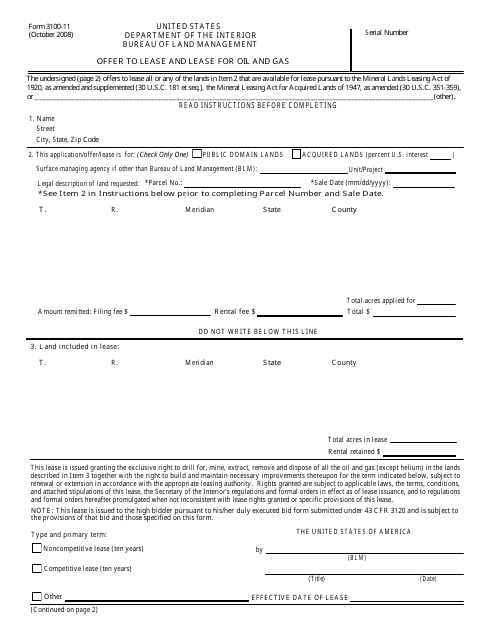

This form is used for offering and leasing land for oil and gas purposes under the Bureau of Land Management (BLM).

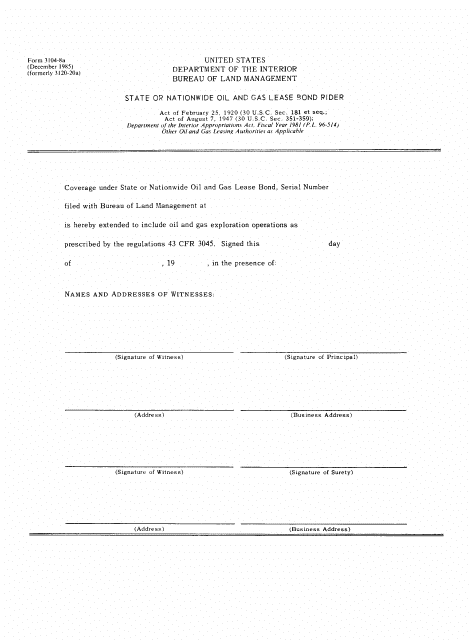

This Form is used for the State or Nationwide Oil and Gas Lease Bond Rider. It is a document that is related to the bonding requirements for oil and gas leases in the United States.

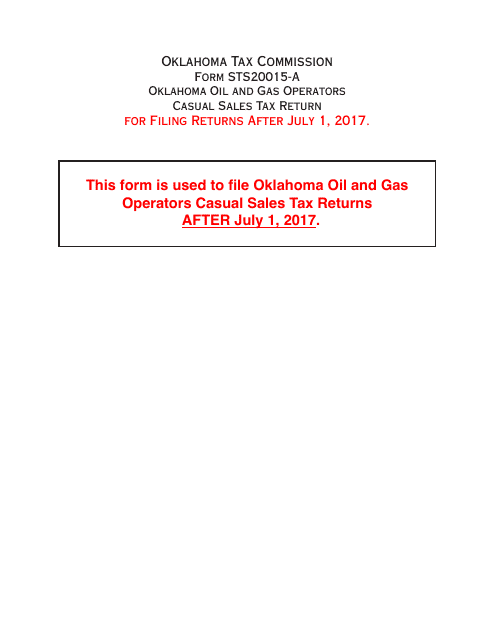

This document is used for reporting and remitting sales tax for casual sales by oil and gas operators in Oklahoma.

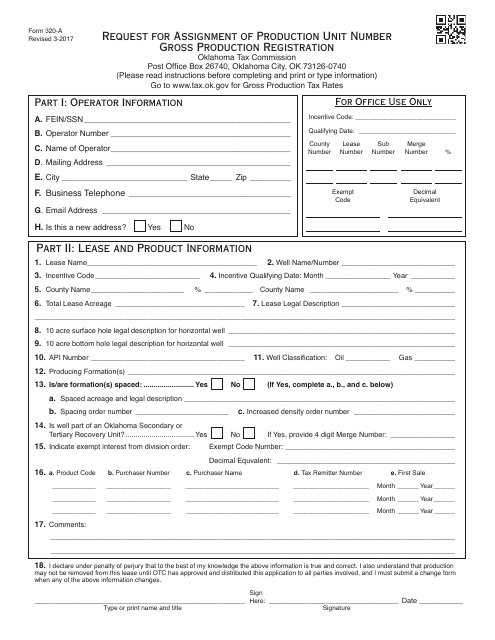

This form is used for requesting the assignment of a production unit number for registering gross production in Oklahoma.

Form DR0021S Extension of Time for Filing Colorado Oil and Gas Severance Tax Return - Colorado, 2023

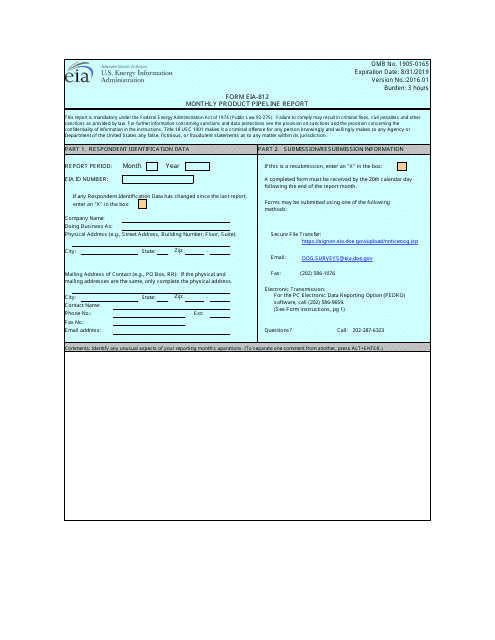

This form is used for reporting monthly product pipeline activities.

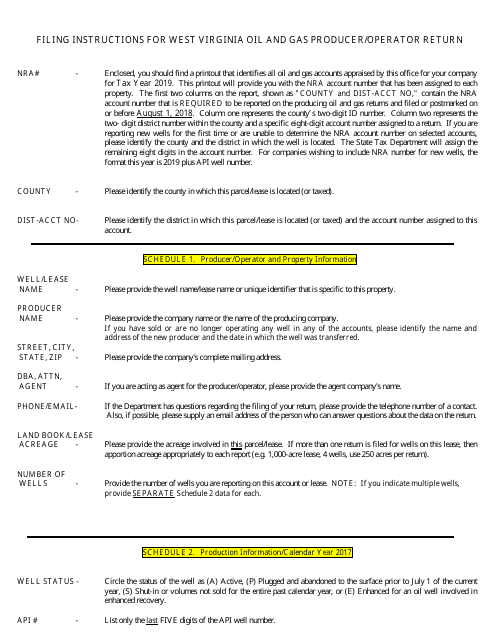

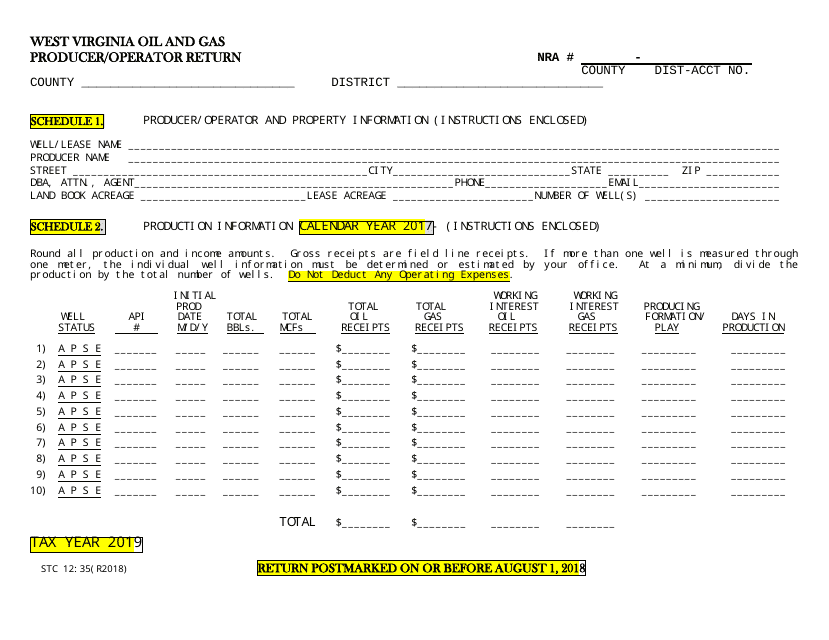

This Form is used for filing the West Virginia Oil and Gas Producer/Operator Return in West Virginia. It provides instructions on how to complete and submit the form.

This form is used for West Virginia oil and gas producers/operators to file their return and report their activity.

This document provides instructions for reporting oil and gas taxes specifically for the Fort Berthold Reservation in North Dakota. It guides individuals or businesses on how to properly report and pay taxes related to oil and gas operations on the reservation.

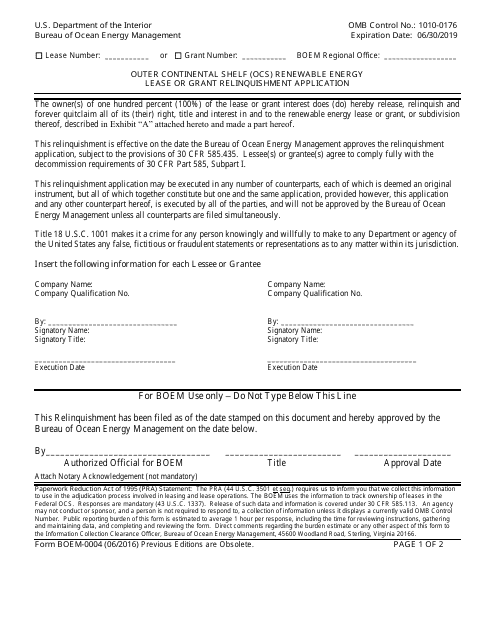

This form is used for relinquishing a lease or grant for renewable energy projects on the Outer Continental Shelf (OCS).

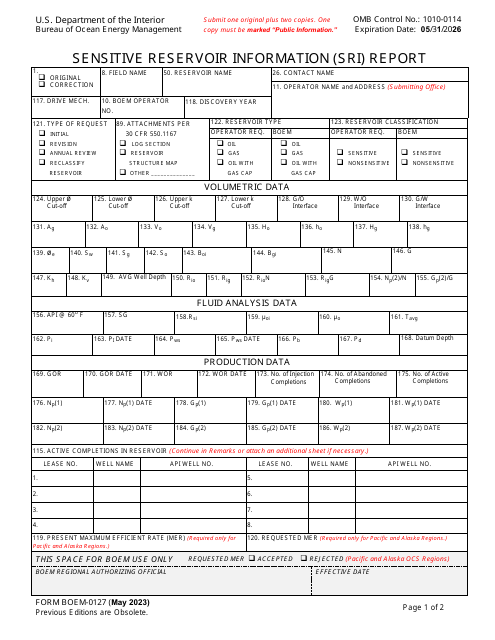

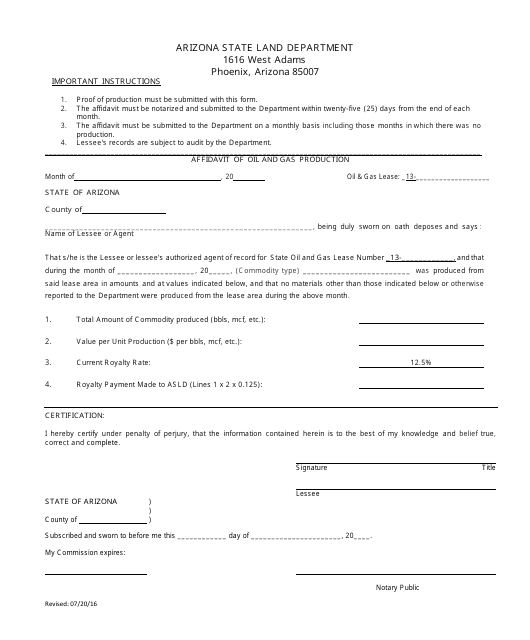

This document is used for providing sworn statement of oil and gas production in the state of Arizona.

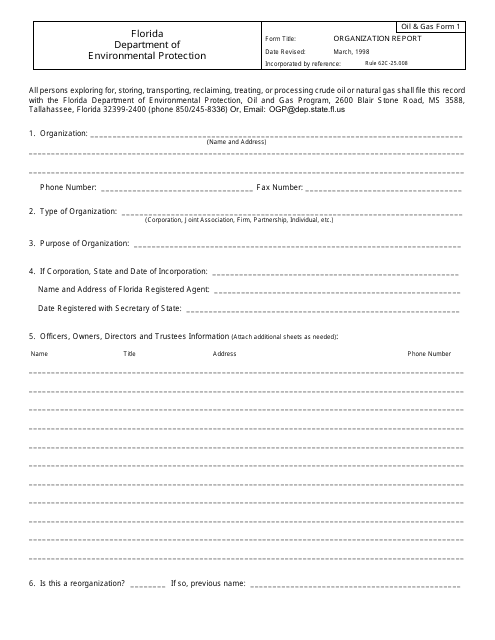

This form is used for reporting organization information related to oil and gas activities in Florida for the Department of Environmental Protection (DEP).

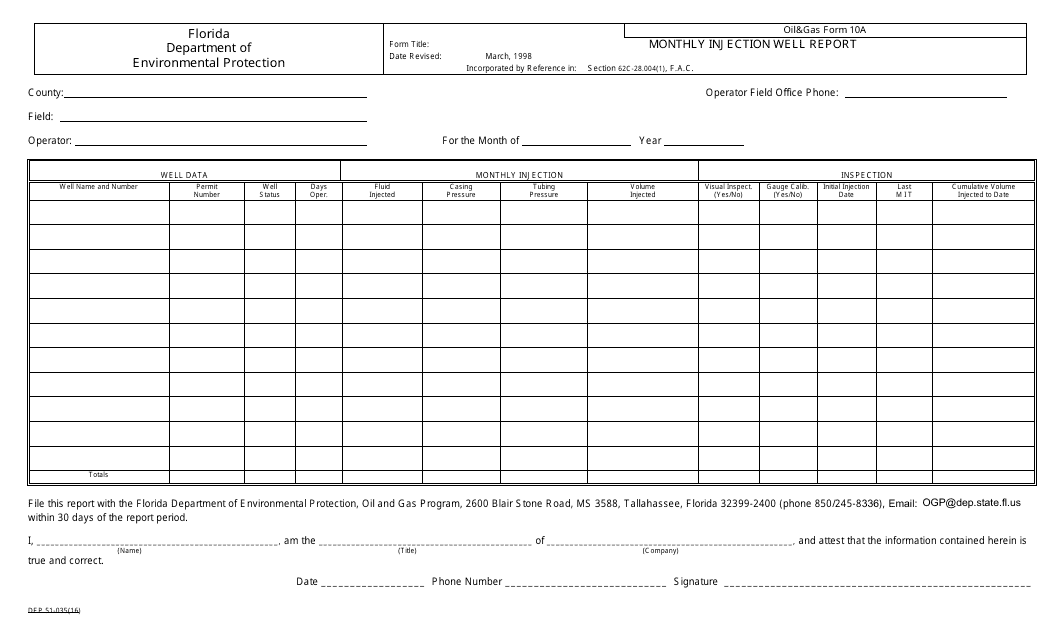

This Form is used for reporting monthly injection well activities related to oil and gas operations in Florida.

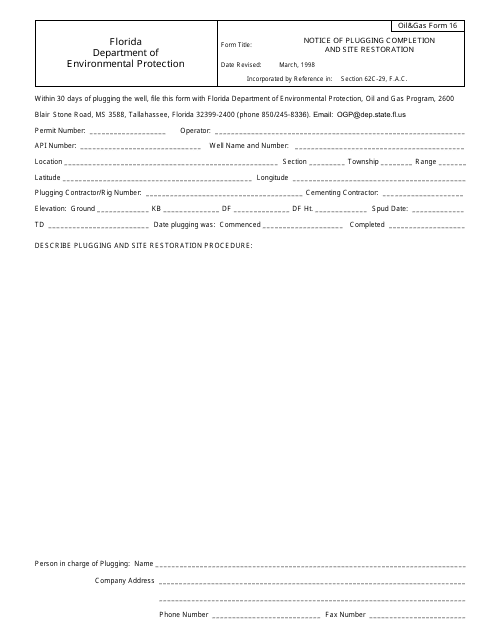

This type of document is used for notifying the completion of plugging and site restoration activities in the oil and gas industry in Florida.

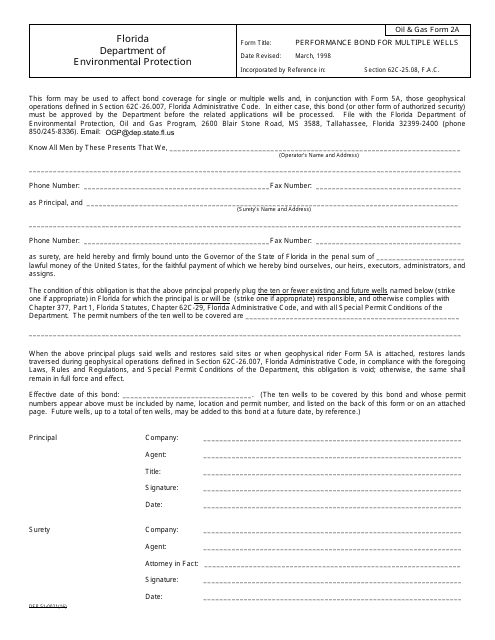

This Form is used for obtaining a performance bond for multiple oil and gas wells in the state of Florida.

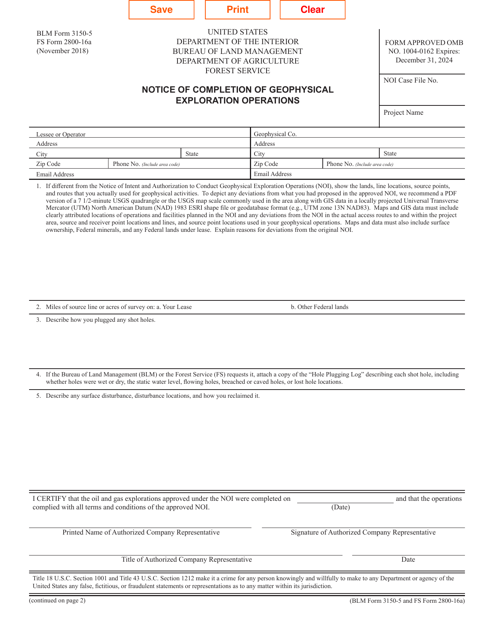

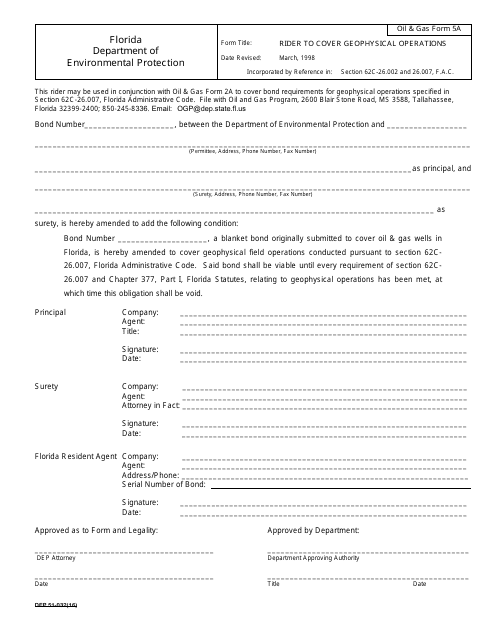

This document is a form used in Florida for covering geophysical operations related to oil and gas exploration.

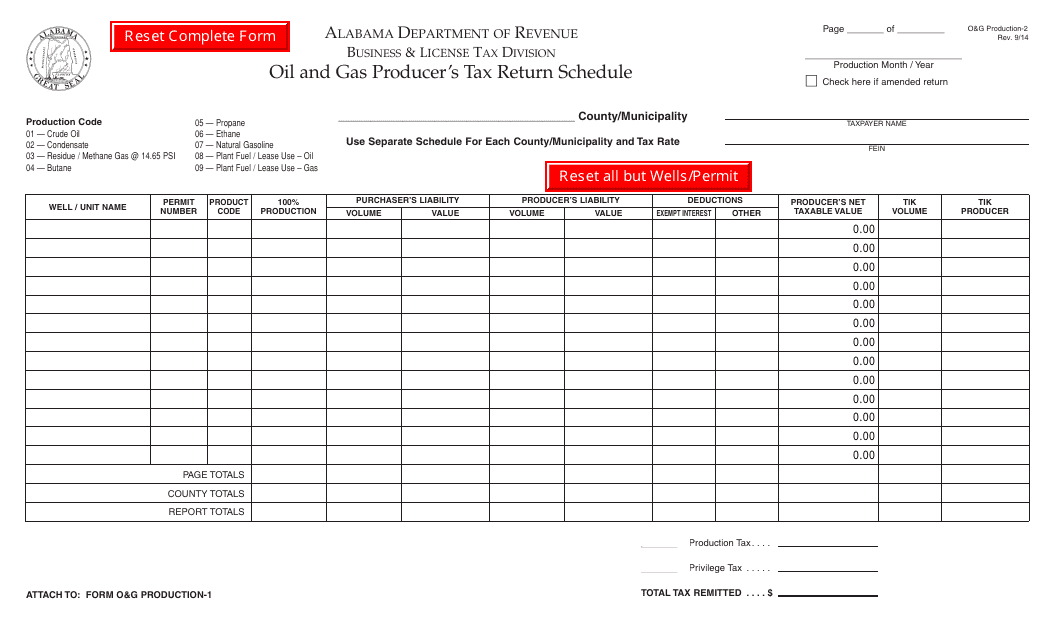

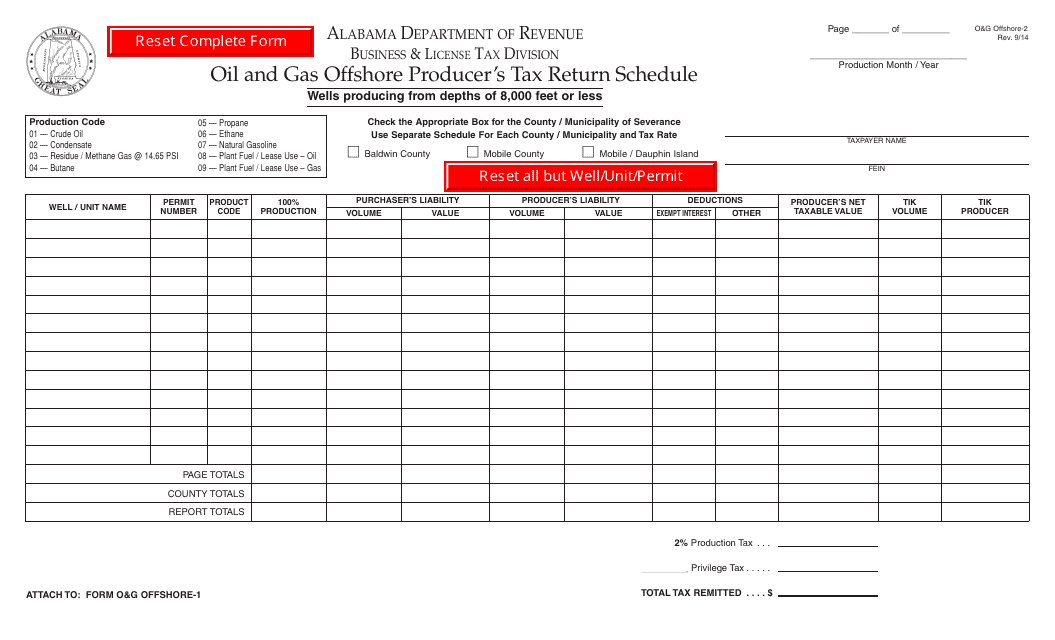

This document is used for filing the Oil and Gas Producer's Tax Return Schedule in the state of Alabama. It is used by individuals or businesses involved in oil and gas production to report their tax liabilities.

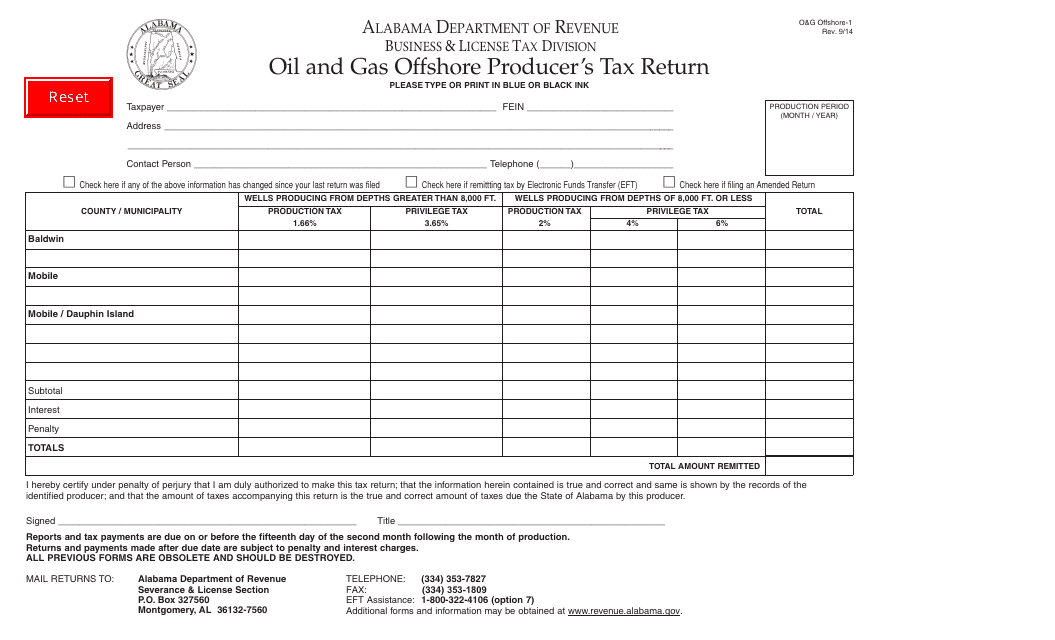

This form is used for reporting and paying the oil and gas offshore producer's tax in Alabama.

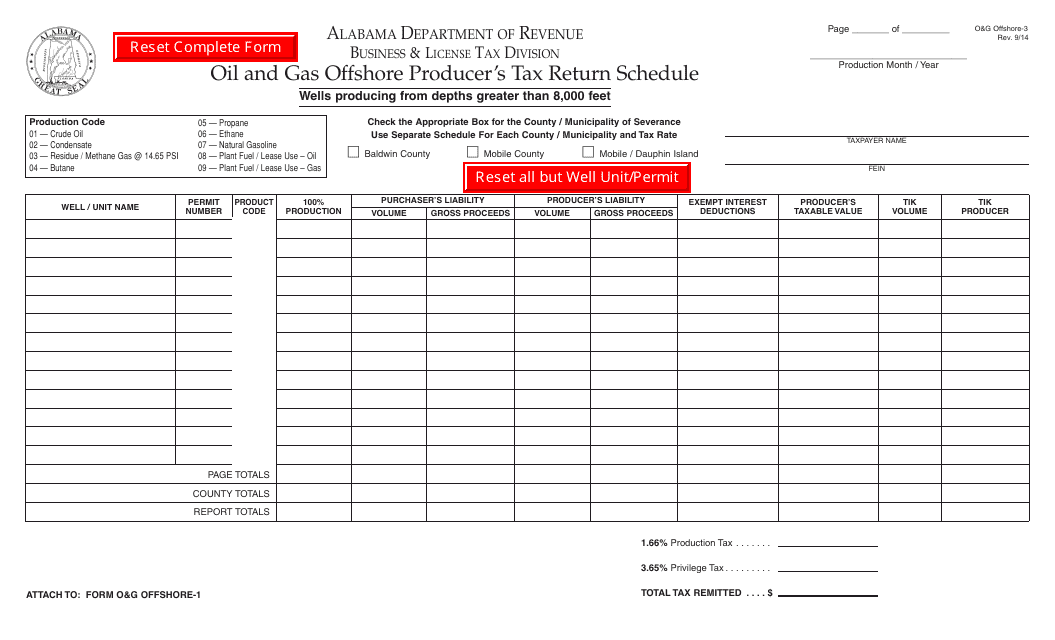

This form is used for filing the oil and gas offshore producer's tax return in Alabama.

This form is used for reporting and paying taxes by oil and gas producers operating offshore in Alabama. It is specifically for the O&G OFFSHORE-3 schedule of the Oil and Gas Offshore Producer's Tax Return.

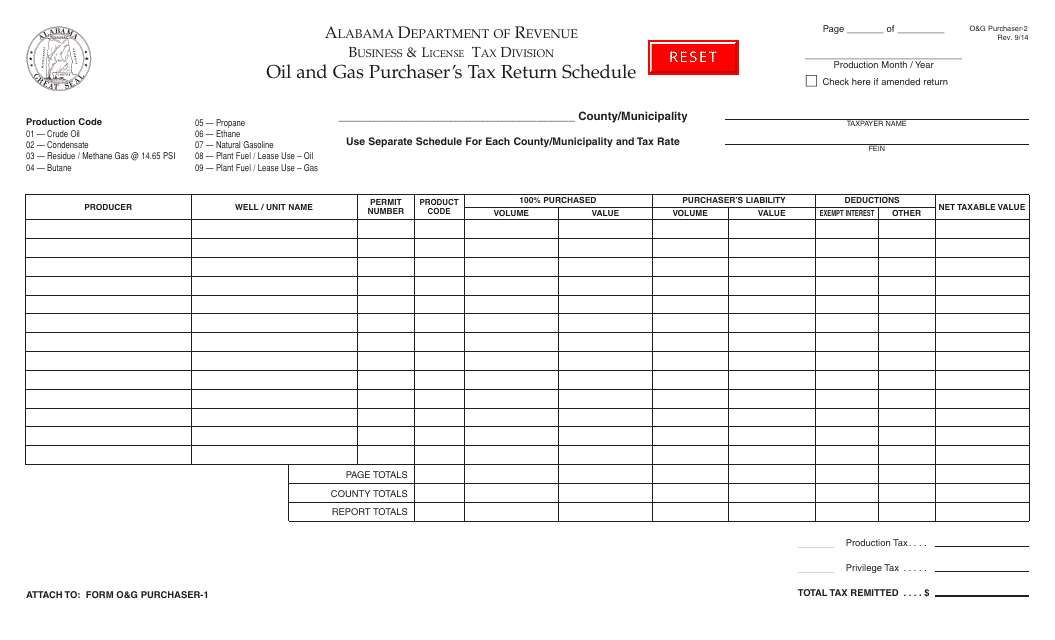

This Form is used for reporting and paying taxes related to oil and gas purchases in the state of Alabama. It must be completed by oil and gas purchasers and submitted to the relevant tax authority.

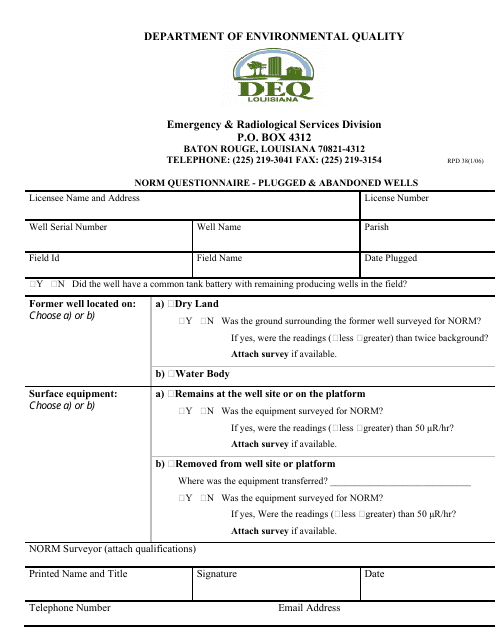

This form is used for completing a questionnaire regarding plugged and abandoned wells in Louisiana.

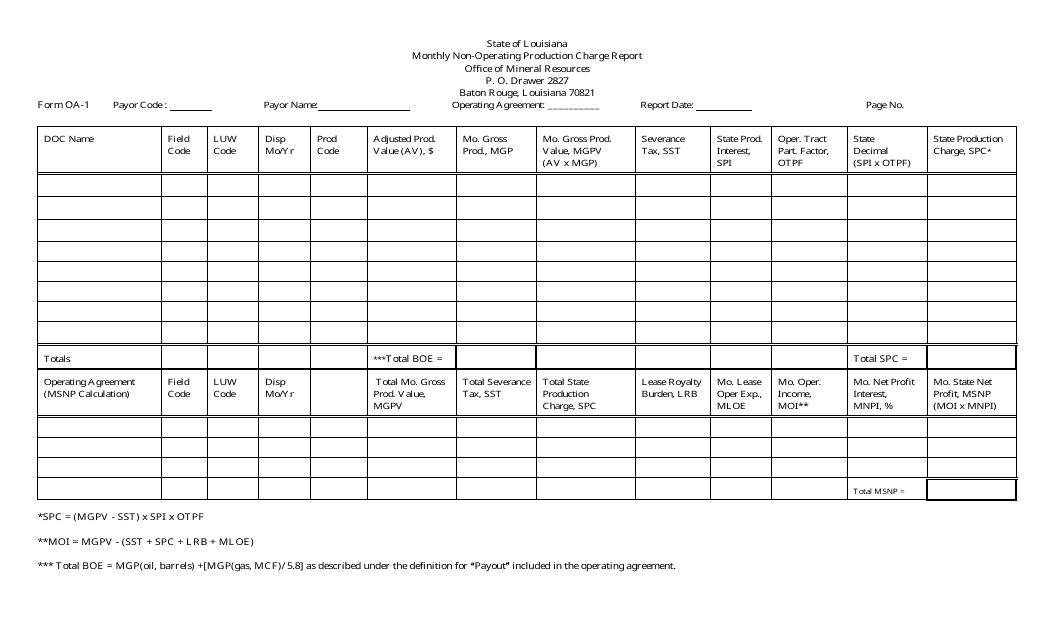

This form is used for reporting the monthly non-operating production charges in Louisiana.

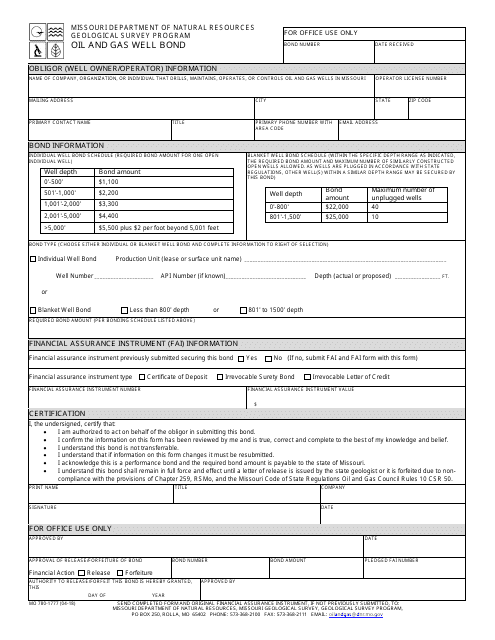

This form is used for obtaining a bond for oil and gas wells in Missouri under the Geological Survey Program.

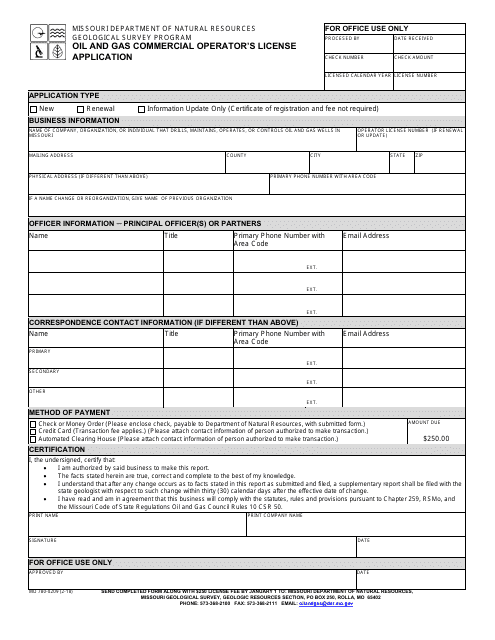

This form is used for applying for an Oil and Gas Commercial Operator's License in Missouri through the Geological Survey Program.