Retirement Plan Documents Templates

Documents:

280

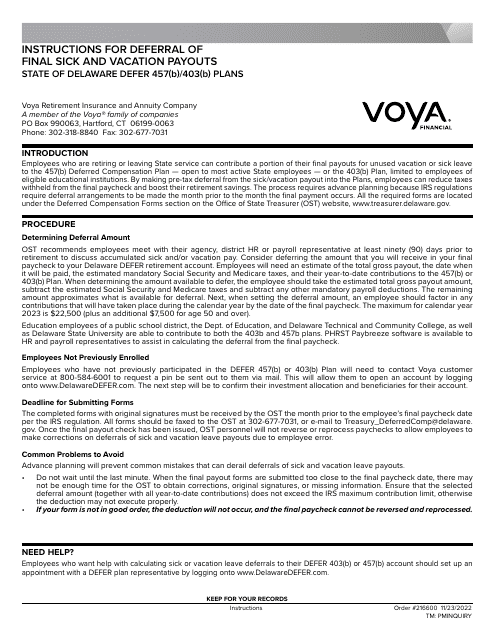

This form is used for inactive retirement investors in Iowa to designate a beneficiary for their Retirement Investors' Club (RIC) account.

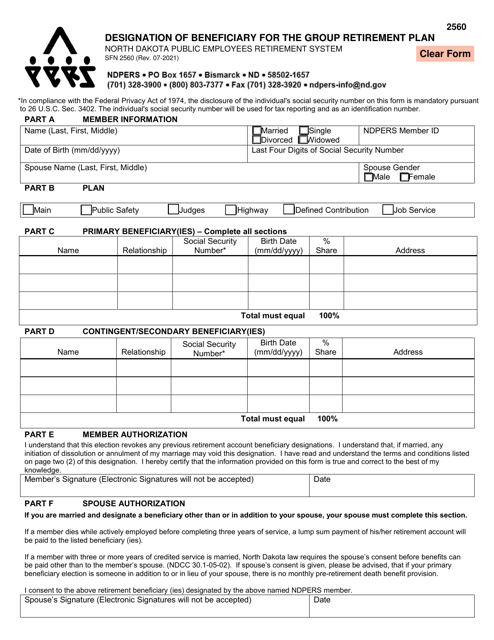

This form is used for designating beneficiaries for the Group Retirement Plan in North Dakota.

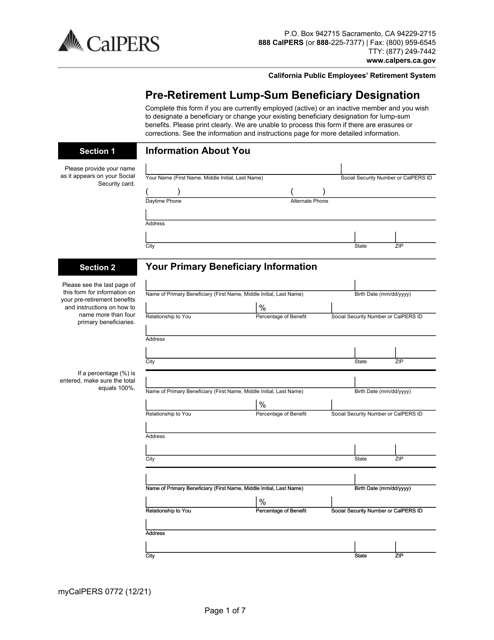

This Form is used for designating a beneficiary to receive a lump-sum payment upon retirement in the state of California.

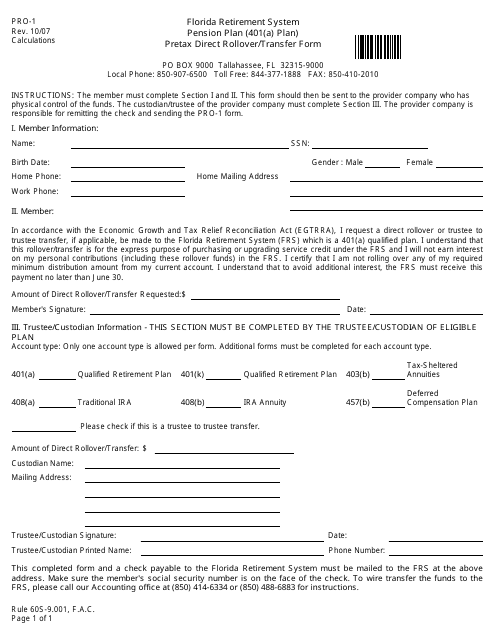

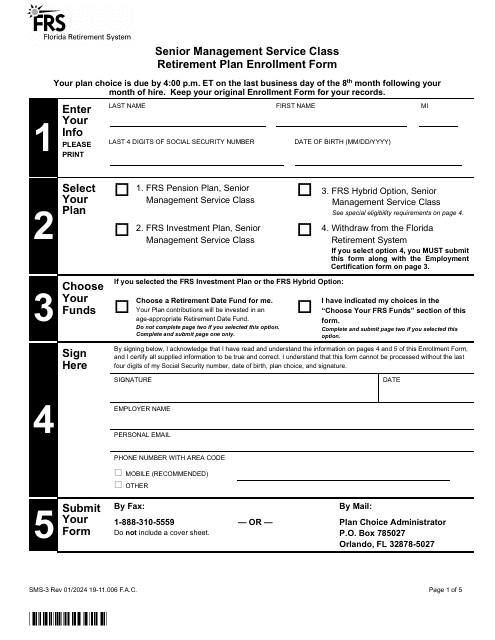

This form is used for pretax direct rollovers or transfers of funds in Florida. It allows individuals to move their retirement savings from one account to another without incurring tax penalties.

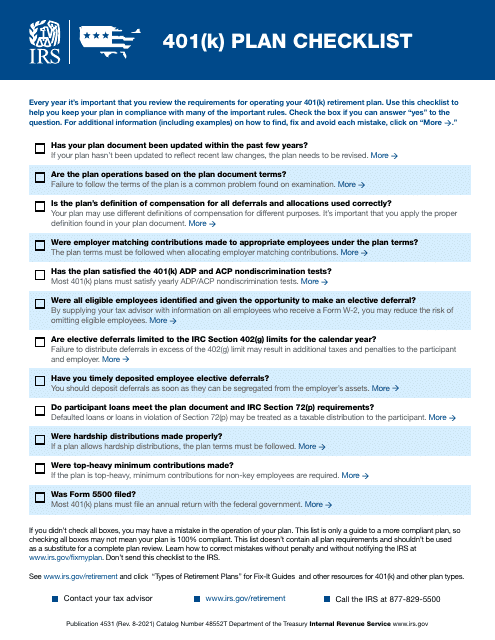

This document is a checklist that outlines the key steps and considerations for setting up and managing a 401(k) retirement plan. It provides guidance on eligibility, contribution limits, investment options, and other important factors to consider when establishing a 401(k) plan for your employees. Use this checklist to ensure compliance and maximize the benefits of your company's retirement plan.

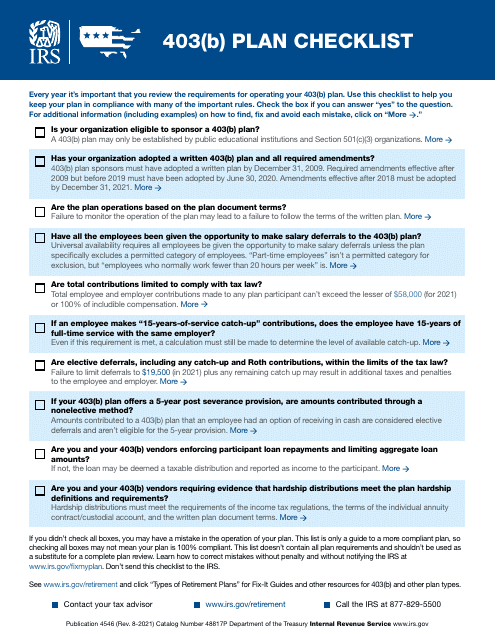

This document is a checklist for individuals who have or are interested in a 403(b) retirement plan. It provides a list of important items to consider and actions to take when managing a 403(b) plan.

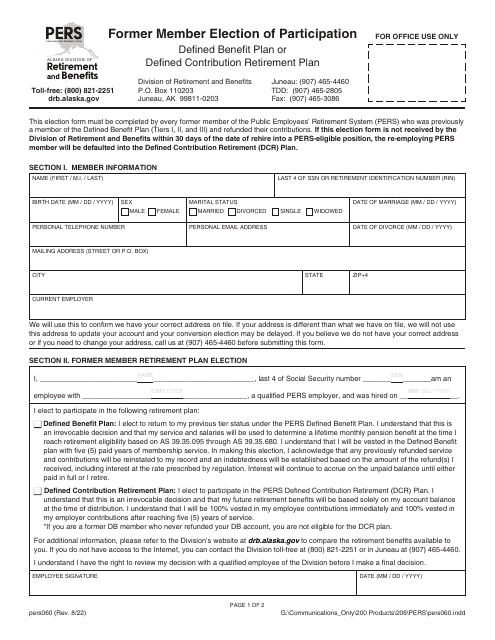

This form is used for a former member to elect their participation in either a defined benefit plan or a defined contribution retirement plan in Alaska.

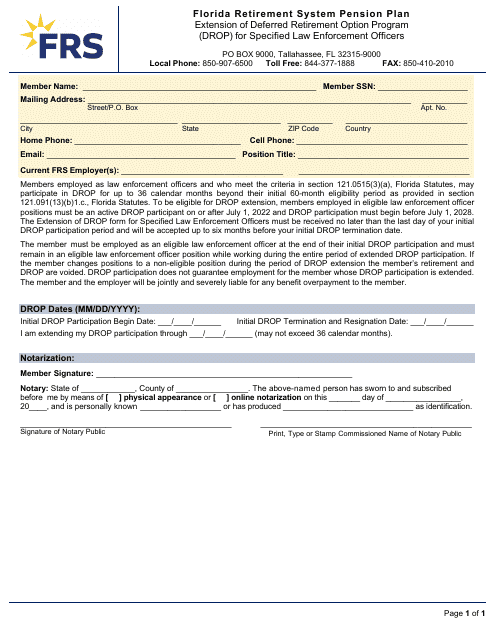

This document is an extension of the Deferred Retirement Option Program (DROP) specifically for law enforcement officers in the state of Florida. It outlines the details and eligibility requirements for participating in the program.

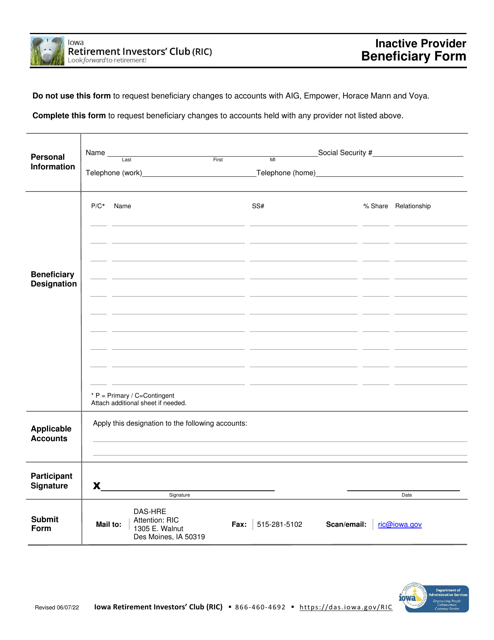

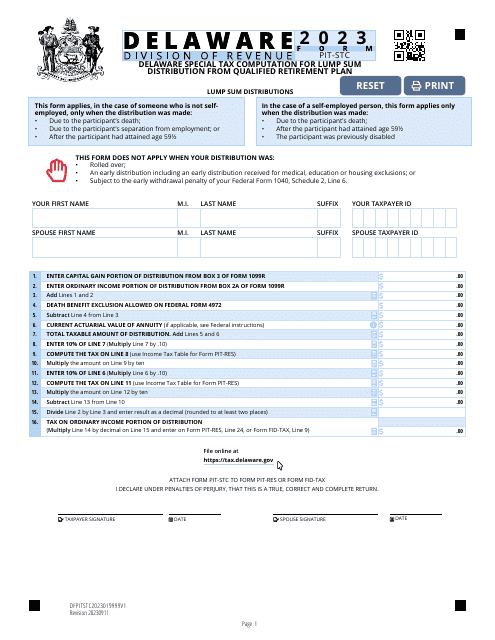

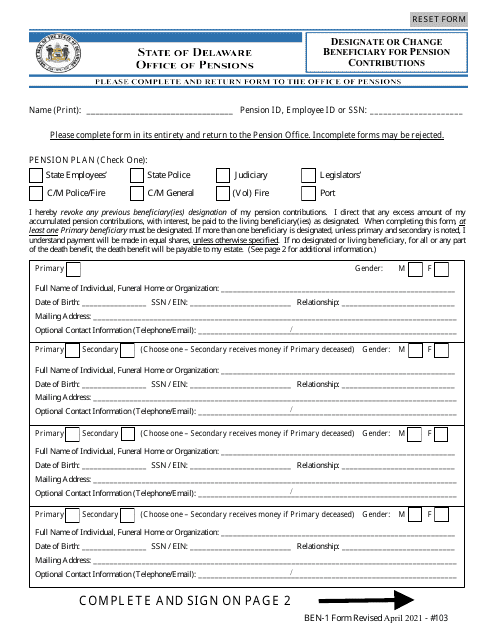

This document is used for designating or changing a beneficiary for pension contributions in the state of Delaware.

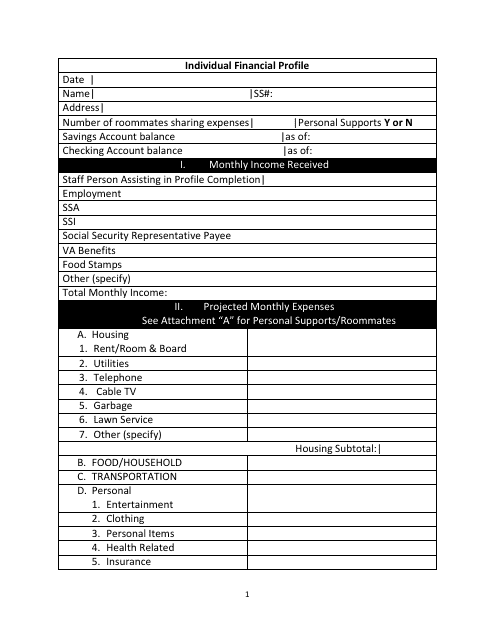

This document provides a comprehensive overview of an individual's financial profile in the state of Florida. It includes details such as income, assets, debts, and expenses to help determine their financial standing.

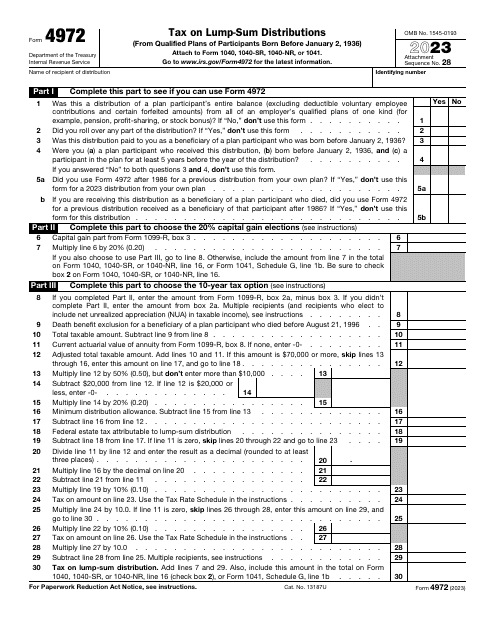

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.