Retirement Plan Documents Templates

Documents:

280

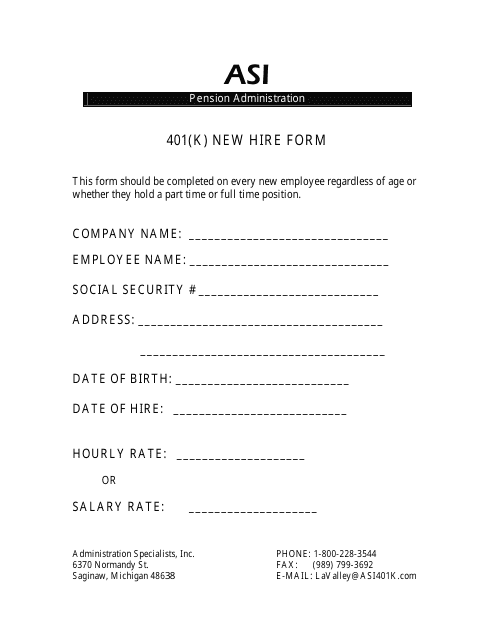

This form is used for new employees to enroll in their employer's 401(k) retirement plan.

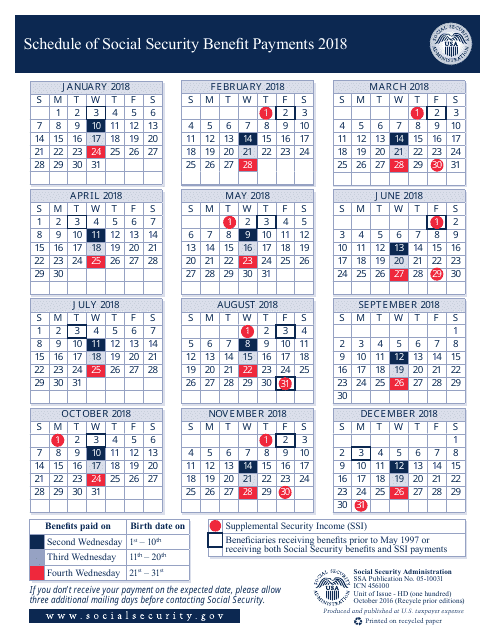

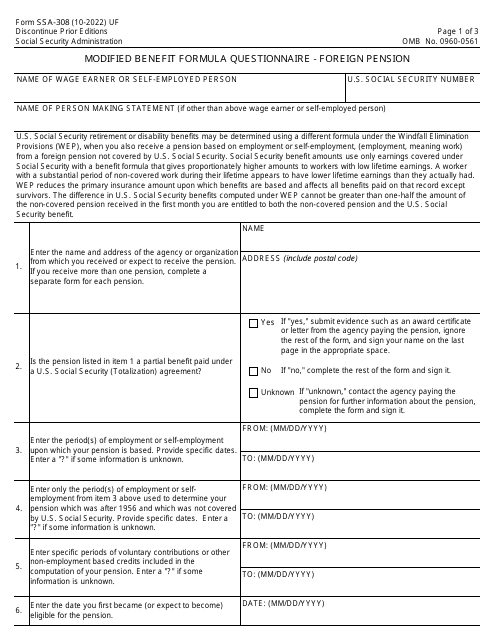

This document provides information on the schedule for receiving Social Security benefit payments. It outlines the dates and frequency of when beneficiaries can expect to receive their payments.

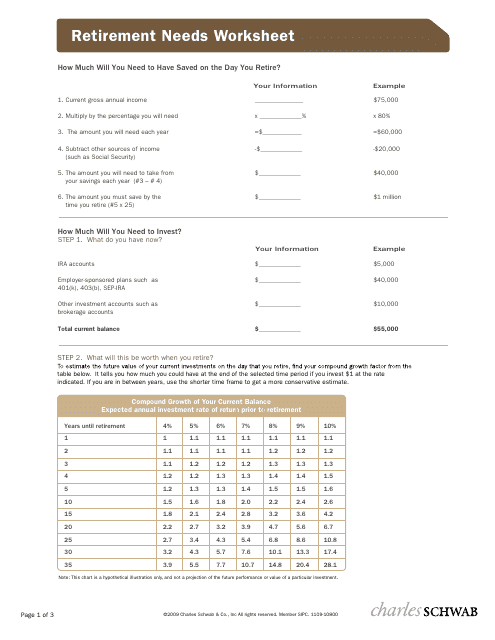

This type of document is a retirement needs worksheet template provided by Charles Schwab. It helps individuals assess their financial goals and estimate how much they need to save for retirement.

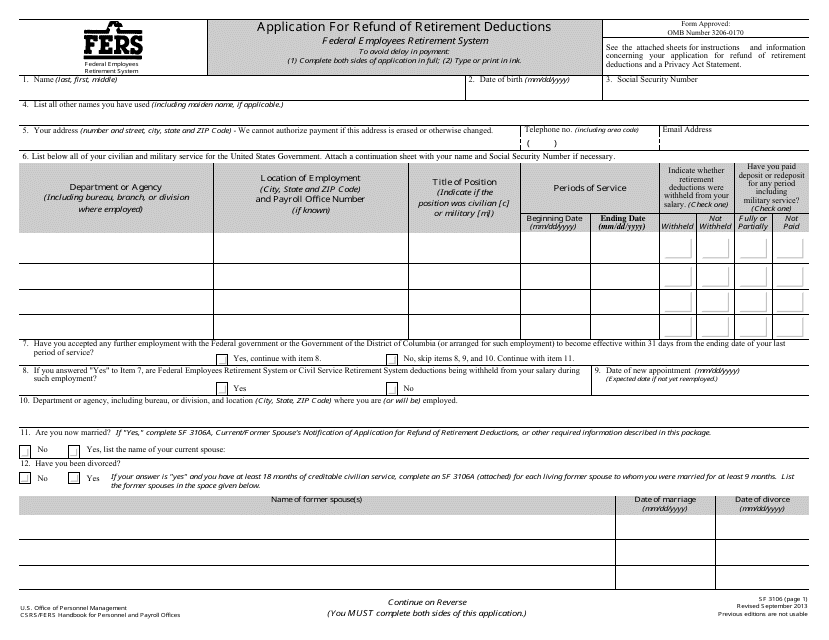

This Form is used for requesting a refund of retirement deductions made from an employee's salary. It is typically used by individuals who are leaving government service and are not eligible for an immediate annuity.

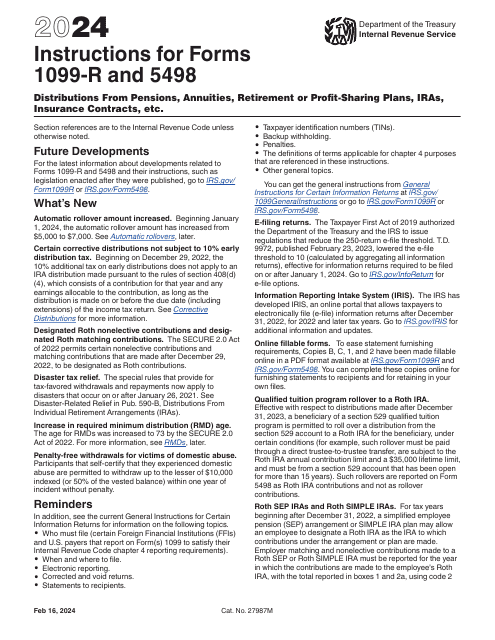

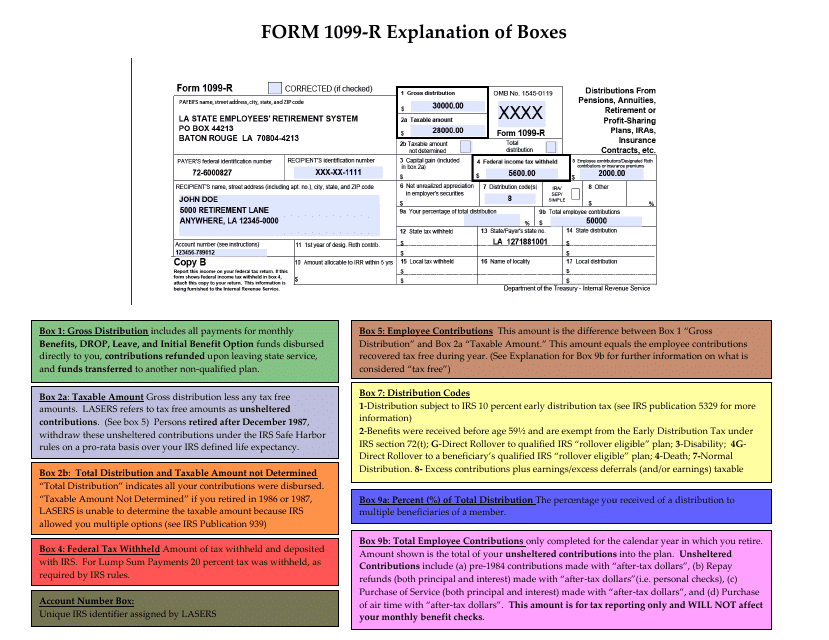

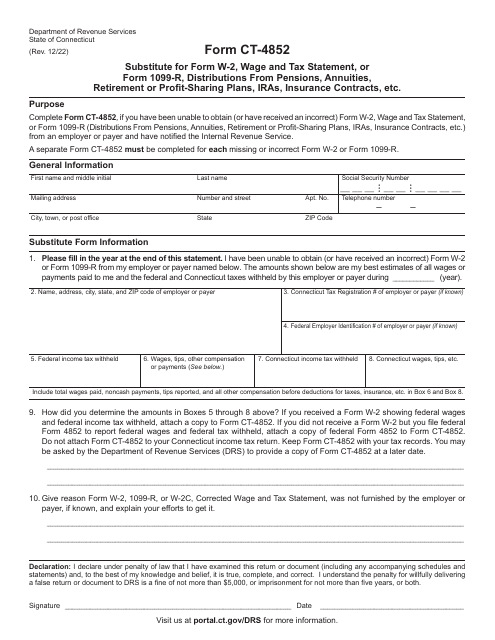

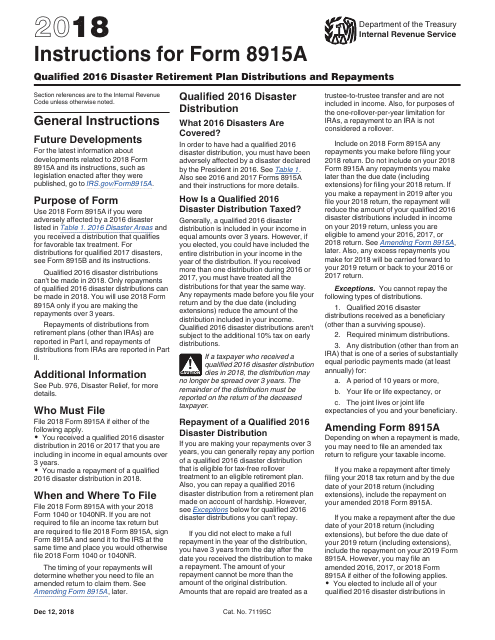

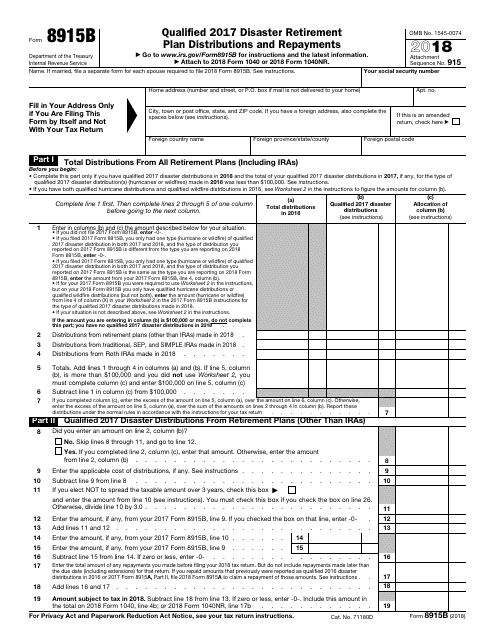

This document provides instructions for IRS Form 1099-R, which is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other types of retirement accounts. The document explains the different boxes on the form and how to fill them out accurately.

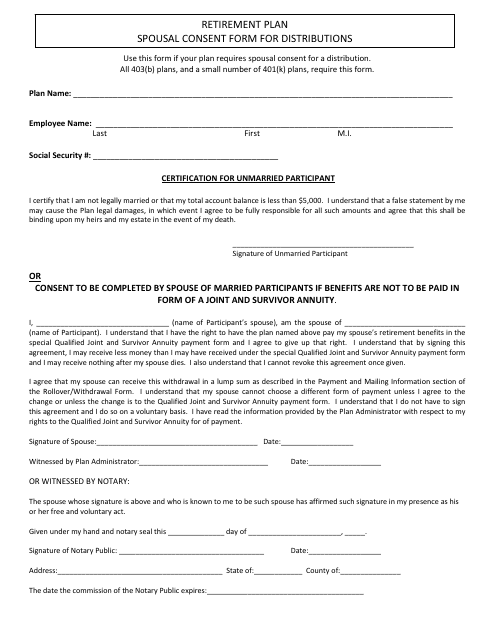

This form is used for obtaining spousal consent for the distribution of retirement plan funds.

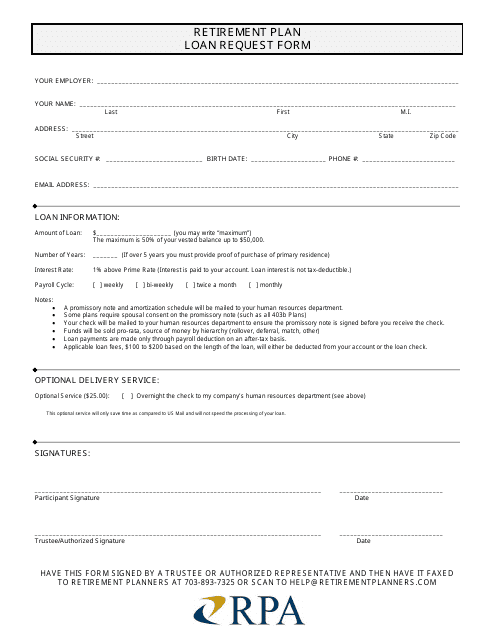

This Form is used for requesting a loan from a retirement plan for financial needs.

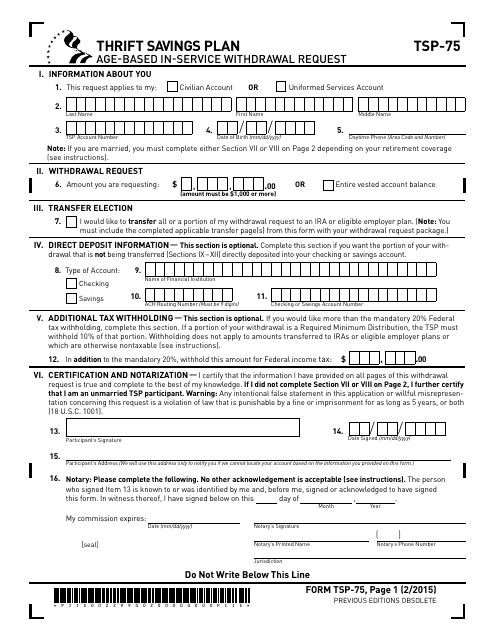

This Form is used for requesting an age-based in-service withdrawal from the Thrift Savings Plan (TSP).

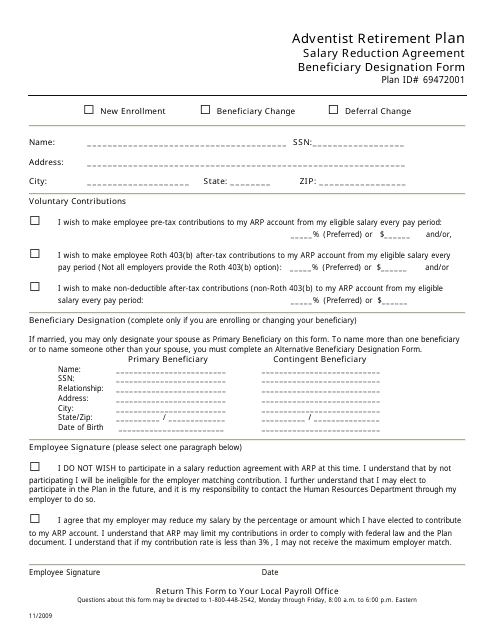

This document is used for designating beneficiaries and signing a salary reduction agreement for the Adventist Retirement Plan, which is associated with the Seventh-Day Adventist Church.

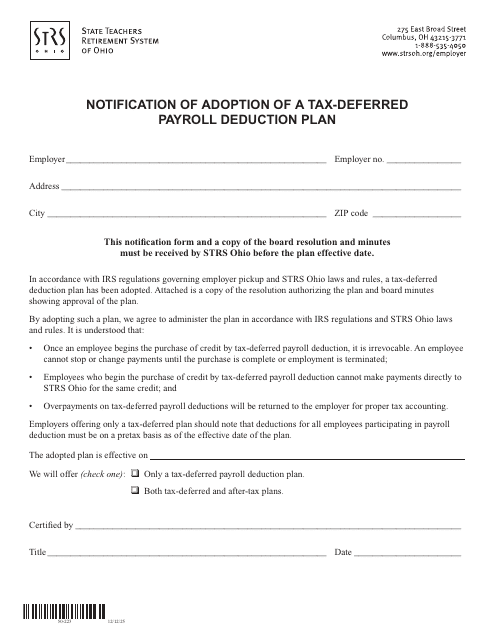

This document is a notification of the adoption of a tax-deferred payroll deduction plan by the State Teachers Retirement System of Ohio. It provides information about the plan and how it will affect Ohio teachers' retirement savings.

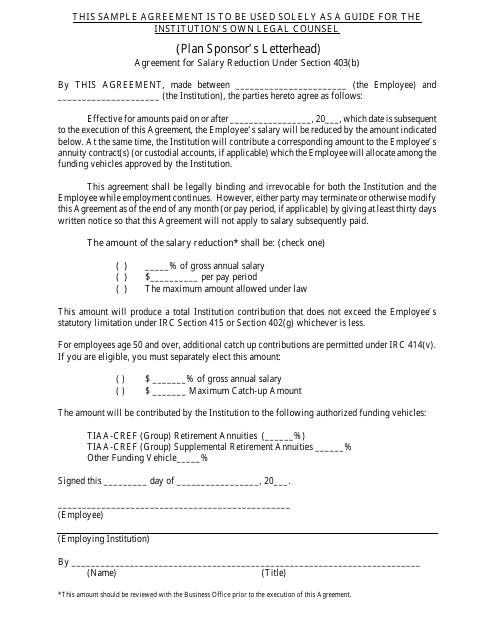

This document is an agreement for a salary reduction under Section 403(b) of the Internal Revenue Code with TIAA-CREF. It provides a sample template for employees who wish to reduce their salary contributions towards a retirement plan.

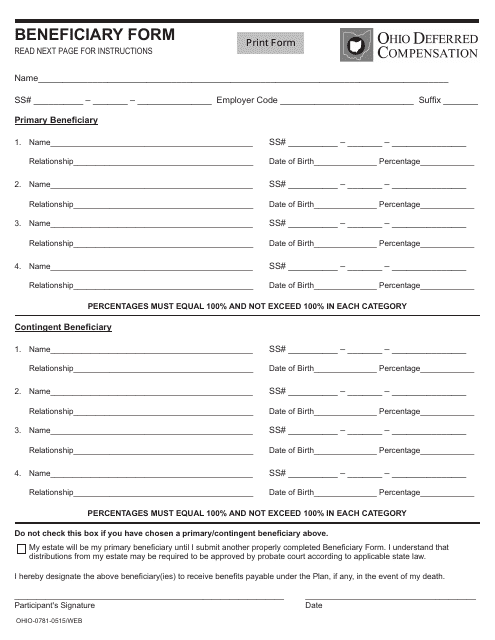

This form is used for specifying beneficiaries for your Ohio Deferred Compensation account in Ohio.

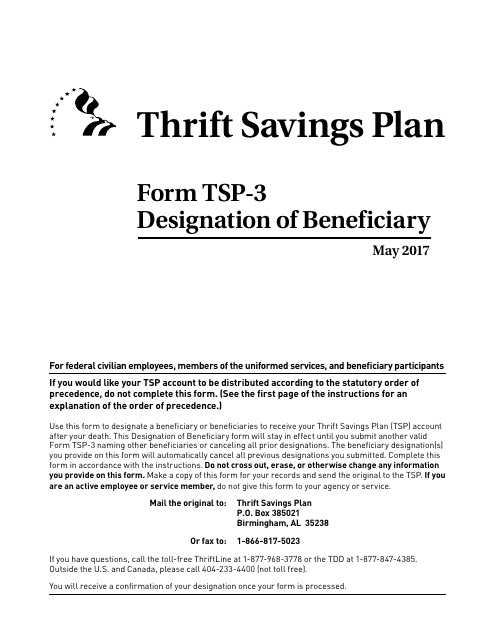

This form is used to designate a beneficiary for your Thrift Savings Plan (TSP) account in case of your death.

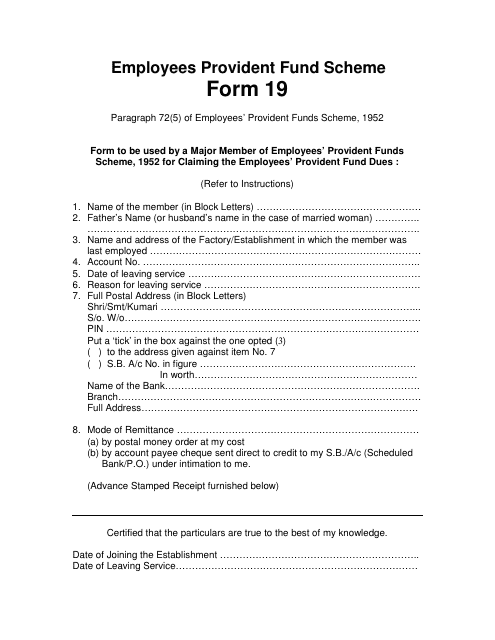

This document is used for applying for the Employees Provident Fund Scheme in India. It allows employees to contribute a portion of their salary towards a retirement fund for future financial security.

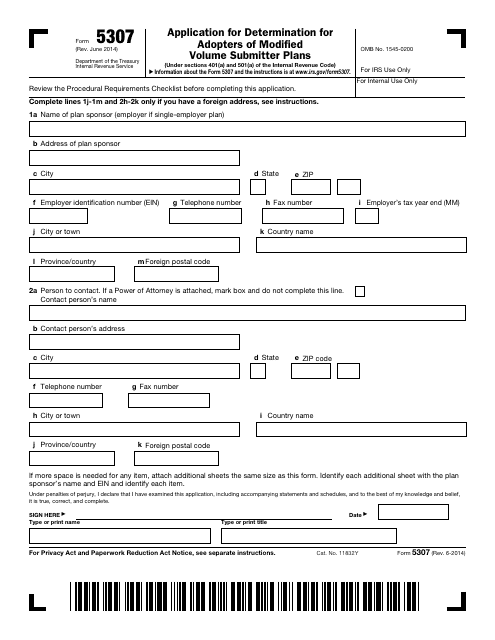

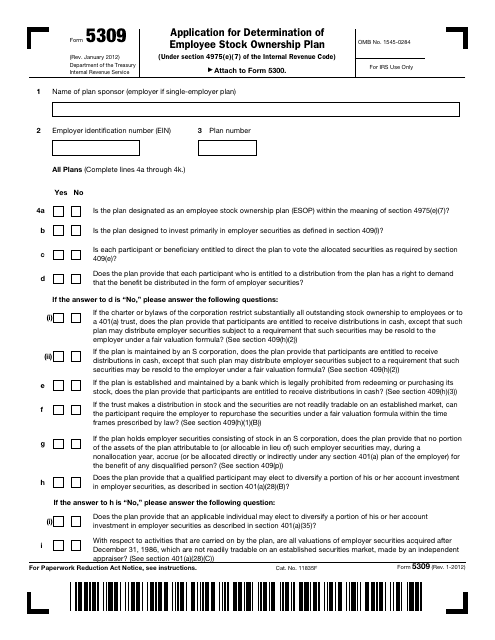

This Form is used for applying for determination for adopters of master or prototype or volume submitter plans with the IRS.

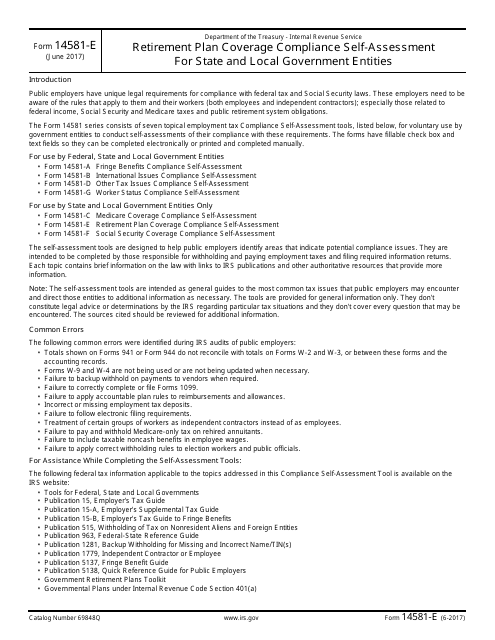

This Form is used for state and local government entities to assess their retirement plan coverage compliance.

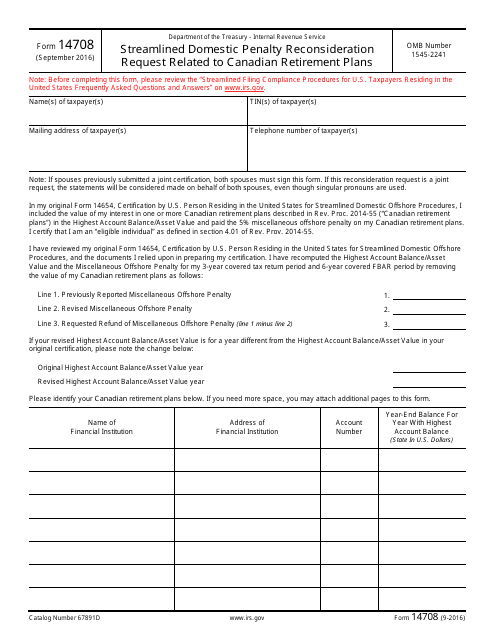

This document is used for requesting a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

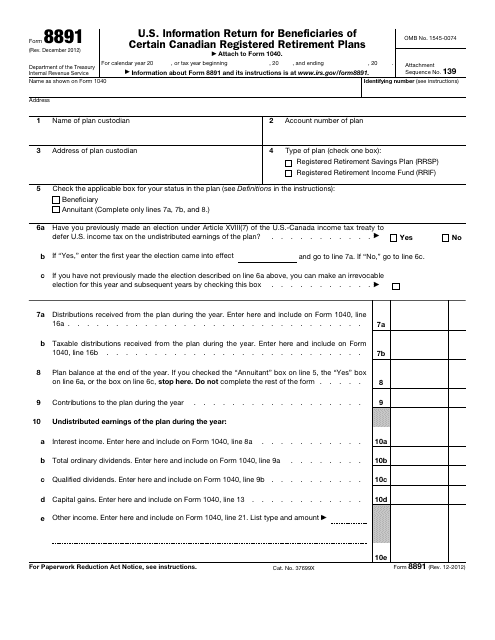

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

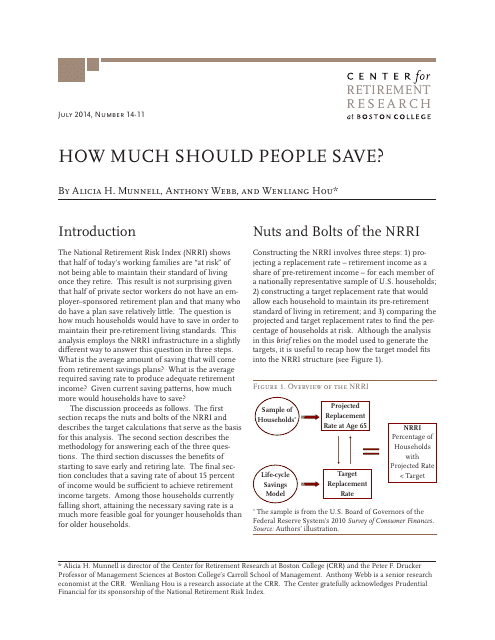

This document provides guidance on how much individuals should save for their financial future. It offers insights and recommendations from experts Alicia H. Munnell, Anthony Webb, and Wenliang Hou.

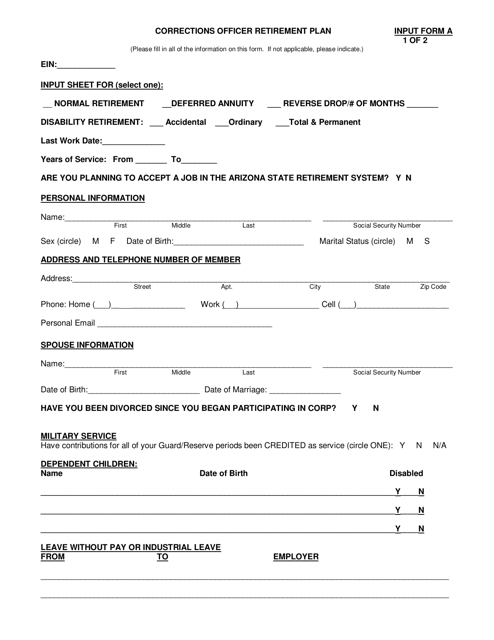

This document is used for applying for deferred retirement if a person was separated before October 1, 1956.

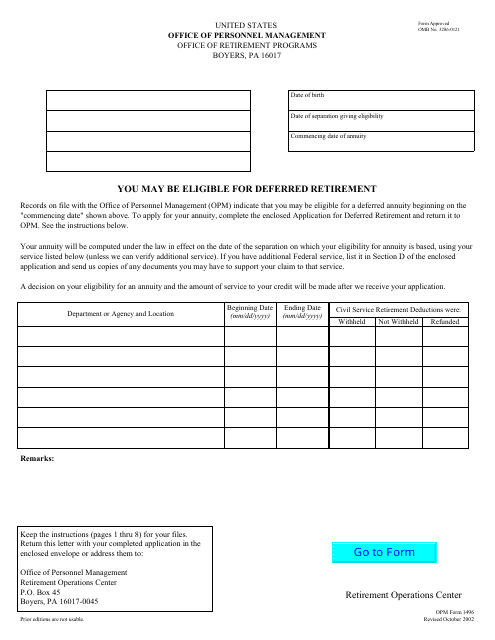

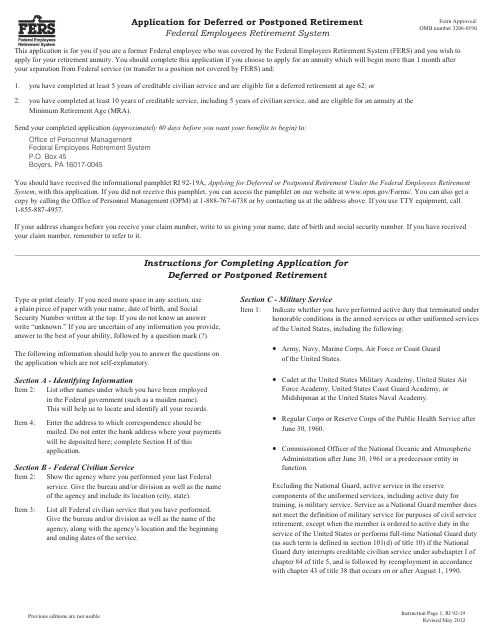

This Form is used for applying for deferred or postponed retirement through the Office of Personnel Management (OPM). It allows federal employees to delay their retirement benefits until a later date.

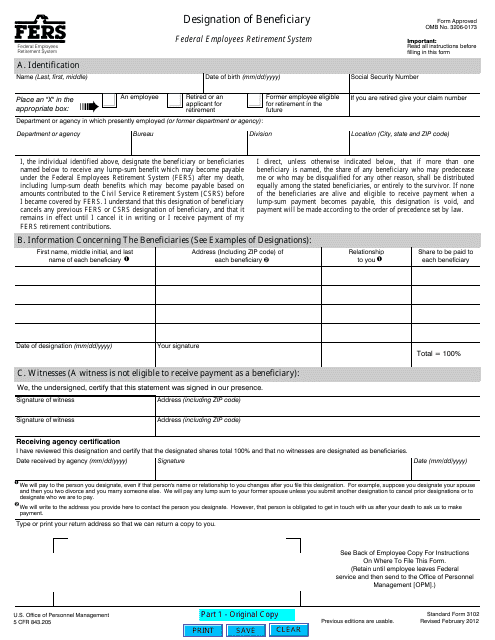

This Form is used for designating beneficiaries for the Federal Employees Retirement System (FERS).

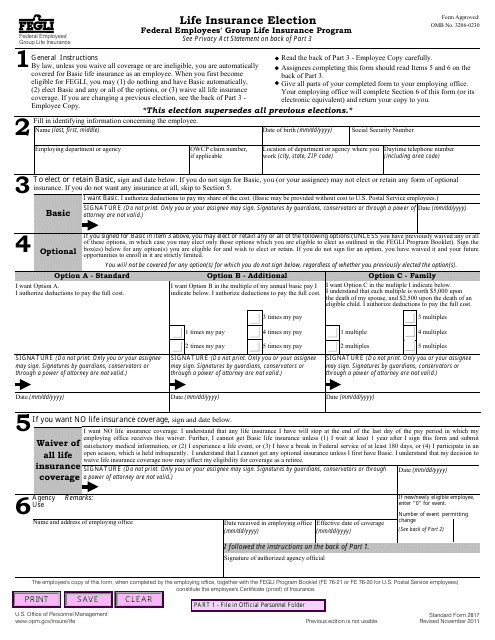

This form is used for making an election for life insurance coverage.

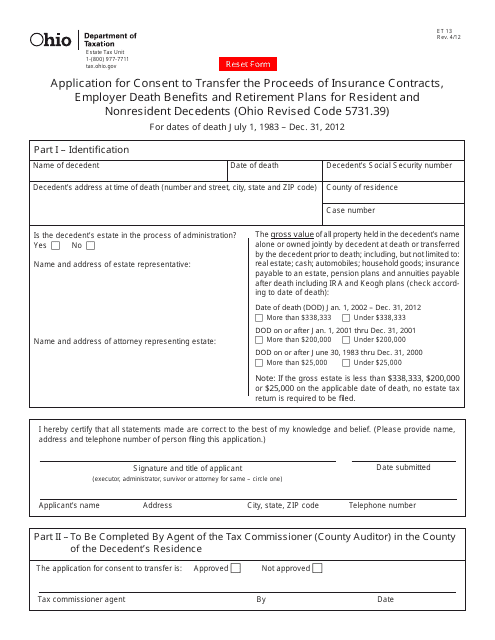

This form is used for applying for consent to transfer the proceeds of insurance contracts, employer death benefits, and retirement plans for both resident and nonresident decedents in the state of Ohio.

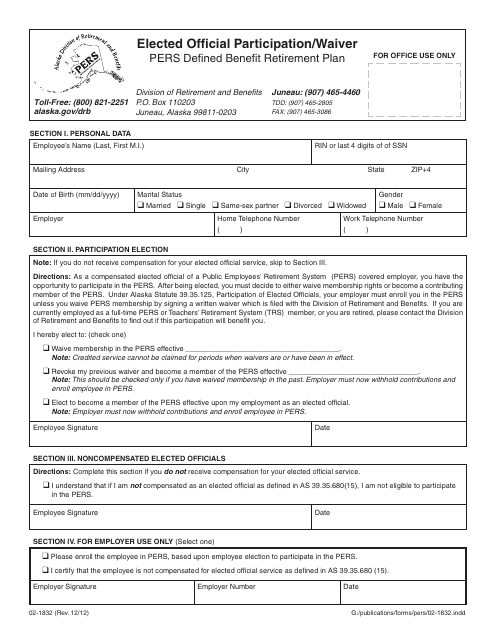

This form is used for elected officials in Alaska to participate or waive participation in the Pers Defined Benefit Retirement Plan.

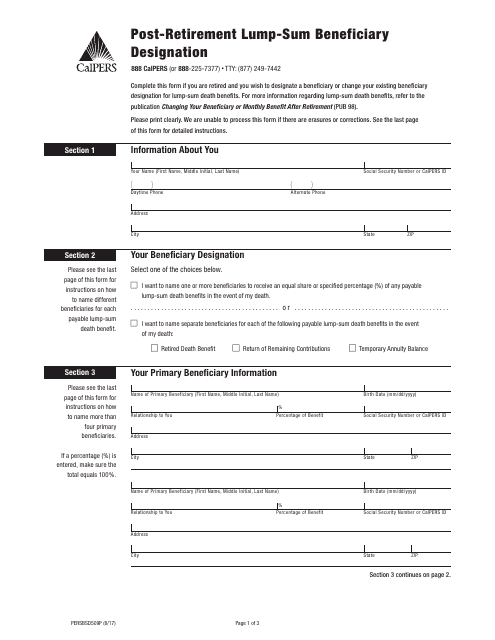

This form is used for designating a lump-sum beneficiary to receive retirement benefits after the employee's retirement in California.