Business Tax Documents Templates

Documents:

611

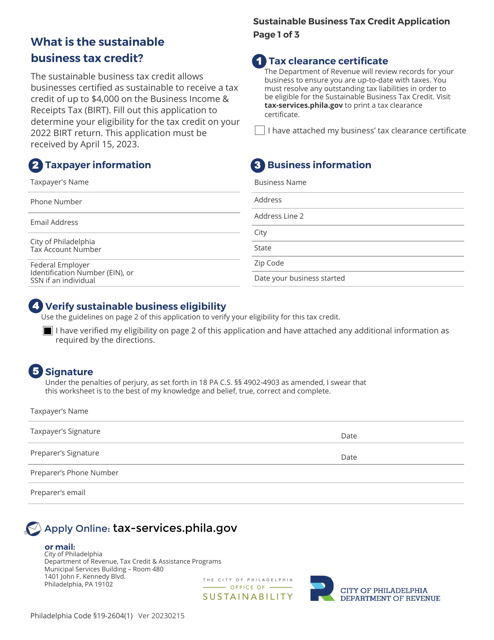

This document is used for applying for the Sustainable Business Tax Credit in the City of Philadelphia, Pennsylvania. It provides information and guidelines on how businesses can apply for and potentially receive tax credits for implementing sustainable practices.

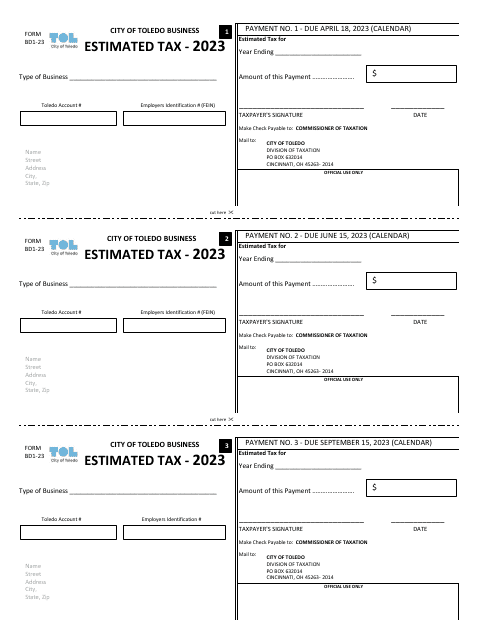

This Form is used for businesses located in Toledo, Ohio to estimate and pay their city taxes.

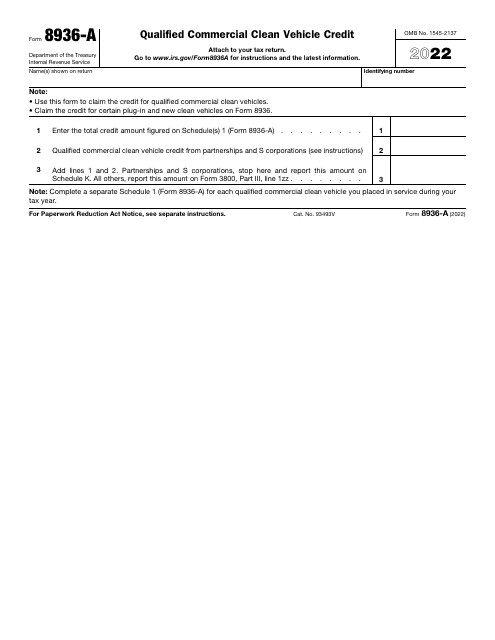

This form is used for claiming a tax credit for the purchase of a qualified commercial clean vehicle.

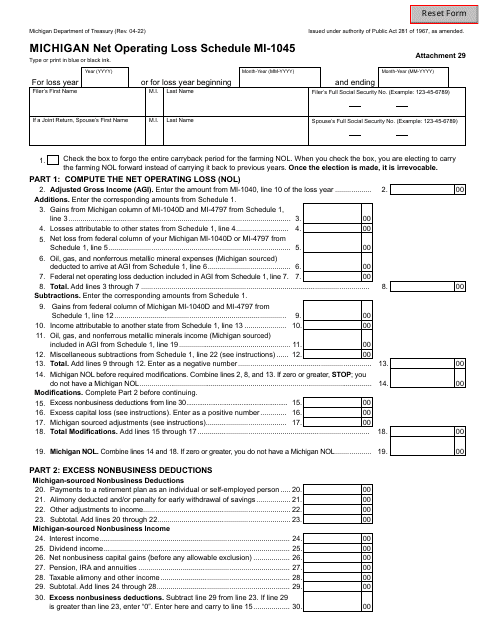

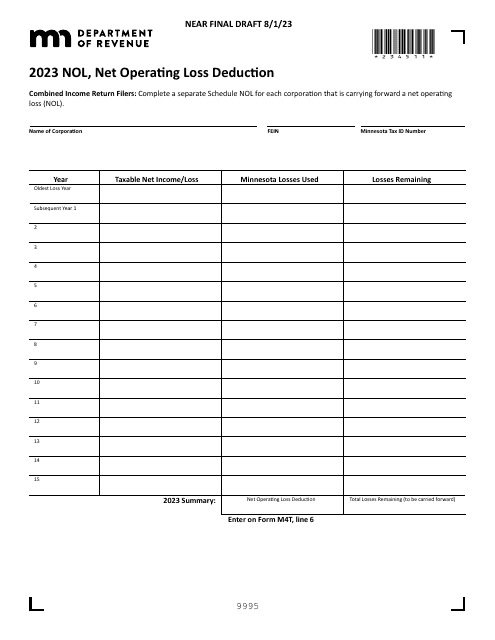

This Form is used for reporting net operating losses in the state of Michigan. It helps individuals and businesses calculate and claim any losses incurred in their operations for tax purposes.

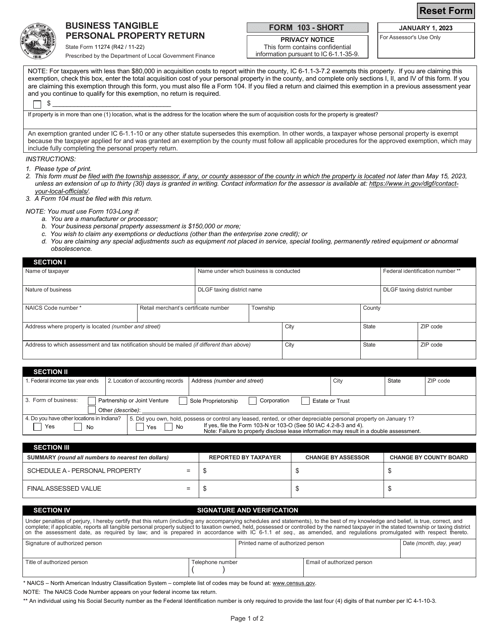

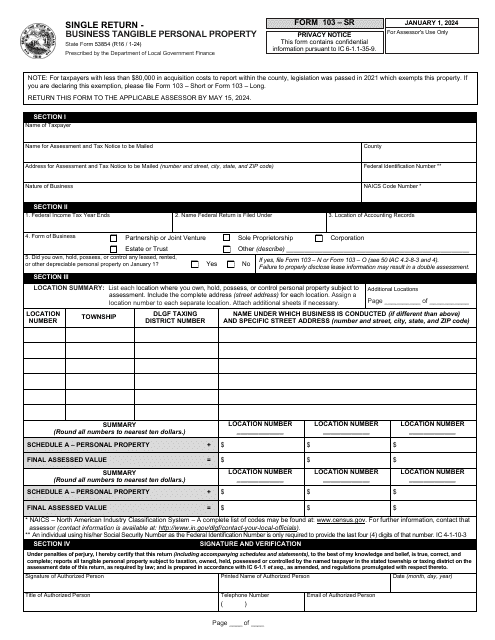

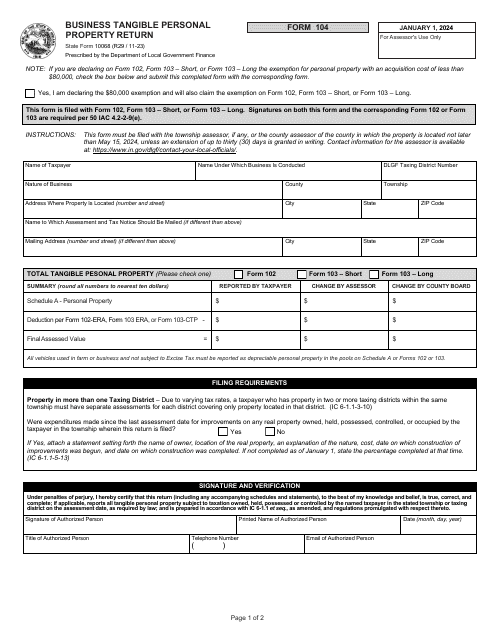

This Form is used for reporting business tangible personal property in Indiana. It is used to calculate and report the value of tangible assets owned by a business for taxation purposes.

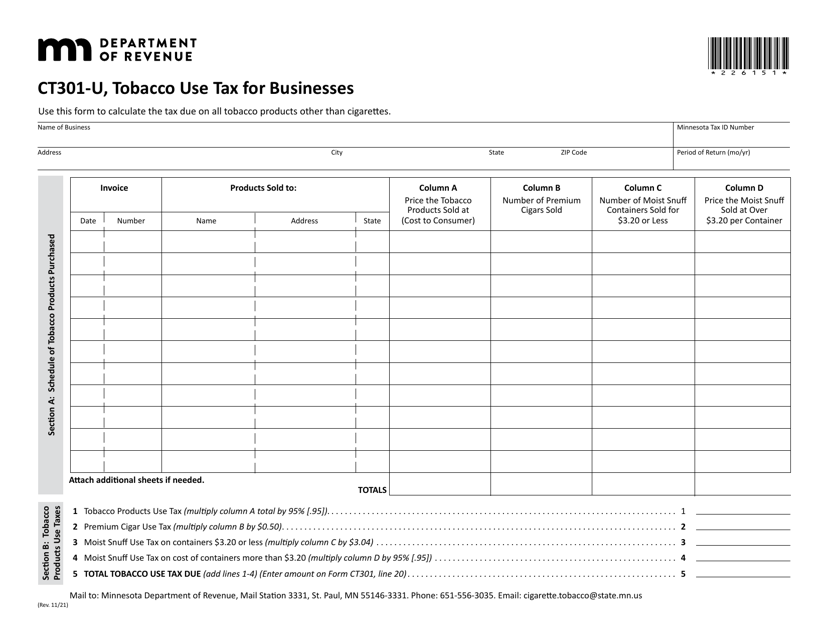

This Form is used for businesses in Connecticut to report and pay tobacco use tax.

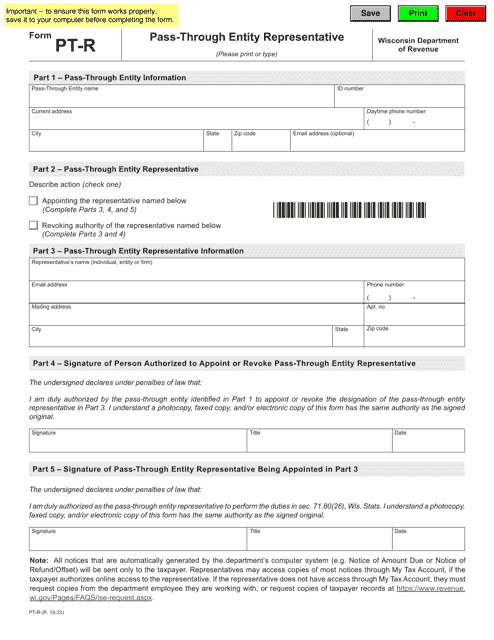

This form is used for appointing a representative for a pass-through entity in Wisconsin.

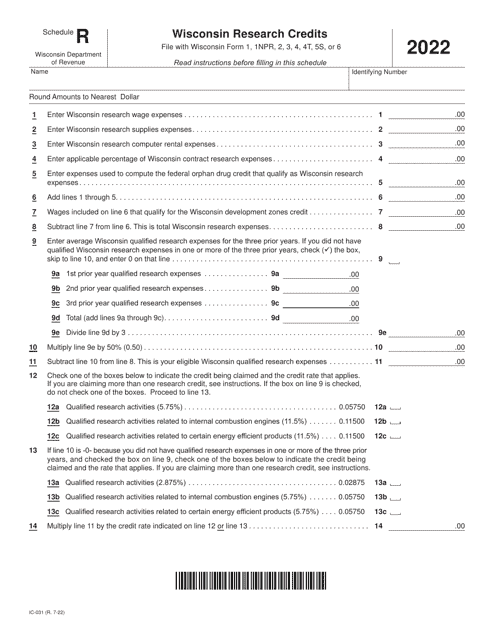

This form is used for claiming research credits in the state of Wisconsin.

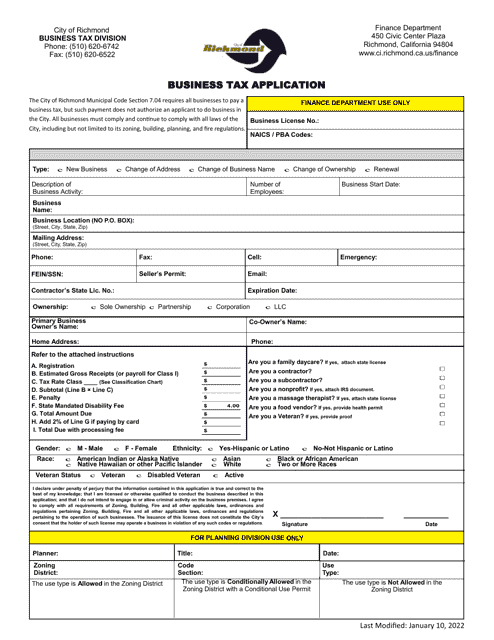

This form is used for applying for business tax in Richmond City, California.

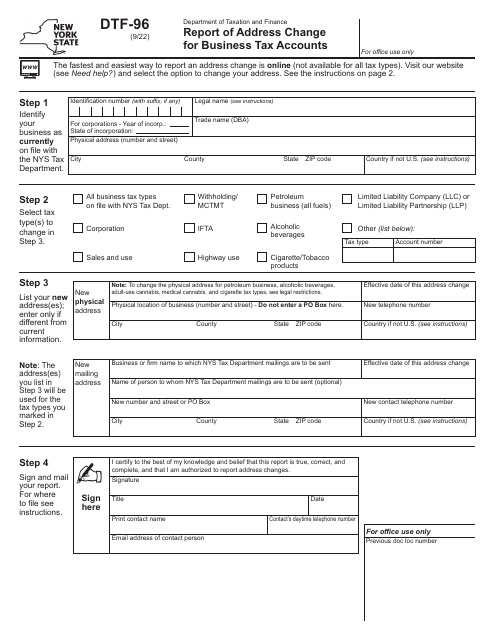

This form is used by businesses in New York to notify the Department of Taxation and Finance about changes in their physical or mailing address. It aids businesses to ensure their tax information is accurately updated.

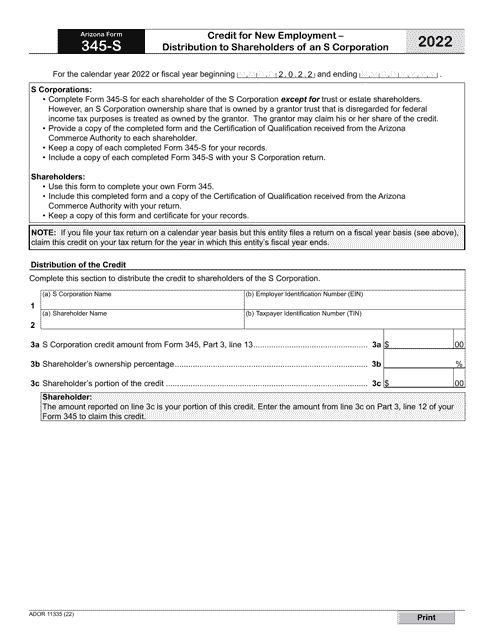

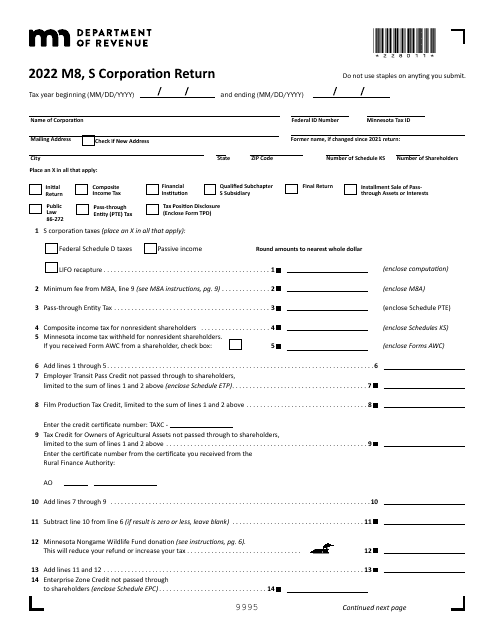

This form is used for filing the S Corporation tax return in the state of Minnesota.

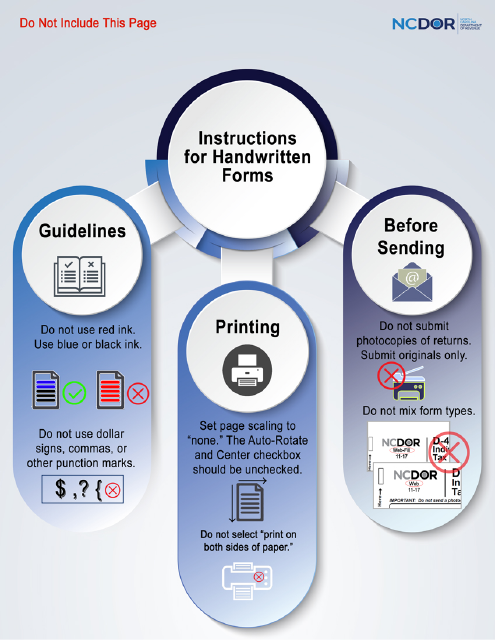

This form is used for filing the Installment Paper Dealer Tax Return in North Carolina. It is a required document for businesses dealing with installment paper sales in the state.