Business Tax Documents Templates

Documents:

611

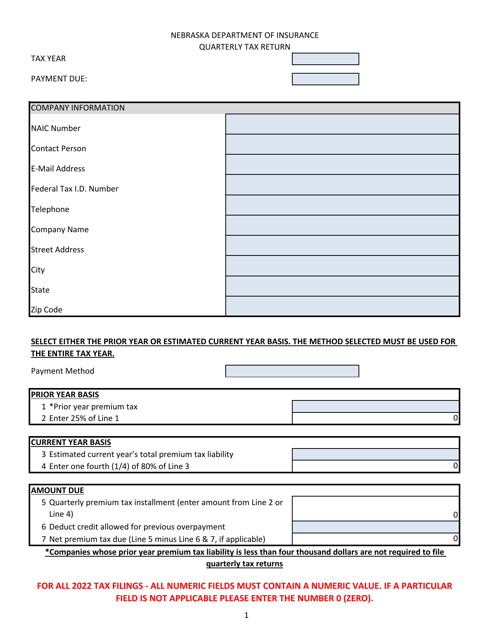

This form is used for reporting and paying quarterly premium taxes in the state of Nebraska.

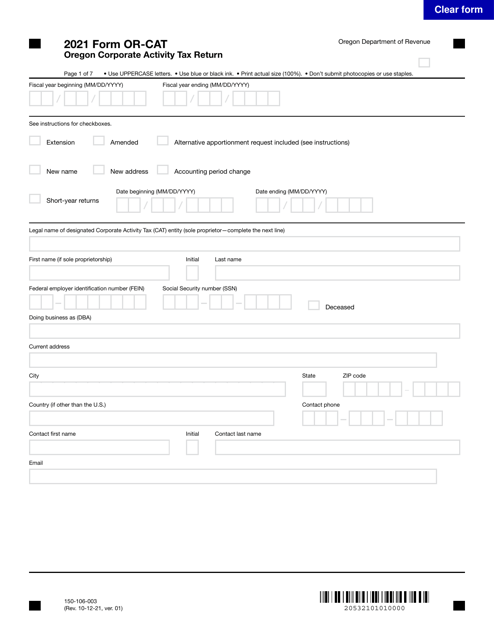

This form is used for filing the Oregon Corporate Activity Tax Return, which is required for businesses operating in Oregon to report their corporate activity tax obligations.

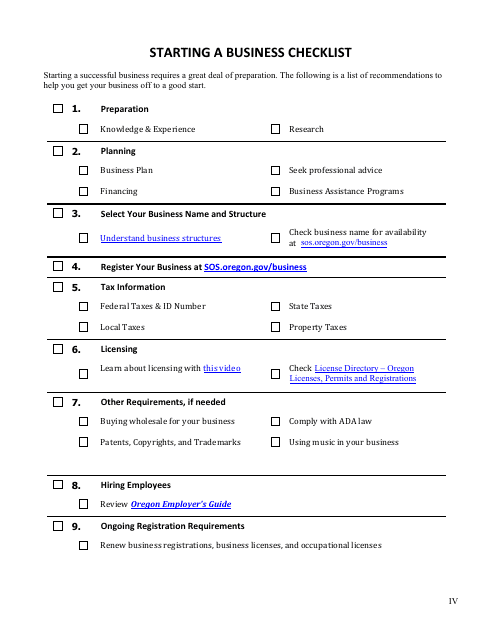

This checklist is a comprehensive guide to help you start a business in the state of Oregon. It covers important steps and requirements such as registering your business, obtaining permits and licenses, and complying with tax obligations. Follow this checklist to ensure you don't miss any important steps in the process of starting your Oregon-based business.

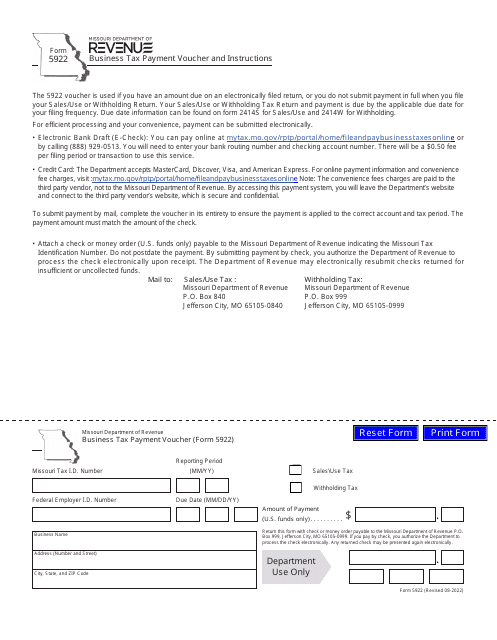

This Form is used for making business tax payments in Missouri.

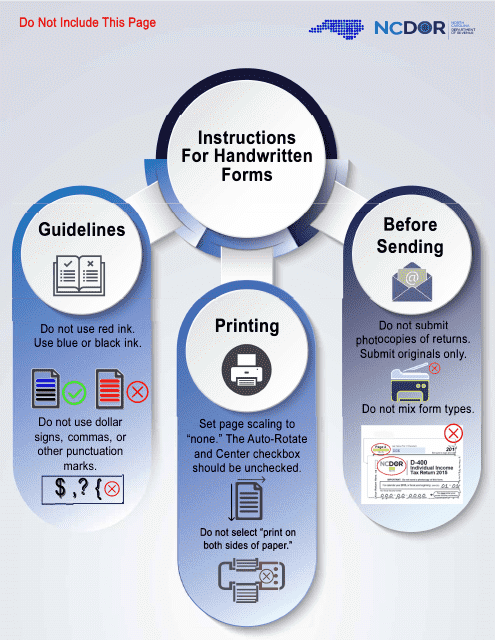

This Form is used for estimating income tax for pass-through entities in North Carolina.

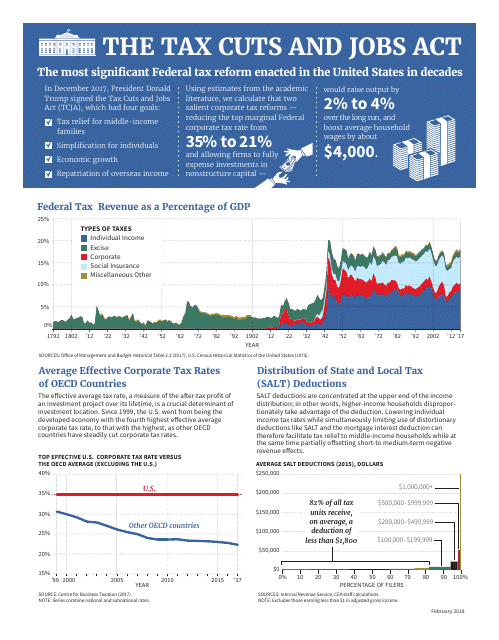

This document explains the Tax Cuts and Jobs Act, a law in the United States that made changes to the tax code with the goal of promoting economic growth and job creation.

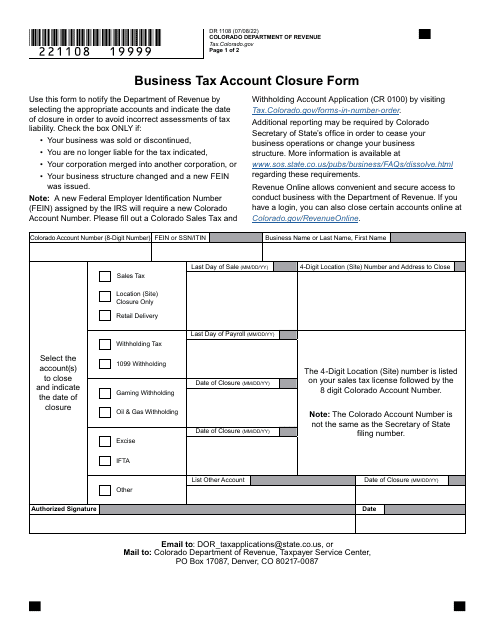

This form is used for closing a business tax account in the state of Colorado. It is required to notify the Colorado Department of Revenue when a business is ceasing operations or no longer liable for taxes.

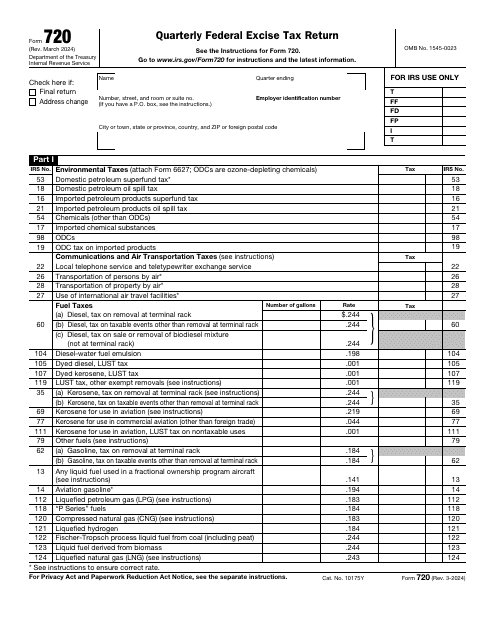

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

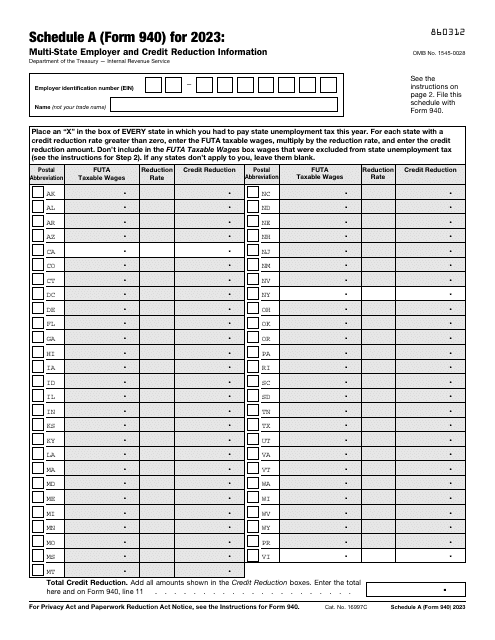

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

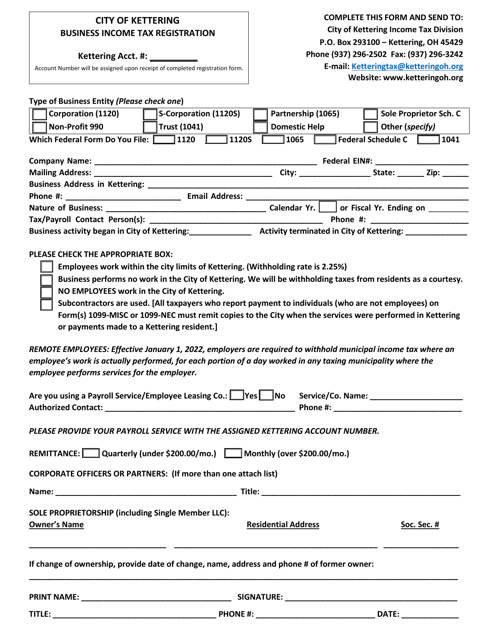

This Form is used for registering your business for income tax purposes in the City of Kettering, Ohio.

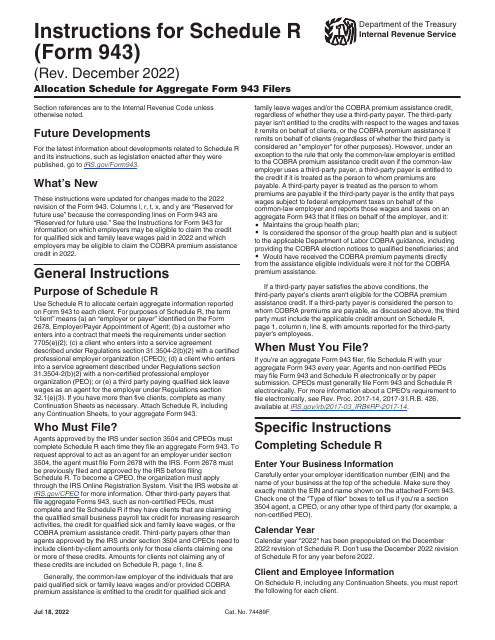

This form is used for allocating wages and taxes for employers who file an Aggregate Form 943 with the IRS. It provides instructions on how to accurately report employee wages and taxes for agricultural workers.

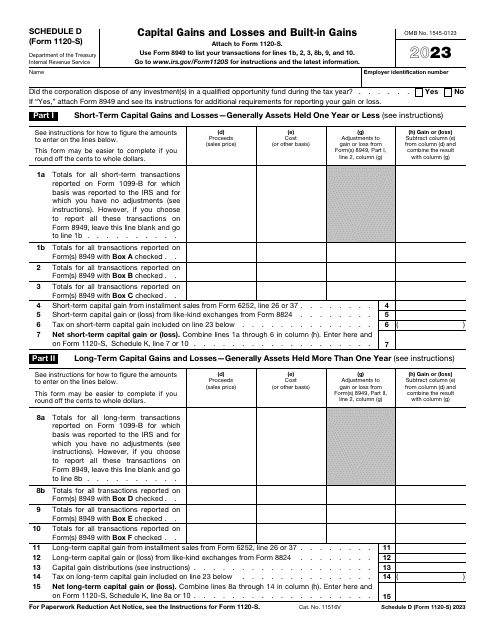

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

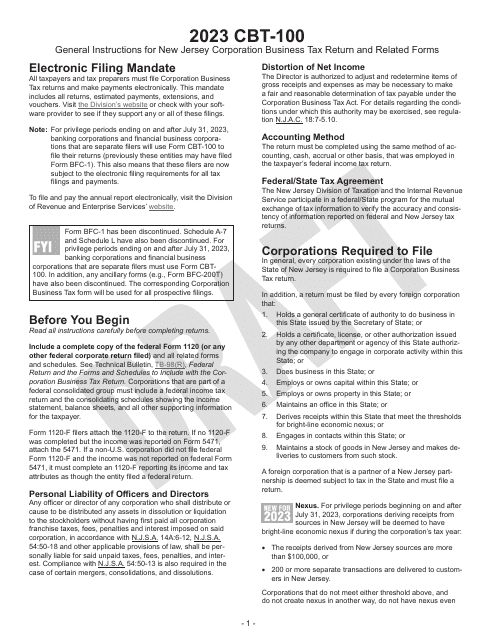

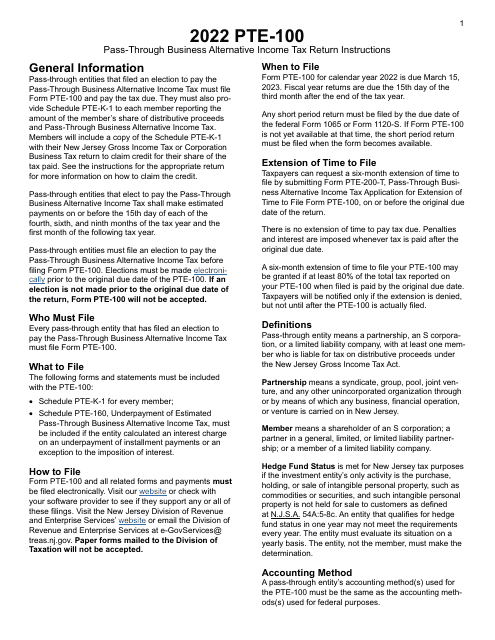

This Form is used for filing the Pass-Through Business Alternative Income Tax Return in the state of New Jersey. It is specifically for businesses classified as pass-through entities.

Instructions for Form PTE-100 Pass-Through Business Alternative Income Tax Return - New Jersey, 2022

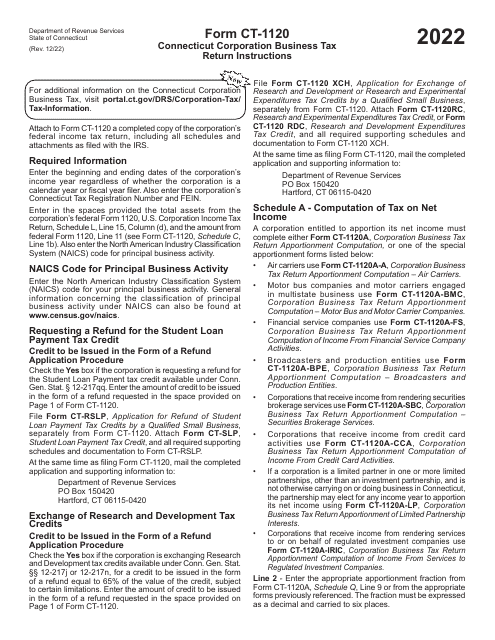

This document provides instructions for completing the Form CT-1120 Corporation Business Tax Return. It is used by corporations in the state of Connecticut to report and calculate their business tax liability. The instructions guide taxpayers on how to properly fill out the form and report their income, deductions, and credits.